Equities

US Stocks Bounce On Friday, But Wilshire 5000 Shed 1% This Week

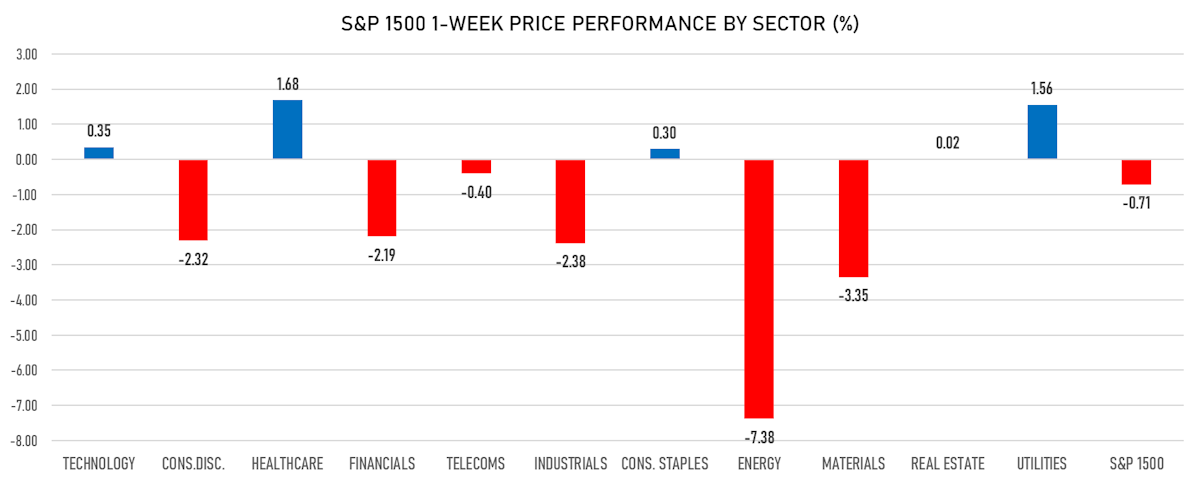

Energy and materials led the declines this week following the fall in the prices of industrial commodities; banks were also down over 2%, hurt by the flattening of the yield curve

Published ET

FactSet Country Indices Year To Date Performance | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.81%; Nasdaq Composite up 1.19%; Wilshire 5000 up 0.90%

- 82.4% of S&P 500 stocks were up today, with 76.0% of stocks above their 200-day moving average (DMA) and 59.2% above their 50-DMA

- Top performing sectors in the S&P 500: technology up 1.30% and utilities up 1.22%

- Bottom performing sectors in the S&P 500: consumer staples up 0.18% and industrials up 0.24%

- The number of shares in the S&P 500 traded today was 526m for a total turnover of US$ 63 bn

- The S&P 500 Value Index was up 0.5%, while the S&P 500 Growth Index was up 1.1%; the S&P small caps index was up 1.6% and mid caps were up 1.2%

- The volume on CME's INX (S&P 500 Index) was 1.8m (3-month z-score: -0.6); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.33%; UK FTSE 100 up 0.41%; China's CSI 300 down -1.91%; Japan's TOPIX 500 down -0.88%

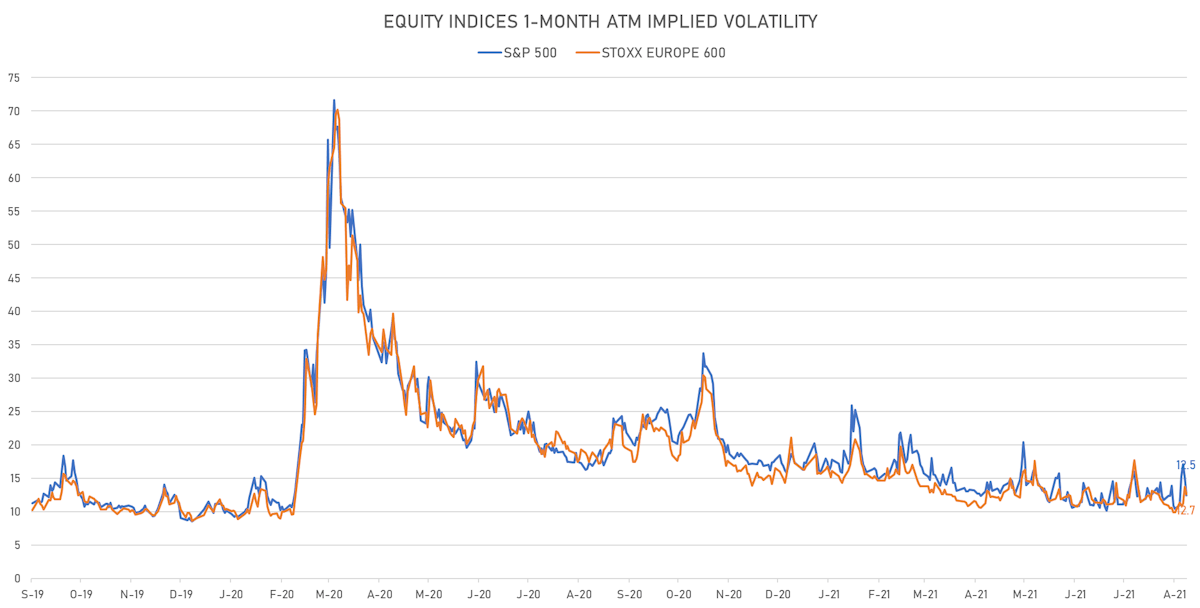

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 12.5%, down from 15.2%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 12.7%, down from 13.7%

NOTABLE S&P 500 EARNINGS RELEASES

- Deere & Co (Industrials): beat on EPS (5.32 act. vs. 4.58 est.) and beat on revenue (10,413m act. vs. 10,305m est.)

TOP WINNERS

- View Inc (VIEW), up 22.2% to $4.41 / YTD price return: -60.0% / 12-Month Price Range: $ 3.45-13.31

- Joby Aviation Inc (JOBY), up 17.1% to $9.93 / 12-Month Price Range: $ 8.25-17.00

- Amyris Inc (AMRS), up 15.3% to $13.99 / YTD price return: +126.6% / 12-Month Price Range: $ 1.88-23.42

- 360 DigiTech Inc (QFIN), up 15.1% to $19.45 / YTD price return: +65.0% / 12-Month Price Range: $ 9.67-45.00 / Short interest (% of float): 3.9%; days to cover: 1.0

- Full Truck Alliance Co Ltd (YMM), up 15.1% to $12.68 / 12-Month Price Range: $ 7.95-22.80 / Short interest (% of float): 0.9%; days to cover: 1.2

- Zhihu Inc (ZH), up 15.0% to $10.25 / 12-Month Price Range: $ 6.81-13.85 / Short interest (% of float): 0.7%; days to cover: 1.8

- Fulcrum Therapeutics Inc (FULC), up 13.1% to $25.67 / YTD price return: +119.2% / 12-Month Price Range: $ 6.85-26.89

- PBF Energy Inc (PBF), up 12.5% to $8.37 / YTD price return: +17.9% / 12-Month Price Range: $ 4.06-18.78

- Companhia de Saneamento Basico do Estado de Sao Paulo SABESP (SBS), up 12.1% to $6.78 / YTD price return: -21.1% / 12-Month Price Range: $ 5.76-9.48 / Short interest (% of float): 1.1%; days to cover: 2.8

- Allogene Therapeutics Inc (ALLO), up 11.6% to $23.45 / YTD price return: -7.1% / 12-Month Price Range: $ 20.58-44.92

BIGGEST LOSERS

- Fate Therapeutics Inc (FATE), down 21.7% to $67.01 / YTD price return: -26.3% / 12-Month Price Range: $ 29.37-121.16 (the stock is currently on the short sale restriction list)

- Century Therapeutics Inc (IPSC), down 12.8% to $26.30 / 12-Month Price Range: $ 18.93-32.90 (the stock is currently on the short sale restriction list)

- ProShares Ultra VIX Short-Term Futures ETF (UVXY), down 11.2% to $24.90 / YTD price return: -76.6% / 12-Month Price Range: $ 22.36-321.80 / Short interest (% of float): 15.9%; days to cover: 0.3 (the stock is currently on the short sale restriction list)

- Beigene Ltd (BGNE), down 9.4% to $249.60 / YTD price return: -3.4% / 12-Month Price Range: $ 219.20-388.97 / Short interest (% of float): 2.7%; days to cover: 7.6 (the stock is currently on the short sale restriction list)

- Blend Labs Inc (BLND), down 8.7% to $18.05 / 12-Month Price Range: $ 16.05-21.04 (the stock is currently on the short sale restriction list)

- Arco Platform Ltd (ARCE), down 8.3% to $24.08 / YTD price return: -32.1% / 12-Month Price Range: $ 23.19-50.40 / Short interest (% of float): 4.8%; days to cover: 5.5 (the stock is currently on the short sale restriction list)

- RLX Technology Inc (RLX), down 7.6% to $3.91 / 12-Month Price Range: $ 4.05-35.00 / Short interest (% of float): 3.8%; days to cover: 4.1

- Membership Collective Group Inc (MCG), down 7.3% to $9.97 / 12-Month Price Range: $ 9.56-14.26 (the stock is currently on the short sale restriction list)

- Gohealth Inc (GOCO), down 7.1% to $4.57 / 12-Month Price Range: $ 4.00-18.24

- Cyxtera Technologies Inc (CYXT), down 7.0% to $8.03 / 12-Month Price Range: $ 8.25-12.00

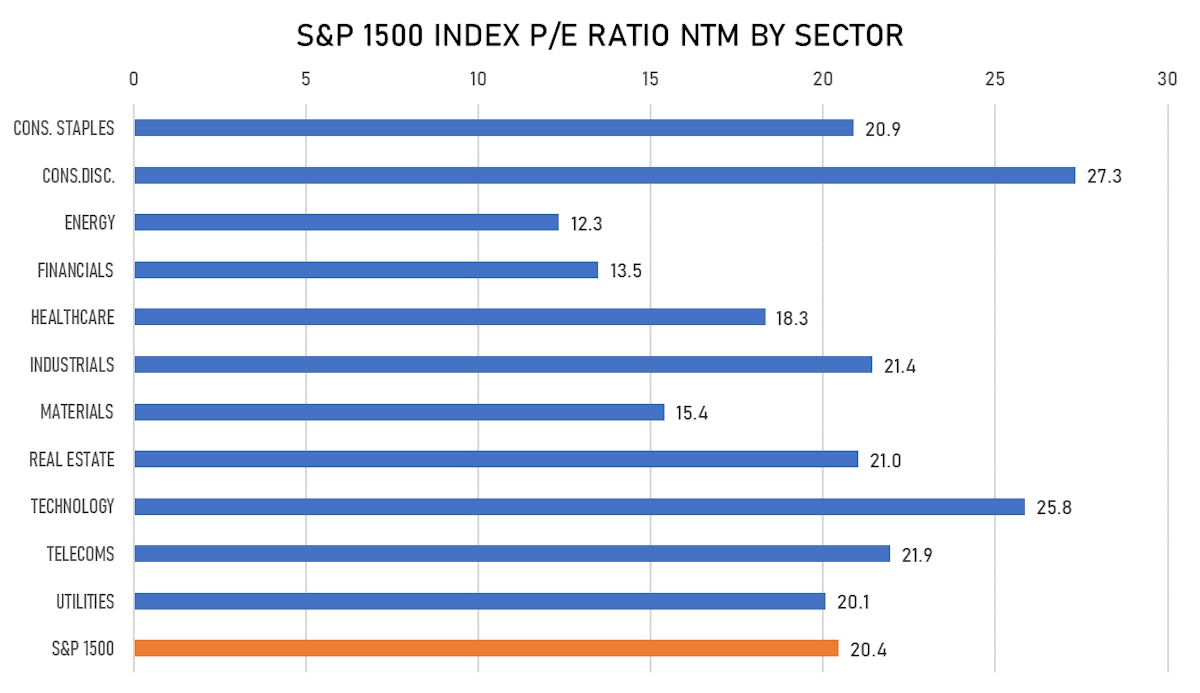

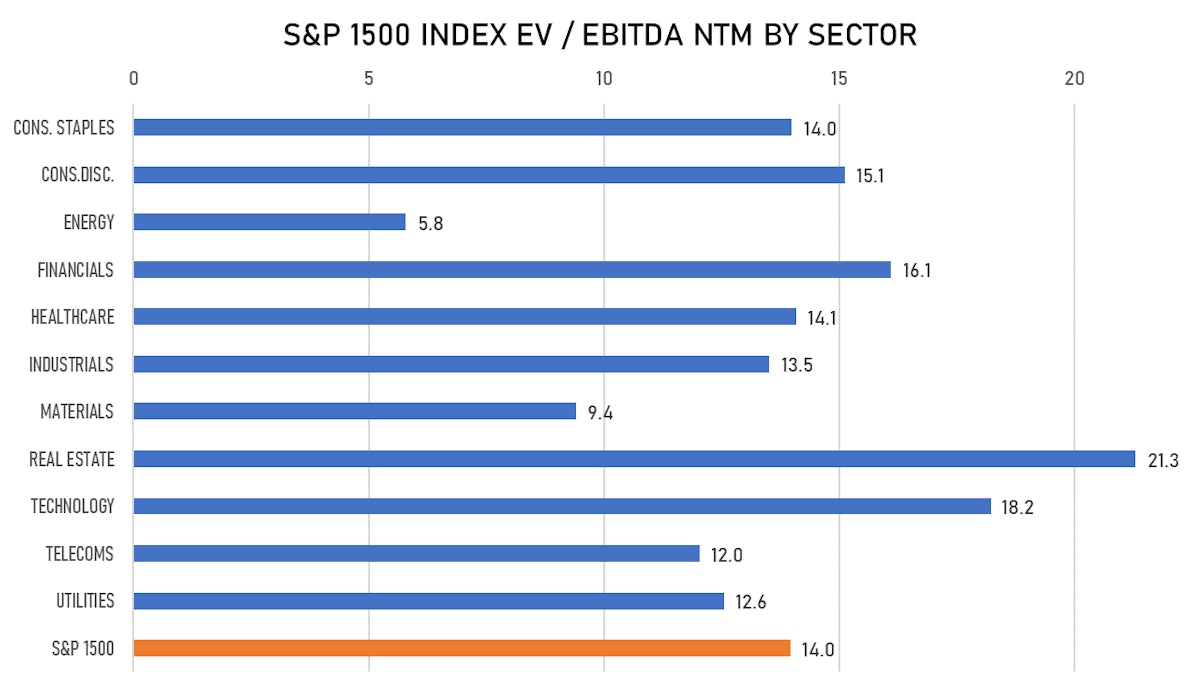

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- BurTech Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: BRKHU / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: EF Hutton & Co Inc

- Accretion Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: ENERU / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Stephens Inc, Earlybirdcapital Inc

- GLP Pet Ltd- China Logistics Singapore REIT / China - Real Estate / Listing Exchange: Singapore / Ticker: - / Gross proceeds (including overallotment): US$ 1,000.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Infervision Medical Technology Co Ltd / China - High Technology / Listing Exchange: Hong Kong / Ticker: - / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Simplex Holdings Inc / Japan - High Technology / Listing Exchange: Tokyo 1 / Ticker: 4373 / Gross proceeds (including overallotment): US$ 152.99m (offering in Japanese Yen) / Bookrunners: Mizuho International PLC, SMBC Nikko Capital Markets

- PT Cemindo Gemilang Tbk / Indonesia - Materials / Listing Exchange: Indonesia / Ticker: N/A / Gross proceeds (including overallotment): US$ 132.41m (offering in U.S. Dollar) / Bookrunners: Ciptadana Securities, PT Mandiri Sekuritas, UBS Securities Indonesia PT

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Aemetis Inc / United States of America - Materials / Listing Exchange: Nasdaq / Ticker: AEBF / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Aavas Financiers Ltd / India - Financials / Listing Exchange: National / Ticker: AAVAS / Gross proceeds (including overallotment): US$ 112.16m (offering in Indian Rupee) / Bookrunners: Citigroup