Equities

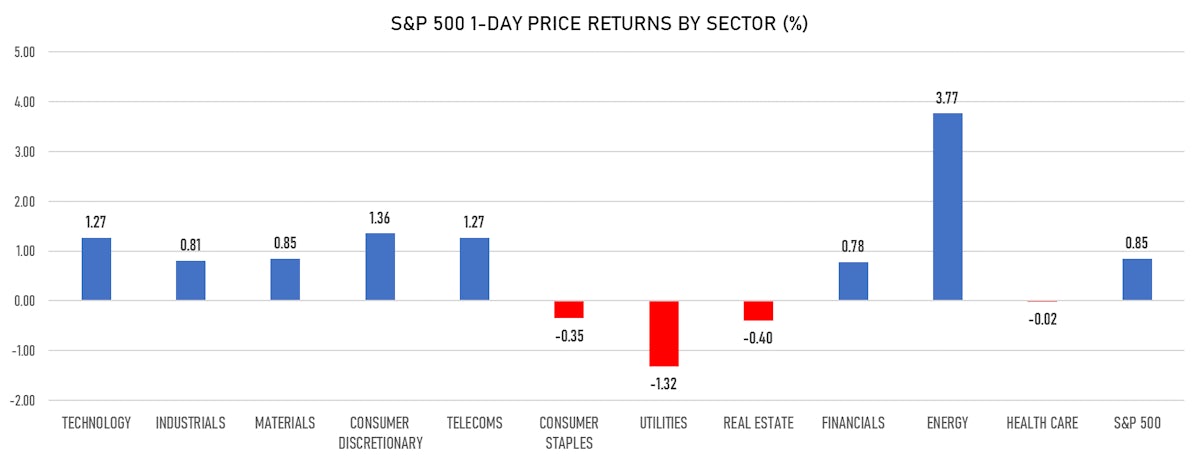

US Equity Indices Rise, With The Energy Sector Up Nearly 4% Today

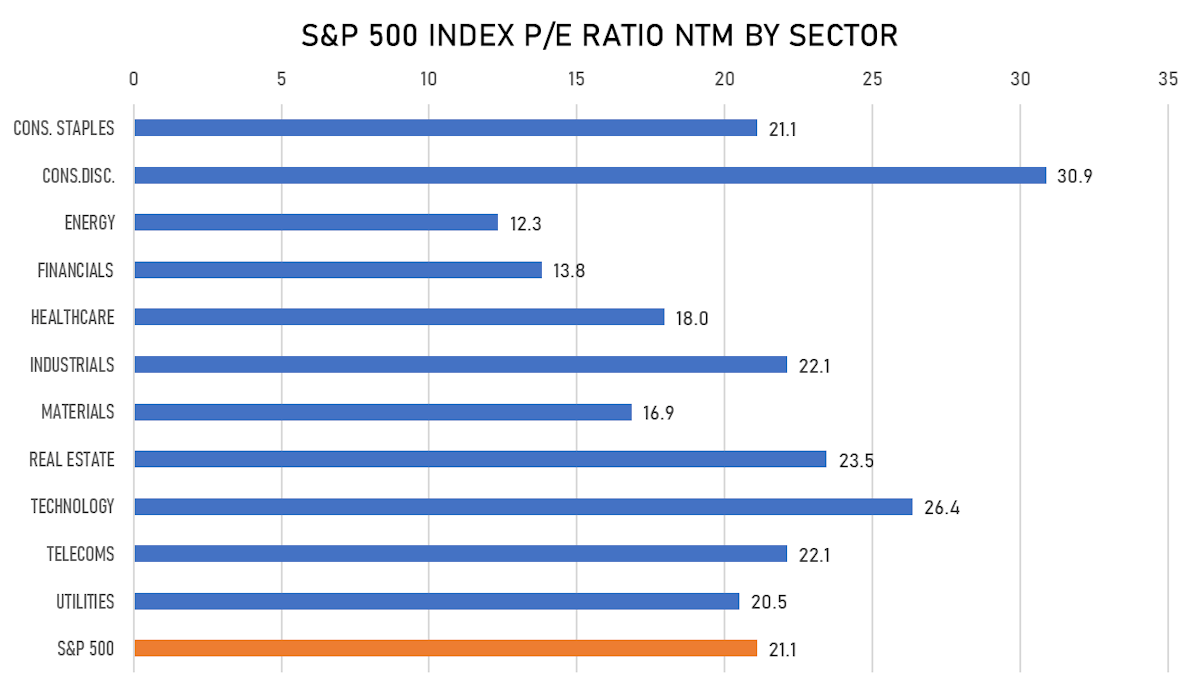

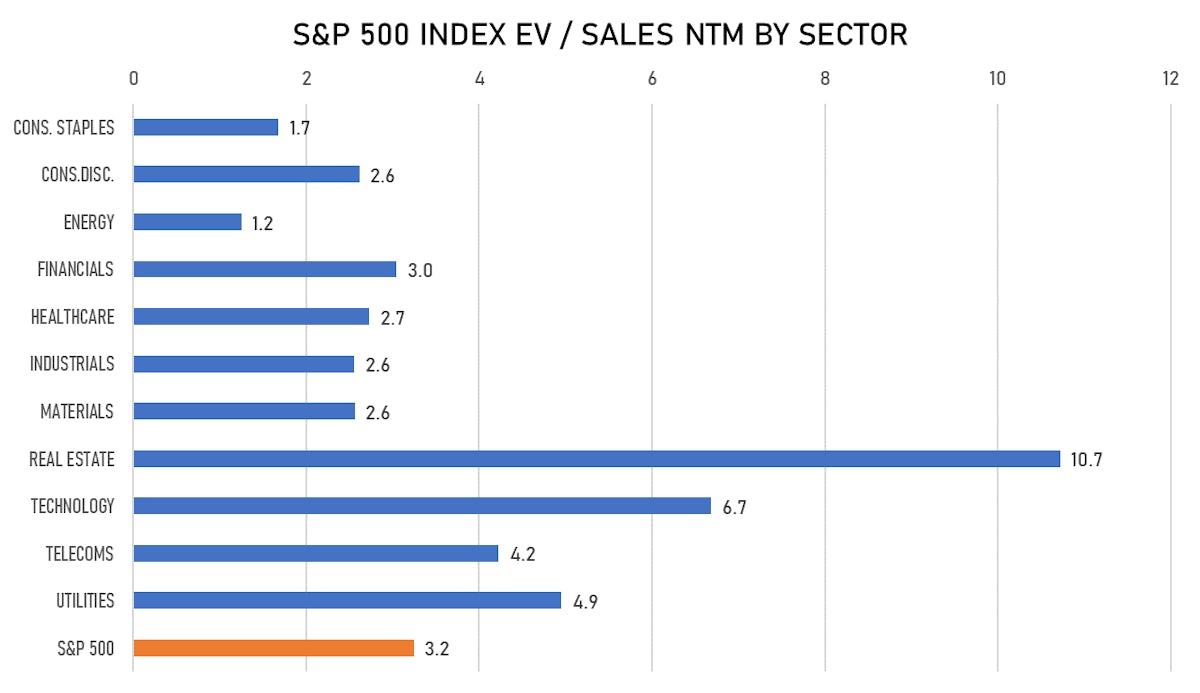

New record levels for equity indices have come from higher earnings, as valuation multiples have declined this year after a strong recovery in 2020

Published ET

S&P 1500 Forward Valuation Multiples Over Time | Source; FactSet

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.85%; Nasdaq Composite up 1.55%; Wilshire 5000 up 1.03%

- 69.7% of S&P 500 stocks were up today, with 79.4% of stocks above their 200-day moving average (DMA) and 62.2% above their 50-DMA

- Top performing sectors in the S&P 500: energy up 3.77% and consumer discretionary up 1.36%

- Bottom performing sectors in the S&P 500: utilities down -1.32% and real estate down -0.40%

- The number of shares in the S&P 500 traded today was 476m for a total turnover of US$ 59 bn

- The S&P 500 Value Index was up 0.6%, while the S&P 500 Growth Index was up 1.1%; the S&P small caps index was up 1.2% and mid caps were up 0.9%

- The volume on CME's INX (S&P 500 Index) was 1.9m (3-month z-score: -0.5); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.66%; UK FTSE 100 up 0.30%; tonight in Asia, China's CSI 300 up 0.62% and Japan's TOPIX 500 up 1.00%

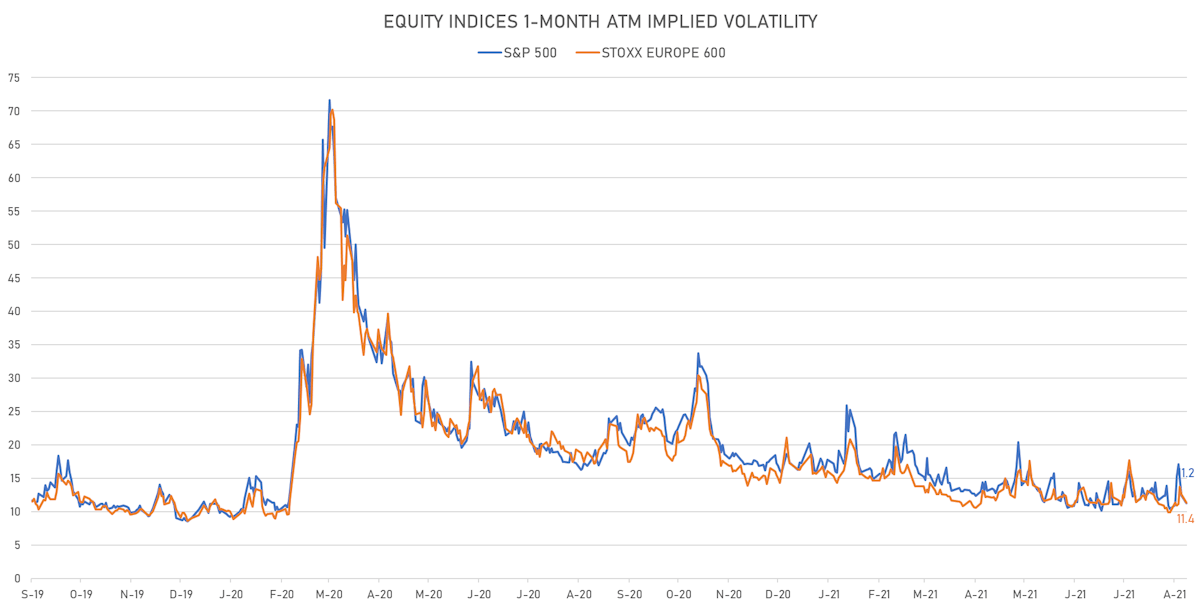

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 11.2%, down from 12.5%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.4%, down from 12.7%

TOP WINNERS

- Trillium Therapeutics Inc (TRIL), up 188.8% to $17.59 / YTD price return: +19.6% / 12-Month Price Range: $ 5.80-20.96 / Short interest (% of float): 6.3%; days to cover: 4.8

- Canoo Inc (GOEV), up 31.8% to $7.79 / YTD price return: -43.6% / 12-Month Price Range: $ 5.75-24.90

- Icosavax Inc (ICVX), up 16.3% to $40.25 / 12-Month Price Range: $ 21.70-49.99

- Madison Square Garden Entertainment Corp (MSGE), up 16.2% to $72.55 / YTD price return: -30.9% / 12-Month Price Range: $ 60.26-121.42 / Short interest (% of float): 6.9%; days to cover: 4.2

- ALX Oncology Holdings Inc (ALXO), up 16.1% to $72.64 / YTD price return: -15.7% / 12-Month Price Range: $ 32.51-117.45

- Singular Genomics Systems Inc (OMIC), up 16.0% to $16.59 / 12-Month Price Range: $ 13.28-33.37 / Short interest (% of float): 0.6%; days to cover: 2.9

- Huaneng Power International Inc (HNP), up 16.0% to $19.16 / 12-Month Price Range: $ 12.79-18.93 / Short interest (% of float): 0.2%; days to cover: 4.2

- Nuvation Bio Inc (NUVB), up 15.9% to $9.32 / YTD price return: -20.3% / 12-Month Price Range: $ 7.66-15.23 / Short interest (% of float): 3.6%; days to cover: 7.5

- Velodyne Lidar Inc (VLDR), up 15.9% to $7.15 / YTD price return: -68.7% / 12-Month Price Range: $ 6.12-32.50 / Short interest (% of float): 18.0%; days to cover: 5.4

- TuSimple Holdings Inc (TSP), up 14.8% to $39.04 / 12-Month Price Range: $ 27.24-79.84 / Short interest (% of float): 5.4%; days to cover: 5.1

BIGGEST LOSERS

- MarketWise Inc (MKTW), down 16.7% to $6.79 / 12-Month Price Range: $ 6.79-16.97 / Short interest (% of float): 4.8%; days to cover: 2.2 (the stock is currently on the short sale restriction list)

- Evolv Technologies Holdings Inc (EVLV), down 10.2% to $8.08 / 12-Month Price Range: $ 7.22-12.90 / Short interest (% of float): 1.5%; days to cover: 4.9 (the stock is currently on the short sale restriction list)

- Century Therapeutics Inc (IPSC), down 8.5% to $24.06 / 12-Month Price Range: $ 18.93-32.90 / Short interest (% of float): 2.7%; days to cover: 3.8

- Zhihu Inc (ZH), down 8.1% to $9.42 / 12-Month Price Range: $ 6.81-13.85 / Short interest (% of float): 0.7%; days to cover: 1.8 (the stock is currently on the short sale restriction list)

- New Oriental Education & Technology Group Inc (EDU), down 6.6% to $1.70 / YTD price return: -90.9% / 12-Month Price Range: $ 1.74-19.97 / Short interest (% of float): 3.1%; days to cover: 0.5

- TAL Education Group (TAL), down 6.4% to $4.80 / YTD price return: -93.3% / 12-Month Price Range: $ 4.03-90.96 / Short interest (% of float): 7.0%; days to cover: 0.7 (the stock is currently on the short sale restriction list)

- Ree Automotive Holding Inc (REE), down 5.8% to $9.07 / 12-Month Price Range: $ 7.81-16.66

- Beachbody Company Inc (BODY), down 5.3% to $7.50 / 12-Month Price Range: $ 6.88-18.20

- ThredUp Inc (TDUP), down 5.3% to $21.29 / 12-Month Price Range: $ 14.23-31.86 / Short interest (% of float): 24.4%; days to cover: 10.2

- Owlet Inc (OWLT), down 5.1% to $9.16 / 12-Month Price Range: $ 7.76-11.56 / Short interest (% of float): 0.8%; days to cover: 2.0

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Acotec Scientific Holdings Ltd / China - Healthcare / Listing Exchange: Hong Kong / Ticker: 6669 / Gross proceeds (including overallotment): US$ 104.84m (offering in Hong Kong Dollar) / Bookrunners: Morgan Stanley Asia Ltd (HK), China Merchants Securities (HK) Co Ltd, China International Capital Corp HK Securities Ltd, Valuable Capital Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Showa Denko KK / Japan - Materials / Listing Exchange: Tokyo 1 / Ticker: 4004 / Gross proceeds (including overallotment): US$ 425.04m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd, Mizuho Securities Co Ltd, Mitsubishi UFJ Morgan Stanley Securities Co Ltd

- Takara Leben Real Estate Investment Corp / Japan - Real Estate / Listing Exchange: Tokyo / Ticker: 3492 / Gross proceeds (including overallotment): US$ 120.71m (offering in Japanese Yen) / Bookrunners: Mizuho Securities Co Ltd, SMBC Nikko Securities Inc