Equities

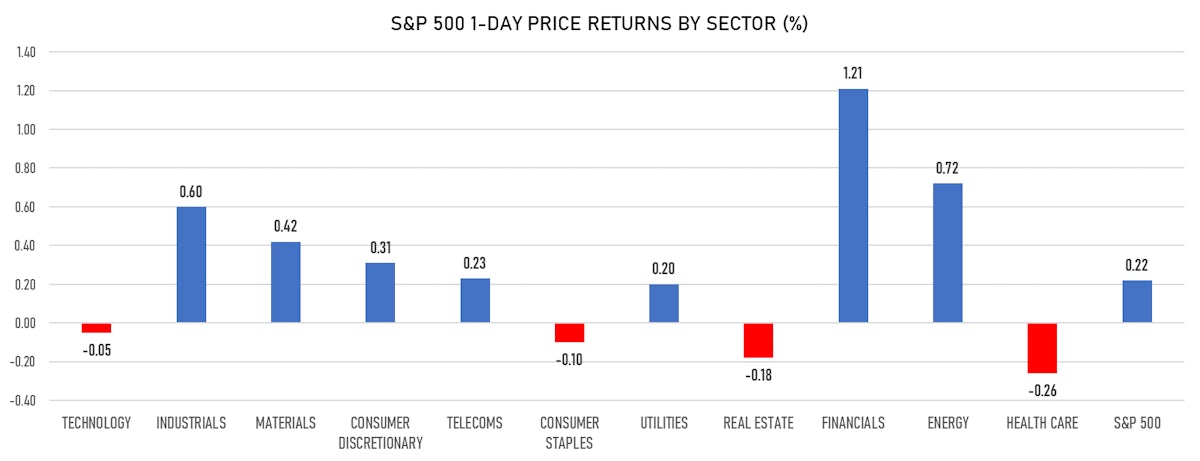

Broad Gains In Low-Volume Session, Financials Top-Performing Sector

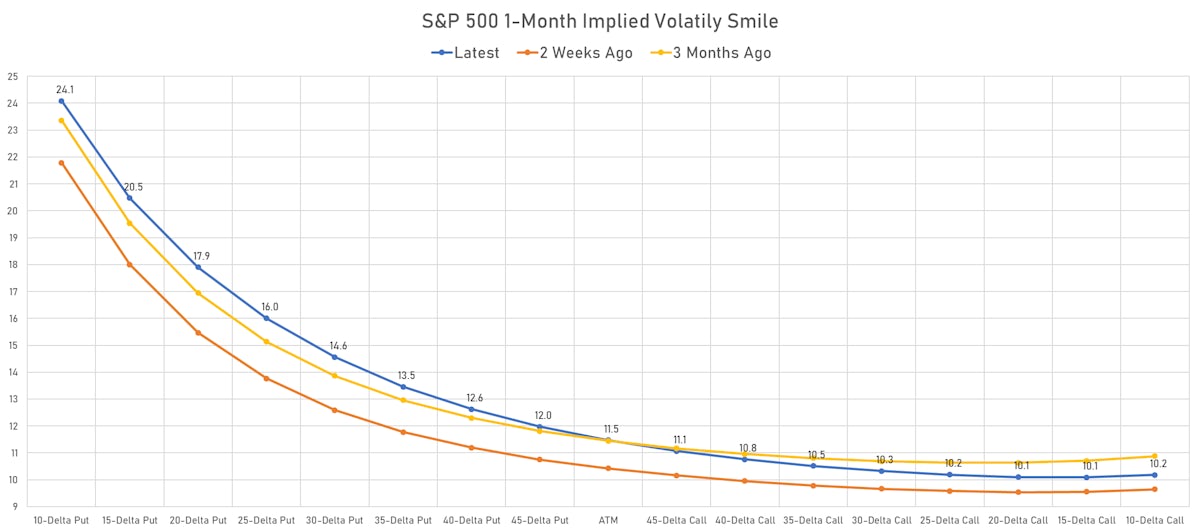

The significant amount of downside hedging, seen in the skewness of implied volatilities, indicates that the pain trade is likely still for prices to move higher

Published ET

S&P 500 Options Still Showing Strong Downside Skewness | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.22%; Nasdaq Composite up 0.15%; Wilshire 5000 up 0.26%

- 71.3% of S&P 500 stocks were up today, with 82.8% of stocks above their 200-day moving average (DMA) and 68.1% above their 50-DMA

- Top performing sectors in the S&P 500: financials up 1.21% and energy up 0.72%

- Bottom performing sectors in the S&P 500: health care down -0.26% and real estate down -0.18%

- The number of shares in the S&P 500 traded today was 493m for a total turnover of US$ 55 bn

- The S&P 500 Value Index was up 0.4%, while the S&P 500 Growth Index was up 0.1%; the S&P small caps index was up 0.4% and mid caps were up 0.6%

- The volume on CME's INX (S&P 500 Index) was 1.8m (3-month z-score: -0.7); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.01%; UK FTSE 100 up 0.34%; tonight in Asia, China's CSI 300 down -1.21%, Japan's TOPIX 500 down -0.26%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 11.5%, up from 11.4%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.2%, down from 11.4%

NOTABLE S&P 500 EARNINGS RELEASES

- Salesforce.com Inc (CRM | Technology): beat on EPS (1.48 act. vs. 0.92 est.) and beat on revenue (6,340m act. vs. 6,237m est.), up +0.46% today

- Autodesk Inc (ADSK | Technology): beat on EPS (1.21 act. vs. 1.13 est.) and beat on revenue (1,060m act. vs. 1,055m est.), up +0.35% today

- Ulta Beauty Inc (ULTA | Consumer Cyclicals): beat on EPS (4.52 act. vs. 2.59 est.) and beat on revenue (1,967m act. vs. 1,764m est.), up +4.29% today

- NetApp Inc (NTAP | Technology): beat on EPS (1.15 act. vs. 0.95 est.) and beat on revenue (1,458m act. vs. 1,433m est.), up +1.84% today

TOP WINNERS

- BioLife Solutions Inc (BLFS), up 19.6% to $55.61 / YTD price return: +39.4% / 12-Month Price Range: $ 19.80-50.45

- Olo Inc (OLO), up 17.7% to $45.16 / 12-Month Price Range: $ 22.88-44.89

- Couchbase Inc (BASE), up 15.0% to $49.15 / 12-Month Price Range: $ 28.00-43.98 / Short interest (% of float): 0.3%; days to cover: 0.2

- Zymergen Inc (ZY), up 14.4% to $12.96 / 12-Month Price Range: $ 7.85-52.00

- DICK'S Sporting Goods Inc (DKS), up 13.3% to $129.60 / YTD price return: +130.6% / 12-Month Price Range: $ 45.57-116.20 / Short interest (% of float): 15.2%; days to cover: 7.3

- 21Vianet Group Inc (VNET), up 11.6% to $20.32 / YTD price return: -41.4% / 12-Month Price Range: $ 14.11-44.45 / Short interest (% of float): 4.1%; days to cover: 2.4

- RMR Group Inc (RMR), up 11.4% to $44.30 / YTD price return: +14.7% / 12-Month Price Range: $ 25.10-44.16

- Ironsource Ltd (IS), up 10.1% to $10.54 / 12-Month Price Range: $ 7.80-13.19 / Short interest (% of float): 1.9%; days to cover: 8.5

- Golden Entertainment Inc (GDEN), up 9.7% to $53.42 / 12-Month Price Range: $ 12.01-54.86

- SkyWest Inc (SKYW), up 9.1% to $47.95 / YTD price return: +19.0% / 12-Month Price Range: $ 27.44-61.16

BIGGEST LOSERS

- Cassava Sciences Inc (SAVA), down 31.4% to $80.86 / YTD price return: +1,085.6% / 12-Month Price Range: $ 2.78-146.16 (the stock is currently on the short sale restriction list)

- Nordstrom Inc (JWN), down 17.6% to $31.14 / YTD price return: -.2% / 12-Month Price Range: $ 11.72-46.45 / Short interest (% of float): 17.7%; days to cover: 6.7 (the stock is currently on the short sale restriction list)

- Lexinfintech Holdings Ltd (LX), down 13.4% to $6.97 / YTD price return: +4.0% / 12-Month Price Range: $ 6.04-15.42 / Short interest (% of float): 1.5%; days to cover: 1.2 (the stock is currently on the short sale restriction list)

- Absci Corp (ABSI), down 12.2% to $19.85 / 12-Month Price Range: $ 19.03-31.53 (the stock is currently on the short sale restriction list)

- Wheels Up Experience Inc (UP), down 12.0% to $6.97 / 12-Month Price Range: $ 7.10-15.00 (the stock is currently on the short sale restriction list)

- Torrid Holdings Inc (CURV), down 10.1% to $28.00 / 12-Month Price Range: $ 21.63-33.19 (the stock is currently on the short sale restriction list)

- Cullinan Oncology Inc (CGEM), down 9.9% to $26.73 / 12-Month Price Range: $ 22.59-59.85 (the stock is currently on the short sale restriction list)

- Vector Acquisition Corp (RKLB), down 9.9% to $10.43 / YTD price return: +3.2% / 12-Month Price Range: $ 9.72-15.15 (the stock is currently on the short sale restriction list)

- Urban Outfitters Inc (URBN), down 9.5% to $36.86 / YTD price return: +44.0% / 12-Month Price Range: $ 19.67-42.10 (the stock is currently on the short sale restriction list)

- Waterdrop Inc (WDH), down 9.2% to $3.47 / 12-Month Price Range: $ 3.30-11.77 / Short interest (% of float): 0.0%; days to cover: 0.4

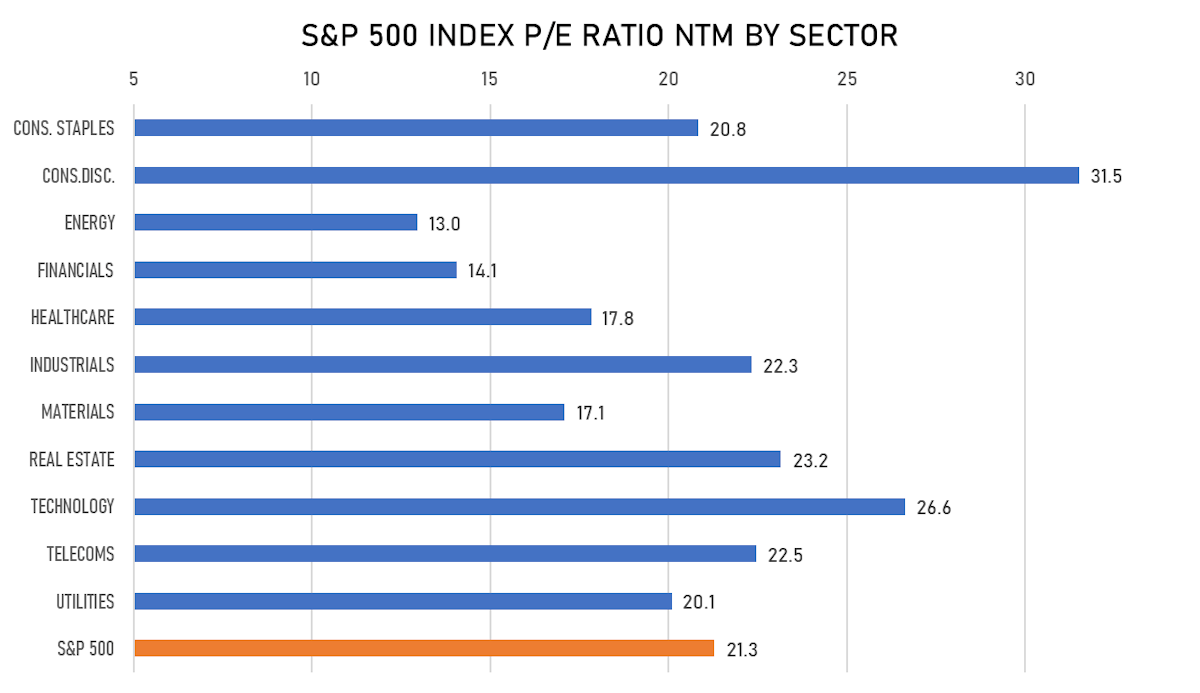

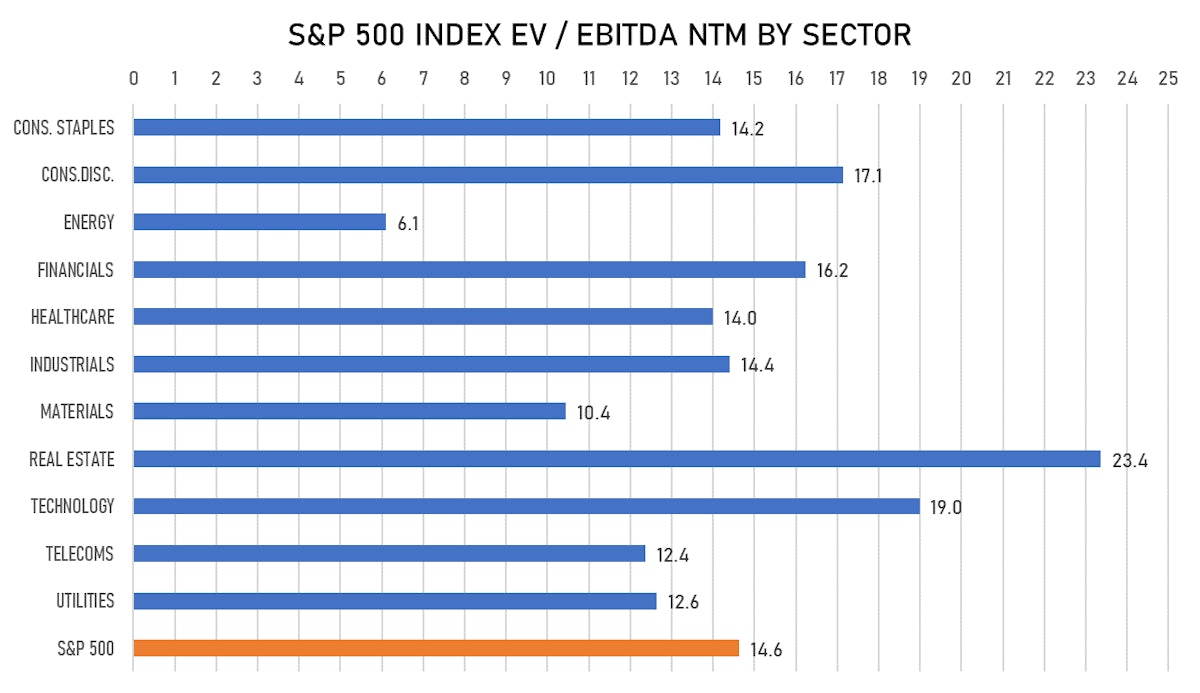

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- ILJIN Hysolus Co Ltd / South Korea - Industrials / Listing Exchange: Korea / Ticker: N/A / Gross proceeds (including overallotment): US$ 175.75m (offering in Korean Won) / Bookrunners: Daishin Securities Co Ltd, Samsung Securities Co Ltd, Mirae Asset Daewoo Co Ltd, Hyundai Motor Securities Co Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Mister Car Wash Inc / United States of America - Industrials / Listing Exchange: New York / Ticker: MCW / Gross proceeds (including overallotment): US$ 234.84m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC

- Industrial Securities Co Ltd / China - Financials / Listing Exchange: Shanghai / Ticker: 601377 / Gross proceeds (including overallotment): US$ 1,725.06m (offering in Chinese Yuan) / Bookrunners: Not Applicable