Equities

Small, Low-Volume Drop In US Stocks After 5 Straight Days Of Gains

Growth is doing better than value this year, despite a period of underperformance from February to May (the value index has gone sideways since May)

Published ET

S&P 500 Growth Index vs. Value Index Year To Date | Source: Refinitiv

QUICK SUMMARY

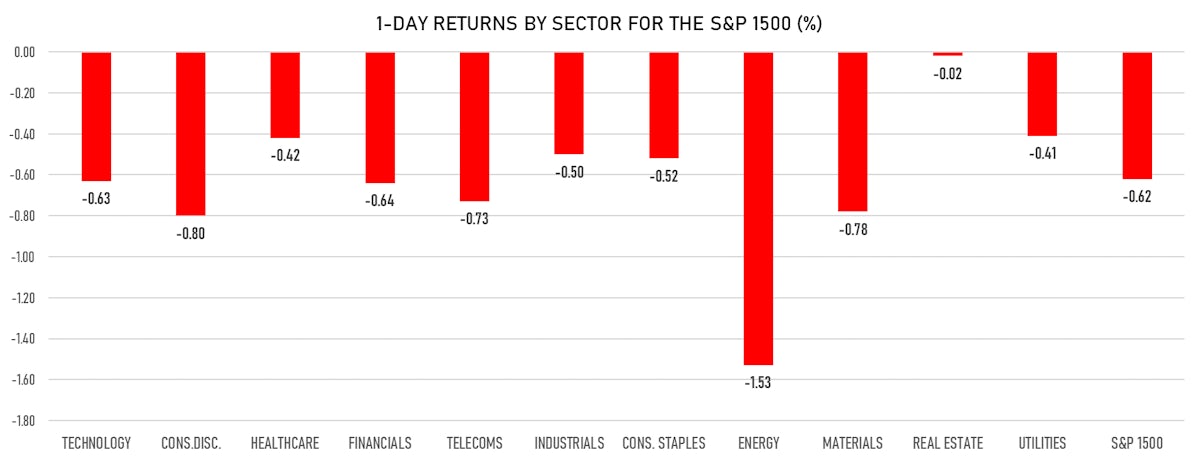

- Daily performance of US indices: S&P 500 down -0.58%; Nasdaq Composite down -0.64%; Wilshire 5000 down -0.65%

- 20.2% of S&P 500 stocks were up today, with 78.8% of stocks above their 200-day moving average (DMA) and 63.0% above their 50-DMA

- Top performing sectors in the S&P 500: real estate up 0.10% and utilities down -0.35%

- Bottom performing sectors in the S&P 500: energy down -1.51% and consumer discretionary down -0.73%

- The number of shares in the S&P 500 traded today was 419m for a total turnover of US$ 49 bn

- The S&P 500 Value Index was down -0.7%, while the S&P 500 Growth Index was down -0.5%; the S&P small caps index was down -1.2% and mid caps were down -0.9%

- The volume on CME's INX (S&P 500 Index) was 1.6m (3-month z-score: -1.1); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -0.32%; UK FTSE 100 down -0.35%; tonight in Asia, China's CSI 300 up 0.24%; tonight in Asia, Japan's TOPIX 500 down -0.34%

VOLATILITY

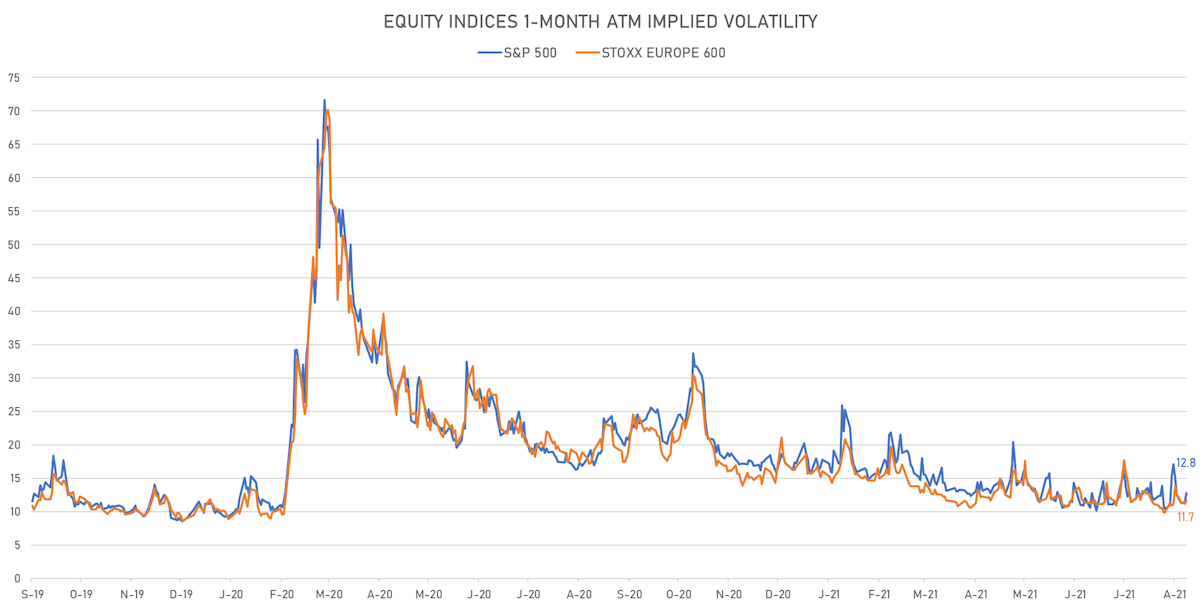

- 1-month at-the-money implied volatility on the S&P 500 at 12.8%, up from 11.5%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.7%, up from 11.2%

NOTABLE S&P 500 EARNINGS RELEASES

- Dollar General Corp (DG | Consumer Cyclicals): beat on EPS (2.69 act. vs. 2.59 est.) and beat on revenue (8,650m act. vs. 8,613m est.), down -3.77% today

- HP Inc (HPQ | Technology): beat on EPS (1.00 act. vs. 0.84 est.) and missed on revenue (15,289m act. vs. 15,920m est.), down -0.99% today

- Dollar Tree Inc (DLTR | Consumer Cyclicals): beat on EPS (1.23 act. vs. 1.00 est.) and missed on revenue (6,340m act. vs. 6,445m est.), down -12.08% today

- J M Smucker Co (SJM | Consumer Non-Cyclicals): beat on EPS (1.90 act. vs. 1.86 est.) and beat on revenue (1,858m act. vs. 1,795m est.), down -2.64% today

- Gap Inc (GPS | Consumer Cyclicals): beat on EPS (0.70 act. vs. 0.46 est.) and beat on revenue (4,211m act. vs. 4,132m est.), down -4.11% today

TOP WINNERS

- Ascendis Pharma A/S (ASND), up 21.1% to $149.70 / YTD price return: -10.2% / 12-Month Price Range: $ 109.36-183.98 / Short interest (% of float): 5.3%; days to cover: 15.3

- BeyondSpring Inc (BYSI), up 18.7% to $29.96 / YTD price return: +145.6% / 12-Month Price Range: $ 8.90-30.01

- RLX Technology Inc (RLX), up 17.9% to $5.14 / 12-Month Price Range: $ 3.70-35.00 / Short interest (% of float): 2.9%; days to cover: 1.9

- Lordstown Motors Corp (RIDE), up 17.8% to $6.49 / YTD price return: -67.6% / 12-Month Price Range: $ 4.77-31.80

- AST SpaceMobile Inc (ASTS), up 17.4% to $11.08 / YTD price return: -18.4% / 12-Month Price Range: $ 6.96-25.37

- Coty Inc (COTY), up 14.7% to $9.44 / YTD price return: +34.5% / 12-Month Price Range: $ 2.65-10.49

- Pure Storage Inc (PSTG), up 13.8% to $23.84 / YTD price return: +5.4% / 12-Month Price Range: $ 13.91-29.53

- ADC Therapeutics SA (ADCT), up 10.2% to $28.50 / YTD price return: -11.0% / 12-Month Price Range: $ 20.01-46.61 / Short interest (% of float): 15.4%; days to cover: 21.0

- Cortexyme Inc (CRTX), up 9.9% to $102.11 / YTD price return: +267.6% / 12-Month Price Range: $ 26.66-121.98

- Williams-Sonoma Inc (WSM), up 9.3% to $186.68 / YTD price return: +83.3% / 12-Month Price Range: $ 81.77-194.69 / Short interest (% of float): 8.3%; days to cover: 7.4

BIGGEST LOSERS

- SelectQuote Inc (SLQT), down 45.0% to $7.89 / YTD price return: -62.0% / 12-Month Price Range: $ 13.00-33.00 (the stock is currently on the short sale restriction list)

- D Market Elektronik Hizmetler ve Ticaret AS (HEPS), down 25.4% to $8.97 / 12-Month Price Range: $ 11.08-15.23 / Short interest days to cover: 0.2 (the stock is currently on the short sale restriction list)

- Yatsen Holding Ltd (YSG), down 17.6% to $4.81 / YTD price return: -71.7% / 12-Month Price Range: $ 5.26-25.47 (the stock is currently on the short sale restriction list)

- Couchbase Inc (BASE), down 14.5% to $42.01 / 12-Month Price Range: $ 28.00-50.33 / Short interest (% of float): 0.3%; days to cover: 0.2 (the stock is currently on the short sale restriction list)

- Doximity Inc (DOCS), down 12.8% to $80.26 / 12-Month Price Range: $ 41.17-95.97 (the stock is currently on the short sale restriction list)

- Cassava Sciences Inc (SAVA), down 12.4% to $70.85 / YTD price return: +938.9% / 12-Month Price Range: $ 2.78-146.16 / Short interest (% of float): 10.7%; days to cover: 0.9 (the stock is currently on the short sale restriction list)

- Dollar Tree Inc (DLTR), down 12.1% to $93.48 / YTD price return: -13.5% / 12-Month Price Range: $ 84.41-120.37 (the stock is currently on the short sale restriction list)

- Abercrombie & Fitch Co (ANF), down 10.4% to $35.68 / YTD price return: +75.2% / 12-Month Price Range: $ 10.96-47.29 / Short interest (% of float): 9.0%; days to cover: 3.3 (the stock is currently on the short sale restriction list)

- Autodesk Inc (ADSK), down 9.4% to $310.19 / YTD price return: +1.6% / 12-Month Price Range: $ 215.83-344.39 / Short interest (% of float): 0.8%; days to cover: 1.5 (the stock is currently on the short sale restriction list)

- Quanterix Corp (QTRX), down 9.2% to $45.96 / YTD price return: -1.2% / 12-Month Price Range: $ 29.72-92.57 (the stock is currently on the short sale restriction list)

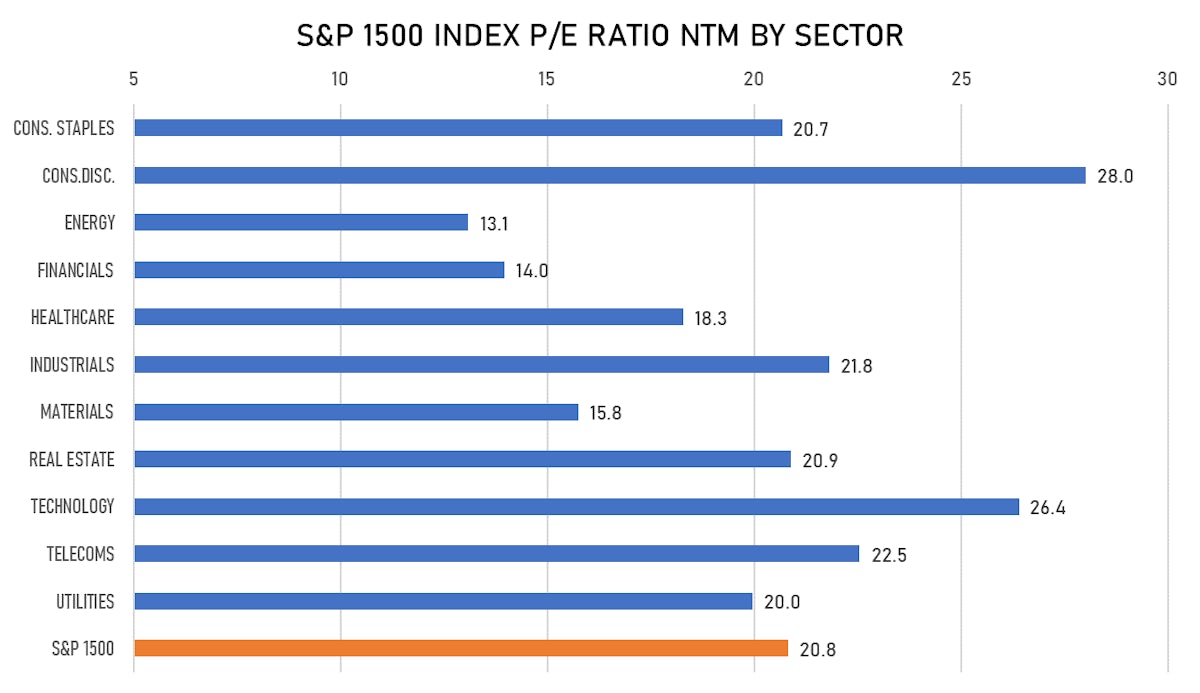

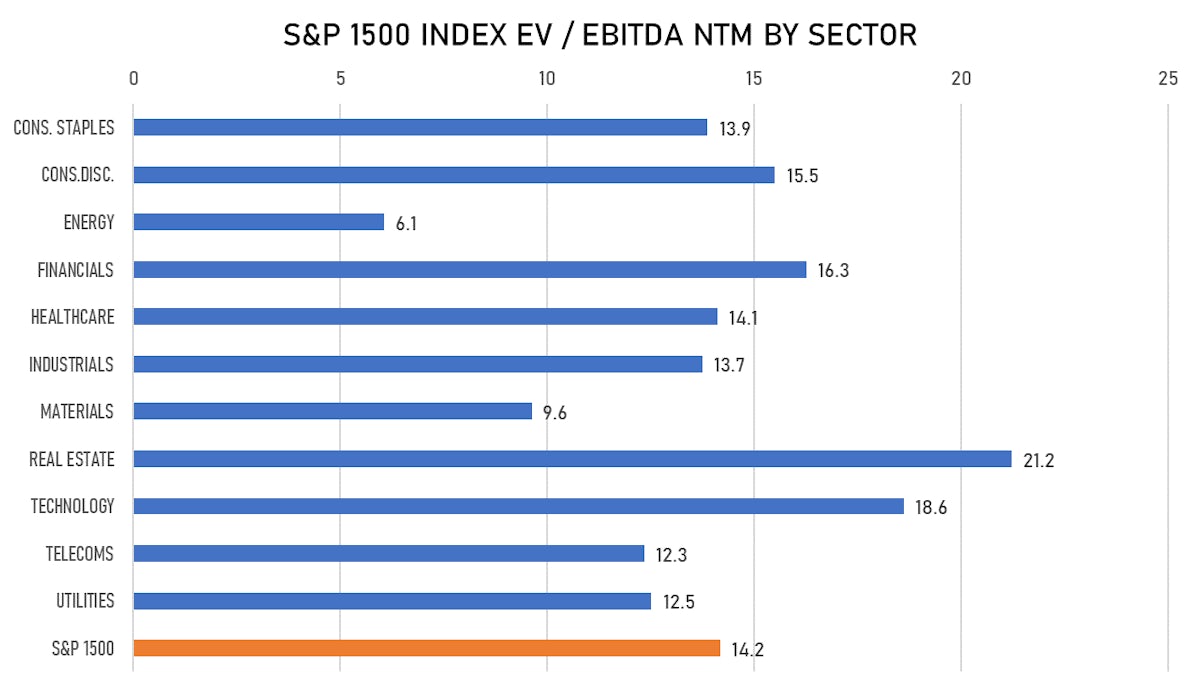

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Springwater Special Situations Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: SWSSU / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Earlybirdcapital Inc

- Cascadia Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: CCAIU / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Cantor Fitzgerald & Co

- HHC Changzhou Corp / China - Retail / Listing Exchange: ShenzChNxt / Ticker: 301061 / Gross proceeds (including overallotment): US$ 224.50m (offering in Chinese Yuan) / Bookrunners: China Securities Co Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Chartwell Retirement Residences / Canada - Real Estate / Listing Exchange: Toronto / Ticker: CSH.UN / Gross proceeds (including overallotment): US$ 159.96m (offering in Canadian Dollar) / Bookrunners: CIBC World Markets Inc, RBC Capital Markets, BMO Capital Markets

- IDP Education Ltd / Australia - Consumer Products and Services / Listing Exchange: Australia / Ticker: IEL / Gross proceeds (including overallotment): US$ 843.63m (offering in Australian Dollar) / Bookrunners: Goldman Sachs & Co, Macquarie Group