Equities

Equity Indices At New All-Time Highs As Fed Chair Shoots Down Hawks

Powell's Jackson Hole speech encourages investors to chase risky assets, with small caps up almost 3% today

Published ET

FactSet Country Indices YTD Performance | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.88%; Nasdaq Composite up 1.23%; Wilshire 5000 up 1.07%

- 87.1% of S&P 500 stocks were up today, with 81.8% of stocks above their 200-day moving average (DMA) and 69.9% above their 50-DMA

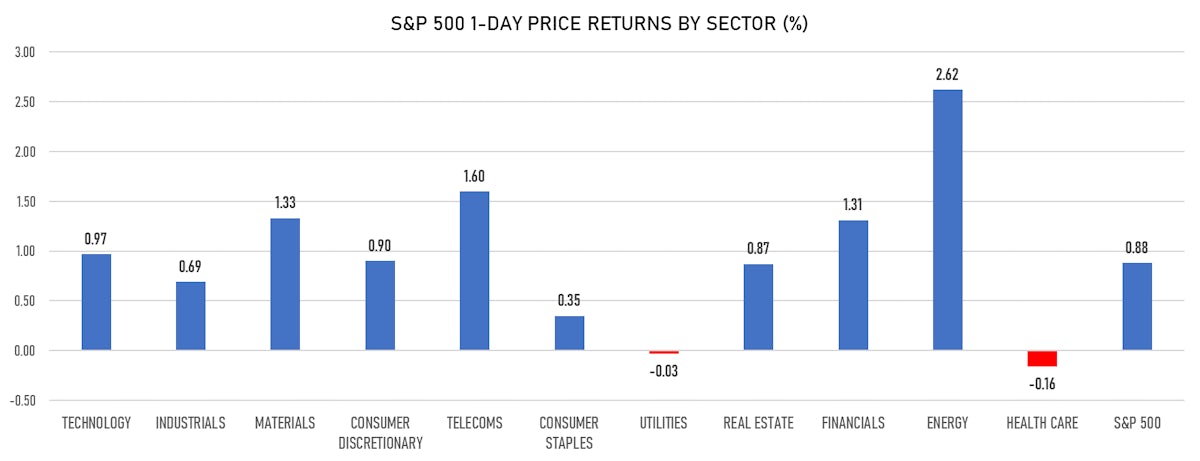

- Top performing sectors in the S&P 500: energy up 2.62% and telecoms up 1.60%

- Bottom performing sectors in the S&P 500: healthcare down -0.16% and utilities down -0.03%

- The number of shares in the S&P 500 traded today was 433m for a total turnover of US$ 54 bn

- The S&P 500 Value Index was up 0.8%, while the S&P 500 Growth Index was up 0.9%; the S&P small caps index was up 2.9% and mid caps were up 1.9%

- The volume on CME's INX (S&P 500 Index) was 1.7m (3-month z-score: -0.9); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.43%; UK FTSE 100 up 0.32%; China CSI 300 up 0.53%; Japan's TOPIX 500 down -0.36%

VOLATILITY

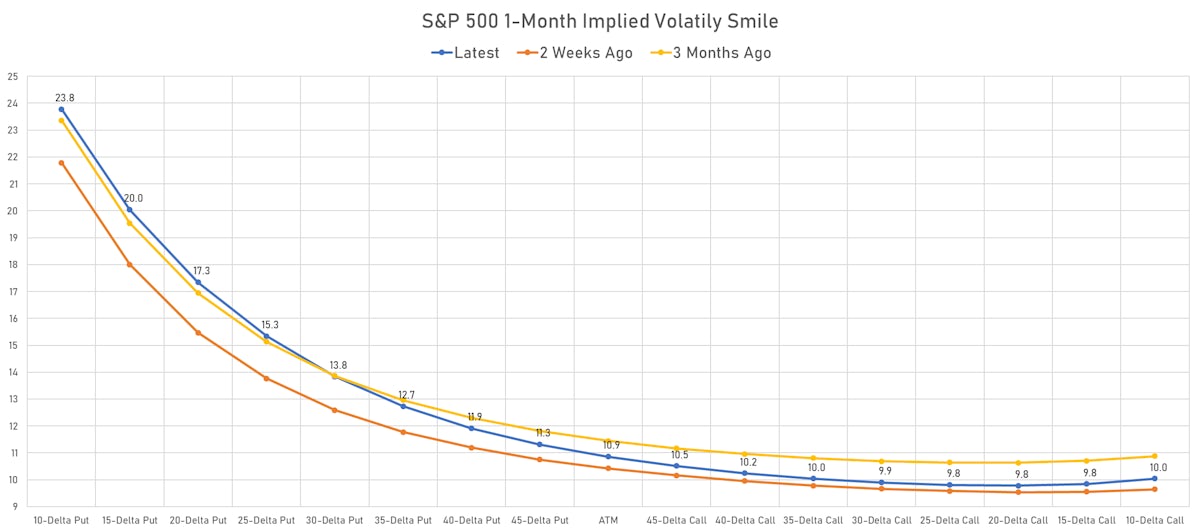

- 1-month at-the-money implied volatility on the S&P 500 at 10.9%, down from 12.8%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 10.9%, down from 11.7%

TOP WINNERS

- Bill.com Holdings Inc (BILL), up 29.6% to $283.98 / YTD price return: +108.0% / 12-Month Price Range: $ 82.19-222.79

- Meta Materials Inc (MMAT), up 19.4% to $4.13 / 12-Month Price Range: $ .42-21.76 / Short interest (% of float): 8.6%; days to cover: 1.0

- Mechel PAO (MTL_p), up 18.8% to $1.39 / 12-Month Price Range: $ .36-1.21 / Short interest days to cover: 0.1

- Hut 8 Mining Corp (HUT), up 14.8% to $7.74 / YTD price return: +181.5% / 12-Month Price Range: $ .59-13.00

- F45 Training Holdings Inc (FXLV), up 14.5% to $15.51 / 12-Month Price Range: $ 12.98-17.75

- Newegg Commerce Inc (NEGG), up 12.8% to $19.05 / 12-Month Price Range: $ 2.76-79.07

- MaxCyte Inc (MXCT), up 12.4% to $15.80 / 12-Month Price Range: $ 5.85-17.44 / Short interest (% of float): 0.1%; days to cover: 0.1

- Couchbase Inc (BASE), up 11.7% to $46.94 / 12-Month Price Range: $ 28.00-50.33 / Short interest (% of float): 0.3%; days to cover: 0.2

- Icosavax Inc (ICVX), up 11.7% to $39.59 / 12-Month Price Range: $ 21.70-49.99

- PBF Energy Inc (PBF), up 11.6% to $10.91 / YTD price return: +53.7% / 12-Month Price Range: $ 4.06-18.78

BIGGEST LOSERS

- Cassava Sciences Inc (SAVA), down 17.7% to $58.34 / YTD price return: +755.4% / 12-Month Price Range: $ 2.78-146.16 / Short interest (% of float): 10.7%; days to cover: 0.9 (the stock is currently on the short sale restriction list)

- Connect Biopharma Holdings Ltd (CNTB), down 11.1% to $18.12 / 12-Month Price Range: $ 14.02-29.27 / Short interest (% of float): 1.5%; days to cover: 12.5 (the stock is currently on the short sale restriction list)

- Weibo Corp (WB), down 10.7% to $48.68 / YTD price return: +18.8% / 12-Month Price Range: $ 32.51-64.70 / Short interest (% of float): 8.0%; days to cover: 5.4 (the stock is currently on the short sale restriction list)

- 21Vianet Group Inc (VNET), down 10.6% to $17.85 / YTD price return: -48.5% / 12-Month Price Range: $ 14.11-44.45 (the stock is currently on the short sale restriction list)

- GDS Holdings Ltd (GDS), down 9.8% to $51.20 / YTD price return: -45.3% / 12-Month Price Range: $ 49.18-116.76 (the stock is currently on the short sale restriction list)

- Hibbett Inc (HIBB), down 9.2% to $89.84 / 12-Month Price Range: $ 29.22-100.32 (the stock is currently on the short sale restriction list)

- Peloton Interactive Inc (PTON), down 8.5% to $104.34 / YTD price return: -31.2% / 12-Month Price Range: $ 68.06-171.09

- Domo Inc (DOMO), down 8.4% to $89.53 / 12-Month Price Range: $ 31.01-98.35 (the stock is currently on the short sale restriction list)

- Absci Corp (ABSI), down 8.2% to $19.80 / 12-Month Price Range: $ 19.03-31.53

- Torrid Holdings Inc (CURV), down 7.4% to $24.45 / 12-Month Price Range: $ 21.63-33.19

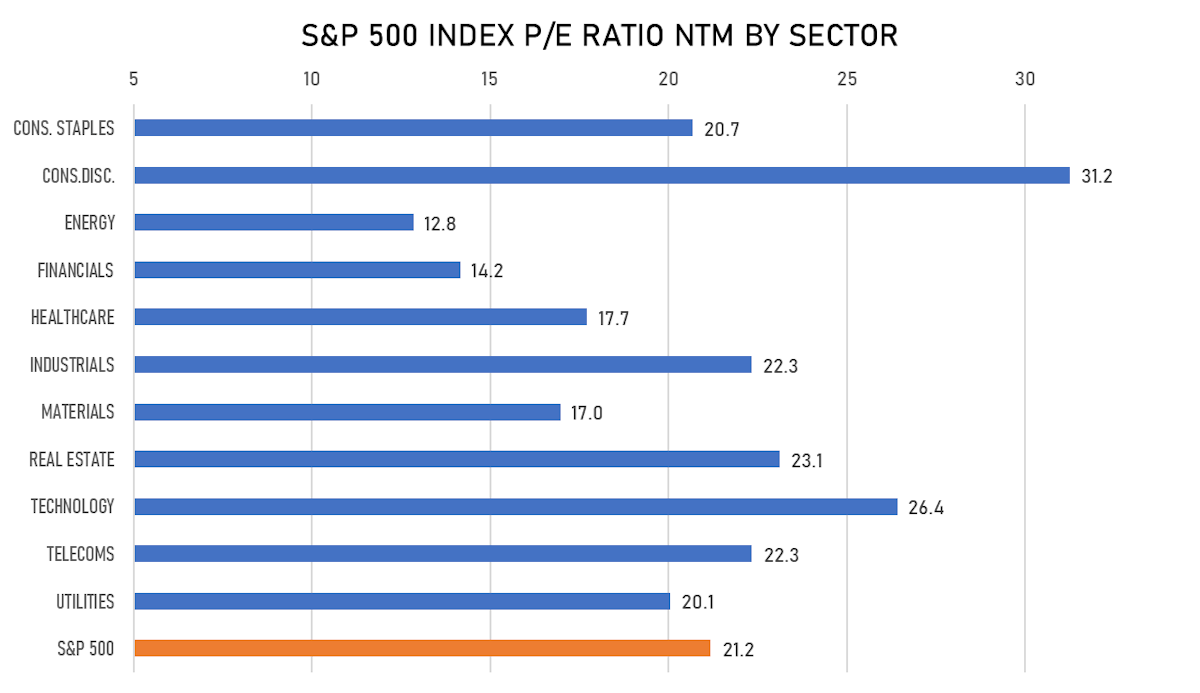

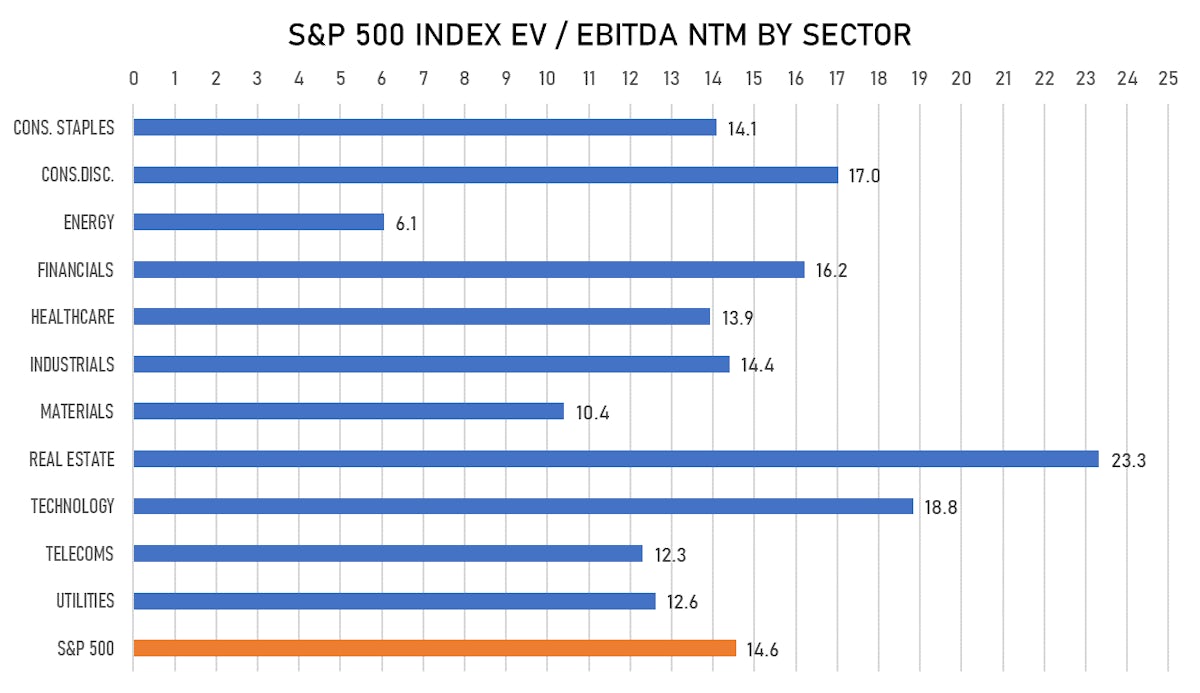

VALUATION MULTIPLES BY SECTORS

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- RumbleOn Inc / United States of America - Retail / Listing Exchange: Nasdaq / Ticker: RMBL / Gross proceeds (including overallotment): US$ 145.00m (offering in U.S. Dollar) / Bookrunners: Robert W Baird & Co Inc, B Riley Securities Inc

- Alm Brand A/S / Denmark - Financials / Listing Exchange: OMX Copen / Ticker: ALMB / Gross proceeds (including overallotment): US$ 144.39m (offering in Danish Krone) / Bookrunners: Danske Bank, Nordea Bank Danmark A/S, JP Morgan AG