Equities

Equities Edge Down On Decent Volume, With A Majority Of S&P 500 Stocks Up For The Day

Value stocks and small caps overperformed slightly, with volatility falling and sectors performance staying in a narrow range

Published ET

SPX Skew Indicates There Is Still A Lot Of Downside Hedging | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.13%; Nasdaq Composite down -0.04%; Wilshire 5000 down -0.14%

- 52.5% of S&P 500 stocks were up today, with 80.4% of stocks above their 200-day moving average (DMA) and 67.3% above their 50-DMA

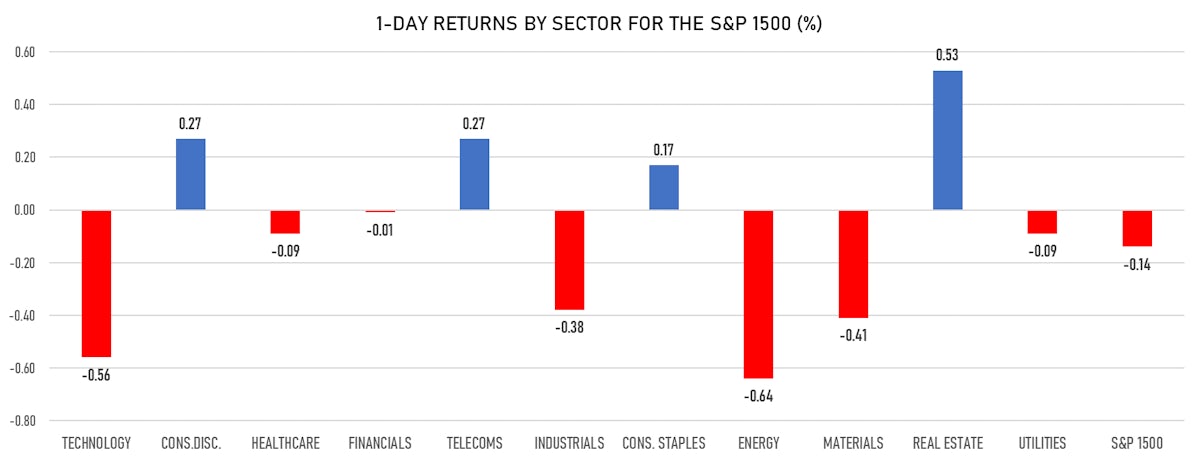

- Top performing sectors in the S&P 500: real estate up 0.62% and consumer discretionary up 0.37%

- Bottom performing sectors in the S&P 500: energy down -0.73% and technology down -0.56%

- The number of shares in the S&P 500 traded today was 716m for a total turnover of US$ 90 bn

- The S&P 500 Value Index was unchanged, while the S&P 500 Growth Index was down -0.2%; the S&P small caps index was unchanged and mid caps were down -0.3%

- The volume on CME's INX (S&P 500 Index) was 2.2m (3-month z-score: 0.6); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: UK FTSE 100 down -0.40%; tonight in Asia, China's CSI 300 up 0.15%, Japan's TOPIX 500 up 1.06%

VOLATILITY

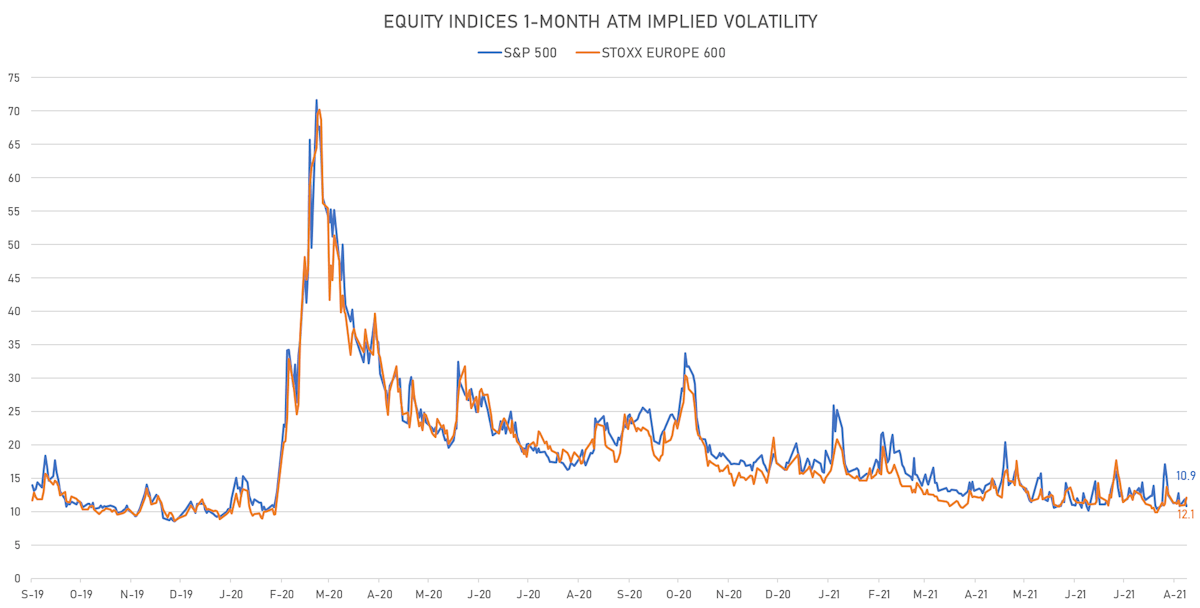

- 1-month at-the-money implied volatility on the S&P 500 at 10.9%, down from 11.9%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 12.1%, up from 11.0%

NOTABLE S&P 500 EARNINGS RELEASES

- PVH Corp (PVH | Consumer Cyclicals): beat on EPS (2.72 act. vs. 1.20 est.) and beat on revenue (2,313m act. vs. 2,141m est.), down -1.79% today

- Copart Inc (CPRT | Consumer Cyclicals): beat on EPS (1.09 act. vs. 0.80 est.) and beat on revenue (734m act. vs. 633m est.), down -0.09% today

TOP WINNERS

- Azure Power Global Ltd (AZRE), up 15.1% to $22.46 / YTD price return: -44.9% / 12-Month Price Range: $ 18.19-53.60 / Short interest (% of float): 2.4%; days to cover: 5.3

- Digital Turbine Inc (APPS), up 14.1% to $58.45 / YTD price return: +3.3% / 12-Month Price Range: $ 20.60-102.56

- Connect Biopharma Holdings Ltd (CNTB), up 13.7% to $23.47 / 12-Month Price Range: $ 14.02-29.27 / Short interest (% of float): 1.5%; days to cover: 12.5 (the stock is currently on the short sale restriction list)

- BeyondSpring Inc (BYSI), up 13.5% to $31.31 / YTD price return: +156.6% / 12-Month Price Range: $ 8.90-31.65 / Short interest (% of float): 16.2%; days to cover: 0.3

- Cytek Biosciences Inc (CTKB), up 13.1% to $22.78 / 12-Month Price Range: $ 17.40-28.46

- Couchbase Inc (BASE), up 12.0% to $50.23 / 12-Month Price Range: $ 28.00-50.33 / Short interest (% of float): 0.3%; days to cover: 0.2

- Douyu International Holdings Ltd (DOYU), up 11.7% to $4.28 / YTD price return: -61.3% / 12-Month Price Range: $ 2.89-20.54 / Short interest (% of float): 2.3%; days to cover: 1.1

- Agora Inc (API), up 11.3% to $33.92 / YTD price return: -14.3% / 12-Month Price Range: $ 24.29-114.97 / Short interest (% of float): 8.2%; days to cover: 5.8

- Doximity Inc (DOCS), up 11.2% to $92.00 / 12-Month Price Range: $ 41.17-95.97

- Skillz Inc (SKLZ), up 11.1% to $11.77 / YTD price return: -41.1% / 12-Month Price Range: $ 10.06-46.30

BIGGEST LOSERS

- Ree Automotive Holding Inc (REE), down 33.7% to $6.00 / 12-Month Price Range: $ 7.81-16.66 (the stock is currently on the short sale restriction list)

- Zoom Video Communications Inc (ZM), down 16.7% to $289.50 / YTD price return: -14.2% / 12-Month Price Range: $ 273.20-588.84 (the stock is currently on the short sale restriction list)

- Globalstar Inc (GSAT), down 15.3% to $1.99 / YTD price return: +487.7% / 12-Month Price Range: $ .29-2.98 / Short interest (% of float): 8.5%; days to cover: 6.7 (the stock is currently on the short sale restriction list)

- Five9 Inc (FIVN), down 14.4% to $158.23 / YTD price return: -9.3% / 12-Month Price Range: $ 107.98-211.68 (the stock is currently on the short sale restriction list)

- American Woodmark Corp (AMWD), down 12.4% to $70.46 / YTD price return: -24.9% / 12-Month Price Range: $ 72.28-108.81 (the stock is currently on the short sale restriction list)

- Sight Sciences Inc (SGHT), down 11.2% to $28.39 / 12-Month Price Range: $ 27.13-42.57 (the stock is currently on the short sale restriction list)

- D Market Elektronik Hizmetler ve Ticaret AS (HEPS), down 10.5% to $8.74 / 12-Month Price Range: $ 8.56-15.23 / Short interest (% of float): 0.0%; days to cover: 0.2 (the stock is currently on the short sale restriction list)

- Mechel PAO (MTL_p), down 10.0% to $1.53 / YTD price return: +207.2% / 12-Month Price Range: $ .36-1.75 / Short interest (% of float): 0.0%; days to cover: 0.1 (the stock is currently on the short sale restriction list)

- CareDx Inc (CDNA), down 9.0% to $73.28 / YTD price return: +1.1% / 12-Month Price Range: $ 29.86-99.83

- MEDNAX Inc (MD), down 8.6% to $32.11 / YTD price return: +30.8% / 12-Month Price Range: $ 12.47-35.68

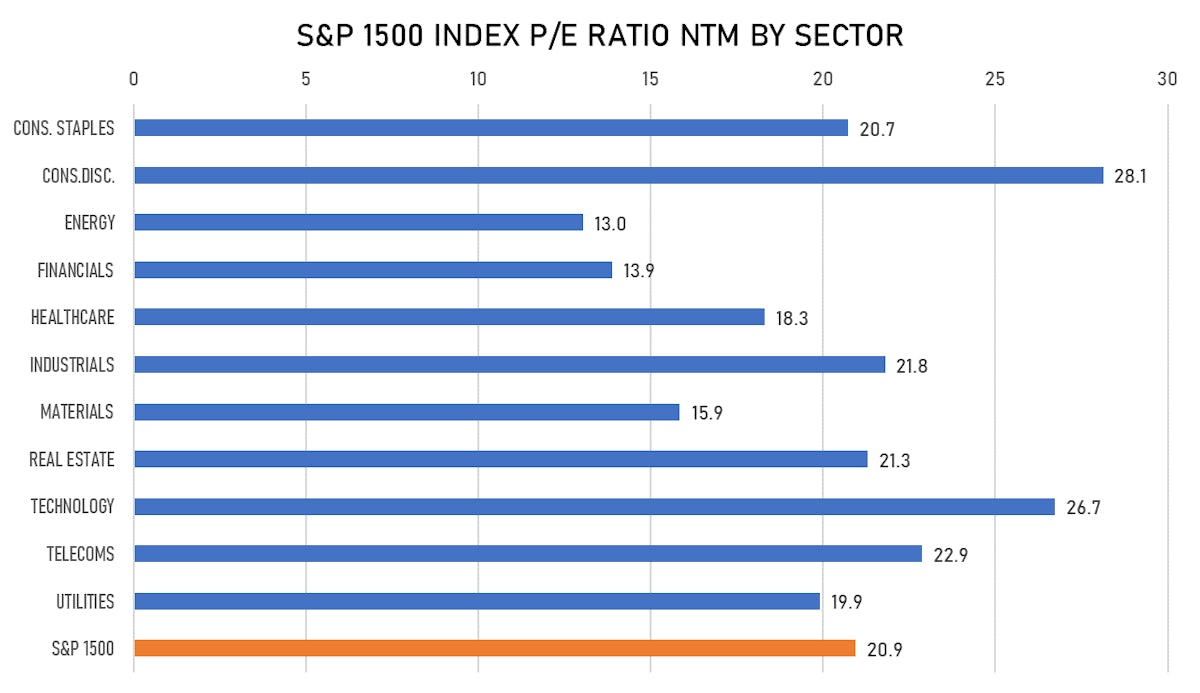

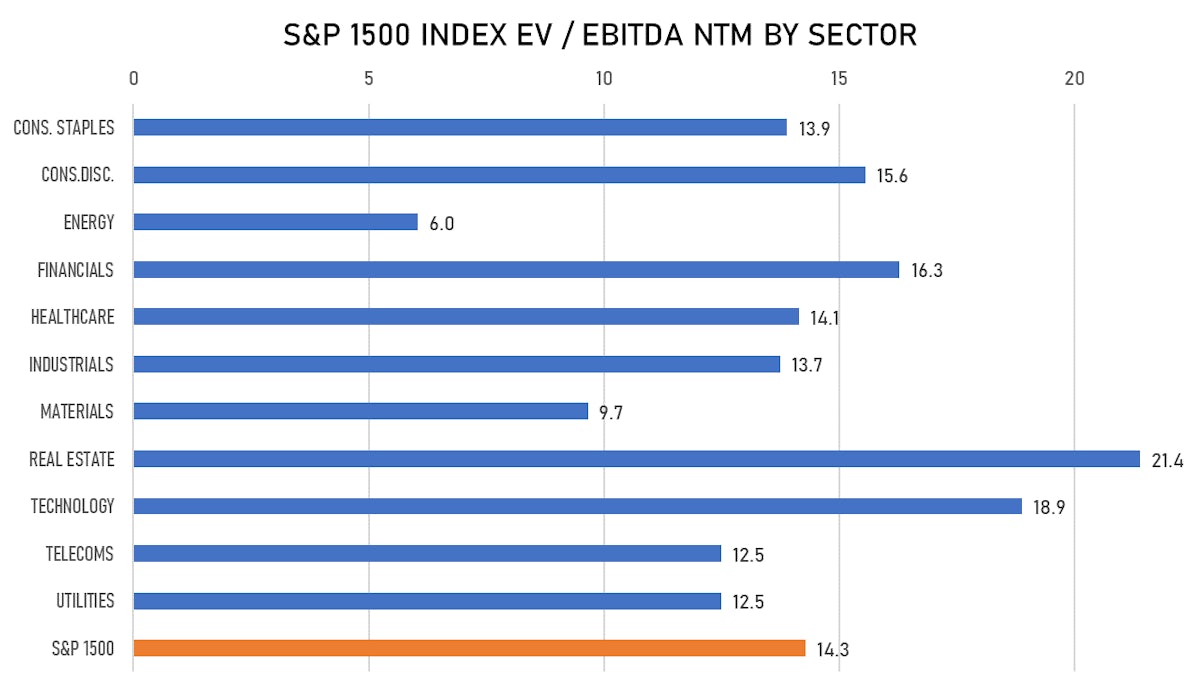

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Zhejiang Benli Technology Co Ltd / China - Healthcare / Listing Exchange: ShenzChNxt / Ticker: 301065 / Gross proceeds (including overallotment): US$ 116.21m (offering in Chinese Yuan) / Bookrunners: China Great Wall Securities Co Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- JEOL Ltd / Japan - Healthcare / Listing Exchange: Tokyo 1 / Ticker: 6951 / Gross proceeds (including overallotment): US$ 332.83m (offering in Japanese Yen) / Bookrunners: Mitsubishi UFJ Morgan Stanley Securities Co Ltd

- Masan Group Corp / Vietnam - Consumer Staples / Listing Exchange: HoChiMinh / Ticker: MSN / Gross proceeds (including overallotment): US$ 109.25m (offering in U.S. Dollar) / Bookrunners: UBS Investment Bank, Viet Capital Securities JSC