Equities

US Stock Indices Up Slightly On Mediocre Volume And Low Volatility

A majority of S&P 500 stocks were down today, with growth overperforming value by 0.4% and small caps stronger than large caps

Published ET

Correlation and relative performance of the S&P Value Index (IVX) and Growth Index (IGX) | Source: Refinitiv

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.03%; Nasdaq Composite up 0.33%; Wilshire 5000 up 0.14%

- 48.3% of S&P 500 stocks were up today, with 79.0% of stocks above their 200-day moving average (DMA) and 65.1% above their 50-DMA

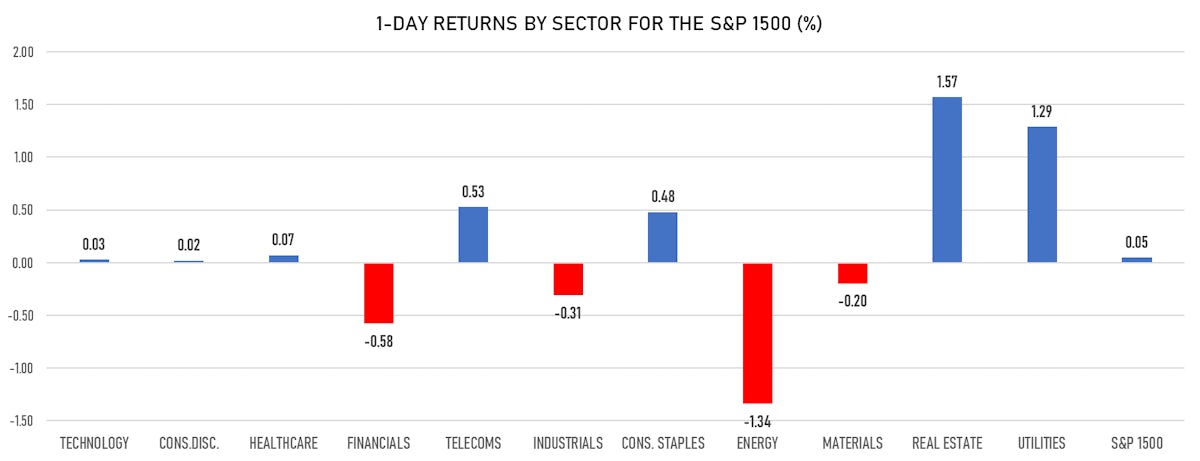

- Top performing sectors in the S&P 500: real estate up 1.69% and utilities up 1.30%

- Bottom performing sectors in the S&P 500: energy down -1.51% and financials down -0.62%

- The number of shares in the S&P 500 traded today was 480m for a total turnover of US$ 59 bn

- The S&P 500 Value Index was down -0.2%, while the S&P 500 Growth Index was up 0.2%; the S&P small caps index was up 0.3% and mid caps were up 0.3%

- The volume on CME's INX (S&P 500 Index) was 1.9m (3-month z-score: -0.1); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.48%; UK FTSE 100 up 0.42%; tonight in Asia, China's CSI 300 down -0.35%, Japan's TOPIX 500 down -0.07%

VOLATILITY

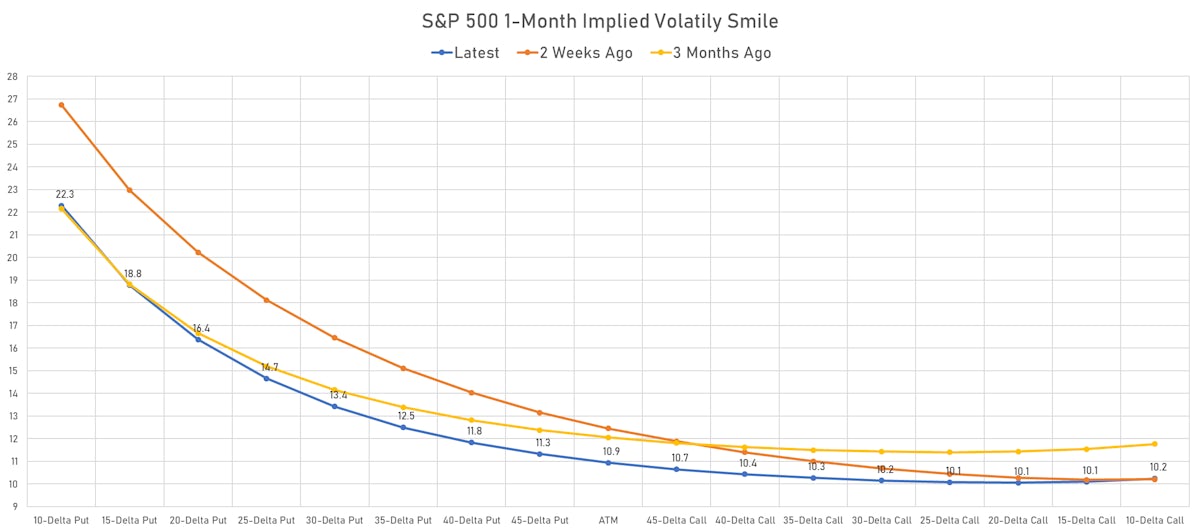

- 1-month at-the-money implied volatility on the S&P 500 unchanged at 10.9%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.6%, down from 12.1%

NOTABLE S&P 500 EARNINGS RELEASES

- Copart Inc (CPRT | Consumer Cyclicals): beat on EPS (1.09 act. vs. 0.80 est.) and beat on revenue (734m act. vs. 633m est.), up 0.43% today

- Brown-Forman Corp (BF.B | Consumer Non-Cyclicals): beat on EPS (0.40 act. vs. 0.39 est.) and beat on revenue (906m act. vs. 828m est.), up 3.42% today

- Campbell Soup Co (CPB | Consumer Non-Cyclicals): beat on EPS (0.55 act. vs. 0.48 est.) and beat on revenue (1,873m act. vs. 1,809m est.), up 2.06% today

TOP WINNERS

- Ambarella Inc (AMBA), up 27.4% to $131.96 / YTD price return: +43.7% / 12-Month Price Range: $ 46.99-137.21

- Humacyte Inc (HUMA), up 16.2% to $16.99 / YTD price return: +67.1% / 12-Month Price Range: $ 9.12-16.96

- Wheels Up Experience Inc (UP), up 15.6% to $7.62 / YTD price return: -23.6% / 12-Month Price Range: $ 6.43-15.00

- PVH Corp (PVH), up 15.1% to $120.58 / YTD price return: +28.4% / 12-Month Price Range: $ 54.12-121.18 / Short interest (% of float): 2.7%; days to cover: 2.4

- Tuya Inc (TUYA), up 15.0% to $11.99 / 12-Month Price Range: $ 9.46-27.65 / Short interest (% of float): 1.2%; days to cover: 4.8

- Futu Holdings Ltd (FUTU), up 14.9% to $109.39 / YTD price return: +139.1% / 12-Month Price Range: $ 27.15-204.25 / Short interest (% of float): 5.9%; days to cover: 0.8

- Cano Health Inc (CANO), up 14.1% to $13.66 / YTD price return: +1.9% / 12-Month Price Range: $ 9.20-17.43 (the stock is currently on the short sale restriction list)

- SelectQuote Inc (SLQT), up 14.0% to $10.89 / YTD price return: -47.5% / 12-Month Price Range: $ 7.72-33.00

- Ke Holdings Inc (BEKE), up 13.4% to $20.52 / YTD price return: -66.7% / 12-Month Price Range: $ 15.35-79.40 / Short interest (% of float): 1.9%; days to cover: 1.3

- DiDi Global Inc (DIDI), up 11.9% to $9.20 / 12-Month Price Range: $ 7.16-18.01 / Short interest (% of float): 1.3%; days to cover: 1.0

BIGGEST LOSERS

- Lucid Group Inc (LCID), down 10.9% to $17.79 / YTD price return: +77.7% / 12-Month Price Range: $ 9.60-64.86 (the stock is currently on the short sale restriction list)

- Fulcrum Therapeutics Inc (FULC), down 9.7% to $26.83 / 12-Month Price Range: $ 6.85-29.82 (the stock is currently on the short sale restriction list)

- BeyondSpring Inc (BYSI), down 9.0% to $28.48 / 12-Month Price Range: $ 8.90-33.00 / Short interest (% of float): 16.2%; days to cover: 0.3 (the stock is currently on the short sale restriction list)

- Cassava Sciences Inc (SAVA), down 8.6% to $51.96 / YTD price return: +661.9% / 12-Month Price Range: $ 2.78-146.16

- Cytek Biosciences Inc (CTKB), down 8.5% to $20.85 / 12-Month Price Range: $ 17.40-28.46 / Short interest (% of float): 0.1%; days to cover: 0.2

- Oi SA em Recuperacao Judicial (OIBRc), down 8.3% to $1.00 / 12-Month Price Range: $ .88-2.41 / Short interest (% of float): 0.1%; days to cover: 2.0 (the stock is currently on the short sale restriction list)

- Vir Biotechnology Inc (VIR), down 7.8% to $47.50 / YTD price return: +77.4% / 12-Month Price Range: $ 25.31-141.01

- AMC Entertainment Holdings Inc (AMC), down 7.3% to $43.69 / YTD price return: +1,960.8% / 12-Month Price Range: $ 1.91-72.62

- Abbvie Inc (ABBV), down 7.0% to $112.27 / YTD price return: +4.8% / 12-Month Price Range: $ 79.11-121.40 / Short interest (% of float): 0.7%; days to cover: 2.3 (the stock is currently on the short sale restriction list)

- Workhorse Group Inc (WKHS), down 6.8% to $9.14 / YTD price return: -53.8% / 12-Month Price Range: $ 7.07-42.96

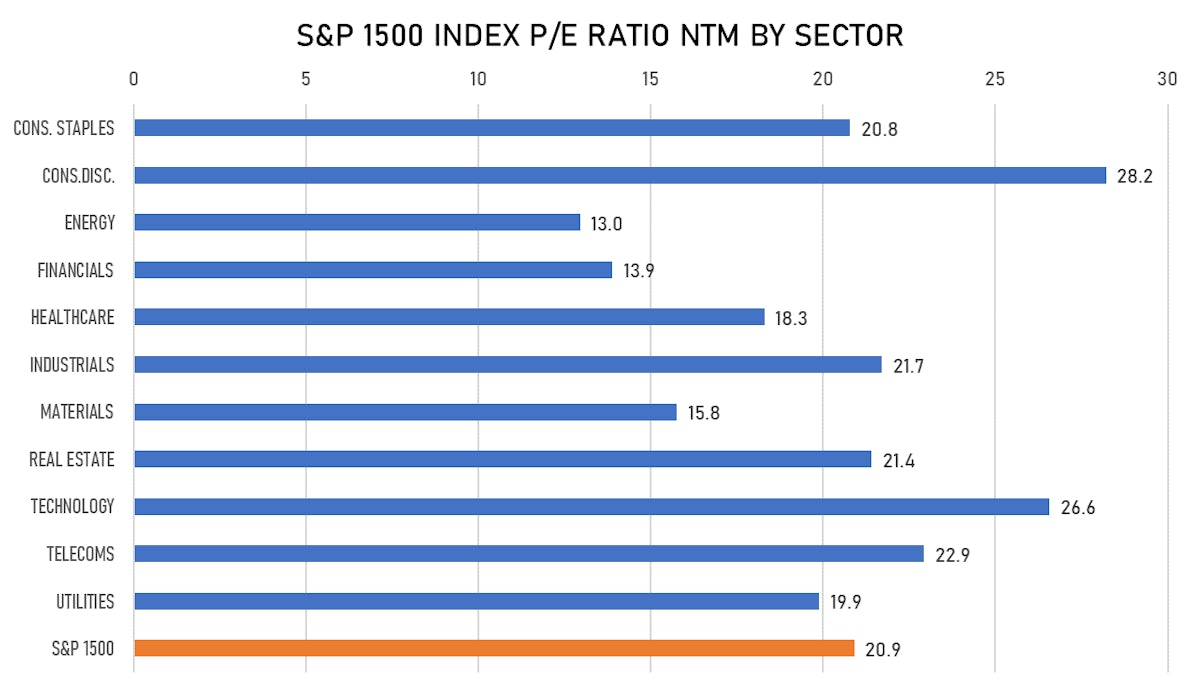

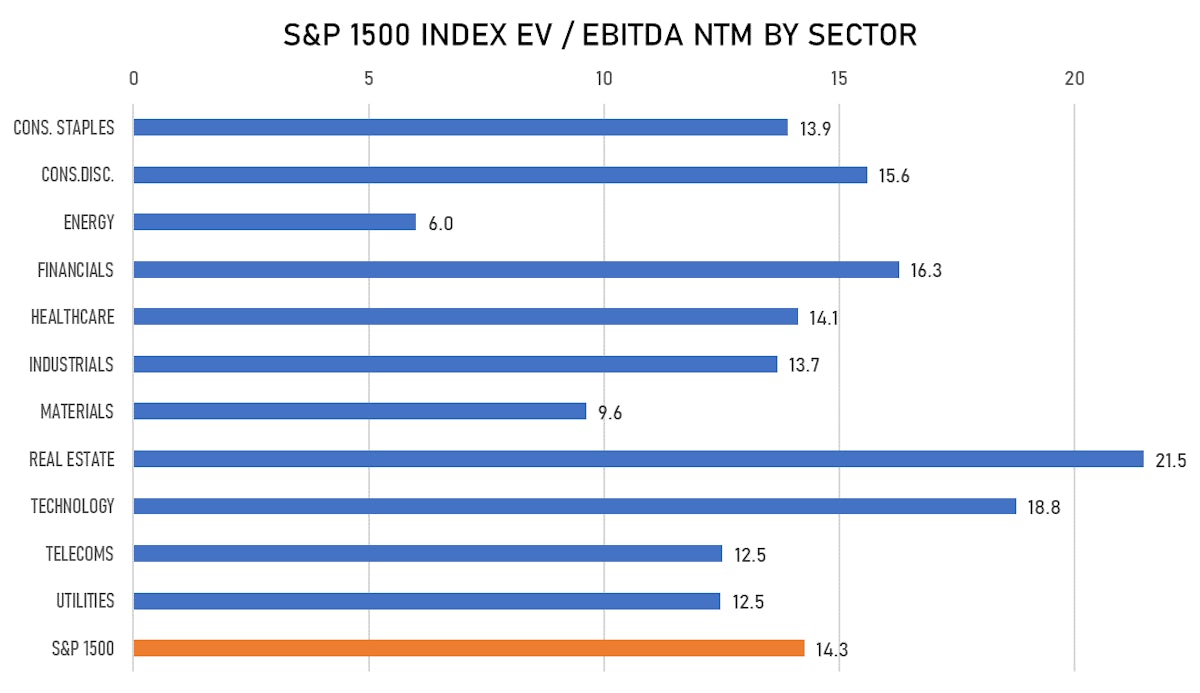

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- CHW Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: CHWAU / Gross proceeds (including overallotment): US$ 110.00m (offering in U.S. Dollar) / Bookrunners: Chardan Capital Markets LLC

- Beijing Lu Daopei Hospital Management Co Ltd / China - Healthcare / Listing Exchange: Hong Kong / Ticker: - / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Lihuayi Weiyuan Chemical Co Ltd / China - Materials / Listing Exchange: Shanghai / Ticker: 600955 / Gross proceeds (including overallotment): US$ 440.40m (offering in Chinese Yuan) / Bookrunners: CITIC Securities Co Ltd, Zhongtai Securities Co Ltd

- Responsible Housing Reit PLC / United Kingdom - Real Estate / Listing Exchange: London / Ticker: N/A / Gross proceeds (including overallotment): US$ 343.95m (offering in British Pound) / Bookrunners: Peel Hunt LLP

- Jinmao Property Development Co Ltd / China - Real Estate / Listing Exchange: Hong Kong / Ticker: N/A / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Lihuayi Weiyuan Chemical Co Ltd / China - Materials / Listing Exchange: Shanghai / Ticker: 600955 / Gross proceeds (including overallotment): US$ 188.74m (offering in Chinese Yuan) / Bookrunners: CITIC Securities Co Ltd, Zhongtai Securities Co Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- West Japan Railway Co / Japan - Industrials / Listing Exchange: Tokyo 1 / Ticker: 9021 / Gross proceeds (including overallotment): US$ 1,501.31m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd, Mitsubishi UFJ Morgan Stanley Securities Co Ltd, SMBC Nikko Securities Inc

- Kakaobank Corp / South Korea - Financials / Listing Exchange: KOSDAQ / Ticker: 323410 / Gross proceeds (including overallotment): US$ 924.90m (offering in U.S. Dollar) / Bookrunners: Citi

- Dongyue Group Ltd / China - Materials / Listing Exchange: Hong Kong / Ticker: 189 / Gross proceeds (including overallotment): US$ 428.83m (offering in Hong Kong Dollar) / Bookrunners: CLSA Asia-Pacific Markets Ltd, China International Capital Corp HK Securities Ltd

- Colowide Co Ltd / Japan - Retail / Listing Exchange: Tokyo 1 / Ticker: 7616 / Gross proceeds (including overallotment): US$ 186.41m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd

- Activia Properties Inc / Japan - Real Estate / Listing Exchange: Tokyo / Ticker: 3279 / Gross proceeds (including overallotment): US$ 127.17m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd, Mizuho Securities Co Ltd, Daiwa Securities Co Ltd, Mitsubishi UFJ Morgan Stanley Securities Co Ltd