Equities

Low-Volume Fall For US Equities, With Over 80% Of S&P 500 Stocks Down Today

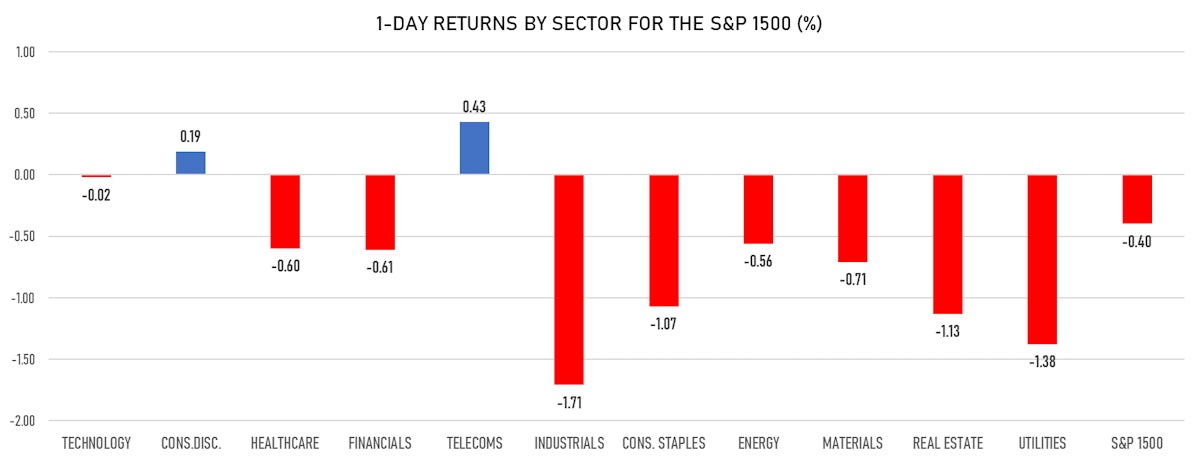

Value stocks, small- and mid-caps underperformed the broader market, while the Telecoms and Consumer Discretionary sectors had the best performances

Published ET

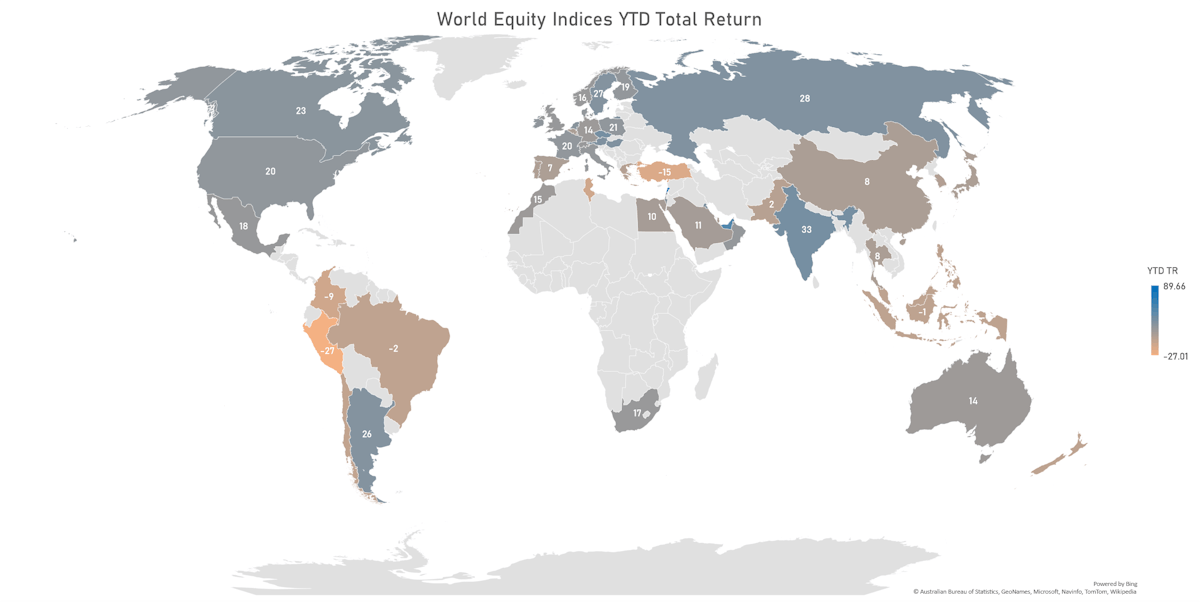

FactSet Country Indices Year-To-Date Total Returns | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.34%; Nasdaq Composite up 0.07%; Wilshire 5000 down -0.40%

- 18.4% of S&P 500 stocks were up today, with 76.4% of stocks above their 200-day moving average (DMA) and 57.8% above their 50-DMA

- Top performing sectors in the S&P 500: telecoms up 0.45% and consumer discretionary up 0.36%

- Bottom performing sectors in the S&P 500: industrials down -1.77% and utilities down -1.37%

- The number of shares in the S&P 500 traded today was 486m for a total turnover of US$ 61 bn

- The S&P 500 Value Index was down -0.8%, while the S&P 500 Growth Index was up 0.0%; the S&P small caps index was down -1.0% and mid caps were down -1.2%

- The volume on CME's INX (S&P 500 Index) was 1.8m (3-month z-score: -0.5); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -0.49%; UK FTSE 100 down -0.53%; tonight in Asia, China's CSI 300 down -0.12%, Japan's TOPIX 500 up 0.67%

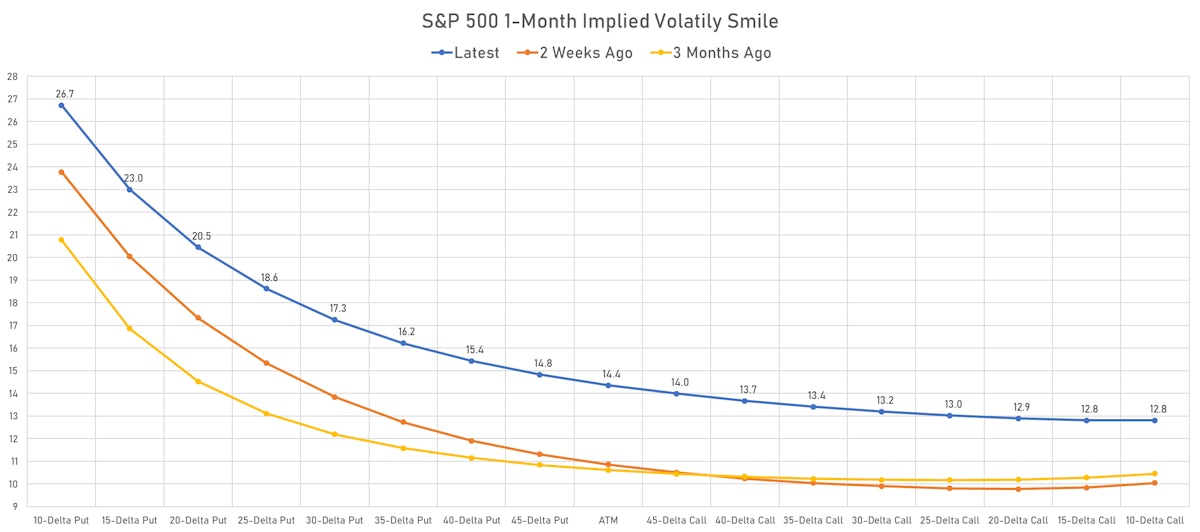

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 14.4%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.9%, up from 11.3%

TOP WINNERS

- Mechel PAO (MTL), up 56.3% to $5.00 / YTD price return: +143.9% / 12-Month Price Range: $ 1.29-3.40 / Short interest (% of float): 0.1%; days to cover: 0.3

- Clover Health Investments Corp (CLOV), up 22.2% to $10.80 / YTD price return: -35.6% / 12-Month Price Range: $ 6.31-28.85 / Short interest (% of float): 15.3%; days to cover: 1.0

- IronNet Inc (IRNT), up 17.6% to $19.59 / 12-Month Price Range: $ 9.37-18.57 / Short interest (% of float): 1.0%; days to cover: 3.3

- Ke Holdings Inc (BEKE), up 15.9% to $22.00 / YTD price return: -64.3% / 12-Month Price Range: $ 15.35-79.40 / Short interest (% of float): 1.9%; days to cover: 1.3

- RLX Technology Inc (RLX), up 15.7% to $7.00 / 12-Month Price Range: $ 3.70-35.00 / Short interest (% of float): 2.9%; days to cover: 1.9

- Hippo Holdings Inc (HIPO), up 15.7% to $6.05 / 12-Month Price Range: $ 3.78-15.05 / Short interest (% of float): 0.1%; days to cover: 1.5

- Columbia Property Trust Inc (CXP), up 15.2% to $19.05 / YTD price return: +32.8% / 12-Month Price Range: $ 10.11-19.49 / Short interest (% of float): 1.0%; days to cover: 2.1

- Tango Therapeutics Inc (TNGX), up 14.8% to $14.85 / 12-Month Price Range: $ 8.90-14.00 / Short interest (% of float): 0.1%; days to cover: 0.7

- Mechel PAO (MTL_p), up 14.8% to $1.76 / 12-Month Price Range: $ .36-1.75 / Short interest days to cover: 0.1

- Tandem Diabetes Care Inc (TNDM), up 13.2% to $129.40 / YTD price return: +35.2% / 12-Month Price Range: $ 76.19-123.74 / Short interest (% of float): 6.4%; days to cover: 7.5

BIGGEST LOSERS

- Sharecare Inc (SHCR), down 21.7% to $7.16 / 12-Month Price Range: $ 5.67-12.81 / Short interest (% of float): 1.3%; days to cover: 3.4 (the stock is currently on the short sale restriction list)

- Aeye Inc (LIDR), down 16.8% to $8.93 / 12-Month Price Range: $ 8.30-14.49 / Short interest (% of float): 1.2%; days to cover: 4.4 (the stock is currently on the short sale restriction list)

- Absci Corp (ABSI), down 14.1% to $17.25 / 12-Month Price Range: $ 17.00-31.53 / Short interest (% of float): 0.9%; days to cover: 1.3 (the stock is currently on the short sale restriction list)

- Hibbett Inc (HIBB), down 13.5% to $85.56 / YTD price return: +85.3% / 12-Month Price Range: $ 32.60-100.32 / Short interest (% of float): 16.4%; days to cover: 7.2 (the stock is currently on the short sale restriction list)

- Markforged Holding Corp (MKFG), down 12.9% to $8.03 / 12-Month Price Range: $ 7.60-15.10 (the stock is currently on the short sale restriction list)

- Apellis Pharmaceuticals Inc (APLS), down 12.9% to $55.78 / YTD price return: -2.5% / 12-Month Price Range: $ 28.37-73.00 / Short interest (% of float): 7.3%; days to cover: 5.7 (the stock is currently on the short sale restriction list)

- Proterra Inc (PTRA), down 12.5% to $10.32 / YTD price return: -6.9% / 12-Month Price Range: $ 8.77-31.06 / Short interest (% of float): 3.4%; days to cover: 2.5 (the stock is currently on the short sale restriction list)

- Danimer Scientific Inc (DNMR), down 12.4% to $18.01 / YTD price return: -23.4% / 12-Month Price Range: $ 9.75-66.30 / Short interest (% of float): 12.9%; days to cover: 6.4 (the stock is currently on the short sale restriction list)

- AvePoint Inc (AVPT), down 12.1% to $9.39 / YTD price return: -37.4% / 12-Month Price Range: $ 8.36-17.90 / Short interest (% of float): 5.3%; days to cover: 3.7 (the stock is currently on the short sale restriction list)

- Astra Space Inc (ASTR), down 12.1% to $9.03 / YTD price return: -10.7% / 12-Month Price Range: $ 8.12-22.47 (the stock is currently on the short sale restriction list)

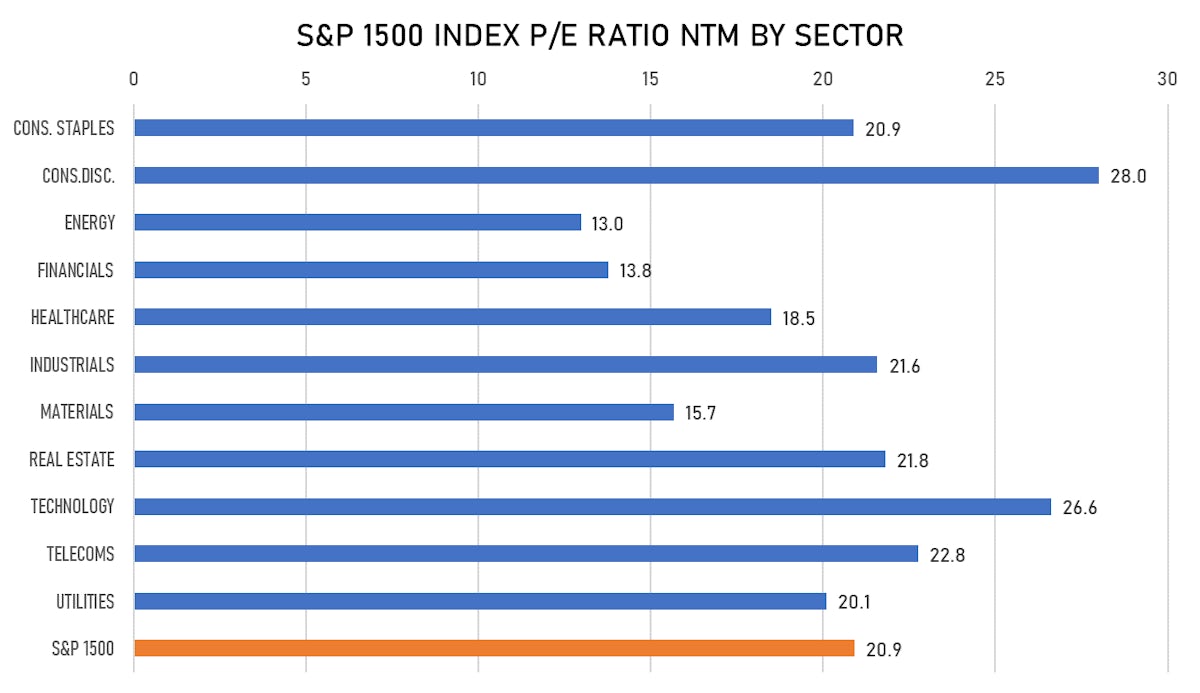

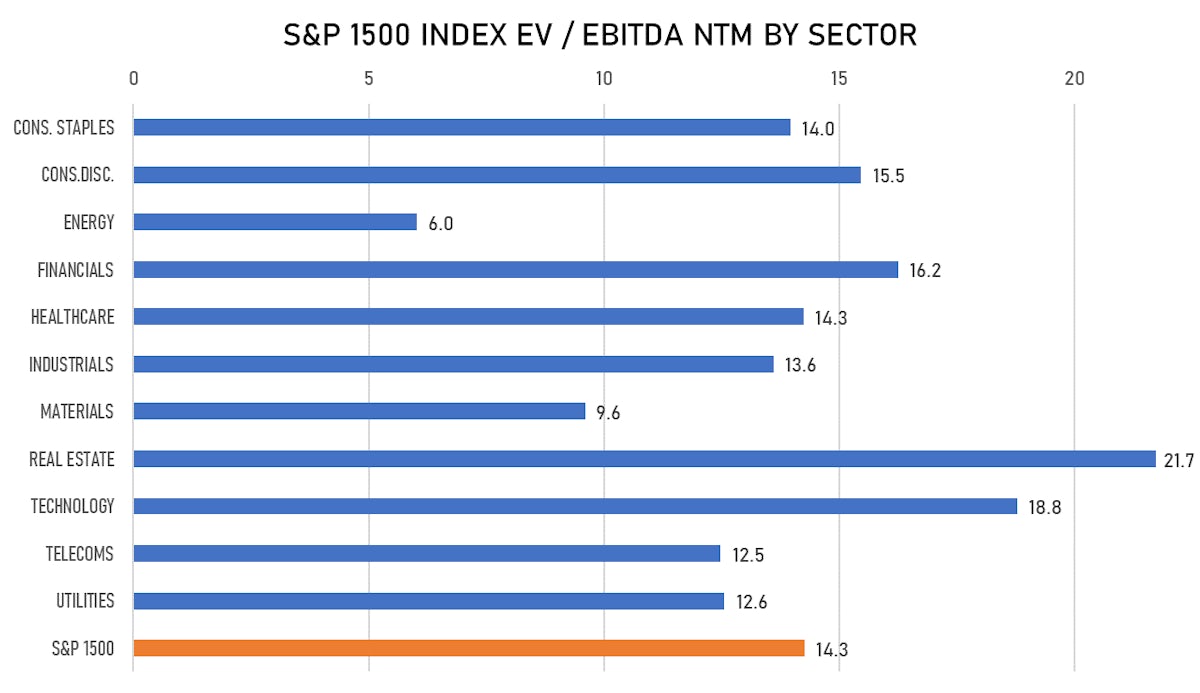

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- McLaren Technology Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: MLAIU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Mizuho Securities USA Inc

- Home Plate Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: HPLTU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Jefferies LLC

- PHC Holdings Corp / Japan - Healthcare / Listing Exchange: Tokyo 1 / Ticker: 6523 / Gross proceeds (including overallotment): US$ 860.85m (offering in Japanese Yen) / Bookrunners: Goldman Sachs International, Merrill Lynch International Ltd, Mizuho International PLC, Morgan Stanley & Co. International plc, SMBC Nikko Capital Markets, KKR Capital Markets LLC, JP Morgan Securities Plc

- Healthium Medtech Ltd / India - Healthcare / Listing Exchange: National / Ticker: N/A / Gross proceeds (including overallotment): US$ 410.55m (offering in Indian Rupee) / Bookrunners: Nomura Finl Advisory & Sec, Credit Suisse Securities, ICICI Securities Ltd, CLSA India Pvt Ltd

- Ji Xing Pharmaceuticals Ltd / China - Healthcare / Listing Exchange: Hong Kong / Ticker: - / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Babbel Group AG / Germany - High Technology / Listing Exchange: Frankfurt / Ticker: N/A / Gross proceeds (including overallotment): US$ 213.62m (offering in EURO) / Bookrunners: BNP Paribas SA, Joh Berenberg Gossler & Co KG(London Branch), Citigroup Global Markets Europe AG, Morgan Stanley Europe SE

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Certara Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: CERT / Gross proceeds (including overallotment): US$ 726.40m (offering in U.S. Dollar) / Bookrunners: Jefferies LLC, Morgan Stanley & Co LLC

- Sphere 3D Corp / Canada - High Technology / Listing Exchange: Nasdaq / Ticker: ANY / Gross proceeds (including overallotment): US$ 192.10m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Nkarta Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: NKTX / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- VBI Vaccines Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: VBIV / Gross proceeds (including overallotment): US$ 125.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Showa Denko KK / Japan - Materials / Listing Exchange: Tokyo 1 / Ticker: 4004 / Gross proceeds (including overallotment): US$ 394.90m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd, Mizuho Securities Co Ltd, Mitsubishi UFJ Morgan Stanley Securities Co Ltd

- Showa Denko KK / Japan - Materials / Listing Exchange: Tokyo 1 / Ticker: 4004 / Gross proceeds (including overallotment): US$ 348.54m (offering in Japanese Yen) / Bookrunners: Nomura International PLC, Mizuho International PLC, JP Morgan Securities Plc

- Pilbara Minerals Ltd / Australia - Materials / Listing Exchange: Australia / Ticker: PLS / Gross proceeds (including overallotment): US$ 243.89m (offering in Australian Dollar) / Bookrunners: JP Morgan & Co Inc

- Centuria Office REIT / Australia - Real Estate / Listing Exchange: Australia / Ticker: COF / Gross proceeds (including overallotment): US$ 130.54m (offering in Australian Dollar) / Bookrunners: Morgan Stanley Australia Securities Ltd, MA Moelis Australia