Equities

Stock Indices Edge Down, With About Half Of The Stocks In The S&P 500 Up Today

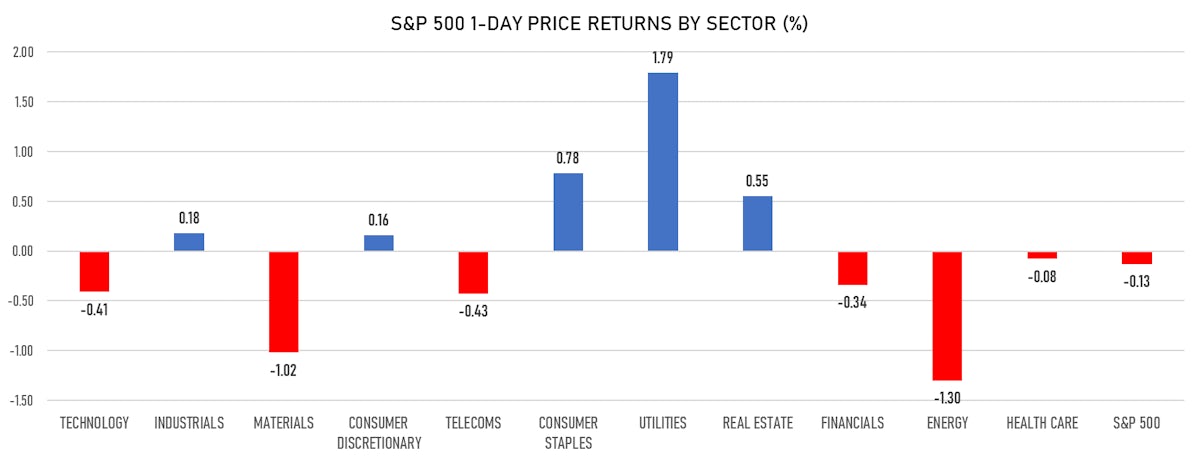

Utilities and real estate sectors rose on lower rates, while growth stocks and small caps underperformed the broader market

Published ET

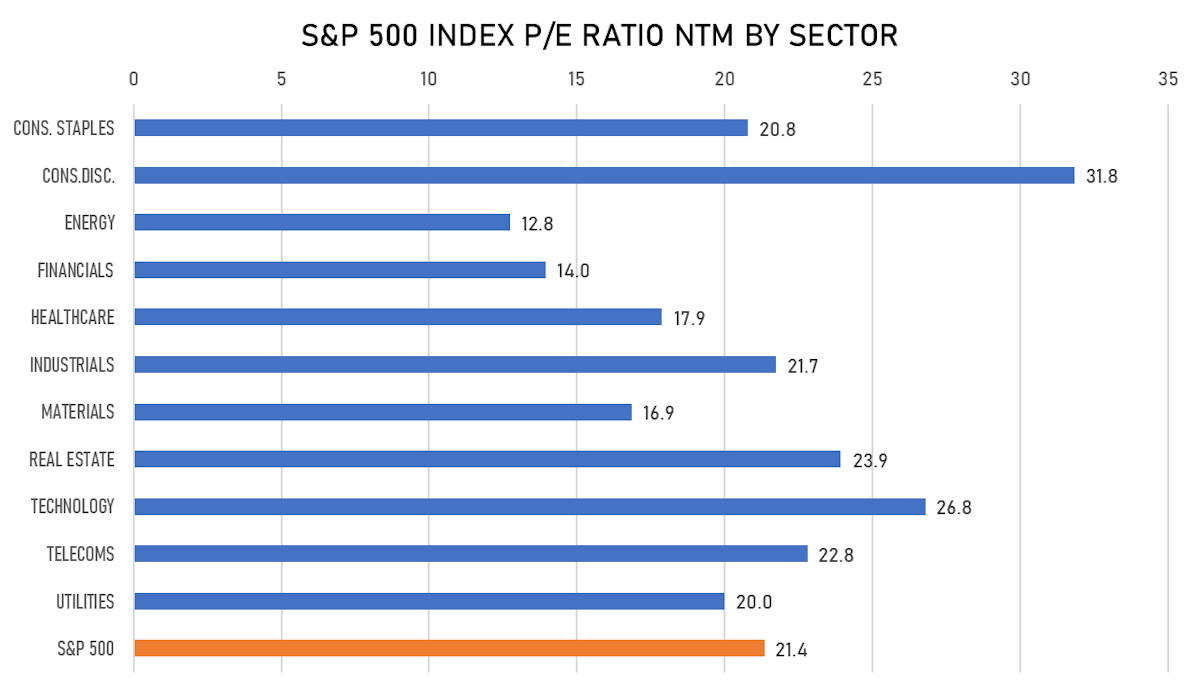

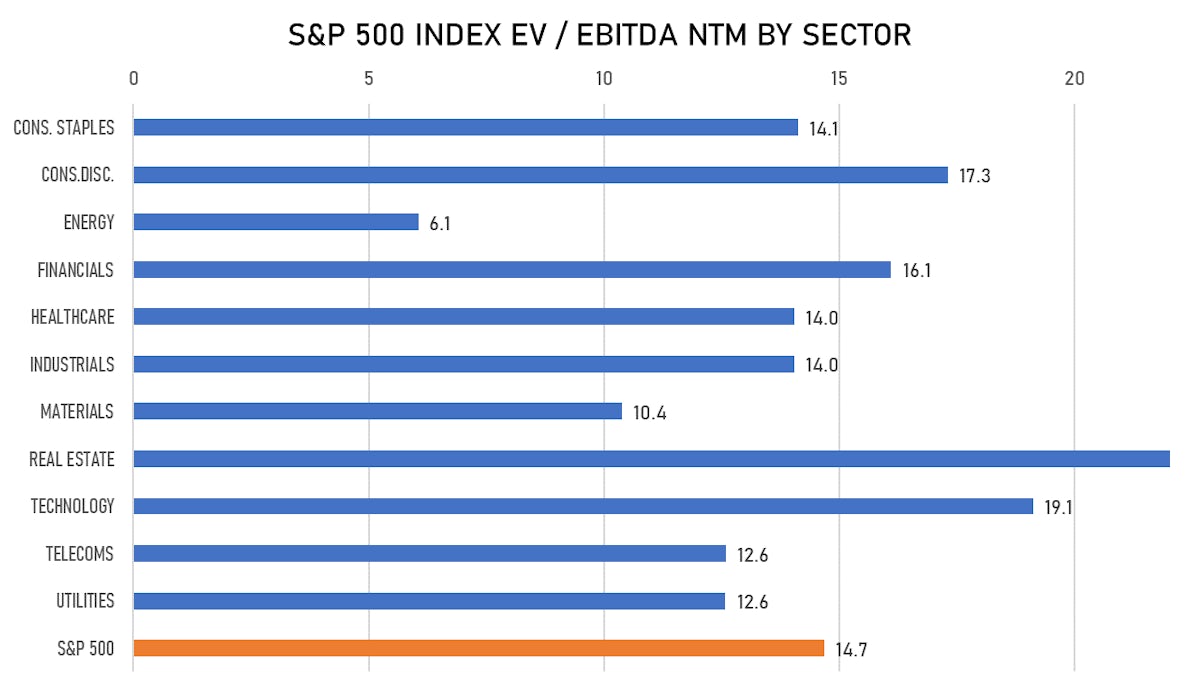

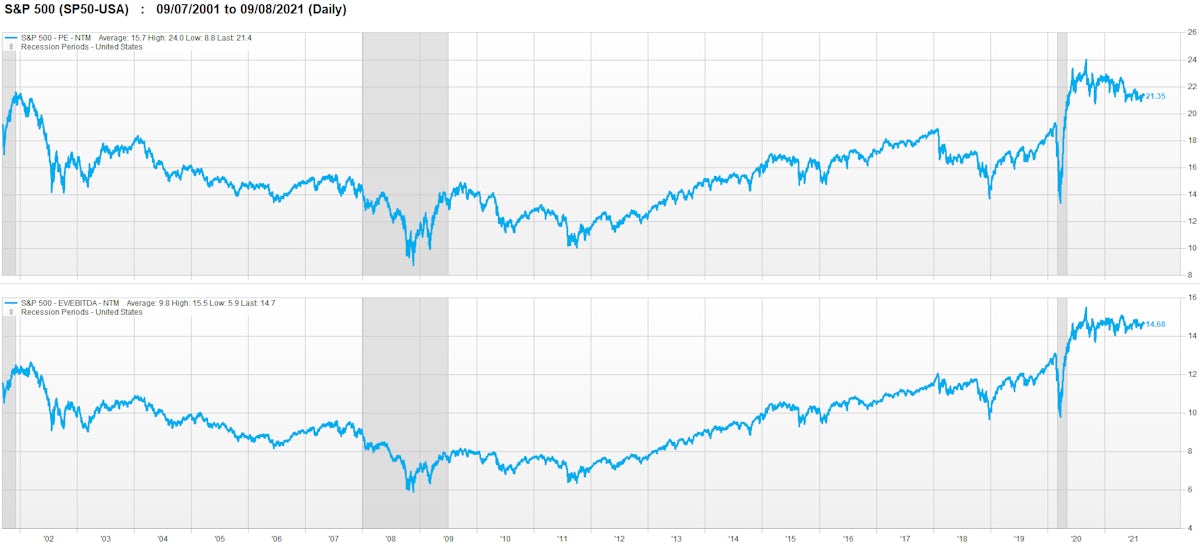

S&P 500 Valuation Multiples Near Highest Levels Over The Past 20 Years | Source: FactSet

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.13%; Nasdaq Composite down -0.57%; Wilshire 5000 down -0.32%

- 49.7% of S&P 500 stocks were up today, with 74.1% of stocks above their 200-day moving average (DMA) and 58.2% above their 50-DMA

- Top performing sectors in the S&P 500: utilities up 1.79% and consumer staples up 0.78%

- Bottom performing sectors in the S&P 500: energy down -1.30% and materials down -1.02%

- The number of shares in the S&P 500 traded today was 468m for a total turnover of US$ 58 bn

- The S&P 500 Value Index was down 0.0%, while the S&P 500 Growth Index was down -0.2%; the S&P small caps index was down -0.9% and mid caps were down -0.4%

- The volume on CME's INX (S&P 500 Index) was 1.8m (3-month z-score: -0.5); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -1.06%; UK FTSE 100 down -0.75%; tonight in Asia: China's CSI 300 down -0.37%, Japan's TOPIX 500 down -0.50%

VOLATILITY

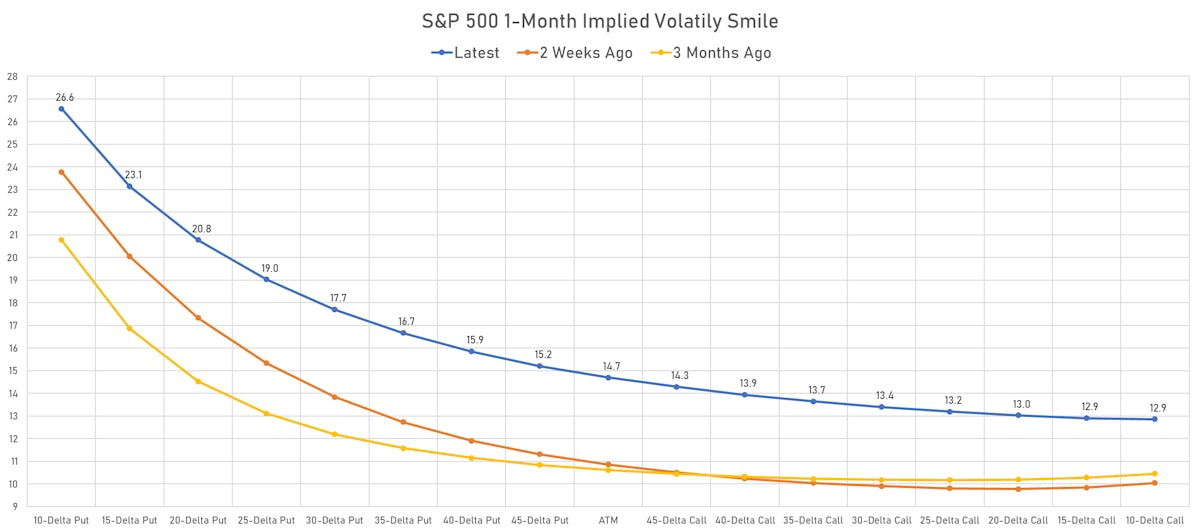

- 1-month at-the-money implied volatility on the S&P 500 at 14.7%, up from 14.4%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 13.1%, up from 11.9%

NOTABLE S&P 500 EARNINGS RELEASES

- Charles River Laboratories International Inc (CRL | Healthcare): beat on EPS (2.61 act. vs. 2.38 est.) and beat on revenue (915m act. vs. 880m est.), down -0.82% today

TOP WINNERS

- eFFECTOR Therapeutics Inc (EFTR), up 111.8% to $27.17 / 12-Month Price Range: $ 8.33-29.20 / Short interest (% of float): 0.1%; days to cover: 0.2 (the stock is currently on the short sale restriction list)

- Kadmon Holdings Inc (KDMN), up 71.1% to $9.07 / YTD price return: +118.6% / 12-Month Price Range: $ 3.15-5.73 / Short interest (% of float): 20.5%; days to cover: 6.4

- Globalstar Inc (GSAT), up 30.0% to $2.69 / YTD price return: +694.4% / 12-Month Price Range: $ .29-2.98 / Short interest (% of float): 8.5%; days to cover: 6.7

- ICU Medical Inc (ICUI), up 26.2% to $260.00 / YTD price return: +21.2% / 12-Month Price Range: $ 176.19-227.07 / Short interest (% of float): 3.3%; days to cover: 4.8

- Arqit Quantum Inc (ARQQ), up 24.0% to $14.01 / 12-Month Price Range: $ 8.00-26.00

- Spectrum Brands Holdings Inc (SPB), up 17.8% to $93.08 / YTD price return: +17.9% / 12-Month Price Range: $ 54.52-97.27 / Short interest (% of float): 3.3%; days to cover: 3.6

- Perrigo Company PLC (PRGO), up 9.0% to $45.34 / YTD price return: +1.4% / 12-Month Price Range: $ 38.20-51.10 / Short interest (% of float): 4.4%; days to cover: 4.5

- Cytek Biosciences Inc (CTKB), up 8.7% to $26.04 / 12-Month Price Range: $ 17.40-28.46 / Short interest (% of float): 0.3%; days to cover: 0.2

- Aurinia Pharmaceuticals Inc (AUPH), up 7.2% to $19.46 / YTD price return: +40.7% / 12-Month Price Range: $ 9.72-20.50 / Short interest (% of float): 15.0%; days to cover: 4.2

- Global Payments Inc (GPN), up 7.2% to $170.02 / YTD price return: -21.1% / 12-Month Price Range: $ 153.33-220.81 / Short interest (% of float): 2.6%; days to cover: 3.0

BIGGEST LOSERS

- Alector Inc (ALEC), down 19.0% to $21.65 / YTD price return: +43.1% / 12-Month Price Range: $ 9.12-43.32 / Short interest (% of float): 8.8%; days to cover: 2.4 (the stock is currently on the short sale restriction list)

- Absci Corp (ABSI), down 17.2% to $14.28 / 12-Month Price Range: $ 17.00-31.53 / Short interest (% of float): 0.9%; days to cover: 1.3 (the stock is currently on the short sale restriction list)

- Smartsheet Inc (SMAR), down 14.4% to $70.84 / YTD price return: +2.2% / 12-Month Price Range: $ 43.64-85.65 (the stock is currently on the short sale restriction list)

- Monte Rosa Therapeutics Inc (GLUE), down 13.5% to $35.47 / 12-Month Price Range: $ 18.01-45.56 / Short interest (% of float): 2.6%; days to cover: 6.0 (the stock is currently on the short sale restriction list)

- Clover Health Investments Corp (CLOV), down 12.5% to $9.45 / YTD price return: -43.6% / 12-Month Price Range: $ 6.31-28.85 / Short interest (% of float): 15.3%; days to cover: 1.0 (the stock is currently on the short sale restriction list)

- Canaan Inc (CAN), down 11.7% to $8.46 / YTD price return: +42.7% / 12-Month Price Range: $ 1.81-39.10 / Short interest (% of float): 5.8%; days to cover: 1.3 (the stock is currently on the short sale restriction list)

- Agiliti Inc (AGTI), down 11.6% to $20.53 / 12-Month Price Range: $ 13.56-26.36 / Short interest (% of float): 4.1%; days to cover: 4.7 (the stock is currently on the short sale restriction list)

- Mechel PAO (MTL), down 11.4% to $4.43 / YTD price return: +116.1% / 12-Month Price Range: $ 1.29-5.19 / Short interest (% of float): 0.1%; days to cover: 0.3 (the stock is currently on the short sale restriction list)

- Erasca Inc (ERAS), down 10.8% to $20.28 / 12-Month Price Range: $ 14.51-24.47 / Short interest (% of float): 1.3%; days to cover: 1.8 (the stock is currently on the short sale restriction list)

- Coty Inc (COTY), down 10.7% to $8.29 / YTD price return: +18.1% / 12-Month Price Range: $ 2.65-10.49 / Short interest (% of float): 14.7%; days to cover: 3.4 (the stock is currently on the short sale restriction list)

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Osisko Green Acquisition Ltd / Canada - Financials / Listing Exchange: Toronto / Ticker: GOGR.U / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Eight Capital

- PHC Holdings Corp / Japan - Healthcare / Listing Exchange: Tokyo 1 / Ticker: 6523 / Gross proceeds (including overallotment): US$ 860.85m (offering in Japanese Yen) / Bookrunners: Goldman Sachs International, Merrill Lynch International Ltd, Mizuho International PLC, Morgan Stanley & Co. International plc, SMBC Nikko Capital Markets, KKR Capital Markets LLC, JP Morgan Securities Plc

- Healthium Medtech Ltd / India - Healthcare / Listing Exchange: National / Ticker: N/A / Gross proceeds (including overallotment): US$ 410.55m (offering in Indian Rupee) / Bookrunners: Nomura Finl Advisory & Sec, Credit Suisse Securities, ICICI Securities Ltd, CLSA India Pvt Ltd

- TDCX Inc / Singapore - High Technology / Listing Exchange: New York / Ticker: TDCX / Gross proceeds (including overallotment): US$ 400.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Credit Suisse Securities (USA) LLC

- Ji Xing Pharmaceuticals Ltd / China - Healthcare / Listing Exchange: Hong Kong / Ticker: - / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Maravai Lifesciences Holdings Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: MRVI / Gross proceeds (including overallotment): US$ 1,172.20m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Jefferies LLC, Morgan Stanley & Co LLC

- Bumble Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: BMBL / Gross proceeds (including overallotment): US$ 899.10m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc

- McAfee Corp / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: MCFE / Gross proceeds (including overallotment): US$ 554.40m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co LLC

- Ortho Clinical Diagnostics Holdings Plc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: OCDX / Gross proceeds (including overallotment): US$ 448.80m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, JP Morgan Securities LLC

- Coty Inc / United States of America - Consumer Products and Services / Listing Exchange: New York / Ticker: COTY / Gross proceeds (including overallotment): US$ 426.50m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC

- Option Care Health Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: OPCH / Gross proceeds (including overallotment): US$ 247.48m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co

- JEOL Ltd / Japan - Healthcare / Listing Exchange: Tokyo 1 / Ticker: 6951 / Gross proceeds (including overallotment): US$ 415.61m (offering in Japanese Yen) / Bookrunners: Mitsubishi UFJ Morgan Stanley Securities Co Ltd

- Adecco Group AG / Switzerland - Consumer Products and Services / Listing Exchange: Swiss Exch / Ticker: ADENE / Gross proceeds (including overallotment): US$ 275.11m (offering in Swiss Franc) / Bookrunners: Societe Generale SA, UBS, JP Morgan Securities Plc, Bofa Securities Inc

- SoftwareONE Holding AG / Switzerland - High Technology / Listing Exchange: Swiss Exch / Ticker: SWON / Gross proceeds (including overallotment): US$ 234.40m (offering in Swiss Franc) / Bookrunners: JP Morgan Securities Plc

- Andes Technology Corp / Taiwan - High Technology / Listing Exchange: Luxembourg / Ticker: 6533 / Gross proceeds (including overallotment): US$ 130.00m (offering in U.S. Dollar) / Bookrunners: Credit Suisse

- Cimb Group Holdings Bhd / Malaysia - Financials / Listing Exchange: Kuala Lump / Ticker: CIMB / Gross proceeds (including overallotment): US$ 117.12m (offering in Malaysian Ringgit) / Bookrunners: Credit Suisse, CIMB Group Sdn Bhd