Equities

Stocks Slide Again, But S&P 500 Closes Less Than 1% Below All-Time High

Value overperformed growth while size wasn't really a factor: mid- and small-caps were in line with the broader index performance

Published ET

S&P 500 Market Cap By Sector | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

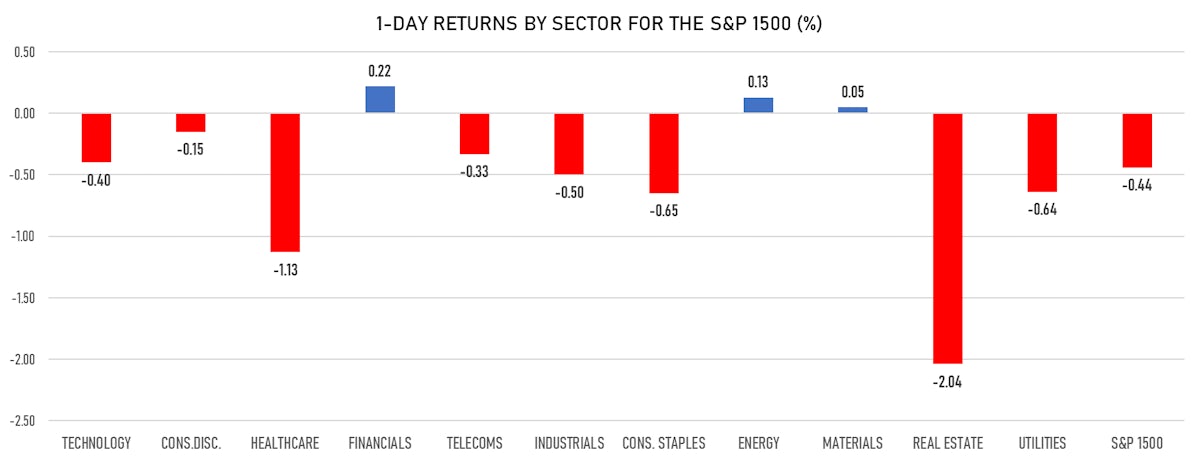

- Daily performance of US indices: S&P 500 down -0.46%; Nasdaq Composite down -0.25%; Wilshire 5000 down -0.33%

- 38.2% of S&P 500 stocks were up today, with 73.9% of stocks above their 200-day moving average (DMA) and 55.6% above their 50-DMA

- Top performing sectors in the S&P 500: financials up 0.25% and energy up 0.12%

- Bottom performing sectors in the S&P 500: real estate down -2.12% and health care down -1.17%

- The number of shares in the S&P 500 traded today was 464m for a total turnover of US$ 56 bn

- The S&P 500 Value Index was down -0.3%, while the S&P 500 Growth Index was down -0.6%; the S&P small caps index was down -0.3% and mid caps were down -0.3%

- The volume on CME's INX (S&P 500 Index) was 1.8m (3-month z-score: -0.4); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -0.06%; UK FTSE 100 down -1.01%; tonight in Asia, China's CSI 300 up 1.06%, Japan's TOPIX 500 up 1.00%

VOLATILITY

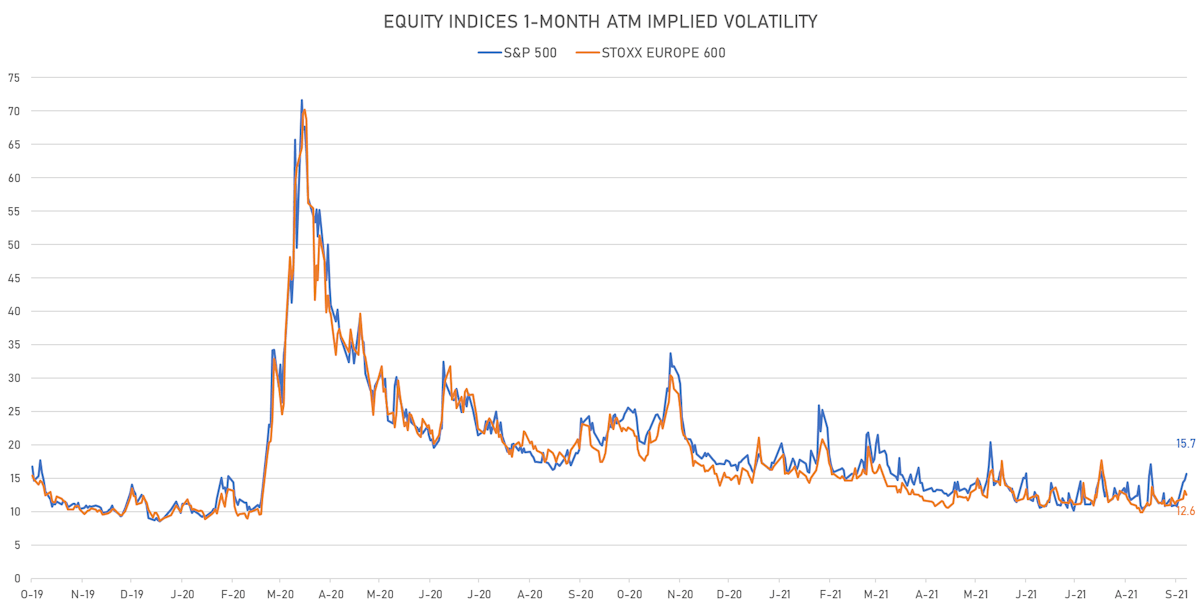

- 1-month at-the-money implied volatility on the S&P 500 at 15.7%, up from 14.7%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 12.6%, down from 13.1%

TOP WINNERS

- Rocket Lab USA Inc (RKLB), up 37.3% to $20.72 / YTD price return: +104.9% / 12-Month Price Range: $ 9.50-16.46

- Gevo Inc (GEVO), up 37.1% to $7.94 / YTD price return: +86.8% / 12-Month Price Range: $ .77-15.57 / Short interest (% of float): 14.0%; days to cover: 4.3

- Torrid Holdings Inc (CURV), up 32.4% to $24.44 / 12-Month Price Range: $ 18.26-33.19 / Short interest (% of float): 0.3%; days to cover: 0.8

- Montauk Renewables Inc (MNTK), up 24.3% to $8.90 / 12-Month Price Range: $ 6.15-14.93 / Short interest (% of float): 0.5%; days to cover: 6.4

- Hyzon Motors Inc (HYZN), up 23.5% to $10.87 / YTD price return: +2.5% / 12-Month Price Range: $ 6.02-19.95 / Short interest (% of float): 5.0%; days to cover: 3.6

- Sprinklr Inc (CXM), up 12.1% to $19.59 / 12-Month Price Range: $ 14.60-26.50 / Short interest (% of float): 8.5%; days to cover: 2.2

- Matterport Inc (MTTR), up 11.3% to $17.66 / 12-Month Price Range: $ 10.45-28.00

- Confluent Inc (CFLT), up 10.5% to $64.90 / 12-Month Price Range: $ 37.71-62.00 / Short interest (% of float): 13.4%; days to cover: 3.3

- Lululemon Athletica Inc (LULU), up 10.5% to $420.71 / YTD price return: +20.9% / 12-Month Price Range: $ 269.28-417.85 / Short interest (% of float): 1.5%

- Adagio Therapeutics Inc (ADGI), up 10.4% to $46.91 / 12-Month Price Range: $ 20.50-44.69

BIGGEST LOSERS

- Couchbase Inc (BASE), down 19.3% to $41.61 / 12-Month Price Range: $ 28.00-52.26 (the stock is currently on the short sale restriction list)

- Inogen Inc (INGN), down 15.5% to $50.33 / YTD price return: +12.6% / 12-Month Price Range: $ 26.57-82.35 / Short interest (% of float): 2.7%; days to cover: 3.1 (the stock is currently on the short sale restriction list)

- Beauty Health Co (SKIN), down 12.8% to $23.97 / YTD price return: +111.9% / 12-Month Price Range: $ 9.71-28.37 / Short interest (% of float): 10.7%; days to cover: 7.0 (the stock is currently on the short sale restriction list)

- AeroVironment Inc (AVAV), down 12.8% to $92.00 / YTD price return: +5.9% / 12-Month Price Range: $ 59.13-143.72 (the stock is currently on the short sale restriction list)

- Avid Bioservices Inc (CDMO), down 12.1% to $20.80 / YTD price return: +80.2% / 12-Month Price Range: $ 6.89-28.36 / Short interest (% of float): 7.4%; days to cover: 8.6 (the stock is currently on the short sale restriction list)

- Riskified Ltd (RSKD), down 10.6% to $31.93 / 12-Month Price Range: $ 25.38-40.48 / Short interest (% of float): 0.8%; days to cover: 0.2 (the stock is currently on the short sale restriction list)

- Pactiv Evergreen Inc (PTVE), down 10.3% to $11.82 / YTD price return: -34.8% / 12-Month Price Range: $ 10.40-19.61 / Short interest (% of float): 2.8%; days to cover: 7.7 (the stock is currently on the short sale restriction list)

- Ortho Clinical Diagnostics Holdings PLC (OCDX), down 9.5% to $17.82 / 12-Month Price Range: $ 15.14-22.99 / Short interest (% of float): 1.7%; days to cover: 2.6 (the stock is currently on the short sale restriction list)

- Zai Lab Ltd (ZLAB), down 8.4% to $136.99 / YTD price return: +1.2% / 12-Month Price Range: $ 72.42-193.54 / Short interest (% of float): 3.4%; days to cover: 4.1

- HUYA Inc (HUYA), down 8.4% to $9.93 / YTD price return: -50.2% / 12-Month Price Range: $ 8.81-36.33 / Short interest (% of float): 16.9%; days to cover: 4.1 (the stock is currently on the short sale restriction list)

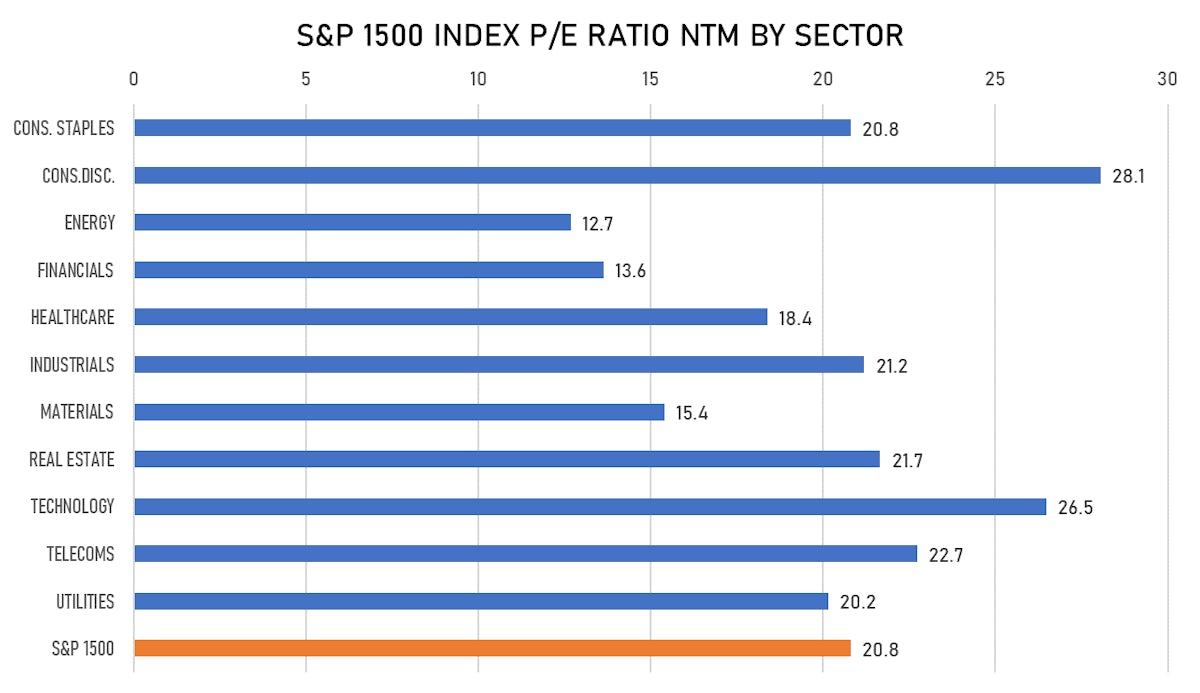

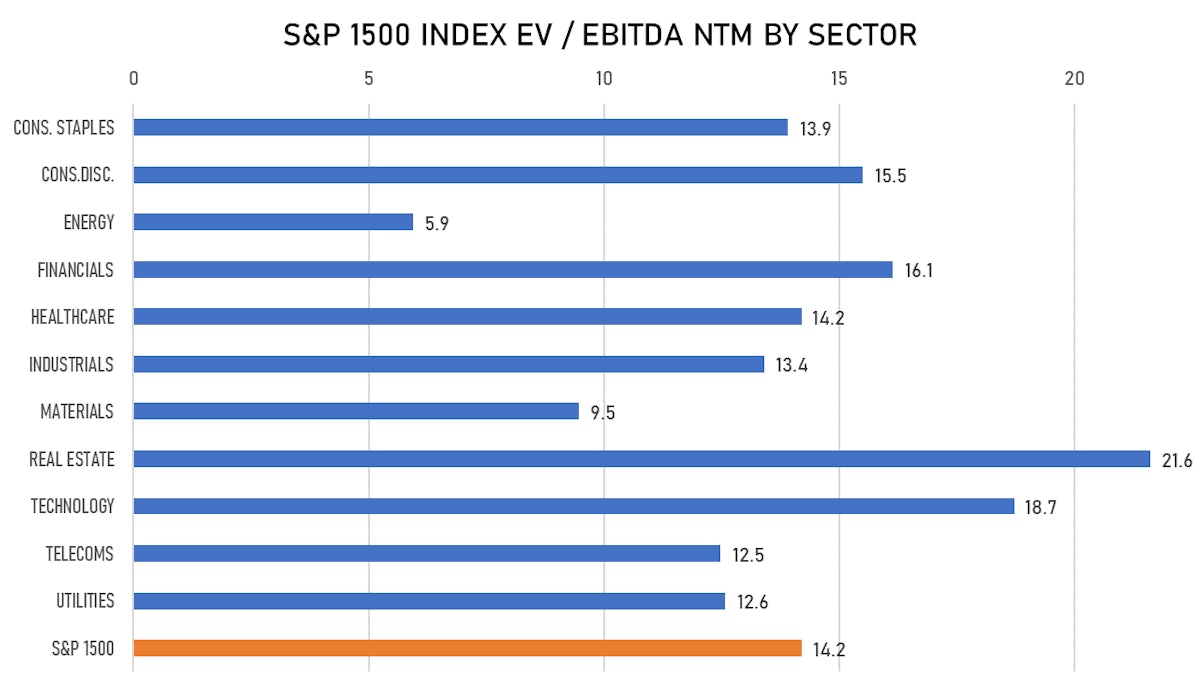

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Osisko Green Acquisition Ltd / Canada - Financials / Listing Exchange: Toronto / Ticker: GOGR.U / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Eight Capital

- Helens International Holdings Co Ltd / China - Retail / Listing Exchange: Hong Kong / Ticker: 9869 / Gross proceeds (including overallotment): US$ 239.64m (offering in Hong Kong Dollar) / Bookrunners: China International Capital Corp HK Securities Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- State Street Corp / United States of America - Financials / Listing Exchange: New York / Ticker: STT / Gross proceeds (including overallotment): US$ 1,896.74m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Bofa Securities Inc

- easyJet PLC / United Kingdom - Industrials / Listing Exchange: London / Ticker: EZJ / Gross proceeds (including overallotment): US$ 1,700.58m (offering in British Pound) / Bookrunners: Goldman Sachs International, Societe Generale SA, BNP Paribas-London Branch, Credit Suisse International, Banco Santander SA

- SBI Life Insurance Co Ltd / India - Financials / Listing Exchange: National / Ticker: SBILIF / Gross proceeds (including overallotment): US$ 365.10m (offering in Indian Rupee) / Bookrunners: BNP Paribas SA

- Cimb Group Holdings Bhd / Malaysia - Financials / Listing Exchange: Kuala Lump / Ticker: CIMB / Gross proceeds (including overallotment): US$ 159.96m (offering in Malaysian Ringgit) / Bookrunners: Credit Suisse, CIMB Group Sdn Bhd

- CRE Logistics REIT Inc / Japan - Real Estate / Listing Exchange: Tokyo / Ticker: 3487 / Gross proceeds (including overallotment): US$ 123.56m (offering in Japanese Yen) / Bookrunners: SMBC Nikko Securities Inc

- Jiangsu Yawei Machine Tool Co Ltd / China - Industrials / Listing Exchange: ShenzSME / Ticker: 002559 / Gross proceeds (including overallotment): US$ 122.70m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Ascott Residence Trust / Singapore - Financials / Listing Exchange: Singapore / Ticker: ASCO / Gross proceeds (including overallotment): US$ 108.06m (offering in Singapore Dollar) / Bookrunners: Oversea-Chinese Banking Corp Ltd, JP Morgan (S.E.A) Ltd