Equities

Index Futures Jump After CPI Data, Then Start Sliding At The Open; S&P 500 Closes Down 0.57%

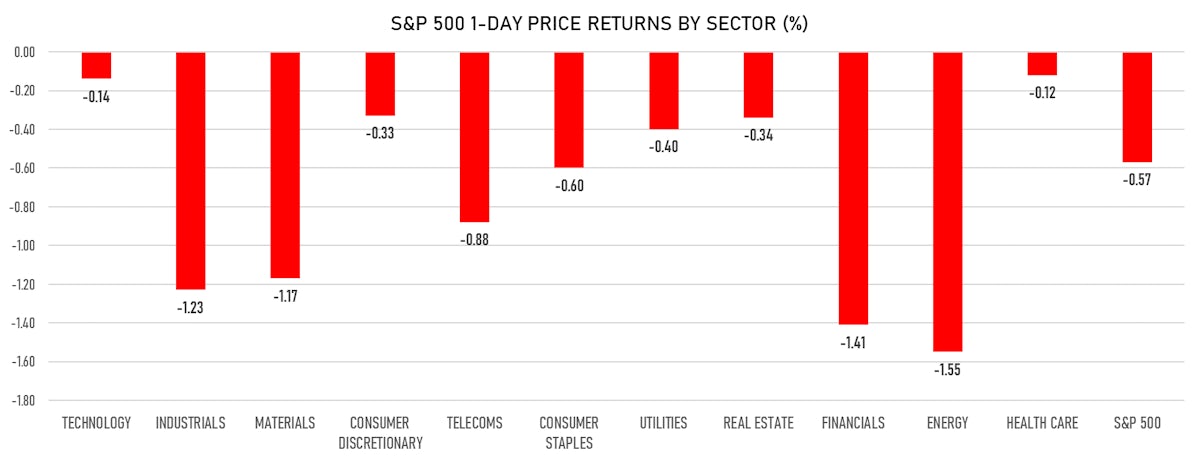

Every sector in the S&P 500 ended the day in red, with technology and healthcare the best performers; growth did better than value, large caps better than small and mid caps

Published ET

S&P 500 E-Mini Front-Month Future Intraday Prices & Volume | Source: Refinitiv

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.57%; Nasdaq Composite down -0.45%; Wilshire 5000 down -0.67%

- 26.3% of S&P 500 stocks were up today, with 71.9% of stocks above their 200-day moving average (DMA) and 45.1% above their 50-DMA

- Top performing sectors in the S&P 500: healthcare down -0.12% and technology down -0.14%

- Bottom performing sectors in the S&P 500: energy down -1.55% and financials down -1.41%

- The number of shares in the S&P 500 traded today was 531m for a total turnover of US$ 62 bn

- The S&P 500 Value Index was down -1.0%, while the S&P 500 Growth Index was down -0.2%; the S&P small caps index was down -1.4% and mid caps were down -1.1%

- The volume on CME's INX (S&P 500 Index) was 2.0m (3-month z-score: 0.2); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -0.01%; UK FTSE 100 down -0.49%; tonight in Asia, China's CSI 300 down -0.45%, Japan's TOPIX 500 down -1.09%

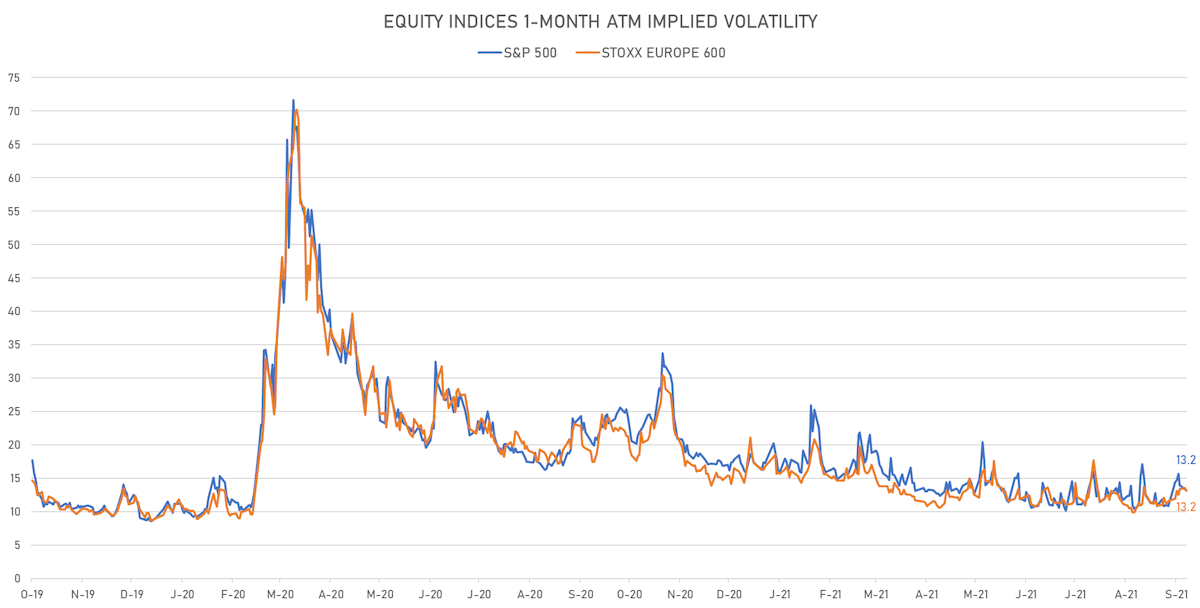

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 13.2%, down from 13.4%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 13.2%, down from 13.6%

TOP WINNERS

- IronNet Inc (IRNT), up 20.3% to $23.32 / YTD price return: +130.4% / 12-Month Price Range: $ 9.37-29.96 / Short interest (% of float): 1.6%; days to cover: 1.3 (the stock is currently on the short sale restriction list)

- Adagio Therapeutics Inc (ADGI), up 14.8% to $49.37 / 12-Month Price Range: $ 20.50-58.59 / Short interest (% of float): 0.6%; days to cover: 0.4

- Fuelcell Energy Inc (FCEL), up 14.6% to $6.44 / YTD price return: -42.3% / 12-Month Price Range: $ 1.58-29.44

- Offerpad Solutions Inc (OPAD), up 12.4% to $11.06 / 12-Month Price Range: $ 8.20-16.00 / Short interest (% of float): 18.1%; days to cover: 11.8 (the stock is currently on the short sale restriction list)

- Angi Inc (ANGI), up 9.2% to $11.68 / YTD price return: -11.5% / 12-Month Price Range: $ 9.28-19.17

- Agiliti Inc (AGTI), up 8.5% to $22.22 / 12-Month Price Range: $ 13.56-26.36 / Short interest (% of float): 4.1%; days to cover: 6.2

- Crocs Inc (CROX), up 8.5% to $149.38 / YTD price return: +138.4% / 12-Month Price Range: $ 40.12-147.76 / Short interest (% of float): 4.5%; days to cover: 2.5

- Treace Medical Concepts Inc (TMCI), up 8.3% to $29.99 / 12-Month Price Range: $ 22.46-37.17 / Short interest (% of float): 1.3%; days to cover: 4.0

- Mesa Laboratories Inc (MLAB), up 8.2% to $302.92 / 12-Month Price Range: $ 229.00-307.97

- Soaring Eagle Acquisition Corp (SRNG), up 7.9% to $9.87 / 12-Month Price Range: $ 8.90-10.89 / Short interest (% of float): 5.5%; days to cover: 1.6

BIGGEST LOSERS

- Globalstar Inc (GSAT), down 23.2% to $1.75 / YTD price return: +416.8% / 12-Month Price Range: $ .29-2.98 / Short interest (% of float): 8.7%; days to cover: 2.2

- Herbalife Nutrition Ltd (HLF), down 21.1% to $42.78 / YTD price return: -11.0% / 12-Month Price Range: $ 43.23-59.00 (the stock is currently on the short sale restriction list)

- PAR Technology Corp (PAR), down 18.1% to $56.01 / YTD price return: -10.8% / 12-Month Price Range: $ 35.16-90.35 (the stock is currently on the short sale restriction list)

- BRP Group Inc (BRP), down 16.9% to $31.27 / YTD price return: +4.3% / 12-Month Price Range: $ 22.79-40.82 / Short interest (% of float): 3.3%; days to cover: 4.8 (the stock is currently on the short sale restriction list)

- Arqit Quantum Inc (ARQQ), down 16.0% to $12.59 / 12-Month Price Range: $ 8.00-26.00 / Short interest (% of float): 0.3%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- MYT Netherlands Parent BV (MYTE), down 13.6% to $26.27 / 12-Month Price Range: $ 24.94-36.25 / Short interest (% of float): 16.0%; days to cover: 25.5 (the stock is currently on the short sale restriction list)

- GreenSky Inc (GSKY), down 12.2% to $7.77 / YTD price return: +67.8% / 12-Month Price Range: $ 3.34-9.02 / Short interest (% of float): 6.0%; days to cover: 5.8 (the stock is currently on the short sale restriction list)

- Agenus Inc (AGEN), down 12.0% to $5.59 / YTD price return: +75.8% / 12-Month Price Range: $ 2.50-6.79 / Short interest (% of float): 11.2%; days to cover: 6.6 (the stock is currently on the short sale restriction list)

- Cassava Sciences Inc (SAVA), down 11.3% to $41.79 / YTD price return: +512.8% / 12-Month Price Range: $ 5.60-146.16 / Short interest (% of float): 21.1%; days to cover: 0.8 (the stock is currently on the short sale restriction list)

- Wynn Resorts Ltd (WYNN), down 10.9% to $92.25 / YTD price return: -18.2% / 12-Month Price Range: $ 67.70-143.88 / Short interest (% of float): 7.9%; days to cover: 1.8 (the stock is currently on the short sale restriction list)

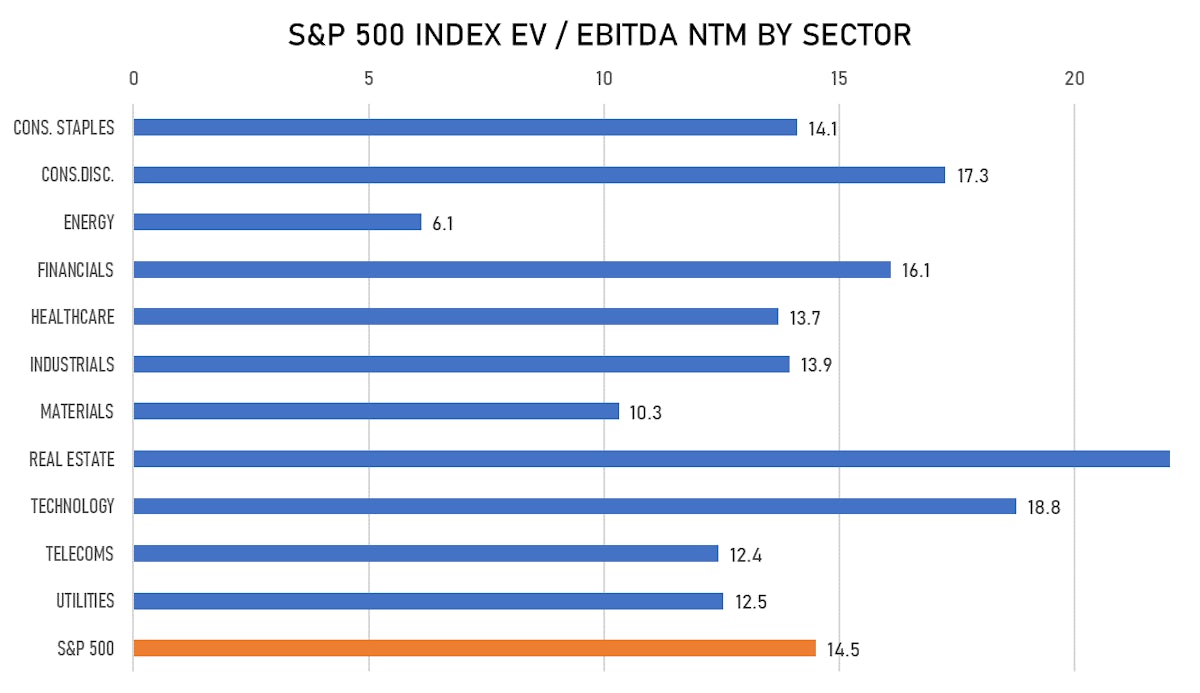

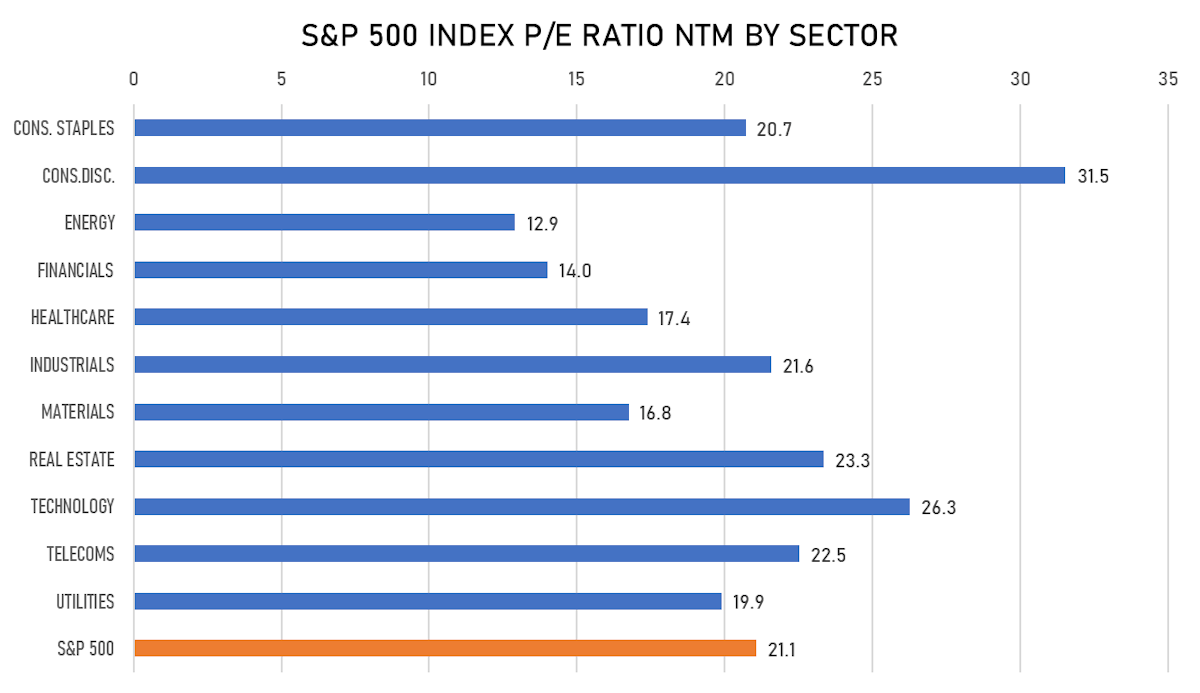

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- MELI Kaszek Pioneer Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: MEKA / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Allen & Co Inc, Goldman Sachs & Co, JP Morgan Securities LLC, BofA Securities Inc

- Phoenix Biotech Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: PBAX / Gross proceeds (including overallotment): US$ 155.00m (offering in U.S. Dollar) / Bookrunners: Cantor Fitzgerald & Co

- Sportradar Group AG / Switzerland - High Technology / Listing Exchange: Nasdaq / Ticker: SRAD / Gross proceeds (including overallotment): US$ 513.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, Morgan Stanley & Co LLC, JP Morgan Securities LLC, UBS Securities LLC

- Shui On Xintiandi Ltd / Hong Kong - Real Estate / Listing Exchange: Hong Kong / Ticker: N/A / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Ximalaya Inc / China - Media and Entertainment / Listing Exchange: Hong Kong / Ticker: N/A / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Shanghai Charm Tea Management Co Ltd / China - Retail / Listing Exchange: Hong Kong / Ticker: - / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Avantor Inc / United States of America - Healthcare / Listing Exchange: New York / Ticker: AVTR / Gross proceeds (including overallotment): US$ 875.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc, BofA Securities Inc

- Opendoor Technologies Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: OPEN / Gross proceeds (including overallotment): US$ 525.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc

- APi Group Corp / United States of America - Industrials / Listing Exchange: New York / Ticker: APG / Gross proceeds (including overallotment): US$ 400.00m (offering in U.S. Dollar) / Bookrunners: Robert W Baird & Co Inc, Citigroup Global Markets Inc, RBC Capital Markets LLC, JP Morgan Securities LLC, BofA Securities Inc, Barclays Capital Inc, UBS Securities LLC

- CS Disco Inc / United States of America - High Technology / Listing Exchange: New York / Ticker: LAW / Gross proceeds (including overallotment): US$ 328.35m (offering in U.S. Dollar) / Bookrunners: JP Morgan Securities LLC, BofA Securities Inc

- Life Storage Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: LSI / Gross proceeds (including overallotment): US$ 306.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, Wells Fargo Securities LLC

- MP Materials Corp / United States of America - Materials / Listing Exchange: New York / Ticker: MP / Gross proceeds (including overallotment): US$ 136.44m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC

- Allfunds Group PLC / United Kingdom - High Technology / Listing Exchange: EuronextAM / Ticker: ALLFG / Gross proceeds (including overallotment): US$ 519.55m (offering in EURO) / Bookrunners: Citigroup Global Markets Europe AG, Morgan Stanley Europe SE

- Vulcan Energy Resources Ltd / Australia - Materials / Listing Exchange: Australia / Ticker: VUL / Gross proceeds (including overallotment): US$ 147.32m (offering in Australian Dollar) / Bookrunners: Goldman Sachs (Australia), Canaccord Genuity (Australia) Ltd