Equities

Equities Take A Tumble: 90% Down Day For S&P 500 Stocks On Fairly High Volume

With the worst US equity drawdown since May, many IPOs planned to launch this week are now waiting for more favorable market conditions

Published ET

S&P 500 1-Month Implied Volatility Smile | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

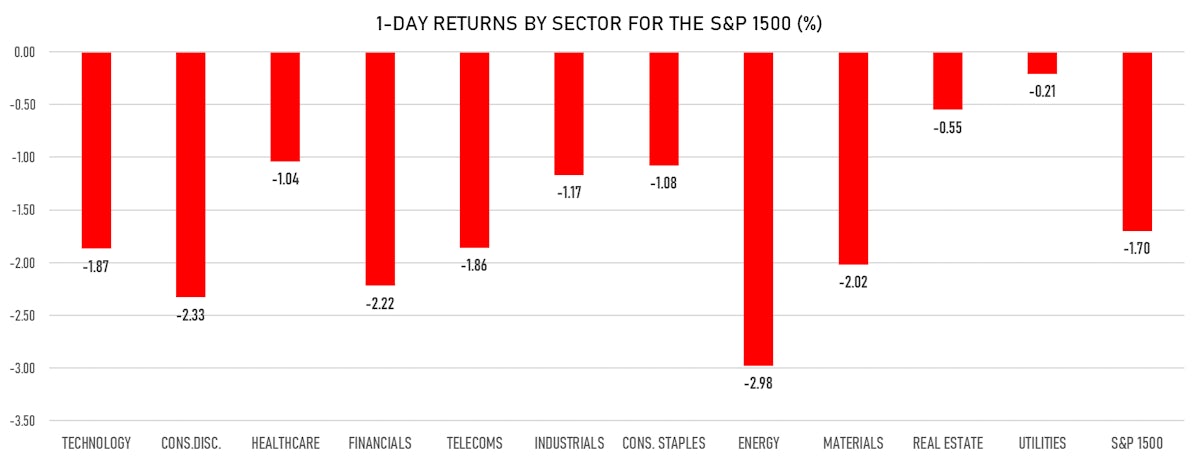

- Daily performance of US indices: S&P 500 down -1.70%; Nasdaq Composite down -2.19%; Wilshire 5000 down -1.82%

- 9.9% of S&P 500 stocks were up today, with 64.8% of stocks above their 200-day moving average (DMA) and 30.7% above their 50-DMA

- Top performing sectors in the S&P 500: utilities down -0.21% and real estate down -0.63%

- Bottom performing sectors in the S&P 500: energy down -3.04% and consumer discretionary down -2.37%

- The number of shares in the S&P 500 traded today was 716m for a total turnover of US$ 87 bn

- The S&P 500 Value Index was down -1.5%, while the S&P 500 Growth Index was down -1.9%; the S&P small caps index was down -2.0% and mid caps were down -1.6%

- The volume on CME's INX (S&P 500 Index) was 2.6m (3-month z-score: 1.8); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -1.67%; UK FTSE 100 down -0.86%; tonight in Asia, Japan's TOPIX 500 down -1.65% (Chinese markets are closed Monday-Tuesday)

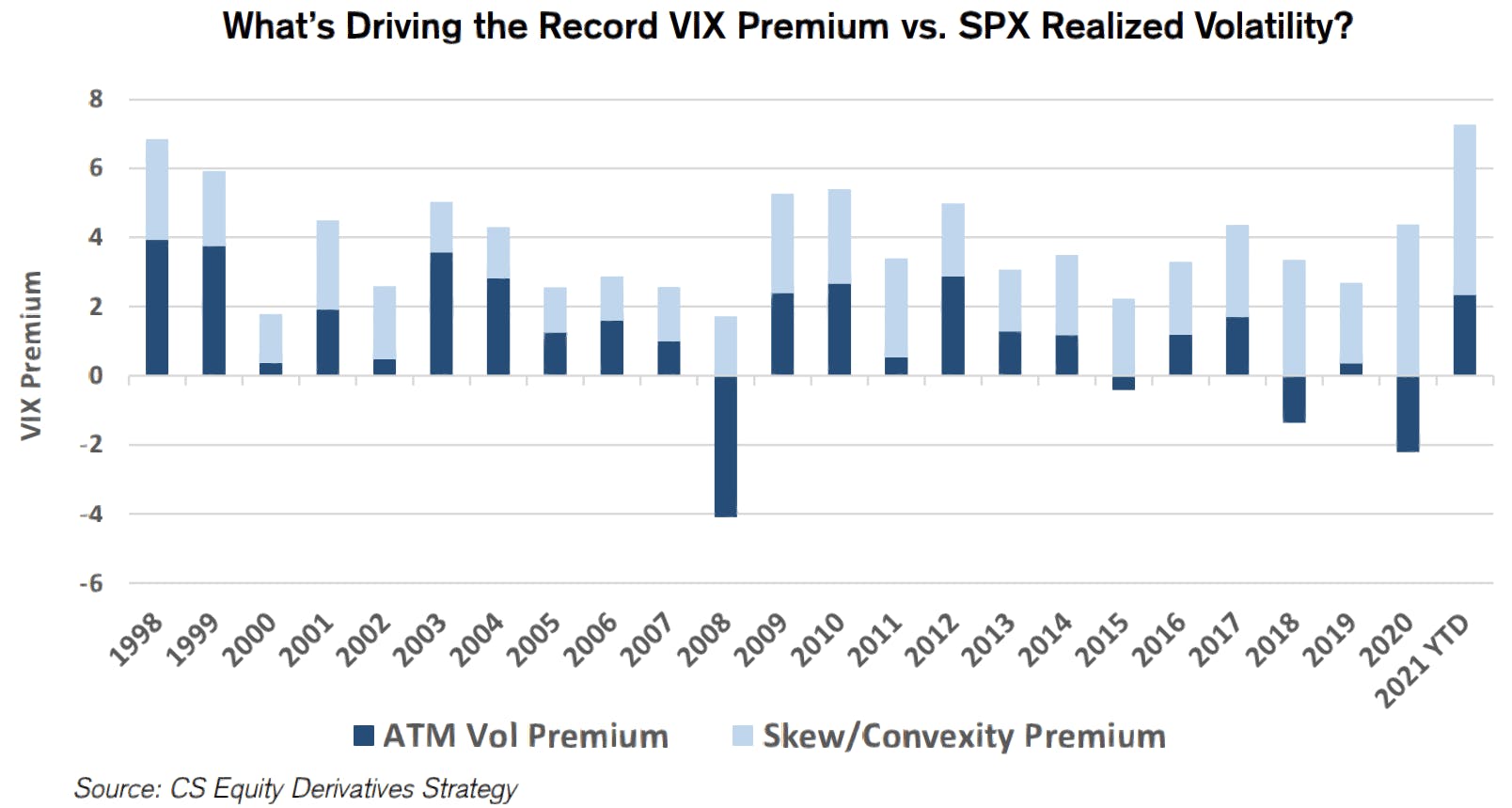

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 19.5%, up from 14.4%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 18.9%, up from 14.6%

NOTABLE S&P 500 EARNINGS RELEASES

- Leidos Holdings Inc (LDOS | Technology): missed on EPS (1.52 act. vs. 1.58 est.) and beat on revenue (3,448m act. vs. 3,375m est.), up 0.46% today

TOP WINNERS

- Discovery Inc (DISCB), up 45.5% to $67.50 / YTD price return: +108.3% / 12-Month Price Range: $ 26.00-150.72 / Short interest (% of float): 1.4%; days to cover: 0.8

- Arqit Quantum Inc (ARQQ), up 36.6% to $24.94 / 12-Month Price Range: $ 8.00-26.00 / Short interest (% of float): 0.3%; days to cover: 0.6

- Dutch Bros Inc (BROS), up 18.4% to $51.56 / 12-Month Price Range: $ 32.42-54.39 (the stock is currently on the short sale restriction list)

- ProShares Ultra VIX Short-Term Futures ETF (UVXY), up 16.3% to $27.31 / YTD price return: -74.4% / 12-Month Price Range: $ 20.60-232.00 / Short interest (% of float): 11.3%; days to cover: 0.2

- Companhia Energetica de Minas Gerais CEMIG (CIGc), up 10.7% to $3.21 / YTD price return: +10.5% / 12-Month Price Range: $ 1.61-3.55 / Short interest (% of float): 0.0%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- Atea Pharmaceuticals Inc (AVIR), up 10.3% to $28.94 / YTD price return: -30.7% / 12-Month Price Range: $ 18.72-94.17 / Short interest (% of float): 7.8%; days to cover: 5.0

- IronNet Inc (IRNT), up 10.2% to $33.34 / YTD price return: +229.4% / 12-Month Price Range: $ 9.37-47.50 / Short interest (% of float): 1.6%; days to cover: 1.3

- Microvast Holdings Inc (MVST), up 10.0% to $10.08 / YTD price return: -41.1% / 12-Month Price Range: $ 7.83-25.20 / Short interest (% of float): 4.9%; days to cover: 1.9

- Brooks Automation Inc (BRKS), up 8.8% to $102.45 / YTD price return: +51.0% / 12-Month Price Range: $ 43.14-108.72

- Li-Cycle Holdings Corp (LICY), up 7.7% to $9.48 / YTD price return: -8.5% / 12-Month Price Range: $ 7.69-15.74 / Short interest (% of float): 3.6%; days to cover: 6.0

BIGGEST LOSERS

- Golden Ocean Group Ltd (GOGL), down 17.0% to $9.30 / YTD price return: +100.9% / 12-Month Price Range: $ 3.17-12.17 (the stock is currently on the short sale restriction list)

- Zhihu Inc (ZH), down 15.8% to $7.87 / 12-Month Price Range: $ 6.81-13.85 / Short interest (% of float): 1.5%; days to cover: 4.2 (the stock is currently on the short sale restriction list)

- Scholar Rock Holding Corp (SRRK), down 15.8% to $34.09 / YTD price return: -29.8% / 12-Month Price Range: $ 13.30-70.00 / Short interest (% of float): 10.6%; days to cover: 17.6 (the stock is currently on the short sale restriction list)

- Icosavax Inc (ICVX), down 14.5% to $28.27 / 12-Month Price Range: $ 21.70-49.99 / Short interest (% of float): 1.4%; days to cover: 0.9 (the stock is currently on the short sale restriction list)

- Apollo Medical Holdings Inc (AMEH), down 14.5% to $82.81 / YTD price return: +353.3% / 12-Month Price Range: $ 16.21-114.55 / Short interest (% of float): 5.9%; days to cover: 4.7 (the stock is currently on the short sale restriction list)

- TMC the metals company Inc (TMC), down 14.3% to $8.90 / YTD price return: -17.3% / 12-Month Price Range: $ 8.31-15.39 / Short interest (% of float): 1.5%; days to cover: 4.7 (the stock is currently on the short sale restriction list)

- Cognyte Software Ltd (CGNT), down 13.7% to $24.31 / 12-Month Price Range: $ 22.22-38.00 / Short interest (% of float): 0.4%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- Verve Therapeutics Inc (VERV), down 13.5% to $51.78 / 12-Month Price Range: $ 29.50-78.00 / Short interest (% of float): 4.2%; days to cover: 6.3 (the stock is currently on the short sale restriction list)

- Connect Biopharma Holdings Ltd (CNTB), down 13.2% to $20.02 / 12-Month Price Range: $ 14.02-29.27 / Short interest (% of float): 1.5%; days to cover: 14.0 (the stock is currently on the short sale restriction list)

- Denison Mines Corp (DNN), down 12.4% to $1.41 / YTD price return: +117.9% / 12-Month Price Range: $ .30-1.81 / Short interest (% of float): 2.5%; days to cover: 4.0

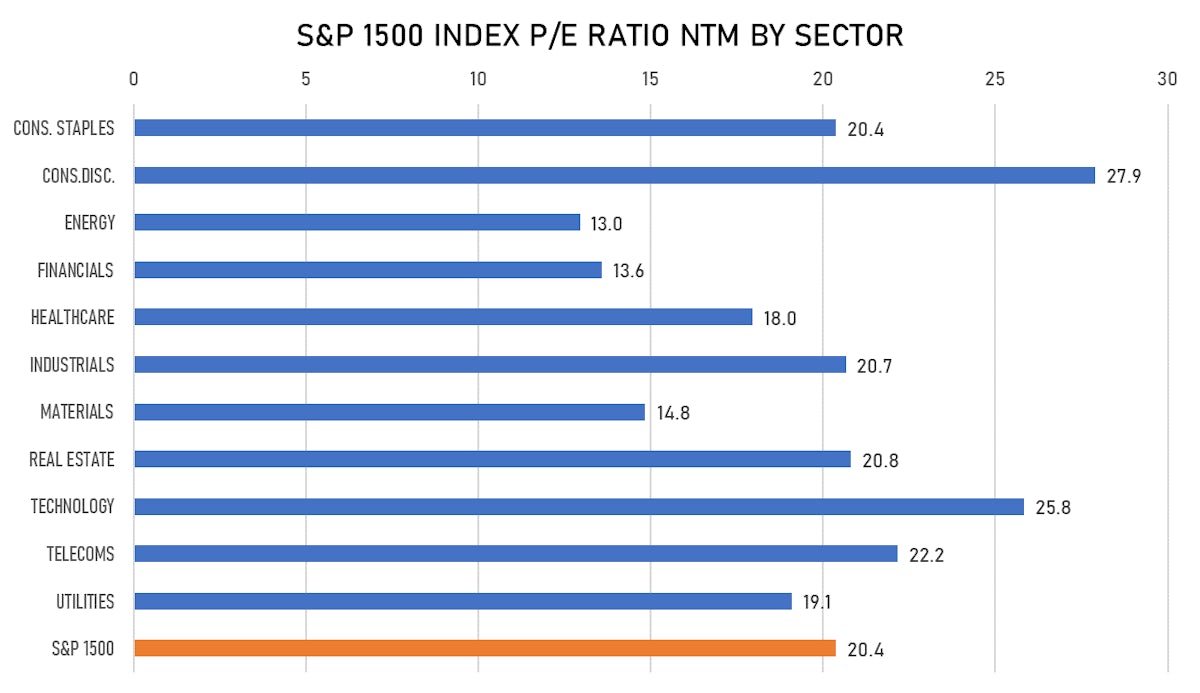

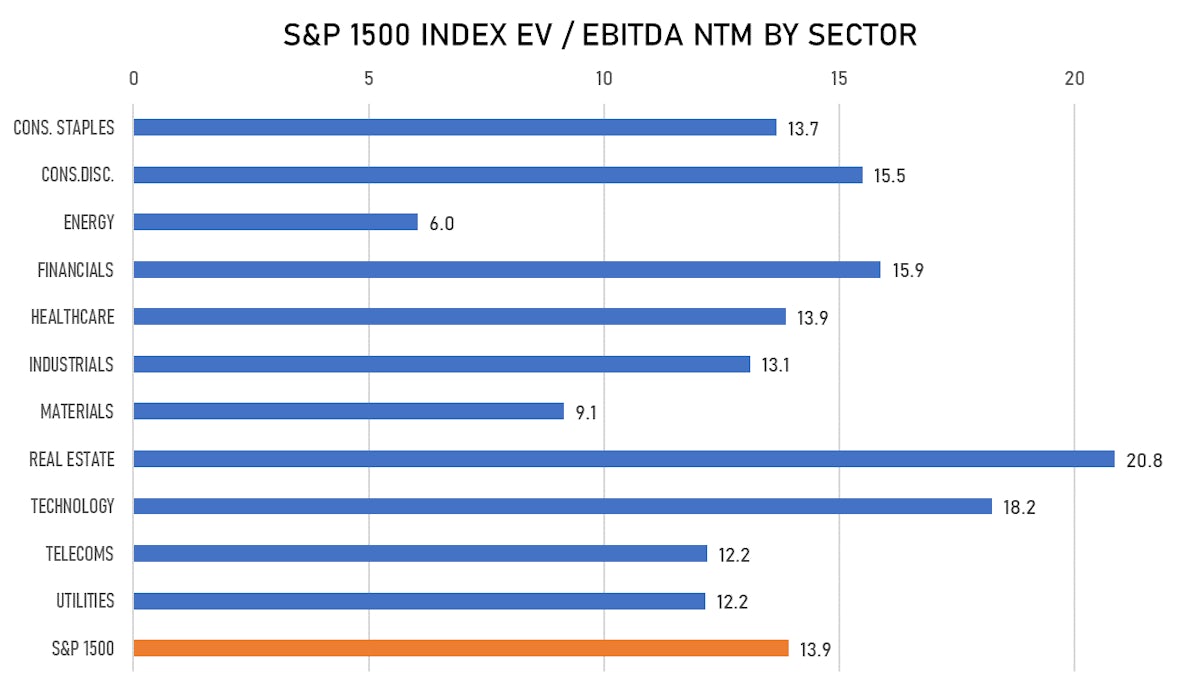

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Droom Technology Pvt Ltd / India - Retail / Listing Exchange: - / Ticker: - / Gross proceeds (including overallotment): US$ 271.59m (offering in Indian Rupee) / Bookrunners: Not Applicable

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Poema Global Holdings Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: PPGHU / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Transurban Group / Australia - Industrials / Listing Exchange: Australia / Ticker: TCL / Gross proceeds (including overallotment): US$ 2,880.75m (offering in Australian Dollar) / Bookrunners: UBS AG, Macquarie Capital (Australia) Ltd, Morgan Stanley Australia Securities Ltd, Barrenjoey Capital Partners Group Pty Ltd

- Tritax Eurobox PLC / United Kingdom - Real Estate / Listing Exchange: London / Ticker: EBOX / Gross proceeds (including overallotment): US$ 293.01m (offering in British Pound) / Bookrunners: Jefferies International Ltd, Van Lanschot Kempen Wealth Management NV

- Transurban Group / Australia - Industrials / Listing Exchange: Australia / Ticker: TCL / Gross proceeds (including overallotment): US$ 181.63m (offering in Australian Dollar) / Bookrunners: Not Applicable