Equities

US Equity Indices Almost Unchanged, Though 2/3 Of S&P 500 Stocks Fall

Growth and large caps overperformed value and small caps, while trading volumes were close to their 3-month average

Published ET

S&P 500 1-Month Implied Volatility Smile Remains Heavily Skewed To The Downside | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

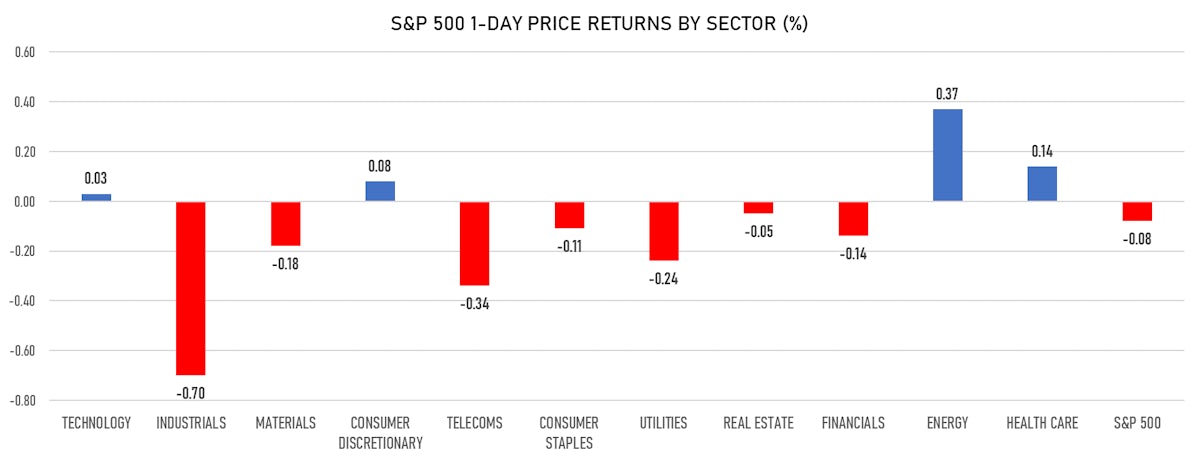

- Daily performance of US indices: S&P 500 down -0.08%; Nasdaq Composite up 0.22%; Wilshire 5000 up 0.05%

- 33.9% of S&P 500 stocks were up today, with 62.6% of stocks above their 200-day moving average (DMA) and 29.3% above their 50-DMA

- Top performing sectors in the S&P 500: energy up 0.37% and health care up 0.14%

- Bottom performing sectors in the S&P 500: industrials down -0.70% and telecoms down -0.34%

- The number of shares in the S&P 500 traded today was 525m for a total turnover of US$ 60 bn

- The S&P 500 Value Index was down -0.4%, while the S&P 500 Growth Index was up 0.2%; the S&P small caps index was down -0.2% and mid caps were down -0.2%

- The volume on CME's INX (S&P 500 Index) was 1.9m (3-month z-score: -0.1); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 1.00%; UK FTSE 100 up 1.12%; tonight in Asia, China's CSI 300 down -1.36%, Japan's TOPIX 500 down -0.70%

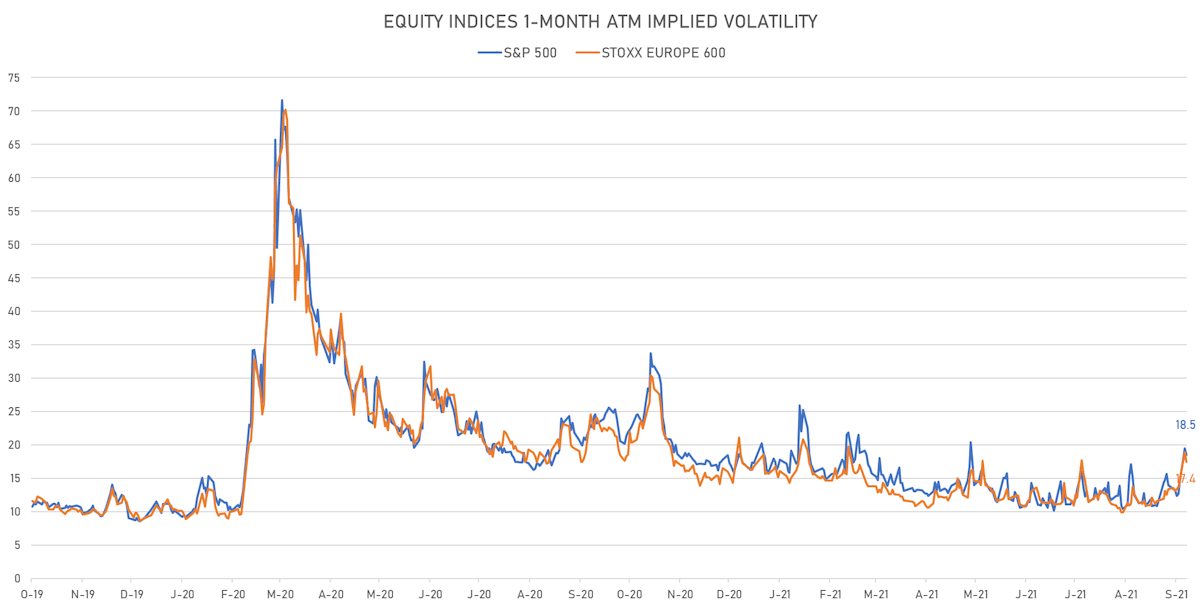

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 18.5%, down from 19.5%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 17.4%, down from 18.9%

NOTABLE S&P 500 EARNINGS RELEASES

- Autozone Inc (AZO | Consumer Cyclicals): beat on EPS (35.72 act. vs. 29.92 est.) and beat on revenue (4,913m act. vs. 4,571m est.), up 3.65% today

- Adobe Inc (ADBE | Technology): beat on EPS (3.11 act. vs. 3.03 est.) and beat on revenue (3,935m act. vs. 3,894m est.), up 0.72% today

- FedEx Corp (FDX | Industrials): missed on EPS (4.37 act. vs. 4.91 est.) and beat on revenue (22,000m act. vs. 21,926m est.), up 0.51% today

TOP WINNERS

- Arqit Quantum Inc (ARQQ), up 26.6% to $31.57 / 12-Month Price Range: $ 8.00-26.48 / Short interest (% of float): 0.3%; days to cover: 0.6

- Spire Global Inc (SPIR), up 17.9% to $15.27 / YTD price return: +52.5% / 12-Month Price Range: $ 8.27-14.80 / Short interest (% of float): 0.6%; days to cover: 1.9 (the stock is currently on the short sale restriction list)

- Quantumscape Corp (QS), up 16.0% to $24.12 / YTD price return: -71.4% / 12-Month Price Range: $ 11.25-132.73 / Short interest (% of float): 17.3%; days to cover: 4.6

- Valneva SE (VALN), up 15.9% to $29.00 / 12-Month Price Range: $ 24.16-59.15 / Short interest (% of float): 0.0%; days to cover: 0.5

- indie Semiconductor Inc (INDI), up 14.2% to $11.52 / YTD price return: -12.9% / 12-Month Price Range: $ 8.00-14.94 / Short interest (% of float): 5.6%; days to cover: 3.3

- Lightwave Logic Inc (LWLG), up 13.6% to $13.40 / 12-Month Price Range: $ .56-17.24 / Short interest (% of float): 1.0%; days to cover: 1.7

- Warner Music Group Corp (WMG), up 11.8% to $45.00 / YTD price return: +18.5% / 12-Month Price Range: $ 25.61-41.59 / Short interest (% of float): 3.8%; days to cover: 6.1

- Uber Technologies Inc (UBER), up 11.5% to $44.36 / YTD price return: -13.0% / 12-Month Price Range: $ 32.89-64.05

- Lucid Group Inc (LCID), up 11.4% to $26.81 / YTD price return: +167.8% / 12-Month Price Range: $ 9.60-64.86 / Short interest (% of float): 2.8%; days to cover: 4.3

- Tegna Inc (TGNA), up 10.8% to $21.62 / YTD price return: +55.0% / 12-Month Price Range: $ 11.26-21.52 / Short interest (% of float): 2.3%; days to cover: 5.5

BIGGEST LOSERS

- Discovery Inc (DISCB), down 29.1% to $47.87 / YTD price return: +47.7% / 12-Month Price Range: $ 26.00-150.72 / Short interest (% of float): 1.4%; days to cover: 0.8 (the stock is currently on the short sale restriction list)

- RBC Bearings Inc (ROLL), down 12.2% to $189.30 / YTD price return: +5.7% / 12-Month Price Range: $ 113.40-250.52 / Short interest (% of float): 1.2%; days to cover: #N/A (the stock is currently on the short sale restriction list)

- Tango Therapeutics Inc (TNGX), down 10.1% to $14.93 / 12-Month Price Range: $ 8.90-18.84 / Short interest (% of float): 0.1%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- Monte Rosa Therapeutics Inc (GLUE), down 8.8% to $24.70 / 12-Month Price Range: $ 18.01-45.56 / Short interest (% of float): 3.8%; days to cover: 9.6 (the stock is currently on the short sale restriction list)

- InnovAge Holding Corp (INNV), down 8.3% to $11.65 / 12-Month Price Range: $ 12.61-27.18 / Short interest (% of float): 13.8%; days to cover: 13.7

- Americold Realty Trust (COLD), down 8.3% to $31.62 / YTD price return: -15.3% / 12-Month Price Range: $ 32.94-40.85 / Short interest (% of float): 4.9%; days to cover: 4.8

- PureTech Health PLC (PRTC), down 8.0% to $48.68 / 12-Month Price Range: $ 33.00-65.90 / Short interest (% of float): 0.0%; days to cover: 1.2 (the stock is currently on the short sale restriction list)

- Golden Nugget Online Gaming Inc (GNOG), down 7.9% to $18.92 / 12-Month Price Range: $ 10.10-27.18 / Short interest (% of float): 8.9%; days to cover: 1.5

- DraftKings Inc (DKNG), down 7.4% to $52.77 / YTD price return: +13.3% / 12-Month Price Range: $ 34.90-74.38 / Short interest (% of float): 8.9%; days to cover: 2.8

- IronNet Inc (IRNT), down 7.1% to $30.96 / YTD price return: +205.9% / 12-Month Price Range: $ 9.37-47.50 / Short interest (% of float): 1.6%; days to cover: 1.3 (the stock is currently on the short sale restriction list)

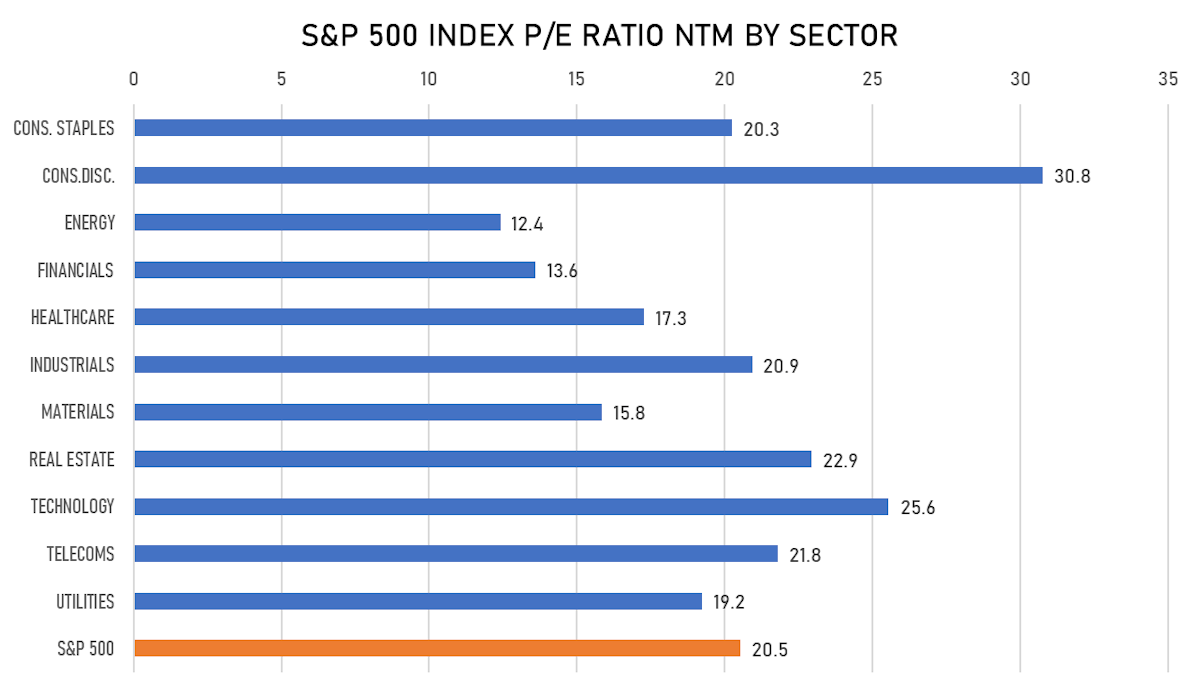

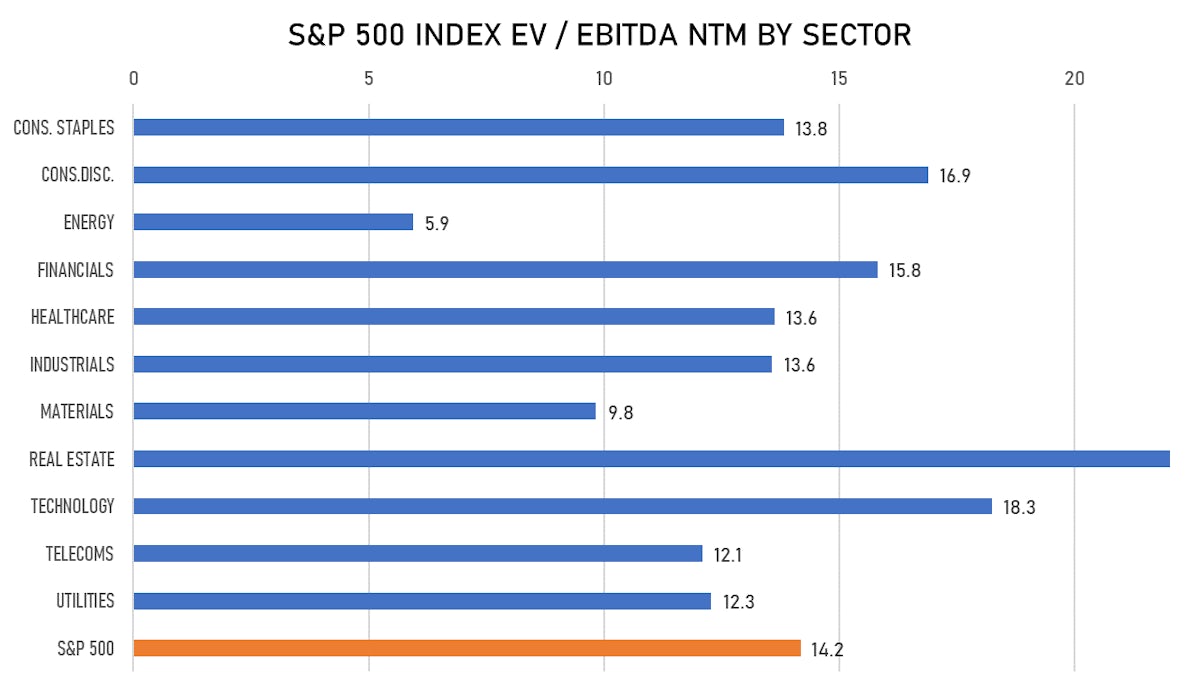

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Droom Technology Pvt Ltd / India - Retail / Listing Exchange: - / Ticker: - / Gross proceeds (including overallotment): US$ 271.59m (offering in Indian Rupee) / Bookrunners: Not Applicable

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Peabody Energy Corp / United States of America - Materials / Listing Exchange: New York / Ticker: BTU / Gross proceeds (including overallotment): US$ 194.38m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- SBI Cards & Payments Services Ltd / India - Financials / Listing Exchange: National / Ticker: SBIC / Gross proceeds (including overallotment): US$ 454.78m (offering in Indian Rupee) / Bookrunners: Bank of America, Citigroup