Equities

Solid Rebound In Equities After Derisking Ahead Of The FOMC

86% up day for S&P 500 stocks on average volume, with strong overperformance of small caps over large caps and value over growth

Published ET

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 1.21%; Nasdaq Composite up 1.04%; Wilshire 5000 up 1.24%

- 85.7% of S&P 500 stocks were up today, with 72.5% of stocks above their 200-day moving average (DMA) and 49.9% above their 50-DMA

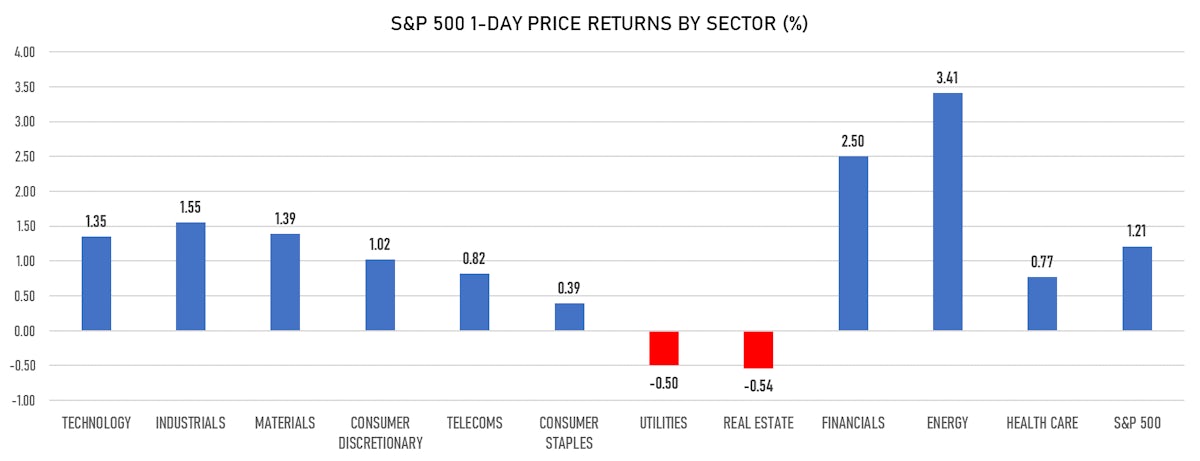

- Top performing sectors in the S&P 500: energy up 3.41% and financials up 2.50%

- Bottom performing sectors in the S&P 500: real estate down -0.54% and utilities down -0.50%

- The number of shares in the S&P 500 traded today was 493m for a total turnover of US$ 59 bn

- The S&P 500 Value Index was up 1.5%, while the S&P 500 Growth Index was up 1.0%; the S&P small caps index was up 1.8% and mid caps were up 1.4%

- The volume on CME's INX (S&P 500 Index) was 2.0m (3-month z-score: 0.0); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.93%; UK FTSE 100 down -0.07%; tonight in Asia, China's CSI 300 up 0.80%, Japan's TOPIX 500 up 2.00%

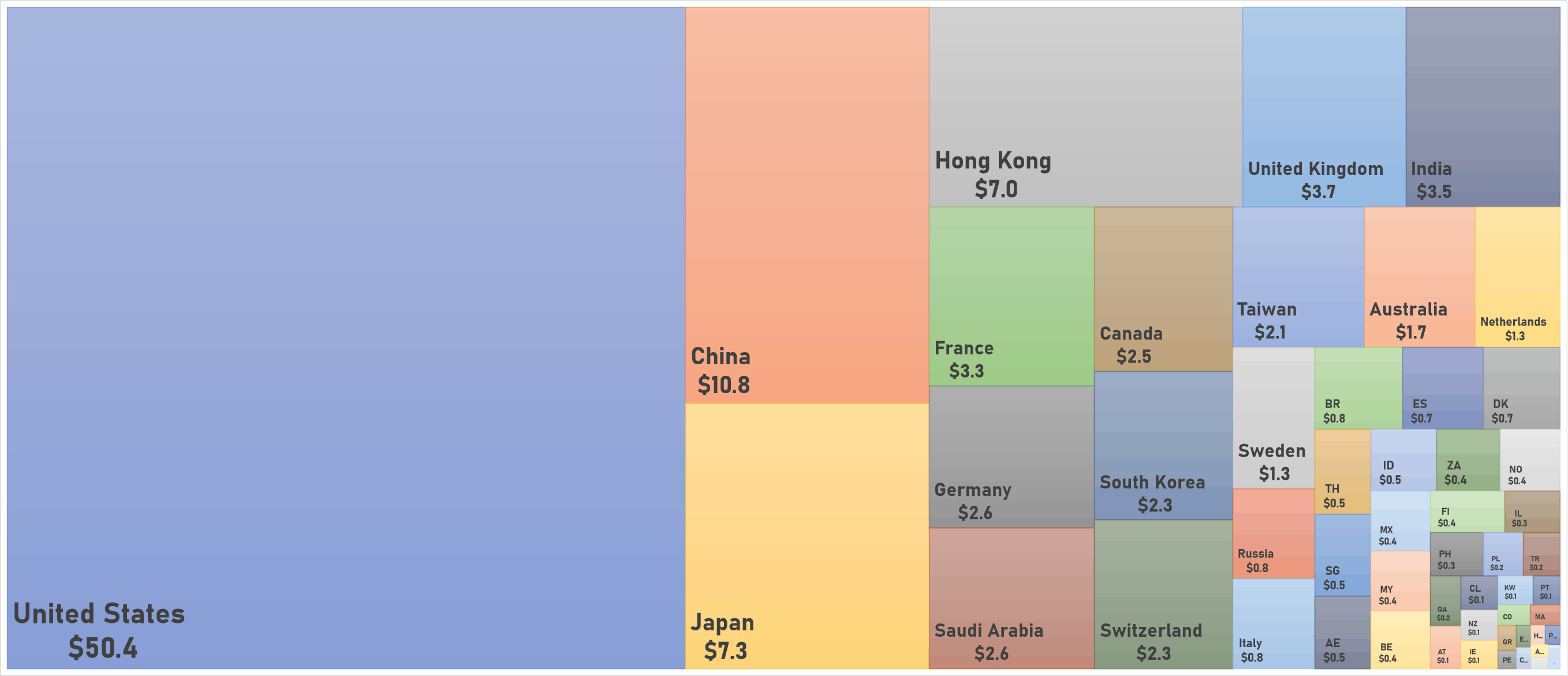

US EQUITIES BACK ABOVE $50 TRILLION

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 13.8%, down from 15.2%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 14.0%, down from 15.7%

TOP WINNERS

- Standard Lithium Ltd (SLI), up 17.5% to $8.27 / YTD price return: +270.0% / 12-Month Price Range: $ 1.04-9.09 / Short interest (% of float): 0.7%; days to cover: 0.6

- Ferroglobe PLC (GSM), up 17.2% to $8.88 / 12-Month Price Range: $ .59-11.25 / Short interest (% of float): 1.4%; days to cover: 0.8

- Cassava Sciences Inc (SAVA), up 14.9% to $60.12 / YTD price return: +781.5% / 12-Month Price Range: $ 6.70-146.16 / Short interest (% of float): 21.1%; days to cover: 0.8

- Quantumscape Corp (QS), up 14.6% to $27.05 / YTD price return: -68.0% / 12-Month Price Range: $ 11.25-132.73 / Short interest (% of float): 17.3%; days to cover: 4.6

- Angi Inc (ANGI), up 13.5% to $13.84 / YTD price return: +4.9% / 12-Month Price Range: $ 9.28-19.17

- Canoo Inc (GOEV), up 13.3% to $7.42 / YTD price return: -46.2% / 12-Month Price Range: $ 5.75-24.90 / Short interest (% of float): 31.3%; days to cover: 12.0

- Enovix Corp (ENVX), up 13.0% to $19.99 / 12-Month Price Range: $ 11.65-28.50 / Short interest (% of float): 2.5%; days to cover: 3.0

- Purecycle Technologies Inc (PCT), up 12.9% to $14.66 / YTD price return: -9.1% / 12-Month Price Range: $ 9.80-35.75 / Short interest (% of float): 20.7%; days to cover: 14.3

- Traeger Inc (COOK), up 11.9% to $23.09 / 12-Month Price Range: $ 20.39-32.59 / Short interest (% of float): 2.4%; days to cover: 0.8

- Embraer SA (ERJ), up 11.8% to $17.95 / YTD price return: +163.6% / 12-Month Price Range: $ 3.96-18.39 / Short interest (% of float): 2.5%; days to cover: 1.9

BIGGEST LOSERS

- Arqit Quantum Inc (ARQQ), down 21.3% to $28.00 / 12-Month Price Range: $ 8.00-38.88 / Short interest (% of float): 0.4%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- TMC the metals company Inc (TMC), down 21.0% to $5.46 / YTD price return: -49.3% / 12-Month Price Range: $ 6.75-15.39 / Short interest (% of float): 2.1%; days to cover: 4.7 (the stock is currently on the short sale restriction list)

- Spire Global Inc (SPIR), down 20.4% to $14.68 / YTD price return: +46.7% / 12-Month Price Range: $ 8.27-19.50 / Short interest (% of float): 0.6%; days to cover: 1.9 (the stock is currently on the short sale restriction list)

- IronNet Inc (IRNT), down 19.1% to $23.79 / YTD price return: +135.1% / 12-Month Price Range: $ 9.37-47.50 / Short interest (% of float): 1.6%; days to cover: 1.3 (the stock is currently on the short sale restriction list)

- Altice USA Inc (ATUS), down 12.7% to $22.06 / YTD price return: -41.7% / 12-Month Price Range: $ 24.91-38.30 (the stock is currently on the short sale restriction list)

- PTC Therapeutics Inc (PTCT), down 9.9% to $39.48 / YTD price return: -35.3% / 12-Month Price Range: $ 36.38-70.82 / Short interest (% of float): 6.6%; days to cover: 11.1 (the stock is currently on the short sale restriction list)

- Vale SA (VALE), down 9.7% to $14.82 / YTD price return: -11.6% / 12-Month Price Range: $ 10.29-23.18 / Short interest (% of float): 0.5%;

- 1Life Healthcare Inc (ONEM), down 8.4% to $22.44 / YTD price return: -48.6% / 12-Month Price Range: $ 21.79-59.82 / Short interest (% of float): 7.1%; days to cover: 10.8

- I-Mab (IMAB), down 8.2% to $70.30 / YTD price return: +49.1% / 12-Month Price Range: $ 32.64-85.40 / Short interest (% of float): 2.6%; days to cover: 2.6 (the stock is currently on the short sale restriction list)

- Discovery Inc (DISCB), down 7.6% to $55.46 / YTD price return: +71.2% / 12-Month Price Range: $ 26.00-150.72 / Short interest (% of float): 1.4%; days to cover: 0.8 (the stock is currently on the short sale restriction list)

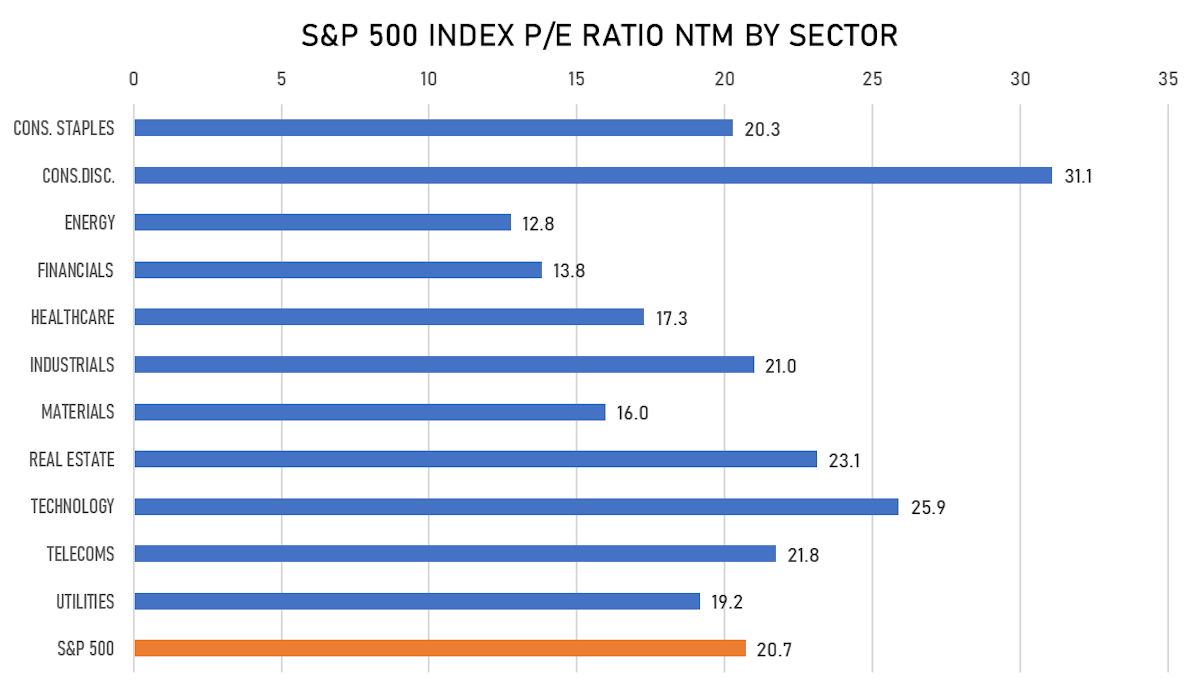

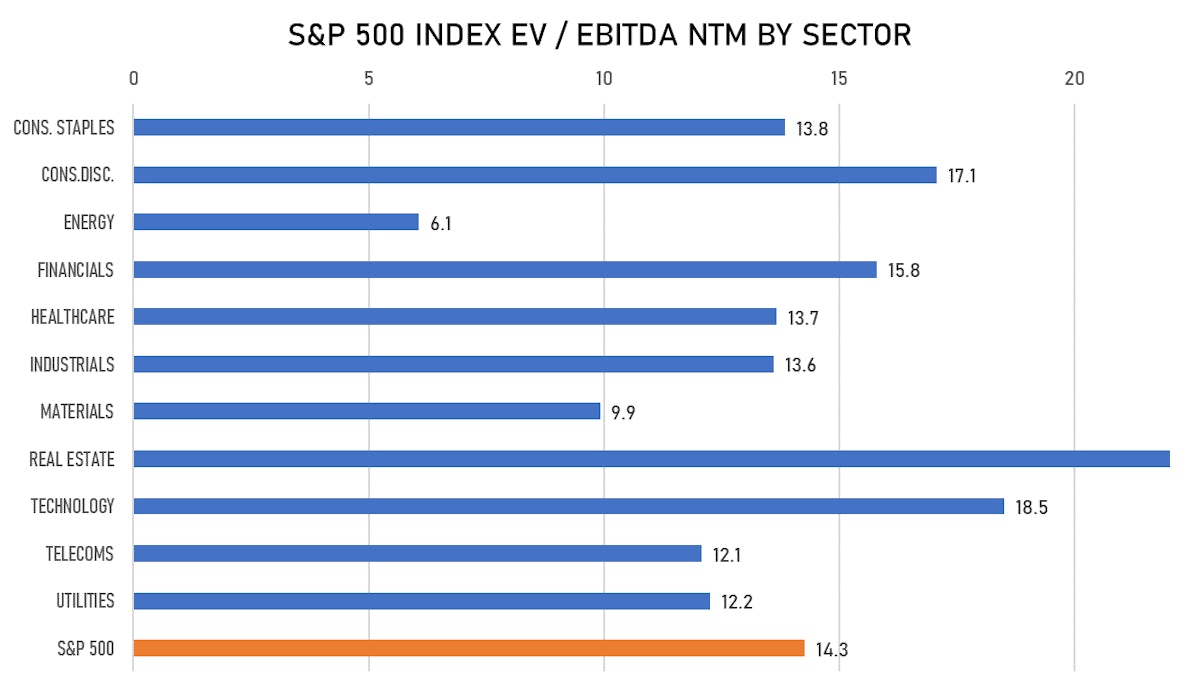

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Freshworks Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: FRSH / Gross proceeds (including overallotment): US$ 1,128.60m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC, JP Morgan Securities LLC, BofA Securities Inc

- Exclusive Networks SA / France - High Technology / Listing Exchange: Euro Paris / Ticker: EXN / Gross proceeds (including overallotment): US$ 427.60m (offering in EURO) / Bookrunners: Morgan Stanley & Co, Societe Generale SA, JP Morgan & Co Inc, BNP Paribas SA, Citigroup

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Rexford Industrial Realty Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: REXR / Gross proceeds (including overallotment): US$ 571.68m (offering in U.S. Dollar) / Bookrunners: JP Morgan Securities LLC, BofA Securities Inc

- Safehold Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: SAFE / Gross proceeds (including overallotment): US$ 167.20m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co LLC, JP Morgan Securities LLC, BofA Securities Inc

- Sandfire Resources Ltd / Australia - Materials / Listing Exchange: Australia / Ticker: SFR / Gross proceeds (including overallotment): US$ 588.70m (offering in Australian Dollar) / Bookrunners: Citigroup Global Markets Australia, Macquarie Capital (Australia) Ltd

- Hygeia Healthcare Holdings Co Ltd / China - Healthcare / Listing Exchange: Hong Kong / Ticker: 6078 / Gross proceeds (including overallotment): US$ 325.69m (offering in Hong Kong Dollar) / Bookrunners: JP Morgan & Co Inc, Morgan Stanley International Hong Kong