Equities

US Equities Rose A Little On Friday, Led By Energy And Telecoms

The market capitalization of US stocks is back over US$ 51 trillion (about 44% of the $116tn world market cap), with Chinese markets (onshore + offshore) coming second at roughly $18tn

Published ET

World Market Capitalization Broken Down By Country | Sources: ϕpost, FactSet data

QUICK SUMMARY

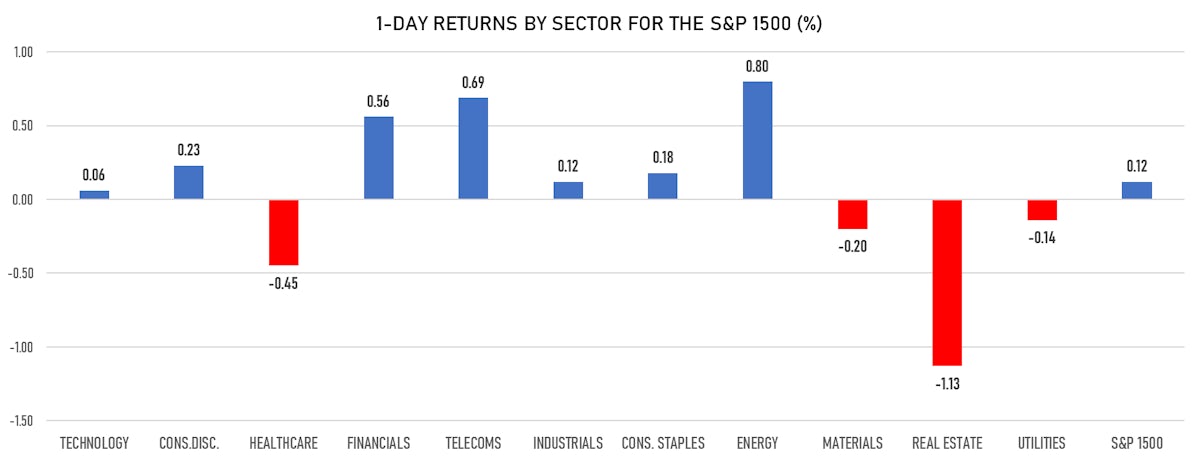

- Daily performance of US indices: S&P 500 up 0.15%; Nasdaq Composite down -0.03%; Wilshire 5000 up 0.05%

- 55.4% of S&P 500 stocks were up today, with 72.7% of stocks above their 200-day moving average (DMA) and 48.3% above their 50-DMA

- Top performing sectors in the S&P 500: energy up 0.84% and telecoms up 0.69%

- Bottom performing sectors in the S&P 500: real estate down -1.21% and healthcare down -0.42%

- The number of shares in the S&P 500 traded today was 448m for a total turnover of US$ 55 bn

- The S&P 500 Value Index was up 0.1%, while the S&P 500 Growth Index was up 0.2%; the S&P small caps index was down -0.2% and mid caps were down -0.2%

- The volume on CME's INX (S&P 500 Index) was 1.7m (3-month z-score: -0.8); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -0.90%; UK FTSE 100 down -0.38%; China CSI 300 down -0.08%; Japan's TOPIX 500 up 2.28%

WEEKLY ECM SUMMARY (IFR DATA)

- Total US issuance for the week excluding SPACs: $10.9bn

- IPOs: $5.4bn

- ABB/BLOCKs: $1.5bn

- FOLLOW-ONs: $2.9bn

- CONVERTIBLES: $1bn

- SPAC IPOs: $1.2bn

VOLATILITY

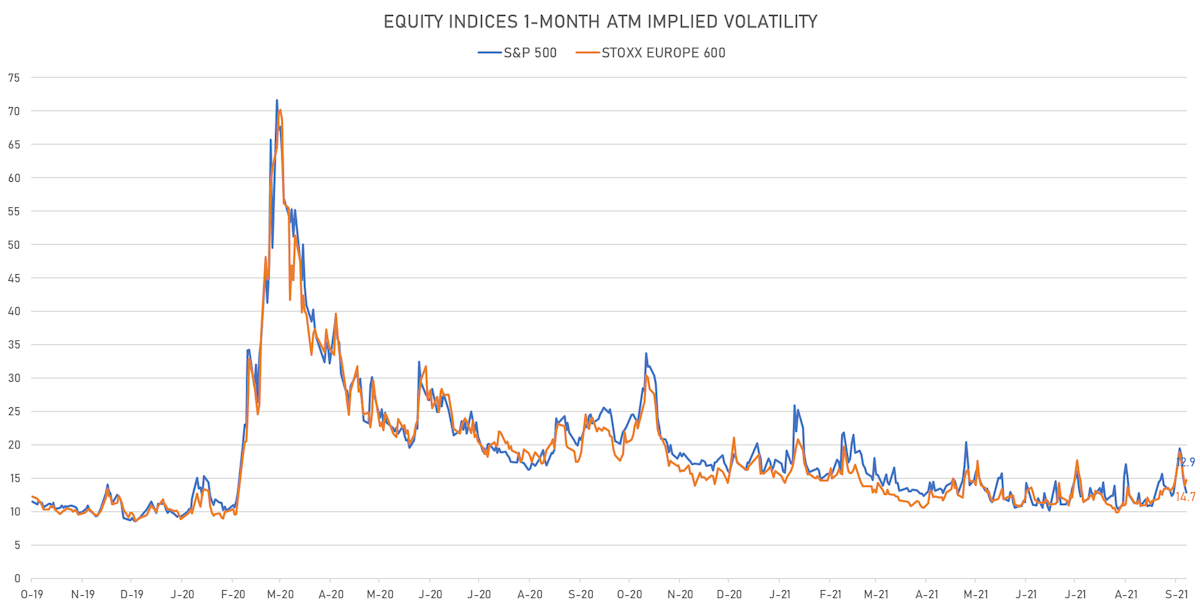

- 1-month at-the-money implied volatility on the S&P 500 at 12.9%, down from 13.8%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 14.7%, up from 14.0%

NOTABLE S&P 500 EARNINGS RELEASES

TOP WINNERS

- Meredith Corp (MDP), up 25.4% to $56.30 / YTD price return: +193.2% / 12-Month Price Range: $ 10.75-47.00

- Canoo Inc (GOEV), up 21.8% to $9.04 / YTD price return: -34.5% / 12-Month Price Range: $ 5.75-24.90 / Short interest (% of float): 31.3%; days to cover: 12.0

- Progress Software Corp (PRGS), up 14.9% to $53.10 / YTD price return: +17.5% / 12-Month Price Range: $ 34.50-49.23

- Sinclair Broadcast Group Inc (SBGI), up 10.0% to $32.36 / YTD price return: +1.6% / 12-Month Price Range: $ 16.72-39.60

- Lyell Immunopharma Inc (LYEL), up 9.4% to $12.28 / 12-Month Price Range: $ 10.62-19.84 / Short interest (% of float): 1.8%; days to cover: 16.3

- IronNet Inc (IRNT), up 8.3% to $25.76 / YTD price return: +154.5% / 12-Month Price Range: $ 9.37-47.50 / Short interest (% of float): 1.6%; days to cover: 1.3 (the stock is currently on the short sale restriction list)

- BJ's Restaurants Inc (BJRI), up 7.8% to $45.19 / YTD price return: +17.4% / 12-Month Price Range: $ 27.46-63.42 / Short interest (% of float): 7.4%; days to cover: 5.8

- Vail Resorts Inc (MTN), up 7.4% to $351.85 / YTD price return: +26.1% / 12-Month Price Range: $ 208.72-338.50

- eHealth Inc (EHTH), up 7.2% to $38.92 / YTD price return: -44.9% / 12-Month Price Range: $ 35.69-94.41 / Short interest (% of float): 7.9%; days to cover: 4.0

- Cricut Inc (CRCT), up 6.6% to $34.01 / 12-Month Price Range: $ 14.88-47.36 / Short interest (% of float): 25.2%; days to cover: 5.3

BIGGEST LOSERS

- Canaan Inc (CAN), down 21.2% to $6.11 / YTD price return: +3.0% / 12-Month Price Range: $ 1.81-39.10 / Short interest (% of float): 5.5%; days to cover: 1.2 (the stock is currently on the short sale restriction list)

- SecureWorks Corp (SCWX), down 20.8% to $21.12 / YTD price return: +48.5% / 12-Month Price Range: $ 10.01-26.89 / Short interest (% of float): 2.5%; days to cover: 4.4 (the stock is currently on the short sale restriction list)

- Chindata Group Holdings Ltd (CD), down 13.6% to $8.48 / YTD price return: -64.6% / 12-Month Price Range: $ 9.21-27.47 / Short interest (% of float): 3.7%; days to cover: 4.5 (the stock is currently on the short sale restriction list)

- Arqit Quantum Inc (ARQQ), down 13.4% to $24.24 / 12-Month Price Range: $ 8.00-41.52 / Short interest (% of float): 0.4%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- Taskus Inc (TASK), down 13.1% to $72.54 / 12-Month Price Range: $ 26.66-84.15 / Short interest (% of float): 2.6%; days to cover: 0.8 (the stock is currently on the short sale restriction list)

- Nuvalent Inc (NUVL), down 12.3% to $22.86 / 12-Month Price Range: $ 17.00-40.82 / Short interest (% of float): 1.9%; days to cover: 3.1 (the stock is currently on the short sale restriction list)

- Aeye Inc (LIDR), down 12.0% to $7.71 / 12-Month Price Range: $ 7.00-14.49 / Short interest (% of float): 0.4%; days to cover: 1.3 (the stock is currently on the short sale restriction list)

- Microvast Holdings Inc (MVST), down 9.6% to $9.93 / 12-Month Price Range: $ 7.83-25.20 / Short interest (% of float): 4.9%; days to cover: 1.9 (the stock is currently on the short sale restriction list)

- Youdao Inc (DAO), down 9.3% to $11.84 / YTD price return: -55.4% / 12-Month Price Range: $ 7.02-42.17 / Short interest (% of float): 3.7%; days to cover: 1.3

- Surgery Partners Inc (SGRY), down 9.1% to $42.00 / YTD price return: +44.8% / 12-Month Price Range: $ 18.25-69.58 / Short interest (% of float): 4.7%; days to cover: 4.2

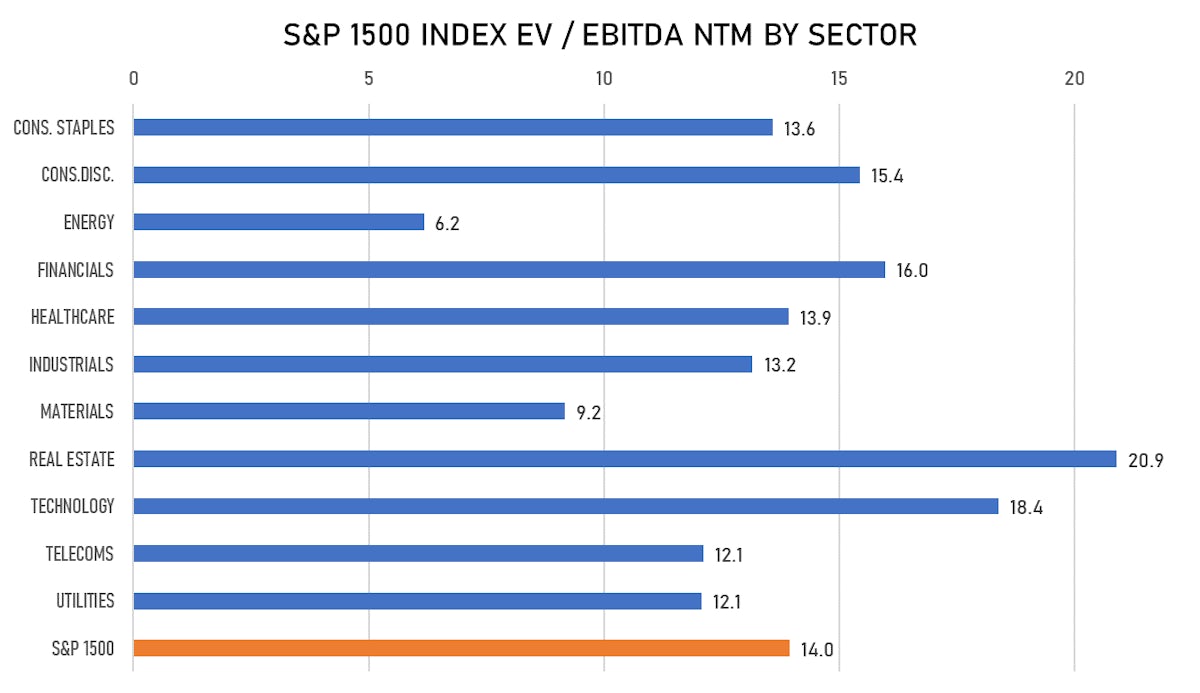

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Sanaby Health Acquisition Corp I / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: SANBU / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: BTIG LLC

- Acrobiosystems Co Ltd / China - Healthcare / Listing Exchange: ShenzChNxt / Ticker: 301080 / Gross proceeds (including overallotment): US$ 348.35m (offering in Chinese Yuan) / Bookrunners: China Merchants Securities Co Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Invitation Homes Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: INVH / Gross proceeds (including overallotment): US$ 400.75m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, Morgan Stanley & Co LLC

- BAWAG Group AG / Austria - Financials / Listing Exchange: Vienna / Ticker: BG / Gross proceeds (including overallotment): US$ 488.04m (offering in EURO) / Bookrunners: BofA Securities Europe SA, JP Morgan AG, Citigroup Global Markets Europe AG, Goldman Sachs Bank Europe SE, Morgan Stanley Europe SE

- High Peak Royalties Ltd / Australia - Financials / Listing Exchange: Australia / Ticker: HPR / Gross proceeds (including overallotment): US$ 454.03m (offering in Australian Dollar) / Bookrunners: Citigroup Global Markets Australia, Macquarie Capital (Australia) Ltd

- Magnitogorsk Iron & Steel Works PJSC / Russian Federation - Materials / Listing Exchange: MICEX-RTS / Ticker: MAGN / Gross proceeds (including overallotment): US$ 172.63m (offering in Russian Rouble) / Bookrunners: Goldman Sachs International