Equities

Higher Rates Cause Broad Slide For US Equities On Fairly High Volumes

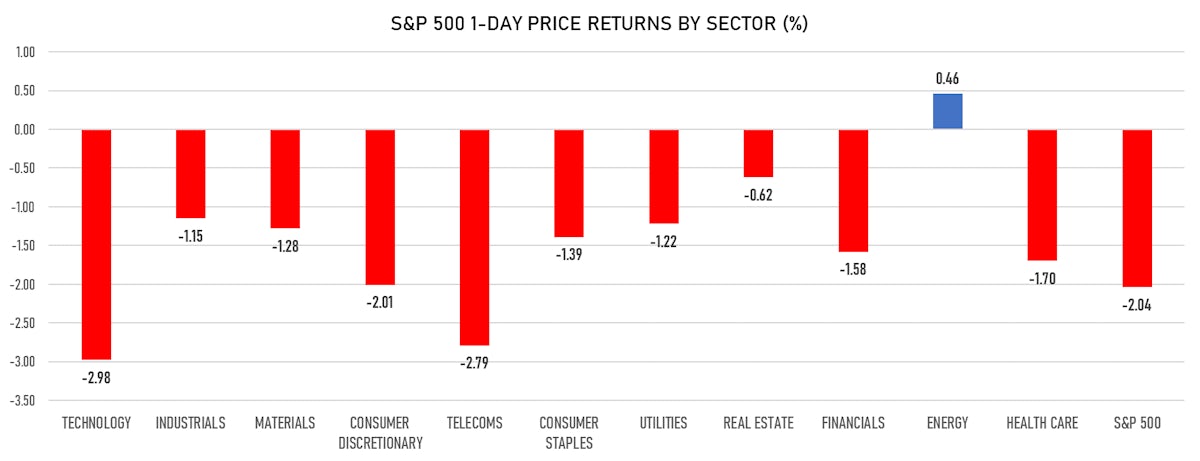

90% down day for S&P 500 stocks, all sectors but energy closed in the red, with the most significant losses in technology and telecoms

Published ET

$18 Trillion Market Capitalization of Chinese Equities (Onshore + HK) Broken Down By Sector | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -2.04%; Nasdaq Composite down -2.83%; Wilshire 5000 down -2.13%

- 10.5% of S&P 500 stocks were up today, with 66.7% of stocks above their 200-day moving average (DMA) and 32.9% above their 50-DMA

- Top performing sectors in the S&P 500: energy up 0.46% and real estate down -0.62%

- Bottom performing sectors in the S&P 500: technology down -2.98% and telecoms down -2.79%

- The number of shares in the S&P 500 traded today was 661m for a total turnover of US$ 84 bn

- The S&P 500 Value Index was down -1.2%, while the S&P 500 Growth Index was down -2.7%; the S&P small caps index was down -1.5% and mid caps were down -1.5%

- The volume on CME's INX (S&P 500 Index) was 2.4m (3-month z-score: 1.2); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -2.18%; UK FTSE 100 down -0.50%; tonight in Asia, China's CSI 300 down -0.94%, Japan's TOPIX 500 down -2.45%

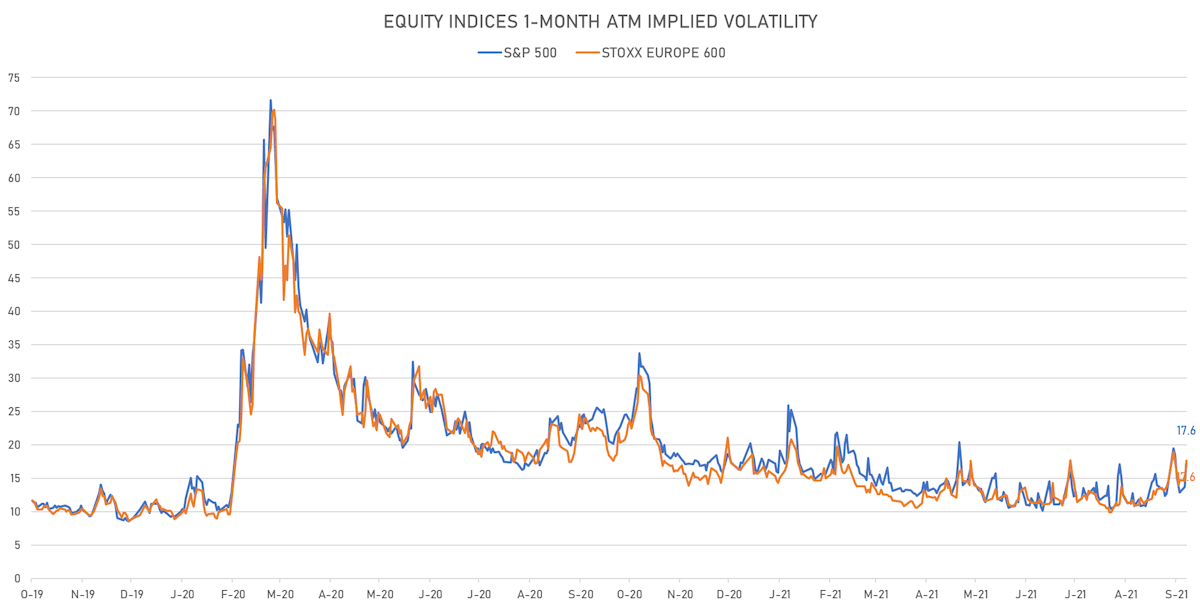

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 17.6%, up from 13.7%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 17.6%, up from 14.7%

NOTABLE S&P 500 EARNINGS RELEASES

- Micron Technology Inc (MU | Technology): beat on EPS (2.42 act. vs. 2.33 est.) and beat on revenue (8,274m act. vs. 8,224m est.), down -2.77% today

- IHS Markit Ltd (INFO | Industrials): beat on EPS (0.85 act. vs. 0.83 est.) and beat on revenue (1,181m act. vs. 1,167m est.), down -5.05% today

TOP WINNERS

- Gogo Inc (GOGO), up 37.6% to $16.82 / YTD price return: +74.7% / 12-Month Price Range: $ 8.02-17.23 / Short interest (% of float): 29.7%; days to cover: 15.2

- United Natural Foods Inc (UNFI), up 23.7% to $46.98 / YTD price return: +194.2% / 12-Month Price Range: $ 14.23-42.40 / Short interest (% of float): 6.9%; days to cover: 9.9

- ProShares Ultra VIX Short-Term Futures ETF (UVXY), up 15.4% to $23.93 / YTD price return: -77.6% / 12-Month Price Range: $ 20.18-232.00 / Short interest (% of float): 11.8%; days to cover: 0.2

- Lyell Immunopharma Inc (LYEL), up 10.0% to $14.12 / 12-Month Price Range: $ 10.62-19.84 / Short interest (% of float): 2.1%; days to cover: 9.3

- Rocket Lab USA Inc (RKLB), up 8.7% to $15.56 / YTD price return: +53.9% / 12-Month Price Range: $ 9.50-21.34

- ProShares UltraPro Short QQQ (SQQQ), up 8.4% to $8.49 / YTD price return: -44.1% / 12-Month Price Range: $ 7.16-25.78 / Short interest (% of float): 9.7%; days to cover: 0.2

- Thor Industries Inc (THO), up 7.9% to $121.75 / YTD price return: +30.9% / 12-Month Price Range: $ 78.64-152.20 / Short interest (% of float): 7.2%; days to cover: 10.2

- Standard Lithium Ltd (SLI), up 7.8% to $8.69 / 12-Month Price Range: $ 1.17-9.09 / Short interest (% of float): 0.9%; days to cover: 0.8

- Federal Agricultural Mortgage Corp (AGMa), up 7.3% to $105.01 / YTD price return: +60.9% / 12-Month Price Range: $ 54.33-107.00 / Short interest (% of float): 0.2%; days to cover: 16.0

- CyrusOne Inc (CONE), up 6.9% to $77.57 / YTD price return: +6.0% / 12-Month Price Range: $ 61.64-82.69 / Short interest (% of float): 4.0%; days to cover: 6.8

BIGGEST LOSERS

- Hyzon Motors Inc (HYZN), down 28.0% to $6.63 / YTD price return: -37.5% / 12-Month Price Range: $ 6.02-19.95 / Short interest (% of float): 4.1%; days to cover: 1.5 (the stock is currently on the short sale restriction list)

- Aeye Inc (LIDR), down 20.2% to $6.07 / 12-Month Price Range: $ 7.00-14.49 / Short interest (% of float): 0.4%; days to cover: 1.9 (the stock is currently on the short sale restriction list)

- Cue Health Inc (HLTH), down 18.5% to $15.18 / 12-Month Price Range: $ 16.75-22.55 (the stock is currently on the short sale restriction list)

- eXp World Holdings Inc (EXPI), down 16.3% to $43.28 / YTD price return: +37.1% / 12-Month Price Range: $ 19.92-90.00 / Short interest (% of float): 5.4%; days to cover: 3.1 (the stock is currently on the short sale restriction list)

- Inmode Ltd (INMD), down 12.8% to $149.07 / YTD price return: +214.0% / 12-Month Price Range: $ 34.92-180.00 / Short interest (% of float): 5.6% (the stock is currently on the short sale restriction list)

- Adagio Therapeutics Inc (ADGI), down 12.4% to $39.53 / 12-Month Price Range: $ 20.50-59.50 (the stock is currently on the short sale restriction list)

- Sprout Social Inc (SPT), down 11.7% to $116.55 / YTD price return: +156.7% / 12-Month Price Range: $ 36.57-145.42 / Short interest (% of float): 4.3%; days to cover: 4.8 (the stock is currently on the short sale restriction list)

- Direxion Daily Semiconductor Bull 3X Shares (SOXL), down 11.4% to $42.23 / YTD price return: +35.8% / 12-Month Price Range: $ 15.76-49.53 / Short interest (% of float): 2.5%; days to cover: 0.2 (the stock is currently on the short sale restriction list)

- Appian Corp (APPN), down 11.4% to $94.35 / YTD price return: -41.8% / 12-Month Price Range: $ 61.02-260.00 (the stock is currently on the short sale restriction list)

- Novavax Inc (NVAX), down 11.3% to $204.83 / YTD price return: +83.7% / 12-Month Price Range: $ 76.59-331.68 / Short interest (% of float): 9.0%; days to cover: 1.1 (the stock is currently on the short sale restriction list)

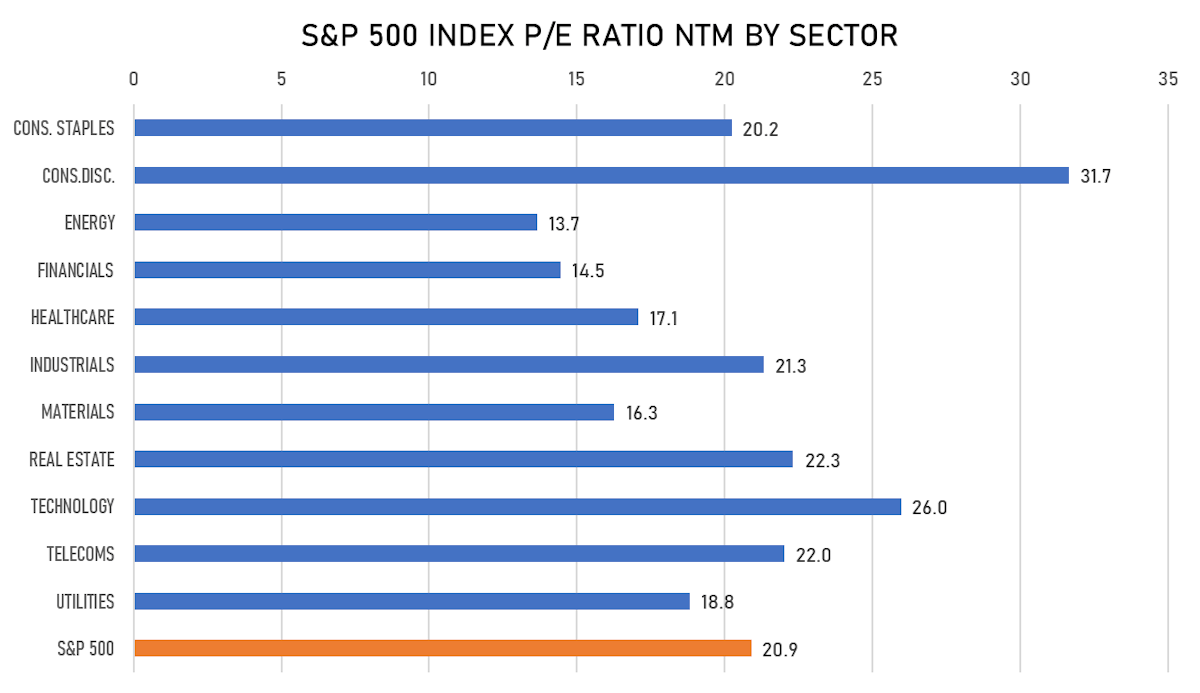

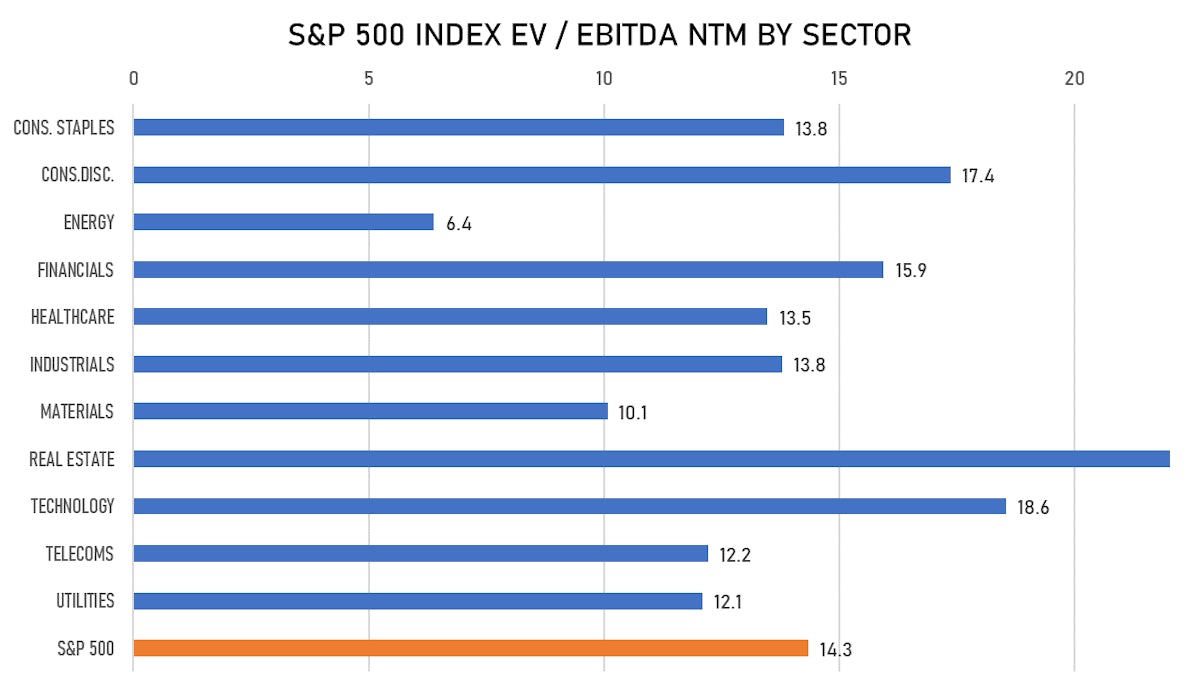

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Enterprise 4.0 Technology Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: ENTFU / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Cantor Fitzgerald & Co, Mizuho Securities USA LLC

- Henley Park Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: HPACU / Gross proceeds (including overallotment): US$ 175.00m (offering in U.S. Dollar) / Bookrunners: Maxim Group LLC

- JM Baxi Group / India - Industrials / Listing Exchange: National / Ticker: - / Gross proceeds (including overallotment): US$ 338.69m (offering in Indian Rupee) / Bookrunners: Not Applicable

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Montrose Environmental Group Inc / United States of America - Consumer Products and Services / Listing Exchange: New York / Ticker: MEG / Gross proceeds (including overallotment): US$ 155.00m (offering in U.S. Dollar) / Bookrunners: William Blair & Co, JP Morgan Securities LLC, Bofa Securities Inc

- Softchoice Corp / Canada - High Technology / Listing Exchange: Toronto / Ticker: SFTC / Gross proceeds (including overallotment): US$ 118.80m (offering in Canadian Dollar) / Bookrunners: Goldman Sachs Canada, TD Securities Inc

- Shenzhen Senior Technology Material Co Ltd / China - Industrials / Listing Exchange: ShenzChNxt / Ticker: 300568 / Gross proceeds (including overallotment): US$ 929.37m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Tongfu Microelectronics Co Ltd / China - High Technology / Listing Exchange: ShenzSME / Ticker: 002156 / Gross proceeds (including overallotment): US$ 851.92m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Futu Holdings Ltd / Hong Kong - Financials / Listing Exchange: Hong Kong / Ticker: FHL / Gross proceeds (including overallotment): US$ 700.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Pony Testing International Group Co Ltd / China - Consumer Products and Services / Listing Exchange: ShenzChNxt / Ticker: 300887 / Gross proceeds (including overallotment): US$ 327.16m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- China Aoyuan Group Ltd / China - Real Estate / Listing Exchange: - / Ticker: 3883 / Gross proceeds (including overallotment): US$ 291.44m (offering in Australian Dollar) / Bookrunners: Not Applicable

- Appier Group Inc / Japan - High Technology / Listing Exchange: Mothers / Ticker: 4180 / Gross proceeds (including overallotment): US$ 169.11m (offering in Japanese Yen) / Bookrunners: Merrill Lynch International Ltd, Mizuho International PLC, SMBC Nikko Securities Inc

- The PRS REIT PLC / United Kingdom - Real Estate / Listing Exchange: London / Ticker: PRSR / Gross proceeds (including overallotment): US$ 102.62m (offering in British Pound) / Bookrunners: Singer Capital Markets Ltd, Panmure Gordon (UK) Ltd