Equities

Stocks Slide Again To End Month On Worst Performance Since March 2020

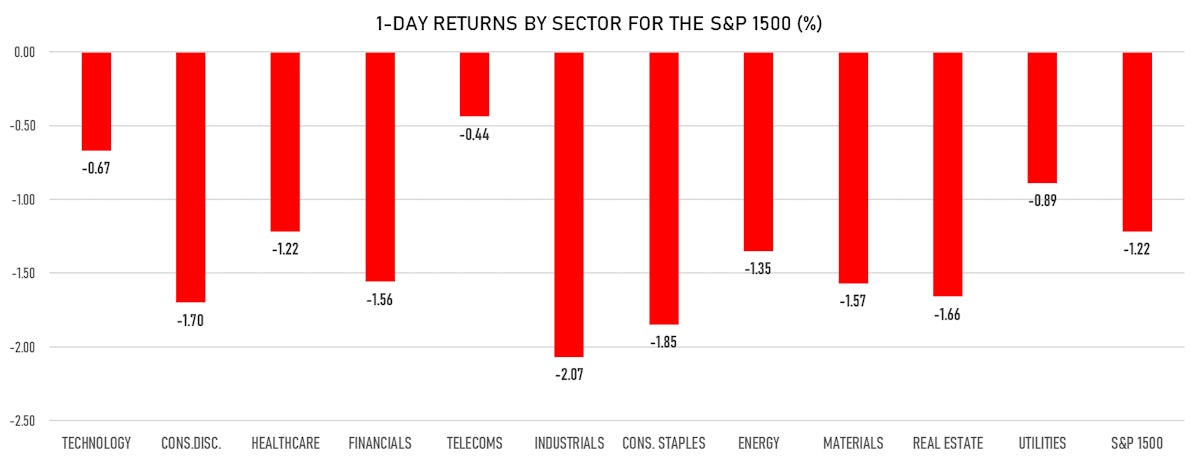

Only 8% of S&P 500 stocks were up today, with industrials and consumer staples leading the fall and growth overperforming widely value

Published ET

S&P 500 1-Month Options Implied Volatility Smile | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -1.19%; Nasdaq Composite down -0.44%; Wilshire 5000 down -1.06%

- 8.1% of S&P 500 stocks were up today, with 61.4% of stocks above their 200-day moving average (DMA) and 24.2% above their 50-DMA

- Top performing sectors in the S&P 500: telecoms down -0.42% and technology down -0.68%

- Bottom performing sectors in the S&P 500: industrials down -2.11% and consumer staples down -1.85%

- The number of shares in the S&P 500 traded today was 709m for a total turnover of US$ 82 bn

- The S&P 500 Value Index was down -1.7%, while the S&P 500 Growth Index was down -0.8%; the S&P small caps index was down -1.7% and mid caps were down -1.5%

- The volume on CME's INX (S&P 500 Index) was 2.3m (3-month z-score: 0.9); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -0.05%; UK FTSE 100 down -0.31%; China CSI 300 up 0.67%, Japan's TOPIX 500 down -2.10%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 18.2%, up from 17.2%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 16.5%, down from 16.9%

NOTABLE S&P 500 EARNINGS RELEASES

- Carmax Inc (KMX | Consumer Cyclicals): missed on EPS (1.72 act. vs. 1.90 est.) and beat on revenue (7,988m act. vs. 6,873m est.), down -12.63% today

- Marketaxess Holdings Inc (MKTX | Financials): beat on EPS (1.77 act. vs. 1.69 est.) and missed on revenue (176m act. vs. 178m est.), down -0.70% today

- People's United Financial Inc (PBCT | Financials): beat on EPS (0.41 act. vs. 0.35 est.) and missed on revenue (488m act. vs. 496m est.), down -2.35% today

TOP WINNERS

- Hyzon Motors Inc (HYZN), up 15.1% to $6.94 / YTD price return: -34.5% / 12-Month Price Range: $ 6.00-19.95 / Short interest (% of float): 5.1%; days to cover: 1.5

- OPTIMIZERx Corp (OPRX), up 14.1% to $85.55 / YTD price return: +174.6% / 12-Month Price Range: $ 17.01-81.00 / Short interest (% of float): 6.9%; days to cover: 6.3

- indie Semiconductor Inc (INDI), up 12.9% to $12.31 / 12-Month Price Range: $ 8.00-14.94

- Virgin Galactic Holdings Inc (SPCE), up 12.1% to $25.30 / YTD price return: +6.6% / 12-Month Price Range: $ 14.27-62.80

- Peabody Energy Corp (BTU), up 11.8% to $14.79 / YTD price return: +513.7% / 12-Month Price Range: $ .80-19.83 / Short interest (% of float): 6.4%; days to cover: 1.3

- James River Group Holdings Ltd (JRVR), up 11.4% to $37.73 / YTD price return: -23.2% / 12-Month Price Range: $ 30.75-57.41 / Short interest (% of float): 2.6%; days to cover: 6.1

- AngioDynamics Inc (ANGO), up 11.0% to $25.94 / YTD price return: +69.3% / 12-Month Price Range: $ 10.17-30.25

- New Oriental Education & Technology Group Inc (EDU), up 10.8% to $2.05 / YTD price return: -89.0% / 12-Month Price Range: $ 1.68-19.97

- Canaan Inc (CAN), up 10.3% to $6.11 / YTD price return: +3.0% / 12-Month Price Range: $ 1.84-39.10 / Short interest (% of float): 7.2%; days to cover: 1.6

- Sophia Genetics SA (SOPH), up 10.3% to $17.53 / 12-Month Price Range: $ 14.88-19.80

BIGGEST LOSERS

- Volta Inc (VLTA), down 23.0% to $8.65 / YTD price return: -18.8% / 12-Month Price Range: $ 8.42-18.33 / Short interest (% of float): 2.0%; days to cover: 2.4 (the stock is currently on the short sale restriction list)

- Bed Bath & Beyond Inc (BBBY), down 22.2% to $17.28 / YTD price return: -2.7% / 12-Month Price Range: $ 14.31-53.90 (the stock is currently on the short sale restriction list)

- IronNet Inc (IRNT), down 14.9% to $17.05 / YTD price return: +68.5% / 12-Month Price Range: $ 9.37-47.50 / Short interest (% of float): 4.7%; days to cover: 0.4

- Dillard's Inc (DDS), down 13.9% to $172.52 / YTD price return: +173.6% / 12-Month Price Range: $ 33.72-217.57 / Short interest (% of float): 10.5%; days to cover: 4.0 (the stock is currently on the short sale restriction list)

- Renew Energy Global PLC (RNW), down 13.6% to $10.20 / 12-Month Price Range: $ 8.43-14.08 / Short interest (% of float): 1.3%; days to cover: 7.5 (the stock is currently on the short sale restriction list)

- Carmax Inc (KMX), down 12.6% to $127.96 / YTD price return: +35.5% / 12-Month Price Range: $ 84.70-147.73 (the stock is currently on the short sale restriction list)

- ChemoCentryx Inc (CCXI), down 12.6% to $17.10 / YTD price return: -72.4% / 12-Month Price Range: $ 9.53-70.29 / Short interest (% of float): 7.0%; days to cover: 3.1 (the stock is currently on the short sale restriction list)

- Kohls Corp (KSS), down 12.2% to $47.09 / YTD price return: +15.7% / 12-Month Price Range: $ 18.36-64.80 (the stock is currently on the short sale restriction list)

- Torrid Holdings Inc (CURV), down 11.8% to $15.43 / 12-Month Price Range: $ 16.56-33.19 / Short interest (% of float): 3.5%; days to cover: 4.6 (the stock is currently on the short sale restriction list)

- Instil Bio Inc (TIL), down 11.7% to $17.88 / 12-Month Price Range: $ 14.42-29.49 / Short interest (% of float): 6.6%; days to cover: 34.8 (the stock is currently on the short sale restriction list)

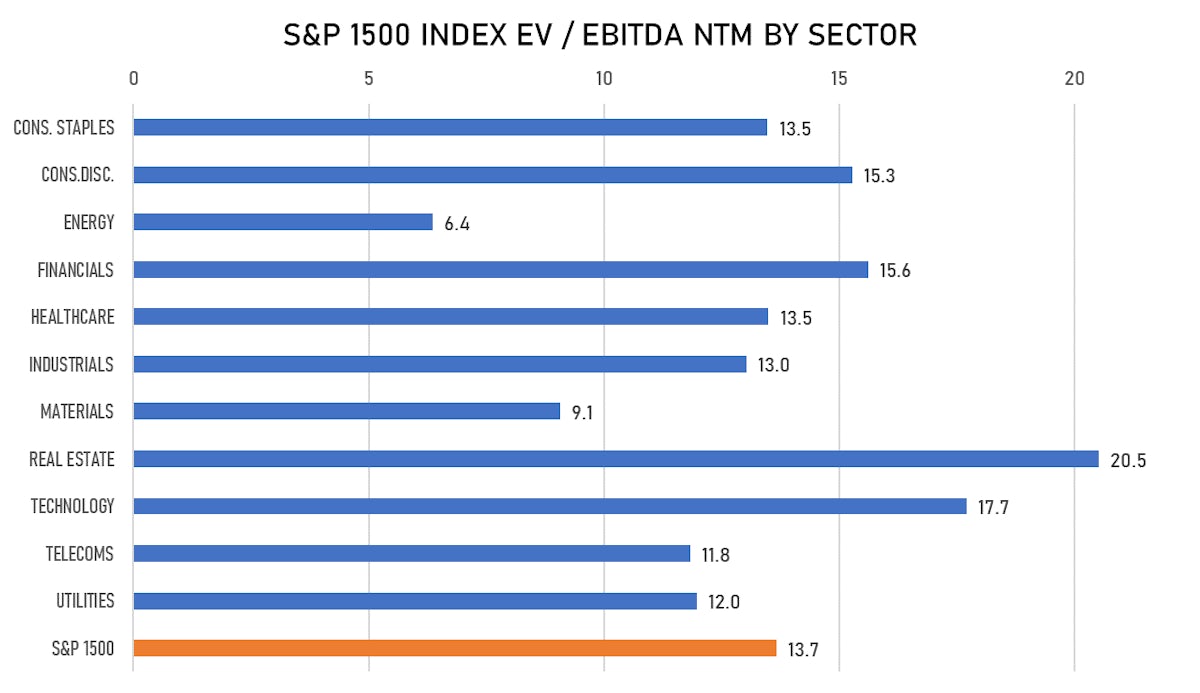

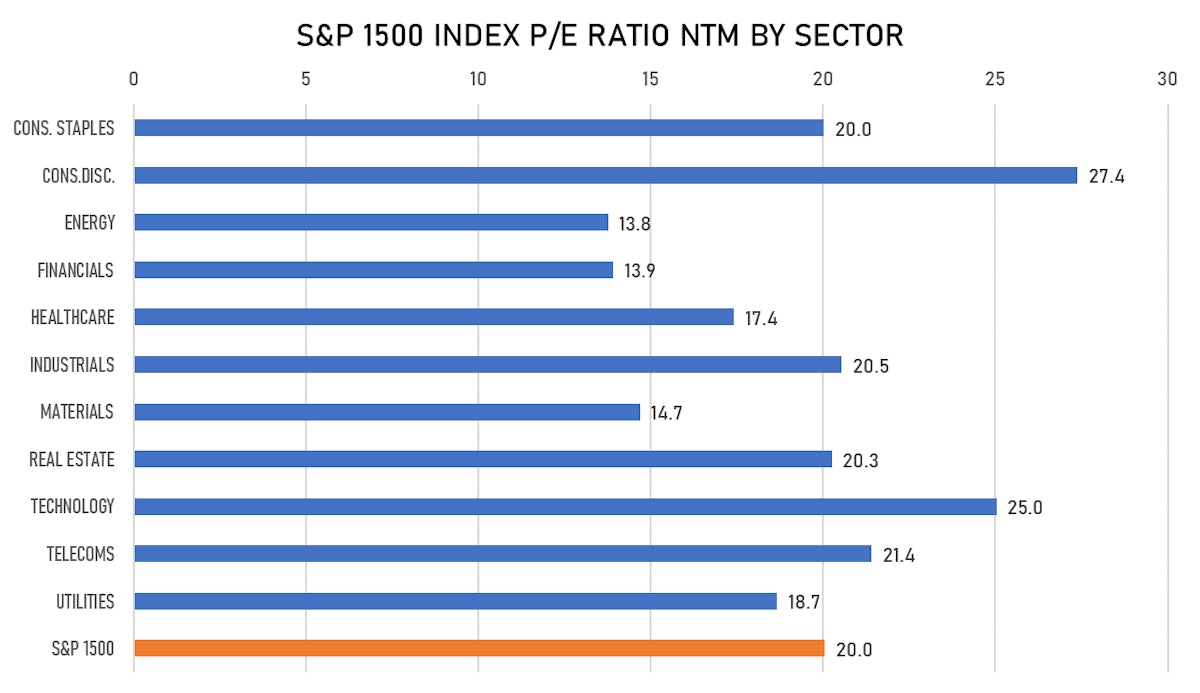

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Olaplex Holdings Inc / United States of America - Consumer Products and Services / Listing Exchange: Nasdaq / Ticker: OLPX / Gross proceeds (including overallotment): US$ 1,547.70m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co LLC, JP Morgan Securities LLC, Barclays Capital Inc

- Oxford Nanopore Technologies Ltd / United Kingdom - Healthcare / Listing Exchange: London / Ticker: - / Gross proceeds (including overallotment): US$ 703.60m (offering in British Pound) / Bookrunners: Barclays Bank PLC, Merrill Lynch International Ltd, Numis Securities Ltd, Citigroup Global Markets Ltd, Guggenheim Securities LLC, JP Morgan Cazenove, RBC Europe Ltd, Joh Berenberg Gossler & Co KG(London Branch)

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- EQT Corp / United States of America - Energy and Power / Listing Exchange: New York / Ticker: EQT / Gross proceeds (including overallotment): US$ 518.60m (offering in U.S. Dollar) / Bookrunners: JP Morgan Securities LLC, Barclays Capital Inc

- Headwater Exploration Inc / Canada - Energy and Power / Listing Exchange: Toronto / Ticker: HWX / Gross proceeds (including overallotment): US$ 161.41m (offering in Canadian Dollar) / Bookrunners: Peterson & Co, BMO Capital Markets

- Montrose Environmental Group Inc / United States of America - Consumer Products and Services / Listing Exchange: New York / Ticker: MEG / Gross proceeds (including overallotment): US$ 155.00m (offering in U.S. Dollar) / Bookrunners: William Blair & Co, JP Morgan Securities LLC, Bofa Securities Inc

- SUMCO Corp / Japan - High Technology / Listing Exchange: Tokyo 1 / Ticker: 3436 / Gross proceeds (including overallotment): US$ 747.40m (offering in Japanese Yen) / Bookrunners: Goldman Sachs International, Morgan Stanley & Co. International plc, SMBC Nikko Capital Markets

- Sinch AB / Sweden - High Technology / Listing Exchange: OMX Stock / Ticker: SINCH / Gross proceeds (including overallotment): US$ 397.06m (offering in Swedish Krona) / Bookrunners: Not Applicable

- Tritax Big Box REIT PLC / United Kingdom - Real Estate / Listing Exchange: London / Ticker: BBOX / Gross proceeds (including overallotment): US$ 397.06m (offering in British Pound) / Bookrunners: Jefferies International Ltd, JP Morgan Cazenove

- Santos Ltd / Australia - Energy and Power / Listing Exchange: Australia / Ticker: STO / Gross proceeds (including overallotment): US$ 289.51m (offering in Australian Dollar) / Bookrunners: Morgan Stanley Australia Ltd, UBS Australia Ltd

- Ros Agro PLC / Russian Federation - Consumer Staples / Listing Exchange: London / Ticker: AGRO / Gross proceeds (including overallotment): US$ 274.82m (offering in U.S. Dollar) / Bookrunners: VTB Capital, Gazprombank (Schweiz) AG, UBS Europe SE, JP Morgan AG

- Novonix Ltd / Australia - Energy and Power / Listing Exchange: Australia / Ticker: NVX / Gross proceeds (including overallotment): US$ 145.44m (offering in Australian Dollar) / Bookrunners: Not Applicable

- Supermarket Income REIT PLC / United Kingdom - Real Estate / Listing Exchange: - / Ticker: SUPR / Gross proceeds (including overallotment): US$ 134.22m (offering in British Pound) / Bookrunners: Stifel/KBW

- Sandfire Resources Ltd / Australia - Materials / Listing Exchange: Australia / Ticker: SFR / Gross proceeds (including overallotment): US$ 109.43m (offering in Australian Dollar) / Bookrunners: Citigroup Global Markets Australia, Macquarie Capital (Australia) Ltd