Equities

Broad Slide In US Equity Indices, As Only 25% Of S&P 500 Stocks Ended Up Today

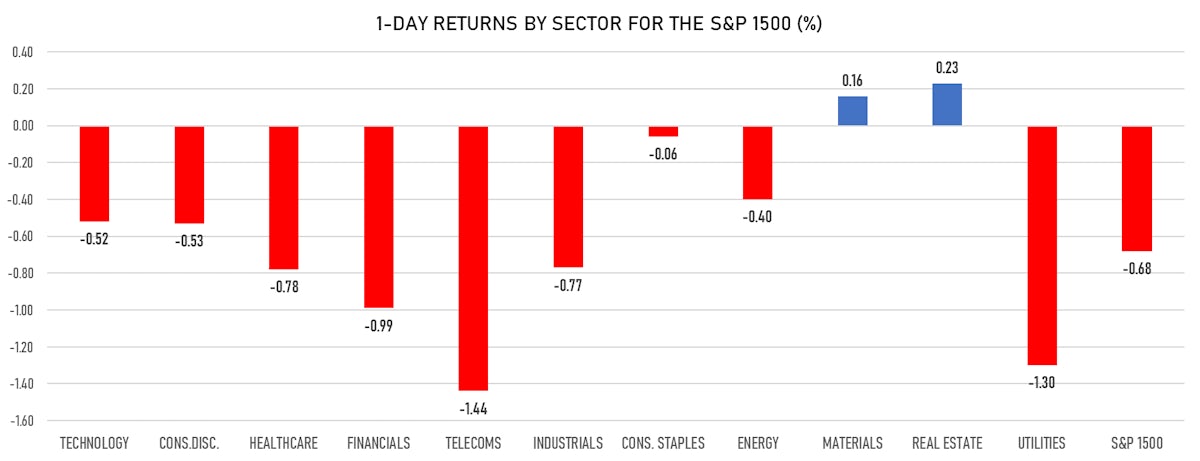

Most sectors fell, with rate-sensitive sectors like telecoms and utilities being worst performers: implied yields on Eurodollar futures were up sharply (while Treasury markets were closed for Columbus Day)

Published ET

Country Indices YTD Total Returns | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.69%; Nasdaq Composite down -0.64%; Wilshire 5000 down -0.69%

- 24.6% of S&P 500 stocks were up today, with 63.0% of stocks above their 200-day moving average (DMA) and 37.0% above their 50-DMA

- Top performing sectors in the S&P 500: real estate up 0.17% and materials up 0.03%

- Bottom performing sectors in the S&P 500: telecoms down -1.45% and utilities down -1.34%

- The number of shares in the S&P 500 traded today was 435m for a total turnover of US$ 49 bn

- The S&P 500 Value Index was down -0.8%, while the S&P 500 Growth Index was down -0.6%; the S&P small caps index was down -0.7% and mid caps were down -0.5%

- The volume on CME's INX (S&P 500 Index) was 1.7m (3-month z-score: -0.9); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.05%; UK FTSE 100 up 0.72%; tonight in Asia, China's CSI 300 down -0.41%, Japan's TOPIX 500 down -0.58%

VOLATILITY

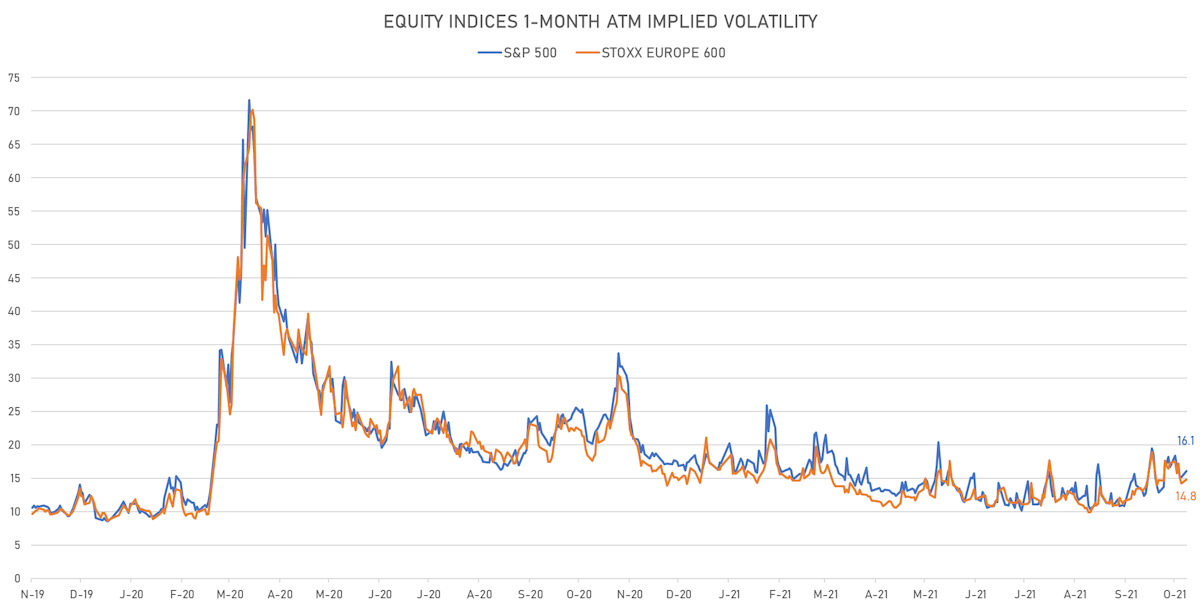

- 1-month at-the-money implied volatility on the S&P 500 at 16.1%, up from 15.1%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 14.8%, up from 14.2%

NOTABLE S&P 500 EARNINGS RELEASES

- Steris plc (STE | Healthcare): beat on EPS (1.76 act. vs. 1.49 est.) and beat on revenue (968m act. vs. 905m est.), up 0.93% today

TOP WINNERS

- Protagonist Therapeutics Inc (PTGX), up 93.9% to $35.36 / YTD price return: +75.4% / 12-Month Price Range: $ 12.80-50.54

- ACON S2 Acquisition Corp (GWH), up 26.9% to $10.42 / YTD price return: +3.4% / 12-Month Price Range: $ 7.22-11.44 / Short interest (% of float): 1.0%; days to cover: 3.6

- Dutch Bros Inc (BROS), up 14.9% to $49.00 / 12-Month Price Range: $ 32.42-62.00

- Century Aluminum Co (CENX), up 13.4% to $16.28 / YTD price return: +47.6% / 12-Month Price Range: $ 6.27-19.60

- SoFi Technologies Inc (SOFI), up 13.4% to $18.39 / YTD price return: +47.8% / 12-Month Price Range: $ 10.10-28.26 / Short interest (% of float): 4.5%; days to cover: 1.2

- Aspen Technology Inc (AZPN), up 12.3% to $159.00 / YTD price return: +22.1% / 12-Month Price Range: $ 108.15-162.56

- Mechel PAO (MTL_p), up 10.9% to $2.04 / YTD price return: +309.6% / 12-Month Price Range: $ .36-1.94

- Immunitybio Inc (IBRX), up 10.7% to $9.75 / YTD price return: -26.9% / 12-Month Price Range: $ 6.80-45.42 / Short interest (% of float): 12.7%; days to cover: 10.8

- Merus NV (MRUS), up 10.3% to $30.99 / YTD price return: +76.8% / 12-Month Price Range: $ 11.19-31.27 / Short interest (% of float): 6.1%; days to cover: 10.3

- Pampa Energia SA (PAM), up 9.8% to $19.93 / YTD price return: +44.6% / 12-Month Price Range: $ 10.65-19.21 / Short interest (% of float): 0.8%; days to cover: 2.6

BIGGEST LOSERS

- Cipher Mining Inc (CIFR), down 22.2% to $6.14 / YTD price return: -38.3% / 12-Month Price Range: $ 7.69-15.39 / Short interest (% of float): 2.9%; days to cover: 1.9 (the stock is currently on the short sale restriction list)

- SecureWorks Corp (SCWX), down 17.4% to $19.18 / YTD price return: +34.9% / 12-Month Price Range: $ 10.01-26.89 (the stock is currently on the short sale restriction list)

- Icosavax Inc (ICVX), down 12.9% to $26.46 / 12-Month Price Range: $ 21.70-49.99 / Short interest (% of float): 1.5%; days to cover: 1.8 (the stock is currently on the short sale restriction list)

- Exscientia PLC (EXAI), down 12.7% to $21.00 / 12-Month Price Range: $ 21.13-30.38 (the stock is currently on the short sale restriction list)

- Brilliant Earth Group Inc (BRLT), down 12.3% to $10.73 / 12-Month Price Range: $ 12.02-18.23 (the stock is currently on the short sale restriction list)

- Hyliion Holdings Corp (HYLN), down 11.8% to $6.90 / YTD price return: -58.1% / 12-Month Price Range: $ 7.54-30.39 / Short interest (% of float): 27.3%; days to cover: 9.5 (the stock is currently on the short sale restriction list)

- Arqit Quantum Inc (ARQQ), down 11.7% to $15.61 / 12-Month Price Range: $ 8.00-41.52 / Short interest (% of float): 0.7%; days to cover: 0.3 (the stock is currently on the short sale restriction list)

- PagSeguro Digital Ltd (PAGS), down 11.5% to $32.37 / YTD price return: -43.1% / 12-Month Price Range: $ 35.58-62.83 / Short interest (% of float): 8.9%; days to cover: 12.8

- Cortexyme Inc (CRTX), down 10.1% to $78.61 / YTD price return: +183.0% / 12-Month Price Range: $ 26.66-121.98 (the stock is currently on the short sale restriction list)

- Dlocal Ltd (DLO), down 9.7% to $50.52 / 12-Month Price Range: $ 29.57-73.43 / Short interest (% of float): 2.6%; days to cover: 1.1 (the stock is currently on the short sale restriction list)

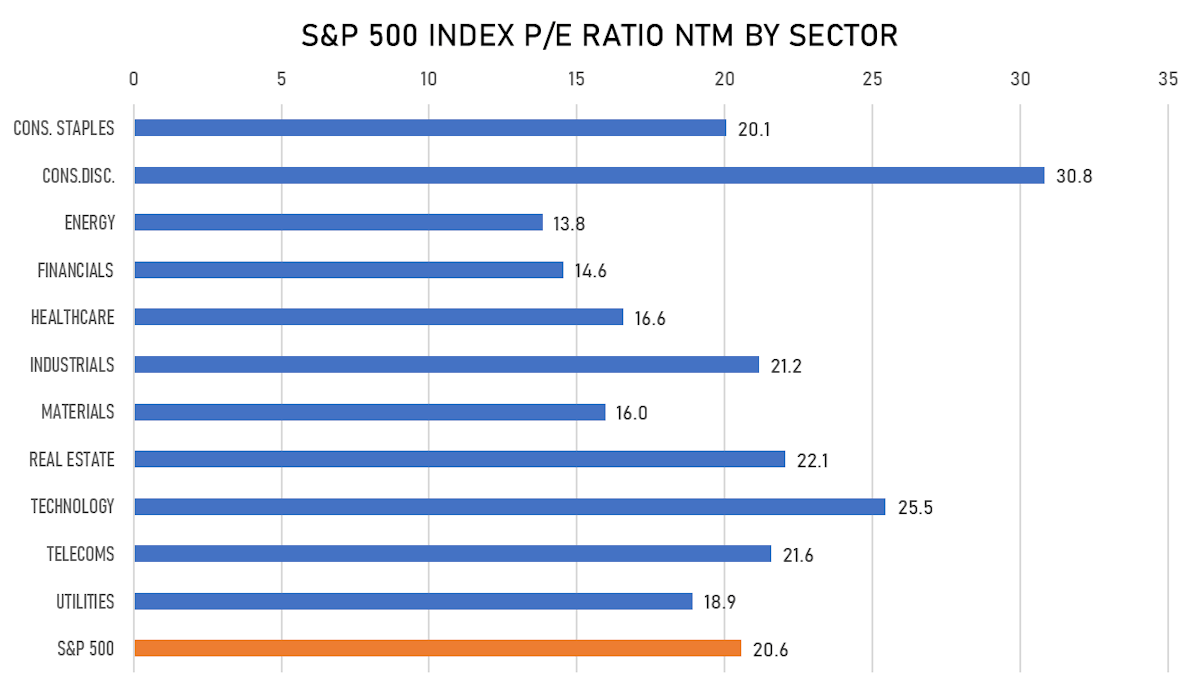

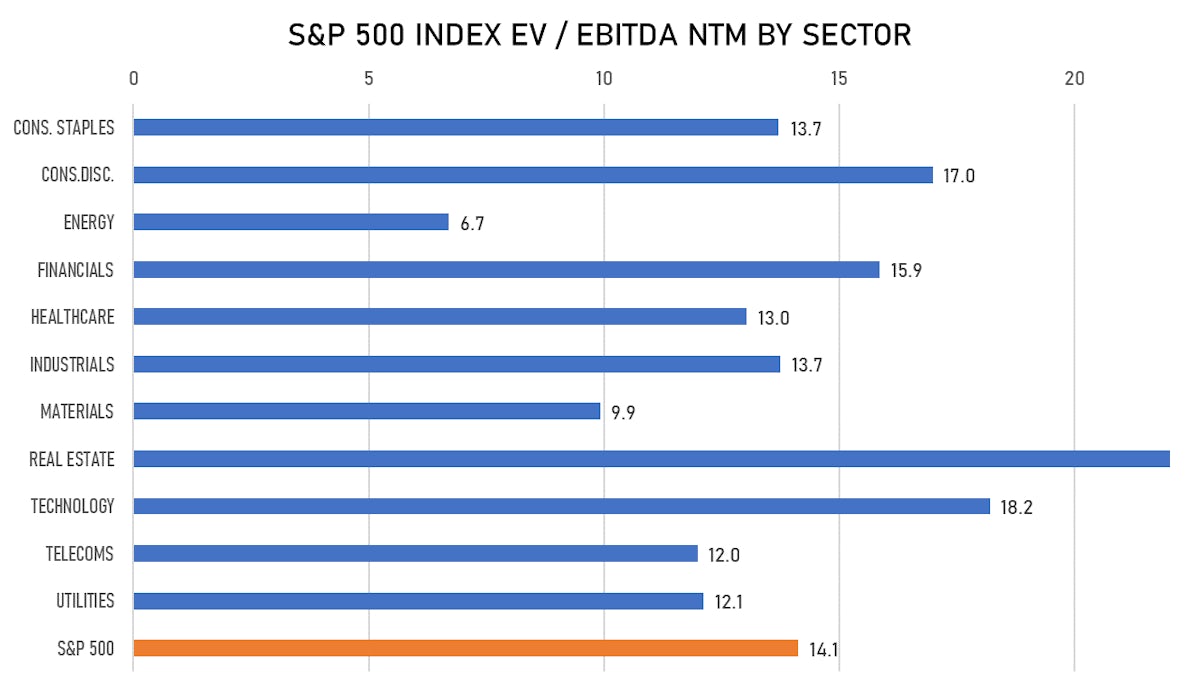

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Decarbonization Plus Acquisition Corp V / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: DCREU / Gross proceeds (including overallotment): US$ 275.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, Credit Suisse Securities (USA) LLC

- Hawks Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: HWKZ.U / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: BTIG LLC, Mizuho Securities USA LLC

- Learn CW Investment Corp / United States of America - Financials / Listing Exchange: New York / Ticker: LCW.U / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Evercore Group

- TKB Critical Technologies 1 / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: USCTU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Jefferies LLC

- Judo Bank Pty Ltd / Australia - Financials / Listing Exchange: Australia / Ticker: N/A / Gross proceeds (including overallotment): US$ 477.08m (offering in Australian Dollar) / Bookrunners: Credit Suisse, Goldman Sachs & Co, Citigroup, Barrenjoey Capital Partners Group Pty Ltd

- Pantheon Infrastructure PLC / United Kingdom - Financials / Listing Exchange: London / Ticker: N/A / Gross proceeds (including overallotment): US$ 408.33m (offering in British Pound) / Bookrunners: Investec Bank PLC

- Harmony Energy Income Trust PLC / United Kingdom - Financials / Listing Exchange: London / Ticker: HEIT / Gross proceeds (including overallotment): US$ 313.05m (offering in British Pound) / Bookrunners: Joh Berenberg Gossler & Co KG(London Branch)

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Neighbourly Pharmacy Inc / Canada - Retail / Listing Exchange: Toronto / Ticker: NBLY / Gross proceeds (including overallotment): US$ 103.68m (offering in Canadian Dollar) / Bookrunners: Scotia Capital Inc, RBC Capital Markets

- Jiangsu Aucksun Co Ltd / China - Industrials / Listing Exchange: ShenzSME / Ticker: 002245 / Gross proceeds (including overallotment): US$ 349.19m (offering in Chinese Yuan) / Bookrunners: Not Applicable