Equities

US Indices Close Nearly Unchanged, With A Modest Overperformance Of Mid Caps And Value Stocks

Equities are likely to remain unsteady until we see third quarter earnings / forward guidance, with JP Morgan kicking things off tomorrow and over 80% of the S&P 500 market cap due to report over the next 3 weeks

Published ET

S&P 500 Index Hourly Prices & Ichimoku Cloud | Source: Refinitiv

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.24%; Nasdaq Composite down -0.14%; Wilshire 5000 down -0.01%

- 47.1% of S&P 500 stocks were up today, with 62.8% of stocks above their 200-day moving average (DMA) and 36.8% above their 50-DMA

- Top performing sectors in the S&P 500: real estate up 1.34% and consumer discretionary up 0.68%

- Bottom performing sectors in the S&P 500: telecoms down -1.05% and technology down -0.51%

- The number of shares in the S&P 500 traded today was 531m for a total turnover of US$ 62 bn

- The S&P 500 Value Index was down -0.2%, while the S&P 500 Growth Index was down -0.3%; the S&P small caps index was up 0.4% and mid caps were up 0.6%

- The volume on CME's INX (S&P 500 Index) was 2.0m (3-month z-score: -0.1); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -0.07%; UK FTSE 100 down -0.23%; tonight in Asia, China's CSI 300 up 0.02%, Japan's TOPIX 500 down -0.23%

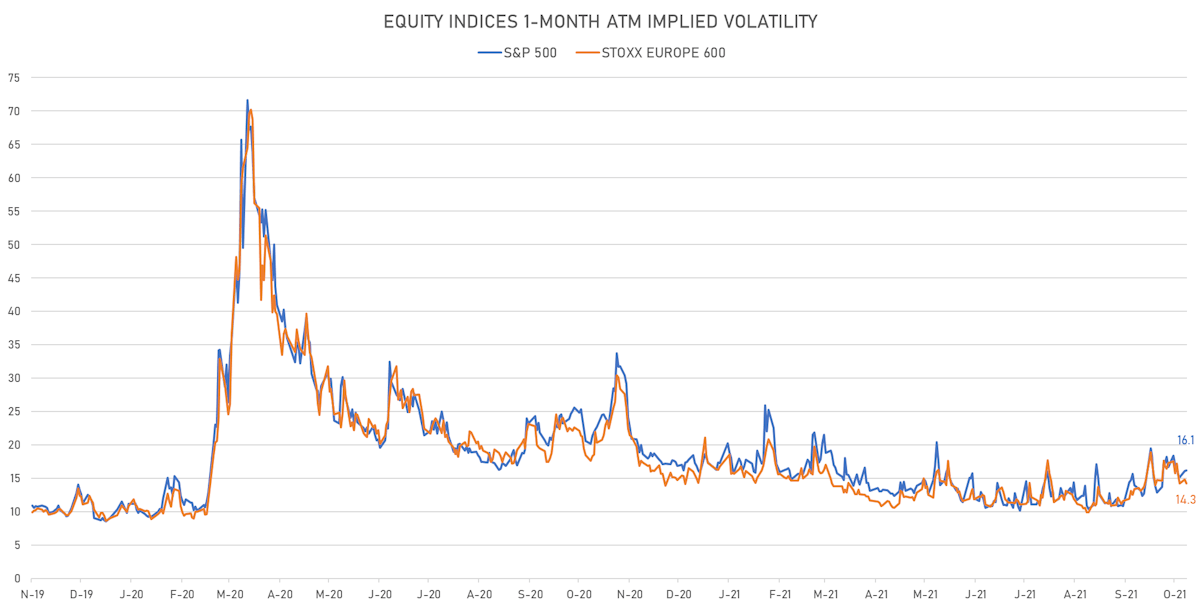

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 unchanged at 16.1%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 14.3%, down from 14.8%

NOTABLE S&P 500 EARNINGS RELEASES

- Fastenal Co (FAST | Industrials): matched EPS estimates (0.42 act. vs. 0.42 est.) and beat on revenue (1,554m act. vs. 1,540m est.), up 3.06% today

TOP WINNERS

- ACON S2 Acquisition Corp (GWH), up 128.4% to $23.80 / YTD price return: +136.1% / 12-Month Price Range: $ 7.22-11.44 / Short interest (% of float): 1.0%; days to cover: 3.6

- Inventrust Properties Corp (IVT), up 52.8% to $26.00 / 12-Month Price Range: $ 1.27-28.90

- Inhibrx Inc (INBX), up 22.0% to $33.68 / 12-Month Price Range: $ 14.27-50.97 / Short interest (% of float): 3.9%; days to cover: 6.5

- Ocugen Inc (OCGN), up 18.5% to $9.11 / 12-Month Price Range: $ .25-18.77 / Short interest (% of float): 27.4%; days to cover: 4.8

- Energy Fuels Inc (UUUU), up 16.3% to $7.49 / YTD price return: +75.8% / 12-Month Price Range: $ 1.42-8.39 / Short interest (% of float): 10.6%; days to cover: 2.6

- Axsome Therapeutics Inc (AXSM), up 15.8% to $37.79 / YTD price return: -53.6% / 12-Month Price Range: $ 19.38-87.24

- Weatherford International PLC (WFRD), up 15.7% to $23.58 / YTD price return: +293.0% / 12-Month Price Range: $ 1.84-21.15 / Short interest (% of float): 0.5%; days to cover: 0.8

- Nexgen Energy Ltd (NXE), up 14.6% to $5.66 / 12-Month Price Range: $ 1.61-6.17 / Short interest (% of float): 2.2%; days to cover: 2.9

- Ginkgo Bioworks Holdings Inc (DNA), up 14.4% to $10.83 / 12-Month Price Range: $ 8.90-14.25 / Short interest (% of float): 0.9%; days to cover: 1.6

- PagSeguro Digital Ltd (PAGS), up 14.2% to $36.96 / YTD price return: -35.0% / 12-Month Price Range: $ 31.10-62.83 / Short interest (% of float): 8.9%; days to cover: 12.8 (the stock is currently on the short sale restriction list)

BIGGEST LOSERS

- Revance Therapeutics Inc (RVNC), down 25.1% to $20.45 / YTD price return: -27.8% / 12-Month Price Range: $ 22.89-33.83 / Short interest (% of float): 5.3%; days to cover: 10.0 (the stock is currently on the short sale restriction list)

- Columbia Banking System Inc (COLB), down 14.2% to $33.68 / 12-Month Price Range: $ 24.84-50.68 / Short interest (% of float): 2.2%; days to cover: 6.9 (the stock is currently on the short sale restriction list)

- Organogenesis Holdings Inc (ORGO), down 14.1% to $10.35 / YTD price return: +37.5% / 12-Month Price Range: $ 3.45-24.34 (the stock is currently on the short sale restriction list)

- Cipher Mining Inc (CIFR), down 11.9% to $5.41 / YTD price return: -45.6% / 12-Month Price Range: $ 6.12-15.39 / Short interest (% of float): 2.9%; days to cover: 1.9 (the stock is currently on the short sale restriction list)

- ChemoCentryx Inc (CCXI), down 11.1% to $36.00 / YTD price return: -41.9% / 12-Month Price Range: $ 9.53-70.29 (the stock is currently on the short sale restriction list)

- Trex Company Inc (TREX), down 10.8% to $91.92 / YTD price return: +9.8% / 12-Month Price Range: $ 64.26-114.61 (the stock is currently on the short sale restriction list)

- Amkor Technology Inc (AMKR), down 10.7% to $22.42 / YTD price return: +48.7% / 12-Month Price Range: $ 10.83-29.50 (the stock is currently on the short sale restriction list)

- Protagonist Therapeutics Inc (PTGX), down 10.3% to $31.72 / YTD price return: +57.3% / 12-Month Price Range: $ 12.80-50.54 / Short interest (% of float): 6.1%; days to cover: 9.5 (the stock is currently on the short sale restriction list)

- Full Truck Alliance Co Ltd (YMM), down 8.9% to $14.20 / 12-Month Price Range: $ 7.95-22.80 / Short interest (% of float): 1.7%; days to cover: 5.9

- Cue Health Inc (HLTH), down 8.4% to $9.97 / 12-Month Price Range: $ 9.55-22.55 / Short interest (% of float): 1.5%; days to cover: 0.4

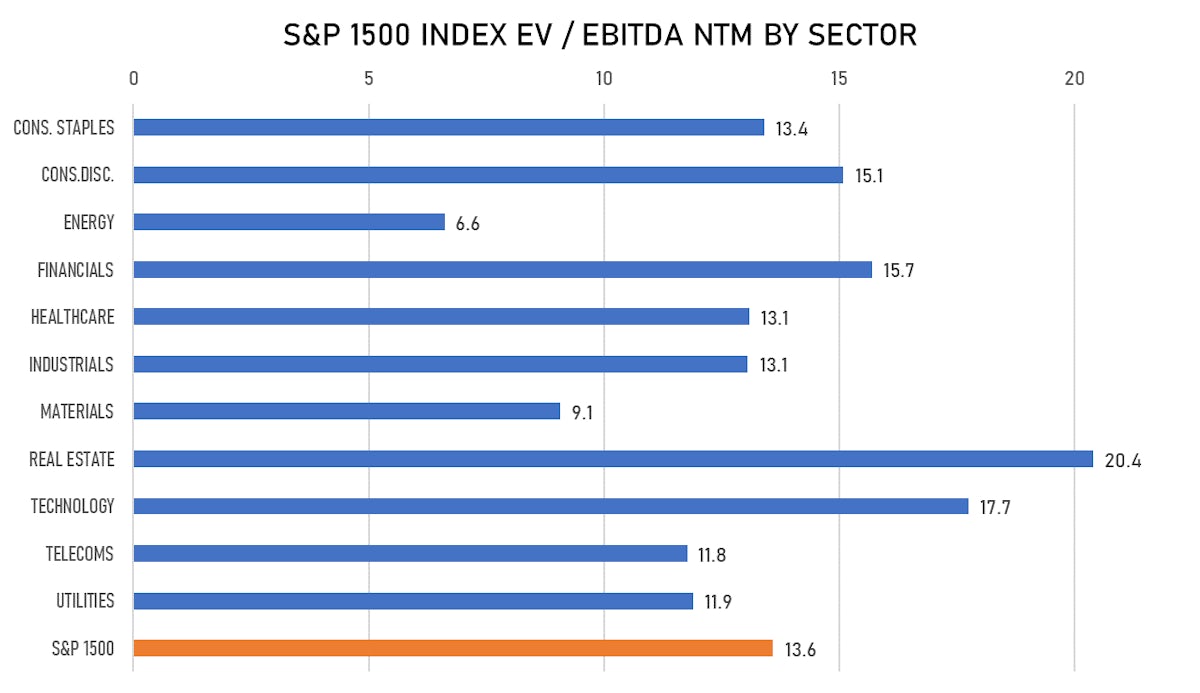

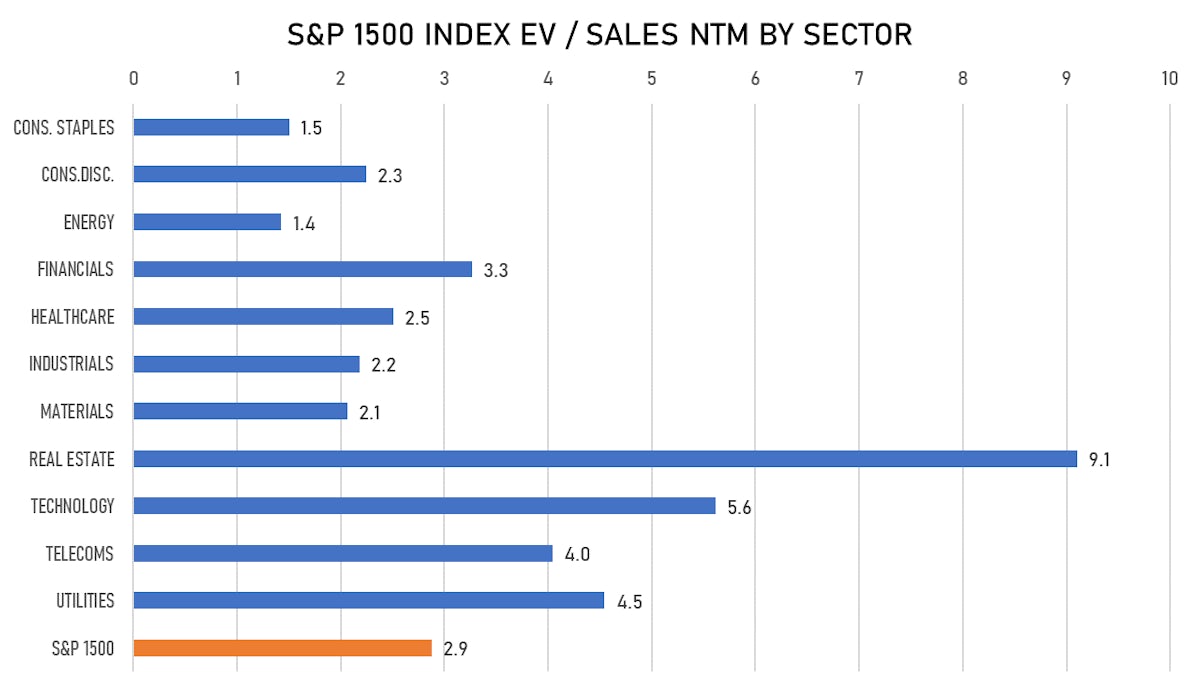

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Daiwa House Industry Co Ltd / Japan - Industrials / Listing Exchange: Singapore / Ticker: 1925 / Gross proceeds (including overallotment): US$ 332.13m (offering in Singapore Dollar) / Bookrunners: Not Applicable

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- SUMCO Corp / Japan - High Technology / Listing Exchange: Tokyo 1 / Ticker: 3436 / Gross proceeds (including overallotment): US$ 765.77m (offering in Japanese Yen) / Bookrunners: Goldman Sachs International, Morgan Stanley & Co. International plc, SMBC Nikko Capital Markets

- Hunan Jinbo Carbon Co Ltd / China - Materials / Listing Exchange: SSES / Ticker: 688598 / Gross proceeds (including overallotment): US$ 481.07m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Transurban Group / Australia - Industrials / Listing Exchange: Australia / Ticker: TCL / Gross proceeds (including overallotment): US$ 273.31m (offering in Australian Dollar) / Bookrunners: UBS Australia Ltd, Macquarie Capital (Australia) Ltd, Morgan Stanley Australia Securities Ltd, Barrenjoey Advisory Pty Ltd