Equities

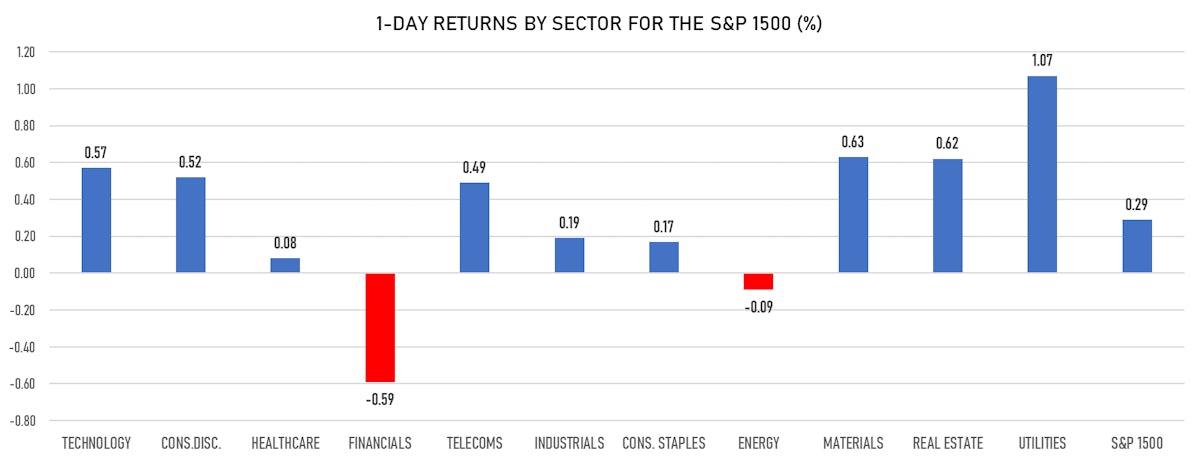

Utilities Rise On Lower Long Rates, While Financials Fall With The Flattening In The Yield Curve

Earnings season kicked off pretty quietly, with average volumes: growth overperformed value, small caps underperformed the broader market as indices closed slightly higher

Published ET

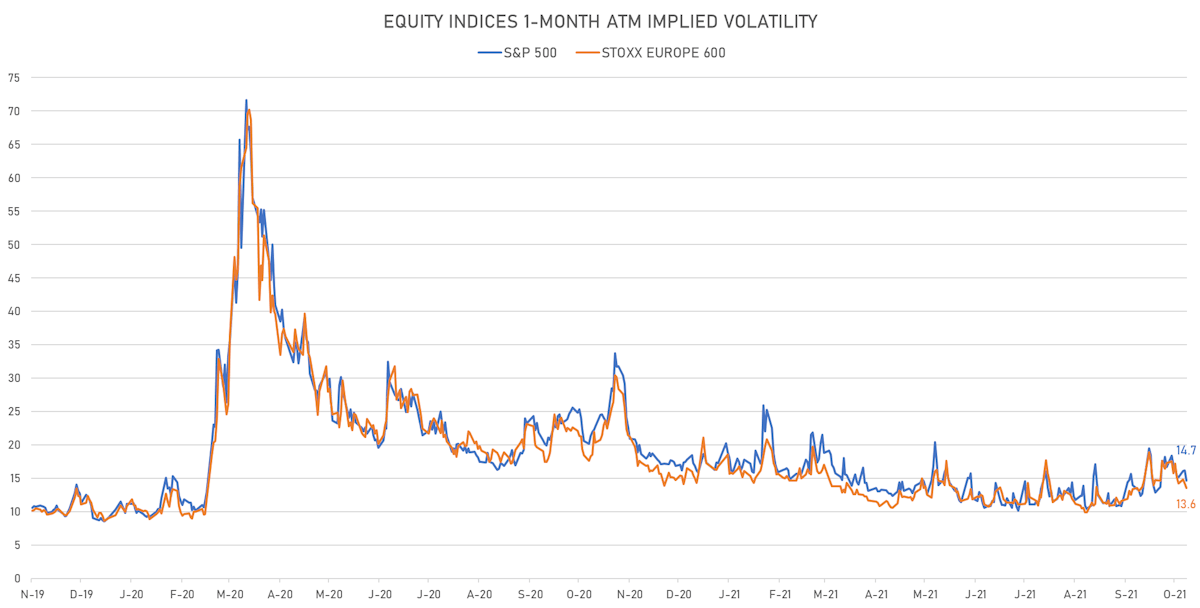

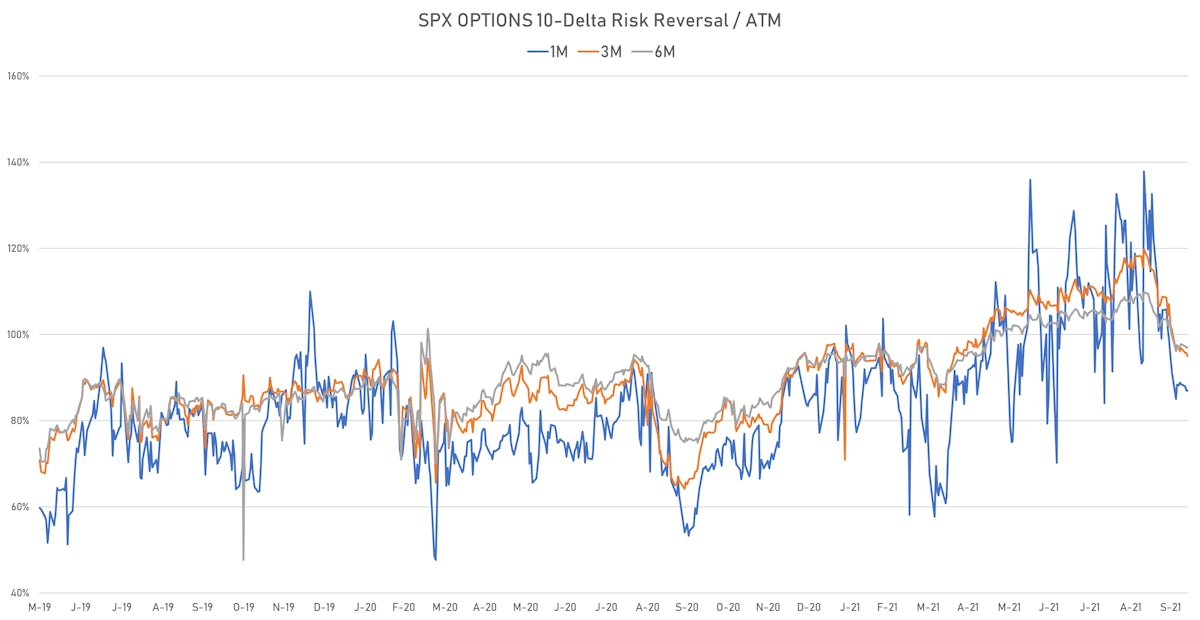

The skew in options positioning has dropped back to more normal levels | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.30%; Nasdaq Composite up 0.73%; Wilshire 5000 up 0.44%

- 56.8% of S&P 500 stocks were up today, with 64.0% of stocks above their 200-day moving average (DMA) and 37.6% above their 50-DMA

- Top performing sectors in the S&P 500: utilities up 1.14% and materials up 0.75%

- Bottom performing sectors in the S&P 500: financials down -0.64% and energy down -0.10%

- The number of shares in the S&P 500 traded today was 522m for a total turnover of US$ 61 bn

- The S&P 500 Value Index was down -0.1%, while the S&P 500 Growth Index was up 0.6%; the S&P small caps index was down -0.1% and mid caps were up 0.3%

- The volume on CME's INX (S&P 500 Index) was 1.9m (3-month z-score: -0.1); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.70%; UK FTSE 100 up 0.16%; tonight in Asia, China's CSI 300 down -0.23%, Japan's TOPIX 500 up 0.37%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 14.7%, down from 16.1%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 13.6%, down from 14.3%

NOTABLE S&P 500 EARNINGS RELEASES

- BlackRock Inc (BLK | Financials): beat on EPS (10.95 act. vs. 9.35 est.) and beat on revenue (5,050m act. vs. 4,896m est.), up 3.78% today

- Charles Schwab Corp (SCHW | Financials): missed on EPS (0.70 act. vs. 0.71 est.) and beat on revenue (4,527m act. vs. 4,462m est.), down -1.29% today

- Delta Air Lines Inc (DAL | Industrials): beat on EPS (0.30 act. vs. 0.17 est.) and beat on revenue (9,154m act. vs. 8,396m est.), down -5.76% today

- First Republic Bank (FRC | Financials): beat on EPS (1.91 act. vs. 1.84 est.) and beat on revenue (1,300m act. vs. 1,271m est.), up 2.05% today

- JPMorgan Chase & Co (JPM | Financials): beat on EPS (3.74 act. vs. 3.00 est.) and beat on revenue (30,441m act. vs. 29,762m est.), down -2.64% today

TOP WINNERS

- Allogene Therapeutics Inc (ALLO), up 18.7% to $15.94 / YTD price return: -36.8% / 12-Month Price Range: $ 12.90-44.92 / Short interest (% of float): 10.6%; days to cover: 11.2

- Smart Global Holdings Inc (SGH), up 18.1% to $51.72 / 12-Month Price Range: $ 24.37-58.39 / Short interest (% of float): 9.7%; days to cover: 6.5

- Relay Therapeutics Inc (RLAY), up 18.0% to $32.76 / YTD price return: -21.2% / 12-Month Price Range: $ 25.72-64.37 / Short interest (% of float): 12.3%; days to cover: 15.9

- Standard Lithium Ltd (SLI), up 15.3% to $9.70 / 12-Month Price Range: $ 1.33-9.36 / Short interest (% of float): 1.5%; days to cover: 1.0

- Taskus Inc (TASK), up 15.1% to $64.95 / 12-Month Price Range: $ 26.66-85.49 / Short interest (% of float): 7.7%; days to cover: 1.2

- RLX Technology Inc (RLX), up 14.9% to $5.33 / 12-Month Price Range: $ 3.70-35.00 / Short interest (% of float): 2.9%; days to cover: 1.4

- Inmode Ltd (INMD), up 13.8% to $85.83 / YTD price return: +261.5% / 12-Month Price Range: $ 18.02-90.00 / Short interest (% of float): 6.0%; days to cover: 2.0

- Vimeo Inc (VMEO), up 13.6% to $30.41 / 12-Month Price Range: $ 26.22-58.00 / Short interest (% of float): 3.0%; days to cover: 3.3

- PubMatic Inc (PUBM), up 13.6% to $27.52 / YTD price return: -1.6% / 12-Month Price Range: $ 21.61-76.96 / Short interest (% of float): 14.3%; days to cover: 3.3

- Centessa Pharmaceuticals PLC (CNTA), up 13.4% to $16.11 / 12-Month Price Range: $ 13.34-26.90 / Short interest (% of float): 1.4%; days to cover: 10.1

BIGGEST LOSERS

- ESS Tech Inc (GWH), down 19.9% to $19.07 / YTD price return: +89.2% / 12-Month Price Range: $ 7.22-28.92 / Short interest (% of float): 0.2%; days to cover: 3.6 (the stock is currently on the short sale restriction list)

- Atara Biotherapeutics Inc (ATRA), down 12.9% to $15.66 / 12-Month Price Range: $ 11.81-28.20 / Short interest (% of float): 14.8%; days to cover: 14.0 (the stock is currently on the short sale restriction list)

- Sarepta Therapeutics Inc (SRPT), down 12.5% to $83.22 / YTD price return: -51.2% / 12-Month Price Range: $ 65.30-181.83 / Short interest (% of float): 7.4%; days to cover: 6.4 (the stock is currently on the short sale restriction list)

- Adagio Therapeutics Inc (ADGI), down 12.0% to $30.74 / 12-Month Price Range: $ 20.50-59.50 / Short interest (% of float): 2.8%; days to cover: 2.5 (the stock is currently on the short sale restriction list)

- GrowGeneration Corp (GRWG), down 11.9% to $20.92 / YTD price return: -48.0% / 12-Month Price Range: $ 15.84-67.75 / Short interest (% of float): 9.9%; days to cover: 2.6 (the stock is currently on the short sale restriction list)

- Evolent Health Inc (EVH), down 11.5% to $29.32 / YTD price return: +82.9% / 12-Month Price Range: $ 9.44-34.60 / Short interest (% of float): 11.8%; days to cover: 10.5 (the stock is currently on the short sale restriction list)

- Inventrust Properties Corp (IVT), down 9.5% to $23.52 / 12-Month Price Range: $ 1.27-28.90 (the stock is currently on the short sale restriction list)

- Sun Country Airlines Holdings Inc (SNCY), down 9.2% to $32.26 / 12-Month Price Range: $ 29.09-44.13 / Short interest (% of float): 2.9%; days to cover: 5.6 (the stock is currently on the short sale restriction list)

- Legend Biotech Corp (LEGN), down 8.8% to $51.92 / YTD price return: +84.4% / 12-Month Price Range: $ 23.41-58.00 / Short interest (% of float): 1.1%; days to cover: 4.0 (the stock is currently on the short sale restriction list)

- Hydrofarm Holdings Group Inc (HYFM), down 7.9% to $35.36 / YTD price return: -32.8% / 12-Month Price Range: $ 35.66-95.48 / Short interest (% of float): 8.2%; days to cover: 3.3

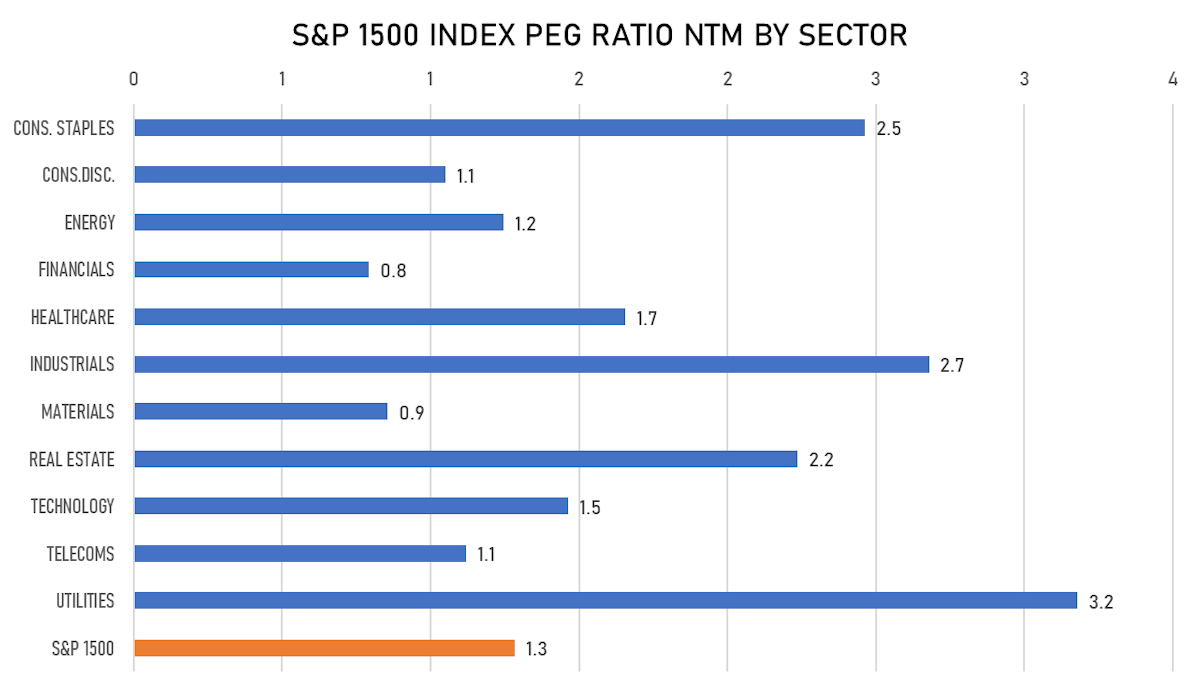

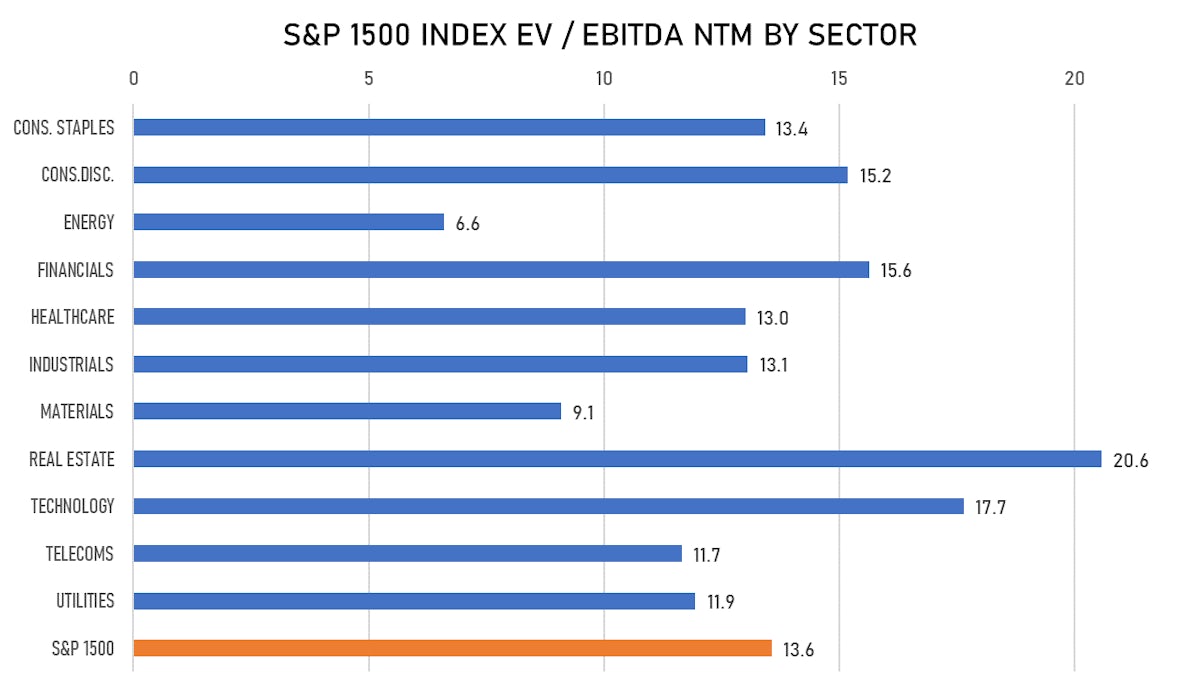

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Avidxchange Holdings Inc / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: AVDX / Gross proceeds (including overallotment): US$ 660.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, JP Morgan Securities LLC

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Sarepta Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: SRPT / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Credit Suisse Securities (USA) LLC, Morgan Stanley & Co LLC, JP Morgan Securities LLC

- Relay Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: RLAY / Gross proceeds (including overallotment): US$ 350.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Guggenheim Securities LLC, Cowen & Co, JP Morgan Securities LLC

- Sun Country Airlines Holdings Inc / United States of America - Industrials / Listing Exchange: Nasdaq / Ticker: SNCY / Gross proceeds (including overallotment): US$ 273.92m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC, Barclays Capital Inc

- Duckhorn Portfolio Inc / United States of America - Consumer Staples / Listing Exchange: New York / Ticker: NAPA / Gross proceeds (including overallotment): US$ 264.84m (offering in U.S. Dollar) / Bookrunners: Credit Suisse Securities (USA) LLC, Jefferies LLC, JP Morgan Securities LLC