Equities

Positive Earnings Surprises Take US Stocks Higher, S&P 500 Up 0.74% And Nasdaq Up 0.71%

Broad gains as close to 75% of S&P 500 stocks rose today, with low overall volume and lower volatility (VIX as well as VVIX)

Published ET

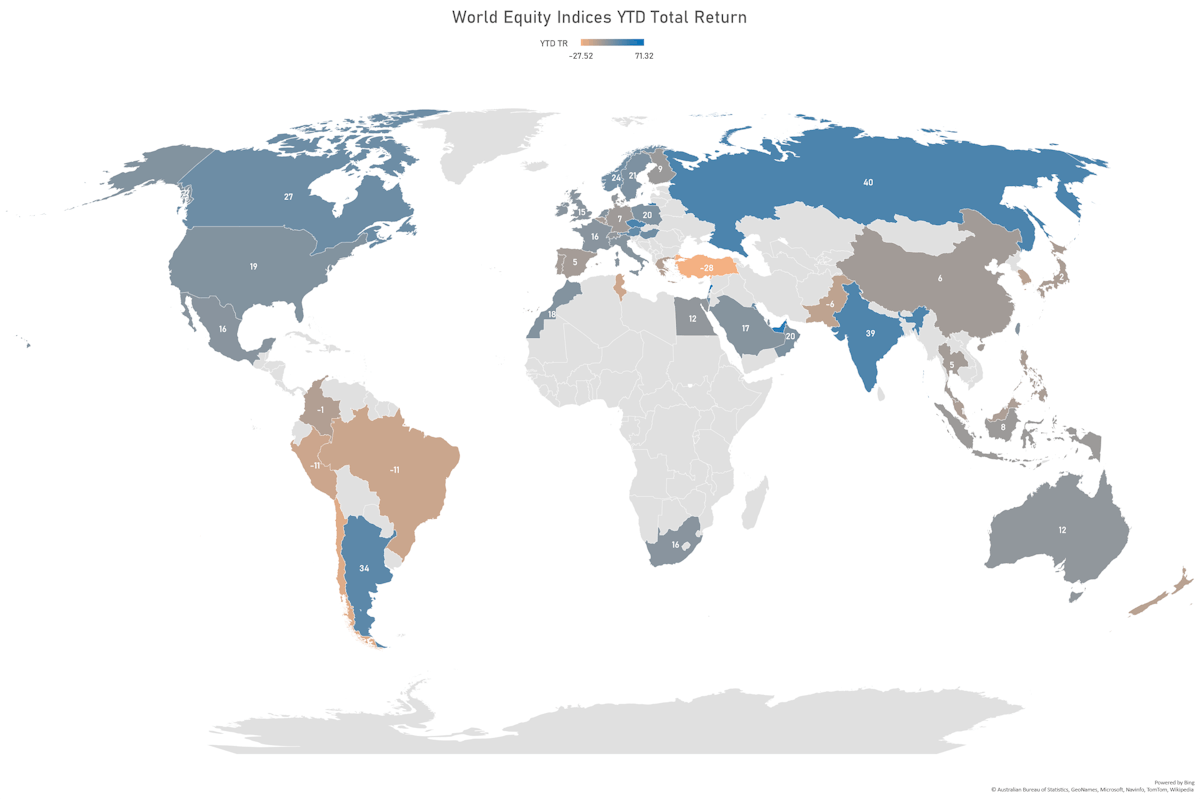

Year-To-Date Total Return By Country | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.74%; Nasdaq Composite up 0.71%; Wilshire 5000 up 0.69%

- 73.3% of S&P 500 stocks were up today, with 72.3% of stocks above their 200-day moving average (DMA) and 57.0% above their 50-DMA

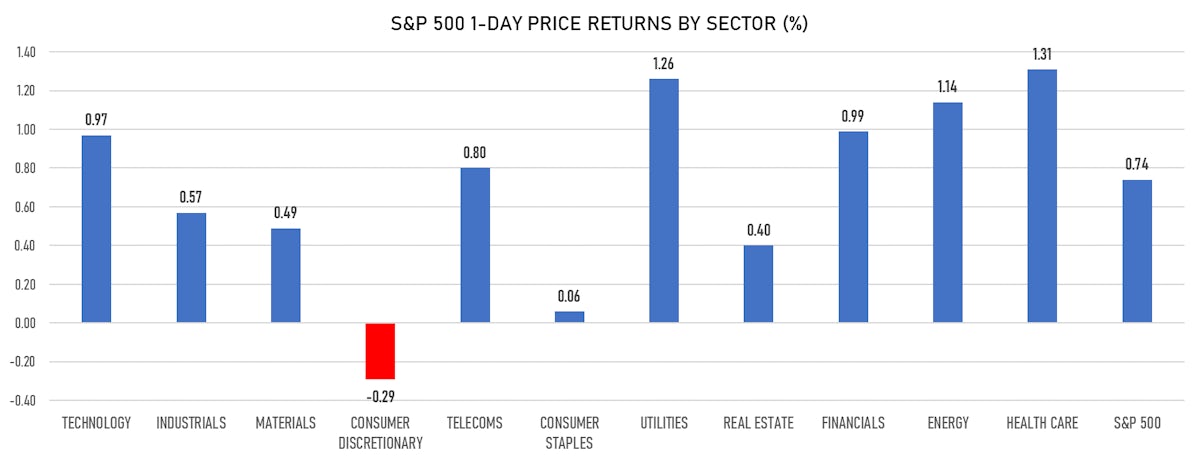

- Top performing sectors in the S&P 500: health care up 1.31% and utilities up 1.26%

- Bottom performing sectors in the S&P 500: consumer discretionary down -0.29% and consumer staples up 0.06%

- The number of shares in the S&P 500 traded today was 426m for a total turnover of US$ 54 bn

- The S&P 500 Value Index was up 0.8%, while the S&P 500 Growth Index was up 0.7%; the S&P small caps index was up 0.1% and mid caps were up 0.3%

- The volume on CME's INX (S&P 500 Index) was 1.7m (3-month z-score: -0.8); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.04%; UK FTSE 100 up 0.19%; tonight in Asia, China's CSI 300 down -0.32%, Japan's TOPIX 500 up 0.18%

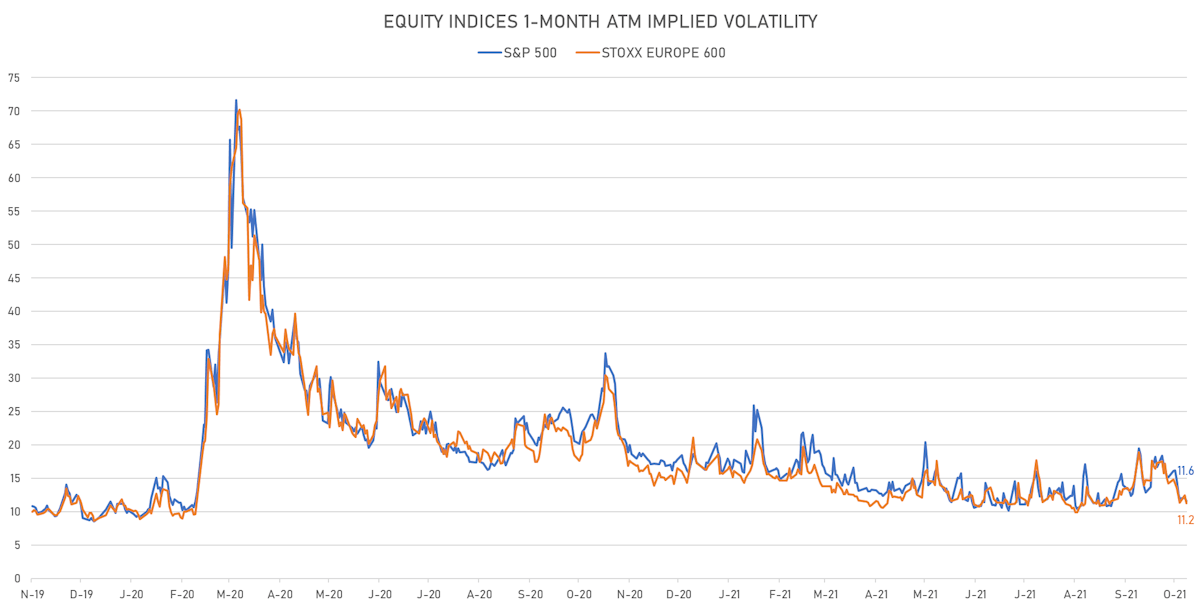

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 11.6%, down from 12.1%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.2%, down from 12.5%

NOTABLE S&P 500 EARNINGS RELEASES

- Bank of New York Mellon Corp (BK | Financials): beat on EPS (1.04 act. vs. 1.01 est.) and beat on revenue (4,035m act. vs. 3,951m est.), up 0.42% today

- Dover Corp (DOV | Industrials): beat on EPS (1.98 act. vs. 1.85 est.) and beat on revenue (2,018m act. vs. 1,999m est.), up 0.67% today

- Fifth Third Bancorp (FITB | Financials): beat on EPS (0.97 act. vs. 0.91 est.) and beat on revenue (2,028m act. vs. 1,982m est.), down -0.27% today

- United Airlines Holdings Inc (UAL | Industrials): beat on EPS (-1.02 act. vs. -1.67 est.) and beat on revenue (7,750m act. vs. 7,639m est.), down -2.01% today

- Halliburton Co (HAL | Energy): matched on EPS (0.28 act. vs. 0.28 est.) and missed on revenue (3,860m act. vs. 3,912m est.), up 0.35% today

- Intuitive Surgical Inc (ISRG | Healthcare): beat on EPS (1.19 act. vs. 1.17 est.) and beat on revenue (1,403m act. vs. 1,385m est.), up 1.20% today

- Johnson & Johnson (JNJ | Healthcare): beat on EPS (2.60 act. vs. 2.35 est.) and missed on revenue (23,338m act. vs. 23,717m est.), up 2.34% today

- Kansas City Southern (KSU | Industrials): missed on EPS (2.02 act. vs. 2.04 est.) and beat on revenue (744m act. vs. 722m est.), up 0.03% today

- Lam Research Corp (LRCX | Technology): beat on EPS (8.09 act. vs. 7.55 est.) and beat on revenue (4,145m act. vs. 4,010m est.), up 0.37% today

- Netflix Inc (NFLX | Technology): beat on EPS (3.19 act. vs. 2.56 est.) and beat on revenue (7,483m act. vs. 7,481m est.), up 0.16% today

- Omnicom Group Inc (OMC | Consumer Cyclicals): beat on EPS (1.65 act. vs. 1.36 est.) and missed on revenue (3,435m act. vs. 3,445m est.), up 0.08% today

- Procter & Gamble Co (PG | Consumer Non-Cyclicals): beat on EPS (1.61 act. vs. 1.59 est.) and beat on revenue (20,338m act. vs. 19,913m est.), down -1.18% today

- Philip Morris International Inc (PM | Consumer Non-Cyclicals): beat on EPS (1.58 act. vs. 1.55 est.) and beat on revenue (8,122m act. vs. 7,902m est.), down -1.70% today

- Synchrony Financial (SYF | Financials): beat on EPS (2.00 act. vs. 1.51 est.) and missed on revenue (2,486m act. vs. 3,572m est.), up 2.65% today

- Travelers Companies Inc (TRV | Financials): beat on EPS (2.60 act. vs. 1.67 est.) and beat on revenue (8,324m act. vs. 8,222m est.), up 1.64% today

TOP WINNERS

- Ginkgo Bioworks Holdings Inc (DNA), up 20.2% to $14.81 / 12-Month Price Range: $ 8.90-14.25 / Short interest (% of float): 0.9%; days to cover: 1.6

- Tilray Inc (TLRY), up 15.8% to $11.66 / YTD price return: +41.2% / 12-Month Price Range: $ 5.25-67.00 / Short interest (% of float): 8.6%; days to cover: 2.5

- Full Truck Alliance Co Ltd (YMM), up 15.2% to $16.56 / 12-Month Price Range: $ 7.95-22.80 / Short interest (% of float): 1.7%; days to cover: 5.9

- BlackBerry Ltd (BB), up 14.1% to $11.52 / YTD price return: +73.8% / 12-Month Price Range: $ 4.44-28.77 / Short interest (% of float): 7.2%; days to cover: 3.7

- iQIYI Inc (IQ), up 12.9% to $9.60 / YTD price return: -45.1% / 12-Month Price Range: $ 7.22-28.97 / Short interest (% of float): 15.4%; days to cover: 7.3

- Dutch Bros Inc (BROS), up 12.9% to $64.73 / 12-Month Price Range: $ 32.42-62.00 / Short interest (% of float): 4.1%; days to cover: 0.2

- ViewRay Inc (VRAY), up 12.8% to $6.72 / YTD price return: +75.9% / 12-Month Price Range: $ 2.75-7.49 / Short interest (% of float): 6.0%; days to cover: 5.6

- Allovir Inc (ALVR), up 12.5% to $23.49 / YTD price return: -38.9% / 12-Month Price Range: $ 16.66-48.96 / Short interest (% of float): 8.9%; days to cover: 10.9

- Plby Group Inc (PLBY), up 12.4% to $27.73 / YTD price return: +163.8% / 12-Month Price Range: $ 9.98-63.04 / Short interest (% of float): 11.2%; days to cover: 2.9

- Canaan Inc (CAN), up 12.0% to $7.39 / YTD price return: +24.6% / 12-Month Price Range: $ 1.85-39.10 / Short interest (% of float): 6.7%; days to cover: 1.3

BIGGEST LOSERS

- Atea Pharmaceuticals Inc (AVIR), down 66.0% to $13.82 / YTD price return: -66.9% / 12-Month Price Range: $ 18.72-94.17 / Short interest (% of float): 9.9%; days to cover: 4.0 (the stock is currently on the short sale restriction list)

- Getnet Adquirencia e Servicos para Meios de Pagamento SA (GETVV), down 23.6% to $3.30 / 12-Month Price Range: $ 2.94-4.32 (the stock is currently on the short sale restriction list)

- Peabody Energy Corp (BTU), down 19.1% to $15.90 / YTD price return: +559.8% / 12-Month Price Range: $ .80-19.83 / Short interest (% of float): 6.5%; days to cover: 1.3 (the stock is currently on the short sale restriction list)

- Remitly Global Inc (RELY), down 16.2% to $33.91 / 12-Month Price Range: $ 35.55-53.65 / Short interest (% of float): 1.0%; days to cover: 0.3 (the stock is currently on the short sale restriction list)

- Highpeak Energy Inc (HPK), down 15.2% to $10.82 / YTD price return: -31.8% / 12-Month Price Range: $ 4.17-21.67 / Short interest (% of float): 6.0%; days to cover: 6.1 (the stock is currently on the short sale restriction list)

- Silvergate Capital Corp (SI), down 13.4% to $137.01 / YTD price return: +84.4% / 12-Month Price Range: $ 16.76-187.86 / Short interest (% of float): 12.4%; days to cover: 5.2 (the stock is currently on the short sale restriction list)

- Zymergen Inc (ZY), down 12.8% to $11.00 / 12-Month Price Range: $ 7.85-52.00 / Short interest (% of float): 5.4%; days to cover: 5.5 (the stock is currently on the short sale restriction list)

- CONSOL Energy Inc (CEIX), down 12.6% to $31.20 / YTD price return: +332.7% / 12-Month Price Range: $ 3.66-36.23 / Short interest (% of float): 3.8%; days to cover: 2.9 (the stock is currently on the short sale restriction list)

- Azul SA (AZUL), down 11.6% to $16.61 / YTD price return: -27.2% / 12-Month Price Range: $ 11.16-29.45 / Short interest (% of float): 7.0%; days to cover: 6.1 (the stock is currently on the short sale restriction list)

- Ulta Beauty Inc (ULTA), down 10.6% to $363.35 / YTD price return: +26.5% / 12-Month Price Range: $ 200.50-414.98 / Short interest (% of float): 2.9%; days to cover: 2.1 (the stock is currently on the short sale restriction list)

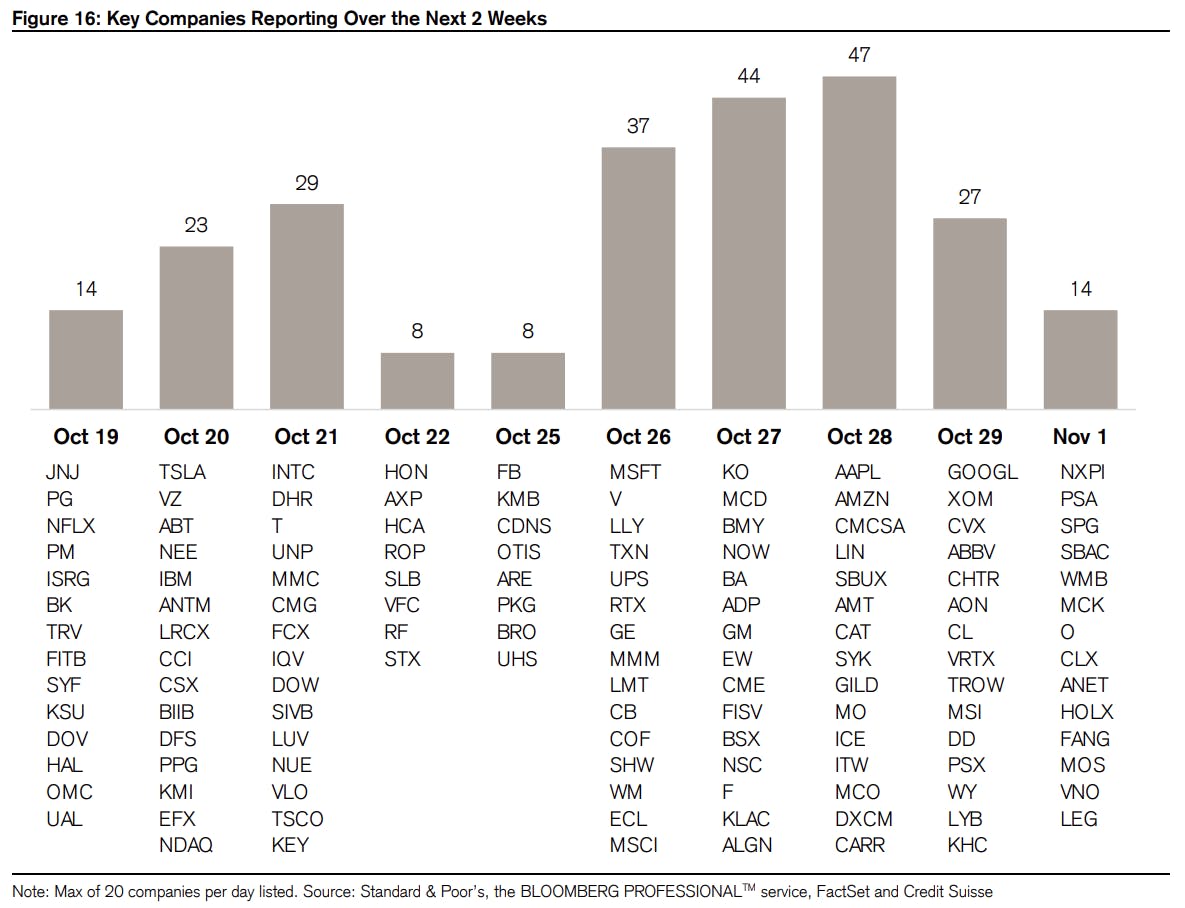

KEY EARNINGS RELEASES OVER THE NEXT COUPLE OF WEEKS