Equities

Modest Rise In Equities On Low Volume, Led By Small Caps And Value Stocks

Except for a slew of SPACs, ECM activity has been pretty limited so far this week, with the largest offerings being the IPO of Norwegian company Autostore Holdings (US$ 2.2 bn) and a secondary offering from Australia's Aristocrat Leisure (US$ 972M)

Published ET

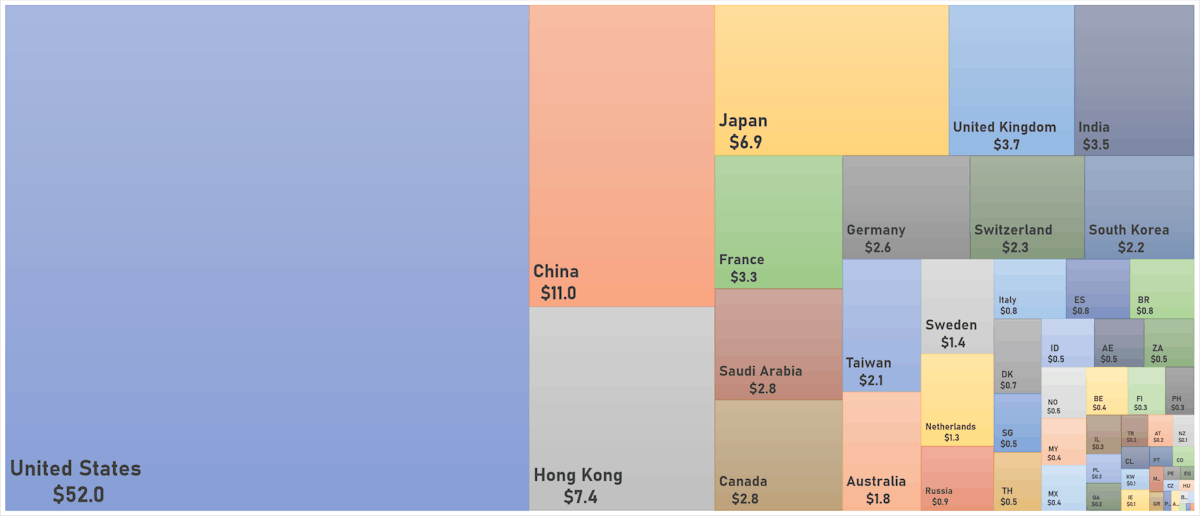

World Market Cap By Country In US$ Trillions | Sources: ϕpost, FactSet data

QUICK SUMMARY

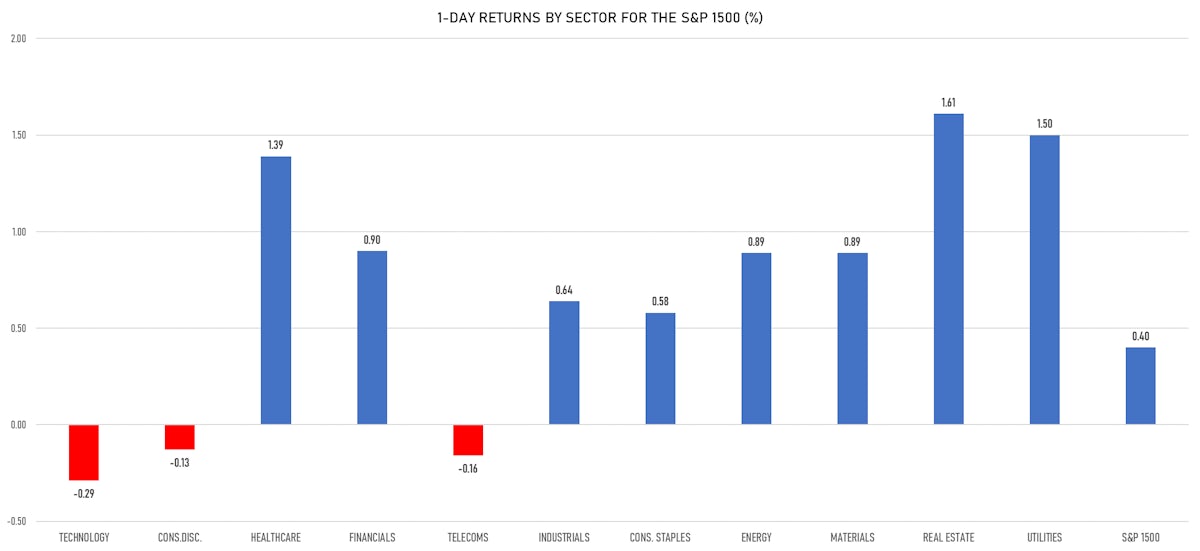

- Daily performance of US indices: S&P 500 up 0.37%, Nasdaq down 0.05, and Russell 2000 up 0.61%

- 77.2% of S&P 500 stocks were up today, with 74.7% of stocks above their 200-day moving average (DMA) and 63.6% above their 50-DMA

- Top performing sectors in the S&P 500: utilities up 1.56% and real estate up 1.55%

- Bottom performing sectors in the S&P 500: technology down -0.29% and telecoms down -0.17%

- The number of shares in the S&P 500 traded today was 464m for a total turnover of US$ 57 bn

- The S&P 500 Value Index was up 0.9%, while the S&P 500 Growth Index was down -0.1%; the S&P small caps index was up 0.7% and mid caps were up 0.8%

- The volume on CME's INX (S&P 500 Index) was 1.8m (3-month z-score: -0.4); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.32%; UK FTSE 100 up 0.08%; China CSI 300 down -0.22%; Japan's TOPIX 500 down -1.34%

VOLATILITY

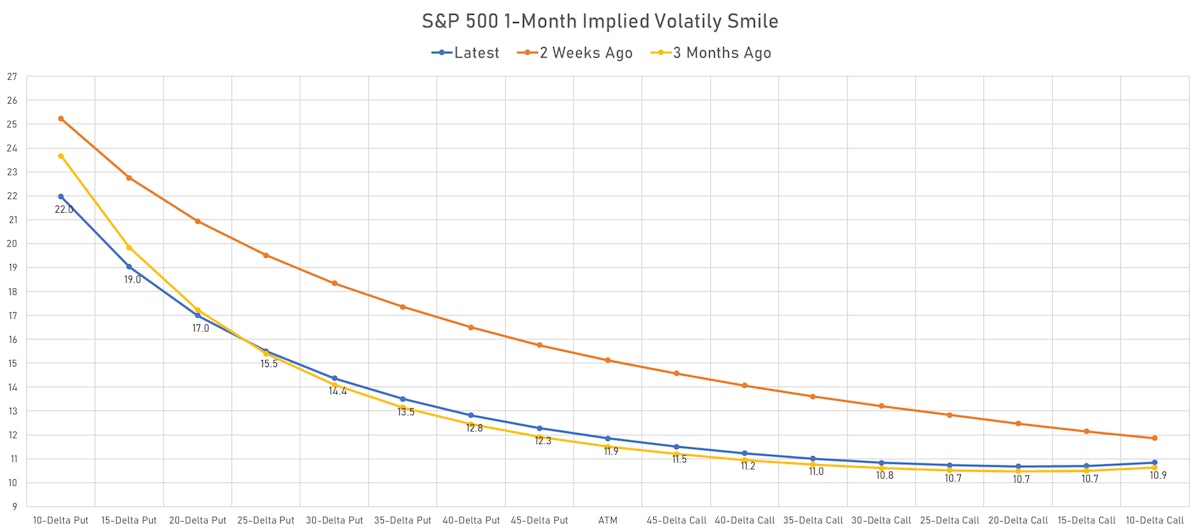

- 1-month at-the-money implied volatility on the S&P 500 at 11.9%, up from 11.6%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.0%, down from 11.2%

NOTABLE S&P 500 EARNINGS RELEASES

- Tesla Inc (TSLA | Consumer Cyclicals): beat on EPS (1.86 act. vs. 1.59 est.) and beat on revenue (13,757m act. vs. 13,626m est.), up 0.18% today

- Verizon Communications Inc (VZ | Technology): beat on EPS (1.41 act. vs. 1.36 est.) and missed on revenue (32,900m act. vs. 33,200m est.), up 2.41% today

- Abbott Laboratories (ABT | Healthcare): beat on EPS (1.40 act. vs. 0.95 est.) and beat on revenue (10,928m act. vs. 9,559m est.), up 3.33% today

- Nextera Energy Inc (NEE | Utilities): beat on EPS (0.75 act. vs. 0.71 est.) and missed on revenue (4,370m act. vs. 5,418m est.), up 2.30% today

- International Business Machines Corp (IBM | Technology): beat on EPS (2.52 act. vs. 2.50 est.) and missed on revenue (17,618m act. vs. 17,772m est.), down -0.06% today

- Anthem Inc (ANTM | Healthcare): beat on EPS (6.79 act. vs. 6.37 est.) and beat on revenue (35,548m act. vs. 35,299m est.), up 7.70% today

- CSX Corp (CSX | Industrials): beat on EPS (0.43 act. vs. 0.38 est.) and beat on revenue (3,292m act. vs. 3,062m est.), up 1.03% today

- Crown Castle International Corp (CCI | Real Estate): beat on EPS (0.81 act. vs. 0.76 est.) and beat on revenue (1,618m act. vs. 1,616m est.), up 1.23% today

- Kinder Morgan Inc (KMI | Energy): missed on EPS (0.22 act. vs. 0.23 est.) and beat on revenue (3,824m act. vs. 3,256m est.), up 1.08% today

- Biogen Inc (BIIB | Healthcare): beat on EPS (4.77 act. vs. 4.09 est.) and beat on revenue (2,779m act. vs. 2,671m est.), down -0.58% today

- Discover Financial Services (DFS | Financials): beat on EPS (3.54 act. vs. 3.53 est.) and missed on revenue (2,777m act. vs. 2,910m est.), up 1.39% today

- PPG Industries Inc (PPG | Basic Materials): beat on EPS (1.69 act. vs. 1.58 est.) and beat on revenue (4,372m act. vs. 4,244m est.), up 0.94% today

- Nasdaq Inc (NDAQ | Financials): beat on EPS (1.78 act. vs. 1.72 est.) and beat on revenue (838m act. vs. 833m est.), down -4.64% today

- Equifax Inc (EFX | Industrials): beat on EPS (1.85 act. vs. 1.72 est.) and beat on revenue (1,223m act. vs. 1,182m est.), down -1.26% today

- Las Vegas Sands Corp (LVS | Consumer Cyclicals): missed on EPS (-0.46 act. vs. -0.20 est.) and missed on revenue (857m act. vs. 1,242m est.), down -1.94% today

- Baker Hughes Co (BKR | Energy): missed on EPS (0.16 act. vs. 0.21 est.) and missed on revenue (5,093m act. vs. 5,321m est.), down -5.66% today

- Northern Trust Corp (NTRS | Financials): beat on EPS (1.80 act. vs. 1.67 est.) and beat on revenue (1,645m act. vs. 1,609m est.), up 3.38% today

- Steris plc (STE | Healthcare): beat on EPS (1.76 act. vs. 1.49 est.) and beat on revenue (968m act. vs. 905m est.), down -0.41% today

- Citizens Financial Group Inc (CFG | Financials): beat on EPS (1.18 act. vs. 1.16 est.) and beat on revenue (1,659m act. vs. 1,639m est.), up 3.63% today

- M&T Bank Corp (MTB | Financials): beat on EPS (3.69 act. vs. 3.50 est.) and beat on revenue (1,536m act. vs. 1,478m est.), up 5.78% today

- Marketaxess Holdings Inc (MKTX | Financials): beat on EPS (1.52 act. vs. 1.46 est.) and missed on revenue (162m act. vs. 166m est.), down -1.34% today

- Comerica Inc (CMA | Financials): beat on EPS (1.90 act. vs. 1.64 est.) and beat on revenue (755m act. vs. 734m est.), up 3.44% today

- Globe Life Inc (GL | Financials): missed on EPS (1.78 act. vs. 1.89 est.) and beat on revenue (1,278m act. vs. 1,264m est.), up 1.03% today

TOP WINNERS

- Valneva SE (VALN), up 18.6% to $41.99 / 12-Month Price Range: $ 24.16-59.15

- Canaan Inc (CAN), up 18.0% to $8.72 / YTD price return: +47.0% / 12-Month Price Range: $ 1.85-39.10 / Short interest (% of float): 6.7%; days to cover: 1.3

- Cipher Mining Inc (CIFR), up 17.2% to $8.73 / YTD price return: -12.3% / 12-Month Price Range: $ 5.13-15.39 / Short interest (% of float): 2.6%; days to cover: 1.8

- Dice Therapeutics Inc (DICE), up 16.1% to $31.41 / 12-Month Price Range: $ 23.16-40.50 / Short interest (% of float): 2.7%; days to cover: 2.6

- ContextLogic Inc (WISH), up 14.5% to $6.09 / YTD price return: -66.6% / 12-Month Price Range: $ 4.61-32.85

- Revance Therapeutics Inc (RVNC), up 13.9% to $15.78 / YTD price return: -44.3% / 12-Month Price Range: $ 13.01-33.83 / Short interest (% of float): 4.8%; days to cover: 9.6

- Pinterest Inc (PINS), up 12.8% to $62.68 / YTD price return: -4.9% / 12-Month Price Range: $ 44.61-89.90 / Short interest (% of float): 3.1%; days to cover: 2.3

- Arqit Quantum Inc (ARQQ), up 12.3% to $17.48 / 12-Month Price Range: $ 8.00-41.52 / Short interest (% of float): 0.8%; days to cover: 0.2

- LumiraDx Ltd (LMDX), up 12.3% to $9.47 / 12-Month Price Range: $ 7.15-10.80 / Short interest (% of float): 0.1%; days to cover: 0.4

- Olema Pharmaceuticals Inc (OLMA), up 11.9% to $30.00 / YTD price return: -37.6% / 12-Month Price Range: $ 19.41-60.27 / Short interest (% of float): 6.8%; days to cover: 6.6

BIGGEST LOSERS

- Novavax Inc (NVAX), down 14.8% to $136.86 / YTD price return: +22.7% / 12-Month Price Range: $ 76.59-331.68 (the stock is currently on the short sale restriction list)

- Healthcare Services Group Inc (HCSG), down 14.0% to $20.02 / YTD price return: -28.8% / 12-Month Price Range: $ 21.80-35.80 (the stock is currently on the short sale restriction list)

- Brinker International Inc (EAT), down 9.7% to $44.21 / YTD price return: -21.8% / 12-Month Price Range: $ 40.73-78.33 / Short interest (% of float): 5.8%; days to cover: 3.0 (the stock is currently on the short sale restriction list)

- Getnet Adquirencia e Servicos para Meios de Pagamento SA (GETVV), down 9.1% to $3.00 / 12-Month Price Range: $ 2.94-4.32 (the stock is currently on the short sale restriction list)

- Peabody Energy Corp (BTU), down 8.9% to $14.49 / YTD price return: +501.2% / 12-Month Price Range: $ .80-19.83 / Short interest (% of float): 6.5%; days to cover: 1.3

- WD-40 Co (WDFC), down 8.8% to $209.20 / YTD price return: -21.3% / 12-Month Price Range: $ 195.33-333.42

- Array Technologies Inc (ARRY), down 8.6% to $18.66 / YTD price return: -56.7% / 12-Month Price Range: $ 12.72-54.78 (the stock is currently on the short sale restriction list)

- Centrais Eletricas Brasileiras SA (EBRb), down 8.3% to $6.89 / 12-Month Price Range: $ 4.93-9.66 / Short interest (% of float): 0.2%; days to cover: 55.6

- ESS Tech Inc (GWH), down 8.0% to $15.78 / YTD price return: +56.5% / 12-Month Price Range: $ 7.22-28.92 / Short interest (% of float): 0.3%; days to cover: 3.6

- New Fortress Energy Inc (NFE), down 7.3% to $32.01 / YTD price return: -40.3% / 12-Month Price Range: $ 23.80-65.90 (the stock is currently on the short sale restriction list)