Equities

Strong Corporate Earnings Keep US Stocks Rising, As Tech, Financials, Energy, Consumer Discretionary Sectors All At Their Closing Highs

Value underperformed growth, while energy stocks were up another 1.5%, with front-month Brent Crude prices at their highest levels in 3 years

Published ET

Range In S&P 500 Prices Over The Past 12 Months | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.47%; Nasdaq Composite up 0.90%; Wilshire 5000 up 0.56%

- 53.3% of S&P 500 stocks were up today, with 74.1% of stocks above their 200-day moving average (DMA) and 64.0% above their 50-DMA

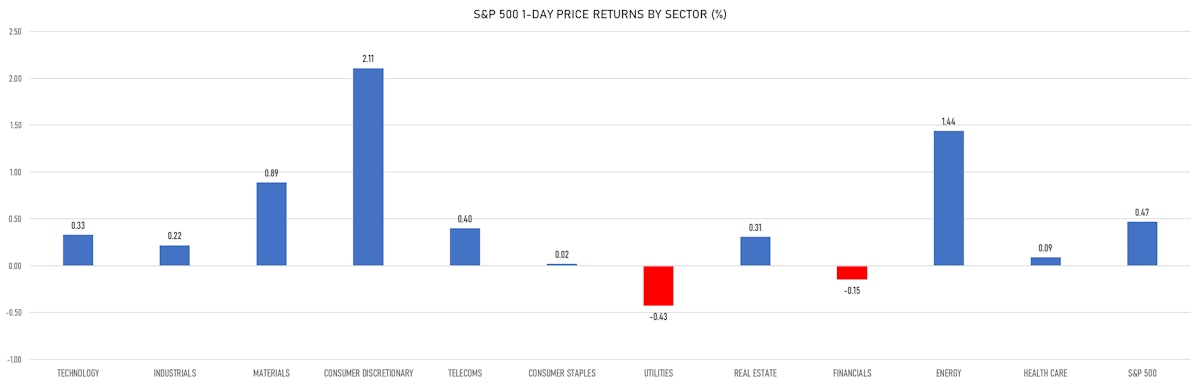

- Top performing sectors in the S&P 500: consumer discretionary up 2.11% and energy up 1.44%

- Bottom performing sectors in the S&P 500: utilities down -0.43% and financials down -0.15%

- The number of shares in the S&P 500 traded today was 503m for a total turnover of US$ 73 bn

- The S&P 500 Value Index was up 0.2%, while the S&P 500 Growth Index was up 0.7%; the S&P small caps index was up 0.9% and mid caps were up 0.5%

- The volume on CME's INX (S&P 500 Index) was 1.8m (3-month z-score: -0.3); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.07%; UK FTSE 100 up 0.25%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -0.21%, Japan's TOPIX 500 up 1.22%

VOLATILITY

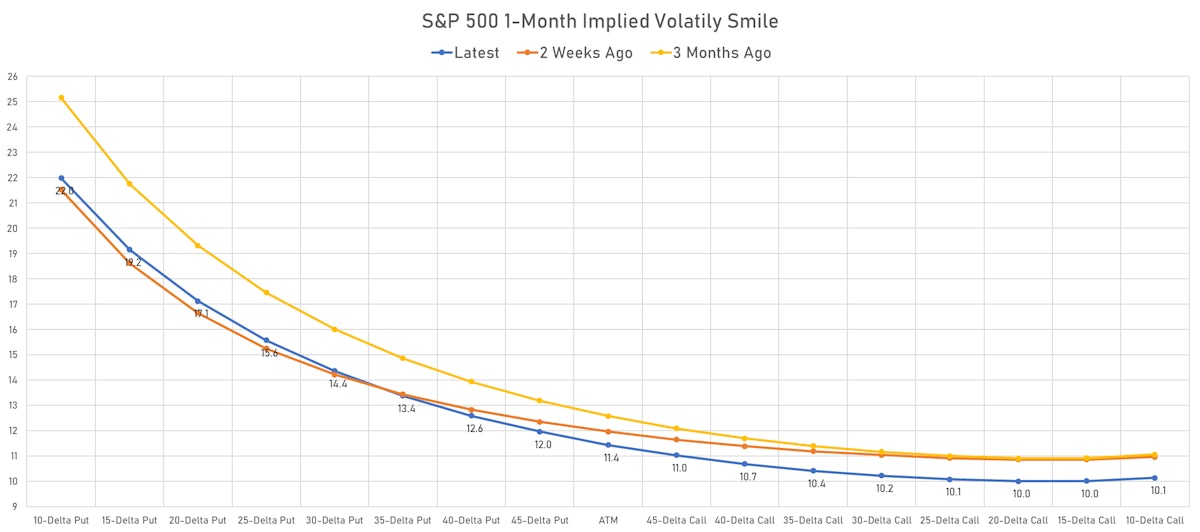

- 1-month at-the-money implied volatility on the S&P 500 at 11.4%, down from 11.5%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.5%, up from 10.8%

NOTABLE S&P 500 EARNINGS RELEASES

- Alexandria Real Estate Equities Inc (ARE | Real Estate): beat on EPS (0.64 act. vs. 0.62 est.) and beat on revenue (547m act. vs. 442m est.), up 0.34% today

- Franklin Resources Inc (BEN | Financials): beat on EPS (0.96 act. vs. 0.77 est.) and missed on revenue (1,647m act. vs. 2,118m est.), up 1.24% today

- Brown & Brown Inc (BRO | Financials): beat on EPS (0.58 act. vs. 0.53 est.) and beat on revenue (770m act. vs. 761m est.), down -0.05% today

- Cadence Design Systems Inc (CDNS | Technology): beat on EPS (0.80 act. vs. 0.75 est.) and beat on revenue (751m act. vs. 741m est.), up 0.37% today

- Facebook Inc (FB | Technology): beat on EPS (3.22 act. vs. 3.19 est.) and missed on revenue (29,010m act. vs. 29,568m est.), up 1.26% today

- Kimberly-Clark Corp (KMB | Consumer Non-Cyclicals): missed on EPS (1.62 act. vs. 1.65 est.) and beat on revenue (5,010m act. vs. 4,987m est.), down -2.20% today

- Otis Worldwide Corp (OTIS | Industrials): beat on EPS (0.77 act. vs. 0.73 est.) and beat on revenue (3,620m act. vs. 3,543m est.), down -4.40% today

- Packaging Corp of America (PKG | Basic Materials): beat on EPS (2.69 act. vs. 2.34 est.) and beat on revenue (2,000m act. vs. 1,930m est.), down -0.05% today

- Universal Health Services Inc (UHS | Healthcare): missed on EPS (2.67 act. vs. 2.75 est.) and beat on revenue (3,156m act. vs. 3,105m est.), down -1.42% today

TOP WINNERS

- Bloom Energy Corp (BE), up 37.1% to $27.69 / YTD price return: -3.4% / 12-Month Price Range: $ 12.37-44.95

- Stratasys Ltd (SSYS), up 21.4% to $34.00 / YTD price return: +64.1% / 12-Month Price Range: $ 12.48-56.95

- Arqit Quantum Inc (ARQQ), up 21.4% to $20.13 / 12-Month Price Range: $ 8.00-41.52 / Short interest (% of float): 0.8%; days to cover: 0.2

- Electric Last Mile Solutions Inc (ELMS), up 17.5% to $8.38 / 12-Month Price Range: $ 6.43-15.30 / Short interest (% of float): 3.4%; days to cover: 2.8

- Hut 8 Mining Corp (HUT), up 17.0% to $13.05 / YTD price return: +374.5% / 12-Month Price Range: $ .79-13.19 / Short interest (% of float): 3.2%; days to cover: 0.5

- Highpeak Energy Inc (HPK), up 16.1% to $12.95 / YTD price return: -18.4% / 12-Month Price Range: $ 4.17-21.67 / Short interest (% of float): 6.0%; days to cover: 6.1

- Canaan Inc (CAN), up 13.5% to $9.25 / YTD price return: +56.0% / 12-Month Price Range: $ 1.85-39.10

- Tesla Inc (TSLA), up 12.7% to $1,024.86 / YTD price return: +45.2% / 12-Month Price Range: $ 379.11-910.00

- Velo3D Inc (VLD), up 12.4% to $9.23 / 12-Month Price Range: $ 7.37-12.10 / Short interest (% of float): 0.5%

- Ocugen Inc (OCGN), up 12.3% to $9.34 / YTD price return: +410.4% / 12-Month Price Range: $ .25-18.77

BIGGEST LOSERS

- Grid Dynamics Holdings Inc (GDYN), down 15.5% to $25.85 / YTD price return: +105.2% / 12-Month Price Range: $ 7.61-32.69 (the stock is currently on the short sale restriction list)

- MoneyLion Inc (ML), down 13.6% to $5.91 / YTD price return: -47.7% / 12-Month Price Range: $ 5.48-12.90 / Short interest (% of float): 1.7%; days to cover: 2.2 (the stock is currently on the short sale restriction list)

- Pinterest Inc (PINS), down 12.7% to $50.68 / YTD price return: -23.1% / 12-Month Price Range: $ 48.57-89.90 (the stock is currently on the short sale restriction list)

- Digital World Acquisition Corp (DWAC), down 11.0% to $83.86 / 12-Month Price Range: $ 9.84-175.00 (the stock is currently on the short sale restriction list)

- Altus Midstream Co (ALTM), down 9.5% to $61.58 / YTD price return: +29.8% / 12-Month Price Range: $ 9.44-91.00 / Short interest (% of float): 5.0%; days to cover: 3.2 (the stock is currently on the short sale restriction list)

- HNI Corp (HNI), down 9.4% to $36.19 / 12-Month Price Range: $ 32.09-46.93 (the stock is currently on the short sale restriction list)

- D Market Elektronik Hizmetler ve Ticaret AS (HEPS), down 9.4% to $4.63 / 12-Month Price Range: $ 4.96-15.23 (the stock is currently on the short sale restriction list)

- Revance Therapeutics Inc (RVNC), down 8.2% to $14.18 / YTD price return: -50.0% / 12-Month Price Range: $ 13.01-33.83 (the stock is currently on the short sale restriction list)

- ESS Tech Inc (GWH), down 7.7% to $15.40 / YTD price return: +52.8% / 12-Month Price Range: $ 7.22-28.92 / Short interest (% of float): 0.2%; days to cover: 3.6

- Membership Collective Group Inc (MCG), down 7.6% to $10.94 / 12-Month Price Range: $ 9.56-14.87 (the stock is currently on the short sale restriction list)

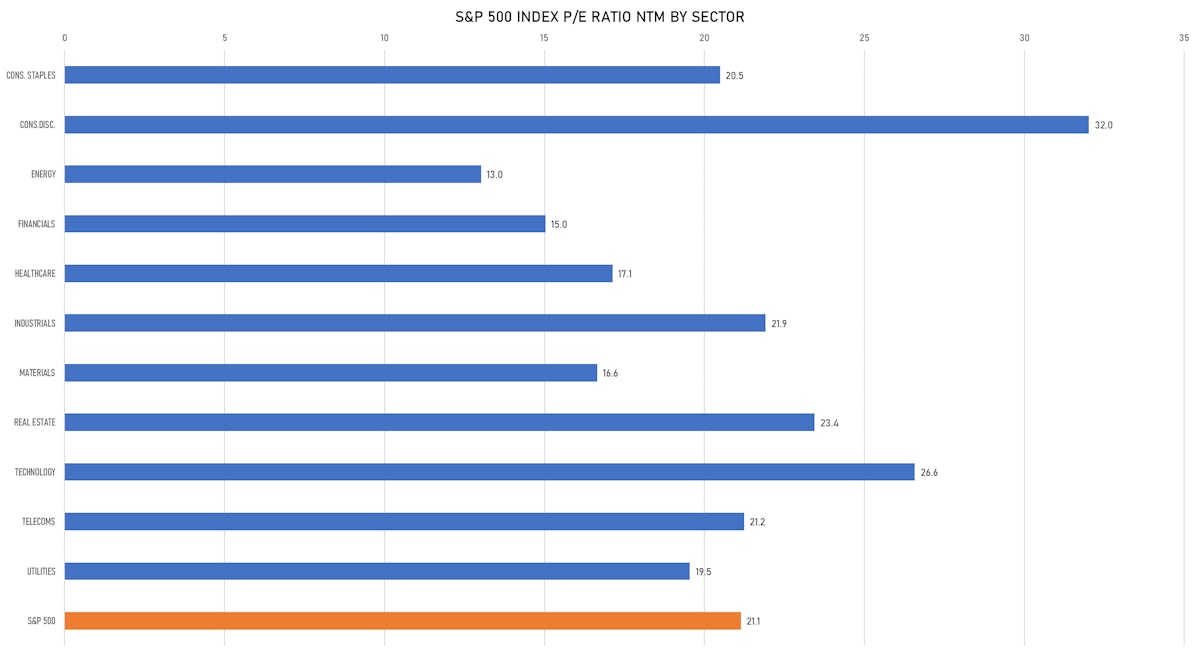

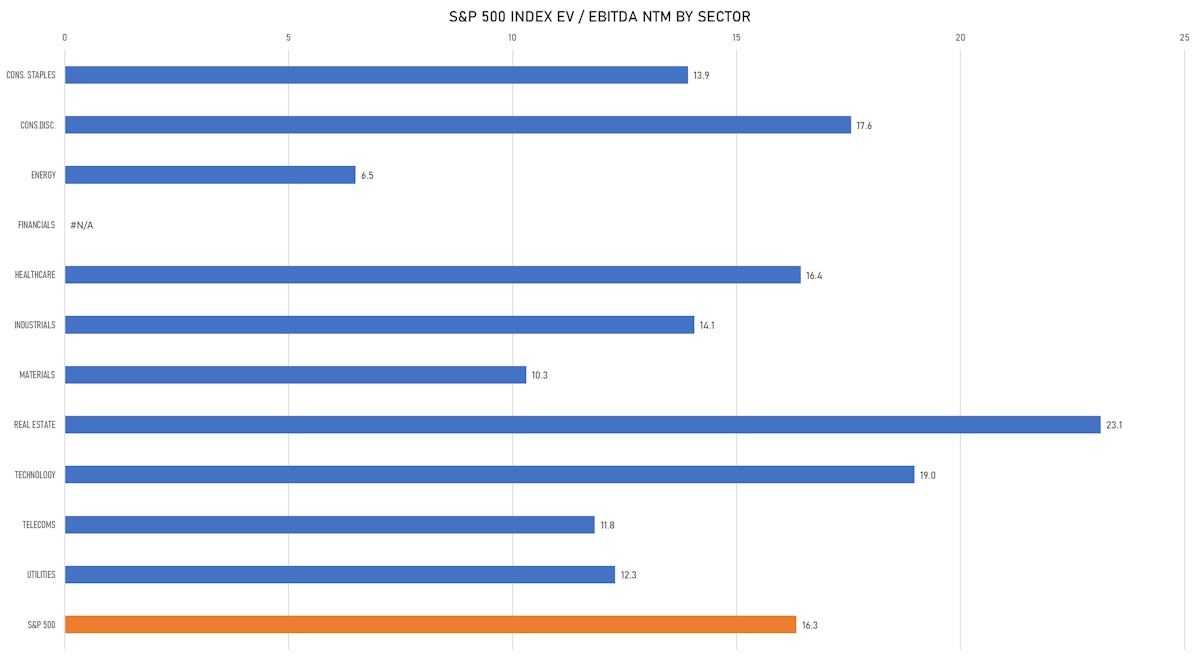

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- GQG Partners Inc / United States of America - Financials / Listing Exchange: Australia / Ticker: GQG / Gross proceeds (including overallotment): US$ 808.64m (offering in Australian Dollar) / Bookrunners: UBS Australia Ltd, Goldman Sachs (Australia)

- Roman Dbdr Tech Acquisition Corp Ii / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: RDTXU / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: B Riley Securities Inc

- DP Cap Acquisition Corp I / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: DPCSU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Cowen & Co

- VMG Consumer Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: VMGA.U / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Credit Suisse Securities (USA) LLC, Moelis & Co

- Freehold Properties Inc / United States of America - Real Estate / Listing Exchange: Nasdaq / Ticker: FHP / Gross proceeds (including overallotment): US$ 115.00m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, Stifel Nicolaus & Co Inc

- Serendipity (WA) Pty Ltd / Australia - Consumer Products and Services / Listing Exchange: Australia / Ticker: N/A / Gross proceeds (including overallotment): US$ 725.50m (offering in Australian Dollar) / Bookrunners: Goldman Sachs & Co, UBS

- Atrato Onsite Energy PLC / United Kingdom - Financials / Listing Exchange: London / Ticker: ROOF / Gross proceeds (including overallotment): US$ 206.27m (offering in British Pound) / Bookrunners: Alvarium Securities Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- IVERIC bio Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: ISEE / Gross proceeds (including overallotment): US$ 150.75m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, Stifel Nicolaus & Co Inc, Credit Suisse Securities (USA) LLC, Morgan Stanley & Co LLC

- JAPAN POST HOLDINGS Co Ltd / Japan - Consumer Products and Services / Listing Exchange: Tokyo 1 / Ticker: 6178 / Gross proceeds (including overallotment): US$ 5,573.43m (offering in Japanese Yen) / Bookrunners: Mizuho Securities Co Ltd, Goldman Sachs Japan Co., Ltd., JPMorgan Securities Japan Co Ltd, Daiwa Securities Co Ltd, SMBC Nikko Securities Inc

- Sekisui House REIT Inc / Japan - Real Estate / Listing Exchange: Tokyo / Ticker: 3309 / Gross proceeds (including overallotment): US$ 111.44m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd, Mizuho Securities Co Ltd, SMBC Nikko Securities Inc