Equities

Mixed Day For US Equities With About 45% Of S&P Stocks Up, As Large Caps Rise And Small Caps Fall

A very busy day for earnings releases, with good quarterly reports from Google, Microsoft, UPS, S&P Global, and less impressive ones from Lockheed Martin and Raytheon Technologies

Published ET

Skews In S&P 500 Options Still At Elevated Levels | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

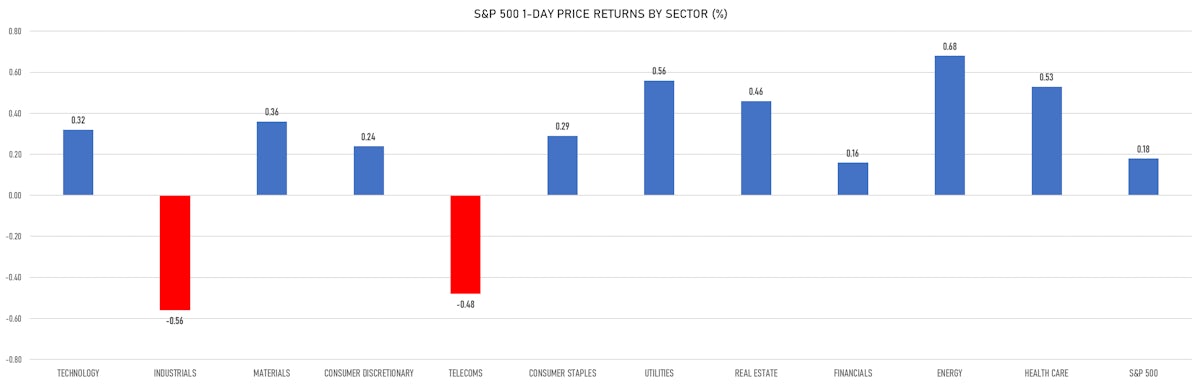

- Daily performance of US indices: S&P 500 up 0.18%; Nasdaq Composite up 0.06%; Wilshire 5000 up 0.03%

- 44.4% of S&P 500 stocks were up today, with 73.3% of stocks above their 200-day moving average (DMA) and 64.2% above their 50-DMA

- Top performing sectors in the S&P 500: energy up 0.68% and utilities up 0.56%

- Bottom performing sectors in the S&P 500: industrials down -0.56% and telecoms down -0.48%

- The number of shares in the S&P 500 traded today was 511m for a total turnover of US$ 77 bn

- The S&P 500 Value Index was unchanged, while the S&P 500 Growth Index was up 0.3%; the S&P small caps index was down -0.9% and mid caps were down -0.6%

- The volume on CME's INX (S&P 500 Index) was 2.0m (3-month z-score: 0.2); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.75%; UK FTSE 100 up 0.76%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -1.71%, Japan's TOPIX 500 down -0.41%

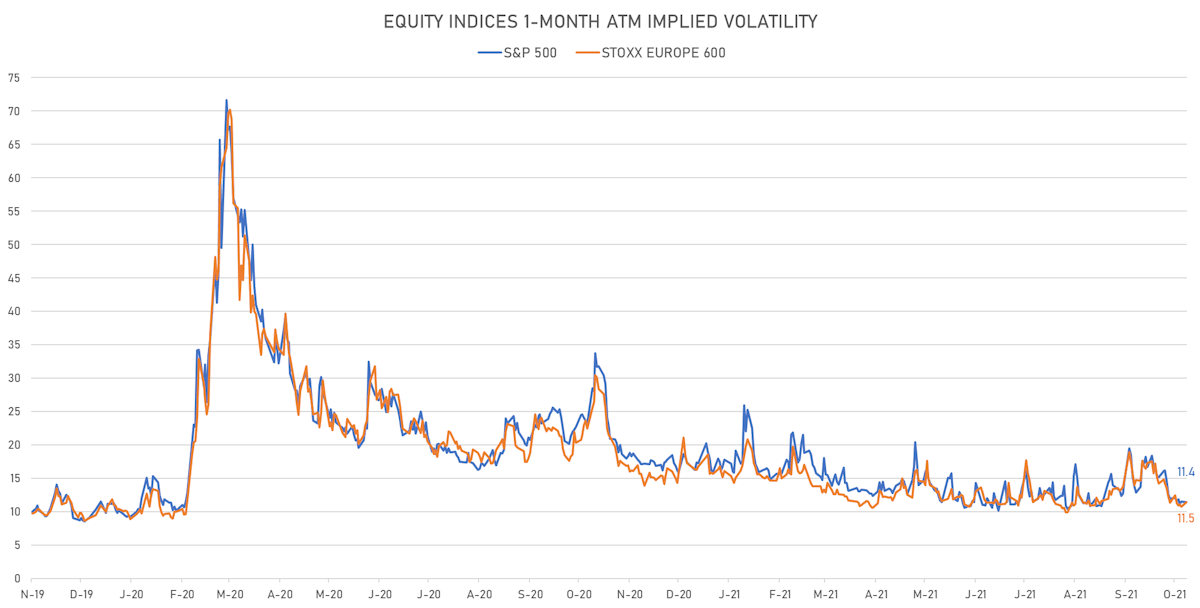

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 11.9%, up from 11.4%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 10.7%, down from 11.5%

NOTABLE S&P 500 EARNINGS RELEASES

- Microsoft Corp (MSFT | Technology): beat on EPS (2.27 act. vs. 1.92 est.) and beat on revenue (45,317m act. vs. 44,243m est.), up 0.64% today

- Alphabet Inc (GOOGL | Technology): beat on EPS (27.99 act. vs. 19.34 est.) and beat on revenue (65,118m act. vs. 56,156m est.), up 1.35% today

- Visa Inc (V | Technology): beat on EPS (1.62 act. vs. 1.35 est.) and beat on revenue (6,559m act. vs. 5,875m est.), down -0.88% today

- Eli Lilly and Co (LLY | Healthcare): beat on EPS (1.94 act. vs. 1.89 est.) and beat on revenue (6,773m act. vs. 6,619m est.), up 1.38% today

- Texas Instruments Inc (TXN | Technology): beat on EPS (2.07 act. vs. 1.83 est.) and beat on revenue (4,643m act. vs. 4,353m est.), down -1.61% today

- United Parcel Service Inc (UPS | Industrials): missed on EPS (2.71 act. vs. 2.82 est.) and missed on revenue (23,114m act. vs. 23,243m est.), up 6.95% today

- Advanced Micro Devices Inc (AMD | Technology): beat on EPS (0.73 act. vs. 0.54 est.) and beat on revenue (4,313m act. vs. 3,622m est.), up 0.47% today

- Raytheon Technologies Corp (RTX | Industrials): beat on EPS (1.26 act. vs. 0.93 est.) and beat on revenue (16,213m act. vs. 15,836m est.), down -2.34% today

- General Electric Co (GE | Consumer Non-Cyclicals): beat on EPS (0.57 act. vs. 0.28 est.) and beat on revenue (18,429m act. vs. 18,145m est.), up 2.03% today

- S&P Global Inc (SPGI | Industrials): beat on EPS (3.54 act. vs. 3.27 est.) and beat on revenue (2,087m act. vs. 1,994m est.), up 3.86% today

- 3M Co (MMM | Consumer Non-Cyclicals): beat on EPS (2.45 act. vs. 2.28 est.) and beat on revenue (8,942m act. vs. 8,565m est.), down -0.13% today

- Lockheed Martin Corp (LMT | Industrials): missed on EPS (2.21 act. vs. 6.53 est.) and missed on revenue (16,028m act. vs. 16,939m est.), down -11.80% today

- Sherwin-Williams Co (SHW | Basic Materials): missed on EPS (2.09 act. vs. 2.68 est.) and missed on revenue (5,147m act. vs. 5,380m est.), up 2.03% today

- Chubb Ltd (CB | Financials): missed on EPS (2.64 act. vs. 3.01 est.) and beat on revenue (10,510m act. vs. 8,330m est.), down -0.45% today

- Capital One Financial Corp (COF | Financials): beat on EPS (6.86 act. vs. 4.64 est.) and beat on revenue (7,830m act. vs. 7,117m est.), down -2.27% today

- Waste Management Inc (WM | Industrials): beat on EPS (1.26 act. vs. 1.19 est.) and beat on revenue (4,665m act. vs. 4,233m est.), down -1.16% today

- Ecolab Inc (ECL | Basic Materials): beat on EPS (1.38 act. vs. 1.21 est.) and beat on revenue (3,321m act. vs. 3,117m est.), up 3.94% today

- MSCI Inc (MSCI | Industrials): beat on EPS (2.53 act. vs. 2.30 est.) and beat on revenue (517m act. vs. 486m est.), down -1.37% today

- Twitter Inc (TWTR | Technology): missed on EPS (-0.54 act. vs. 0.07 est.) and beat on revenue (1,284m act. vs. 1,066m est.), down -1.09% today

- Digital Realty Trust Inc (DLR | Real Estate): beat on EPS (0.44 act. vs. 0.23 est.) and beat on revenue (1,133m act. vs. 1,069m est.), up 0.34% today

TOP WINNERS

- Valens Semiconductor Ltd (VLN), up 20.6% to $9.60 / YTD price return: -5.3% / 12-Month Price Range: $ 6.12-11.34 / Short interest days to cover: 0.8

- Roivant Sciences Ltd (ROIV), up 19.5% to $8.41 / YTD price return: -17.3% / 12-Month Price Range: $ 5.80-10.87 / Short interest days to cover: 0.6

- Avid Bioservices Inc (CDMO), up 14.0% to $29.64 / YTD price return: +156.8% / 12-Month Price Range: $ 6.99-28.36

- Marqeta Inc (MQ), up 13.5% to $32.10 / 12-Month Price Range: $ 19.78-32.75

- Medpace Holdings Inc (MEDP), up 13.1% to $213.02 / YTD price return: +53.0% / 12-Month Price Range: $ 105.48-199.04

- Omega Therapeutics Inc (OMGA), up 12.5% to $26.25 / 12-Month Price Range: $ 15.50-24.29 / Short interest (% of float): 0.8%; days to cover: 3.2

- ESS Tech Inc (GWH), up 10.4% to $17.00 / YTD price return: +68.7% / 12-Month Price Range: $ 7.22-28.92 / Short interest (% of float): 0.3%; days to cover: 3.6 (the stock is currently on the short sale restriction list)

- Nuvalent Inc (NUVL), up 10.2% to $23.25 / 12-Month Price Range: $ 17.00-40.82

- Dingdong (Cayman) Ltd (DDL), up 10.1% to $28.05 / 12-Month Price Range: $ 17.30-46.00

- Valneva SE (VALN), up 10.0% to $52.69 / 12-Month Price Range: $ 24.16-59.15

BIGGEST LOSERS

- Digital World Acquisition Corp (DWAC), down 29.6% to $59.07 / 12-Month Price Range: $ 9.84-175.00 (the stock is currently on the short sale restriction list)

- World Acceptance Corp (WRLD), down 27.3% to $151.61 / YTD price return: +48.3% / 12-Month Price Range: $ 82.44-212.76 (the stock is currently on the short sale restriction list)

- Commvault Systems Inc (CVLT), down 19.4% to $61.04 / YTD price return: +10.2% / 12-Month Price Range: $ 39.20-84.22 (the stock is currently on the short sale restriction list)

- James River Group Holdings Ltd (JRVR), down 16.2% to $32.75 / YTD price return: -33.4% / 12-Month Price Range: $ 30.75-57.41 (the stock is currently on the short sale restriction list)

- Canon Inc (CAJ), down 13.9% to $21.54 / YTD price return: +11.0% / 12-Month Price Range: $ 17.13-25.94 / Short interest (% of float): 0.2%; days to cover: 4.9 (the stock is currently on the short sale restriction list)

- Ke Holdings Inc (BEKE), down 13.2% to $20.80 / YTD price return: -66.2% / 12-Month Price Range: $ 15.15-79.40 (the stock is currently on the short sale restriction list)

- Dana Inc (DAN), down 12.2% to $22.11 / YTD price return: +13.3% / 12-Month Price Range: $ 13.78-28.44 (the stock is currently on the short sale restriction list)

- Mp Materials Corp (MP), down 12.1% to $33.48 / YTD price return: +4.1% / 12-Month Price Range: $ 10.80-51.77 (the stock is currently on the short sale restriction list)

- TrueBlue Inc (TBI), down 11.9% to $28.81 / YTD price return: +54.1% / 12-Month Price Range: $ 14.99-32.91 / Short interest (% of float): 2.0%; days to cover: 4.2 (the stock is currently on the short sale restriction list)

- NewMarket Corp (NEU), down 11.8% to $332.01 / YTD price return: -16.6% / 12-Month Price Range: $ 297.29-432.55 (the stock is currently on the short sale restriction list)