Equities

Equities Slide Into The Close As Budget Negotiations Said To Be Leaning Towards Increased Income Tax

Another busy day of earnings releases, which ended with only 16% of S&P 500 stocks up, with a large overperformance of growth over value and large caps over small caps

Published ET

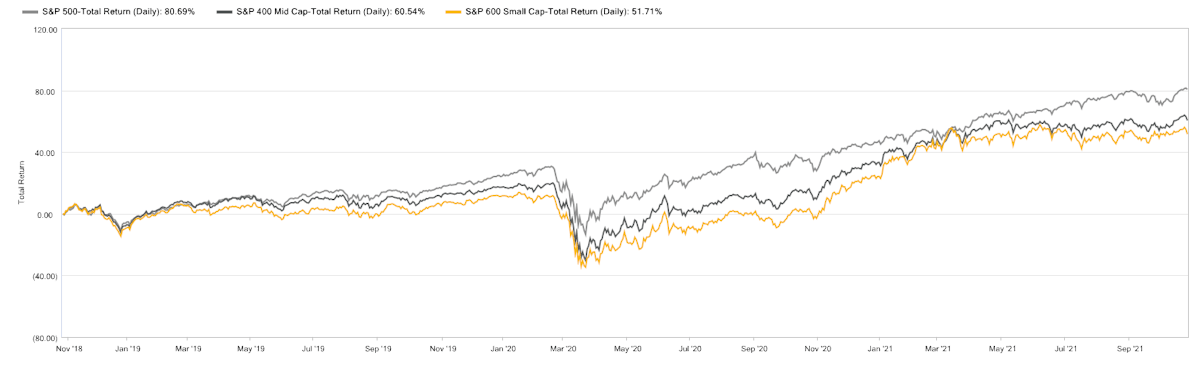

3-Year Total Returns For The S&P 500, S&P 400 Mid Caps, S&P 600 Small Caps | Source: S&P Capital IQ Pro

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.51%; Nasdaq Composite unchanged, Wilshire 5000 down -0.79%

- 16.0% of S&P 500 stocks were up today, with 69.5% of stocks above their 200-day moving average (DMA) and 56.4% above their 50-DMA

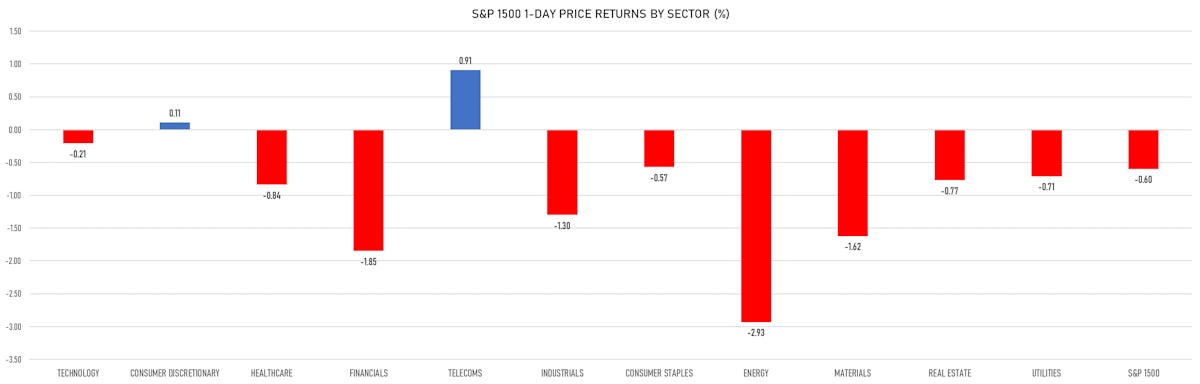

- Top performing sectors in the S&P 500: telecoms up 0.95% and consumer discretionary up 0.24%

- Bottom performing sectors in the S&P 500: energy down -2.86% and financials down -1.69%

- The number of shares in the S&P 500 traded today was 562m for a total turnover of US$ 78 bn

- The S&P 500 Value Index was down -1.4%, while the S&P 500 Growth Index was up 0.3%; the S&P small caps index was down -2.0% and mid caps were down -1.6%

- The volume on CME's INX (S&P 500 Index) was 2.2m (3-month z-score: 0.9); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -0.36%; UK FTSE 100 down -0.33%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index up 0.02%, Japan's TOPIX 500 down -0.74%

VOLATILITY

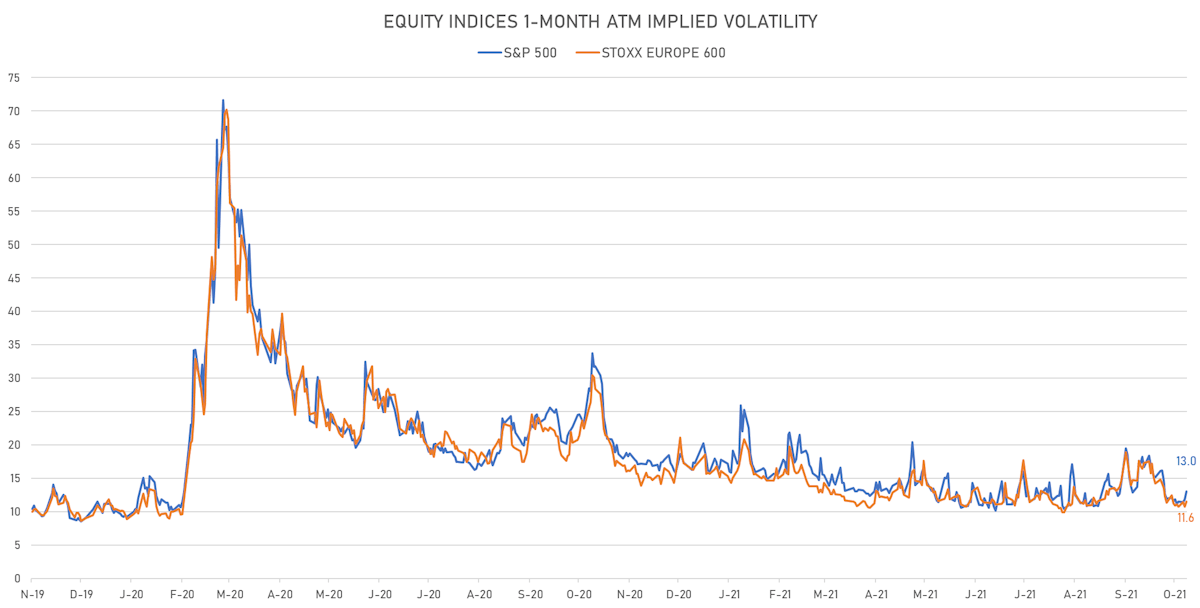

- 1-month at-the-money implied volatility on the S&P 500 at 13.0%, up from 11.9%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.6%, up from 10.7%

NOTABLE S&P 500 EARNINGS RELEASES

- Thermo Fisher Scientific Inc (TMO | Healthcare): beat on EPS (5.76 act. vs. 4.67 est.) and beat on revenue (9,330m act. vs. 8,393m est.), up 0.65% today

- Coca-Cola Co (KO | Consumer Non-Cyclicals): beat on EPS (0.65 act. vs. 0.58 est.) and beat on revenue (10,044m act. vs. 9,752m est.), up 1.93% today

- McDonald's Corp (MCD | Consumer Cyclicals): beat on EPS (2.76 act. vs. 2.46 est.) and beat on revenue (6,201m act. vs. 6,035m est.), up 2.67% today

- ServiceNow Inc (NOW | Technology): beat on EPS (1.55 act. vs. 1.38 est.) and beat on revenue (1,512m act. vs. 1,475m est.), down -1.77% today

- Bristol-Myers Squibb Co (BMY | Healthcare): beat on EPS (2.00 act. vs. 1.92 est.) and beat on revenue (11,624m act. vs. 11,582m est.), down -3.00% today

- Boeing Co (BA | Industrials): missed on EPS (-0.60 act. vs. -0.20 est.) and missed on revenue (15,278m act. vs. 16,295m est.), down -1.53% today

- Automatic Data Processing Inc (ADP | Technology): beat on EPS (1.65 act. vs. 1.49 est.) and beat on revenue (3,832m act. vs. 3,752m est.), up 1.44% today

- General Motors Co (GM | Consumer Cyclicals): beat on EPS (1.52 act. vs. 0.96 est.) and beat on revenue (26,779m act. vs. 26,513m est.), down -5.42% today

- CME Group Inc (CME | Financials): beat on EPS (1.60 act. vs. 1.56 est.) and missed on revenue (1,110m act. vs. 1,151m est.), down -1.01% today

- Edwards Lifesciences Corp (EW | Healthcare): beat on EPS (0.54 act. vs. 0.53 est.) and missed on revenue (1,310m act. vs. 1,321m est.), down -0.79% today

- Fiserv Inc (FISV | Industrials): beat on EPS (1.47 act. vs. 1.45 est.) and missed on revenue (3,962m act. vs. 3,962m est.), down -10.02% today

- Norfolk Southern Corp (NSC | Industrials): beat on EPS (3.06 act. vs. 2.91 est.) and beat on revenue (2,850m act. vs. 2,748m est.), up 0.11% today

- Boston Scientific Corp (BSX | Healthcare): beat on EPS (0.41 act. vs. 0.40 est.) and missed on revenue (2,932m act. vs. 2,969m est.), down -1.33% today

- Ford Motor Co (F | Consumer Cyclicals): beat on EPS (0.51 act. vs. 0.27 est.) and beat on revenue (35,683m act. vs. 32,542m est.), down -2.70% today

- General Dynamics Corp (GD | Industrials): beat on EPS (3.07 act. vs. 2.98 est.) and missed on revenue (9,568m act. vs. 9,845m est.), up 0.60% today

- KLA Corp (KLAC | Technology): beat on EPS (4.64 act. vs. 4.52 est.) and beat on revenue (2,084m act. vs. 2,043m est.), down -0.41% today

- eBay Inc (EBAY | Technology): beat on EPS (0.90 act. vs. 0.89 est.) and beat on revenue (2,501m act. vs. 2,456m est.), down -1.07% today

- TE Connectivity Ltd (TEL | Industrials): beat on EPS (1.69 act. vs. 1.64 est.) and beat on revenue (3,818m act. vs. 3,777m est.), down -2.77% today

- Amphenol Corp (APH | Technology): beat on EPS (0.65 act. vs. 0.63 est.) and beat on revenue (2,819m act. vs. 2,716m est.), down -3.80% today

- Align Technology Inc (ALGN | Healthcare): beat on EPS (2.87 act. vs. 2.60 est.) and beat on revenue (1,016m act. vs. 978m est.), up 1.87% today

TOP WINNERS

- IronNet Inc (IRNT), up 58.6% to $16.34 / 12-Month Price Range: $ 9.37-47.50 / Short interest (% of float): 5.7%; days to cover: 0.2

- Enphase Energy Inc (ENPH), up 24.7% to $216.22 / YTD price return: +23.2% / 12-Month Price Range: $ 93.49-229.04 / Short interest (% of float): 4.1%; days to cover: 2.4

- Silicon Laboratories Inc (SLAB), up 18.9% to $184.06 / YTD price return: +44.5% / 12-Month Price Range: $ 94.77-163.43

- Nurix Therapeutics Inc (NRIX), up 17.3% to $33.98 / YTD price return: +3.3% / 12-Month Price Range: $ 21.53-52.38

- IONQ Inc (IONQ), up 16.7% to $12.28 / 12-Month Price Range: $ 7.07-15.39 / Short interest (% of float): 3.3%; days to cover: 1.4

- Huaneng Power International Inc (HNP), up 15.6% to $20.65 / YTD price return: +43.3% / 12-Month Price Range: $ 12.79-23.36 / Short interest (% of float): 0.1%; days to cover: 1.4

- MakeMyTrip Ltd (MMYT), up 14.1% to $32.55 / YTD price return: +10.2% / 12-Month Price Range: $ 17.80-39.02

- Rani Therapeutics Holdings Inc (RANI), up 13.3% to $22.94 / 12-Month Price Range: $ 9.24-29.40 / Short interest (% of float): 3.5%; days to cover: 2.5

- Chefs' Warehouse Inc (CHEF), up 12.1% to $33.21 / YTD price return: +29.3% / 12-Month Price Range: $ 12.35-35.57

- Brinks Co (BCO), up 11.5% to $65.81 / YTD price return: -8.6% / 12-Month Price Range: $ 41.81-84.72

BIGGEST LOSERS

- Agilysys Inc (AGYS), down 19.9% to $41.92 / YTD price return: +9.2% / 12-Month Price Range: $ 25.06-64.09 (the stock is currently on the short sale restriction list)

- Nexa Resources SA (NEXA), down 17.3% to $9.28 / YTD price return: -3.7% / 12-Month Price Range: $ 5.39-12.86 (the stock is currently on the short sale restriction list)

- WeWork Inc (WE), down 16.1% to $10.36 / YTD price return: +1.0% / 12-Month Price Range: $ 8.85-14.97 / Short interest (% of float): 1.0%; days to cover: 9.2 (the stock is currently on the short sale restriction list)

- Archer Aviation Inc (ACHR), down 14.8% to $5.39 / YTD price return: -46.4% / 12-Month Price Range: $ 6.18-18.60 / Short interest (% of float): 4.4%; days to cover: 4.5 (the stock is currently on the short sale restriction list)

- Arqit Quantum Inc (ARQQ), down 13.1% to $19.11 / 12-Month Price Range: $ 8.00-41.52 / Short interest (% of float): 1.7%; days to cover: 0.4 (the stock is currently on the short sale restriction list)

- Liberty Oilfield Services Inc (LBRT), down 12.5% to $13.63 / YTD price return: +32.2% / 12-Month Price Range: $ 6.20-17.78 (the stock is currently on the short sale restriction list)

- Mechel PAO (MTL), down 11.2% to $4.11 / YTD price return: +100.5% / 12-Month Price Range: $ 1.29-5.19 / Short interest (% of float): 0.5%; days to cover: 0.5 (the stock is currently on the short sale restriction list)

- Rollins Inc (ROL), down 10.8% to $35.08 / YTD price return: -10.2% / 12-Month Price Range: $ 31.44-43.00 (the stock is currently on the short sale restriction list)

- Twitter Inc (TWTR), down 10.8% to $54.81 / YTD price return: +1.2% / 12-Month Price Range: $ 38.93-80.75 (the stock is currently on the short sale restriction list)

- Gibraltar Industries Inc (ROCK), down 10.6% to $64.13 / 12-Month Price Range: $ 56.97-103.02 (the stock is currently on the short sale restriction list)

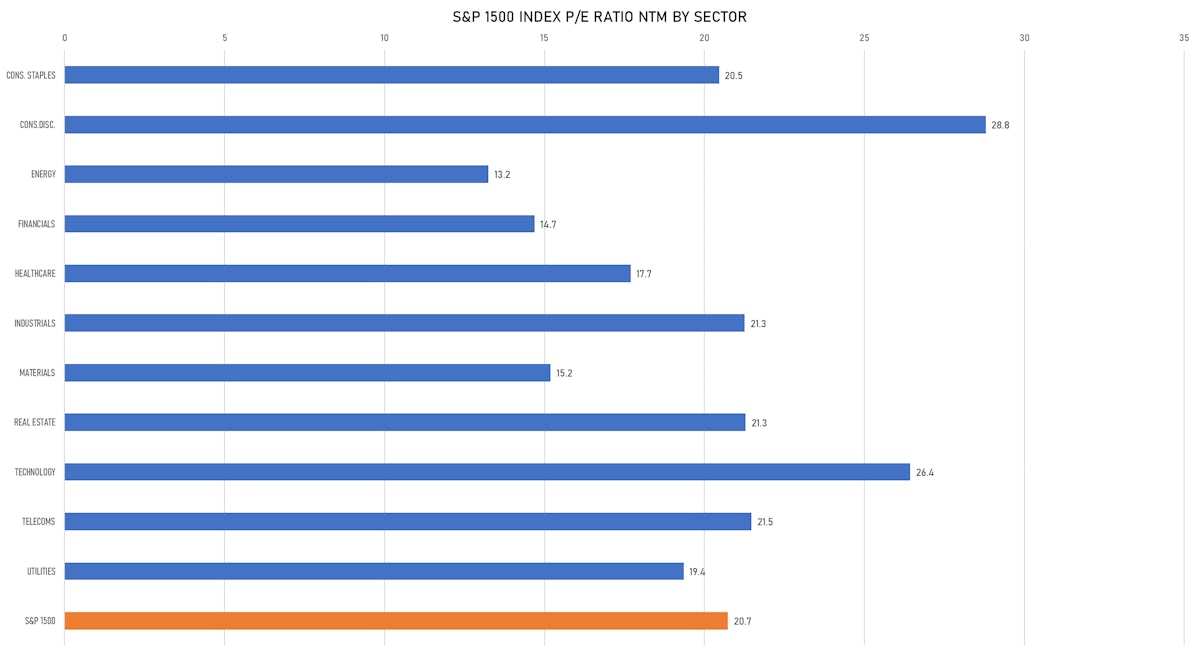

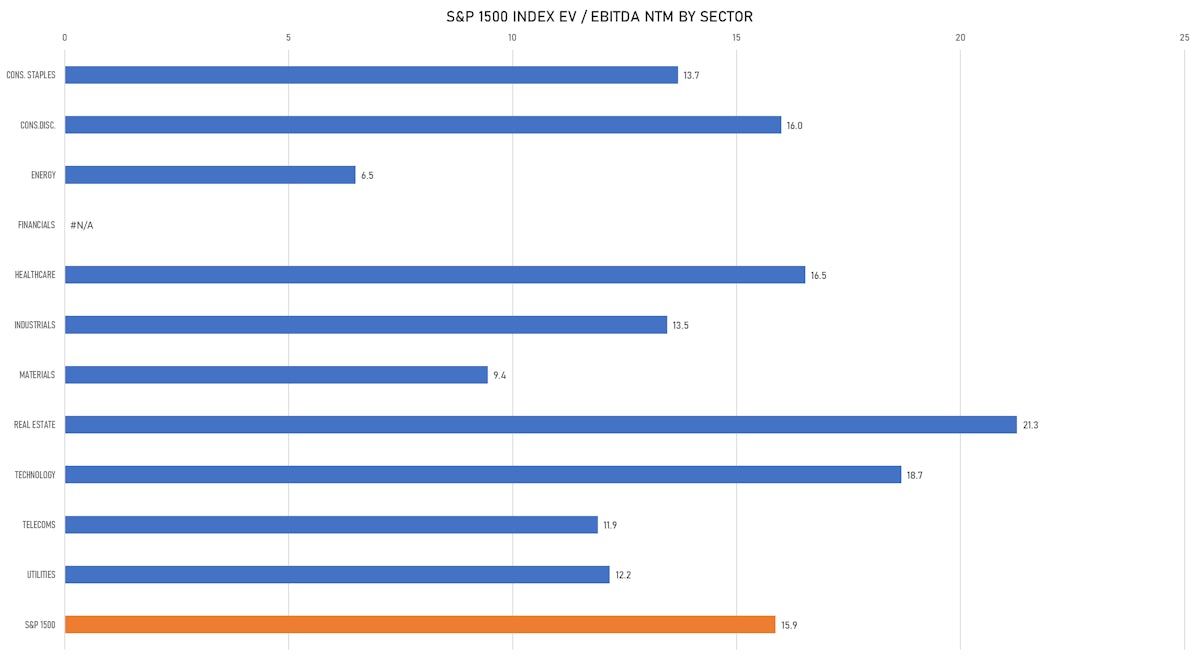

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Informatica Inc (Software | Redwood City, California | Ticker: INFA) raised US$ 841 M, placing 29 M class A common shares. Financial advisors on the transaction: Deutsche Bank Securities Inc, Citigroup Global Markets Inc, Wells Fargo Securities LLC, Credit Suisse Securities (USA) LLC, Nomura Securities International Inc, RBC Capital Markets LLC, Academy Securities Inc, Macquarie Capital (USA) Inc, LionTree Advisors LLC, JP Morgan Securities LLC, BofA Securities Inc, Siebert Williams Shank & Co, UBS Securities LLC, Goldman Sachs & Co

- Innovative International Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: IOACU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Cantor Fitzgerald & Co

- OPY Acquisition Corp I / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: OHAAU / Gross proceeds (including overallotment): US$ 110.00m (offering in U.S. Dollar) / Bookrunners: Oppenheimer & Co Inc, Lake Street Capital Markets LLC

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Japan Post Holdings Ltd (Chiyoda-Ku, Tokyo, Japan), raised US$ 7,416 M, placing 1,027 M ordinary or common shares. Financial advisors on the transaction: Mizuho Securities Co Ltd, Goldman Sachs Japan Co., Ltd., JPMorgan Securities Japan Co Ltd, Daiwa Securities Co Ltd, SMBC Nikko Securities Inc

- Nordea Bank Abp (Banks | Helsinki, Finland), raised US$ 2,000 M, placing 162 M ordinary or common shares. Financial advisors on the transaction: BofA Securities Europe SA, Citigroup Global Markets Europe AG

- TUI AG (Travel Services | Hanover, Germany), raised US$ 1,314 M, placing 524 M ordinary or common shares. Financial advisors on the transaction: Barclays Bank (Ireland), Deutsche Bank, Landesbank Baden-Wurttemberg, Natixis, HSBC Trinkaus & Burkhardt AG, BofA Securities Europe SA, Citigroup Global Markets Europe AG, Commerzbank AG

- Admiral Group PLC (Insurance | Cardiff, United Kingdom), raised US$ 489 M, placing 12 M ordinary or common shares. Financial advisors on the transaction: UBS AG

- OneMain Holdings Inc / United States of America - Financials / Listing Exchange: New York / Ticker: LEAF / Gross proceeds (including overallotment): US$ 541.85m (offering in U.S. Dollar) / Bookrunners: Barclays Capital Inc

- Two Harbors Investment Corp / United States of America - Real Estate / Listing Exchange: New York / Ticker: TWO / Gross proceeds (including overallotment): US$ 195.60m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, Credit Suisse Securities (USA) LLC, RBC Capital Markets LLC

- Yellow Cake PLC / United Kingdom - Materials / Listing Exchange: London AIM / Ticker: YCA / Gross proceeds (including overallotment): US$ 150.33m (offering in British Pound) / Bookrunners: Canaccord Genuity Ltd, Joh Berenberg Gossler & Co KG(London Branch), Cantor Fitzgerald Canada Corp

- China Yuhua Education Corp Ltd / China - Consumer Products and Services / Listing Exchange: Hong Kong / Ticker: 6169 / Gross proceeds (including overallotment): US$ 118.55m (offering in Hong Kong Dollar) / Bookrunners: Merrill Lynch (Asia Pacific) Ltd

- Samsung Heavy Industries Co Ltd (Automobiles & Components | Seongnam, South Korea), raised US$ 1,091 M, placing 250 M ordinary or common shares. Financial advisors on the transaction: Korea Investment & Securities Co Ltd, Shinhan Investment Corp, NH Investment & Securities Co, Mirae Asset Daewoo Co Ltd, KBI Securities Co Ltd

- Algonquin Power & Utilities Corp (Power | Oakville, Canada), raised US$ 646 M, placing 44 M ordinary or common shares. Financial advisors on the transaction: CIBC Capital Markets, Scotiabank