Equities

Broad Rise In Equities To Kick Off The Month, A Continuation Of The Recent Divergence From Credit

Some growth-to-value rotation value today, with small caps, medium caps and value stocks overperforming the market by wide margins

Published ET

Year-To-Date Price Performance Of The S&P 500 Across Sectors | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

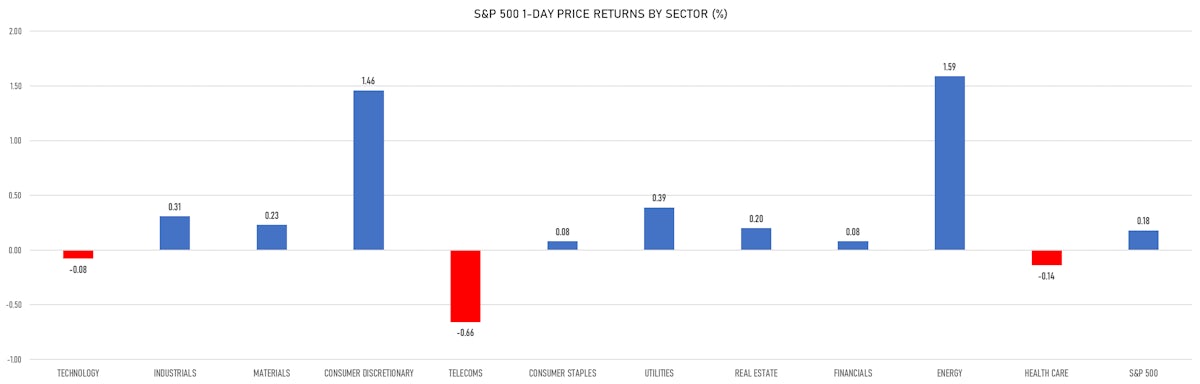

- Daily performance of US indices: S&P 500 up 0.18%; Nasdaq Composite up 0.63%; Wilshire 5000 up 0.51%

- 66.9% of S&P 500 stocks were up today, with 71.7% of stocks above their 200-day moving average (DMA) and 65.5% above their 50-DMA

- Top performing sectors in the S&P 500: energy up 1.59% and consumer discretionary up 1.46%

- Bottom performing sectors in the S&P 500: telecoms down -0.66% and health care down -0.14%

- The number of shares in the S&P 500 traded today was 521m for a total turnover of US$ 77 bn

- The S&P 500 Value Index was up 0.5%, while the S&P 500 Growth Index was down -0.1%; the S&P small caps index was up 2.5% and mid caps were up 2.1%

- The volume on CME's INX (S&P 500 Index) was 2.0m (3-month z-score: 0.2); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.71%; UK FTSE 100 up 0.71%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index up 0.34, Japan's TOPIX 500 down -0.45%

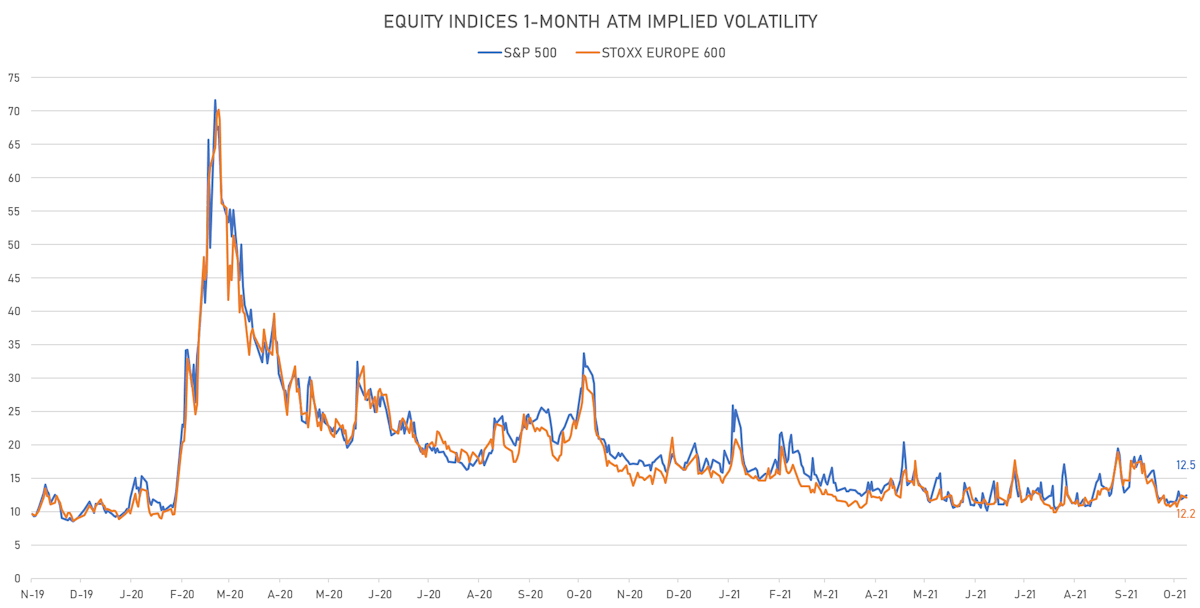

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 12.5%, up from 11.9%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 12.2%, down from 12.5%

NOTABLE US EARNINGS RELEASES

- Public Storage (PSA | Real Estate): beat EPS median estimate (2.52 act. vs. 2.12 est.) and beat revenue median estimate (895m act. vs. 861m est.), down -0.16% today, closed at 331.64 and now at 333.80 (+0.65%) after hours

- NXP Semiconductors NV (NXPI | Technology): beat EPS median estimate (2.89 act. vs. 2.75 est.) and beat revenue median estimate (2,861m act. vs. 2,850m est.), up 2.13% today, closed at 205.13 and now at 201.25 (-1.89%) after hours

- Simon Property Group Inc (SPG | Real Estate): beat EPS median estimate (1.77 act. vs. 1.09 est.) and beat revenue median estimate (1,208m act. vs. 1,166m est.), up 1.90% today, closed at 149.36 and now at 146.41 (-1.98%) after hours

- SBA Communications Corp (SBAC | Real Estate): missed EPS median estimate (0.43 act. vs. 0.81 est.) and beat revenue median estimate (589m act. vs. 576m est.), up 0.60% today, closed at 347.40 and now at 345.33 (-0.60%) after hours

- Williams Companies Inc (WMB | Energy): beat EPS median estimate (0.34 act. vs. 0.28 est.) and beat revenue median estimate (2,866m act. vs. 2,247m est.), up 1.60% today, closed at 28.54 and now at 28.34 (-0.70%) after hours

- Mckesson Corp (MCK | Consumer Non-Cyclicals): beat EPS median estimate (6.15 act. vs. 4.60 est.) and beat revenue median estimate (66,576m act. vs. 63,060m est.), up 0.10% today, closed at 208.08 and now at 207.20 (-0.42%) after hours

- Arista Networks Inc (ANET | Technology): beat EPS median estimate (2.96 act. vs. 2.71 est.) and beat revenue median estimate (749m act. vs. 736m est.), down -0.27% today, closed at 408.57 and now at 389.49 (-4.67%) after hours

- Realty Income Corp (O | Real Estate): missed EPS median estimate (0.34 act. vs. 0.40 est.) and beat revenue median estimate (492m act. vs. 469m est.), down -0.47% today, closed at 70.86 and now at 71.60 (+1.04%) after hours

- ZoomInfo Technologies Inc (ZI | Technology): beat EPS median estimate (0.13 act. vs. 0.12 est.) and beat revenue median estimate (198m act. vs. 183m est.), up 1.70% today, closed at 68.36 and now at 67.81 (-0.80%) after hours

- PG&E Corp (PCG | Utilities): missed EPS median estimate (0.24 act. vs. 0.25 est.) and beat revenue median estimate (5,465m act. vs. 5,232m est.), down -1.64% today, closed at 11.41 and now at 11.67 (+2.28%) after hours

- ON Semiconductor Corp (ON | Technology): beat EPS median estimate (0.87 act. vs. 0.74 est.) and beat revenue median estimate (1,742m act. vs. 1,710m est.), up 14.40% today, closed at 54.99 and now at 48.94 (-11.00%) after hours

- Clorox Co (CLX | Consumer Non-Cyclicals): beat EPS median estimate (1.21 act. vs. 1.04 est.) and beat revenue median estimate (1,806m act. vs. 1,696m est.), up 0.24% today, closed at 163.40 and now at 163.10 (-0.18%) after hours

- Diamondback Energy Inc (FANG | Energy): beat EPS median estimate (2.94 act. vs. 2.76 est.) and beat revenue median estimate (1,910m act. vs. 1,483m est.), up 4.12% today, closed at 111.61 and now at 107.90 (-3.32%) after hours

- Hologic Inc (HOLX | Healthcare): beat EPS median estimate (1.61 act. vs. 0.97 est.) and beat revenue median estimate (1,317m act. vs. 1,020m est.), down -0.86% today, closed at 72.68 and now at 73.31 (+0.87%) after hours

- AMC Entertainment Holdings Inc (AMC | Consumer Cyclicals): beat EPS median estimate (-0.71 act. vs. -0.86 est.) and beat revenue median estimate (445m act. vs. 380m est.), up 4.81% today, closed at 37.07 and now at 35.63 (-3.88%) after hours

- Franklin Resources Inc (BEN | Financials): beat EPS median estimate (1.26 act. vs. 0.86 est.) and beat revenue median estimate (2,181m act. vs. 2,147m est.), up 11.62% today, closed at 35.15 and now at 31.49 (-10.41%) after hours

- Mosaic Co (MOS | Basic Materials): missed EPS median estimate (1.35 act. vs. 1.57 est.) and missed revenue median estimate (3,419m act. vs. 3,757m est.), down -0.26% today, closed at 41.46 and now at 41.85 (+0.94%) after hours

- Darling Ingredients Inc (DAR | Consumer Non-Cyclicals): beat EPS median estimate (1.17 act. vs. 0.89 est.) and beat revenue median estimate (1,199m act. vs. 1,141m est.), up 0.97% today, closed at 85.34 and now at 84.52 (-0.96%) after hours

- CNA Financial Corp (CNA | Financials): beat EPS median estimate (0.87 act. vs. 0.63 est.) and beat revenue median estimate (2,959m act. vs. 2,061m est.), up 2.61% today, closed at 46.03 and now at 44.86 (-2.54%) after hours

- Bruker Corp (BRKR | Healthcare): beat EPS median estimate (0.63 act. vs. 0.45 est.) and beat revenue median estimate (609m act. vs. 576m est.), up 1.15% today, closed at 81.22 and now at 80.94 (-0.34%) after hours

TOP WINNERS

- Cipher Mining Inc (CIFR), up 25.3% to $9.85 / YTD price return: -1.0% / 12-Month Price Range: $ 5.13-15.39

- Desktop Metal Inc (DM), up 23.9% to $8.66 / YTD price return: -49.7% / 12-Month Price Range: $ 6.70-34.94

- Loandepot Inc (LDI), up 22.0% to $8.00 / 12-Month Price Range: $ 5.95-38.68

- Silvergate Capital Corp (SI), up 21.5% to $190.34 / YTD price return: +156.1% / 12-Month Price Range: $ 22.33-187.86

- Hyzon Motors Inc (HYZN), up 20.9% to $6.30 / YTD price return: -40.6% / 12-Month Price Range: $ 5.09-19.95

- Danimer Scientific Inc (DNMR), up 20.4% to $17.77 / YTD price return: -24.4% / 12-Month Price Range: $ 10.73-66.30

- Fuelcell Energy Inc (FCEL), up 19.3% to $9.53 / YTD price return: -14.7% / 12-Month Price Range: $ 2.01-29.44

- Humacyte Inc (HUMA), up 18.7% to $10.80 / YTD price return: +6.2% / 12-Month Price Range: $ 8.61-17.45

- Volta Inc (VLTA), up 18.2% to $9.62 / YTD price return: -9.7% / 12-Month Price Range: $ 6.63-18.33

- Ocugen Inc (OCGN), up 18.1% to $13.98 / YTD price return: +663.9% / 12-Month Price Range: $ .25-18.77

BIGGEST LOSERS

- Centessa Pharmaceuticals PLC (CNTA), down 18.5% to $14.01 / 12-Month Price Range: $ 13.34-26.90 (the stock is currently on the short sale restriction list)

- A10 Networks Inc (ATEN), down 17.9% to $15.35 / YTD price return: +55.7% / 12-Month Price Range: $ 6.79-19.05 / Short interest (% of float): 2.5%; days to cover: 2.8 (the stock is currently on the short sale restriction list)

- LianBio (LIAN), down 14.4% to $13.70 in their trading debut

- Mirati Therapeutics Inc (MRTX), down 13.6% to $163.37 / YTD price return: -25.6% / 12-Month Price Range: $ 131.47-249.42 (the stock is currently on the short sale restriction list)

- Digital World Acquisition Corp (DWAC), down 10.2% to $60.82 / 12-Month Price Range: $ 9.84-175.00 (the stock is currently on the short sale restriction list)

- Westpac Banking Corp (WBK), down 9.0% to $17.80 / YTD price return: +19.5% / 12-Month Price Range: $ 12.28-20.82 / Short interest (% of float): 0.0%; days to cover: 3.0 (the stock is currently on the short sale restriction list)

- Zillow Group Inc (ZG), down 8.6% to $96.61 / YTD price return: -28.9% / 12-Month Price Range: $ 83.54-212.40 (the stock is currently on the short sale restriction list)

- Middlesex Water Co (MSEX), down 8.2% to $101.12 / YTD price return: +39.5% / 12-Month Price Range: $ 65.00-116.40

- Vicarious Surgical Inc (RBOT), down 7.3% to $12.12 / YTD price return: +19.3% / 12-Month Price Range: $ 9.50-15.79 / Short interest (% of float): 2.9%; days to cover: 2.4

- VTEX (VTEX), down 6.8% to $14.89 / 12-Month Price Range: $ 15.86-33.36

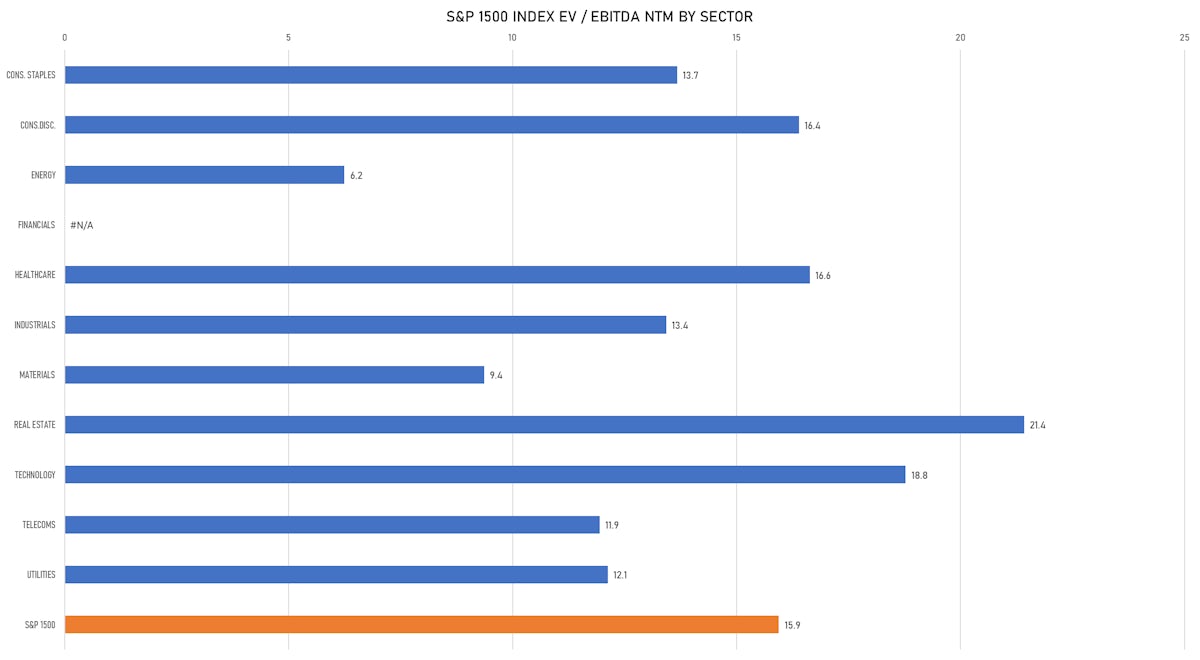

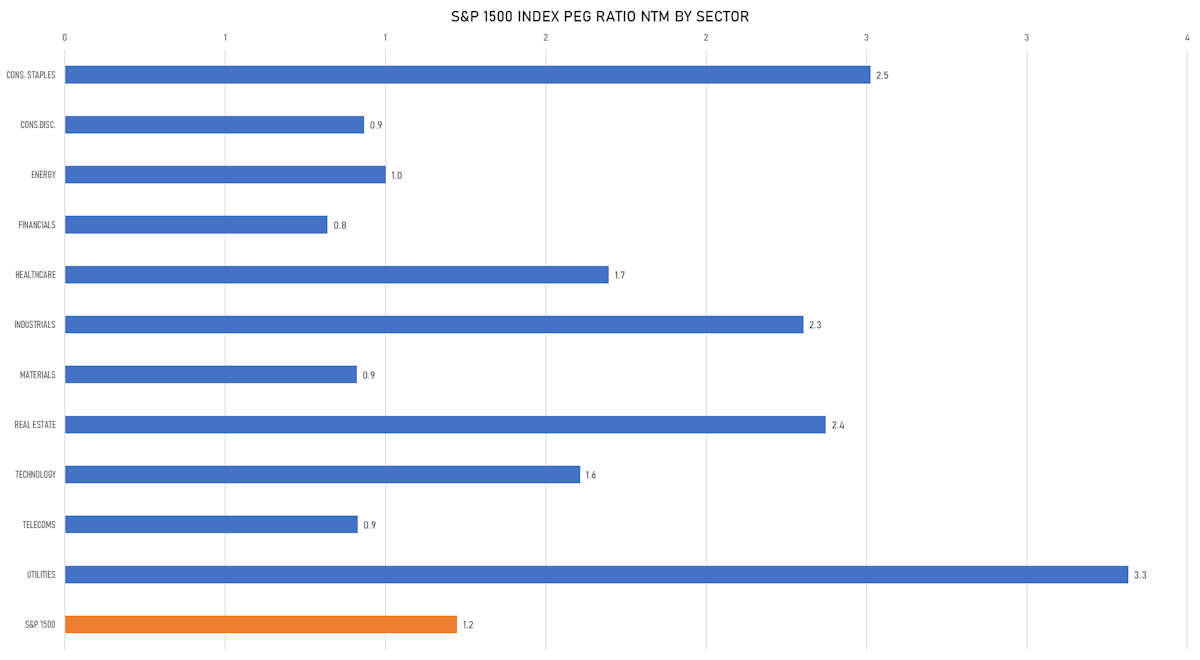

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- The One Enterprise PCL / Thailand - Media and Entertainment / Listing Exchange: Thailand / Ticker: N/A / Gross proceeds (including overallotment): US$ 119.26m (offering in Thai Baht) / Bookrunners: Kiatnakin Phatra Securities PCL

- Shanghai Microport Medbot (Group) Co Ltd / China - Healthcare / Listing Exchange: Hong Kong / Ticker: 2252 / Gross proceeds (including overallotment): US$ 100.52m (offering in Hong Kong Dollar) / Bookrunners: JP Morgan Securities (Asia) Ltd (Hong Kong), China International Capital Corp HK Securities Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Orchid Island Capital Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: ORC / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- SITE Centers Corp / United States of America - Real Estate / Listing Exchange: New York / Ticker: SITC / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- BYD Co Ltd / China - Industrials / Listing Exchange: Hong Kong / Ticker: 1211 / Gross proceeds (including overallotment): US$ 1,774.08m (offering in Hong Kong Dollar) / Bookrunners: Goldman Sachs (Asia), Merrill Lynch (Asia Pacific) Ltd, China International Capital Corp HK Securities Ltd

- Kuwait Projects Co Holding KSCP / Kuwait - Financials / Listing Exchange: Kuwait / Ticker: KPROJ / Gross proceeds (including overallotment): US$ 265.69m (offering in Kuwaiti Dinar) / Bookrunners: Not Applicable

- Kakao Games Corp / South Korea - High Technology / Listing Exchange: KOSDAQ / Ticker: 293490 / Gross proceeds (including overallotment): US$ 178.02m (offering in Korean Won) / Bookrunners: Not Applicable