Equities

Another Record Day For US Equities, Nasdaq Now Up For 9 Straight Days, S&P Up For 6 Straight Days

Only 42% of stocks rose though, with the rally today led by technology and retail; value stocks and small caps underperformed growth stocks very widely

Published ET

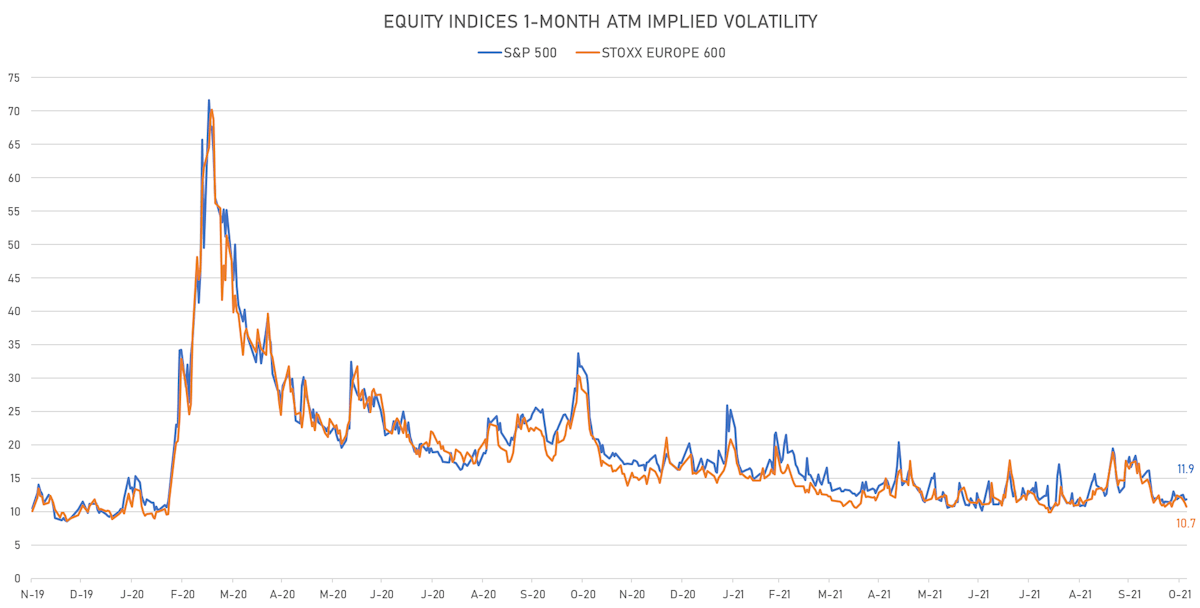

Skew In Implied Volatility Getting Lower Despite Successive Record Highs | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.42%; Nasdaq Composite up 0.81%; Wilshire 5000 up 0.31%

- 42.2% of S&P 500 stocks were up today, with 71.3% of stocks above their 200-day moving average (DMA) and 67.1% above their 50-DMA

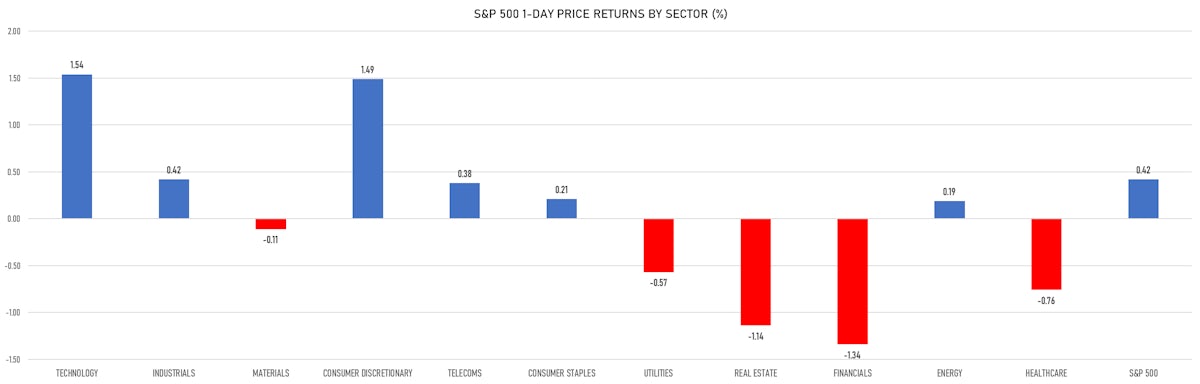

- Top performing sectors in the S&P 500: technology up 1.54% and consumer discretionary up 1.49%

- Bottom performing sectors in the S&P 500: financials down -1.34% and real estate down -1.14%

- The number of shares in the S&P 500 traded today was 620m for a total turnover of US$ 85 bn

- The S&P 500 Value Index was down -0.5%, while the S&P 500 Growth Index was up 1.2%; the S&P small caps index was down -0.2% and mid caps were down -0.3%

- The volume on CME's INX (S&P 500 Index) was 2.6m (3-month z-score: 1.8); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.41%; UK FTSE 100 up 0.43%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -0.34%, Japan's TOPIX 500 down -0.82%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 11.9%, up from 11.7%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 10.7%, down from 11.3%

NOTABLE S&P 500 EARNINGS RELEASES

- Moderna Inc (MRNA | Healthcare): beat EPS median estimate (6.46 act. vs. 5.96 est.) and beat revenue median estimate (4,354m act. vs. 4,255m est.), down -17.89% today, closed at 284.02 and at 345.75 (+21.73%) after hours

- Square Inc (SQ | Industrials): beat EPS median estimate (0.66 act. vs. 0.31 est.) and missed revenue median estimate (4,681m act. vs. 5,219m est.), down -1.99% today, closed at 247.46 and at 255.22 (+3.14%) after hours

- Airbnb Inc (ABNB | Technology): beat EPS median estimate (-0.11 act. vs. -0.44 est.) and beat revenue median estimate (1,335m act. vs. 1,254m est.), up 3.23% today, closed at 178.45 and at 176.47 (-1.11%) after hours

- Zoetis Inc (ZTS | Healthcare): beat EPS median estimate (1.19 act. vs. 1.09 est.) and beat revenue median estimate (1,948m act. vs. 1,819m est.), up 3.15% today, closed at 217.77 and at 212.22 (-2.55%) after hours

- Uber Technologies Inc (UBER | Technology): beat EPS median estimate (-0.19 act. vs. -0.49 est.) and beat revenue median estimate (3,929m act. vs. 3,743m est.), down -0.98% today, closed at 45.27 and at 46.19 (+2.03%) after hours

- Duke Energy Corp (DUK | Utilities): beat EPS median estimate (1.15 act. vs. 1.09 est.) and missed revenue median estimate (5,758m act. vs. 5,777m est.), down -1.48% today, closed at 101.02 and at 102.45 (+1.42%) after hours

- Cigna Corp (CI | Healthcare): beat EPS median estimate (5.24 act. vs. 4.93 est.) and beat revenue median estimate (43,107m act. vs. 41,247m est.), down -2.33% today, closed at 213.16 and at 218.24 (+2.38%) after hours

- Becton Dickinson and Co (BDX | Healthcare): beat EPS median estimate (2.74 act. vs. 2.43 est.) and beat revenue median estimate (4,890m act. vs. 4,494m est.), down -1.19% today, closed at 244.08 and at 238.00 (-2.49%) after hours

- Air Products and Chemicals Inc (APD | Basic Materials): missed EPS median estimate (2.31 act. vs. 2.36 est.) and beat revenue median estimate (2,605m act. vs. 2,459m est.), down -0.30% today, closed at 301.21 and at 300.54 (-0.22%) after hours

- Cloudflare Inc (NET | Technology): beat EPS median estimate (-0.02 act. vs. -0.04 est.) and beat revenue median estimate (152m act. vs. 146m est.), up 3.20% today, closed at 201.09 and at 195.00 (-3.03%) after hours

- EOG Resources Inc (EOG | Energy): beat EPS median estimate (1.73 act. vs. 1.57 est.) and beat revenue median estimate (4,139m act. vs. 4,036m est.), down -0.06% today, closed at 90.90 and at 91.00 (+0.11%) after hours

- American International Group Inc (AIG | Financials): beat EPS median estimate (1.52 act. vs. 1.21 est.) and beat revenue median estimate (12,251m act. vs. 11,266m est.), down -1.13% today, closed at 60.39 and at 61.08 (+1.14%) after hours

- Carvana Co (CVNA | Consumer Cyclicals): beat EPS median estimate (0.26 act. vs. -0.41 est.) and beat revenue median estimate (3,336m act. vs. 2,452m est.), down -0.27% today, closed at 300.59 and at 302.57 (+0.66%) after hours

- Datadog Inc (DDOG | Technology): beat EPS median estimate (0.10 act. vs. 0.03 est.) and beat revenue median estimate (234m act. vs. 212m est.), up 2.56% today, closed at 166.95 and at 163.50 (-2.07%) after hours

- Aptiv PLC (APTV | Consumer Cyclicals): missed EPS median estimate (0.60 act. vs. 0.67 est.) and beat revenue median estimate (3,807m act. vs. 3,578m est.), down -0.37% today, closed at 177.46 and at 177.92 (+0.26%) after hours

- Epam Systems Inc (EPAM | Technology): beat EPS median estimate (2.05 act. vs. 1.94 est.) and beat revenue median estimate (881m act. vs. 860m est.), up 5.34% today, closed at 716.26 and at 685.00 (-4.36%) after hours

- Rocket Companies Inc (RKT | Financials): missed EPS median estimate (0.46 act. vs. 0.47 est.) and missed revenue median estimate (2,790m act. vs. 2,845m est.), up 1.36% today, closed at 17.86 and at 17.75 (-0.62%) after hours

- Liberty Media Corp (FWONA | Consumer Cyclicals): beat EPS median estimate (0.24 act. vs. -0.39 est.) and beat revenue median estimate (501m act. vs. 498m est.), up 1.38% today, closed at 52.81 and at 52.09 (-1.36%) after hours

- Ball Corp (BLL | Basic Materials): beat EPS median estimate (0.86 act. vs. 0.83 est.) and beat revenue median estimate (3,459m act. vs. 3,209m est.), down -2.80% today, closed at 91.48 and at 94.50 (+3.30%) after hours

- Liberty Broadband Corp (LBRDA | Consumer Cyclicals): beat EPS median estimate (0.97 act. vs. 0.93 est.) and missed revenue median estimate (242m act. vs. 251m est.), down -0.80% today, closed at 165.58 and at 166.92 (+0.81%) after hours

TOP WINNERS

- Cassava Sciences Inc (SAVA), up 49.0% to $84.40 / YTD price return: +1,137.5% / 12-Month Price Range: $ 6.70-146.16

- Keros Therapeutics Inc (KROS), up 27.7% to $53.08 / YTD price return: -24.8% / 12-Month Price Range: $ 28.50-88.80

- Nikola Corporation (NKLA), up 21.5% to $15.44 / YTD price return: +1.2% / 12-Month Price Range: $ 9.02-37.95

- Houghton Mifflin Harcourt Co (HMHC), up 20.7% to $16.88 / YTD price return: +406.9% / 12-Month Price Range: $ 2.18-14.85

- Portillos Inc (PTLO), up 20.3% to $51.39 / 12-Month Price Range: $ 25.72-46.00

- Cross Country Healthcare Inc (CCRN), up 20.0% to $26.53 / YTD price return: +199.1% / 12-Month Price Range: $ 7.27-23.22

- Sangamo Therapeutics Inc (SGMO), up 19.1% to $10.89 / YTD price return: -30.2% / 12-Month Price Range: $ 7.89-19.43

- Maxar Technologies Inc (MAXR), up 17.9% to $31.88 / YTD price return: -17.4% / 12-Month Price Range: $ 21.05-58.75

- Opendoor Technologies Inc (OPEN), up 14.8% to $23.94 / YTD price return: +5.3% / 12-Month Price Range: $ 13.44-39.24

- Shyft Group Inc (SHYF), up 14.7% to $47.00 / YTD price return: +65.6% / 12-Month Price Range: $ 19.56-45.08

BIGGEST LOSERS

- Vimeo Inc (VMEO), down 30.1% to $24.49 / 12-Month Price Range: $ 26.22-58.00 (the stock is currently on the short sale restriction list)

- Lightspeed Commerce Inc (LSPD), down 27.9% to $71.36 / YTD price return: +1.4% / 12-Month Price Range: $ 32.80-130.02 / Short interest (% of float): 2.4%; days to cover: 2.0 (the stock is currently on the short sale restriction list)

- Qurate Retail Inc (QRTEA), down 27.4% to $8.22 / YTD price return: -25.1% / 12-Month Price Range: $ 5.98-14.62 (the stock is currently on the short sale restriction list)

- Qurate Retail Inc (QRTEB), down 24.1% to $8.75 / YTD price return: -19.4% / 12-Month Price Range: $ 6.13-17.39 / Short interest days to cover: 0.1 (the stock is currently on the short sale restriction list)

- Penn National Gaming Inc (PENN), down 21.1% to $57.40 / YTD price return: -33.5% / 12-Month Price Range: $ 57.52-142.00 (the stock is currently on the short sale restriction list)

- Ocugen Inc (OCGN), down 21.0% to $10.06 / YTD price return: +449.7% / 12-Month Price Range: $ .27-18.77 / Short interest (% of float): 29.4%; days to cover: 2.8 (the stock is currently on the short sale restriction list)

- Rent-A-Center Inc (RCII), down 18.4% to $45.11 / YTD price return: +17.8% / 12-Month Price Range: $ 29.95-67.76 (the stock is currently on the short sale restriction list)

- Moderna Inc (MRNA), down 17.9% to $284.02 / YTD price return: +171.9% / 12-Month Price Range: $ 68.92-497.49 (the stock is currently on the short sale restriction list)

- Neogenomics Inc (NEO), down 17.6% to $38.35 / YTD price return: -28.8% / 12-Month Price Range: $ 36.00-61.57 (the stock is currently on the short sale restriction list)

- Magnite Inc (MGNI), down 16.1% to $22.90 / YTD price return: -25.4% / 12-Month Price Range: $ 9.34-64.39 (the stock is currently on the short sale restriction list)

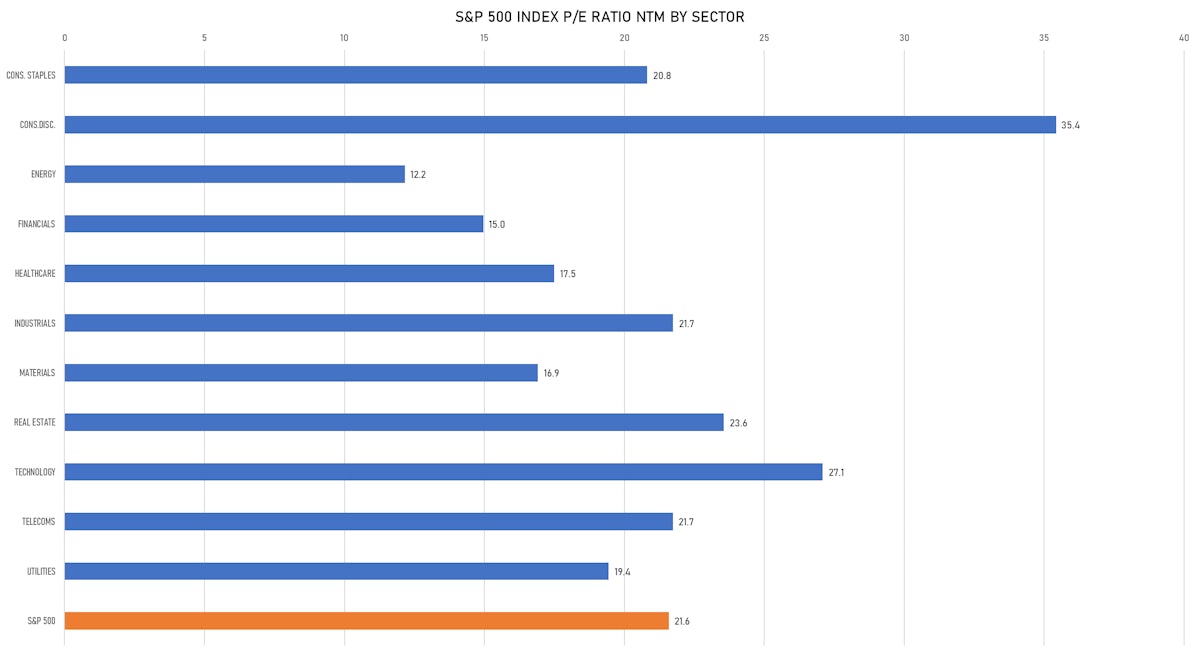

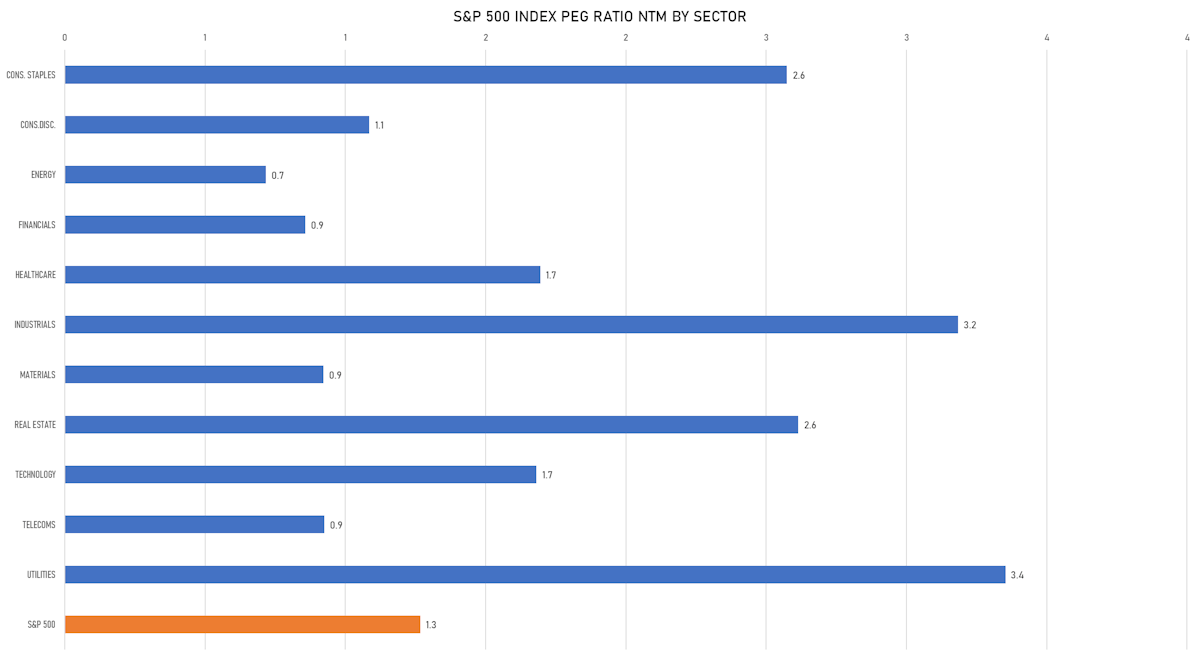

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Devolver Digital Inc / United States of America - High Technology / Listing Exchange: London AIM / Ticker: DEVO / Gross proceeds (including overallotment): US$ 261.12m (offering in British Pound) / Bookrunners: Zeus Capital Ltd

- Austasia Investment Holdings Pte Ltd / Singapore - Consumer Staples / Listing Exchange: Hong Kong / Ticker: N/A / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Trine II Acquisition Corp (Alternative Financial Investments | New York City, New York), raised US$ 360 M, placing 36 M units. Financial advisors on the transaction: Morgan Stanley & Co LLC

- Semper Paratus Acquisition Corp (Alternative Financial Investments | New York City, New York), raised US$ 300 M, placing 30 M units. Financial advisors on the transaction: Cantor Fitzgerald & Co

- Mercato Partners Acquisition Corp (Alternative Financial Investments | Cottonwood Heights, Utah), raised US$ 200 M, placing 20 M units. Financial advisors on the transaction: BofA Securities Inc

- Talon 1 Acquisition Corp (Alternative Financial Investments | Coral Gables, Florida), raised US$ 200 M, placing 20 M units. Financial advisors on the transaction: Credit Suisse Securities (USA) LLC

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- MTN Nigeria Communications PLC / Nigeria - Telecommunications / Listing Exchange: Nigeria / Ticker: MTNN / Gross proceeds (including overallotment): US$ 247.42m (offering in Nigerian naira) / Bookrunners: Not Applicable