Equities

US Equities Finally Take A Breather After 8 Straight All-Time Records For The S&P 500

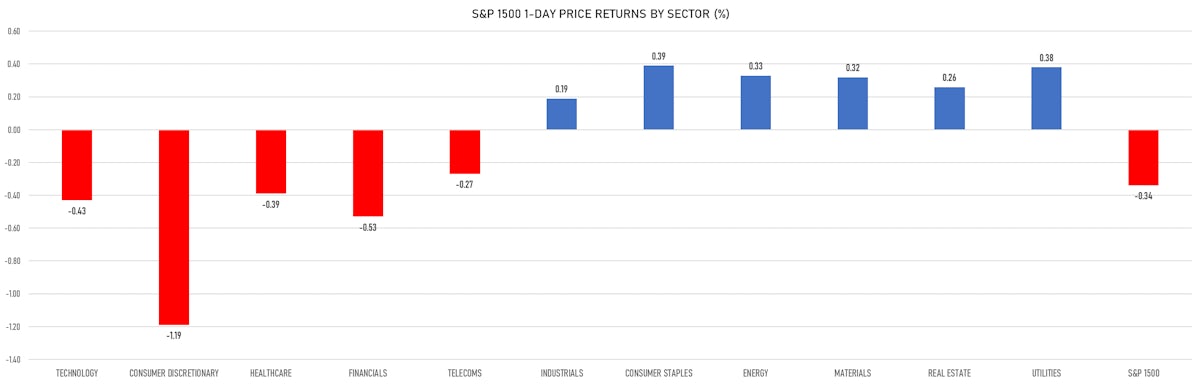

A mixed day: about 50% of S&P stocks rising, financials the worst performing sector with the yield curve flattening further, and implied volatility only very slightly higher

Published ET

S&P 500 Financial Sector vs US 2s5s Treasury Spread | Source: Refinitiv

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.35%; Nasdaq Composite down -0.60%; Wilshire 5000 down -0.34%

- 50.3% of S&P 500 stocks were up today, with 74.7% of stocks above their 200-day moving average (DMA) and 72.5% above their 50-DMA

- Top performing sectors in the S&P 500: utilities up 0.44% and materials up 0.42%

- Bottom performing sectors in the S&P 500: consumer discretionary down -1.35% and financials down -0.55%

- The number of shares in the S&P 500 traded today was 536m for a total turnover of US$ 80 bn

- The S&P 500 Value Index was down -0.1%, while the S&P 500 Growth Index was down -0.5%; the S&P small caps index was down -0.3% and mid caps were down -0.2%

- The volume on CME's INX (S&P 500 Index) was 2.1m (3-month z-score: 0.2); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 down 0.00%; UK FTSE 100 down -0.36%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -1.07%, Japan's TOPIX 500 down -0.52%

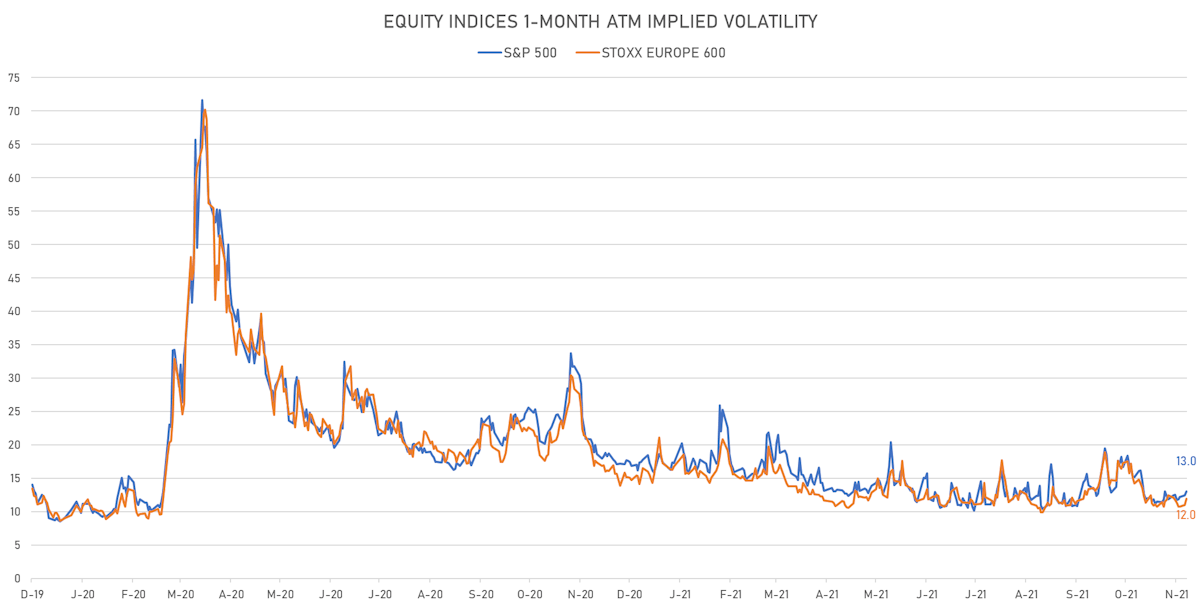

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 13.0%, up from 12.5%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 12.0%, up from 11.0%

NOTABLE S&P 500 EARNINGS RELEASES

- DoorDash Inc (DASH | Technology): missed EPS median estimate (-0.30 act. vs. -0.26 est.) and beat revenue median estimate (1,275m act. vs. 1,166m est.), down -0.59% today, closed at 192.01 and at 192.11 (+0.05%) after hours

- Palantir Technologies Inc (PLTR | Technology): matched EPS median estimate (0.04 act. vs. 0.04 est.) and beat revenue median estimate (392m act. vs. 385m est.), down -9.35% today, closed at 24.25 and at 27.30 (+12.58%) after hours

- Unity Software Inc (U | Technology): beat EPS median estimate (-0.06 act. vs. -0.07 est.) and beat revenue median estimate (286m act. vs. 265m est.), up 5.23% today, closed at 171.63 and at 166.00 (-3.28%) after hours

- Sysco Corp (SYY | Consumer Non-Cyclicals): missed EPS median estimate (0.83 act. vs. 0.86 est.) and beat revenue median estimate (16,457m act. vs. 16,016m est.), down -1.01% today, closed at 79.60 and at 80.90 (+1.63%) after hours

- D R Horton Inc (DHI | Consumer Cyclicals): beat EPS median estimate (3.70 act. vs. 3.40 est.) and beat revenue median estimate (8,109m act. vs. 7,845m est.), up 5.18% today, closed at 97.52 and at 93.25 (-4.38%) after hours

- Upstart Holdings Inc (UPST | Financials): beat EPS median estimate (0.60 act. vs. 0.33 est.) and beat revenue median estimate (228m act. vs. 215m est.), down -6.24% today, closed at 313.71 and at 334.49 (+6.62%) after hours

- Plug Power Inc (PLUG | Energy): missed EPS median estimate (-0.18 act. vs. -0.08 est.) and beat revenue median estimate (144m act. vs. 142m est.), down -0.54% today, closed at 40.72 and at 41.10 (+0.93%) after hours

- Bentley Systems Inc (BSY | Technology): beat EPS median estimate (0.18 act. vs. 0.16 est.) and missed revenue median estimate (248m act. vs. 249m est.), down -0.40% today, closed at 60.26 and at 60.50 (+0.40%) after hours

- Cardinal Health Inc (CAH | Consumer Non-Cyclicals): missed EPS median estimate (1.29 act. vs. 1.34 est.) and beat revenue median estimate (43,968m act. vs. 41,956m est.), down -0.62% today, closed at 49.32 and at 49.60 (+0.57%) after hours

- Darling Ingredients Inc (DAR | Consumer Non-Cyclicals): beat EPS median estimate (0.88 act. vs. 0.78 est.) and beat revenue median estimate (1,186m act. vs. 1,181m est.), down -1.87% today, closed at 81.88 and at 84.09 (+2.70%) after hours

TOP WINNERS

- Roblox Corp (RBLX), up 42.2% to $109.52 / 12-Month Price Range: $ 60.50-103.87

- New Relic Inc (NEWR), up 38.5% to $125.97 / YTD price return: +92.6% / 12-Month Price Range: $ 51.52-91.09

- Pretium Resources Inc (PVG), up 18.9% to $14.45 / YTD price return: +25.9% / 12-Month Price Range: $ 8.29-12.80 / Short interest (% of float): 3.9%; days to cover: 6.0

- RealReal Inc (REAL), up 18.7% to $16.28 / YTD price return: -16.7% / 12-Month Price Range: $ 11.18-30.22

- Monday.Com Ltd (MNDY), up 16.0% to $444.70 / 12-Month Price Range: $ 155.01-425.84 / Short interest (% of float): 2.2%; days to cover: 2.0

- Yalla Group Ltd (YALA), up 15.8% to $8.52 / YTD price return: -40.5% / 12-Month Price Range: $ 6.26-41.35

- Luminar Technologies Inc (LAZR), up 15.0% to $20.12 / YTD price return: -40.8% / 12-Month Price Range: $ 10.11-47.80

- Trex Company Inc (TREX), up 14.7% to $132.80 / YTD price return: +58.6% / 12-Month Price Range: $ 64.26-117.00

- Five9 Inc (FIVN), up 14.5% to $166.27 / YTD price return: -4.7% / 12-Month Price Range: $ 130.32-211.68

- GH Research PLC (GHRS), up 13.9% to $27.90 / 12-Month Price Range: $ 12.38-26.91

BIGGEST LOSERS

- Amyris Inc (AMRS), down 38.7% to $7.96 / YTD price return: +28.9% / 12-Month Price Range: $ 1.98-23.42 (the stock is currently on the short sale restriction list)

- Arrival SA (ARVL), down 27.6% to $12.88 / YTD price return: -54.2% / 12-Month Price Range: $ 9.92-37.18 (the stock is currently on the short sale restriction list)

- Lifestance Health Group Inc (LFST), down 24.2% to $9.73 / 12-Month Price Range: $ 10.67-29.81 (the stock is currently on the short sale restriction list)

- Invitae Corp (NVTA), down 21.9% to $20.53 / YTD price return: -50.9% / 12-Month Price Range: $ 24.16-61.59 (the stock is currently on the short sale restriction list)

- ALX Oncology Holdings Inc (ALXO), down 21.5% to $40.93 / YTD price return: -52.5% / 12-Month Price Range: $ 46.18-117.45 (the stock is currently on the short sale restriction list)

- Absci Corp (ABSI), down 21.1% to $14.23 / 12-Month Price Range: $ 9.62-31.53 (the stock is currently on the short sale restriction list)

- Oak Street Health Inc (OSH), down 20.8% to $37.14 / YTD price return: -39.3% / 12-Month Price Range: $ 35.67-66.31 (the stock is currently on the short sale restriction list)

- SmileDirectClub Inc (SDC), down 20.6% to $4.17 / YTD price return: -65.1% / 12-Month Price Range: $ 4.63-16.08 (the stock is currently on the short sale restriction list)

- Compass Pathways PLC (CMPS), down 16.4% to $36.00 / YTD price return: -24.4% / 12-Month Price Range: $ 28.58-61.69 / Short interest (% of float): 2.0%; days to cover: 2.6 (the stock is currently on the short sale restriction list)

- Freshpet Inc (FRPT), down 16.3% to $125.95 / YTD price return: -11.3% / 12-Month Price Range: $ 116.93-186.98 / Short interest (% of float): 3.4%; days to cover: 3.8 (the stock is currently on the short sale restriction list)

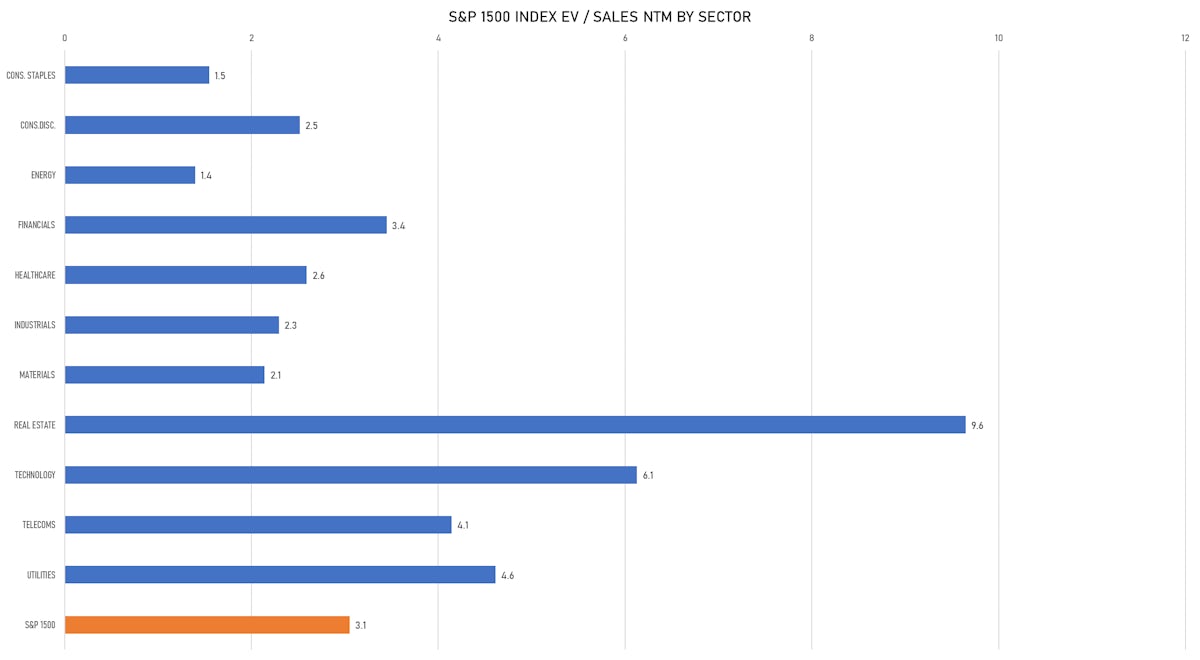

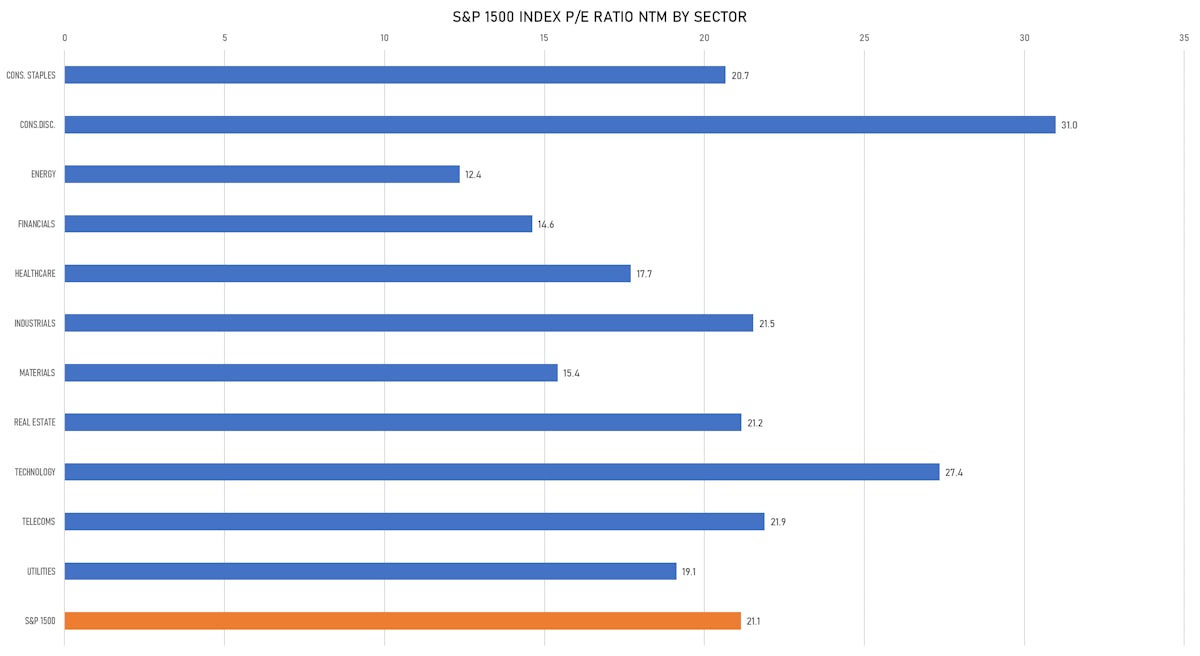

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- ROC Energy Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: ROC.U / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Earlybirdcapital Inc

- Blue Ocean Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: BOCNU / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Needham & Co LLC

- Spear Investments I BV / Netherlands - Financials / Listing Exchange: EuronextAM / Ticker: SPR1 / Gross proceeds (including overallotment): US$ 173.79m (offering in EURO) / Bookrunners: JP Morgan AG, Citigroup Global Markets Europe AG, Jefferies GmbH

- Saint-Petersburg Exchange PJSC / Russian Federation - Financials / Listing Exchange: SPetersbrg / Ticker: NA / Gross proceeds (including overallotment): US$ 157.30m (offering in U.S. Dollar) / Bookrunners: Aton, Alfa Capital Markets, VTB Capital, OOO "INVESTITSIONNAYA KOMPANIYA FINAM", Sovkombank PAO, BCS Global Markets, Investitsionnaia kompaniia Freedom Finance OOO, Sova Capital, Bank Otkritie Financial Corp PJSC, Bank GPB International SA, Tinkoff Bank JSC

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Hertz Global Holdings Inc / United States of America - Consumer Products and Services / Listing Exchange: Nasdaq / Ticker: HTZZ / Gross proceeds (including overallotment): US$ 1,291.08m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co LLC, JP Morgan Securities LLC

- SiTime Corp / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: SITM / Gross proceeds (including overallotment): US$ 574.86m (offering in U.S. Dollar) / Bookrunners: Stifel Nicolaus & Co Inc, Credit Suisse Securities (USA) LLC, Barclays Capital Inc

- First Advantage Corp / United States of America - Consumer Products and Services / Listing Exchange: Nasdaq / Ticker: FA / Gross proceeds (including overallotment): US$ 315.75m (offering in U.S. Dollar) / Bookrunners: Bofa Securities Inc, Barclays Capital Inc

- Surgery Partners Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: SGRY / Gross proceeds (including overallotment): US$ 279.00m (offering in U.S. Dollar) / Bookrunners: KKR Capital Markets LLC, Macquarie Capital (USA) Inc, Jefferies LLC, JP Morgan Securities LLC, SVB Leerink LLC, Bofa Securities Inc, Barclays Capital Inc

- Ping Identity Holding Corp / United States of America - High Technology / Listing Exchange: New York / Ticker: PING / Gross proceeds (including overallotment): US$ 273.20m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC

- Diversey Holdings Ltd / United States of America - Materials / Listing Exchange: Nasdaq / Ticker: DSEY / Gross proceeds (including overallotment): US$ 254.85m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, Morgan Stanley & Co LLC

- European Wax Center Inc / United States of America - Consumer Products and Services / Listing Exchange: Nasdaq / Ticker: EWCZ / Gross proceeds (including overallotment): US$ 160.94m (offering in U.S. Dollar) / Bookrunners: Jefferies LLC, Morgan Stanley & Co LLC, Bofa Securities Inc

- Apria Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: APR / Gross proceeds (including overallotment): US$ 160.88m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc

- 908 Devices Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: MASS / Gross proceeds (including overallotment): US$ 104.34m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, SVB Leerink LLC

- Montana Aerospace AG / Switzerland - Industrials / Listing Exchange: Swiss Exch / Ticker: AERO / Gross proceeds (including overallotment): US$ 307.83m (offering in Swiss Franc) / Bookrunners: Not Applicable

- Aristocrat Leisure Ltd / Australia - Consumer Products and Services / Listing Exchange: Australia / Ticker: ALL / Gross proceeds (including overallotment): US$ 301.96m (offering in Australian Dollar) / Bookrunners: Goldman Sachs (Australia), UBS AG

- Basic-Fit NV / Netherlands - Media and Entertainment / Listing Exchange: EuronextAM / Ticker: BFIT / Gross proceeds (including overallotment): US$ 230.71m (offering in EURO) / Bookrunners: Cooperatieve Rabobank UA, ABN AMRO Bank

- Eneti Inc / Monaco - Industrials / Listing Exchange: New York / Ticker: NETI / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Nomura Securities International Inc, Citigroup Global Markets Inc, BTIG LLC, DNB Markets Inc

- Sirius Real Estate Ltd / Guernsey - Real Estate / Listing Exchange: London / Ticker: SRE / Gross proceeds (including overallotment): US$ 197.03m (offering in British Pound) / Bookrunners: HSBC Bank PLC, Peel Hunt LLP, Panmure Gordon (UK) Ltd, Joh Berenberg Gossler & Co KG(London Branch)

- Create Restaurants Holdings Inc / Japan - Retail / Listing Exchange: Tokyo 1 / Ticker: 3387 / Gross proceeds (including overallotment): US$ 158.89m (offering in Japanese Yen) / Bookrunners: Mizuho Securities Co Ltd, Daiwa Securities Co Ltd

- Arvida Group Ltd / New Zealand - Healthcare / Listing Exchange: NewZealand / Ticker: ARV / Gross proceeds (including overallotment): US$ 125.56m (offering in New Zealand Dollar) / Bookrunners: Forsyth Barr, Jarden Partners Ltd