Equities

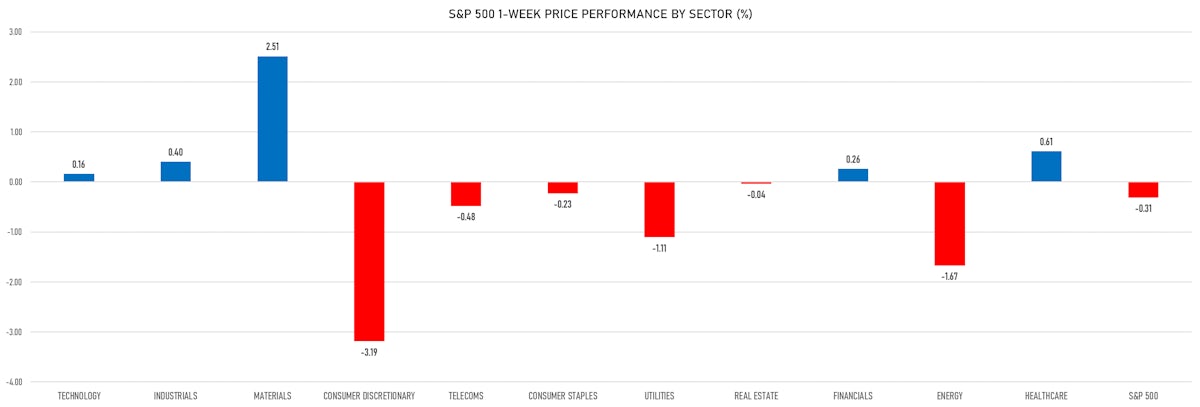

Decent Gains For US Equities Today Left The S&P 500 Down 0.31% For The Week

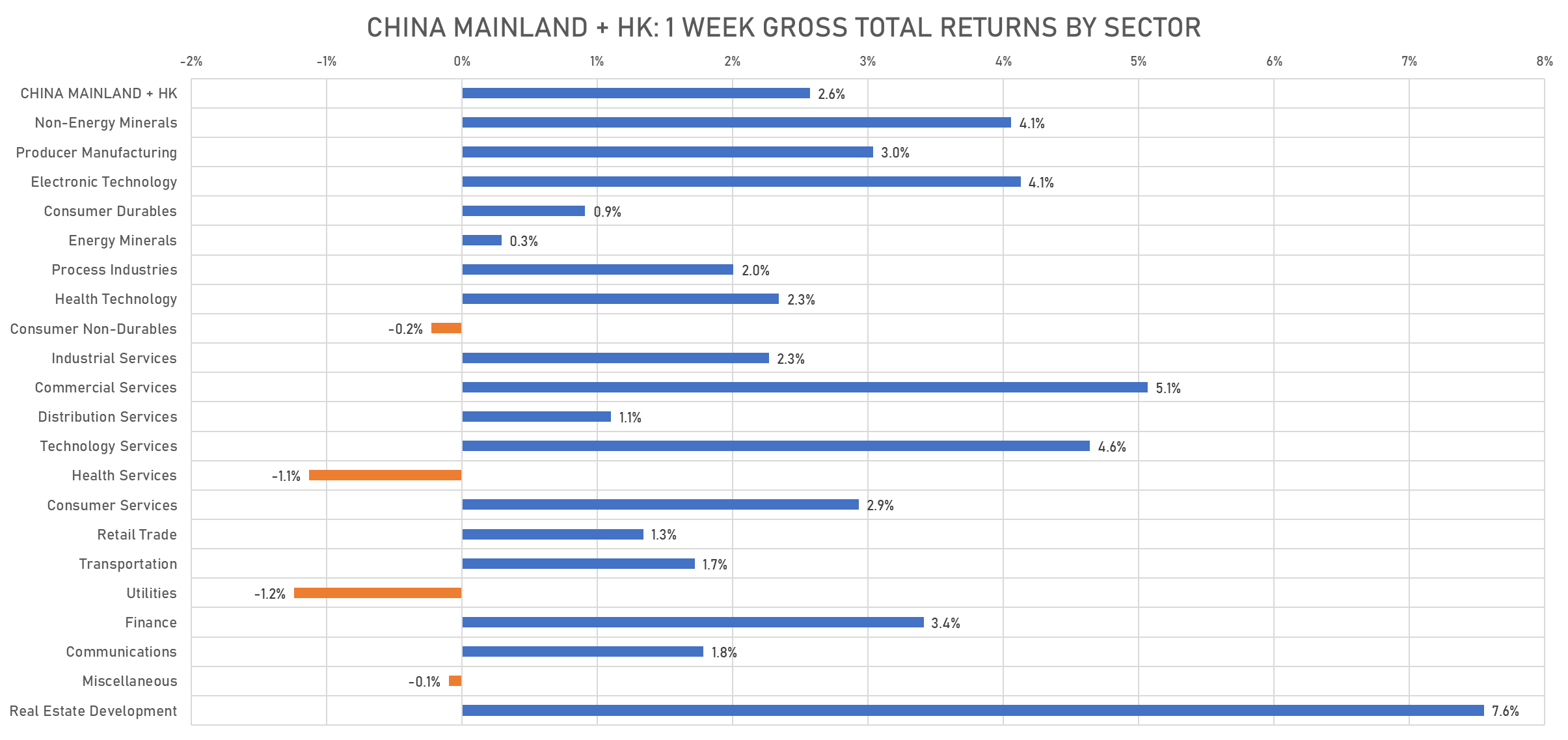

Chinese equities had a good weekly performance (up 2.6%), led a rebound in the real estate sector (up 7.6%) after Evergrande's bondholders received coupons that had been postponed for a few weeks

Published ET

Year-To-Date Total Returns For World Equity Markets | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.72%; Nasdaq Composite up 1.00%; Wilshire 5000 up 0.73%

- 65.9% of S&P 500 stocks were up today, with 73.9% of stocks above their 200-day moving average (DMA) and 73.7% above their 50-DMA

- Top performing sectors in the S&P 500: telecoms up 1.68% and technology up 1.19%

- Bottom performing sectors in the S&P 500: energy down -0.26% and utilities down -0.18%

- The number of shares in the S&P 500 traded today was 472m for a total turnover of US$ 62 bn

- The S&P 500 Value Index was up 0.2%, while the S&P 500 Growth Index was up 1.2%; the S&P small caps index was down -0.1% and mid caps were up 0.3%

- The volume on CME's INX (S&P 500 Index) was 1.9m (3-month z-score: -0.4); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 up 0.30%; UK FTSE 100 down -0.49%; Hang Seng SH-SZ-HK 300 Index down -0.01%; Japan's TOPIX 500 up 1.31%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 13.0%, up from 12.9%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 10.6%, down from 11.1%

NOTABLE US EARNINGS RELEASES TODAY

- RBC Bearings Inc (ROLL | Industrials): missed EPS median estimate (0.89 act. vs. 1.04 est.) and missed revenue median estimate (161m act. vs. 159m est.), down -1.38% today, closed at 231.14 and unchanged after hours

- Warby Parker Inc (WRBY | Healthcare): beat EPS median estimate (0.03 act. vs. -0.66 est.) and missed revenue median estimate (137m act. vs. 133m est.), up 9.03% today, closed at 58.34 and at 59.00 (+1.13%) after hours

- Spectrum Brands Holdings Inc (SPB | Consumer Cyclicals): beat EPS median estimate (1.11 act. vs. 0.72 est.) and missed revenue median estimate (1,156m act. vs. 1,133m est.), up 9.20% today, closed at 102.72 and at 103.75 (+1.00%) after hours

- Riot Blockchain Inc (RIOT | Technology): beat EPS median estimate (0.22 act. vs. -0.01 est.) and beat revenue median estimate (32m act. vs. 34m est.), up 11.79% today, closed at 44.19 and at 44.26 (+0.16%) after hours

- Lyell Immunopharma Inc (LYEL | Healthcare): missed EPS median estimate (-1.47 act. vs. -0.38 est.) and missed revenue median estimate (3m act. vs. 2m est.), down -1.13% today, closed at 11.39 and unchanged after hours

- Hyzon Motors Inc (HYZN | Industrials): beat EPS median estimate (0.13 act. vs. -0.07 est.) and beat revenue median estimate (1m act. vs. 2m est.), up 13.04% today, closed at 7.11 and at 7.17 (+0.84%) after hours

- Brilliant Earth Group Inc (BRLT | Consumer Cyclicals): beat EPS median estimate (0.09 act. vs. 0.01 est.) and missed revenue median estimate (95m act. vs. 87m est.), up 30.67% today, closed at 18.49 and at 18.40 (-0.49%) after hours

- F45 Training Holdings Inc (FXLV | Consumer Cyclicals): missed EPS median estimate (-1.52 act. vs. -0.01 est.) and beat revenue median estimate (27m act. vs. 30m est.), down -18.93% today, closed at 12.98 and at 13.21 (+1.77%) after hours

- Meridian Bioscience Inc (VIVO | Healthcare): beat EPS median estimate (0.23 act. vs. 0.21 est.) and missed revenue median estimate (76m act. vs. 68m est.), up 7.19% today, closed at 20.73 and unchanged after hours

- IDEAYA Biosciences Inc (IDYA | Healthcare): missed EPS median estimate (-0.33 act. vs. -0.22 est.) and beat revenue median estimate (9m act. vs. 9m est.), up 2.08% today, closed at 23.03 and unchanged after hours

- Circor International Inc (CIR | Industrials): missed EPS median estimate (0.50 act. vs. 0.56 est.) and beat revenue median estimate (191m act. vs. 202m est.), down -8.48% today, closed at 32.50 and unchanged after hours

- Newlake Capital Partners Inc (NLCP | Real Estate): missed EPS median estimate (0.14 act. vs. 0.16 est.) and beat revenue median estimate (8m act. vs. 8m est.), up 0.65% today, closed at 29.20 and unchanged after hours

- Target Hospitality Corp (TH | Consumer Cyclicals): beat EPS median estimate (0.10 act. vs. 0.02 est.) and missed revenue median estimate (89m act. vs. 78m est.), up 1.02% today, closed at 4.95 and at 4.96 (+0.20%) after hours

COMPANIES REPORTING NEXT WEEK

TOP WINNERS TODAY

- Brilliant Earth Group Inc (BRLT), up 30.7% to $18.49 / 12-Month Price Range: $ 10.63-18.23 / Short interest (% of float): 3.9%; days to cover: 0.5

- Sundial Growers Inc (SNDL), up 27.8% to $.92 / YTD price return: +94.3% / 12-Month Price Range: $ .24-3.96 / Short interest (% of float): 14.5%; days to cover: 3.2

- Xponential Fitness Inc (XPOF), up 20.8% to $23.60 / 12-Month Price Range: $ 9.87-20.29 / Short interest (% of float): 3.1%; days to cover: 1.0

- Array Technologies Inc (ARRY), up 20.1% to $26.55 / YTD price return: -38.5% / 12-Month Price Range: $ 12.72-54.78 / Short interest (% of float): 9.3%; days to cover: #N/A

- Xometry Inc (XMTR), up 18.2% to $54.17 / 12-Month Price Range: $ 40.90-97.57 / Short interest (% of float): 10.1%; days to cover: 15.6

- Farfetch Ltd (FTCH), up 17.7% to $46.37 / YTD price return: -27.3% / 12-Month Price Range: $ 34.29-73.87 / Short interest (% of float): 5.6%; days to cover: 5.0

- Gores Guggenheim Inc (GGPI), up 15.8% to $12.81 / 12-Month Price Range: $ 9.70-11.66 / Short interest (% of float): 3.0%; days to cover: 0.6

- Arqit Quantum Inc (ARQQ), up 14.6% to $22.58 / 12-Month Price Range: $ 8.00-41.52 / Short interest (% of float): 1.7%; days to cover: 0.5

- Volta Inc (VLTA), up 13.5% to $12.71 / YTD price return: +19.3% / 12-Month Price Range: $ 6.63-18.33 / Short interest (% of float): 2.2%; days to cover: 1.1

- Hyzon Motors Inc (HYZN), up 13.0% to $7.11 / YTD price return: -32.9% / 12-Month Price Range: $ 5.09-19.95 / Short interest (% of float): 7.8%; days to cover: 2.2

BIGGEST LOSERS TODAY

- D Market Elektronik Hizmetler ve Ticaret AS (HEPS), down 36.7% to $3.57 / 12-Month Price Range: $ 4.12-15.23 / Short interest (% of float): 0.2%; days to cover: 0.9 (the stock is currently on the short sale restriction list)

- Jamf Holding Corp (JAMF), down 22.1% to $32.14 / YTD price return: +7.4% / 12-Month Price Range: $ 27.77-49.27 / Short interest (% of float): 11.0%; days to cover: 9.6 (the stock is currently on the short sale restriction list)

- Fortuna Silver Mines Inc (FSM), down 21.7% to $3.87 / YTD price return: -53.0% / 12-Month Price Range: $ 3.74-9.85 / Short interest (% of float): 3.5%; days to cover: 2.8 (the stock is currently on the short sale restriction list)

- WM Technology Inc (MAPS), down 19.6% to $9.33 / YTD price return: -26.9% / 12-Month Price Range: $ 10.08-29.50 / Short interest (% of float): 6.3%; days to cover: 5.3 (the stock is currently on the short sale restriction list)

- F45 Training Holdings Inc (FXLV), down 18.9% to $12.98 / 12-Month Price Range: $ 12.40-17.75 (the stock is currently on the short sale restriction list)

- Lordstown Motors Corp (RIDE), down 17.6% to $5.68 / YTD price return: -71.7% / 12-Month Price Range: $ 4.64-31.57 / Short interest (% of float): 28.1%; days to cover: 3.3 (the stock is currently on the short sale restriction list)

- Natura & Co Holding SA (NTCO), down 17.0% to $12.23 / YTD price return: -38.8% / 12-Month Price Range: $ 12.86-23.73 / Short interest (% of float): 0.3%; days to cover: 1.6 (the stock is currently on the short sale restriction list)

- Celsius Holdings Inc (CELH), down 14.7% to $83.35 / YTD price return: +65.7% / 12-Month Price Range: $ 25.50-110.22 (the stock is currently on the short sale restriction list)

- Absci Corp (ABSI), down 13.7% to $11.18 / 12-Month Price Range: $ 9.62-31.53 / Short interest (% of float): 3.1%; days to cover: 10.8 (the stock is currently on the short sale restriction list)

- Blacksky Technology Inc (BKSY), down 13.2% to $8.85 / YTD price return: -15.5% / 12-Month Price Range: $ 8.75-17.47 / Short interest (% of float): 3.6%; days to cover: 4.4 (the stock is currently on the short sale restriction list)

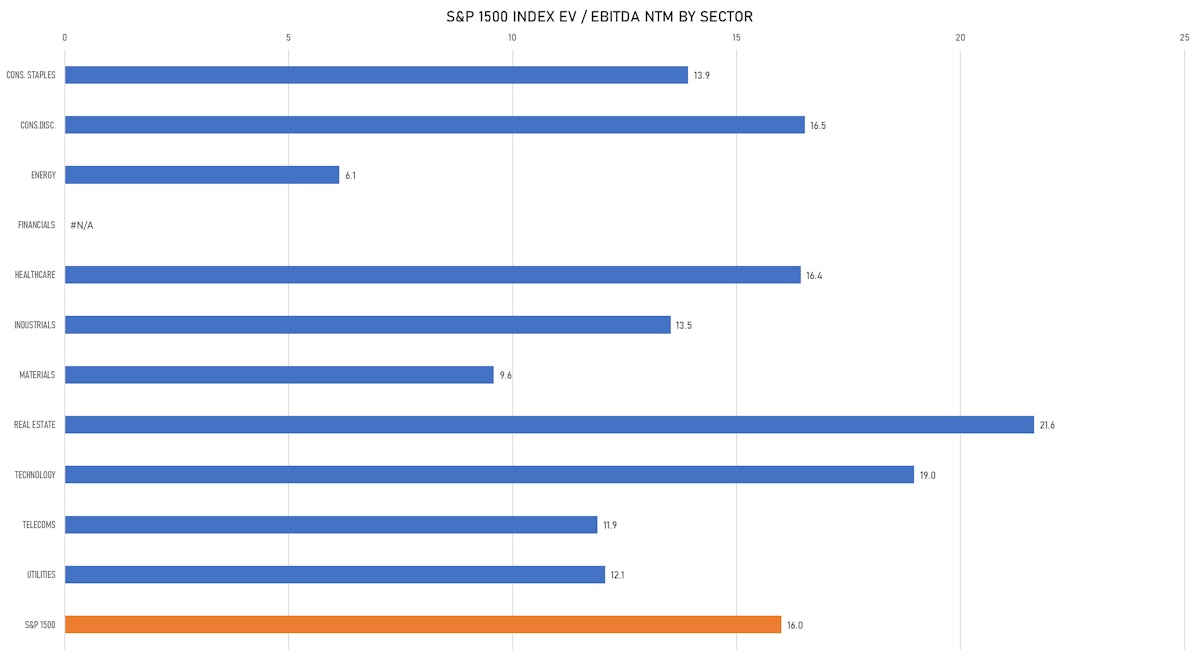

VALUATION MULTIPLES BY SECTORS

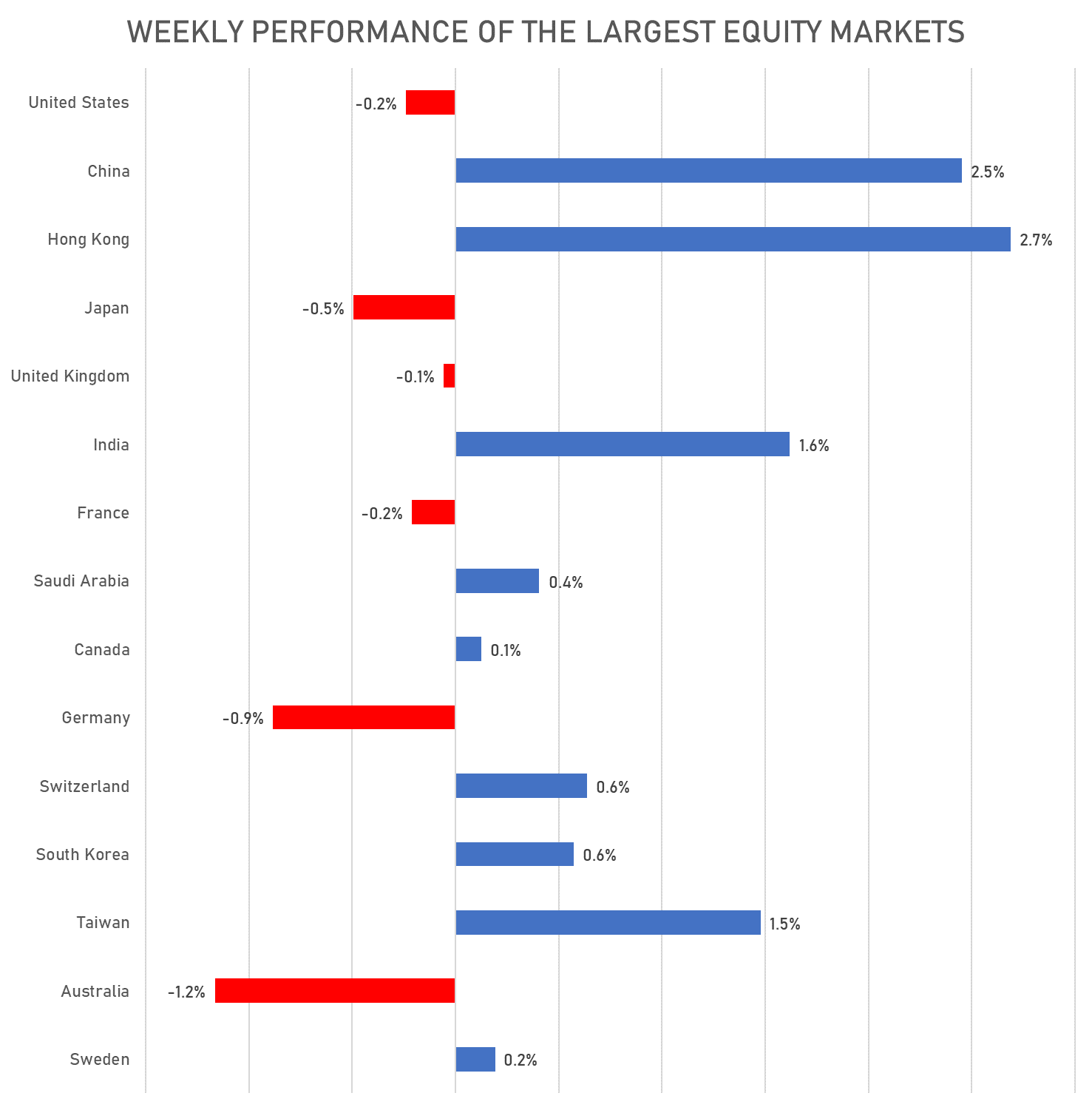

WEEKLY PERFORMANCE OF LARGEST EQUITY MARKETS

THE REBOUND IN CHINESE EQUITIES THIS WEEK WAS LED BY REAL ESTATE

NEW IPOs ANNOUNCED OR PRICED

- LAMF Global Ventures Corp I / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: LGVCU / Gross proceeds (including overallotment): US$ 220.00m (offering in U.S. Dollar) / Bookrunners: Wells Fargo Securities LLC

- Uta Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: UTAAU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Credit Suisse Securities (USA) LLC

- VMG Consumer Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: VMGA.U / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Credit Suisse Securities (USA) LLC, Moelis & Co

- Weave Communications Inc / United States of America - High Technology / Listing Exchange: New York / Ticker: WEAV / Gross proceeds (including overallotment): US$ 120.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc, Bofa Securities Inc

- Pantheon Infrastructure PLC / United Kingdom - Financials / Listing Exchange: London / Ticker: PINT / Gross proceeds (including overallotment): US$ 534.84m (offering in British Pound) / Bookrunners: Investec Bank PLC

- Jiangsu Haili Wind Power Equipment Technology Co Ltd / China - Industrials / Listing Exchange: ShenzChNxt / Ticker: 301155 / Gross proceeds (including overallotment): US$ 368.90m (offering in Chinese Yuan) / Bookrunners: Huatai United Securities Co Ltd

- Net Protections Holdings Inc / Japan - High Technology / Listing Exchange: Tokyo 1 / Ticker: 7383 / Gross proceeds (including overallotment): US$ 333.07m (offering in Japanese Yen) / Bookrunners: Citigroup Global Markets Ltd, Credit Suisse (Hong Kong) Ltd, Daiwa Capital Markets Europe Ltd, SMBC Nikko Capital Markets

- Hoegh Autoliners AS / Norway - Industrials / Listing Exchange: Oslo / Ticker: N/A / Gross proceeds (including overallotment): US$ 115.29m (offering in Norwegian Krone) / Bookrunners: Skandinaviska Enskilda Banken AB, DnB Markets AS, ABG Sundal Collier, Clarksons Platou Securities AS

- One 97 Communications Ltd (Telecommunications Services | Noida, India), raised US$ 2,460 M, placing 85 M ordinary or common shares. Financial advisors on the transaction: HDFC Bank Ltd, JP Morgan India, Citigroup Global Markets India, Morgan Stanley India Co Pvt, ICICI Securities Ltd, Axis Capital Ltd, Goldman Sachs(India)Securities

NEW FOLLOW-ONS / SECONDARY OFFERINGS

- Hain Celestial Group Inc / United States of America - Consumer Staples / Listing Exchange: Nasdaq / Ticker: HAIN / Gross proceeds (including overallotment): US$ 593.60m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC

- Mirati Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: MRTX / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Cowen & Co, SVB Leerink LLC

- Brookfield Infrastructure Partners LP / Canada - Industrials / Listing Exchange: New York / Ticker: BIP / Gross proceeds (including overallotment): US$ 483.32m (offering in U.S. Dollar) / Bookrunners: CIBC World Markets Inc, National Bank Financial Inc, Wells Fargo Securities LLC, BMO Capital Markets, RBC Dominion Securities Inc

- Revolution Medicines Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: RVMD / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Diversey Holdings Ltd / United States of America - Materials / Listing Exchange: Nasdaq / Ticker: DSEY / Gross proceeds (including overallotment): US$ 225.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, Morgan Stanley & Co LLC, JP Morgan Securities LLC

- KnowBe4 Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: KNBE / Gross proceeds (including overallotment): US$ 206.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, KKR Capital Markets LLC, Morgan Stanley & Co LLC, Bofa Securities Inc

- European Wax Center Inc / United States of America - Consumer Products and Services / Listing Exchange: Nasdaq / Ticker: EWCZ / Gross proceeds (including overallotment): US$ 157.49m (offering in U.S. Dollar) / Bookrunners: Jefferies LLC, Morgan Stanley & Co LLC, Bofa Securities Inc

- Apria Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: APR / Gross proceeds (including overallotment): US$ 141.75m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc

- 908 Devices Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: MASS / Gross proceeds (including overallotment): US$ 100.80m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, SVB Leerink LLC

- Aker BP ASA / Norway - Energy and Power / Listing Exchange: Oslo / Ticker: AKERBP / Gross proceeds (including overallotment): US$ 643.67m (offering in Norwegian Krone) / Bookrunners: Goldman Sachs International, DnB Markets AS, Pareto Securities, Morgan Stanley & Co. International plc, JP Morgan AG

- Regie Nationale des Usines Renault SA / France - Industrials / Listing Exchange: Euro Paris / Ticker: RENA / Gross proceeds (including overallotment): US$ 350.78m (offering in EURO) / Bookrunners: BNP Paribas SA, Bank of America

- Jiangsu Hengshun Vinegar-Industry Co Ltd / China - Consumer Staples / Listing Exchange: Shanghai / Ticker: 600305 / Gross proceeds (including overallotment): US$ 313.08m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Assura PLC / United Kingdom - Real Estate / Listing Exchange: London / Ticker: AGR / Gross proceeds (including overallotment): US$ 239.45m (offering in British Pound) / Bookrunners: Barclays Bank PLC, JP Morgan Cazenove, Stifel Nicolaus Europe Ltd

- Wuxi NCE Power Co Ltd / China - High Technology / Listing Exchange: Shanghai / Ticker: 605111 / Gross proceeds (including overallotment): US$ 226.92m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- TI Fluid Systems PLC / United Kingdom - Industrials / Listing Exchange: London / Ticker: TIFS / Gross proceeds (including overallotment): US$ 133.71m (offering in British Pound) / Bookrunners: Deutsche Bank AG (London), Barclays Bank PLC, Goldman Sachs International, Numis Securities Ltd, Citigroup Global Markets Ltd, Peel Hunt LLP, JP Morgan Securities Plc

- Wuxi Longsheng Technology Co Ltd / China - Industrials / Listing Exchange: ShenzChNxt / Ticker: 300680 / Gross proceeds (including overallotment): US$ 112.09m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Jiangsu Xiuqiang Glasswork Co Ltd / China - Materials / Listing Exchange: ShenzChNxt / Ticker: 300160 / Gross proceeds (including overallotment): US$ 109.01m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Haidilao International Holding Ltd (Food & Beverage Retailing | Beijing, China (Mainland)), raised US$ 302 M, placing 115 M ordinary or common shares. Financial advisors on the transaction: Morgan Stanley & Co. International plc