Equities

A Mixed Day For US Equities, With Broad Indices Ending Close To Unchanged

Volume was mediocre, volatility lower, and value stocks narrowly beat out growth stocks; in Asia, the rebound in Chinese equities continued, though the Hang Seng Shanghai-Shenzhen-Hong Kong 300 Index is still down about 9% this year

Published ET

World Market Cap By Country (In US$ Trillion) | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 unchanged; Nasdaq Composite down -0.04%; Wilshire 5000 down -0.06%

- 55.8% of S&P 500 stocks were up today, with 74.3% of stocks above their 200-day moving average (DMA) and 74.3% above their 50-DMA

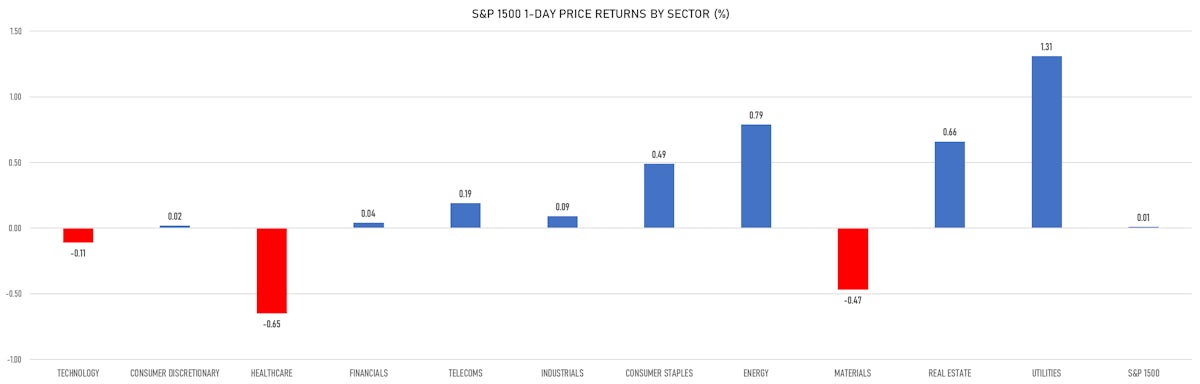

- Top performing sectors in the S&P 500: utilities up 1.31% and energy up 0.83%

- Bottom performing sectors in the S&P 500: healthcare down -0.64% and materials down -0.46%

- The number of shares in the S&P 500 traded today was 489m for a total turnover of US$ 64 bn

- The S&P 500 Value Index was up 0.1%, while the S&P 500 Growth Index was down -0.1%; the S&P small caps index was unchanged and mid caps were up 0.2%

- The volume on CME's INX (S&P 500 Index) was 1.8m (3-month z-score: -0.5); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 up 0.35%; UK FTSE 100 up 0.05%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index up 0.62%, Japan's TOPIX 500 up 0.39%

VOLATILITY

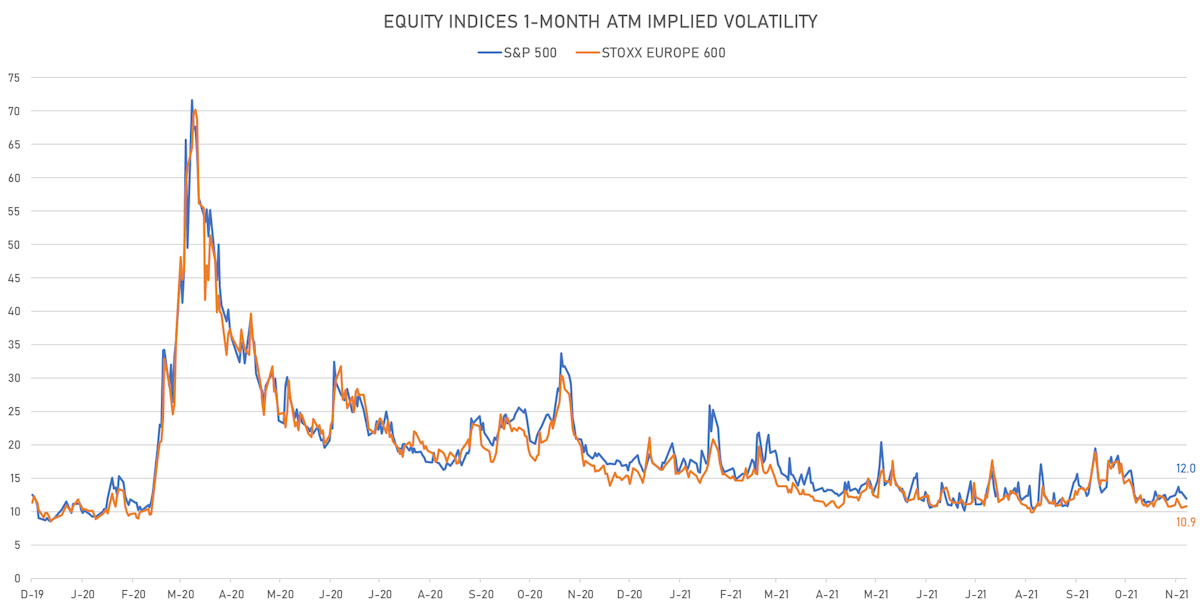

- 1-month at-the-money implied volatility on the S&P 500 at 12.0%, down from 13.0%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 10.9%, up from 10.6%

TOP WINNERS

- Matterport Inc (MTTR), up 22.3% to $27.12 / 12-Month Price Range: $ 10.45-28.00 / Short interest (% of float): 5.9%; days to cover: 4.1

- Newegg Commerce Inc (NEGG), up 21.3% to $19.21 / YTD price return: +362.9% / 12-Month Price Range: $ 3.61-79.07 / Short interest (% of float): 7.5%; days to cover: 2.2

- Blink Charging Co (BLNK), up 17.1% to $46.85 / YTD price return: +9.6% / 12-Month Price Range: $ 9.95-64.50 / Short interest (% of float): 36.1%; days to cover: 9.1

- Vivint Smart Home Inc (VVNT), up 16.8% to $11.40 / YTD price return: -45.1% / 12-Month Price Range: $ 8.18-25.10 / Short interest (% of float): 1.2%; days to cover: 4.0

- Gores Guggenheim Inc (GGPI), up 15.4% to $14.78 / 12-Month Price Range: $ 9.70-13.05 / Short interest (% of float): 3.0%; days to cover: 0.6

- Rivian Automotive Inc (RIVN), up 14.9% to $149.36 / 12-Month Price Range: $ 95.20-135.20

- Dollar Tree Inc (DLTR), up 14.3% to $129.23 / YTD price return: +19.6% / 12-Month Price Range: $ 84.26-120.37

- Purecycle Technologies Inc (PCT), up 14.2% to $10.86 / YTD price return: -32.7% / 12-Month Price Range: $ 8.78-35.75 / Short interest (% of float): 16.1%; days to cover: 19.0

- AKA Brands Holding Corp (AKA), up 12.1% to $14.27 / 12-Month Price Range: $ 7.79-12.94 / Short interest (% of float): 2.5%; days to cover: 0.4

- Luminar Technologies Inc (LAZR), up 12.0% to $21.99 / YTD price return: -35.3% / 12-Month Price Range: $ 10.17-47.80 / Short interest (% of float): 11.3%; days to cover: 10.3

BIGGEST LOSERS

- Telos Corp (TLS), down 28.1% to $17.54 / YTD price return: -46.8% / 12-Month Price Range: $ 18.08-41.84 / Short interest (% of float): 5.4%; days to cover: 5.9 (the stock is currently on the short sale restriction list)

- Marathon Digital Holdings Inc (MARA), down 27.0% to $55.40 / YTD price return: +430.7% / 12-Month Price Range: $ 2.33-83.45 / Short interest (% of float): 16.9%; days to cover: 1.4 (the stock is currently on the short sale restriction list)

- Rocket Pharmaceuticals Inc (RCKT), down 23.7% to $25.90 / YTD price return: -52.8% / 12-Month Price Range: $ 26.87-67.48 / Short interest (% of float): 13.3%; days to cover: 28.9 (the stock is currently on the short sale restriction list)

- Oatly Group AB (OTLY), down 20.8% to $9.36 / 12-Month Price Range: $ 11.13-29.00 / Short interest (% of float): 2.9%; days to cover: 6.5 (the stock is currently on the short sale restriction list)

- Splunk Inc (SPLK), down 18.1% to $137.38 / YTD price return: -19.1% / 12-Month Price Range: $ 110.28-207.41 / Short interest (% of float): 4.1%; days to cover: #N/A (the stock is currently on the short sale restriction list)

- Regenxbio Inc (RGNX), down 16.1% to $31.72 / YTD price return: -30.1% / 12-Month Price Range: $ 27.02-50.26 / Short interest (% of float): 8.7%; days to cover: 7.4 (the stock is currently on the short sale restriction list)

- TG Therapeutics Inc (TGTX), down 14.9% to $27.05 / YTD price return: -48.0% / 12-Month Price Range: $ 21.06-56.74 / Short interest (% of float): 10.2%; days to cover: 16.7 (the stock is currently on the short sale restriction list)

- EVgo Inc (EVGO), down 14.3% to $16.19 / YTD price return: +51.2% / 12-Month Price Range: $ 7.17-24.34 / Short interest (% of float): 13.6%; days to cover: 3.4 (the stock is currently on the short sale restriction list)

- ATAI Life Sciences NV (ATAI), down 13.9% to $12.85 / 12-Month Price Range: $ 12.12-22.91 / Short interest (% of float): 1.5%; days to cover: 7.0 (the stock is currently on the short sale restriction list)

- Centrus Energy Corp (LEU), down 12.7% to $74.74 / YTD price return: +223.1% / 12-Month Price Range: $ 9.42-88.88 / Short interest (% of float): 5.6%; days to cover: 4.4 (the stock is currently on the short sale restriction list)

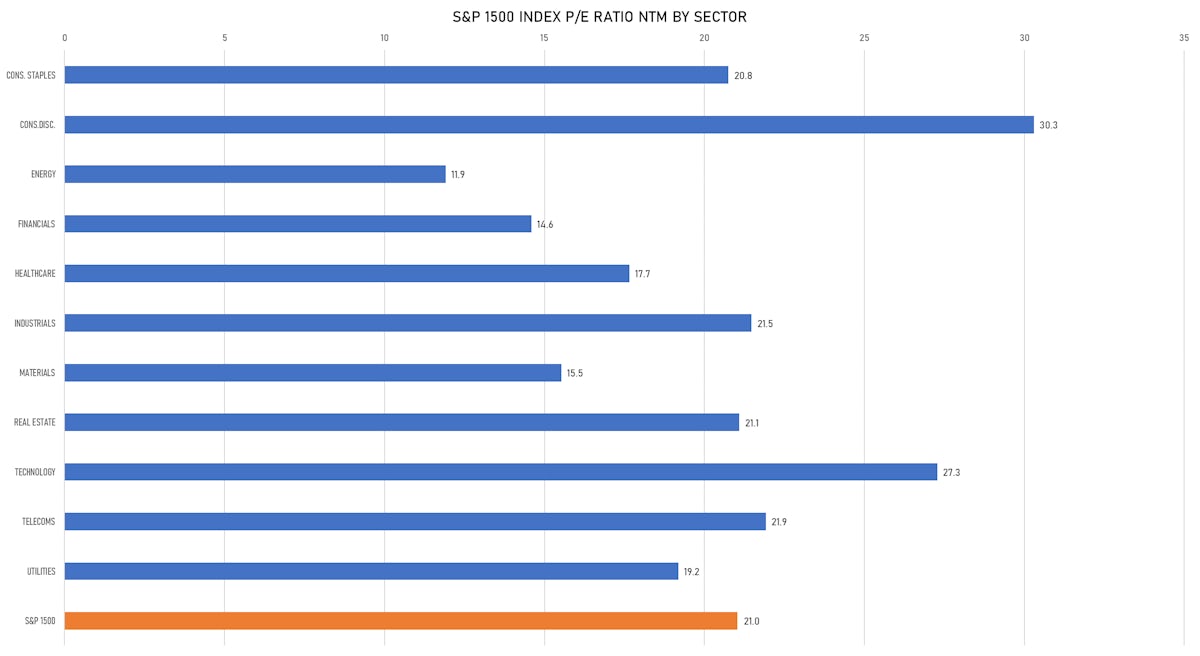

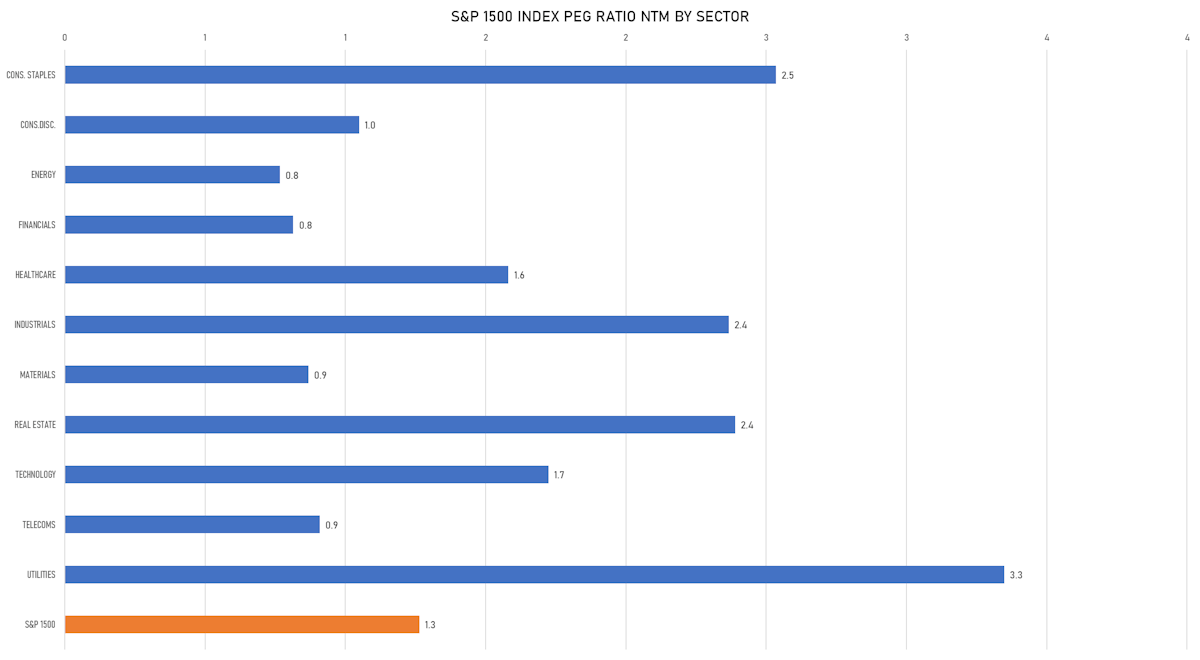

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Eve Mobility Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: EVE.U / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Moelis & Co, Cantor Fitzgerald & Co

- Crypto 1 Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: DAOOU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: B Riley Securities Inc

- Proof Acquisition Corp I / United States of America - Financials / Listing Exchange: New York / Ticker: PACI.U / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Bofa Securities Inc

- Altmore Bdc Inc / United States of America - Financials / Listing Exchange: No Listing / Ticker: N/A / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Ladenburg Thalmann & Co

- Qingdao Yunlu Advanced Materials Technology Co Ltd / China - Materials / Listing Exchange: SSES / Ticker: 688190 / Gross proceeds (including overallotment): US$ 143.64m (offering in Chinese Yuan) / Bookrunners: Guotai Junan Securities

- Hoegh Autoliners AS / Norway - Industrials / Listing Exchange: Oslo / Ticker: N/A / Gross proceeds (including overallotment): US$ 115.29m (offering in Norwegian Krone) / Bookrunners: Skandinaviska Enskilda Banken AB, DnB Markets AS, ABG Sundal Collier, Clarksons Platou Securities AS

- APM Human Services International Ltd (Employment Services | Perth, Australia), raised US$ 720 M, placing 277 M ordinary or common shares. Financial advisors on the transaction: UBS Australia Ltd, Bell Potter Securities Ltd, Credit Suisse Australia Ltd, Morgans Financial Ltd, Merrill Lynch Equities (Australia) Ltd, Goldman Sachs Australia Pty Ltd

- Jiangsu Haili Wind Power Equipment Technology Co Ltd (Other Industrials | Nantong, China (Mainland)), raised US$ 516 M, placing 54 M class a ordinary shares. Financial advisors on the transaction: Huatai United Securities Co Ltd

NEW FOLLOW-ONS / SECONDARY OFFERINGS

- SK IE Technology Co Ltd / South Korea - Energy and Power / Listing Exchange: Korea / Ticker: 361610 / Gross proceeds (including overallotment): US$ 402.84m (offering in Korean Won) / Bookrunners: Credit Suisse

- Sunac China Holdings Ltd (Other Real Estate | Tianjin, China (Mainland)), raised US$ 653 M, placing 335 M ordinary or common shares. Financial advisors on the transaction: Citigroup Global Markets Ltd, Morgan Stanley & Co. International plc

- Sunac Services Holdings Ltd (Real Estate Management & Development | Tianjin, China (Mainland)), raised US$ 299 M, placing 158 M ordinary or common shares. Financial advisors on the transaction: Morgan Stanley & Co. International plc

- Haidilao International Holding Ltd (Food & Beverage Retailing | Beijing, China (Mainland)), raised US$ 302 M, placing 115 M ordinary or common shares. Financial advisors on the transaction: Morgan Stanley & Co. International plc