Equities

Small Gains For US Equity Indices Led By Consumer Discretionary And Technology

The S&P 500 Pure Growth Index traded sideways from January to June this year, has since been rising over the past 6 months; the pure value index did the opposite: rose from January to May and has been trading sideways since

Published ET

S&P 500 Pure Growth vs Pure Value Indices Performance Year To Date | Source: Refinitiv

QUICK SUMMARY

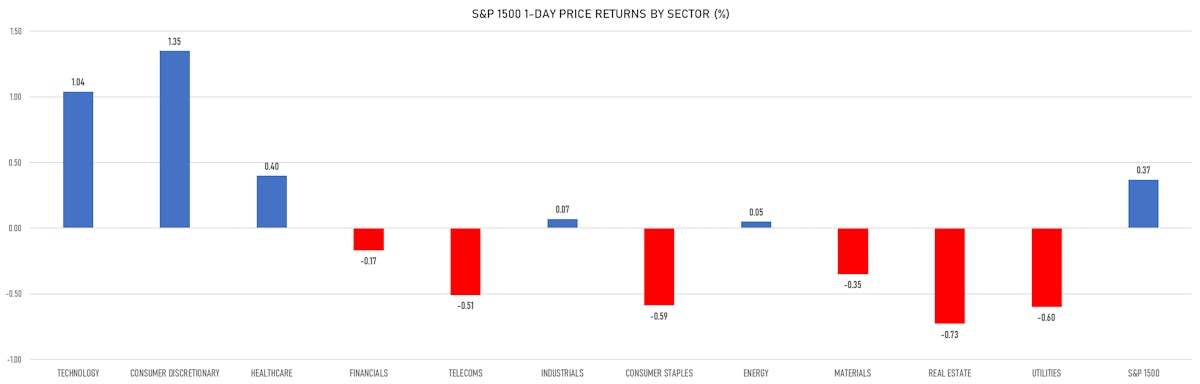

- Daily performance of US indices: S&P 500 up 0.39%; Nasdaq Composite up 0.76%; Wilshire 5000 up 0.42%

- 52.5% of S&P 500 stocks were up today, with 72.9% of stocks above their 200-day moving average (DMA) and 73.9% above their 50-DMA

- Top performing sectors in the S&P 500: consumer discretionary up 1.38% and technology up 1.07%

- Bottom performing sectors in the S&P 500: real estate down -0.65% and consumer staples down -0.60%

- The number of shares in the S&P 500 traded today was 495m for a total turnover of US$ 64 bn

- The S&P 500 Value Index was down -0.2%, while the S&P 500 Growth Index was up 0.9%; the S&P small caps index was up 0.3% and mid caps were up 0.1%

- The volume on CME's INX (S&P 500 Index) was 1.9m (3-month z-score: -0.2); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 up 0.17%; UK FTSE 100 down -0.34%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -0.01%, Japan's TOPIX 500 down -0.50%

VOLATILITY

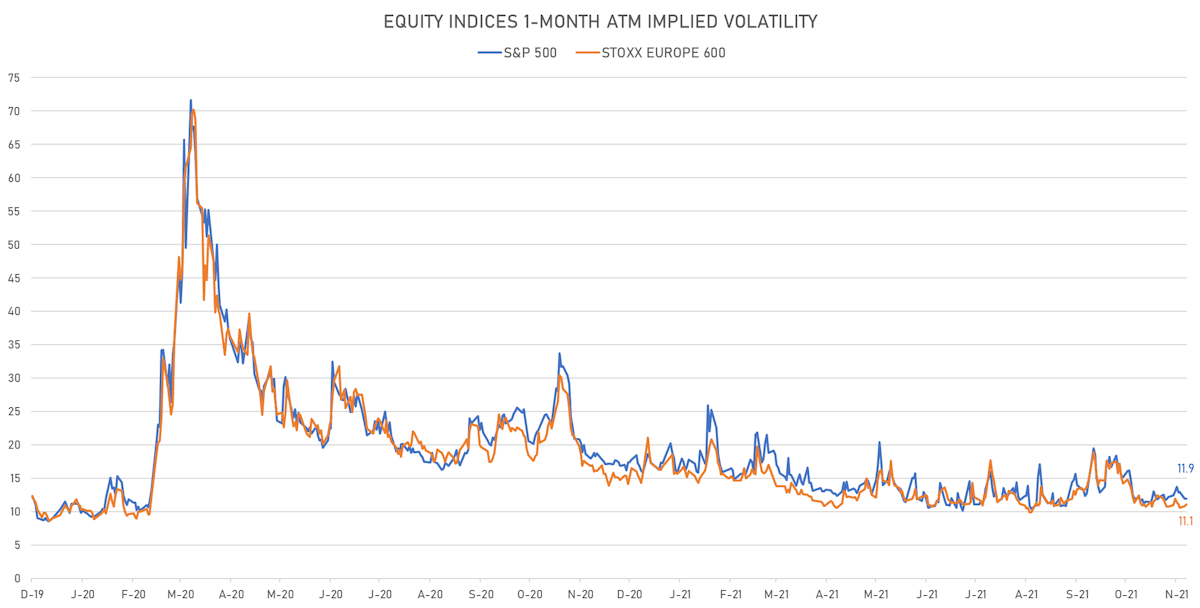

- 1-month at-the-money implied volatility on the S&P 500 at 11.9%, down from 12.0%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.1%, up from 10.9%

NOTABLE S&P 500 EARNINGS RELEASES

- Walmart Inc (WMT | Consumer Non-Cyclicals): beat EPS median estimate (1.45 act. vs. 1.40 est.) and missed revenue median estimate (140,525m act. vs. 135,849m est.), down -2.55% today, closed at 143.17 and at 146.88 (+2.59%) after hours

- Home Depot Inc (HD | Consumer Cyclicals): beat EPS median estimate (3.92 act. vs. 3.39 est.) and missed revenue median estimate (36,820m act. vs. 35,152m est.), up 5.73% today, closed at 392.33 and at 370.98 (-5.44%) after hours

- TransDigm Group Inc (TDG | Industrials): beat EPS median estimate (4.25 act. vs. 3.69 est.) and beat revenue median estimate (1,279m act. vs. 1,308m est.), down -1.02% today, closed at 647.09 and at 653.70 (+1.02%) after hours

- Aramark (ARMK | Consumer Cyclicals): beat EPS median estimate (0.21 act. vs. 0.19 est.) and missed revenue median estimate (3,441m act. vs. 3,294m est.), up 0.71% today, closed at 38.24 and at 37.92 (-0.84%) after hours

- Evoqua Water Technologies Corp (AQUA | Industrials): beat EPS median estimate (0.34 act. vs. 0.30 est.) and missed revenue median estimate (426m act. vs. 414m est.), up 8.95% today, closed at 46.64 and at 42.81 (-8.21%) after hours

- Griffon Corp (GFF | Consumer Cyclicals): missed EPS median estimate (0.40 act. vs. 0.45 est.) and beat revenue median estimate (570m act. vs. 676m est.), down -9.72% today, closed at 26.01 and at 28.81 (+10.77%) after hours

TOP WINNERS

- IONQ Inc (IONQ), up 33.1% to $26.38 / 12-Month Price Range: $ 7.07-23.14 / Short interest (% of float): 2.7%; days to cover: 0.8

- Plby Group Inc (PLBY), up 31.6% to $40.83 / YTD price return: +288.5% / 12-Month Price Range: $ 10.02-63.04 / Short interest (% of float): 15.1%; days to cover: 3.8

- On Holding AG (ONON), up 25.2% to $45.61 / 12-Month Price Range: $ 28.10-40.80 / Short interest (% of float): 1.1%

- Lucid Group Inc (LCID), up 23.7% to $55.52 / YTD price return: +454.6% / 12-Month Price Range: $ 9.67-64.86

- Canoo Inc (GOEV), up 23.7% to $10.45 / YTD price return: -24.3% / 12-Month Price Range: $ 5.75-24.90 / Short interest (% of float): 26.1%; days to cover: 7.5

- Youdao Inc (DAO), up 17.2% to $17.68 / YTD price return: -33.4% / 12-Month Price Range: $ 7.02-42.17 / Short interest (% of float): 4.5%; days to cover: 5.3

- Peloton Interactive Inc (PTON), up 15.5% to $54.85 / YTD price return: -63.8% / 12-Month Price Range: $ 46.70-171.09

- Global-E Online Ltd (GLBE), up 15.3% to $63.91 / 12-Month Price Range: $ 24.22-83.77 / Short interest (% of float): 6.8%; days to cover: 3.1

- Rivian Automotive Inc (RIVN), up 15.2% to $172.01 / 12-Month Price Range: $ 95.20-135.20

- Butterfly Network Inc (BFLY), up 15.2% to $8.66 / YTD price return: -56.2% / 12-Month Price Range: $ 6.75-29.13 (the stock is currently on the short sale restriction list)

BIGGEST LOSERS

- Riskified Ltd (RSKD), down 27.0% to $12.90 / 12-Month Price Range: $ 17.44-40.48 / Short interest (% of float): 1.4%; days to cover: 0.9 (the stock is currently on the short sale restriction list)

- Nerdy Inc (NRDY), down 21.3% to $6.29 / YTD price return: -43.3% / 12-Month Price Range: $ 7.08-13.49 / Short interest (% of float): 9.5%; days to cover: 5.1 (the stock is currently on the short sale restriction list)

- Compass Minerals International Inc (CMP), down 20.8% to $57.01 / YTD price return: -7.6% / 12-Month Price Range: $ 57.16-75.44 / Short interest (% of float): 3.7%; days to cover: 4.8 (the stock is currently on the short sale restriction list)

- Beachbody Company Inc (BODY), down 20.6% to $3.67 / 12-Month Price Range: $ 4.48-18.20 / Short interest (% of float): 6.6%; days to cover: 6.0 (the stock is currently on the short sale restriction list)

- Jumia Technologies AG (JMIA), down 19.2% to $14.96 / YTD price return: -62.9% / 12-Month Price Range: $ 14.44-69.89 (the stock is currently on the short sale restriction list)

- Danimer Scientific Inc (DNMR), down 16.8% to $14.76 / YTD price return: -37.2% / 12-Month Price Range: $ 10.78-66.30 / Short interest (% of float): 14.6%; days to cover: 6.9 (the stock is currently on the short sale restriction list)

- Traeger Inc (COOK), down 15.9% to $16.57 / 12-Month Price Range: $ 18.47-32.59 / Short interest (% of float): 6.9%; days to cover: 6.0 (the stock is currently on the short sale restriction list)

- Desktop Metal Inc (DM), down 14.8% to $6.83 / YTD price return: -60.3% / 12-Month Price Range: $ 6.70-34.94 / Short interest (% of float): 13.2%; days to cover: 6.5 (the stock is currently on the short sale restriction list)

- Custom Truck One Source Inc (CTOS), down 14.0% to $9.61 / YTD price return: +30.4% / 12-Month Price Range: $ 4.12-11.36 / Short interest (% of float): 4.8%; days to cover: 9.1 (the stock is currently on the short sale restriction list)

- EverCommerce Inc (EVCM), down 12.6% to $17.52 / 12-Month Price Range: $ 14.87-23.41 / Short interest (% of float): 6.0% (the stock is currently on the short sale restriction list)

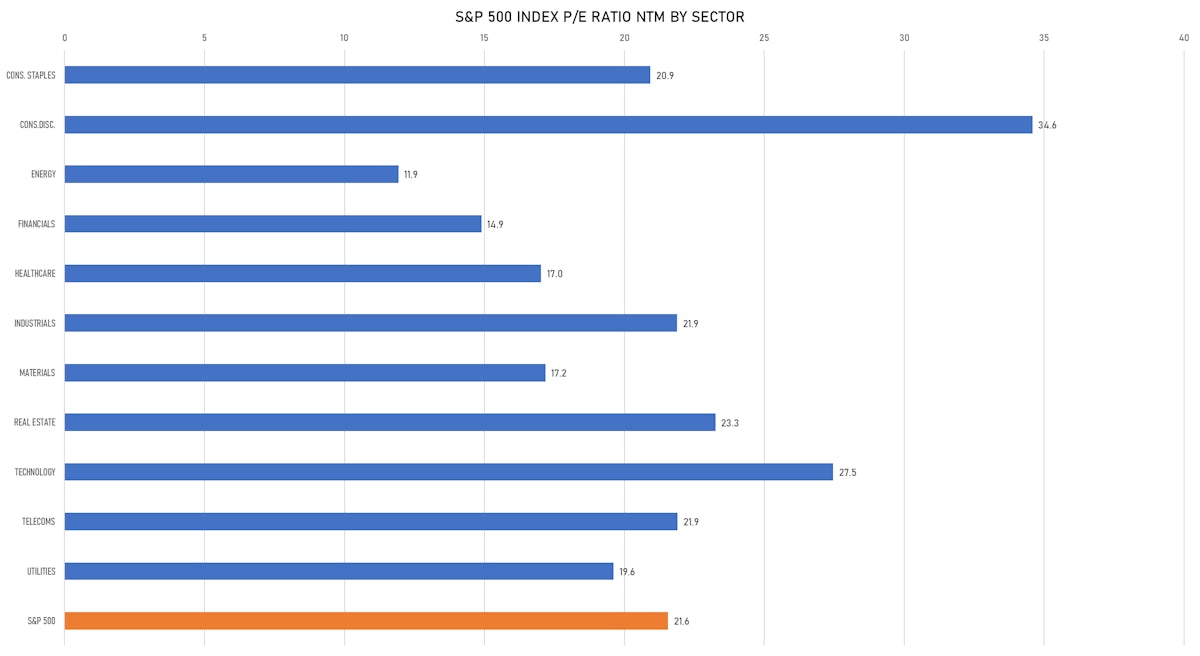

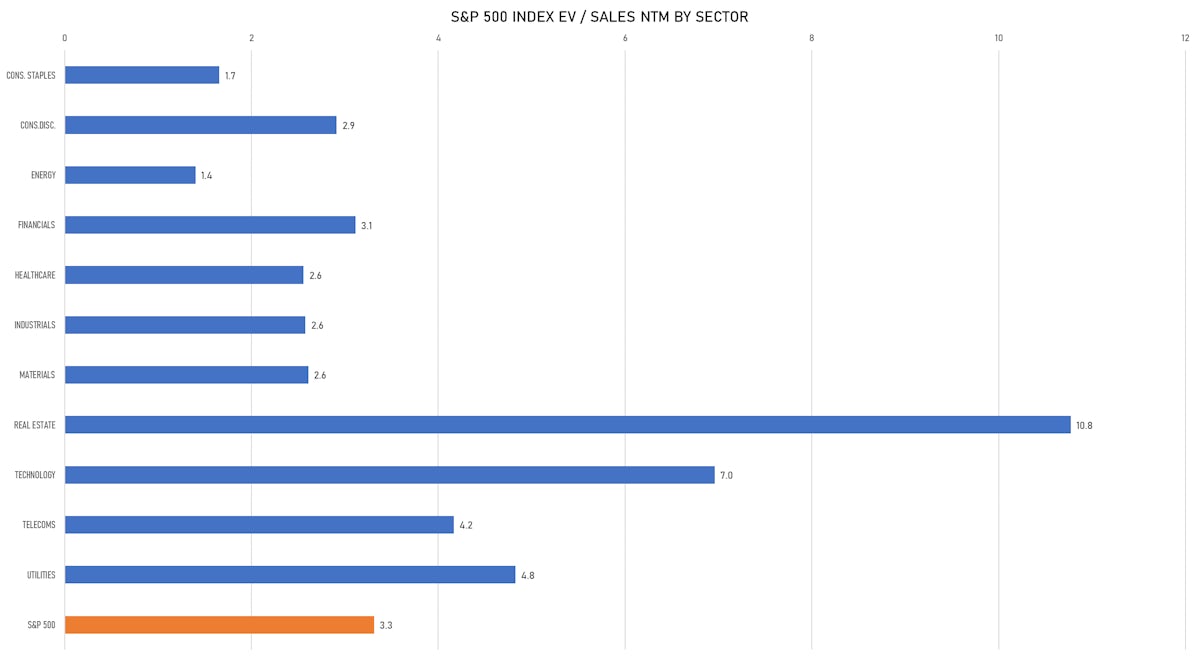

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Motive Capital Corp Ii / United States of America - Financials / Listing Exchange: New York / Ticker: MTVCU / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: JP Morgan Securities LLC, UBS Securities LLC

- European Healthcare Acquisition & Growth Co BV / Netherlands - Financials / Listing Exchange: EuronextAM / Ticker: EHCS / Gross proceeds (including overallotment): US$ 227.34m (offering in EURO) / Bookrunners: Berenberg, ABN AMRO Bank, Deutsche Bank Aktiengesellschaft London Branch, JP Morgan AG

- Finatext Holdings Ltd / Japan - High Technology / Listing Exchange: Mothers / Ticker: 4419 / Gross proceeds (including overallotment): US$ 154.78m (offering in Japanese Yen) / Bookrunners: Daiwa Securities Co Ltd, Mitsubishi UFJ Morgan Stanley Securities Co Ltd

- Nivika Fastigheter AB (publ) / Sweden - Real Estate / Listing Exchange: OMX Stock / Ticker: NA / Gross proceeds (including overallotment): US$ 113.66m (offering in Swedish Krona) / Bookrunners: Skandinaviska Enskilda Banken AB, Danske Bank

- Yongan Futures Co Ltd (Brokerage | Hangzhou, China (Mainland)), raised US$ 410 M, placing 146 M class a ordinary shares. Financial advisors on the transaction: Caitong Securities Co Ltd, China Securities Co Ltd

- Starlight US Residential Fund (Other Financials | Toronto, Canada), raised US$ 256 M, placing 31 M units. Financial advisors on the transaction: CIBC World Markets Inc

NEW FOLLOW-ONS / SECONDARY OFFERINGS

- Definitive Healthcare Corp / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: DH / Gross proceeds (including overallotment): US$ 460.90m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co LLC, JP Morgan Securities LLC, Barclays Capital Inc

- Certara Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: CERT / Gross proceeds (including overallotment): US$ 389.60m (offering in U.S. Dollar) / Bookrunners: Jefferies LLC, Morgan Stanley & Co LLC

- Apellis Pharmaceuticals Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: APLS / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Evercore Group, JP Morgan Securities LLC

- HIAG Immobilien Holding AG / Switzerland - Real Estate / Listing Exchange: Swiss Exch / Ticker: HIAG / Gross proceeds (including overallotment): US$ 173.22m (offering in Swiss Franc) / Bookrunners: Zuercher Kantonalbank