Equities

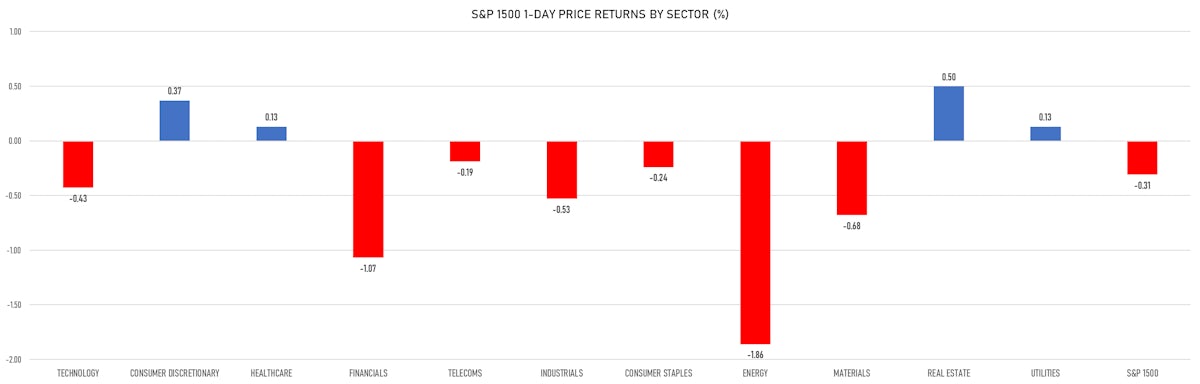

Broad Selloff For US Equities, With Fewer Than A Third Of S&P 500 Stocks Closing Up Today

The energy sector led the declines, as both the WTI and Brent crude spot prices fell close to 3%; volatility rose slightly and volume was pretty average

Published ET

S&P 1500 Energy vs Brent Crude Front Month Prices | Source: Refinitiv

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.26%; Nasdaq Composite down -0.33%; Wilshire 5000 down -0.43%

- 32.3% of S&P 500 stocks were up today, with 71.5% of stocks above their 200-day moving average (DMA) and 68.9% above their 50-DMA

- Top performing sectors in the S&P 500: real estate up 0.64% and consumer discretionary up 0.59%

- Bottom performing sectors in the S&P 500: energy down -1.74% and financials down -1.11%

- The number of shares in the S&P 500 traded today was 508m for a total turnover of US$ 67 bn

- The S&P 500 Value Index was down -0.5%, while the S&P 500 Growth Index was down -0.1%; the S&P small caps index was down -1.0% and mid caps were down -0.8%

- The volume on CME's INX (S&P 500 Index) was 2.1m (3-month z-score: 0.2); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 up 0.14%; UK FTSE 100 down -0.49%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -1.54%; tonight in Asia, Japan's TOPIX 500 down -0.62%

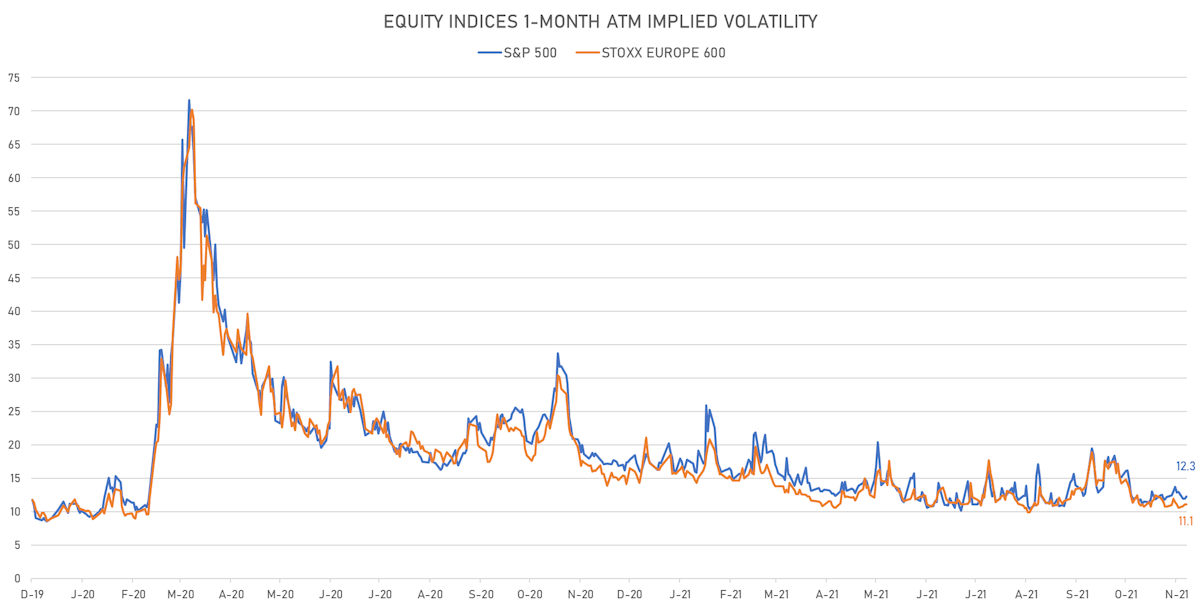

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 12.3%, up from 11.9%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.1%, up from 11.1%

NOTABLE S&P 500 EARNINGS RELEASES

- NVIDIA Corp (NVDA | Technology): matched EPS median estimate (1.17 act. vs. 1.17 est.) and matched revenue median estimate (7,103m act. vs. 7,103m est.), down -3.12% today, closed at 292.61 and at 303.50 (+3.72%) after hours

- Lowe's Companies Inc (LOW | Consumer Cyclicals): beat EPS median estimate (2.73 act. vs. 2.35 est.) and missed revenue median estimate (22,918m act. vs. 21,974m est.), up 0.39% today, closed at 245.73 and at 245.98 (+0.10%) after hours

- Target Corp (TGT | Consumer Cyclicals): beat EPS median estimate (3.03 act. vs. 2.82 est.) and missed revenue median estimate (25,652m act. vs. 24,595m est.), down -4.73% today, closed at 253.80 and at 268.65 (+5.85%) after hours

- TJX Companies Inc (TJX | Consumer Cyclicals): beat EPS median estimate (0.84 act. vs. 0.80 est.) and missed revenue median estimate (12,532m act. vs. 12,309m est.), up 5.83% today, closed at 73.55 and at 70.30 (-4.42%) after hours

- Meritor Inc (MTOR | Consumer Cyclicals): beat EPS median estimate (0.80 act. vs. 0.53 est.) and beat revenue median estimate (945m act. vs. 1,012m est.), down -0.94% today, closed at 27.35 and at 27.90 (+2.01%) after hours

- Brightview Holdings Inc (BV | Industrials): missed EPS median estimate (0.38 act. vs. 0.42 est.) and missed revenue median estimate (674m act. vs. 651m est.), down -9.89% today, closed at 15.03 and at 16.68 (+10.98%) after hours

- Shoe Carnival Inc (SCVL | Consumer Cyclicals): beat EPS median estimate (1.64 act. vs. 1.15 est.) and missed revenue median estimate (356m act. vs. 315m est.), down -0.23% today, closed at 43.72 and at 44.58 (+1.97%) after hours

- iMedia Brands Inc (IMBI | Consumer Cyclicals): beat EPS median estimate (-0.44 act. vs. -0.49 est.) and missed revenue median estimate (131m act. vs. 127m est.), up 14.59% today, closed at 7.07 and at 6.17 (-12.73%) after hours

- Williams Industrial Services Group Inc (WLMS | Industrials): missed EPS median estimate (0.03 act. vs. 0.11 est.) and beat revenue median estimate (73m act. vs. 83m est.), down -6.12% today, closed at 4.60 and at 4.90 (+6.52%) after hours

TOP WINNERS

- Sono Group NV (SEV), up 154.7% to $38.20 on its trading debut

- IONQ Inc (IONQ), up 17.5% to $31.00 / 12-Month Price Range: $ 7.07-26.89 / Short interest (% of float): 2.7%; days to cover: 0.8

- Tattooed Chef Inc (TTCF), up 14.8% to $18.30 / YTD price return: -20.1% / 12-Month Price Range: $ 14.09-27.80 / Short interest (% of float): 32.8%; days to cover: 17.6

- On Holding AG (ONON), up 12.8% to $51.45 / 12-Month Price Range: $ 28.10-46.70 / Short interest (% of float): 1.1%; days to cover: 2.2

- Varex Imaging Corp (VREX), up 12.0% to $30.05 / YTD price return: +80.2% / 12-Month Price Range: $ 14.02-29.95

- ForgeRock Inc (FORG), up 11.9% to $31.47 / 12-Month Price Range: $ 27.10-48.88 / Short interest (% of float): 8.3%; days to cover: 1.8

- Dice Therapeutics Inc (DICE), up 9.9% to $37.54 / 12-Month Price Range: $ 23.16-40.50 / Short interest (% of float): 2.8%; days to cover: 7.0

- Danimer Scientific Inc (DNMR), up 9.8% to $16.20 / YTD price return: -31.1% / 12-Month Price Range: $ 10.78-66.30 / Short interest (% of float): 14.6%; days to cover: 6.9 (the stock is currently on the short sale restriction list)

- GH Research PLC (GHRS), up 9.6% to $25.24 / 12-Month Price Range: $ 12.38-28.65 / Short interest (% of float): 3.0%; days to cover: 11.3

- LumiraDx Ltd (LMDX), up 9.0% to $10.49 / 12-Month Price Range: $ 7.15-10.80 / Short interest (% of float): 0.3%; days to cover: 0.8

BIGGEST LOSERS

- StoneCo Ltd (STNE), down 34.6% to $20.70 / YTD price return: -75.3% / 12-Month Price Range: $ 28.40-95.12 / Short interest (% of float): 4.9%; days to cover: 2.8 (the stock is currently on the short sale restriction list)

- Dlocal Ltd (DLO), down 25.7% to $34.90 / 12-Month Price Range: $ 29.57-73.43 / Short interest (% of float): 5.2%; days to cover: 1.7 (the stock is currently on the short sale restriction list)

- Cassava Sciences Inc (SAVA), down 23.7% to $47.07 / YTD price return: +590.2% / 12-Month Price Range: $ 6.70-146.16 / Short interest (% of float): 30.3%; days to cover: 2.1 (the stock is currently on the short sale restriction list)

- Arrival SA (ARVL), down 19.0% to $10.73 / YTD price return: -61.8% / 12-Month Price Range: $ 10.00-37.18 / Short interest (% of float): 10.1% (the stock is currently on the short sale restriction list)

- Yatsen Holding Ltd (YSG), down 17.9% to $2.70 / YTD price return: -84.1% / 12-Month Price Range: $ 2.75-25.47 / Short interest (% of float): 5.8%; days to cover: 5.8 (the stock is currently on the short sale restriction list)

- iQIYI Inc (IQ), down 17.2% to $7.11 / YTD price return: -59.3% / 12-Month Price Range: $ 7.22-28.97 (the stock is currently on the short sale restriction list)

- Rover Group Inc (ROVR), down 15.9% to $11.74 / 12-Month Price Range: $ 8.61-15.59 / Short interest (% of float): 3.4%; days to cover: 13.0 (the stock is currently on the short sale restriction list)

- Ecovyst Inc (ECVT), down 15.6% to $10.73 / YTD price return: -7.1% / 12-Month Price Range: $ 8.63-15.31 / Short interest (% of float): 1.3%; days to cover: 4.1 (the stock is currently on the short sale restriction list)

- Rivian Automotive Inc (RIVN), down 15.1% to $146.07 / 12-Month Price Range: $ 95.20-179.47 (the stock is currently on the short sale restriction list)

- Iris Energy Ltd (IREN), down 12.7% to $24.45 on its trading debut

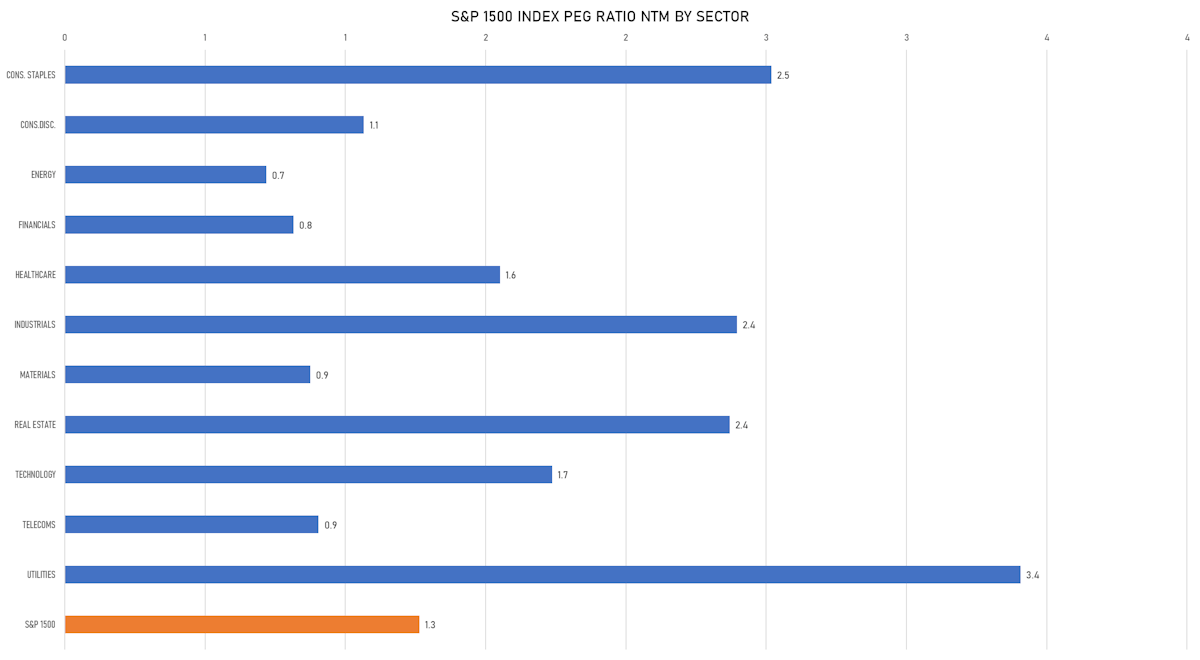

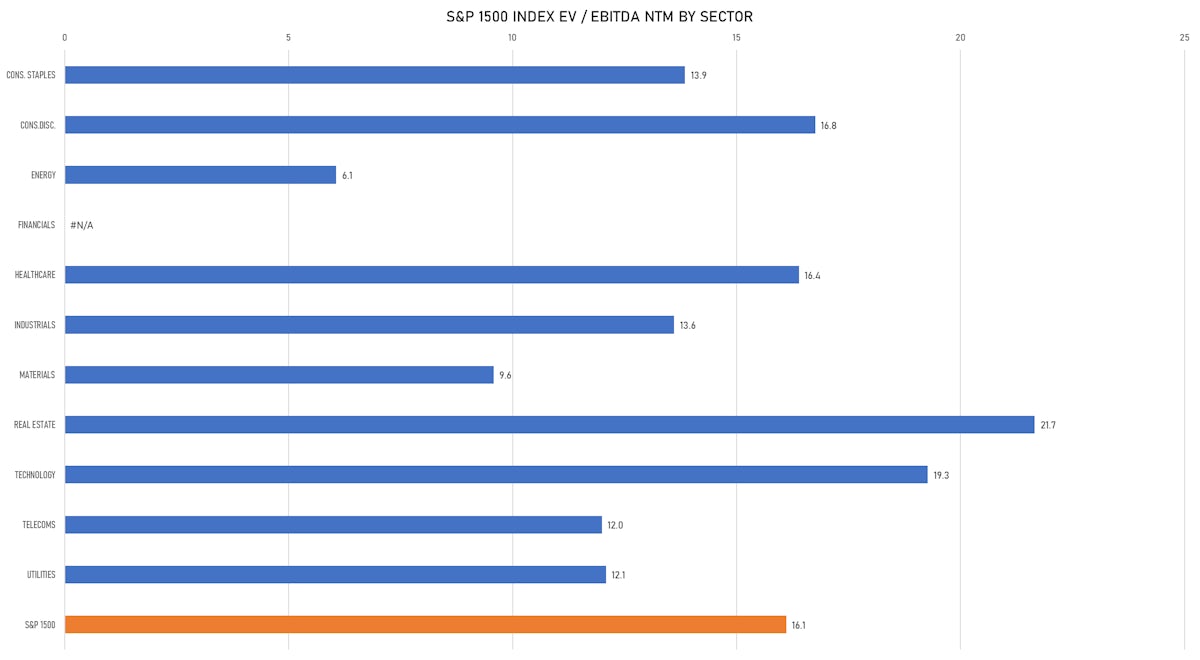

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Braze Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: BRZE / Gross proceeds (including overallotment): US$ 520.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, William Blair & Co, JP Morgan Securities LLC, Barclays Capital Inc, Piper Sandler & Co

- Nabors Energy Transition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: NETC.U / Gross proceeds (including overallotment): US$ 240.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, Wells Fargo Securities LLC

- LF Capital Acquisition Corp II / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: LFACU / Gross proceeds (including overallotment): US$ 225.00m (offering in U.S. Dollar) / Bookrunners: Jefferies LLC

- Life Science REIT PLC / United Kingdom - Real Estate / Listing Exchange: London AIM / Ticker: N/A / Gross proceeds (including overallotment): US$ 469.95m (offering in British Pound) / Bookrunners: Jefferies International Ltd, Panmure Gordon (UK) Ltd

- Actions Technology Co Ltd (Semiconductors | Zhuhai, China (Mainland)), raised US$ 205 M, placing 31 M class a ordinary shares. Financial advisors on the transaction: Shenwan Hongyuan Securities

NEW FOLLOW-ONS / SECONDARIES

- Peloton Interactive Inc / United States of America - Consumer Products and Services / Listing Exchange: Nasdaq / Ticker: PTON / Gross proceeds (including overallotment): US$ 1,100.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, JP Morgan Securities LLC

- CubeSmart / United States of America - Real Estate / Listing Exchange: New York / Ticker: CUBE / Gross proceeds (including overallotment): US$ 688.50m (offering in U.S. Dollar) / Bookrunners: Wells Fargo Securities LLC, Bofa Securities Inc

- NorthWestern Corp / United States of America - Energy and Power / Listing Exchange: Nasdaq / Ticker: NWE / Gross proceeds (including overallotment): US$ 325.00m (offering in U.S. Dollar) / Bookrunners: Wells Fargo Securities LLC, JP Morgan Securities LLC, Bofa Securities Inc

- Privia Health Group Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: PRVA / Gross proceeds (including overallotment): US$ 178.56m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, JP Morgan Securities LLC

- Montana Aerospace AG / Switzerland - Industrials / Listing Exchange: Swiss Exch / Ticker: AERO / Gross proceeds (including overallotment): US$ 163.78m (offering in Swiss Franc) / Bookrunners: Berenberg

- Hoshino Resorts REIT Inc / Japan - Real Estate / Listing Exchange: Tokyo / Ticker: 3287 / Gross proceeds (including overallotment): US$ 117.58m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd, SMBC Nikko Securities Inc

- Mercadolibre Inc (Professional Services | Buenos Aires, Argentina), raised US$ 1,550 M, placing 01 M common stock. Financial advisors on the transaction: Morgan Stanley & Co LLC, JP Morgan Securities LLC, Goldman Sachs & Co

- Jeronimo Martins SGPS SA (Food & Beverage Retailing | Lisboa, Portugal), raised US$ 706 M, placing 31 M ordinary or common shares. Financial advisors on the transaction: Goldman Sachs International