Equities

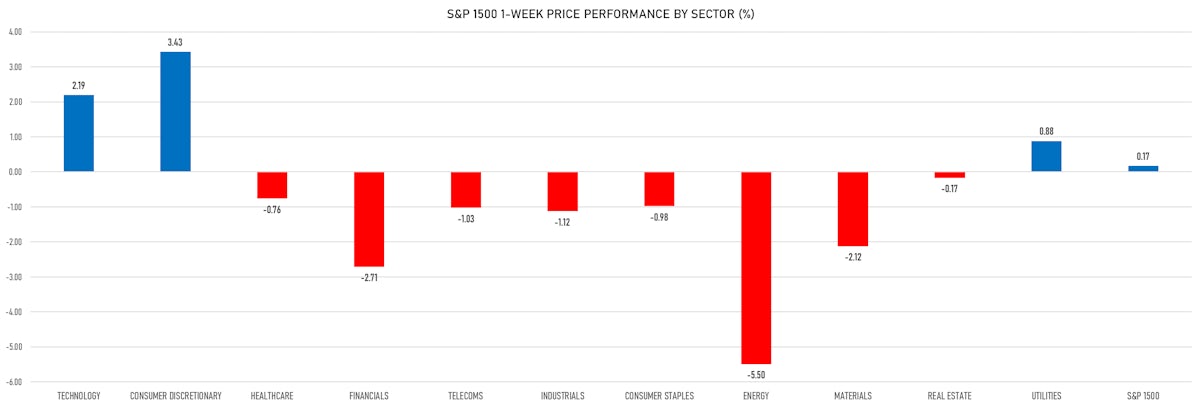

Mediocre Weekly Performance For US Indices, Saved By The Consumer Discretionary / Technology Sectors, As Energy Stocks Took A Dive

Very busy week for ECM, with $15.6bn raised by US offerings (IFR Data): $1.4bn in 5 IPOs, $2.3bn in 12 SPAC IPOs, $5bn in 22 follow-ons, $6.9bn in 13 ABB / Block trades

Published ET

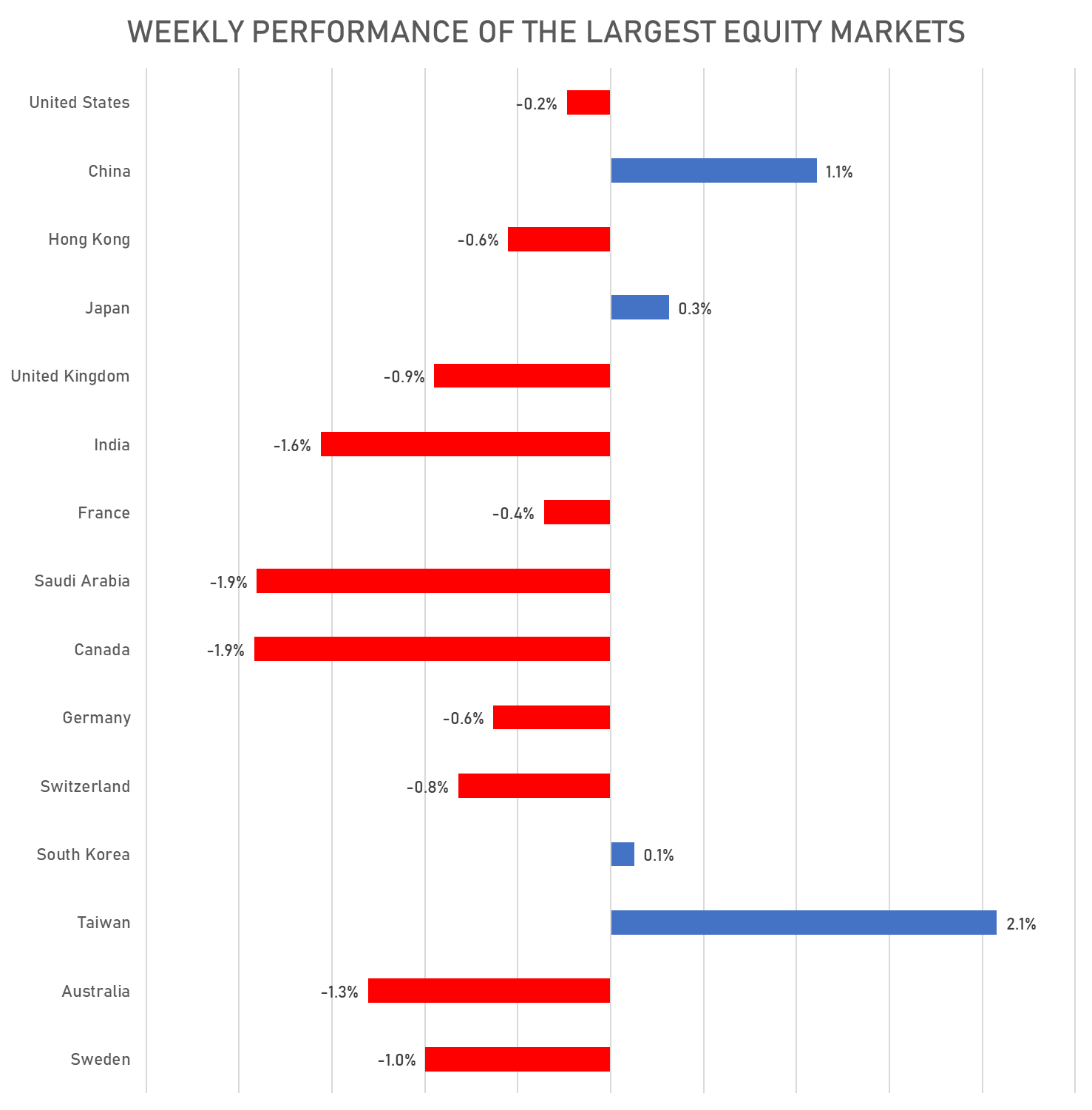

Year-To-Date Total Returns For Global Equity Indices | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.14%; Nasdaq Composite up 0.40%; Wilshire 5000 down -0.25%

- 33.9% of S&P 500 stocks were up today, with 68.7% of stocks above their 200-day moving average (DMA) and 61.6% above their 50-DMA

- Top performing sectors in the S&P 500: technology up 0.77% and utilities up 0.58%

- Bottom performing sectors in the S&P 500: energy down -3.91% and financials down -1.11%

- The number of shares in the S&P 500 traded today was 680m for a total turnover of US$ 88 bn

- The S&P 500 Value Index was down -0.9%, while the S&P 500 Growth Index was up 0.5%; the S&P small caps index was down -1.1% and mid caps were down -0.4%

- The volume on CME's INX (S&P 500 Index) was 2.4m (3-month z-score: 1.3); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 down -0.33%; UK FTSE 100 down -0.45%; Hang Seng SH-SZ-HK 300 Index up 0.15%; Japan's TOPIX 500 up 0.46%

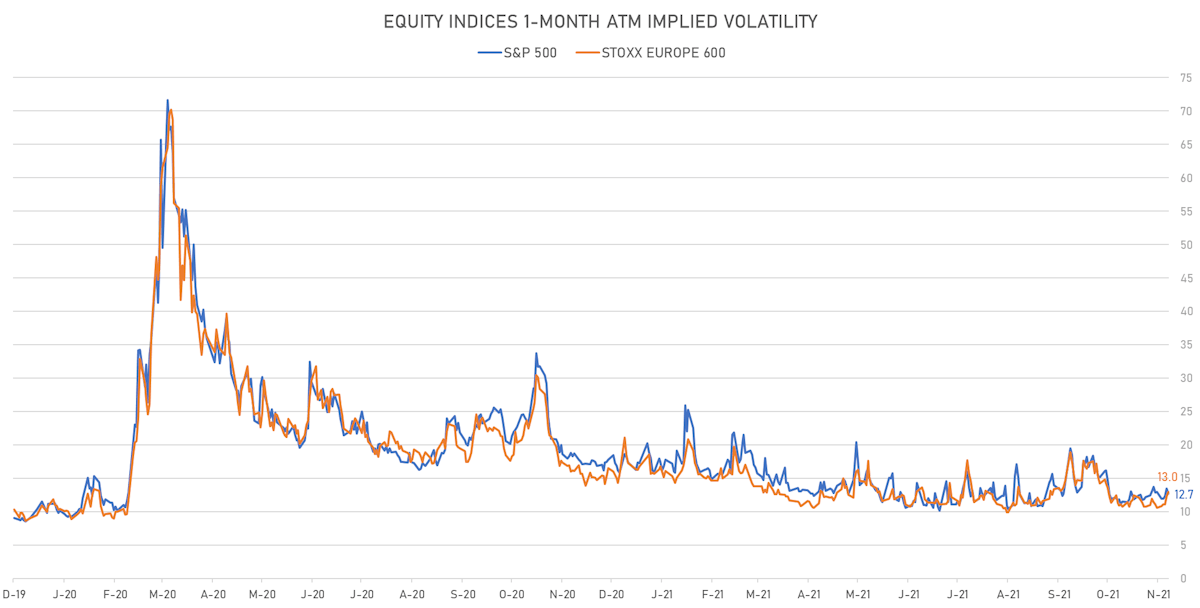

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 12.7%, down from 13.5%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 13.0%, up from 12.3%

NOTABLE S&P 500 EARNINGS RELEASES

- Foot Locker Inc (FL | Consumer Cyclicals): beat EPS median estimate (1.93 act. vs. 1.37 est.) and beat revenue median estimate (2,189m act. vs. 2,135m est.), down -11.95% today, closed at 50.68 and at 51.10 (+0.83%) after hours

TOP WINNERS

- Aurora Innovation Inc (AUR), up 51.4% to $17.11 / 12-Month Price Range: $ 9.50-11.83

- TAL Education Group (TAL), up 18.3% to $5.16 / YTD price return: -92.8% / 12-Month Price Range: $ 3.76-90.96

- Lucid Group Inc (LCID), up 17.3% to $55.21 / YTD price return: +451.5% / 12-Month Price Range: $ 9.69-64.86

- UWM Holdings Corp (UWMC), up 16.7% to $6.44 / YTD price return: -51.0% / 12-Month Price Range: $ 5.41-14.38

- Standard Lithium Ltd (SLI), up 15.9% to $9.28 / YTD price return: +315.2% / 12-Month Price Range: $ 1.80-12.92 / Short interest (% of float): 2.2%; days to cover: 1.0 (the stock is currently on the short sale restriction list)

- Kornit Digital Ltd (KRNT), up 13.8% to $176.40 / YTD price return: +97.9% / 12-Month Price Range: $ 76.90-170.67

- Avidxchange Holdings Inc (AVDX), up 13.2% to $26.57 / 12-Month Price Range: $ 20.39-26.75 / Short interest (% of float): 1.5%; days to cover: 1.0

- Lithium Americas Corp (LAC), up 13.0% to $37.49 / YTD price return: +198.7% / 12-Month Price Range: $ 8.95-36.49 / Short interest (% of float): 9.5%; days to cover: 2.1

- Centessa Pharmaceuticals PLC (CNTA), up 12.9% to $13.37 / 12-Month Price Range: $ 11.06-26.90

- Ginkgo Bioworks Holdings Inc (DNA), up 12.3% to $13.45 / 12-Month Price Range: $ 8.90-15.86 (the stock is currently on the short sale restriction list)

BIGGEST LOSERS

- Enanta Pharmaceuticals Inc (ENTA), down 18.6% to $75.33 / YTD price return: +78.9% / 12-Month Price Range: $ 40.32-102.00 (the stock is currently on the short sale restriction list)

- Sono Group NV (SEV), down 15.3% to $24.80 / 12-Month Price Range: $ 20.06-47.49 (the stock is currently on the short sale restriction list)

- VNET Group Inc (VNET), down 14.6% to $12.97 / YTD price return: -62.6% / 12-Month Price Range: $ 14.11-44.45 (the stock is currently on the short sale restriction list)

- Farfetch Ltd (FTCH), down 13.9% to $39.26 / YTD price return: -38.5% / 12-Month Price Range: $ 34.29-73.87 (the stock is currently on the short sale restriction list)

- Uranium Energy Corp (UEC), down 12.4% to $4.29 / YTD price return: +143.8% / 12-Month Price Range: $ .93-5.79 / Short interest (% of float): 7.5%; days to cover: 2.6 (the stock is currently on the short sale restriction list)

- Foot Locker Inc (FL), down 12.0% to $50.68 / YTD price return: +25.3% / 12-Month Price Range: $ 36.94-66.71 (the stock is currently on the short sale restriction list)

- Couchbase Inc (BASE), down 11.5% to $36.27 / 12-Month Price Range: $ 27.23-52.26 (the stock is currently on the short sale restriction list)

- MINISO Group Holding Ltd (MNSO), down 11.2% to $14.08 / YTD price return: -46.6% / 12-Month Price Range: $ 12.05-35.21 (the stock is currently on the short sale restriction list)

- Ci&T Inc (CINT), down 11.0% to $14.66 / 12-Month Price Range: $ 15.61-22.50 (the stock is currently on the short sale restriction list)

- Squarespace Inc (SQSP), down 10.6% to $36.85 / 12-Month Price Range: $ 33.12-64.71 (the stock is currently on the short sale restriction list)

EARNINGS NEXT WEEK

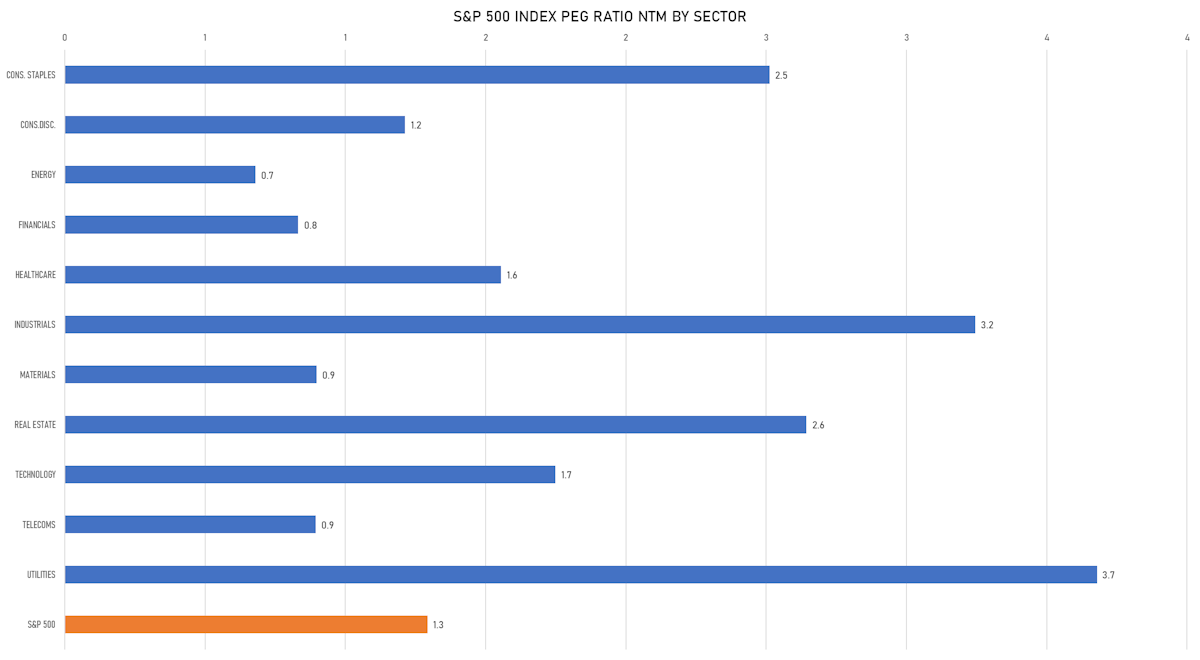

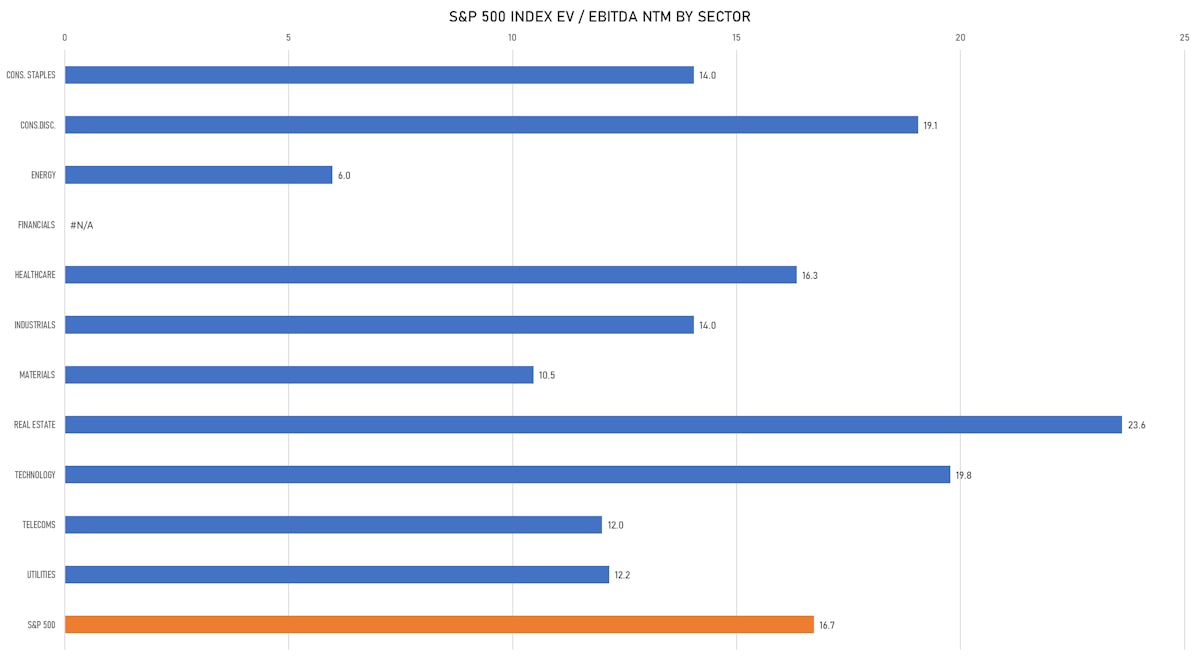

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Power & Digital Infrastructure Acquisition II Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: XPDBU / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Bofa Securities Inc, Barclays Capital Inc

- Atrato Onsite Energy PLC / United Kingdom - Financials / Listing Exchange: London / Ticker: ROOF / Gross proceeds (including overallotment): US$ 202.32m (offering in British Pound) / Bookrunners: Alvarium Securities Ltd

- Saint-Petersburg Exchange PJSC / Russian Federation - Financials / Listing Exchange: SPetersbrg / Ticker: SPBE / Gross proceeds (including overallotment): US$ 175.00m (offering in U.S. Dollar) / Bookrunners: Aton, Alfa Capital Markets, VTB Capital, OOO "INVESTITSIONNAYA KOMPANIYA FINAM", Sovkombank PAO, BCS Global Markets, Investitsionnaia kompaniia Freedom Finance OOO, Sova Capital, Bank Otkritie Financial Corp PJSC, Bank GPB International SA, Tinkoff Bank JSC

NEW FOLLOW-ONS / SECONDARIES

- Blackstone Mortgage Trust Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: BXMT / Gross proceeds (including overallotment): US$ 317.80m (offering in U.S. Dollar) / Bookrunners: Deutsche Bank Securities Inc, Citigroup Global Markets Inc, Wells Fargo Securities LLC, JP Morgan Securities LLC, Bofa Securities Inc, Barclays Capital Inc

- Forestar Group Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: FOR / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- EQT Corp / United States of America - Energy and Power / Listing Exchange: New York / Ticker: EQT / Gross proceeds (including overallotment): US$ 231.55m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, RBC Capital Markets LLC

- Privia Health Group Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: PRVA / Gross proceeds (including overallotment): US$ 174.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, JP Morgan Securities LLC

- Alignment Healthcare Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: ALHC / Gross proceeds (including overallotment): US$ 168.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, William Blair & Co, Morgan Stanley & Co LLC, JP Morgan Securities LLC, Bofa Securities Inc

- SEMrush Holdings Inc / United States of America - High Technology / Listing Exchange: New York / Ticker: SEMR / Gross proceeds (including overallotment): US$ 102.50m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, KeyBanc Capital Markets Inc, Morgan Stanley & Co LLC, JP Morgan Securities LLC

- GB Group PLC / United Kingdom - High Technology / Listing Exchange: London AIM / Ticker: GBG / Gross proceeds (including overallotment): US$ 404.64m (offering in British Pound) / Bookrunners: Jefferies International Ltd, Peel Hunt LLP