Equities

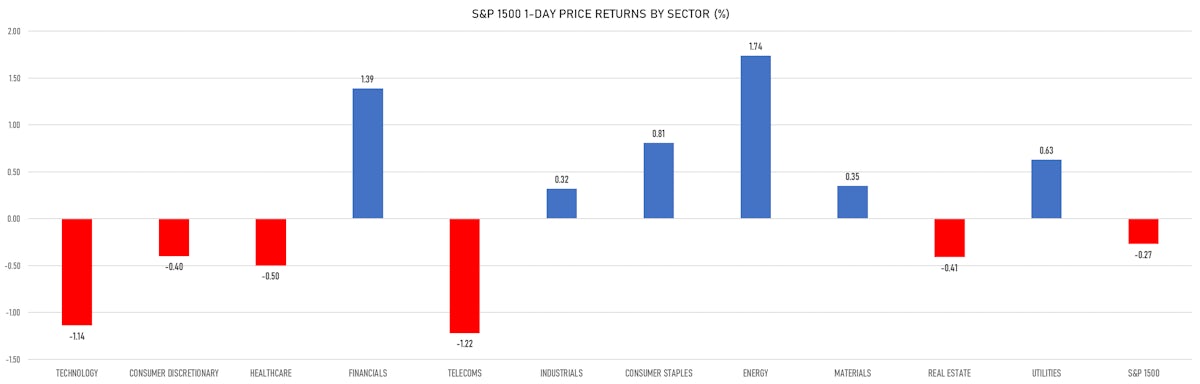

Yield Curve Steepening Helps Financials But Higher Rates Take Down Technology Stocks, As The Nasdaq Composite Falls 1.26%

The energy sector rebounded with rising crude oil prices, as OPEC+ reaffirmed their 2022 demand forecasts and said it would adjust supply down if global strategic petroleum reserves were released

Published ET

S&P 1500 Energy and front-month Brent futures prices | Source: Refinitiv

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.32%; Nasdaq Composite down -1.26%; Wilshire 5000 down -0.60%

- 56.0% of S&P 500 stocks were up today, with 70.5% of stocks above their 200-day moving average (DMA) and 63.8% above their 50-DMA

- Top performing sectors in the S&P 500: energy up 1.81% and financials up 1.43%

- Bottom performing sectors in the S&P 500: telecoms down -1.24% and technology down -1.14%

- The number of shares in the S&P 500 traded today was 634m for a total turnover of US$ 86 bn

- The S&P 500 Value Index was up 0.6%, while the S&P 500 Growth Index was down -1.0%; the S&P small caps index was up 0.7% and mid caps were up 0.2%

- The volume on CME's INX (S&P 500 Index) was 2.5m (3-month z-score: 1.3); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 down -0.13%; UK FTSE 100 up 0.44%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -0.46%, Japan's TOPIX 500 down -0.09%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 14.1%, up from 12.7%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 12.4%, down from 13.0%

NOTABLE S&P 500 EARNINGS RELEASES

- Zoom Video Communications Inc (ZM | Technology): beat EPS median estimate (1.11 act. vs. 1.08 est.) and beat revenue median estimate (1,051m act. vs. 1,018m est.), down -3.59% today, closed at 242.28 and at 250.63 (+3.45%) after hours

- Agilent Technologies Inc (A | Healthcare): matched EPS median estimate (1.21 act. vs. 1.21 est.) and missed revenue median estimate (1,652m act. vs. 1,660m est.), down -0.93% today, closed at 162.78 and at 164.90 (+1.30%) after hours

- Keysight Technologies Inc (KEYS | Industrials): beat EPS median estimate (1.82 act. vs. 1.64 est.) and beat revenue median estimate (1,294m act. vs. 1,270m est.), down -1.38% today, closed at 191.94 and at 194.63 (+1.40%) after hours

- Arrowhead Pharmaceuticals Inc (ARWR | Healthcare): missed EPS median estimate (-0.61 act. vs. -0.60 est.) and missed revenue median estimate (38m act. vs. 41m est.), down -2.57% today, closed at 69.28 and at 71.11 (+2.64%) after hours

TOP WINNERS

- Multiplan Corp (MPLN), up 32.7% to $4.67 / YTD price return: -41.6% / 12-Month Price Range: $ 3.48-9.82 / Short interest (% of float): 4.8%; days to cover: 5.4

- Vonage Holdings Corp (VG), up 27.0% to $20.79 / YTD price return: +61.5% / 12-Month Price Range: $ 10.85-17.59 / Short interest (% of float): 8.3%; days to cover: 13.3

- Avaya Holdings Corp (AVYA), up 22.4% to $22.00 / YTD price return: +14.9% / 12-Month Price Range: $ 16.50-34.06 / Short interest (% of float): 10.9%; days to cover: 9.9

- Partner Communications Company Ltd (PTNR), up 18.6% to $6.50 / 12-Month Price Range: $ 3.92-5.60 / Short interest days to cover: 0.4

- Astra Space Inc (ASTR), up 17.2% to $11.17 / YTD price return: +10.5% / 12-Month Price Range: $ 7.34-22.47

- Aeva Technologies Inc (AEVA), up 14.3% to $10.10 / YTD price return: -30.5% / 12-Month Price Range: $ 7.05-21.83

- Itau Corpbanca (ITCB), up 14.2% to $3.45 / YTD price return: -30.3% / 12-Month Price Range: $ 2.91-6.23 / Short interest (% of float): 0.2%; days to cover: 8.0

- Enel Chile SA (ENIC), up 14.1% to $2.26 / YTD price return: -41.9% / 12-Month Price Range: $ 1.90-4.50 / Short interest (% of float): 1.2%; days to cover: 7.8

- Canoo Inc (GOEV), up 14.1% to $11.43 / YTD price return: -17.2% / 12-Month Price Range: $ 5.75-24.90 / Short interest (% of float): 25.8%; days to cover: 7.5

- Navitas Semiconductor Corp (NVTS), up 12.7% to $18.04 / 12-Month Price Range: $ 9.66-22.19

BIGGEST LOSERS

- Aurinia Pharmaceuticals Inc (AUPH), down 31.0% to $19.65 / YTD price return: +42.1% / 12-Month Price Range: $ 9.72-33.97 / Short interest (% of float): 10.3%; days to cover: 2.7 (the stock is currently on the short sale restriction list)

- Rani Therapeutics Holdings Inc (RANI), down 23.0% to $26.21 / 12-Month Price Range: $ 9.24-36.27 / Short interest (% of float): 4.4%; days to cover: 4.7 (the stock is currently on the short sale restriction list)

- Asana Inc (ASAN), down 22.7% to $106.09 / YTD price return: +259.0% / 12-Month Price Range: $ 21.46-145.79 / Short interest (% of float): 6.6%; days to cover: 1.9 (the stock is currently on the short sale restriction list)

- Prometheus Biosciences Inc (RXDX), down 21.4% to $30.24 / 12-Month Price Range: $ 16.11-39.98 (the stock is currently on the short sale restriction list)

- Cerence Inc (CRNC), down 20.6% to $82.59 / YTD price return: -17.8% / 12-Month Price Range: $ 79.53-139.00 (the stock is currently on the short sale restriction list)

- DigitalOcean Holdings Inc (DOCN), down 20.0% to $102.82 / 12-Month Price Range: $ 35.35-133.40 / Short interest (% of float): 10.0%; days to cover: 3.6 (the stock is currently on the short sale restriction list)

- Ci&T Inc (CINT), down 18.9% to $11.89 / 12-Month Price Range: $ 14.50-22.50 (the stock is currently on the short sale restriction list)

- IONQ Inc (IONQ), down 17.2% to $23.18 / 12-Month Price Range: $ 7.07-35.90 (the stock is currently on the short sale restriction list)

- MaxCyte Inc (MXCT), down 17.1% to $10.60 / 12-Month Price Range: $ 5.85-17.44 / Short interest (% of float): 3.2%; days to cover: 4.5 (the stock is currently on the short sale restriction list)

- NIU Technologies (NIU), down 16.8% to $20.01 / YTD price return: -28.7% / 12-Month Price Range: $ 21.08-53.38 (the stock is currently on the short sale restriction list)

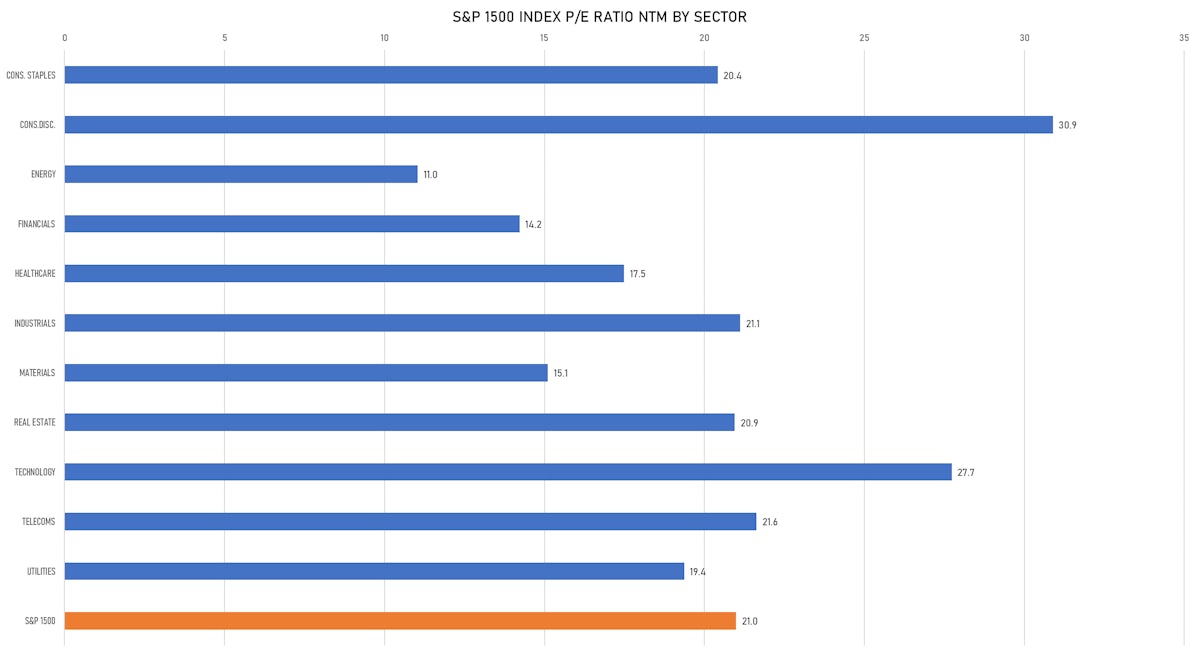

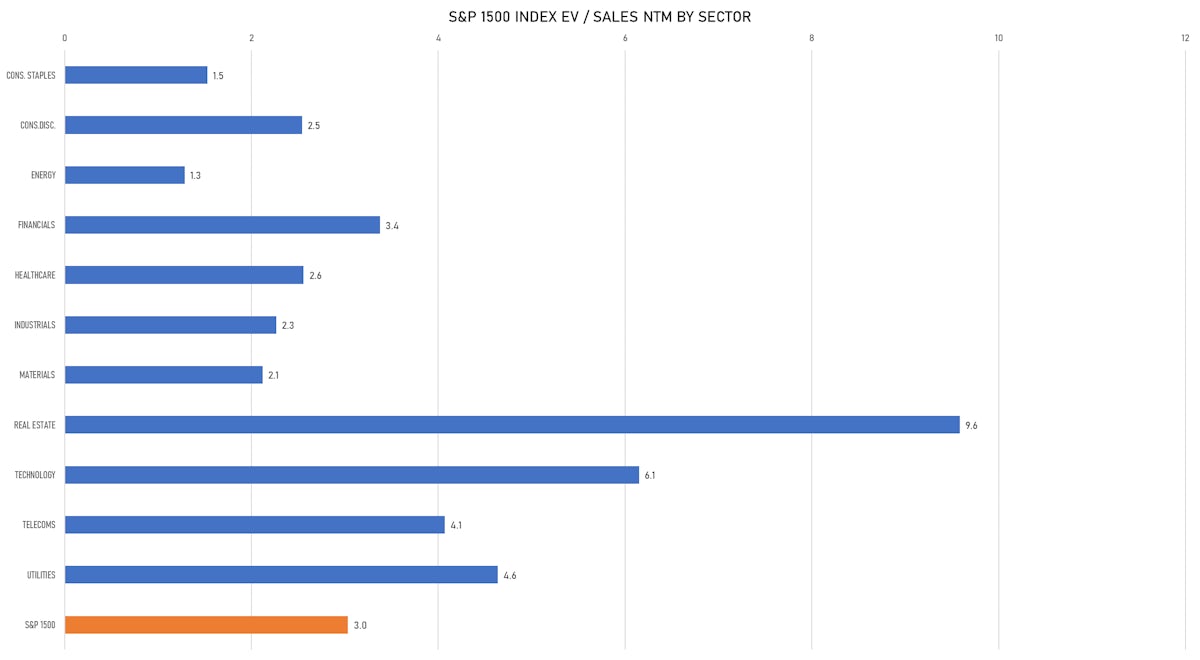

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- C5 Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: CXAC.U / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Moelis & Co, Cantor Fitzgerald & Co

- Jesons Industries Ltd / India - Materials / Listing Exchange: National / Ticker: N/A / Gross proceeds (including overallotment): US$ 107.62m (offering in Indian Rupee) / Bookrunners: Not Applicable

NEW FOLLOW-ONS / SECONDARIES

- China Evergrande New Energy Vehicle Group Ltd / China - Industrials / Listing Exchange: Hong Kong / Ticker: 708 / Gross proceeds (including overallotment): US$ 346.57m (offering in Hong Kong Dollar) / Bookrunners: Kingston Securities Limited

- Ferrotec Holdings Corp / Japan - High Technology / Listing Exchange: Jasdaq Std / Ticker: 6890 / Gross proceeds (including overallotment): US$ 188.83m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd