Equities

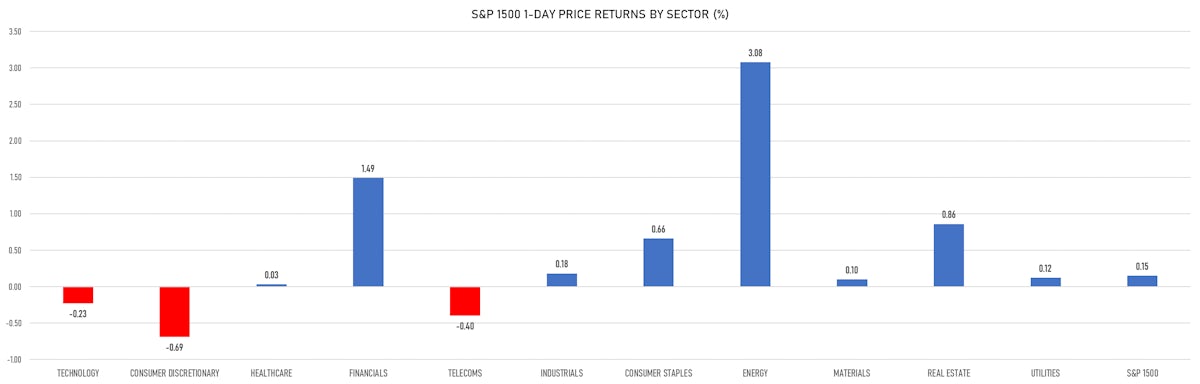

A Mixed Day For US Equities, With The Nasdaq Falling Again, While Nearly Two Thirds Of S&P 500 Stocks Closed Higher

Value stocks widely overperformed growth, with energy and financials the best-performing sectors on rising crude oil prices and a steepening yield curve (respectively)

Published ET

S&P 1500 Market Cap By Sector | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.17%; Nasdaq Composite down -0.50%; Wilshire 5000 unchanged

- 62.2% of S&P 500 stocks were up today, with 72.1% of stocks above their 200-day moving average (DMA) and 66.7% above their 50-DMA

- Top performing sectors in the S&P 500: energy up 3.04% and financials up 1.55%

- Bottom performing sectors in the S&P 500: consumer discretionary down -0.63% and telecoms down -0.40%

- The number of shares in the S&P 500 traded today was 563m for a total turnover of US$ 77 bn

- The S&P 500 Value Index was up 0.8%, while the S&P 500 Growth Index was down -0.3%; the S&P small caps index was unchanged and mid caps were down -0.1%

- The volume on CME's INX (S&P 500 Index) was 2.2m (3-month z-score: 0.6); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 down -1.28%; UK FTSE 100 up 0.15%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -0.19%, Japan's TOPIX 500 down -1.00%

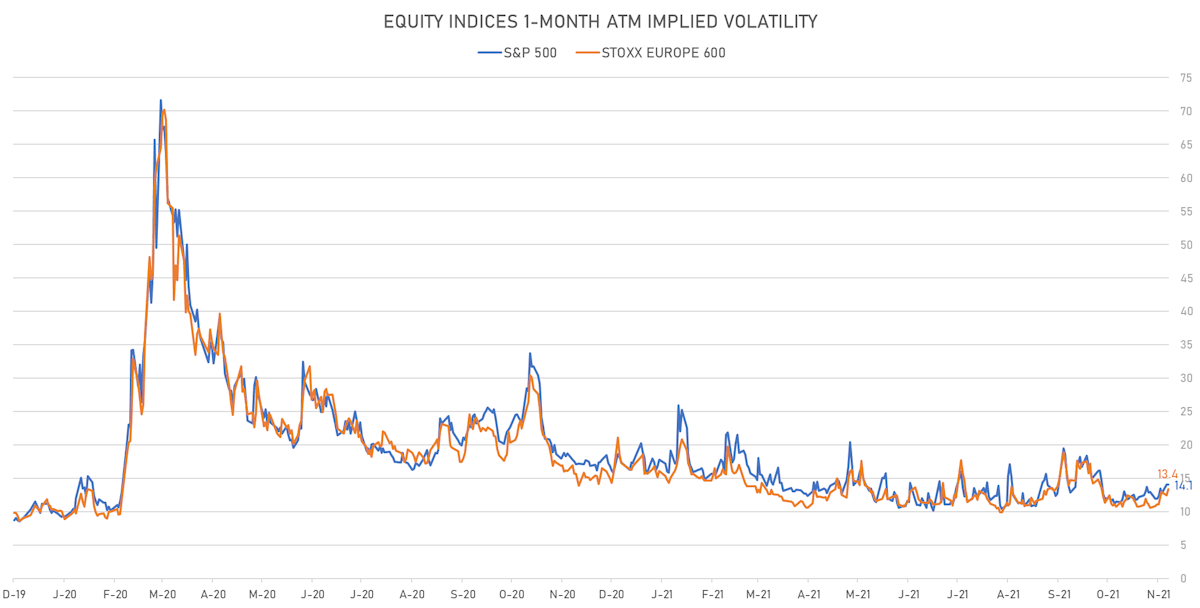

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 14.1%, down from 14.1%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 13.4%, up from 12.4%

NOTABLE US EARNINGS RELEASES

- Analog Devices Inc (ADI | Technology): beat EPS median estimate (1.73 act. vs. 1.69 est.) and beat revenue median estimate (2,340m act. vs. 2,300m est.), down -1.64% today, closed at 182.45 and at 186.25 (+2.08%) after hours

- Autodesk Inc (ADSK | Technology): beat EPS median estimate (1.33 act. vs. 1.25 est.) and beat revenue median estimate (1,126m act. vs. 1,118m est.), down -2.09% today, closed at 304.00 and at 311.10 (+2.34%) after hours

- VMware Inc (VMW | Technology): beat EPS median estimate (1.72 act. vs. 1.53 est.) and beat revenue median estimate (3,188m act. vs. 3,121m est.), down -1.86% today, closed at 116.48 and at 119.75 (+2.81%) after hours

- Dell Technologies Inc (DELL | Technology): beat EPS median estimate (2.37 act. vs. 2.32 est.) and beat revenue median estimate (28,405m act. vs. 27,600m est.), down -0.83% today, closed at 54.67 and at 55.10 (+0.79%) after hours

- HP Inc (HPQ | Technology): matched EPS median estimate (0.94 act. vs. 0.94 est.) and matched revenue median estimate (16,675m act. vs. 16,675m est.), up 0.81% today, closed at 32.19 and at 32.15 (-0.12%) after hours

- Dollar Tree Inc (DLTR | Consumer Cyclicals): matched EPS median estimate (0.96 act. vs. 0.96 est.) and beat revenue median estimate (6,415m act. vs. 6,412m est.), up 9.17% today, closed at 144.71 and at 131.70 (-8.99%) after hours

- Best Buy Co Inc (BBY | Consumer Cyclicals): beat EPS median estimate (2.08 act. vs. 1.90 est.) and beat revenue median estimate (11,910m act. vs. 11,536m est.), down -12.31% today, closed at 121.01 and at 139.00 (+14.87%) after hours

- Burlington Stores Inc (BURL | Consumer Cyclicals): beat EPS median estimate (1.36 act. vs. 1.28 est.) and beat revenue median estimate (2,300m act. vs. 2,246m est.), up 8.57% today, closed at 285.55 and at 265.00 (-7.20%) after hours

- Jacobs Engineering Group Inc (J | Industrials): beat EPS median estimate (1.58 act. vs. 1.57 est.) and missed revenue median estimate (3,586m act. vs. 3,820m est.), down -1.75% today, closed at 144.00 and at 148.00 (+2.78%) after hours

- J M Smucker Co (SJM | Consumer Non-Cyclicals): beat EPS median estimate (2.43 act. vs. 2.04 est.) and beat revenue median estimate (2,050m act. vs. 1,959m est.), up 5.69% today, closed at 133.63 and at 128.00 (-4.21%) after hours

- DICK'S Sporting Goods Inc (DKS | Consumer Cyclicals): beat EPS median estimate (3.19 act. vs. 1.99 est.) and beat revenue median estimate (2,748m act. vs. 2,523m est.), down -4.08% today, closed at 134.55 and at 141.40 (+5.09%) after hours

- Gap Inc (GPS | Consumer Cyclicals): missed EPS median estimate (0.27 act. vs. 0.50 est.) and missed revenue median estimate (3,943m act. vs. 4,455m est.), down -1.80% today, closed at 23.51 and at 23.50 (-0.04%) after hours

- Pure Storage Inc (PSTG | Technology): matched EPS median estimate (0.22 act. vs. 0.22 est.) and matched revenue median estimate (563m act. vs. 563m est.), down -0.73% today, closed at 27.28 and at 27.78 (+1.83%) after hours

- Anaplan Inc (PLAN | Technology): matched EPS median estimate (-0.05 act. vs. -0.05 est.) and matched revenue median estimate (155m act. vs. 155m est.), down -3.59% today, closed at 52.06 and at 53.12 (+2.04%) after hours

- Nutanix Inc (NTNX | Technology): matched EPS median estimate (-0.22 act. vs. -0.22 est.) and matched revenue median estimate (379m act. vs. 379m est.), down -1.51% today, closed at 32.58 and at 32.82 (+0.74%) after hours

- Nordstrom Inc (JWN | Consumer Cyclicals): missed EPS median estimate (0.39 act. vs. 0.56 est.) and beat revenue median estimate (3,637m act. vs. 3,527m est.), down -1.21% today, closed at 31.93 and at 32.39 (+1.44%) after hours

TOP WINNERS

- Dycom Industries Inc (DY), up 19.7% to $99.91 / YTD price return: +32.3% / 12-Month Price Range: $ 61.50-101.16

- Enanta Pharmaceuticals Inc (ENTA), up 15.1% to $86.50 / YTD price return: +105.5% / 12-Month Price Range: $ 40.32-102.00

- Movado Group Inc (MOV), up 11.7% to $44.58 / 12-Month Price Range: $ 15.95-40.72 / Short interest (% of float): 5.6%; days to cover: 9.0

- SiTime Corp (SITM), up 11.1% to $280.00 / YTD price return: +150.2% / 12-Month Price Range: $ 75.81-301.52

- Montauk Renewables Inc (MNTK), up 9.8% to $9.88 / 12-Month Price Range: $ 6.15-14.93

- Life Time Group Holdings Inc (LTH), up 9.4% to $21.92 / 12-Month Price Range: $ 15.81-21.04 / Short interest (% of float): 7.1%; days to cover: 1.9

- Dollar Tree Inc (DLTR), up 9.2% to $144.71 / YTD price return: +33.9% / 12-Month Price Range: $ 84.26-135.59

- Kosmos Energy Ltd (KOS), up 9.1% to $3.71 / YTD price return: +57.9% / 12-Month Price Range: $ 1.51-4.24 / Short interest (% of float): 5.3%; days to cover: 2.3

- Callon Petroleum Co (CPE), up 9.0% to $58.18 / YTD price return: +342.1% / 12-Month Price Range: $ 8.10-65.45

- Peabody Energy Corp (BTU), up 8.8% to $11.57 / YTD price return: +380.1% / 12-Month Price Range: $ 1.18-19.83

BIGGEST LOSERS

- Genius Sports Ltd (GENI), down 25.3% to $10.19 / YTD price return: -42.1% / 12-Month Price Range: $ 10.26-25.18 (the stock is currently on the short sale restriction list)

- Aurora Innovation Inc (AUR), down 18.7% to $12.15 / 12-Month Price Range: $ 9.50-17.77 (the stock is currently on the short sale restriction list)

- Benson Hill Inc (BHIL), down 17.6% to $6.10 / 12-Month Price Range: $ 5.50-12.25 / Short interest (% of float): 0.7%; days to cover: 1.8 (the stock is currently on the short sale restriction list)

- Science 37 Holdings Inc (SNCE), down 17.1% to $9.43 / 12-Month Price Range: $ 8.42-15.10 / Short interest (% of float): 0.2%; days to cover: 1.2 (the stock is currently on the short sale restriction list)

- Zoom Video Communications Inc (ZM), down 14.7% to $206.64 / YTD price return: -38.7% / 12-Month Price Range: $ 238.20-486.83 (the stock is currently on the short sale restriction list)

- GameStop Corp (GME), down 13.6% to $213.90 / YTD price return: +1,035.4% / 12-Month Price Range: $ 12.14-483.00 (the stock is currently on the short sale restriction list)

- Allbirds Inc (BIRD), down 13.4% to $18.90 / 12-Month Price Range: $ 20.25-32.44 (the stock is currently on the short sale restriction list)

- Prothena Corporation PLC (PRTA), down 13.3% to $51.17 / 12-Month Price Range: $ 10.72-79.75 (the stock is currently on the short sale restriction list)

- Abercrombie & Fitch Co (ANF), down 12.6% to $41.12 / YTD price return: +102.0% / 12-Month Price Range: $ 18.69-48.97 / Short interest (% of float): 11.5%; days to cover: 4.7 (the stock is currently on the short sale restriction list)

- Alignment Healthcare Inc (ALHC), down 12.4% to $18.12 / 12-Month Price Range: $ 15.00-28.59 (the stock is currently on the short sale restriction list)

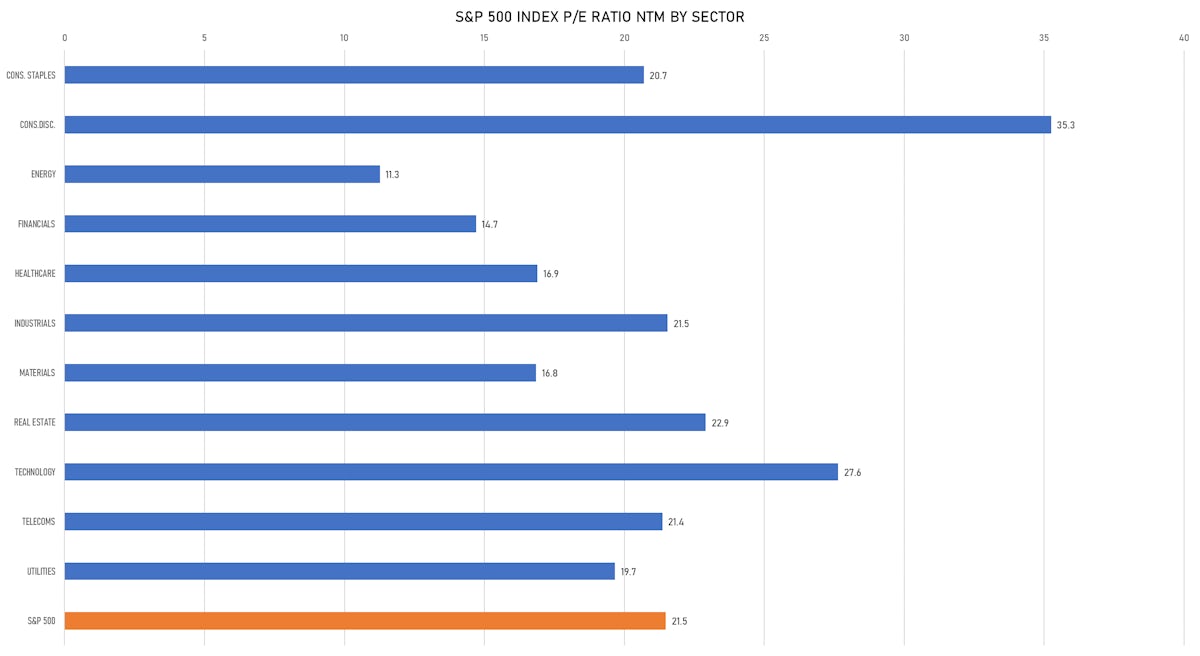

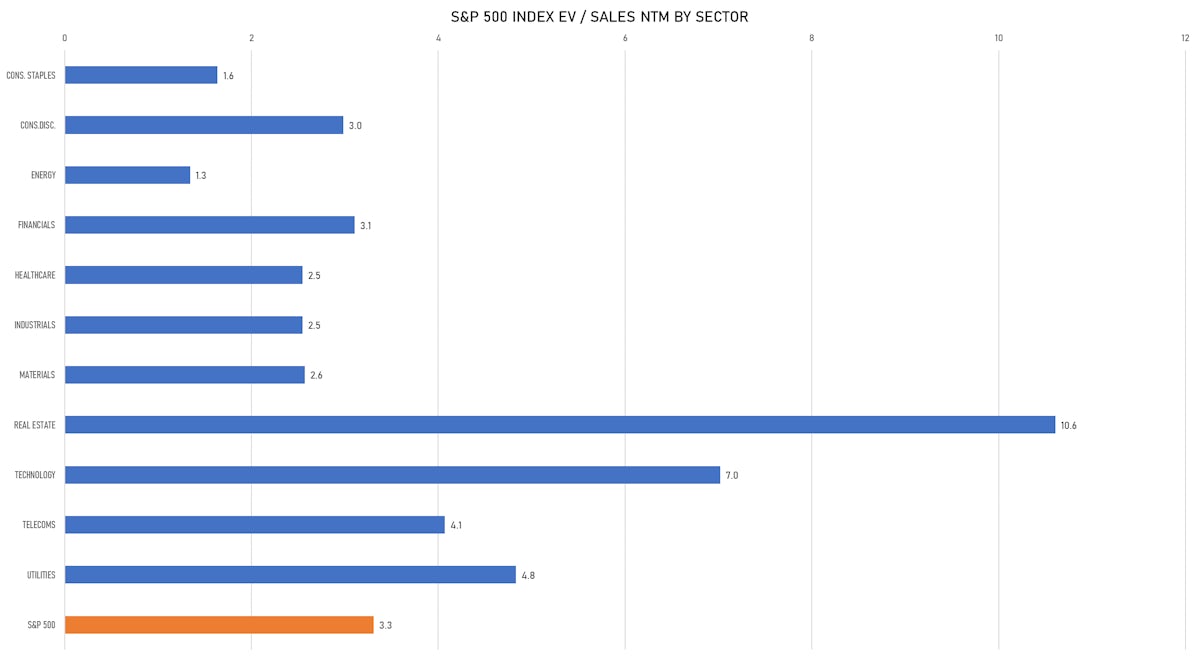

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Athena Technology Acquisition Corp II / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: N/A / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc

- Legato Merger Corp II / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: LGTOU / Gross proceeds (including overallotment): US$ 240.00m (offering in U.S. Dollar) / Bookrunners: Earlybirdcapital Inc

- FTAC Emerald Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: N/A / Gross proceeds (including overallotment): US$ 220.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co

- Igniting Consumer Growth Acquisition Co Ltd / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: ICGCU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Nomura Securities International Inc, RBC Capital Markets LLC

- Qualitas Property Partners Pty Ltd / Australia - Real Estate / Listing Exchange: Australia / Ticker: N/A / Gross proceeds (including overallotment): US$ 241.97m (offering in Australian Dollar) / Bookrunners: Not Applicable

- Hambro Perks Acquisition Co Ltd / Guernsey - Financials / Listing Exchange: London / Ticker: N/A / Gross proceeds (including overallotment): US$ 200.94m (offering in British Pound) / Bookrunners: Citigroup Global Markets Ltd

NEW FOLLOW-ONS / SECONDARIES

- Nexus Real Estate Investment Trust / Canada - Real Estate / Listing Exchange: Toronto / Ticker: NXR.UN / Gross proceeds (including overallotment): US$ 128.01m (offering in Canadian Dollar) / Bookrunners: Desjardins Capital Markets, BMO Capital Markets

- Indian Hotels Co Ltd / India - Media and Entertainment / Listing Exchange: National / Ticker: 500850 / Gross proceeds (including overallotment): US$ 267.24m (offering in Indian Rupee) / Bookrunners: HSBC Securities & Capital Markets(India)Pvt Ltd, Kotak Mahindra Capital Co

- Vedanta Ltd (Metals & Mining | Mumbai, India), raised US$ 788 M, placing 168 M ordinary or common shares. Financial advisors on the transaction: JP Morgan India

- ThyssenKrupp AG (Metals & Mining | Essen, Germany), raised US$ 519 M, placing 45 M ordinary or common shares. Financial advisors on the transaction: UBS AG

- CPI Property Group SA (REITs | Luxembourg, Czech Republic), raised US$ 337 M, placing 487 M ordinary or common shares. Financial advisors on the transaction: Not Applicable