Equities

Solid Rebound In US Equities After Friday's Selloff, Led By Technology And Consumer Discretionary

The high volume of trading after a long weekend favored liquid stocks, which helped large-cap / growth stocks trounce the performance of small-caps / value stocks

Published ET

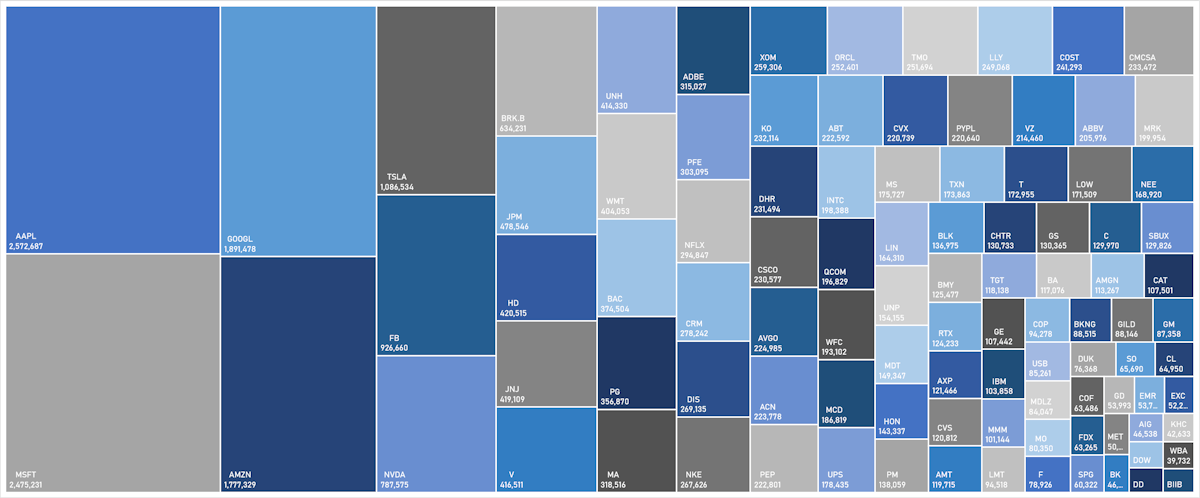

S&P 100 Market Caps | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 1.32%; Nasdaq Composite up 1.88%; Wilshire 5000 up 1.07%

- 67.1% of S&P 500 stocks were up today, with 65.1% of stocks above their 200-day moving average (DMA) and 54.9% above their 50-DMA

- Top performing sectors in the S&P 500: technology up 2.64% and consumer discretionary up 1.63%

- Bottom performing sectors in the S&P 500: industrials up 0.24% and financials up 0.31%

- The number of shares in the S&P 500 traded today was 684m for a total turnover of US$ 88 bn

- The S&P 500 Value Index was up 0.4%, while the S&P 500 Growth Index was up 2.0%; the S&P small caps index was down -0.3% and mid-caps were up 0.1%

- The volume on CME's INX (S&P 500 Index) was 2.5m (3-month z-score: 1.3); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 up 0.69%; UK FTSE 100 up 0.94%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -0.92% Japan's TOPIX 500 up 1.03%

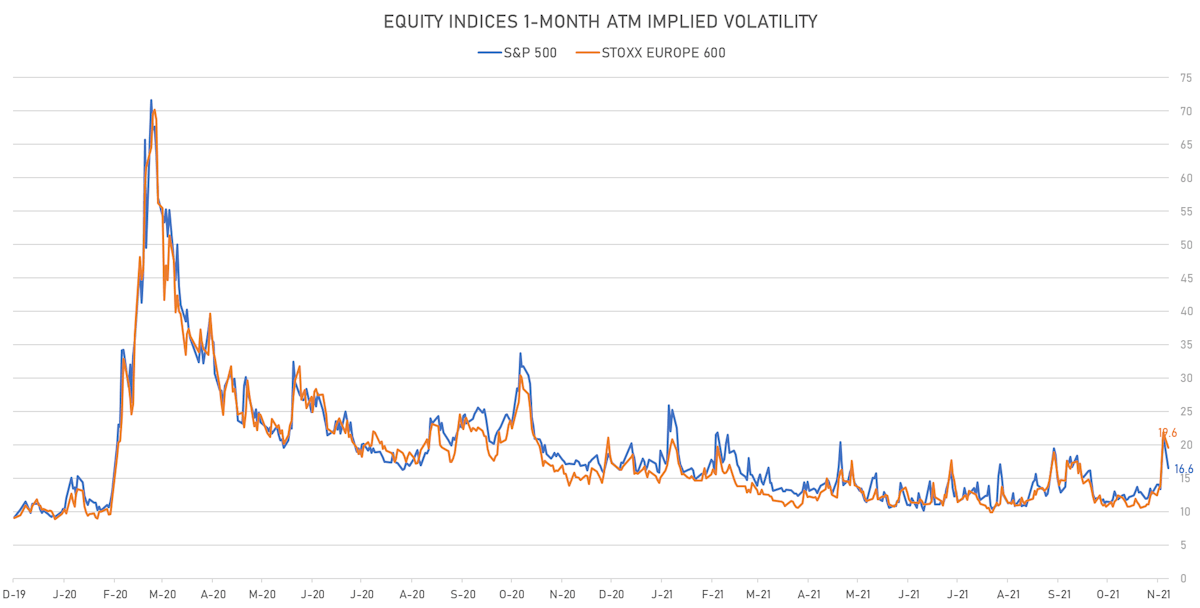

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 16.6%, down from 21.5%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 19.6%, down from 21.8%

TOP WINNERS

- Krystal Biotech Inc (KRYS), up 121.7% to $88.24 / 12-Month Price Range: $ 38.86-87.29 / Short interest (% of float): 12.4%; days to cover: 12.3

- Adagio Therapeutics Inc (ADGI), up 86.4% to $46.83 / 12-Month Price Range: $ 17.38-59.50 / Short interest (% of float): 7.2%; days to cover: 8.0

- AeroClean Technologies Inc (AERC), up 44.9% to $117.35 / 12-Month Price Range: $ 40.00-101.87 (the stock is currently on the short sale restriction list)

- Matterport Inc (MTTR), up 21.2% to $33.05 / 12-Month Price Range: $ 10.45-30.80 / Short interest (% of float): 6.7%; days to cover: 3.6

- Lithium Americas Corp (LAC), up 14.8% to $40.96 / YTD price return: +226.4% / 12-Month Price Range: $ 8.95-39.04 / Short interest (% of float): 6.2%; days to cover: 1.3

- Valneva SE (VALN), up 12.9% to $67.28 / 12-Month Price Range: $ 24.16-59.84 / Short interest (% of float): 0.1%; days to cover: 0.3

- Vir Biotechnology Inc (VIR), up 12.4% to $40.48 / YTD price return: +51.2% / 12-Month Price Range: $ 25.31-141.01

- Moderna Inc (MRNA), up 11.8% to $368.51 / YTD price return: +252.7% / 12-Month Price Range: $ 102.66-497.49

- Fisker Inc (FSR), up 11.6% to $22.08 / YTD price return: +50.7% / 12-Month Price Range: $ 9.61-31.96 / Short interest (% of float): 7.8%; days to cover: 1.3

BIGGEST LOSERS

- Vaxxinity Inc (VAXX), down 25.8% to $13.70 / 12-Month Price Range: $ 13.50-22.77 / Short interest (% of float): 0.4%; days to cover: 0.1 (the stock is currently on the short sale restriction list)

- LianBio (LIAN), down 16.1% to $13.43 / 12-Month Price Range: $ 12.99-16.37 / Short interest (% of float): 0.9%; days to cover: 1.6 (the stock is currently on the short sale restriction list)

- Global Blue Group Holding Ltd (GB), down 12.1% to $8.00 / YTD price return: -38.5% / 12-Month Price Range: $ 5.74-15.90 / Short interest (% of float): 0.7%; days to cover: 17.7 (the stock is currently on the short sale restriction list)

- Novavax Inc (NVAX), down 11.0% to $193.96 / YTD price return: +73.9% / 12-Month Price Range: $ 106.11-331.68 (the stock is currently on the short sale restriction list)

- Bright Health Group Inc (BHG), down 10.5% to $3.34 / 12-Month Price Range: $ 3.61-17.93 / Short interest (% of float): 1.3%; days to cover: 6.2 (the stock is currently on the short sale restriction list)

- Life Time Group Holdings Inc (LTH), down 9.8% to $19.96 / 12-Month Price Range: $ 15.81-23.37 / Short interest (% of float): 7.1%; days to cover: 1.9

- Jumia Technologies AG (JMIA), down 9.8% to $12.31 / YTD price return: -69.5% / 12-Month Price Range: $ 11.96-69.89 (the stock is currently on the short sale restriction list)

- Avidity Biosciences Inc (RNA), down 9.5% to $21.92 / 12-Month Price Range: $ 17.58-36.02 / Short interest (% of float): 11.6%; days to cover: 29.6 (the stock is currently on the short sale restriction list)

- Ventyx Biosciences Inc (VTYX), down 8.9% to $20.33 / 12-Month Price Range: $ 16.32-26.00 / Short interest (% of float): 1.4%; days to cover: 1.6 (the stock is currently on the short sale restriction list)

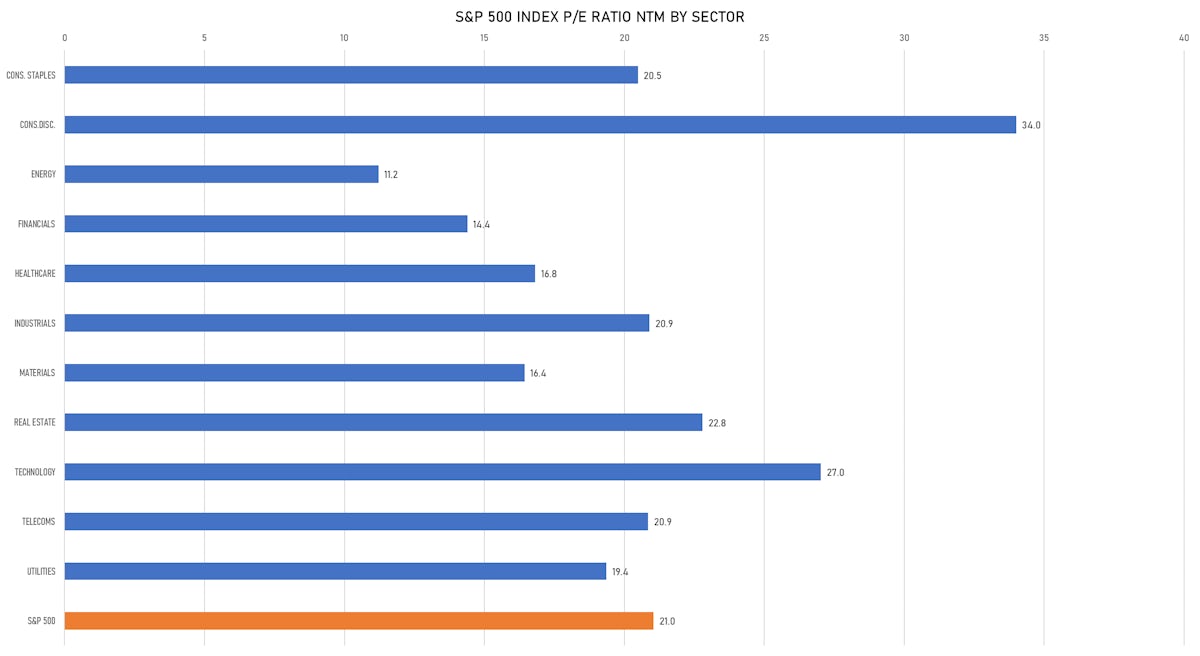

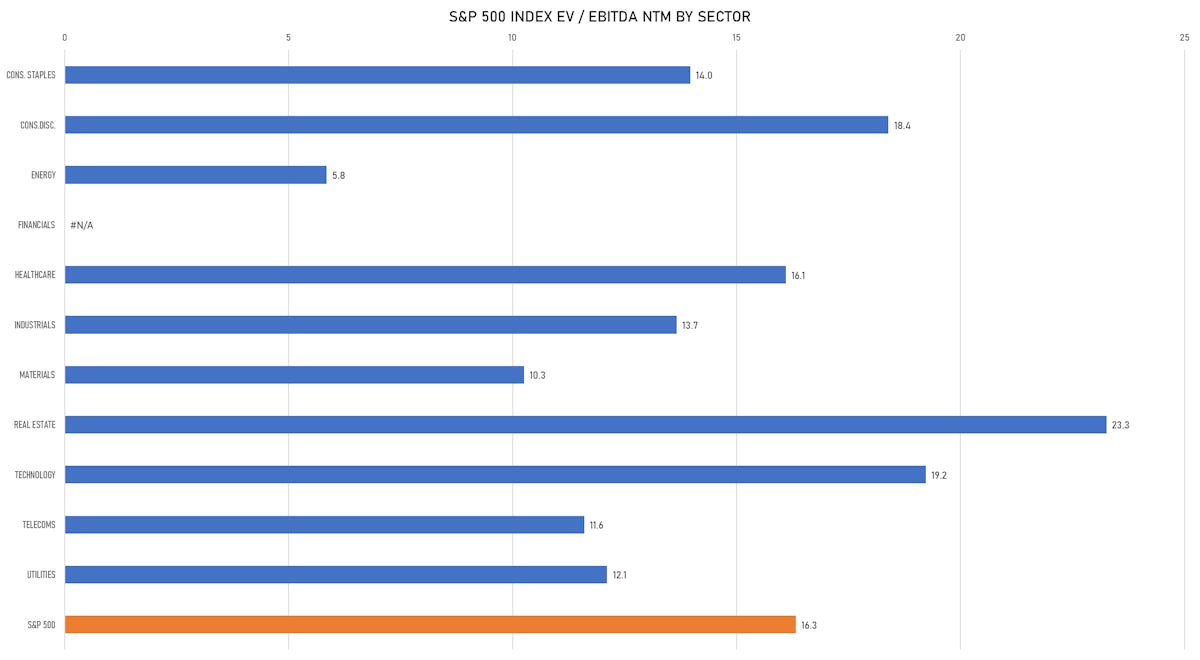

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Phoenix Motor Inc / United States of America - Industrials / Listing Exchange: Nasdaq / Ticker: PEV / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Maxim Group LLC

NEW FOLLOW-ONS / SECONDARIES

- Nippon Prologis REIT Inc / Japan - Real Estate / Listing Exchange: Tokyo / Ticker: 3283 / Gross proceeds (including overallotment): US$ 119.60m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd, Mizuho Securities Co Ltd, Goldman Sachs Japan Co., Ltd., Mitsubishi UFJ Morgan Stanley Securities Co Ltd, SMBC Nikko Securities Inc