Equities

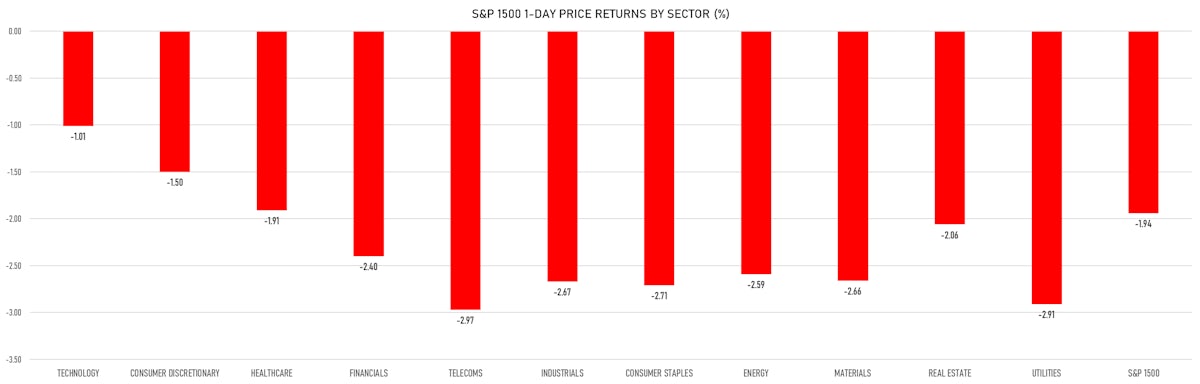

Broad Slide In US Equities As The S&P 1500 Falls 1.9%, Led Down By The Telecom And Utilies Sectors

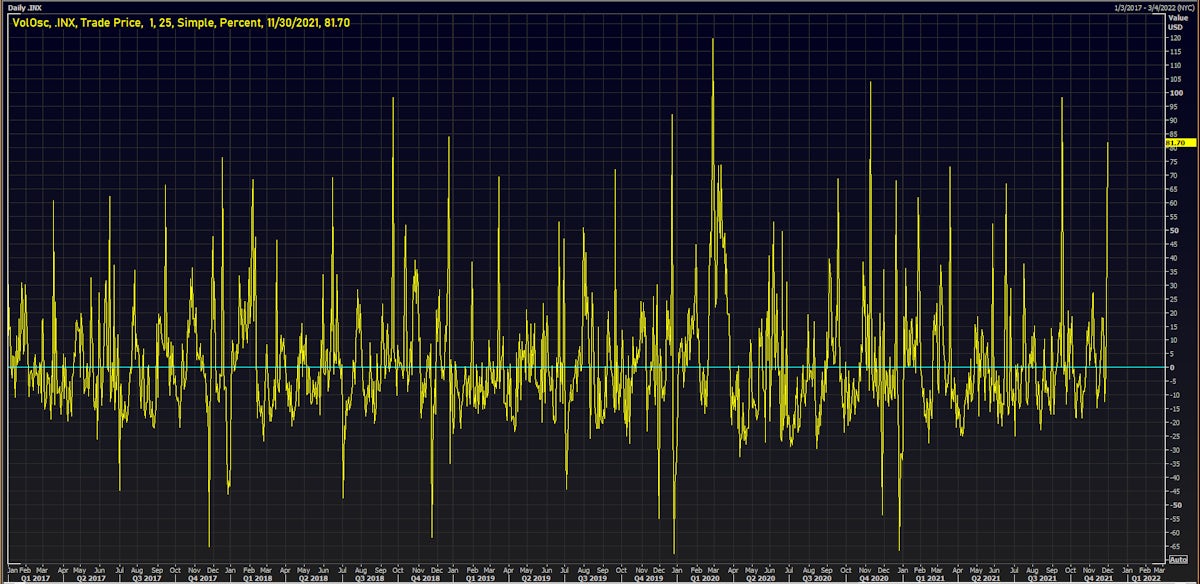

Huge volume of trading in US markets today, with close to 1.5 billion shares in S&P 500 stocks changing hands, 4.8 standard deviations above the 3-month average volume

Published ET

CME S&P 500 Index Volume Oscillator Over The Last 5 Years | Source: Refinitiv

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -1.90%; Nasdaq Composite down -1.55%; Wilshire 5000 down -1.98%

- 1.4% of S&P 500 stocks were up today, with 56.0% of stocks above their 200-day moving average (DMA) and 35.6% above their 50-DMA

- Top performing sectors in the S&P 500: technology down -0.96% and consumer discretionary down -1.42%

- Bottom performing sectors in the S&P 500: telecoms down -3.00% and utilities down -2.92%

- The number of shares in the S&P 500 traded today was 1,495m for a total turnover of US$ 174 bn

- The S&P 500 Value Index was down -2.4%, while the S&P 500 Growth Index was down -1.5%; the S&P small caps index was down -2.1% and mid caps were down -2.6%

- The volume on CME's INX (S&P 500 Index) was 4.1m (3-month z-score: 4.8); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 down -0.92%; UK FTSE 100 down -0.71%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index up 0.39%, Japan's TOPIX 500 up 0.82%

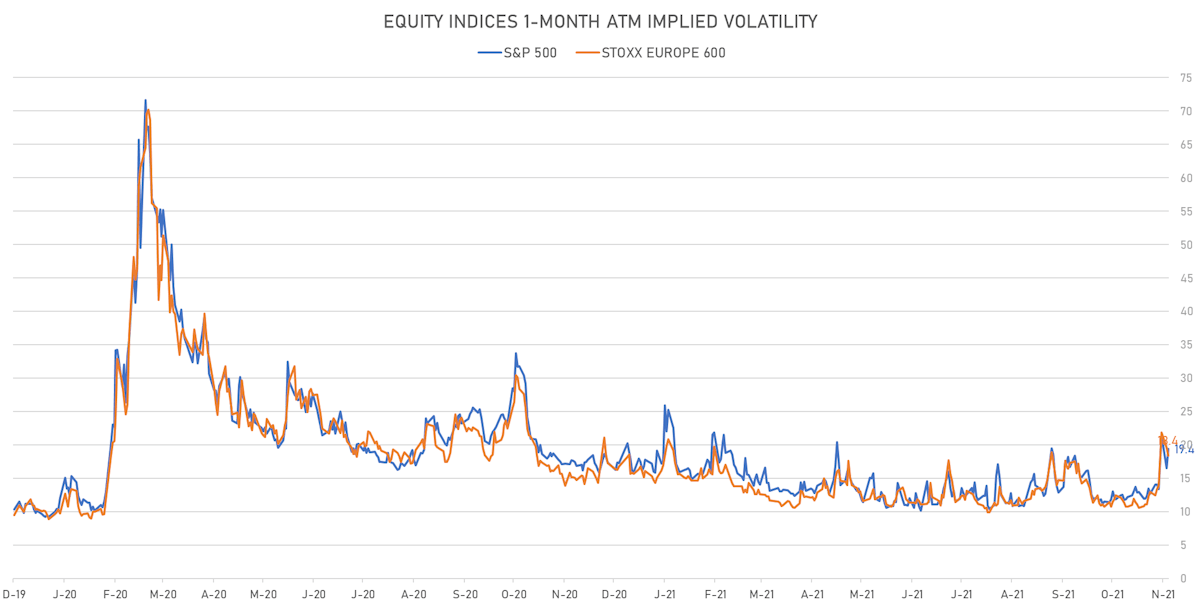

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 19.4%, up from 16.6%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 18.4%, down from 19.6%

NOTABLE US EARNINGS RELEASES

- Salesforce.Com Inc (CRM | Technology): beat EPS median estimate (1.27 act. vs. 0.92 est.) and beat revenue median estimate (6,863m act. vs. 6,790m est.), down -3.97% today, closed at 284.96 and at 297.90 (+4.54%) after hours

- Zscaler Inc (ZS | Technology): beat EPS median estimate (0.14 act. vs. 0.12 est.) and beat revenue median estimate (231m act. vs. 211m est.), down -2.51% today, closed at 346.97 and at 358.86 (+3.43%) after hours

- Globalfoundries Inc (GFS | Technology): beat EPS median estimate (0.07 act. vs. -0.02 est.) and beat revenue median estimate (1,700m act. vs. 1,698m est.), down -1.84% today, closed at 69.24 and at 70.98 (+2.51%) after hours

- NetApp Inc (NTAP | Technology): matched EPS median estimate (1.28 act. vs. 1.28 est.) and matched revenue median estimate (1,566m act. vs. 1,566m est.), down -2.88% today, closed at 88.88 and at 91.80 (+3.29%) after hours

- Hewlett Packard Enterprise Co (HPE | Technology): matched EPS median estimate (0.52 act. vs. 0.52 est.) and beat revenue median estimate (7,509m act. vs. 7,354m est.), down -1.78% today, closed at 14.35 and at 14.70 (+2.44%) after hours

- Informatica Inc (INFA | Technology): beat EPS median estimate (0.23 act. vs. 0.18 est.) and matched revenue median estimate (362m act. vs. 362m est.), down -6.42% today, closed at 32.19 and at 34.40 (+6.87%) after hours

- Ambarella Inc (AMBA | Technology): matched EPS median estimate (0.57 act. vs. 0.57 est.) and matched revenue median estimate (92m act. vs. 92m est.), down -1.28% today, closed at 179.52 and at 182.85 (+1.85%) after hours

TOP WINNERS

- ImmunoGen Inc (IMGN), up 29.9% to $6.17 / 12-Month Price Range: $ 4.73-10.88 / Short interest (% of float): 5.2%; days to cover: 6.6

- Immunitybio Inc (IBRX), up 21.9% to $7.79 / 12-Month Price Range: $ 5.78-45.42 / Short interest (% of float): 11.3%; days to cover: 10.3

- Vir Biotechnology Inc (VIR), up 17.1% to $47.42 / YTD price return: +77.1% / 12-Month Price Range: $ 25.31-141.01 / Short interest (% of float): 4.7%; days to cover: 6.5

- Crinetics Pharmaceuticals Inc (CRNX), up 14.3% to $27.32 / 12-Month Price Range: $ 12.60-28.78

- Century Therapeutics Inc (IPSC), up 12.1% to $19.11 / 12-Month Price Range: $ 16.29-32.90 / Short interest (% of float): 3.5%; days to cover: 19.5

- Intercorp Financial Services Inc (IFS), up 10.9% to $29.00 / YTD price return: -11.6% / 12-Month Price Range: $ 17.67-35.96 / Short interest (% of float): 0.1%; days to cover: 1.6

- Latham Group Inc (SWIM), up 9.9% to $25.77 / 12-Month Price Range: $ 12.69-34.73 / Short interest (% of float): 1.9%; days to cover: 4.0

- HUYA Inc (HUYA), up 9.5% to $8.61 / YTD price return: -56.8% / 12-Month Price Range: $ 7.50-36.33

- Caribou Biosciences Inc (CRBU), up 9.0% to $18.59 / 12-Month Price Range: $ 15.00-32.65 / Short interest (% of float): 2.8%; days to cover: 4.1

BIGGEST LOSERS

- TG Therapeutics Inc (TGTX), down 34.9% to $15.20 / YTD price return: -70.8% / 12-Month Price Range: $ 21.06-56.74 (the stock is currently on the short sale restriction list)

- Array Technologies Inc (ARRY), down 21.2% to $18.02 / YTD price return: -58.2% / 12-Month Price Range: $ 12.72-54.78 / Short interest (% of float): 7.5%; days to cover: 3.4 (the stock is currently on the short sale restriction list)

- Dillard's Inc (DDS), down 19.4% to $273.90 / YTD price return: +352.4% / 12-Month Price Range: $ 44.68-400.16 (the stock is currently on the short sale restriction list)

- RLX Technology Inc (RLX), down 18.9% to $4.11 / 12-Month Price Range: $ 3.70-35.00 / Short interest (% of float): 2.9%; days to cover: 2.7 (the stock is currently on the short sale restriction list)

- Dada Nexus Ltd (DADA), down 15.4% to $18.07 / YTD price return: -50.5% / 12-Month Price Range: $ 17.57-61.27 (the stock is currently on the short sale restriction list)

- Stonex Group Inc (SNEX), down 14.6% to $56.18 / YTD price return: -3.0% / 12-Month Price Range: $ 50.02-72.34 (the stock is currently on the short sale restriction list)

- Discovery Inc (DISCB), down 12.5% to $35.02 / YTD price return: +8.1% / 12-Month Price Range: $ 30.03-150.72 / Short interest (% of float): 0.7%; days to cover: 0.2

- Nerdwallet Inc (NRDS), down 12.4% to $18.08 / 12-Month Price Range: $ 20.50-34.44 / Short interest (% of float): 0.9%; days to cover: 0.1 (the stock is currently on the short sale restriction list)

- ZoomInfo Technologies Inc (ZI), down 11.7% to $61.70 / YTD price return: +27.9% / 12-Month Price Range: $ 37.86-79.17 / Short interest (% of float): 2.3%; days to cover: 2.1 (the stock is currently on the short sale restriction list)

- Newegg Commerce Inc (NEGG), down 10.9% to $18.43 / YTD price return: +344.1% / 12-Month Price Range: $ 3.82-79.07 / Short interest (% of float): 17.9%; days to cover: 1.1 (the stock is currently on the short sale restriction list)

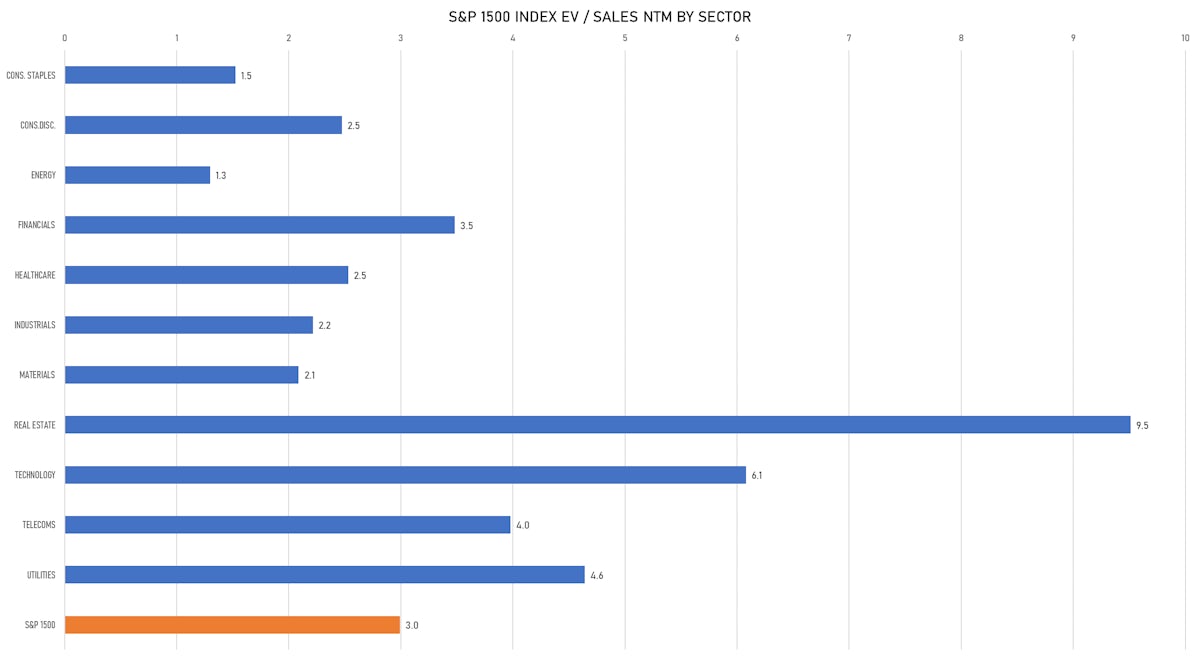

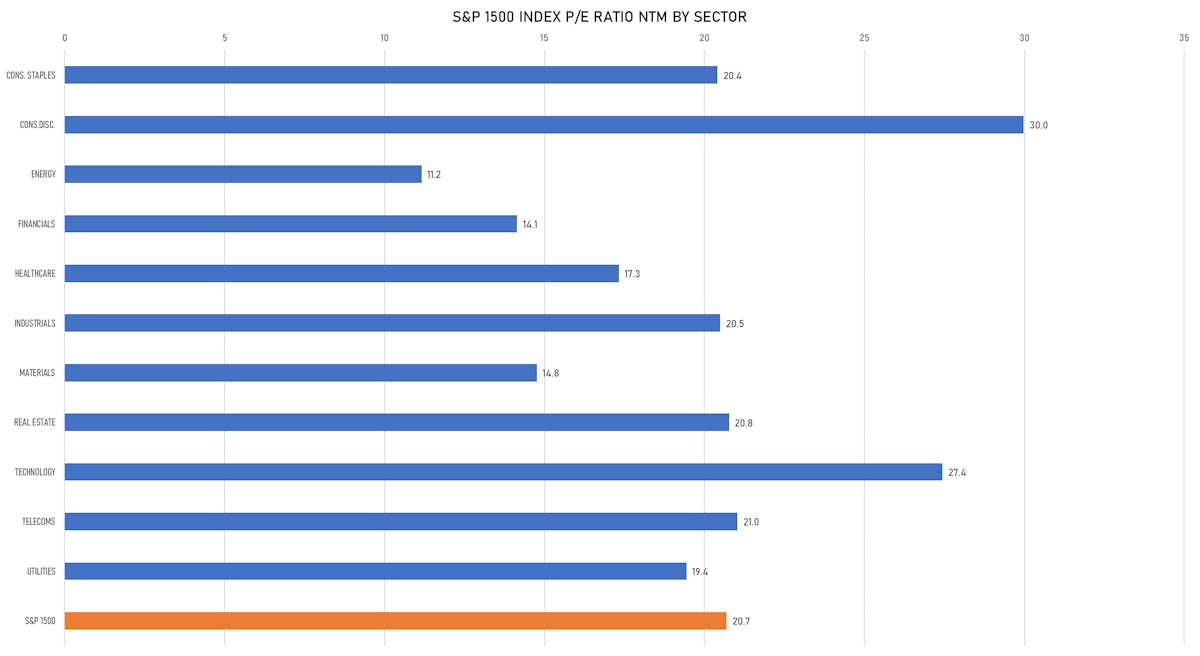

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Viva Wine Group AB / Sweden - Consumer Staples / Listing Exchange: FirNoStock / Ticker: N/A / Gross proceeds (including overallotment): US$ 132.46m (offering in Swedish Krona) / Bookrunners: Skandinaviska Enskilda Banken AB, ABG Sundal Collier

NEW FOLLOW-ONS / SECONDARIES

- Intuit Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: INTU / Gross proceeds (including overallotment): US$ 1,036.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co

- Krystal Biotech Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: KRYS / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, Goldman Sachs & Co, William Blair & Co, Bofa Securities Inc

- PT Bank Kb Bukopin Tbk / Indonesia - Financials / Listing Exchange: Indonesia / Ticker: BBKP / Gross proceeds (including overallotment): US$ 491.82m (offering in Indonesian Rupiah) / Bookrunners: Not Applicable

- GUD Holdings Ltd / Australia - Industrials / Listing Exchange: Australia / Ticker: GUD / Gross proceeds (including overallotment): US$ 203.58m (offering in Australian Dollar) / Bookrunners: Citigroup Global Markets Australia, Macquarie Capital (Australia) Ltd

- Sanwei Holding Group Co Ltd / China - Industrials / Listing Exchange: Shanghai / Ticker: 603033 / Gross proceeds (including overallotment): US$ 156.56m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- BeiGene Ltd (Biotechnology | Beijing, China (Mainland)), raised US$ 3,482 M, placing 115 M class a ordinary shares. Financial advisors on the transaction: China International Capital Corp, CITIC Securities Co Ltd, Guotai Junan Securities, Goldman Sachs Gao Hua, J.P. Morgan Securities (China) Co Ltd