Equities

US Stocks Opened Higher, Turned Around Midday And Fell Hard Into The Close

Some reported that an omicron case in California was the cause of the slide, but it sounds like a weak explanation at best; fund managers are more likely to be booking some gains to crystallize the solid YTD performance in US equities

Published ET

S&P 500 Index (INX) Performance Intraday | Source: Refinitiv

QUICK SUMMARY

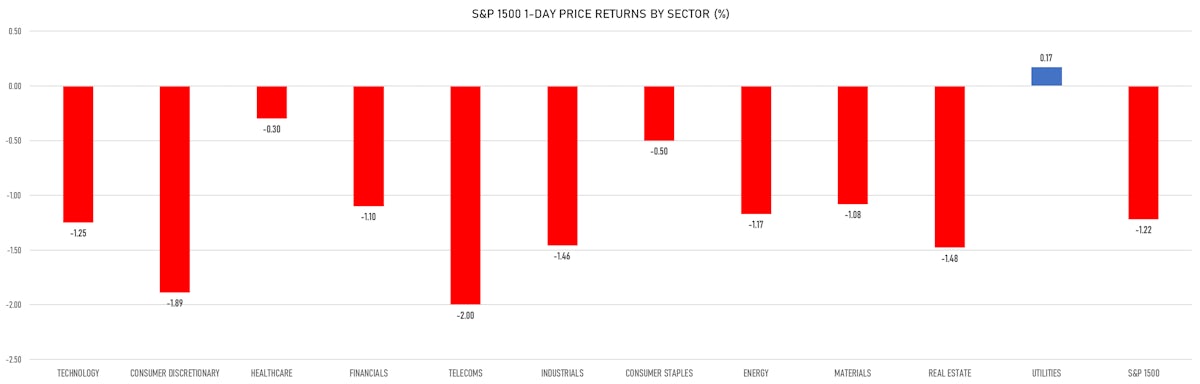

- Daily performance of US indices: S&P 500 down -1.18%; Nasdaq Composite down -1.83%; Wilshire 5000 down -1.62%

- 19.8% of S&P 500 stocks were up today, with 52.1% of stocks above their 200-day moving average (DMA) and 29.1% above their 50-DMA

- Top performing sectors in the S&P 500: utilities up 0.16% and healthcare down -0.19%

- Bottom performing sectors in the S&P 500: telecoms down -1.98% and consumer discretionary down -1.86%

- The number of shares in the S&P 500 traded today was 760m for a total turnover of US$ 94 bn

- The S&P 500 Value Index was down -0.9%, while the S&P 500 Growth Index was down -1.4%; the S&P small caps index was down -1.5% and mid caps were down -1.6%

- The volume on CME's INX (S&P 500 Index) was 3.0m (3-month z-score: 2.2); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 up 1.71%; UK FTSE 100 up 1.55%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index up 0.02%, Japan's TOPIX 500 down -0.49%

VOLATILITY

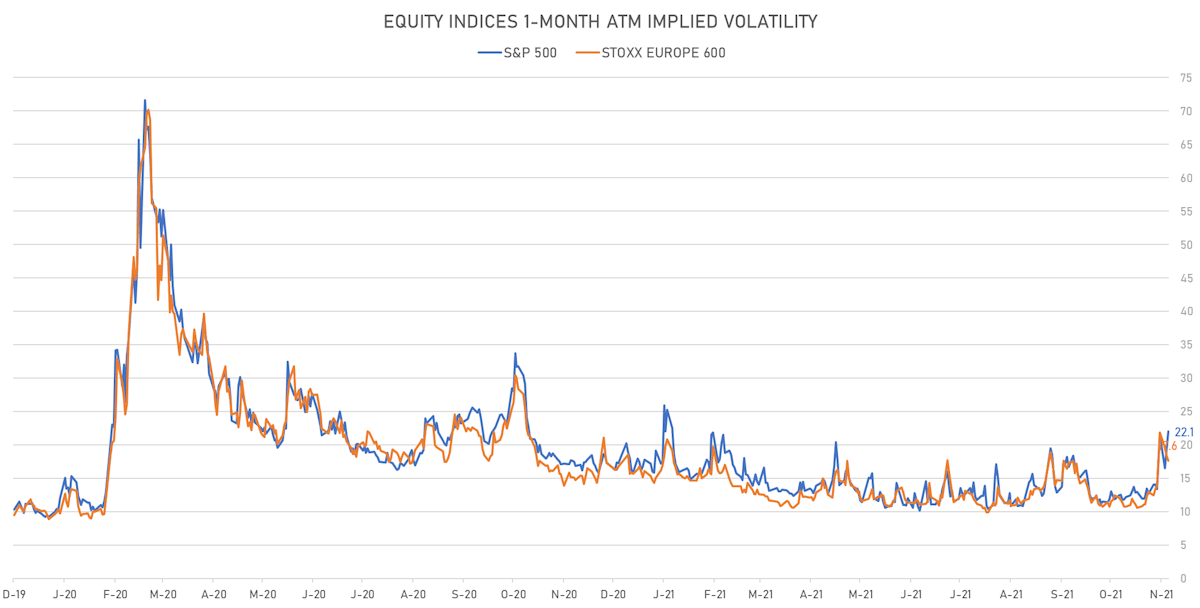

- 1-month at-the-money implied volatility on the S&P 500 at 22.1%, up from 19.4%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 17.6%, down from 18.4%

NOTABLE US EARNINGS RELEASES

- Snowflake Inc. (SNOW | Technology): beat EPS median estimate (0.04 act. vs. -0.06 est.) and beat revenue median estimate (334m act. vs. 305m est.), down -8.57% today, closed at 311.00 and at 340.88 (+9.61%) after hours

- Synopsys Inc (SNPS | Technology): matched EPS median estimate (1.82 act. vs. 1.82 est.) and matched revenue median estimate (1,152m act. vs. 1,152m est.), down -1.83% today, closed at 334.75 and at 345.86 (+3.32%) after hours

- CrowdStrike Holdings Inc (CRWD | Technology): beat EPS median estimate (0.17 act. vs. 0.10 est.) and beat revenue median estimate (380m act. vs. 363m est.), down -7.20% today, closed at 201.50 and at 219.70 (+9.03%) after hours

- Veeva Systems Inc (VEEV | Healthcare): matched EPS median estimate (0.97 act. vs. 0.97 est.) and matched revenue median estimate (476m act. vs. 476m est.), down -3.70% today, closed at 272.12 and at 283.74 (+4.27%) after hours

- Okta Inc (OKTA | Technology): beat EPS median estimate (-0.07 act. vs. -0.24 est.) and beat revenue median estimate (351m act. vs. 326m est.), down -7.97% today, closed at 198.08 and at 217.59 (+9.85%) after hours

- Splunk Inc (SPLK | Technology): beat EPS median estimate (-0.37 act. vs. -0.49 est.) and beat revenue median estimate (665m act. vs. 644m est.), down -7.69% today, closed at 111.70 and at 122.50 (+9.67%) after hours

- Five Below Inc (FIVE | Consumer Cyclicals): matched EPS median estimate (0.43 act. vs. 0.43 est.) and matched revenue median estimate (608m act. vs. 608m est.), down -7.00% today, closed at 189.19 and at 204.43 (+8.06%) after hours

- PVH Corp (PVH | Consumer Cyclicals): beat EPS median estimate (2.67 act. vs. 2.04 est.) and missed revenue median estimate (2,333m act. vs. 2,413m est.), down -1.58% today, closed at 105.09 and at 107.51 (+2.30%) after hours

- Donaldson Company Inc (DCI | Industrials): beat EPS median estimate (0.61 act. vs. 0.56 est.) and beat revenue median estimate (761m act. vs. 748m est.), down -1.91% today, closed at 55.35 and at 56.43 (+1.95%) after hours

- nCino Inc (NCNO | Technology): matched EPS median estimate (-0.04 act. vs. -0.04 est.) and matched revenue median estimate (70m act. vs. 70m est.), down -4.86% today, closed at 59.10 and at 62.25 (+5.33%) after hours

- Semtech Corp (SMTC | Technology): beat EPS median estimate (0.74 act. vs. 0.72 est.) and beat revenue median estimate (195m act. vs. 193m est.), up 1.19% today, closed at 86.69 and at 87.00 (+0.36%) after hours

TOP WINNERS

- Roivant Sciences Ltd (ROIV), up 34.1% to $8.89 / YTD price return: -12.6% / 12-Month Price Range: $ 5.80-10.87 / Short interest (% of float): 0.4%; days to cover: 2.8

- GCP Applied Technologies Inc (GCP), up 14.1% to $26.64 / YTD price return: +12.6% / 12-Month Price Range: $ 20.76-27.78 / Short interest (% of float): 1.3%; days to cover: 3.9

- Ambarella Inc (AMBA), up 14.1% to $204.89 / YTD price return: +123.1% / 12-Month Price Range: $ 77.06-207.00

- Box Inc (BOX), up 10.3% to $25.81 / YTD price return: +43.0% / 12-Month Price Range: $ 16.62-27.41 / Short interest (% of float): 6.7%; days to cover: 4.9

- ImmunoGen Inc (IMGN), up 9.7% to $6.77 / YTD price return: +5.0% / 12-Month Price Range: $ 4.73-10.88 / Short interest (% of float): 5.2%; days to cover: 6.6

- Vertex Pharmaceuticals Inc (VRTX), up 9.7% to $205.00 / YTD price return: -13.3% / 12-Month Price Range: $ 176.36-242.99

- Grupo Financiero Galicia SA (GGAL), up 8.6% to $9.43 / YTD price return: +7.9% / 12-Month Price Range: $ 7.00-12.75

- Stonex Group Inc (SNEX), up 8.0% to $60.69 / YTD price return: +4.8% / 12-Month Price Range: $ 50.02-72.34 / Short interest (% of float): 0.7%; days to cover: 3.5

- Banco Macro SA (BMA), up 7.8% to $14.30 / YTD price return: -8.2% / 12-Month Price Range: $ 12.24-21.20 / Short interest (% of float): 1.5%; days to cover: 1.3

BIGGEST LOSERS

- Allbirds Inc (BIRD), down 16.5% to $16.06 / 12-Month Price Range: $ 18.33-32.44 / Short interest (% of float): 2.2%; days to cover: 0.4 (the stock is currently on the short sale restriction list)

- AMC Entertainment Holdings Inc (AMC), down 15.8% to $28.57 / YTD price return: +1,247.6% / 12-Month Price Range: $ 1.91-72.62 (the stock is currently on the short sale restriction list)

- Immunitybio Inc (IBRX), down 15.8% to $6.56 / YTD price return: -50.8% / 12-Month Price Range: $ 5.78-45.42 / Short interest (% of float): 11.3%; days to cover: 10.3 (the stock is currently on the short sale restriction list)

- Sprout Social Inc (SPT), down 15.2% to $94.67 / YTD price return: +108.5% / 12-Month Price Range: $ 44.30-145.42 (the stock is currently on the short sale restriction list)

- Couchbase Inc (BASE), down 14.5% to $28.25 / 12-Month Price Range: $ 27.23-52.26 / Short interest (% of float): 7.8%; days to cover: 10.3 (the stock is currently on the short sale restriction list)

- Sweetgreen Inc (SG), down 14.5% to $32.66 / 12-Month Price Range: $ 37.50-56.20 (the stock is currently on the short sale restriction list)

- Youdao Inc (DAO), down 14.4% to $13.58 / YTD price return: -48.8% / 12-Month Price Range: $ 7.02-42.17 / Short interest (% of float): 3.9%; days to cover: 5.3 (the stock is currently on the short sale restriction list)

- FLEX LNG Ltd (FLNG), down 14.0% to $20.80 / 12-Month Price Range: $ 7.50-25.44 / Short interest (% of float): 0.2%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- Udemy Inc (UDMY), down 13.8% to $23.71 / 12-Month Price Range: $ 25.24-32.62 / Short interest (% of float): 0.9%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- Krystal Biotech Inc (KRYS), down 13.5% to $69.68 / 12-Month Price Range: $ 38.86-102.99 / Short interest (% of float): 12.4%; days to cover: 12.3 (the stock is currently on the short sale restriction list)

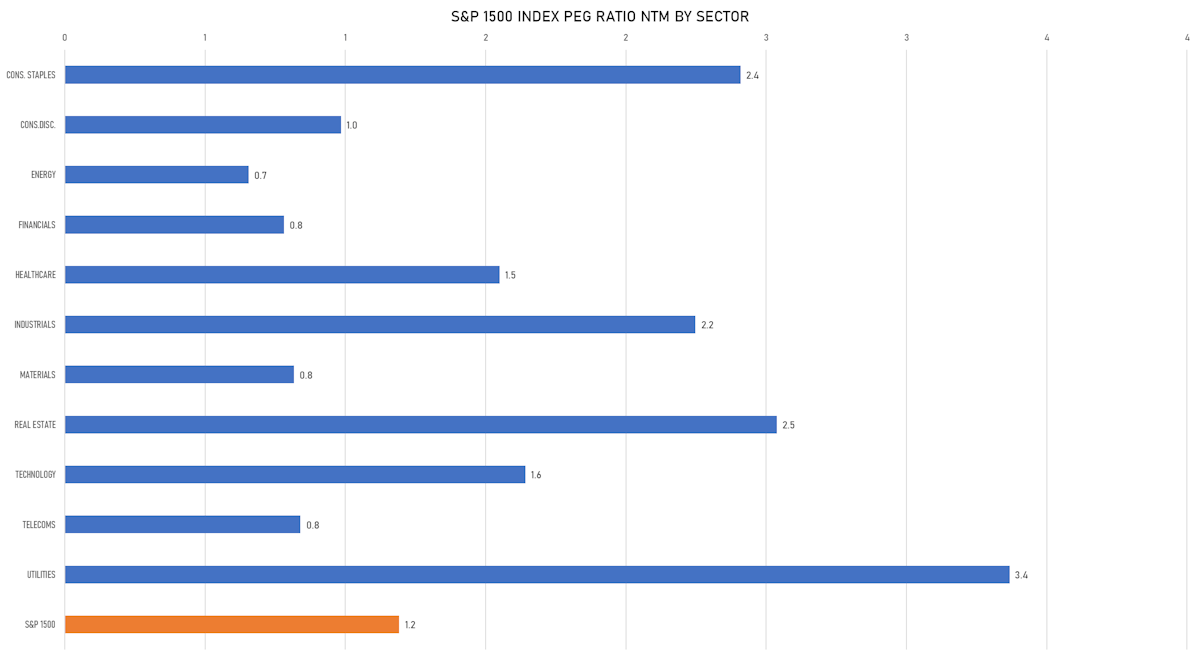

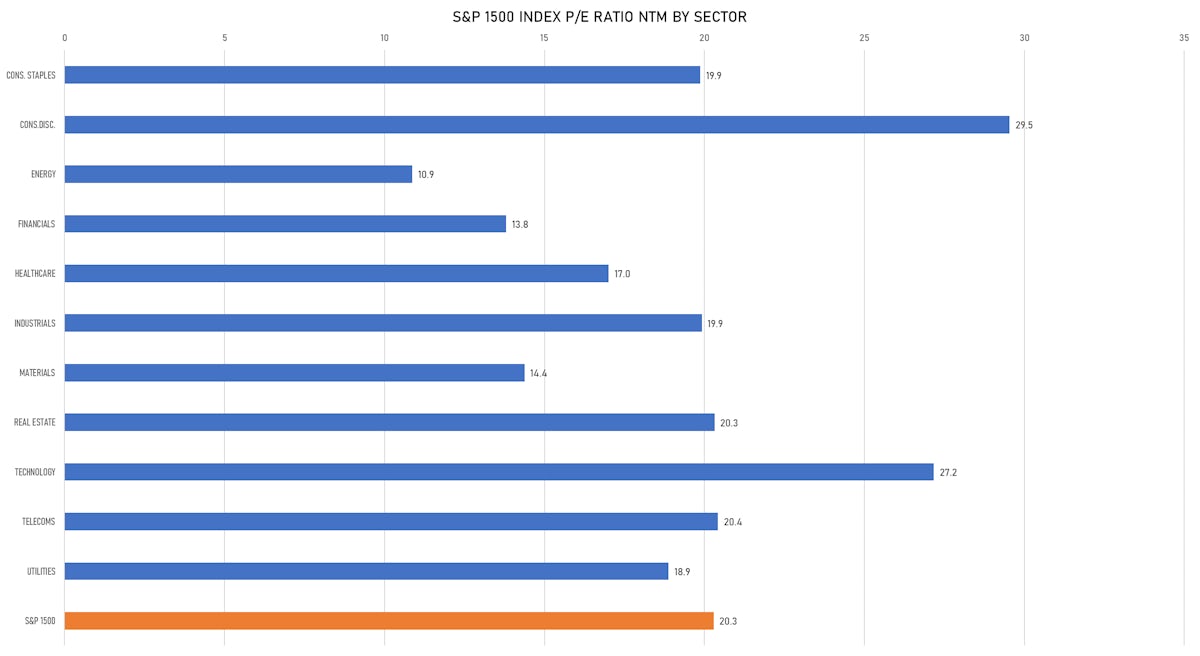

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Proof Acquisition Corp I / United States of America - Financials / Listing Exchange: New York / Ticker: PACI.U / Gross proceeds (including overallotment): US$ 276.00m (offering in U.S. Dollar) / Bookrunners: BofA Securities Inc

- Cloud Village Inc / China - Media and Entertainment / Listing Exchange: Hong Kong / Ticker: 9899 / Gross proceeds (including overallotment): US$ 349.97m (offering in Hong Kong Dollar) / Bookrunners: Hongkong & Shanghai Banking Corp Ltd, BOCI Asia Ltd, Merrill Lynch (Asia Pacific) Ltd, Citigroup Global Markets Ltd, CCB International Capital Ltd, CMB International Capital Corp, Credit Suisse (Hong Kong) Ltd, China International Capital Corp HK Securities Ltd, ICBC International Capital Ltd, Huatai Financial holdings (Hong Kong) Ltd, ABCI Capital Ltd, US Tiger Securities Inc

- Winton Property Ltd / New Zealand - Industrials / Listing Exchange: NewZealand / Ticker: N/A / Gross proceeds (including overallotment): US$ 170.48m (offering in New Zealand Dollar) / Bookrunners: Not Applicable

NEW FOLLOW-ONS / SECONDARIES

- Krystal Biotech Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: KRYS / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, Goldman Sachs & Co, William Blair & Co, BofA Securities Inc

- ImmunoGen Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: IMGN / Gross proceeds (including overallotment): US$ 175.00m (offering in U.S. Dollar) / Bookrunners: Guggenheim Securities LLC, Cowen & Co, Jefferies LLC

- Kite Realty Group Trust / United States of America - Real Estate / Listing Exchange: New York / Ticker: KRG / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Liontown Resources Ltd / Australia - Materials / Listing Exchange: Australia / Ticker: LTR / Gross proceeds (including overallotment): US$ 319.68m (offering in Australian Dollar) / Bookrunners: Bell Potter Securities Ltd, Macquarie Capital (Australia) Ltd, Barrenjoey Capital Partners Group Pty Ltd

- Ferrotec Holdings Corp / Japan - High Technology / Listing Exchange: Jasdaq Std / Ticker: 6890 / Gross proceeds (including overallotment): US$ 181.71m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd

- Shandong Lukang Pharmaceutical Co Ltd / China - Healthcare / Listing Exchange: Shanghai / Ticker: 600789 / Gross proceeds (including overallotment): US$ 123.44m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- GUD Holdings Ltd / Australia - Industrials / Listing Exchange: Australia / Ticker: GUD / Gross proceeds (including overallotment): US$ 121.17m (offering in Australian Dollar) / Bookrunners: Citigroup Global Markets Australia, Macquarie Capital (Australia) Ltd