Equities

Broad, Solid Rebound In US Equities, With 91% Of S&P 500 Constituents Closing Up

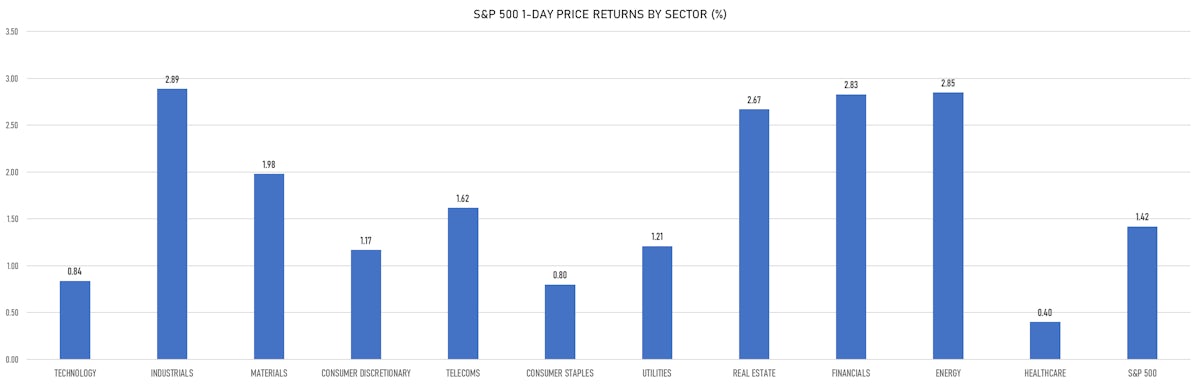

All sectors rose today, led by industrials and energy stocks; value and small-cap stocks overperformed widely growth and large caps after underperforming over the past week

Published ET

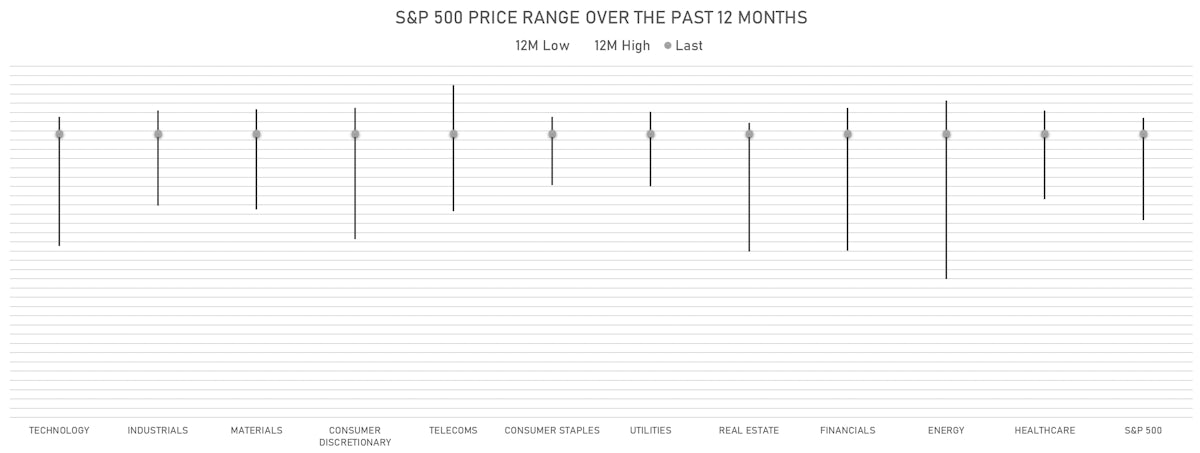

12-Month Range Of Prices For S&P 500 Sub Indices | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 1.42%; Nasdaq Composite up 0.83%; Wilshire 5000 up 1.57%

- 90.7% of S&P 500 stocks were up today, with 59.4% of stocks above their 200-day moving average (DMA) and 42.6% above their 50-DMA

- Top performing sectors in the S&P 500: industrials up 2.89% and energy up 2.85%

- Bottom performing sectors in the S&P 500: healthcare up 0.40% and consumer staples up 0.80%

- The number of shares in the S&P 500 traded today was 770m for a total turnover of US$ 94 bn

- The S&P 500 Value Index was up 2.1%, while the S&P 500 Growth Index was up 0.9%; the S&P small caps index was up 2.8% and mid-caps were up 2.7%

- The volume on CME's INX (S&P 500 Index) was 2.8m (3-month z-score: 1.5); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 down -1.15%; UK FTSE 100 down -0.55%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -0.73%, Japan's TOPIX 500 up 0.49%

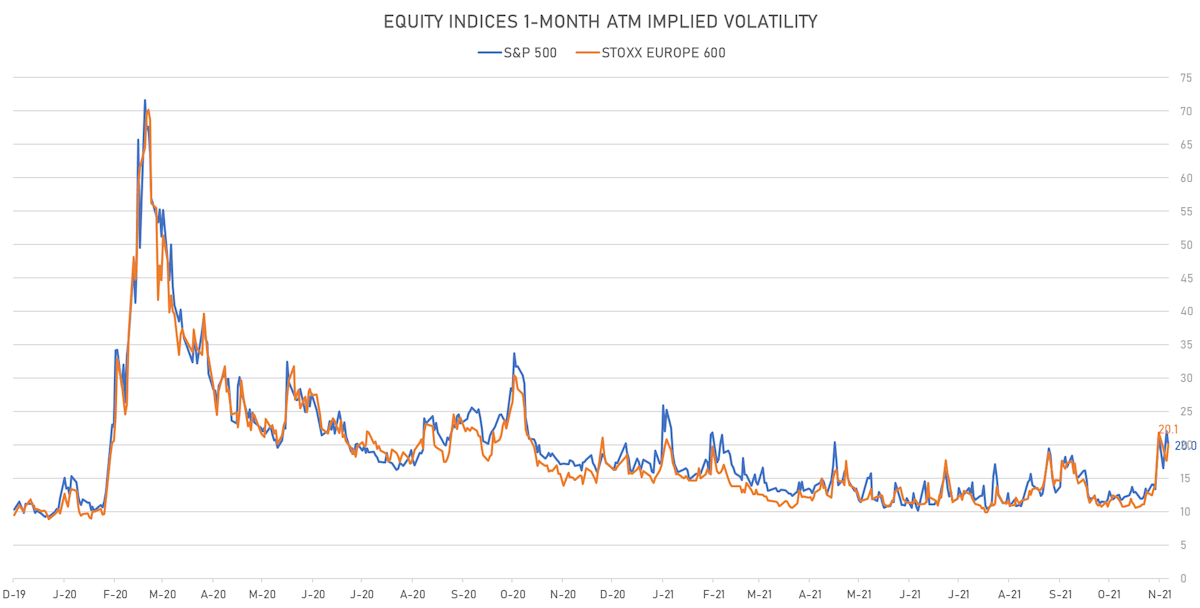

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 20.0%, down from 22.1%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 20.1%, up from 17.6%

NOTABLE US EARNINGS RELEASES

- Marvell Technology Inc (MRVL | Technology): matched EPS median estimate (0.43 act. vs. 0.43 est.) and matched revenue median estimate (1,211m act. vs. 1,211m est.), up 0.11% today, closed at 71.03 and at 71.60 (+0.80%) after hours

- Dollar General Corp (DG | Consumer Cyclicals): beat EPS median estimate (2.08 act. vs. 2.03 est.) and beat revenue median estimate (8,518m act. vs. 8,484m est.), down -3.13% today, closed at 215.81 and at 223.00 (+3.33%) after hours

- DocuSign Inc (DOCU | Technology): beat EPS median estimate (0.58 act. vs. 0.45 est.) and beat revenue median estimate (545m act. vs. 530m est.), up 1.31% today, closed at 233.82 and at 233.10 (-0.31%) after hours

- Kroger Co (KR | Consumer Non-Cyclicals): beat EPS median estimate (0.78 act. vs. 0.67 est.) and beat revenue median estimate (31,860m act. vs. 31,326m est.), up 11.04% today, closed at 44.65 and at 40.80 (-8.62%) after hours

- Ulta Beauty Inc (ULTA | Consumer Cyclicals): missed EPS median estimate (3.93 act. vs. 3.94 est.) and matched revenue median estimate (1,996m act. vs. 1,996m est.), up 3.68% today, closed at 383.64 and at 374.00 (-2.51%) after hours

- Cooper Companies Inc (COO | Healthcare): missed EPS median estimate (3.28 act. vs. 3.38 est.) and beat revenue median estimate (759m act. vs. 749m est.), up 1.18% today, closed at 377.95 and at 373.53 (-1.17%) after hours

- Asana Inc (ASAN | Technology): matched EPS median estimate (-0.23 act. vs. -0.23 est.) and matched revenue median estimate (100m act. vs. 100m est.), up 1.16% today, closed at 91.00 and at 91.40 (+0.44%) after hours

- Guidewire Software Inc (GWRE | Technology): beat EPS median estimate (-0.21 act. vs. -0.22 est.) and matched revenue median estimate (166m act. vs. 166m est.), up 3.77% today, closed at 117.18 and at 112.92 (-3.64%) after hours

- Smartsheet Inc (SMAR | Technology): beat EPS median estimate (-0.03 act. vs. -0.11 est.) and beat revenue median estimate (145m act. vs. 139m est.), up 2.81% today, closed at 61.16 and at 60.10 (-1.73%) after hours

TOP WINNERS

- Bird Global Inc (BRDS), up 22.2% to $8.16 / 12-Month Price Range: $ 5.80-11.32

- Day One Biopharmaceuticals Inc (DAWN), up 17.7% to $19.33 / 12-Month Price Range: $ 16.13-28.70 / Short interest (% of float): 4.5%; days to cover: 36.5

- Snowflake Inc. (SNOW), up 15.8% to $360.28 / YTD price return: +28.0% / 12-Month Price Range: $ 184.71-429.00 / Short interest (% of float): 2.6% (the stock is currently on the short sale restriction list)

- Aurinia Pharmaceuticals Inc (AUPH), up 13.3% to $20.14 / YTD price return: +45.6% / 12-Month Price Range: $ 9.72-33.97 / Short interest (% of float): 9.1%; days to cover: 2.3

- Lifestance Health Group Inc (LFST), up 12.9% to $8.92 / 12-Month Price Range: $ 7.64-29.81 / Short interest (% of float): 5.7%; days to cover: 4.4

- CLARIVATE PLC (CLVT), up 12.6% to $25.22 / YTD price return: -15.1% / 12-Month Price Range: $ 20.31-34.79 / Short interest (% of float): 7.5%; days to cover: 8.0

- Okta Inc (OKTA), up 11.7% to $221.18 / YTD price return: -13.0% / 12-Month Price Range: $ 196.78-294.00 / Short interest (% of float): 4.9%; days to cover: 6.3

- Mechel PAO (MTL_p), up 11.3% to $1.78 / 12-Month Price Range: $ .39-2.43

- Kroger Co (KR), up 11.0% to $44.65 / YTD price return: +40.6% / 12-Month Price Range: $ 30.35-47.99 / Short interest (% of float): 4.9%; days to cover: 6.6

- Nuvalent Inc (NUVL), up 10.9% to $20.90 / 12-Month Price Range: $ 17.00-40.82 / Short interest (% of float): 3.6%; days to cover: 24.1

BIGGEST LOSERS

- Novavax Inc (NVAX), down 15.9% to $161.97 / YTD price return: +45.3% / 12-Month Price Range: $ 106.11-331.68 / Short interest (% of float): 11.5%; days to cover: 1.6 (the stock is currently on the short sale restriction list)

- nCino Inc (NCNO), down 15.6% to $49.88 / YTD price return: -31.1% / 12-Month Price Range: $ 48.00-90.22 / Short interest (% of float): 4.5%; days to cover: 10.1 (the stock is currently on the short sale restriction list)

- Elastic NV (ESTC), down 15.0% to $118.28 / YTD price return: -19.1% / 12-Month Price Range: $ 97.89-189.84 (the stock is currently on the short sale restriction list)

- Vaxxinity Inc (VAXX), down 14.5% to $9.35 / 12-Month Price Range: $ 10.73-22.77 / Short interest (% of float): 0.4%; days to cover: 0.1 (the stock is currently on the short sale restriction list)

- PureTech Health PLC (PRTC), down 14.2% to $37.37 / 12-Month Price Range: $ 41.00-65.90 / Short interest days to cover: 0.2 (the stock is currently on the short sale restriction list)

- LianBio (LIAN), down 13.7% to $10.31 / 12-Month Price Range: $ 11.63-16.37 / Short interest (% of float): 0.9%; days to cover: 1.6 (the stock is currently on the short sale restriction list)

- Daqo New Energy Corp (DQ), down 11.3% to $48.21 / YTD price return: -16.0% / 12-Month Price Range: $ 37.02-130.33 / Short interest (% of float): 5.4%; days to cover: 2.3 (the stock is currently on the short sale restriction list)

- C3Ai Inc (AI), down 11.2% to $30.04 / YTD price return: -78.3% / 12-Month Price Range: $ 33.73-183.90 / Short interest (% of float): 16.1%; days to cover: 6.1 (the stock is currently on the short sale restriction list)

- Hut 8 Mining Corp (HUT), down 11.0% to $10.49 / 12-Month Price Range: $ 1.12-16.57 / Short interest (% of float): 7.4%; days to cover: 0.7 (the stock is currently on the short sale restriction list)

- Burning Rock Biotech Ltd (BNR), down 10.5% to $12.98 / YTD price return: -43.8% / 12-Month Price Range: $ 12.24-39.75 / Short interest (% of float): 2.2%; days to cover: 6.7 (the stock is currently on the short sale restriction list)

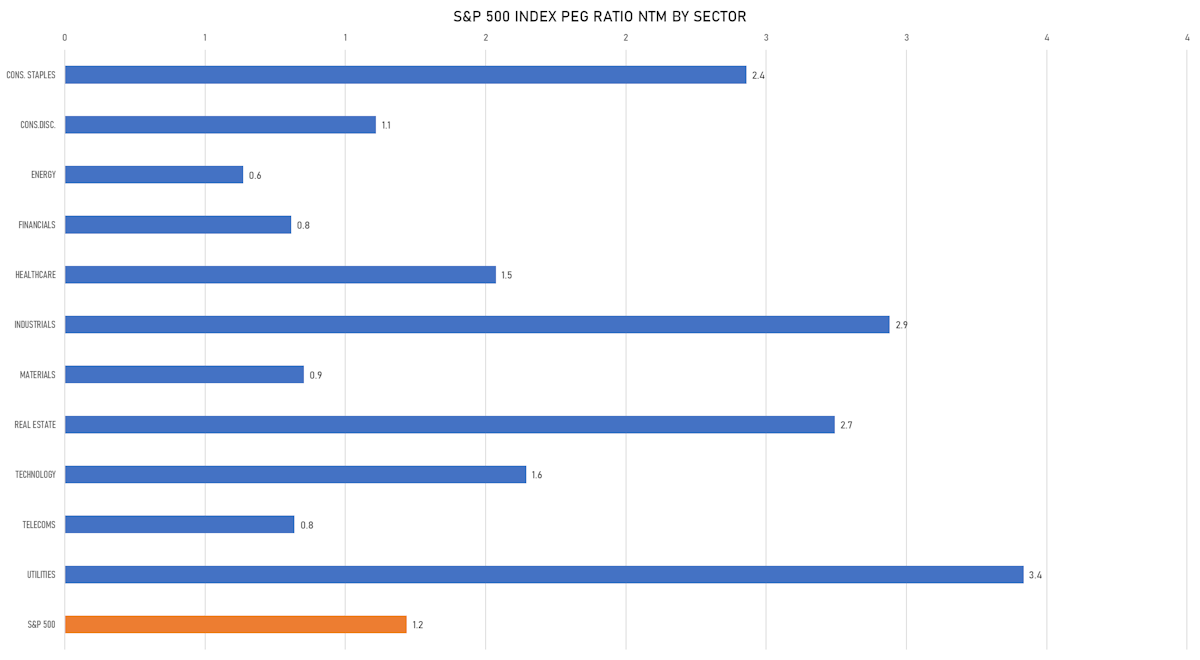

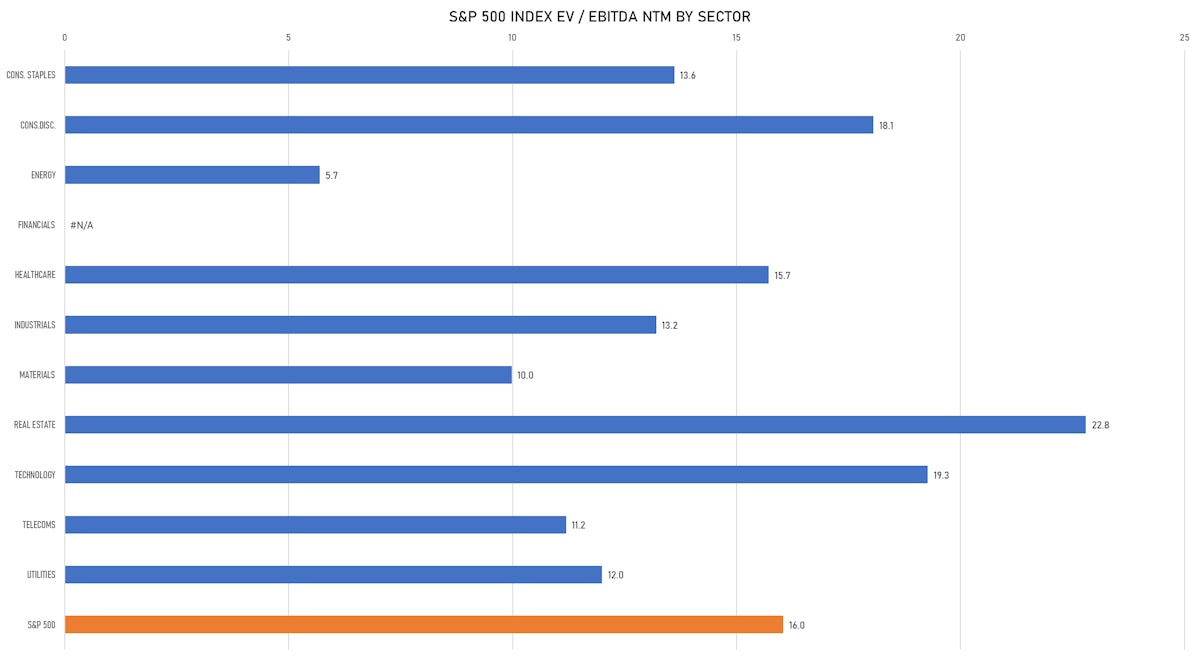

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- UTA Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: UTAAU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Credit Suisse Securities (USA) LLC

- ROC Energy Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: ROCAU / Gross proceeds (including overallotment): US$ 180.00m (offering in U.S. Dollar) / Bookrunners: Earlybirdcapital Inc

- EPIC Acquisition Corp / United Kingdom - Financials / Listing Exchange: EuronextAM / Ticker: EPIC / Gross proceeds (including overallotment): US$ 169.79m (offering in EURO) / Bookrunners: JP Morgan Securities Plc

- Goodwill E-Health Info Co Ltd (Healthcare Equipment & Supplies | Beijing, China (Mainland)), raised US$ 214 M, placing 34 M class a ordinary shares. Financial advisors on the transaction: Huatai United Securities Co Ltd

NEW SECONDARIES / FOLLOW-ONS

- Krystal Biotech Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: KRYS / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, Goldman Sachs & Co, William Blair & Co, Bofa Securities Inc

- Kite Realty Group Trust / United States of America - Real Estate / Listing Exchange: New York / Ticker: KRG / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Weibo Corp / China - High Technology / Listing Exchange: Hong Kong / Ticker: WB / Gross proceeds (including overallotment): US$ 346.57m (offering in Hong Kong Dollar) / Bookrunners: Nomura International (Hong Kong) Ltd, Goldman Sachs (Asia), Deutsche Bank AG (Hong Kong), CLSA Asia-Pacific Markets Ltd, CMB International Capital Corp, Credit Suisse (Hong Kong) Ltd, China International Capital Corp HK Securities Ltd, Huatai Financial holdings (Hong Kong) Ltd, Haitong International Securities Co Ltd, ABCI Capital Ltd, Valuable Capital Ltd, CMBC Securities Co Ltd

- Sinch AB (IT Consulting & Services | Stockholm, Sweden), raised US$ 739 M, placing 40 M ordinary or common shares. Financial advisors on the transaction: Not Applicable

- Guangzhou Rural Commercial Bank Co Ltd (Banks | Guangzhou, China (Mainland)), raised US$ 1,532 M, placing 1,645 M ordinary or common shares. Financial advisors on the transaction: China International Capital Corp HK Securities Ltd

- China Power International Development Ltd (Power | Hong Kong), raised US$ 501 M, placing 1,027 M ordinary or common shares. Financial advisors on the transaction: UBS (Hong Kong)