Equities

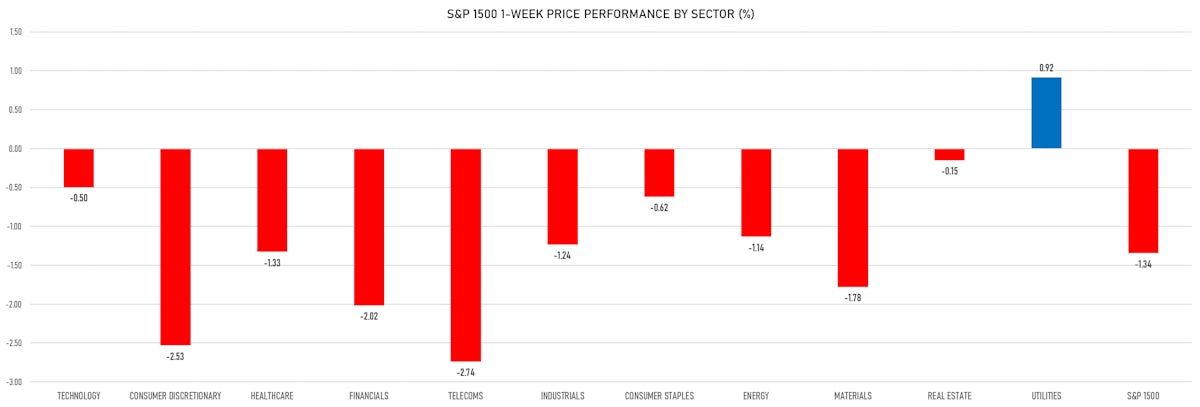

Mixed Day For US Equities, With Declines Led By The Technology And Consumer Discretionary Sectors

Volatility weighed on issuance this week, with very little ECM activity: $2.1bn of SPAC IPOs, $1.7bn in Accelerated Book Building / Blocks, $500m of Follow-Ons, $800m of Convertibles, $157m in international deals (IFR Markets data)

Published ET

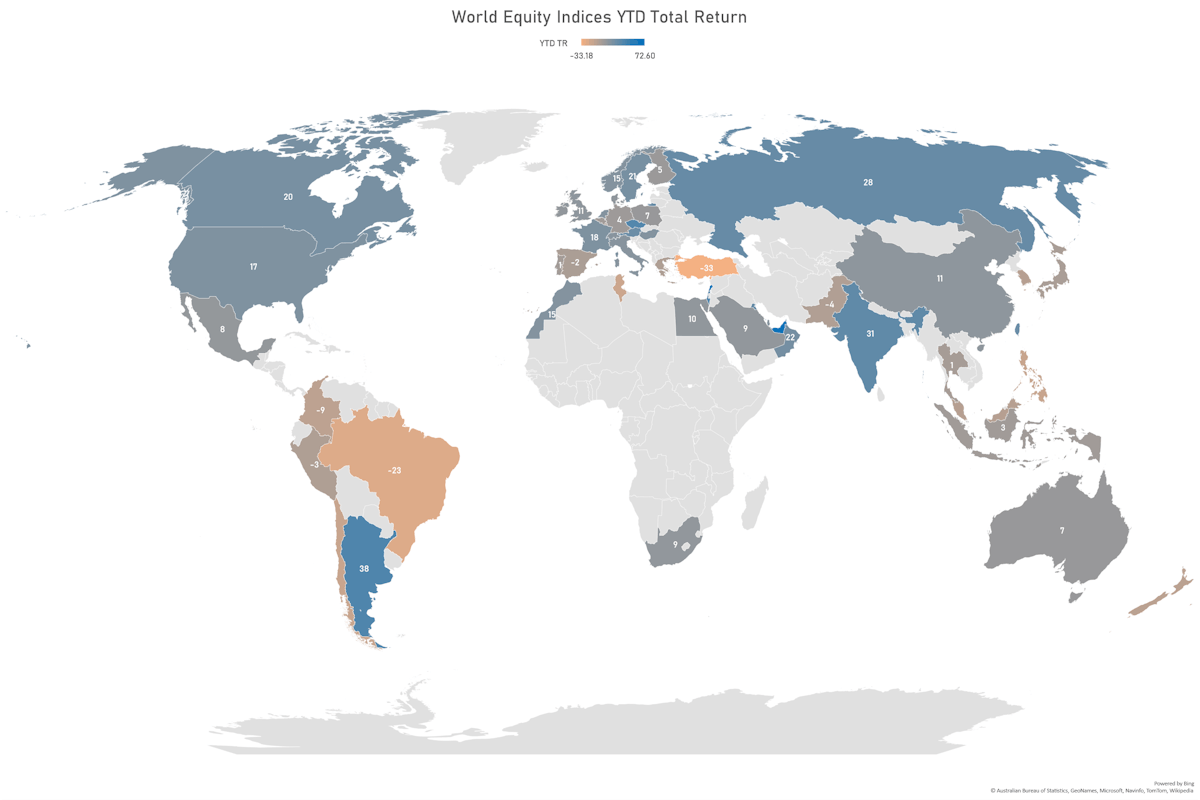

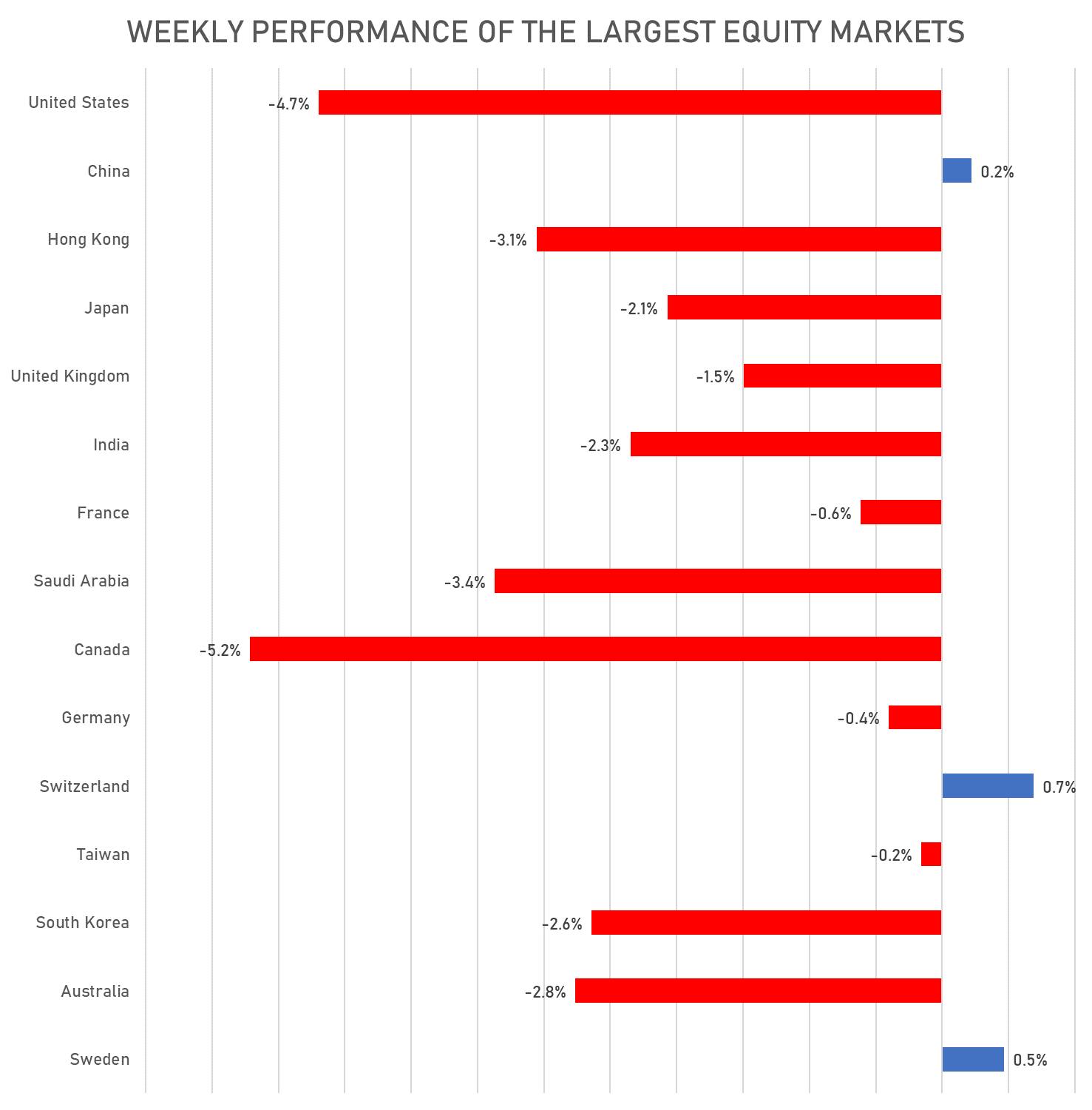

FactSet Country Indices YTD Total Returns | Sources: ϕpost, FactSet data

QUICK SUMMARY

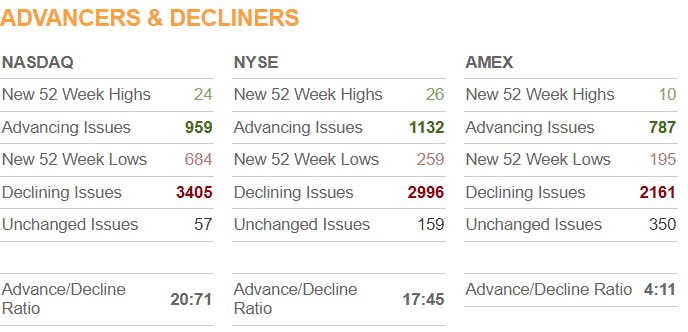

- Daily performance of US indices: S&P 500 down -0.84%; Nasdaq Composite down -1.92%; Wilshire 5000 down -1.16%

- 39.0% of S&P 500 stocks were up today, with 57.8% of stocks above their 200-day moving average (DMA) and 40.2% above their 50-DMA

- Top performing sectors in the S&P 500: consumer staples up 1.40% and utilities up 1.02%

- Bottom performing sectors in the S&P 500: consumer discretionary down -1.84% and technology down -1.65%

- The number of shares in the S&P 500 traded today was 731m for a total turnover of US$ 93 bn

- The S&P 500 Value Index was down -0.2%, while the S&P 500 Growth Index was down -1.4%; the S&P small caps index was down -1.3% and mid caps were down -1.3%

- The volume on CME's INX (S&P 500 Index) was 2.7m (3-month z-score: 1.3); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 down -0.57%; UK FTSE 100 down -0.10%; Hang Seng SH-SZ-HK 300 Index up 0.01%; Japan's TOPIX 500 up 1.57%

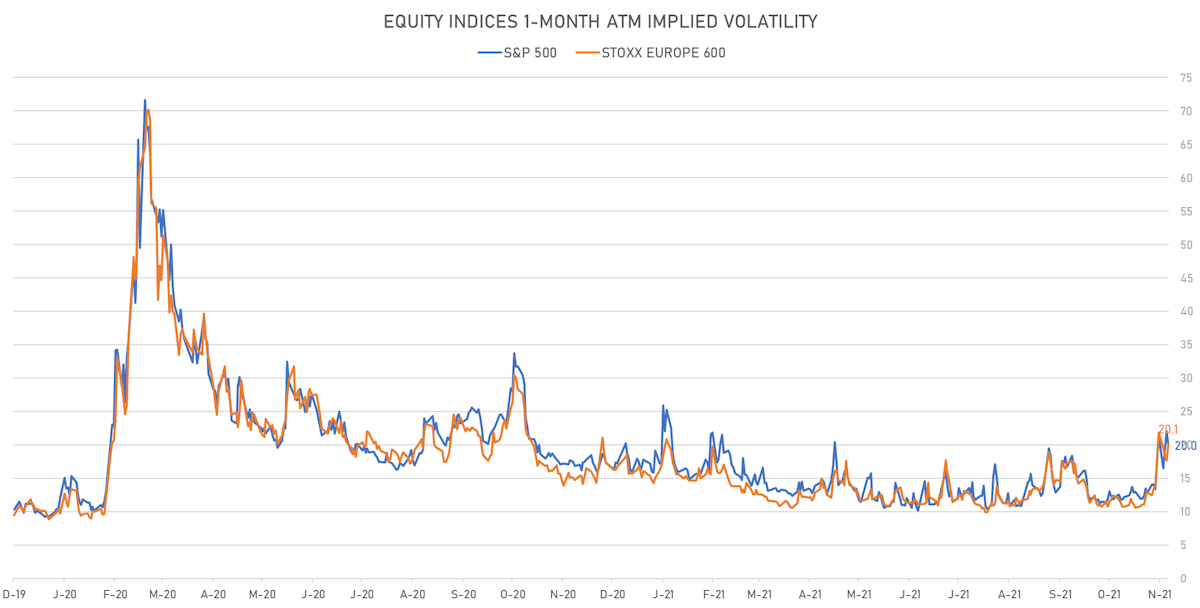

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 22.3%, up from 20.0%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 21.5%, up from 20.1%

TOP WINNERS

- Bird Global Inc (BRDS), up 22.2% to $7.96 / 12-Month Price Range: $ 5.80-11.32 / Short interest (% of float): 1.5%

- Day One Biopharmaceuticals Inc (DAWN), up 17.7% to $18.00 / 12-Month Price Range: $ 16.13-28.70 / Short interest (% of float): 4.5%; days to cover: 36.5

- Snowflake Inc. (SNOW), up 15.8% to $345.11 / YTD price return: +28.0% / 12-Month Price Range: $ 184.71-429.00 / Short interest (% of float): 2.6%; days to cover: 3.4 (the stock is currently on the short sale restriction list)

- Aurinia Pharmaceuticals Inc (AUPH), up 13.3% to $18.67 / YTD price return: +45.6% / 12-Month Price Range: $ 9.72-33.97 / Short interest (% of float): 9.1%; days to cover: 2.3

- Lifestance Health Group Inc (LFST), up 12.9% to $8.67 / 12-Month Price Range: $ 7.64-29.81 / Short interest (% of float): 5.7%; days to cover: 4.4

- CLARIVATE PLC (CLVT), up 12.6% to $23.57 / YTD price return: -15.1% / 12-Month Price Range: $ 20.31-34.79 / Short interest (% of float): 7.5%; days to cover: 8.0

- Okta Inc (OKTA), up 11.7% to $214.59 / YTD price return: -13.0% / 12-Month Price Range: $ 196.78-294.00 / Short interest (% of float): 4.9%; days to cover: 6.3

- Mechel PAO (MTL_p), up 11.3% to $1.77 / 12-Month Price Range: $ .42-2.43 / Short interest (% of float): 0.0%; days to cover: 0.1

- Kroger Co (KR), up 11.0% to $43.43 / YTD price return: +40.6% / 12-Month Price Range: $ 30.35-47.99 / Short interest (% of float): 4.9%; days to cover: 6.6

- Nuvalent Inc (NUVL), up 10.9% to $19.97 / 12-Month Price Range: $ 17.00-40.82 / Short interest (% of float): 3.6%; days to cover: 24.1

BIGGEST LOSERS

- Novavax Inc (NVAX), down 15.9% to $160.48 / YTD price return: +45.3% / 12-Month Price Range: $ 106.11-331.68 / Short interest (% of float): 11.5%; days to cover: 1.6 (the stock is currently on the short sale restriction list)

- nCino Inc (NCNO), down 15.6% to $48.39 / YTD price return: -31.1% / 12-Month Price Range: $ 48.00-90.22 / Short interest (% of float): 4.5%; days to cover: 10.1 (the stock is currently on the short sale restriction list)

- Elastic NV (ESTC), down 15.0% to $112.67 / YTD price return: -19.1% / 12-Month Price Range: $ 97.89-189.84 / Short interest (% of float): 10.2%; days to cover: 8.9 (the stock is currently on the short sale restriction list)

- Vaxxinity Inc (VAXX), down 14.5% to $8.82 / 12-Month Price Range: $ 8.90-22.77 / Short interest (% of float): 0.4%; days to cover: 0.1 (the stock is currently on the short sale restriction list)

- PureTech Health PLC (PRTC), down 14.2% to $37.00 / 12-Month Price Range: $ 37.29-65.90 / Short interest days to cover: 0.2 (the stock is currently on the short sale restriction list)

- LianBio (LIAN), down 13.7% to $10.08 / 12-Month Price Range: $ 9.71-16.37 / Short interest (% of float): 0.9%; days to cover: 1.6 (the stock is currently on the short sale restriction list)

- Daqo New Energy Corp (DQ), down 11.3% to $43.32 / YTD price return: -16.0% / 12-Month Price Range: $ 37.02-130.33 (the stock is currently on the short sale restriction list)

- C3Ai Inc (AI), down 11.2% to $29.75 / YTD price return: -78.3% / 12-Month Price Range: $ 27.52-183.90 / Short interest (% of float): 16.1%; days to cover: 6.1 (the stock is currently on the short sale restriction list)

- Hut 8 Mining Corp (HUT), down 11.0% to $9.37 / 12-Month Price Range: $ 1.12-16.57 / Short interest (% of float): 7.4%; days to cover: 0.7 (the stock is currently on the short sale restriction list)

- Burning Rock Biotech Ltd (BNR), down 10.5% to $12.26 / YTD price return: -43.8% / 12-Month Price Range: $ 12.24-39.75 / Short interest (% of float): 2.2%; days to cover: 6.7 (the stock is currently on the short sale restriction list)

NEW IPOs ANNOUNCED OR PRICED

- Atlantic Coastal Acquisition Corp II / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: ACABU / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Cantor Fitzgerald & Co

- Bullpen Parlay Acquisition Co / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: BPACU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc

- Blue Ocean Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: BOCNU / Gross proceeds (including overallotment): US$ 165.00m (offering in U.S. Dollar) / Bookrunners: Needham & Co LLC

- Nivika Fastigheter AB (Publ) / Sweden - Real Estate / Listing Exchange: OMX Stock / Ticker: NIVI B / Gross proceeds (including overallotment): US$ 110.54m (offering in Swedish Krona) / Bookrunners: Skandinaviska Enskilda Banken AB, Danske Bank

- DR Corp Ltd (Other Consumer Products | Shenzhen, China (Mainland)), raised US$ 733 M, placing 40 M class a ordinary shares. Financial advisors on the transaction: China Securities Co Ltd

- ZJMI Environmental Energy Co Ltd (Water and Waste Management | Hangzhou, China (Mainland)), raised US$ 243 M, placing 100 M class a ordinary shares. Financial advisors on the transaction: CITIC Securities Co Ltd

- St Energy Transition I Ltd (Alternative Financial Investments | Bermuda), raised US$ 250 M, placing 25 M

stock appreciation income linked securities (sails). Financial advisors on the transaction: Morgan Stanley & Co LLC, DNB Markets Inc

NEW SECONDARIES / FOLLOW-ONS

- AppLovin Corp / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: APP / Gross proceeds (including overallotment): US$ 715.88m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, JP Morgan Securities LLC, Bofa Securities Inc

- NFI Group Inc / Canada - Industrials / Listing Exchange: Toronto / Ticker: NFYEF / Gross proceeds (including overallotment): US$ 117.12m (offering in Canadian Dollar) / Bookrunners: CIBC World Markets Inc, National Bank Financial Inc, Scotia Capital Inc, BMO Nesbitt Burns Inc

- TPG Telecom Ltd / Australia - Telecommunications / Listing Exchange: Australia / Ticker: TPG / Gross proceeds (including overallotment): US$ 237.28m (offering in Australian Dollar) / Bookrunners: Macquarie Capital (Australia) Ltd

- Xior Student Housing NV / Belgium - Real Estate / Listing Exchange: Euronext B / Ticker: XIOR / Gross proceeds (including overallotment): US$ 139.81m (offering in EURO) / Bookrunners: KBC Securities, ING, ABN AMRO Bank, Belfius Bank SA/NV, BNP Paribas Fortis SA/NV

- Medios AG / Germany - Healthcare / Listing Exchange: Frankfurt / Ticker: ILM1 / Gross proceeds (including overallotment): US$ 104.95m (offering in EURO) / Bookrunners: Berenberg, MM Warburg und Co, Bryan, Garnier & Co