Equities

86% Up Day For S&P 500 Stocks, As Value And Small Caps Outperformed Growth And Large Caps

Chinese equities are bouncing tonight after the PBOC unexpectedly cut the RRR by 50bp, thereby releasing RMB 1.2 trillion of liquidity (about US$ 185 bn): the Hang Seng SH-SZ-HK 300 Index is currently up 0.90%, led by Hong Kong's battered market (up 1.28%)

Published ET

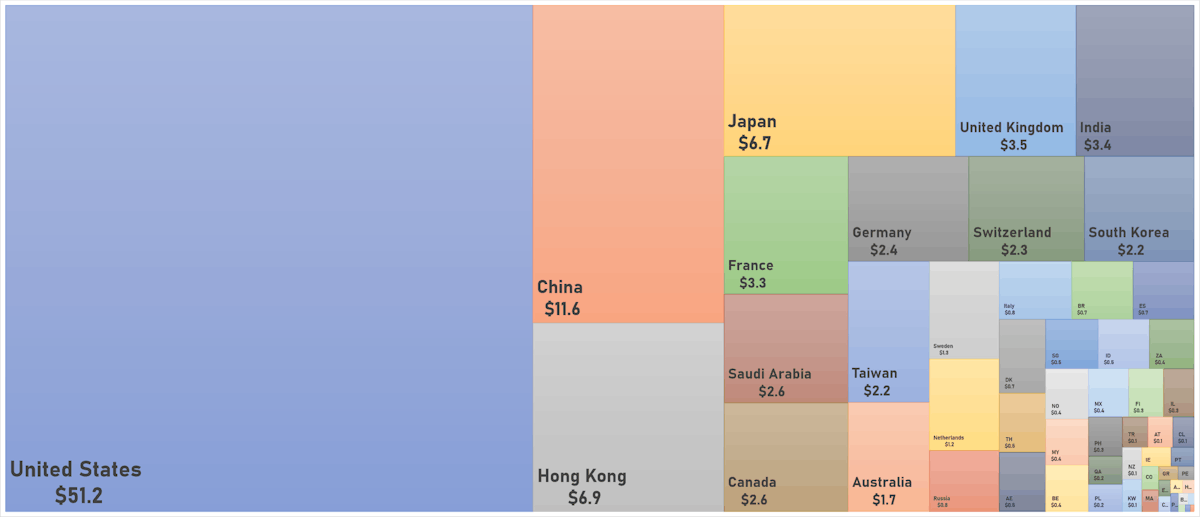

The World Market Cap Broken Down By Country (US$ Trillion) | Sources: ϕpost, Factset data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 1.17%; Nasdaq Composite up 0.93%; Wilshire 5000 up 1.19%

- 85.7% of S&P 500 stocks were up today, with 64.8% of stocks above their 200-day moving average (DMA) and 49.9% above their 50-DMA

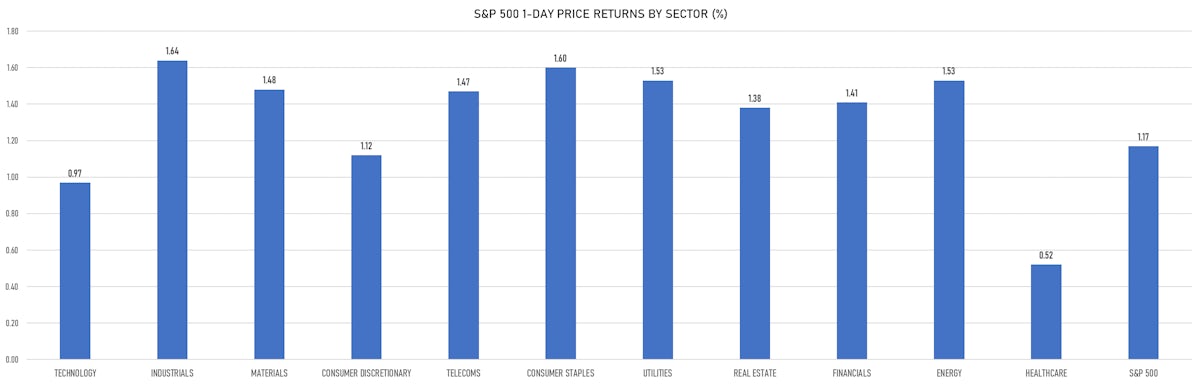

- Top performing sectors in the S&P 500: industrials up 1.64% and consumer staples up 1.60%

- Bottom performing sectors in the S&P 500: healthcare up 0.52% and technology up 0.97%

- The number of shares in the S&P 500 traded today was 687m for a total turnover of US$ 86 bn

- The S&P 500 Value Index was up 1.5%, while the S&P 500 Growth Index was up 0.9%; the S&P small caps index was up 2.4% and mid-caps were up 2.0%

- The volume on CME's INX (S&P 500 Index) was 2.6m (3-month z-score: 1.0); the 3-month average volume is 2.2m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 up 1.28%; UK FTSE 100 up 1.54%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index up 0.90%, Japan's TOPIX 500 up 1.19%

VOLATILITY

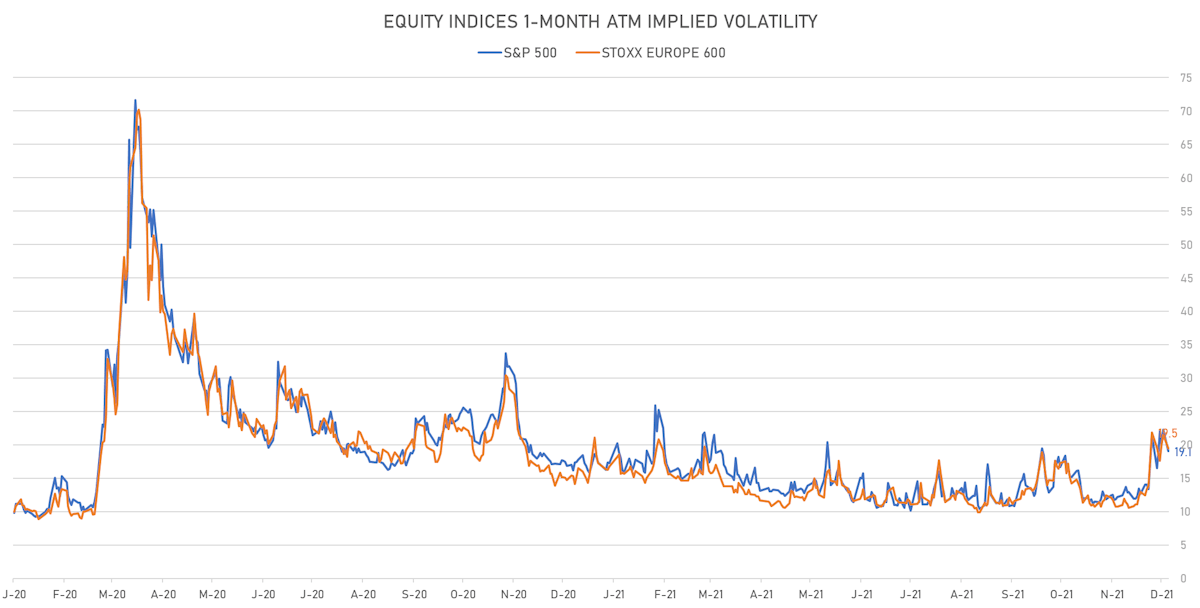

- 1-month at-the-money implied volatility on the S&P 500 at 19.1%, down from 22.3%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 19.5%, down from 21.5%

NOTABLE S&P 500 EARNINGS RELEASES

- MongoDB Inc (MDB | Technology): beat EPS median estimate (-0.11 act. vs. -0.42 est.) and beat revenue median estimate (227m act. vs. 204m est.), down -4.63% today, closed at 429.34 and at 446.00 (+3.88%) after hours

- Coupa Software Inc (COUP | Technology): beat EPS median estimate (0.31 act. vs. 0.02 est.) and beat revenue median estimate (186m act. vs. 178m est.), up 1.97% today, closed at 174.10 and at 171.00 (-1.78%) after hours

- Gitlab Inc (GTLB | Technology): beat EPS median estimate (-0.34 act. vs. -0.48 est.) and beat revenue median estimate (67m act. vs. 59m est.), up 1.32% today, closed at 89.16 and at 88.77 (-0.44%) after hours

TOP WINNERS

- GH Research PLC (GHRS), up 21.9% to $23.47 / 12-Month Price Range: $ 12.38-30.43 / Short interest (% of float): 3.2%; days to cover: 6.7

- GCP Applied Technologies Inc (GCP), up 17.1% to $31.64 / YTD price return: +33.8% / 12-Month Price Range: $ 20.76-29.18

- Volta Inc (VLTA), up 15.4% to $9.37 / YTD price return: -12.0% / 12-Month Price Range: $ 6.63-18.33 / Short interest (% of float): 3.4%; days to cover: 1.2 (the stock is currently on the short sale restriction list)

- Offerpad Solutions Inc (OPAD), up 14.8% to $7.38 / 12-Month Price Range: $ 6.27-20.97 / Short interest (% of float): 1.4%; days to cover: 1.0

- Latch Inc (LTCH), up 14.8% to $8.24 / 12-Month Price Range: $ 7.01-19.70 / Short interest (% of float): 9.0%; days to cover: 8.6

- Mister Car Wash Inc (MCW), up 14.7% to $19.01 / 12-Month Price Range: $ 15.67-24.49 / Short interest (% of float): 2.9%; days to cover: 3.9

- Jackson Financial Inc (JXN), up 13.7% to $38.82 / 12-Month Price Range: $ 22.29-36.74 / Short interest (% of float): 3.7%; days to cover: 2.4

- Lightwave Logic Inc (LWLG), up 13.3% to $15.53 / 12-Month Price Range: $ .83-17.24 / Short interest (% of float): 1.7%; days to cover: 3.4

- Aluminum Corp of China Ltd (ACH), up 12.9% to $13.33 / 12-Month Price Range: $ 7.57-23.90 / Short interest (% of float): 0.1%; days to cover: 0.7

- Ginkgo Bioworks Holdings Inc (DNA), up 12.6% to $9.74 / 12-Month Price Range: $ 7.91-15.86 / Short interest (% of float): 1.9%; days to cover: 2.3 (the stock is currently on the short sale restriction list)

BIGGEST LOSERS

- Reata Pharmaceuticals Inc (RETA), down 37.8% to $48.92 / YTD price return: -60.4% / 12-Month Price Range: $ 76.34-153.41 (the stock is currently on the short sale restriction list)

- Adagio Therapeutics Inc (ADGI), down 29.0% to $32.53 / 12-Month Price Range: $ 17.38-78.82 / Short interest (% of float): 7.2%; days to cover: 8.0 (the stock is currently on the short sale restriction list)

- Arqit Quantum Inc (ARQQ), down 27.6% to $27.07 / 12-Month Price Range: $ 8.00-41.52 / Short interest (% of float): 1.2%; days to cover: 0.9 (the stock is currently on the short sale restriction list)

- BioNTech SE (BNTX), down 18.7% to $279.83 / YTD price return: +243.3% / 12-Month Price Range: $ 80.55-464.00 / Short interest (% of float): 4.0%; days to cover: 1.1 (the stock is currently on the short sale restriction list)

- ESS Tech Inc (GWH), down 13.9% to $13.84 / 12-Month Price Range: $ 7.22-28.92 / Short interest (% of float): 4.1%; days to cover: 0.7 (the stock is currently on the short sale restriction list)

- Bird Global Inc (BRDS), down 13.7% to $6.87 / 12-Month Price Range: $ 5.80-11.32 / Short interest (% of float): 1.5%; days to cover: 1.9 (the stock is currently on the short sale restriction list)

- Moderna Inc (MRNA), down 13.5% to $265.33 / YTD price return: +154.0% / 12-Month Price Range: $ 102.66-497.49 / Short interest (% of float): 4.0%; days to cover: 1.3 (the stock is currently on the short sale restriction list)

- Vir Biotechnology Inc (VIR), down 13.4% to $38.39 / 12-Month Price Range: $ 25.31-141.01 / Short interest (% of float): 4.7%; days to cover: 6.5 (the stock is currently on the short sale restriction list)

- Zscaler Inc (ZS), down 12.4% to $274.36 / YTD price return: +37.4% / 12-Month Price Range: $ 157.03-376.11 / Short interest (% of float): 9.2%; days to cover: 5.0 (the stock is currently on the short sale restriction list)

- Cipher Mining Inc (CIFR), down 12.4% to $6.34 / 12-Month Price Range: $ 5.13-15.39 / Short interest (% of float): 3.8%; days to cover: 0.5 (the stock is currently on the short sale restriction list)

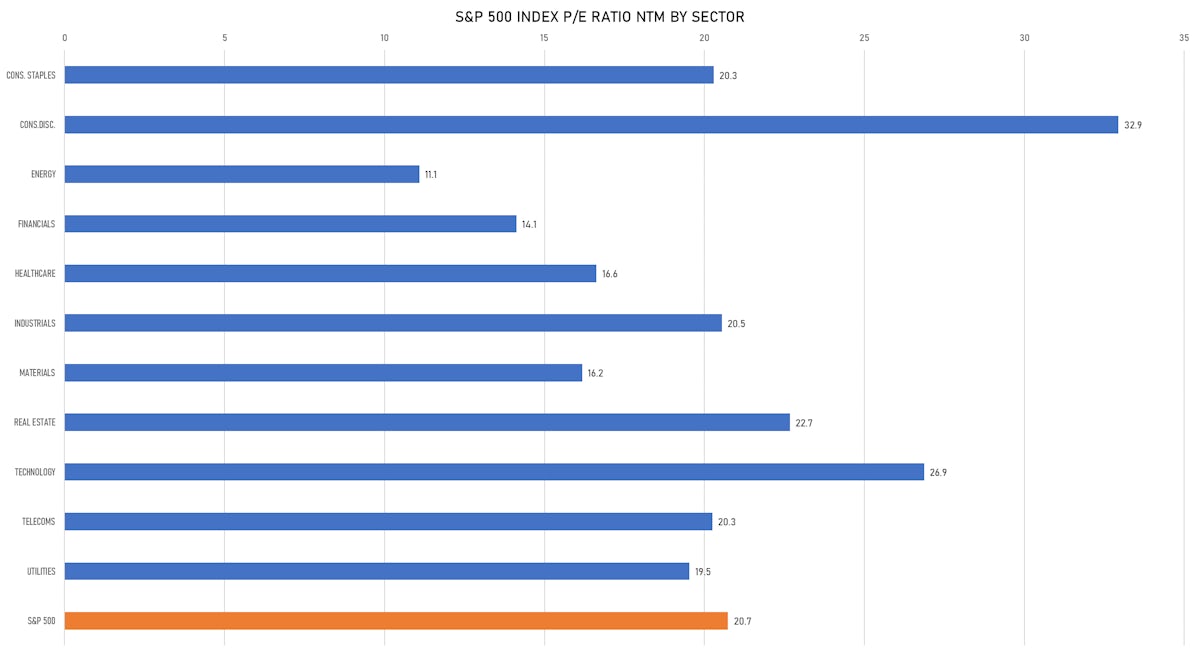

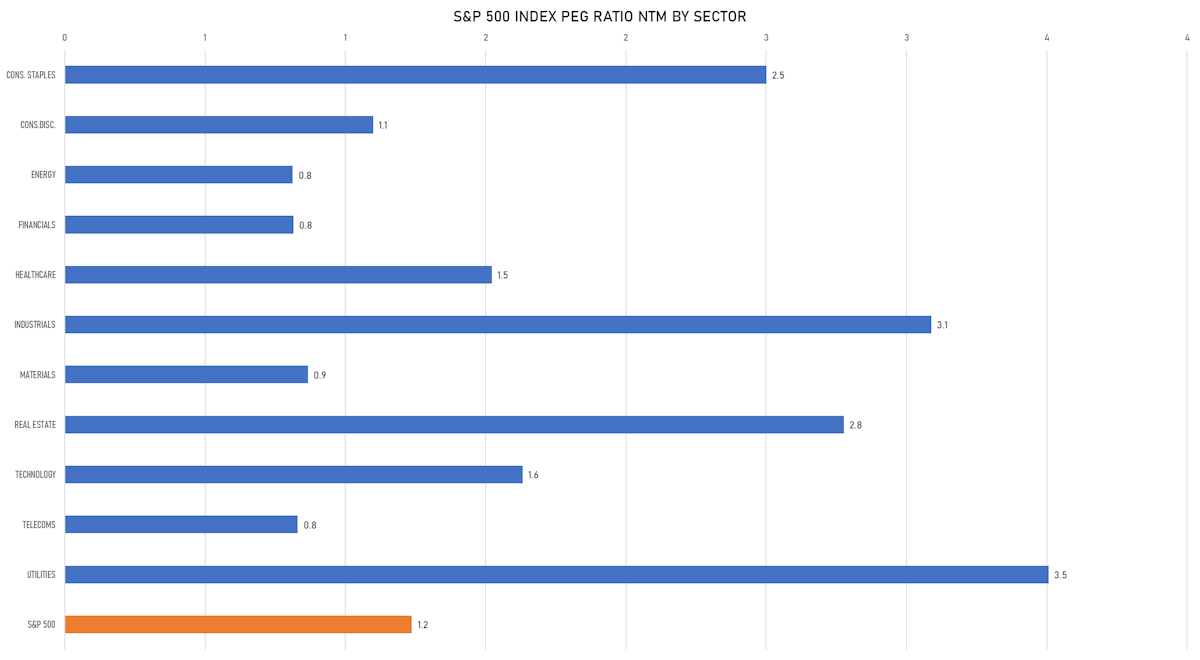

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- USA Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: USAXU / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: BTIG LLC, Jefferies LLC

- Net Protections Holdings Inc / Japan - High Technology / Listing Exchange: Tokyo 1 / Ticker: 7383 / Gross proceeds (including overallotment): US$ 450.15m (offering in Japanese Yen) / Bookrunners: Credit Suisse (Hong Kong) Ltd, Daiwa Capital Markets Europe Ltd, SMBC Nikko Capital Markets

- VT5 Acquisition Co AG / Switzerland - Financials / Listing Exchange: Swiss Exch / Ticker: N/A / Gross proceeds (including overallotment): US$ 217.91m (offering in Swiss Franc) / Bookrunners: UBS, Credit Suisse AG

NEW SECONDARIES / FOLLOW-ONS

- Icahn Enterprises LP / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: IEP / Gross proceeds (including overallotment): US$ 400.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- American Assets Trust Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: AAT / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- AP Memory Technology Corp / Taiwan - High Technology / Listing Exchange: Taiwan / Ticker: 6531 / Gross proceeds (including overallotment): US$ 265.98m (offering in Taiwanese Dollar) / Bookrunners: Not Applicable

- Mapletree Logistics Trust / Singapore - Real Estate / Listing Exchange: Singapore / Ticker: M44U / Gross proceeds (including overallotment): US$ 151.01m (offering in Singapore Dollar) / Bookrunners: Oversea-Chinese Banking Corp Ltd, Hongkong and Shanghai Banking Corp (Singapore), DBS Bank Ltd

- Logan Group Co Ltd / China - Real Estate / Listing Exchange: Hong Kong / Ticker: 3380 / Gross proceeds (including overallotment): US$ 150.07m (offering in Hong Kong Dollar) / Bookrunners: UBS (Hong Kong), BNP Paribas (Hong Kong), Citigroup

- Nippon Prologis REIT Inc / Japan - Real Estate / Listing Exchange: Tokyo / Ticker: 3283 / Gross proceeds (including overallotment): US$ 120.58m (offering in Japanese Yen) / Bookrunners: Nomura International PLC, Goldman Sachs International, Merrill Lynch International Ltd, Mizuho International PLC, Morgan Stanley & Co. International plc, SMBC Nikko Capital Markets