Equities

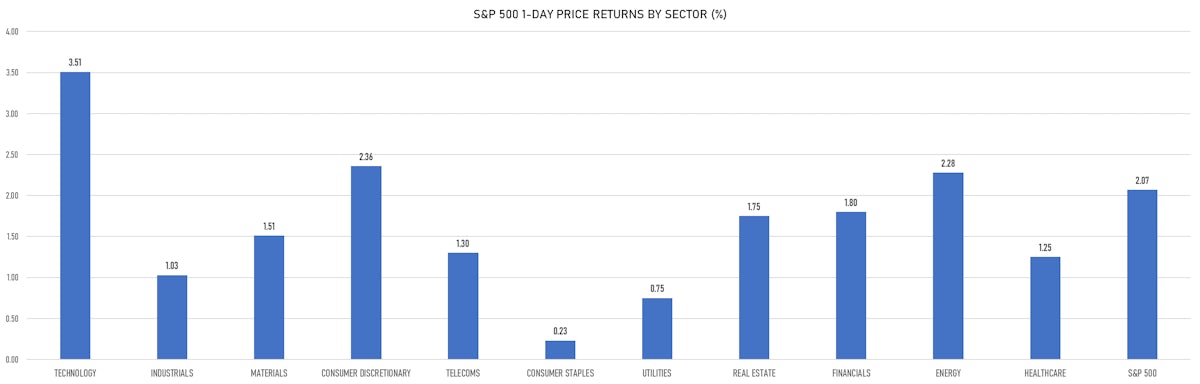

Huge Day For S&P 500 Technology Stocks (Up 3.51%), As Well As Consumer Discretionary (Up 2.36%)

Volume and volatility are both down markedly since last week, as we saw a second straight day ending with over 86% of S&P 500 stocks up

Published ET

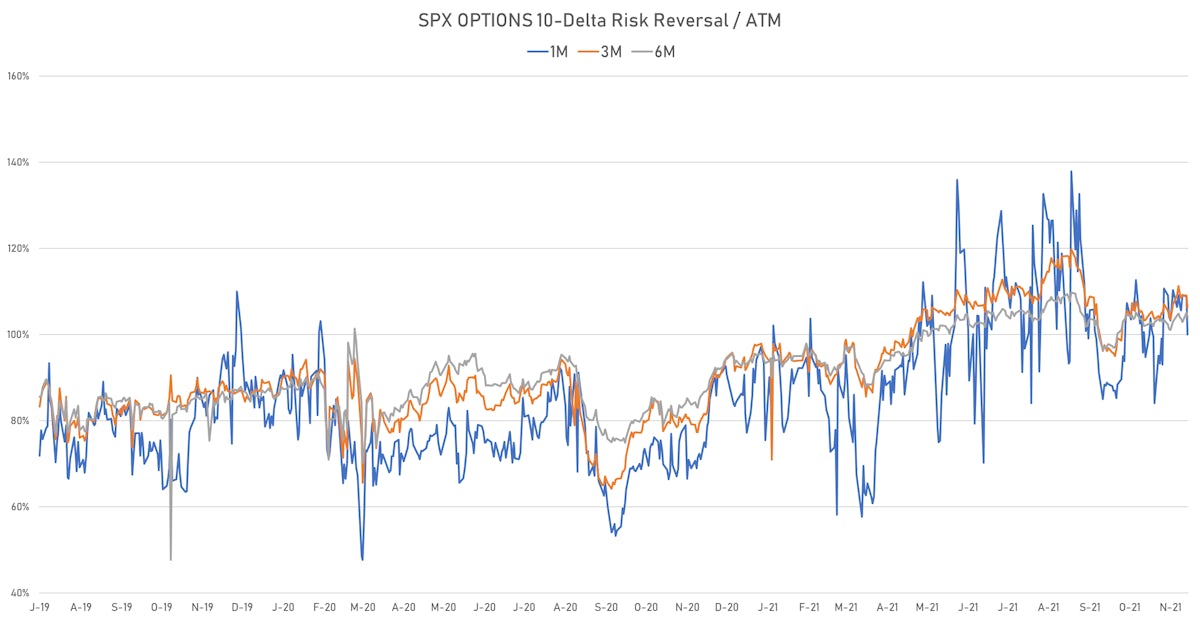

The Skew In 10-Delta S&P 500 Risk Reversals Is Down As Well (% of ATM) | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 2.07%; Nasdaq Composite up 3.03%; Wilshire 5000 up 2.18%

- 86.1% of S&P 500 stocks were up today, with 68.7% of stocks above their 200-day moving average (DMA) and 61.4% above their 50-DMA

- Top performing sectors in the S&P 500: technology up 3.51% and consumer discretionary up 2.36%

- Bottom performing sectors in the S&P 500: consumer staples up 0.23% and utilities up 0.75%

- The number of shares in the S&P 500 traded today was 686m for a total turnover of US$ 87 bn

- The S&P 500 Value Index was up 1.3%, while the S&P 500 Growth Index was up 2.7%; the S&P small caps index was up 1.5% and mid-caps were up 1.7%

- The volume on CME's INX (S&P 500 Index) was 2.5m (3-month z-score: 0.7); the 3-month average volume is 2.2m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 up 2.45%; UK FTSE 100 up 1.49%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index up 0.67%, Japan's TOPIX 500 up 0.85%

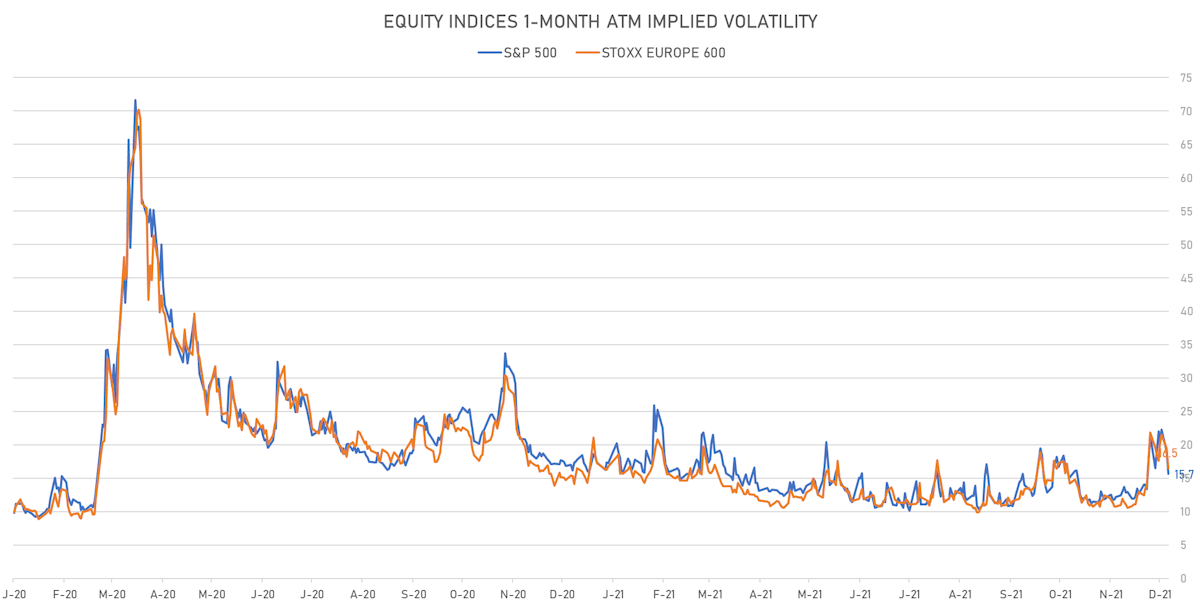

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 15.7%, down from 19.1%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 16.5%, down from 19.5%

NOTABLE US EARNINGS RELEASES

- Autozone Inc (AZO | Consumer Cyclicals): beat EPS median estimate (25.69 act. vs. 20.96 est.) and beat revenue median estimate (3,669m act. vs. 3,366m est.), up 7.64% today, closed at 2023.57 and at 1885.00 (-6.85%) after hours

- SentinelOne Inc (S | Technology): beat EPS median estimate (-0.15 act. vs. -0.18 est.) and beat revenue median estimate (56m act. vs. 50m est.), up 13.40% today, closed at 51.04 and at 45.40 (-11.05%) after hours

- Toll Brothers Inc (TOL | Consumer Cyclicals): beat EPS median estimate (3.02 act. vs. 2.59 est.) and beat revenue median estimate (3,041m act. vs. 2,903m est.), up 0.55% today, closed at 71.24 and at 70.50 (-1.04%) after hours

- Caseys General Stores Inc (CASY | Consumer Non-Cyclicals): missed EPS median estimate (2.59 act. vs. 3.06 est.) and beat revenue median estimate (3,263m act. vs. 3,234m est.), down -0.33% today, closed at 201.22 and at 202.88 (+0.82%) after hours

- ChargePoint Holdings Inc (CHPT | Utilities): missed EPS median estimate (-0.14 act. vs. -0.13 est.) and matched revenue median estimate (65m act. vs. 65m est.), up 5.01% today, closed at 21.78 and at 21.08 (-3.21%) after hours

- Core & Main Inc (CNM | Industrials): beat EPS median estimate (0.39 act. vs. 0.31 est.) and beat revenue median estimate (1,405m act. vs. 1,298m est.), up 9.31% today, closed at 28.52 and at 26.09 (-8.52%) after hours

TOP WINNERS

- Trupanion Inc (TRUP), up 39.0% to $155.41 / YTD price return: +29.8% / 12-Month Price Range: $ 69.74-140.46 / Short interest (% of float): 10.8%; days to cover: 11.3

- Novavax Inc (NVAX), up 28.9% to $182.85 / YTD price return: +64.0% / 12-Month Price Range: $ 106.11-331.68 / Short interest (% of float): 11.5%

- Vaxxinity Inc (VAXX), up 24.5% to $9.11 / 12-Month Price Range: $ 7.11-22.77 / Short interest (% of float): 0.4%; days to cover: 0.1

- Jumia Technologies AG (JMIA), up 20.8% to $13.37 / YTD price return: -66.9% / 12-Month Price Range: $ 9.94-69.89 / Short interest (% of float): 11.2%; days to cover: 3.2

- Adagio Therapeutics Inc (ADGI), up 19.1% to $38.73 / 12-Month Price Range: $ 17.38-78.82 / Short interest (% of float): 7.2%; days to cover: 8.0

- Design Therapeutics Inc (DSGN), up 18.0% to $19.71 / 12-Month Price Range: $ 12.52-50.50 / Short interest (% of float): 4.9%; days to cover: 16.6

- Digital World Acquisition Corp (DWAC), up 16.6% to $51.07 / 12-Month Price Range: $ 9.84-175.00 / Short interest (% of float): 10.8%; days to cover: 0.1

- MongoDB Inc (MDB), up 16.4% to $499.82 / YTD price return: +39.2% / 12-Month Price Range: $ 238.01-590.00

- Intellia Therapeutics Inc (NTLA), up 16.2% to $117.10 / YTD price return: +115.3% / 12-Month Price Range: $ 43.86-202.73 / Short interest (% of float): 5.2%; days to cover: 5.1

- Silicon Motion Technology Corp (SIMO), up 15.8% to $87.98 / YTD price return: +82.7% / 12-Month Price Range: $ 43.50-81.87 / Short interest (% of float): 2.6%; days to cover: 3.8

BIGGEST LOSERS

- AeroVironment Inc (AVAV), down 27.5% to $57.98 / YTD price return: -33.3% / 12-Month Price Range: $ 76.16-143.72 / Short interest (% of float): 4.7%; days to cover: 11.6 (the stock is currently on the short sale restriction list)

- Healthequity Inc (HQY), down 24.6% to $42.73 / YTD price return: -38.7% / 12-Month Price Range: $ 53.60-93.32 / Short interest (% of float): 3.8%; days to cover: 9.1 (the stock is currently on the short sale restriction list)

- Arqit Quantum Inc (ARQQ), down 11.8% to $23.88 / 12-Month Price Range: $ 8.00-41.52 / Short interest (% of float): 1.2%; days to cover: 0.9 (the stock is currently on the short sale restriction list)

- Patrick Industries Inc (PATK), down 10.4% to $77.01 / YTD price return: +12.7% / 12-Month Price Range: $ 65.30-98.83 (the stock is currently on the short sale restriction list)

- Gitlab Inc (GTLB), down 8.3% to $81.74 / 12-Month Price Range: $ 82.18-137.00 / Short interest (% of float): 10.0%; days to cover: 1.0 (the stock is currently on the short sale restriction list)

- ACV Auctions Inc (ACVA), down 6.3% to $19.80 / 12-Month Price Range: $ 16.15-37.77 / Short interest (% of float): 2.5%; days to cover: 2.5

- Comcast Corp (CMCSA), down 5.3% to $49.58 / YTD price return: -5.4% / 12-Month Price Range: $ 48.15-61.80 / Short interest (% of float): 1.5%; days to cover: 3.8

- AngloGold Ashanti Ltd (AU), down 5.1% to $19.86 / YTD price return: -12.2% / 12-Month Price Range: $ 14.57-26.77 / Short interest (% of float): 2.6%; days to cover: 3.8

- Avis Budget Group Inc (CAR), down 4.7% to $252.86 / YTD price return: +577.9% / 12-Month Price Range: $ 34.41-545.11 / Short interest (% of float): 15.6%

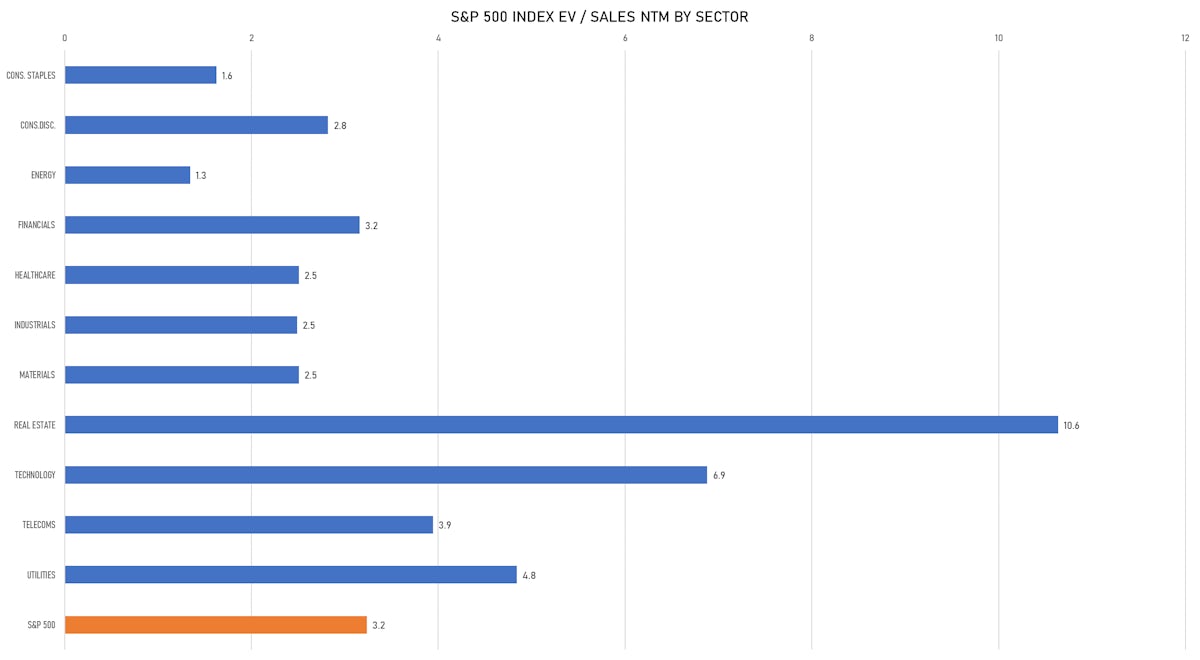

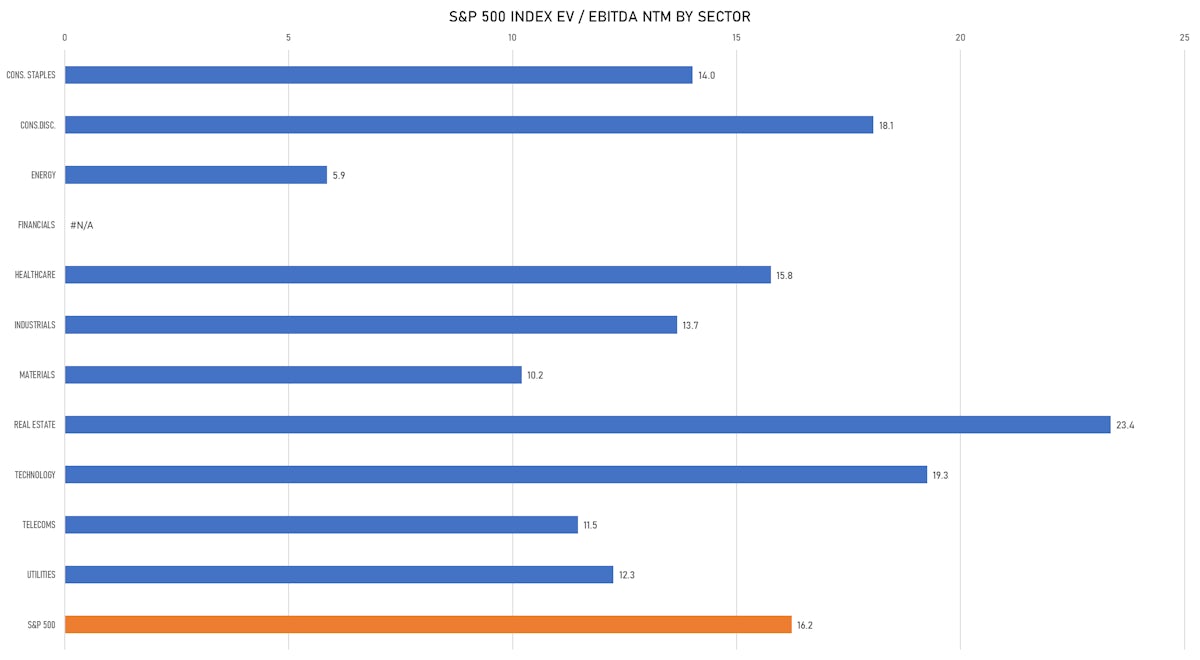

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Twelve Seas Investment Co IV Tmt / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: TSIVU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Mizuho Securities USA LLC

- LG Energy Solution Ltd / South Korea - Energy and Power / Listing Exchange: Korea / Ticker: N/A / Gross proceeds (including overallotment): US$ 5,514.37m (offering in U.S. Dollar) / Bookrunners: Daishin Securities Co Ltd, Goldman Sachs & Co, Morgan Stanley & Co, Citigroup, Shinhan Investment Corp, Merrill Lynch International Limited, KBI Securities Co Ltd

NEW SECONDARIES / FOLLOW-ONS

- Blue Owl Capital Inc / United States of America - Financials / Listing Exchange: New York / Ticker: OWL / Gross proceeds (including overallotment): US$ 387.40m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, JP Morgan Securities LLC, Bofa Securities Inc

- Shimao Group Holdings Ltd / Hong Kong - Real Estate / Listing Exchange: Hong Kong / Ticker: 0813 / Gross proceeds (including overallotment): US$ 151.32m (offering in Hong Kong Dollar) / Bookrunners: JP Morgan Securities (Asia) Ltd (Hong Kong), Hongkong & Shanghai Banking Corp Ltd, Morgan Stanley & Co. International plc

- Capitaland Integrated Commercial Trust Management Ltd / Singapore - Real Estate / Listing Exchange: Singapore / Ticker: C38U / Gross proceeds (including overallotment): US$ 148.06m (offering in Singapore Dollar) / Bookrunners: United Overseas Bank Ltd, JP Morgan India