Equities

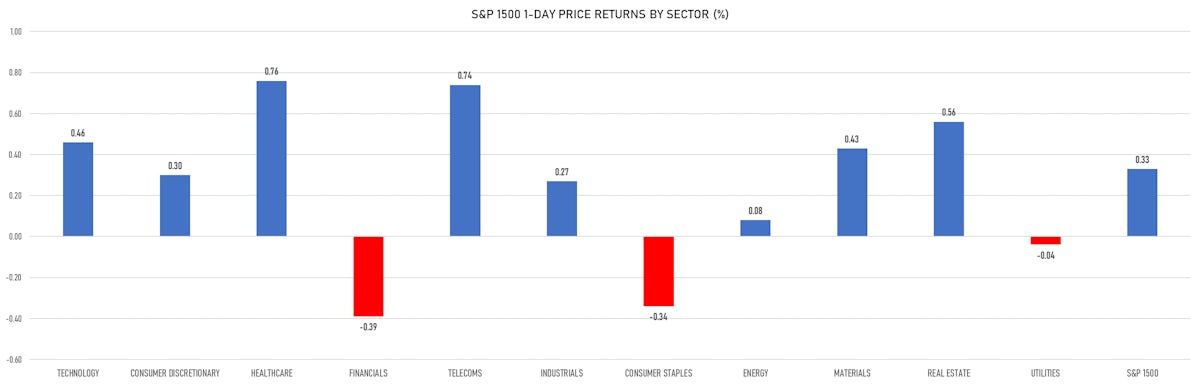

Positive, Though Less Impressive Performance Today In US Equities, Led By Telecoms And Healthcare

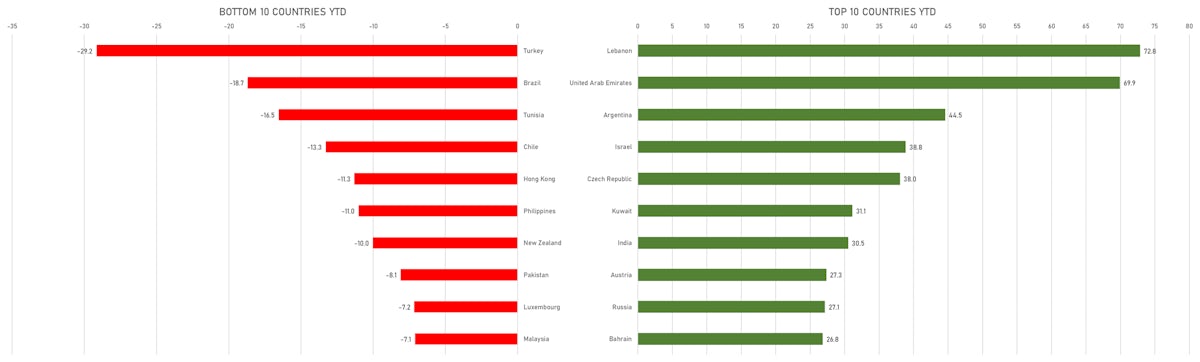

Of all the markets that have struggled this year, Hong Kong might be among those that see a positive reversal in 2022, with more clarity on the macro front, as well as supportive policies from Mainland China

Published ET

Countries With The Best And Worst YTD USD Total Returns | Sources: ϕpost, FactSet

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.31%; Nasdaq Composite up 0.64%; Wilshire 5000 up 0.46%

- 61.6% of S&P 500 stocks were up today, with 68.7% of stocks above their 200-day moving average (DMA) and 62.8% above their 50-DMA

- Top performing sectors in the S&P 500: telecoms up 0.75% and healthcare up 0.74%

- Bottom performing sectors in the S&P 500: financials down -0.46% and consumer staples down -0.37%

- The number of shares in the S&P 500 traded today was 575m for a total turnover of US$ 72 bn

- The S&P 500 Value Index was unchanged, while the S&P 500 Growth Index was up 0.6%; the S&P small caps index was up 0.5% and mid-caps were up 0.6%

- The volume on CME's INX (S&P 500 Index) was 2.2m (3-month z-score: 0.0); the 3-month average volume is 2.2m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 down -0.59%; UK FTSE 100 down -0.04%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index up 1.51%, Japan's TOPIX 500 down -0.22%

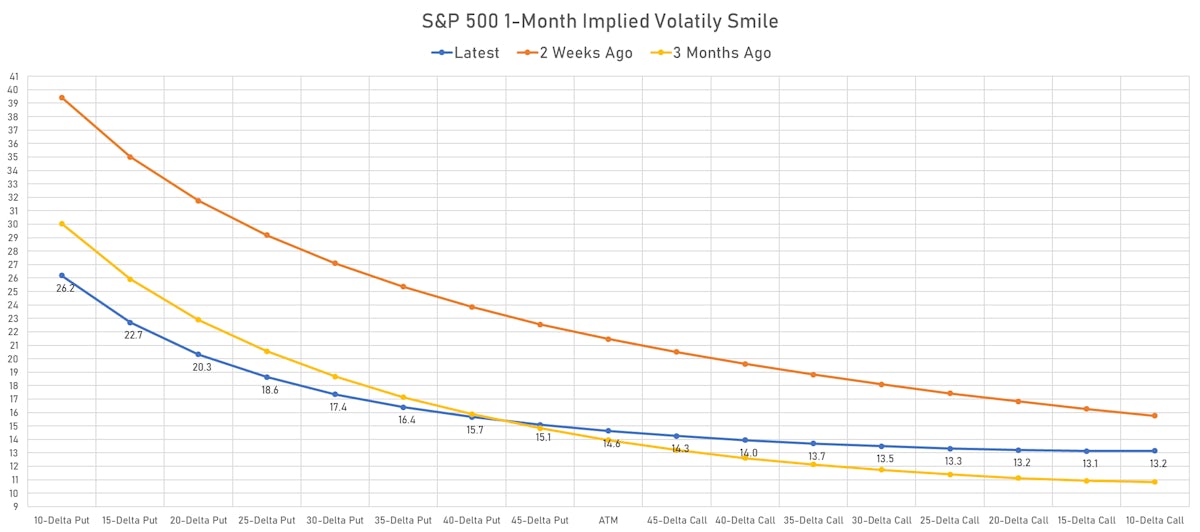

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 14.6%, down from 15.7%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 16.5%, down from 16.5%

NOTABLE S&P 500 EARNINGS RELEASES

- Brown-Forman Corp (BF.B | Consumer Non-Cyclicals): missed EPS median estimate (0.49 act. vs. 0.53 est.) and missed revenue median estimate (994m act. vs. 1,045m est.), down -2.75% today, closed at 70.46 and at 74.75 (+6.09%) after hours

- UiPath Inc (PATH | Technology): beat EPS median estimate (0.00 act. vs. -0.03 est.) and beat revenue median estimate (221m act. vs. 208m est.), up 1.55% today, closed at 47.71 and at 47.22 (-1.03%) after hours

- GameStop Corp (GME | Consumer Cyclicals): missed EPS median estimate (-1.39 act. vs. -0.40 est.) and missed revenue median estimate (1,297m act. vs. 1,300m est.), down -2.34% today, closed at 173.65 and at 179.22 (+3.21%) after hours

- Campbell Soup Co (CPB | Consumer Non-Cyclicals): beat EPS median estimate (0.89 act. vs. 0.81 est.) and missed revenue median estimate (2,236m act. vs. 2,275m est.), up 1.73% today, closed at 41.83 and at 41.48 (-0.84%) after hours

- RH (RH | Consumer Cyclicals): matched EPS median estimate (7.03 act. vs. 7.03 est.) and matched revenue median estimate (1,006m act. vs. 1,006m est.), up 0.11% today, closed at 576.96 and at 579.00 (+0.35%) after hours

- Thor Industries Inc (THO | Consumer Cyclicals): beat EPS median estimate (4.34 act. vs. 3.22 est.) and beat revenue median estimate (3,958m act. vs. 3,465m est.), down -1.90% today, closed at 104.37 and at 108.00 (+3.48%) after hours

- Fluence Energy Inc (FLNC | Industrials): missed EPS median estimate (-0.74 act. vs. -0.24 est.) and matched revenue median estimate (188m act. vs. 188m est.), down -0.72% today, closed at 31.62 and at 32.44 (+2.59%) after hours

TOP WINNERS

- Bakkt Holdings Inc (BKKT), up 29.8% to $17.14 / YTD price return: +70.0% / 12-Month Price Range: $ 8.00-50.80 / Short interest (% of float): 28.4%; days to cover: 0.5

- Digital World Acquisition Corp (DWAC), up 28.1% to $65.42 / 12-Month Price Range: $ 9.84-175.00 / Short interest (% of float): 10.8%; days to cover: 0.1

- Photronics Inc (PLAB), up 25.9% to $17.91 / YTD price return: +60.5% / 12-Month Price Range: $ 10.10-15.15

- RLX Technology Inc (RLX), up 21.7% to $4.76 / 12-Month Price Range: $ 3.30-35.00 / Short interest (% of float): 2.9%; days to cover: 2.7

- Lovesac Co (LOVE), up 20.8% to $77.95 / 12-Month Price Range: $ 32.09-95.51

- Roku Inc (ROKU), up 18.2% to $256.08 / YTD price return: -22.9% / 12-Month Price Range: $ 196.94-490.76

- Epam Systems Inc (EPAM), up 17.7% to $700.14 / YTD price return: +95.4% / 12-Month Price Range: $ 314.08-725.40 / Short interest (% of float): 0.9%; days to cover: 2.0

- Paysafe Ltd (PSFE), up 17.6% to $4.28 / YTD price return: -71.7% / 12-Month Price Range: $ 3.18-19.57 / Short interest (% of float): 5.7%; days to cover: 1.6

- Telesat Corp (TSAT), up 17.0% to $31.50 / YTD price return: +50.1% / 12-Month Price Range: $ 19.69-56.54

- Pear Therapeutics Inc (PEAR), up 15.9% to $9.27 / 12-Month Price Range: $ 7.76-12.95 / Short interest (% of float): 1.3%; days to cover: 1.5

BIGGEST LOSERS

- Nuvei Corp (NVEI), down 40.5% to $57.97 / YTD price return: -4.5% / 12-Month Price Range: $ 46.69-140.23 / Short interest (% of float): 2.4%; days to cover: 7.4 (the stock is currently on the short sale restriction list)

- Stitch Fix Inc (SFIX), down 23.9% to $19.00 / YTD price return: -67.6% / 12-Month Price Range: $ 22.04-113.76 (the stock is currently on the short sale restriction list)

- Corcept Therapeutics Inc (CORT), down 16.9% to $18.23 / 12-Month Price Range: $ 17.57-31.18 (the stock is currently on the short sale restriction list)

- Albertsons Companies Inc (ACI), down 11.2% to $31.84 / YTD price return: +81.1% / 12-Month Price Range: $ 14.70-37.85 / Short interest (% of float): 5.2%; days to cover: 8.0 (the stock is currently on the short sale restriction list)

- Solo Brands Inc (DTC), down 8.7% to $15.92 / 12-Month Price Range: $ 15.28-23.39 / Short interest (% of float): 4.3%; days to cover: 0.5 (the stock is currently on the short sale restriction list)

- Dingdong (Cayman) Ltd (DDL), down 8.2% to $14.91 / 12-Month Price Range: $ 15.38-46.00 / Short interest (% of float): 0.2%; days to cover: 5.2 (the stock is currently on the short sale restriction list)

- IDT Corp (IDT), down 7.8% to $46.18 / 12-Month Price Range: $ 11.85-67.30

- Allbirds Inc (BIRD), down 7.0% to $14.92 / 12-Month Price Range: $ 13.91-32.44 / Short interest (% of float): 11.2%; days to cover: 0.4

- Caseys General Stores Inc (CASY), down 6.9% to $187.36 / YTD price return: +4.9% / 12-Month Price Range: $ 172.58-229.18

- United Microelectronics Corp (UMC), down 6.8% to $11.69 / YTD price return: +38.7% / 12-Month Price Range: $ 7.83-12.68 / Short interest (% of float): 1.6%; days to cover: 4.2

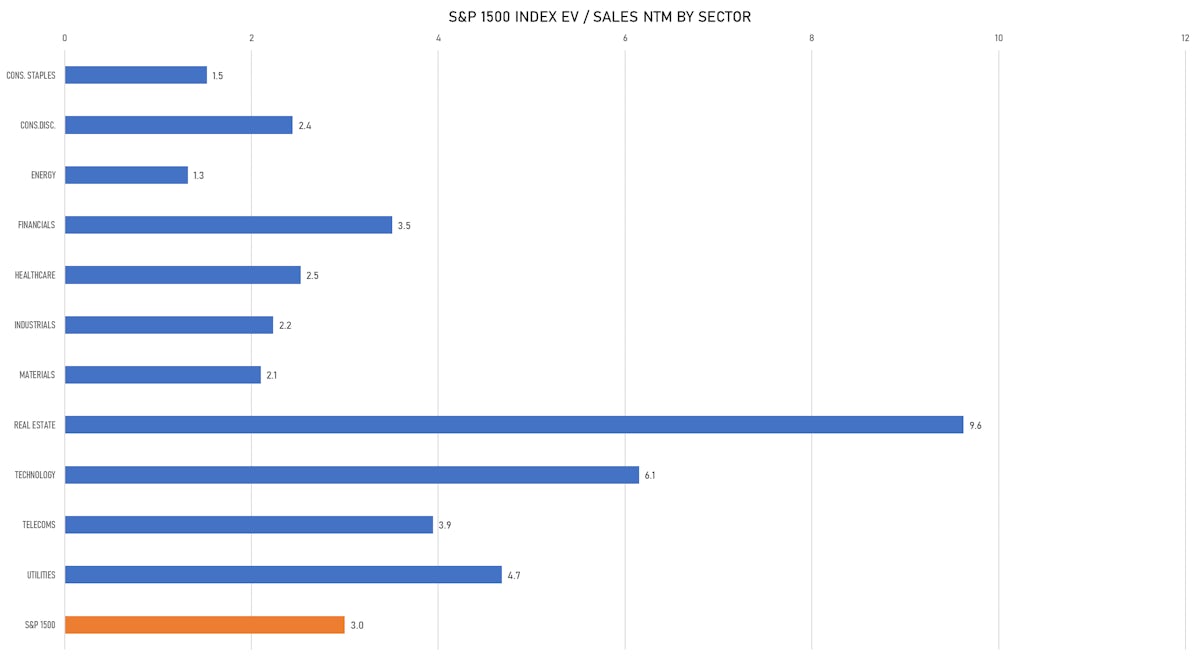

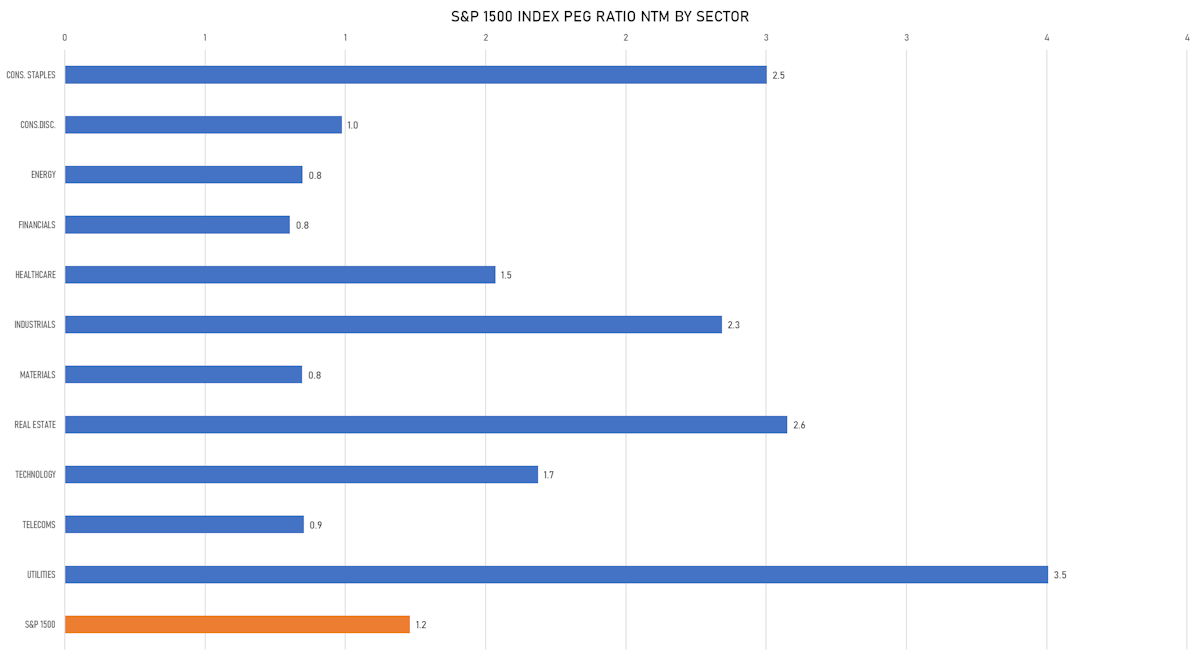

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Motive Capital Corp II / United States of America - Financials / Listing Exchange: New York / Ticker: MTVC.U / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: JP Morgan Securities LLC, UBS Securities LLC

- Crypto 1 Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: DAOOU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: B Riley Securities Inc

- Jupiter Wellness Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: JWACU / Gross proceeds (including overallotment): US$ 120.00m (offering in U.S. Dollar) / Bookrunners: I-Bankers Securities Inc

- Hoymiles Power Electronics Inc / China - Industrials / Listing Exchange: SSES / Ticker: 688032 / Gross proceeds (including overallotment): US$ 876m (offering in Chinese Yuan) / Bookrunners: CITIC Securities Co Ltd

- Hangzhou Bio-Sincerity Pharma-Tech Co Ltd / China - Healthcare / Listing Exchange: ShenzChNxt / Ticker: 301096 / Gross proceeds (including overallotment): US$ 338m (offering in Chinese Yuan) / Bookrunners: Sinolink Securities Co Ltd

- Hubei Biocause Heilen Pharmaceutical Co Ltd (Pharmaceuticals | Jingmen, China Mainland), raised US$ 244 M, placing 60 M class A ordinary shares. Financial advisors on the transaction: Guotai Junan Securities

NEW SECONDARIES / FOLLOW-ONS

- Vonovia SE / Germany - Real Estate / Listing Exchange: Frankfurt / Ticker: ANN / Gross proceeds (including overallotment): US$ 9,125m (offering in EURO) / Bookrunners: ING Bank NV, Commerzbank AG, Societe Generale SA, Deutsche Bank, Landesbank Baden-Wurttemberg, BNP Paribas SA, UBS AG London, UniCredit Bank AG, INTESA SANPAOLO S.P.A, BofA Securities Europe SA, JP Morgan AG, Citigroup Global Markets Europe AG, Goldman Sachs Bank Europe SE, Morgan Stanley Europe SE