Equities

Broad Slide For US Equities On Lower Than Average Volumes, Slightly Higher Volatility

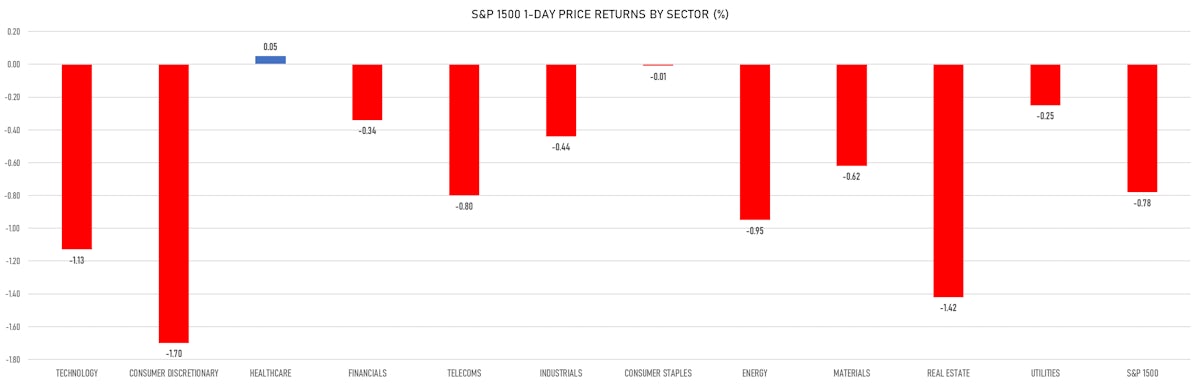

Small caps really struggled, with the Russell 2000 down 2.27%; the consumer discretionary sector was the worst performer and healthcare the best today

Published ET

S&P 1500 Price Performance By Sector Today | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.72%; Nasdaq Composite down -1.71%; Wilshire 5000 down -1.07%

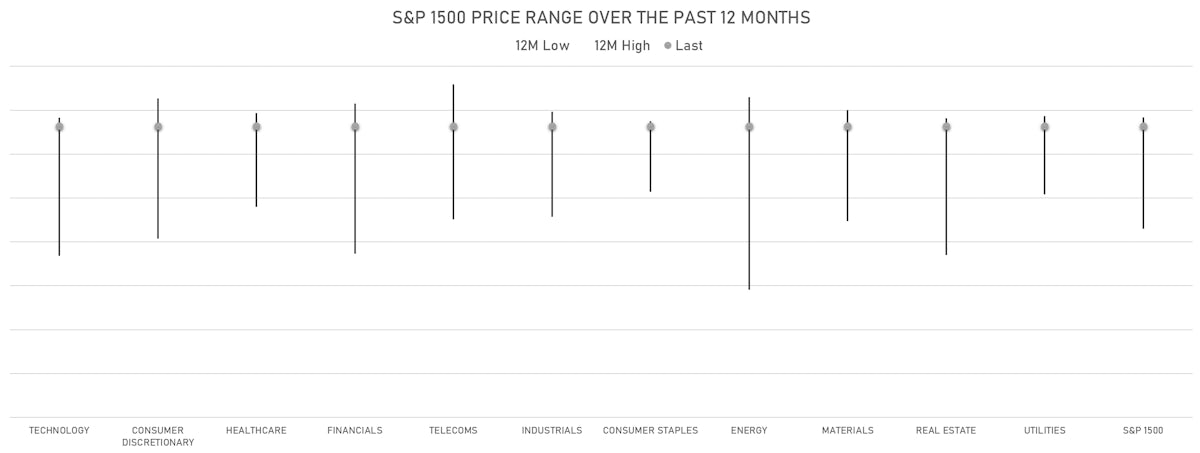

- 24.0% of S&P 500 stocks were up today, with 68.1% of stocks above their 200-day moving average (DMA) and 56.2% above their 50-DMA

- Top performing sectors in the S&P 500: healthcare up 0.24% and consumer staples up 0.06%

- Bottom performing sectors in the S&P 500: consumer discretionary down -1.70% and real estate down -1.36%

- The number of shares in the S&P 500 traded today was 512m for a total turnover of US$ 67 bn

- The S&P 500 Value Index was down -0.3%, while the S&P 500 Growth Index was down -1.1%; the S&P small caps index was down -1.7% and mid-caps were down -1.5%

- The volume on CME's INX (S&P 500 Index) was 2.0m (3-month z-score: -0.4); the 3-month average volume is 2.2m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 down -0.08%; UK FTSE 100 down -0.22%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -0.40%, Japan's TOPIX 500 down -0.24%

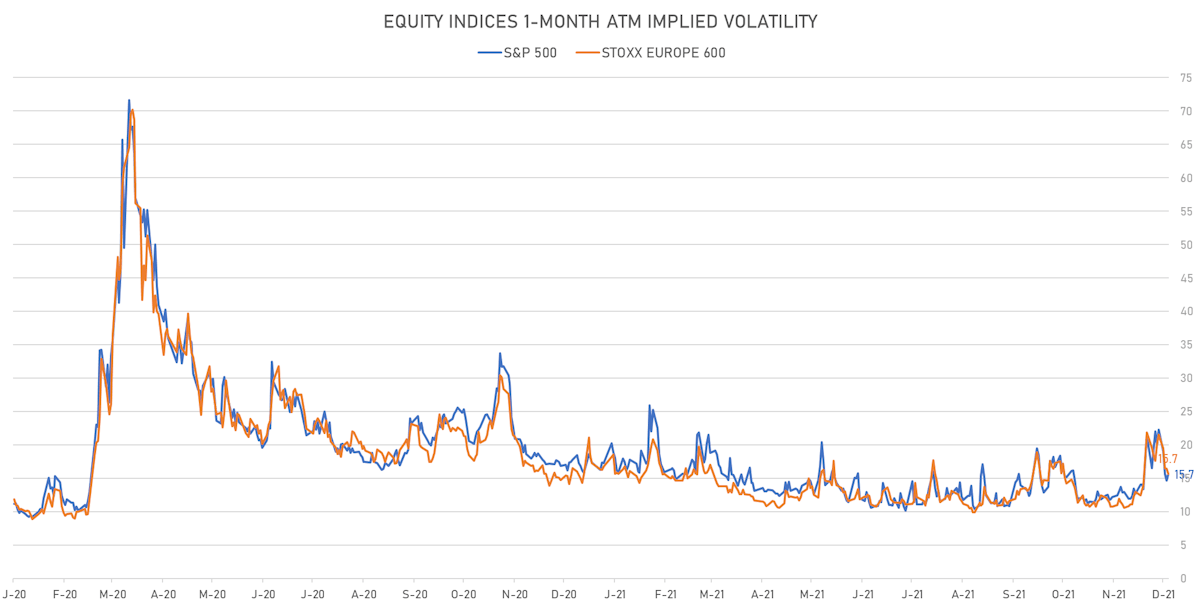

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 15.7%, up from 14.6%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 15.7%, down from 16.5%

NOTABLE S&P 500 EARNINGS RELEASES

- Oracle Corp (ORCL | Technology): beat EPS median estimate (1.21 act. vs. 1.16 est.) and matched revenue median estimate (10,360m act. vs. 10,360m est.), down -0.19% today, closed at 88.77 and at 88.98 (+0.24%) after hours

- Broadcom Inc (AVGO | Technology): matched EPS median estimate (7.81 act. vs. 7.81 est.) and matched revenue median estimate (7,407m act. vs. 7,407m est.), down -0.87% today, closed at 583.42 and at 588.00 (+0.79%) after hours

- Costco Wholesale Corp (COST | Consumer Cyclicals): matched EPS median estimate (2.97 act. vs. 2.97 est.) and matched revenue median estimate (50,363m act. vs. 50,363m est.), down -1.09% today, closed at 524.33 and at 530.50 (+1.18%) after hours

- Hormel Foods Corp (HRL | Consumer Non-Cyclicals): matched EPS median estimate (0.51 act. vs. 0.51 est.) and missed revenue median estimate (3,185m act. vs. 3,262m est.), up 4.70% today, closed at 44.80 and at 43.00 (-4.02%) after hours

- Chewy Inc (CHWY | Consumer Cyclicals): missed EPS median estimate (-0.08 act. vs. -0.04 est.) and beat revenue median estimate (2,212m act. vs. 2,210m est.), down -6.32% today, closed at 56.30 and at 60.26 (+7.03%) after hours

- Vail Resorts Inc (MTN | Consumer Cyclicals): matched EPS median estimate (-3.44 act. vs. -3.44 est.) and matched revenue median estimate (176m act. vs. 176m est.), down -2.54% today, closed at 336.12 and at 347.98 (+3.53%) after hours

- Ciena Corp (CIEN | Technology): matched EPS median estimate (0.85 act. vs. 0.85 est.) and beat revenue median estimate (1,041m act. vs. 1,022m est.), up 15.64% today, closed at 71.93 and at 63.30 (-12.00%) after hours

TOP WINNERS

- Kanzhun Ltd (BZ), up 19.1% to $36.51 / 12-Month Price Range: $ 27.90-44.96 / Short interest (% of float): 2.0%; days to cover: 8.4

- Ciena Corp (CIEN), up 15.6% to $71.93 / YTD price return: +36.1% / 12-Month Price Range: $ 43.63-64.08 / Short interest (% of float): 2.2%; days to cover: 3.9

- Nu Holdings Ltd (NU), up 14.8% to $10.33 in their trading debut

- Wallbox NV (WBX), up 12.7% to $14.77 / 12-Month Price Range: $ 7.28-27.50 / Short interest (% of float): 1.0%; days to cover: 0.8

- Bright Health Group Inc (BHG), up 10.1% to $4.35 / 12-Month Price Range: $ 3.07-17.93 / Short interest (% of float): 1.7%; days to cover: 4.5

- Arhaus Inc (ARHS), up 9.3% to $9.95 / 12-Month Price Range: $ 7.62-14.00

- GH Research PLC (GHRS), up 7.2% to $25.23 / 12-Month Price Range: $ 12.38-30.43 / Short interest (% of float): 3.2%; days to cover: 6.7

- Hashicorp Inc (HCP), up 6.5% to $85.19 in their trading debut

- Gray Television Inc (GTNa), up 6.5% to $20.25 / 12-Month Price Range: $ 14.99-23.75 / Short interest days to cover: 1.3

- Exscientia PLC (EXAI), up 6.3% to $24.13 / 12-Month Price Range: $ 19.03-30.38 / Short interest (% of float): 0.3%; days to cover: 2.8

BIGGEST LOSERS

- Reata Pharmaceuticals Inc (RETA), down 46.5% to $29.11 / YTD price return: -76.5% / 12-Month Price Range: $ 46.28-153.41 / Short interest (% of float): 14.1%; days to cover: 20.9 (the stock is currently on the short sale restriction list)

- Tecnoglass Inc (TGLS), down 36.0% to $21.56 / YTD price return: +212.0% / 12-Month Price Range: $ 5.48-34.90 / Short interest (% of float): 4.0%; days to cover: 2.5 (the stock is currently on the short sale restriction list)

- Torrid Holdings Inc (CURV), down 27.9% to $11.28 / 12-Month Price Range: $ 13.26-33.19 / Short interest (% of float): 3.5%; days to cover: 6.5 (the stock is currently on the short sale restriction list)

- Phreesia Inc (PHR), down 21.2% to $42.56 / YTD price return: -21.6% / 12-Month Price Range: $ 42.25-81.59 / Short interest (% of float): 3.1%; days to cover: 6.4 (the stock is currently on the short sale restriction list)

- Lucid Group Inc (LCID), down 18.3% to $36.52 / YTD price return: +264.8% / 12-Month Price Range: $ 9.84-64.86 / Short interest (% of float): 2.6%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- Bakkt Holdings Inc (BKKT), down 14.4% to $14.68 / YTD price return: +45.6% / 12-Month Price Range: $ 8.00-50.80 / Short interest (% of float): 28.4%; days to cover: 0.5 (the stock is currently on the short sale restriction list)

- Digital World Acquisition Corp (DWAC), down 13.6% to $56.55 / 12-Month Price Range: $ 9.84-175.00 / Short interest (% of float): 10.8%; days to cover: 0.1 (the stock is currently on the short sale restriction list)

- RingCentral Inc (RNG), down 13.2% to $186.21 / YTD price return: -50.9% / 12-Month Price Range: $ 180.09-449.00 / Short interest (% of float): 9.0%; days to cover: 6.0 (the stock is currently on the short sale restriction list)

- Arqit Quantum Inc (ARQQ), down 13.0% to $21.33 / 12-Month Price Range: $ 8.00-41.52 / Short interest (% of float): 1.2%; days to cover: 0.9 (the stock is currently on the short sale restriction list)

- Sumo Logic Inc (SUMO), down 12.5% to $14.25 / YTD price return: -50.1% / 12-Month Price Range: $ 12.90-46.37 / Short interest (% of float): 5.0%; days to cover: 8.0 (the stock is currently on the short sale restriction list)

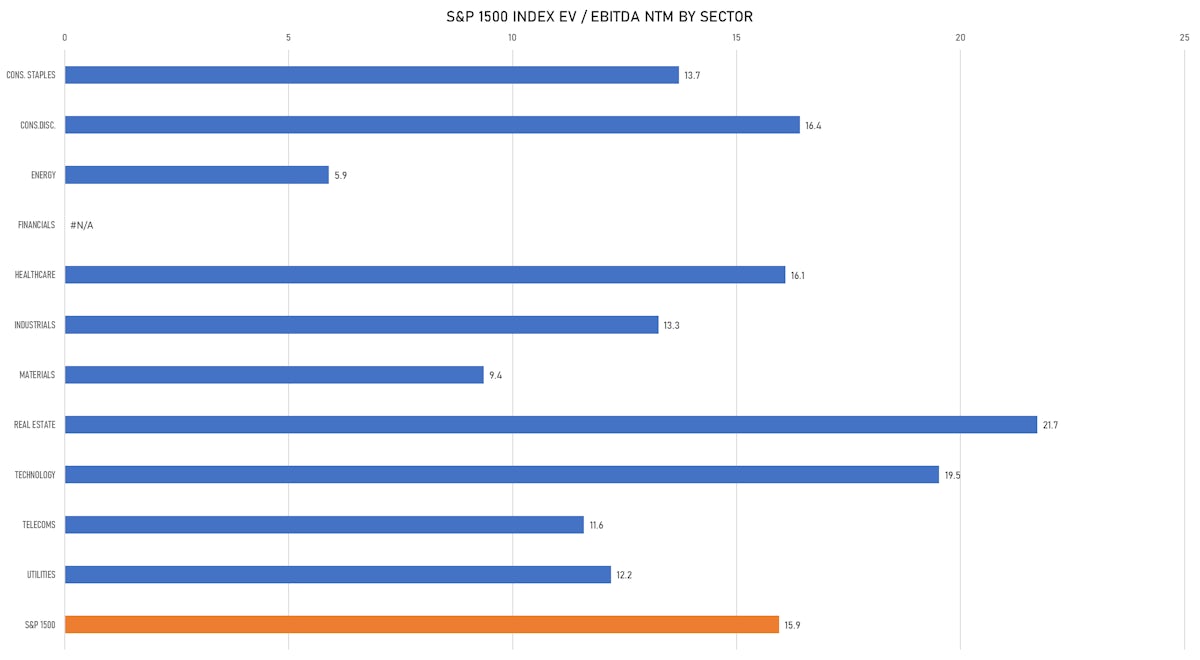

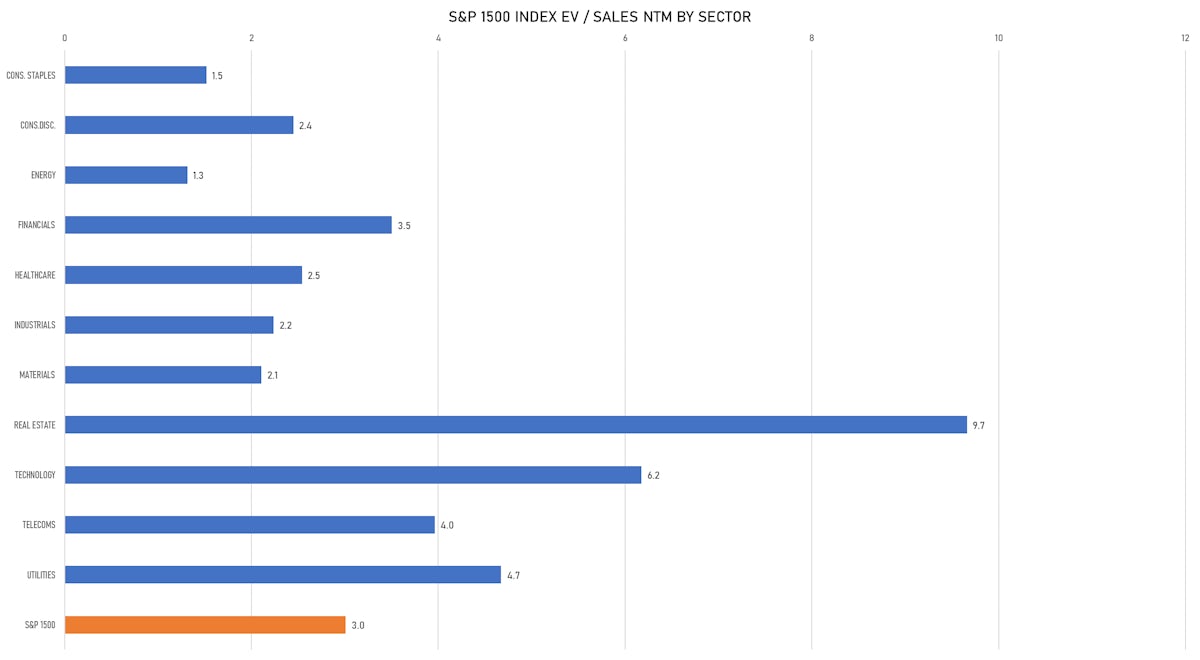

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- HashiCorp Inc / United States of America - High Technology / Listing Exchange: New York / Ticker: HCP / Gross proceeds (including overallotment): US$ 1,224.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co LLC, JP Morgan Securities LLC

- Jackson Acquisition Co / United States of America - Financials / Listing Exchange: New York / Ticker: RJAC.U / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Bofa Securities Inc

- Sculptor Acquisition Corp I / United States of America - Financials / Listing Exchange: New York / Ticker: SCUA.U / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co

- Nu Holdings Ltd / Brazil - High Technology / Listing Exchange: New York / Ticker: NU / Gross proceeds (including overallotment): US$ 2,602.36m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc, Morgan Stanley & Co LLC

- Emerging Markets Horizon Corp / Cyprus - Financials / Listing Exchange: Nasdaq / Ticker: HORIU / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, VTB Capital

- Brigade-M3 European Acquisition Corp / Cayman Islands - Financials / Listing Exchange: EuronextAM / Ticker: BACEW / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Aurel BGC SASU

- Genesis Growth Tech Acquisition Corp / Switzerland - Financials / Listing Exchange: Nasdaq / Ticker: GGAAU / Gross proceeds (including overallotment): US$ 220.00m (offering in U.S. Dollar) / Bookrunners: Nomura Securities International Inc

- Target Global Acquisition I Corp / Cayman Islands - Financials / Listing Exchange: Nasdaq / Ticker: TGAAU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Bofa Securities Inc, UBS Securities LLC

- China Southern Power Grid Technology Co Ltd / China - Consumer Products and Services / Listing Exchange: SSES / Ticker: 688248 / Gross proceeds (including overallotment): US$ 120.23m (offering in Chinese Yuan) / Bookrunners: China Securities Co Ltd

NEW SECONDARIES / FOLLOW-ONS

- Agree Realty Corp / United States of America - Real Estate / Listing Exchange: New York / Ticker: ADC / Gross proceeds (including overallotment): US$ 340.75m (offering in U.S. Dollar) / Bookrunners: Wells Fargo Securities LLC, Morgan Stanley & Co LLC, Bofa Securities Inc

- Relmada Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: RLMD / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Guggenheim Securities LLC, Jefferies LLC

- Ebos Group Ltd / New Zealand - Consumer Products and Services / Listing Exchange: NewZealand / Ticker: EBO / Gross proceeds (including overallotment): US$ 529m (offering in New Zealand Dollar) / Bookrunners: Macquarie Securities (NZ) Ltd

- Zur Rose Group AG / Switzerland - Consumer Products and Services / Listing Exchange: Swiss Exch / Ticker: ROSE / Gross proceeds (including overallotment): US$ 204.18m (offering in Swiss Franc) / Bookrunners: Merrill Lynch International Ltd, Jefferies International Ltd

- Ideagen PLC / United Kingdom - High Technology / Listing Exchange: London AIM / Ticker: IDEA / Gross proceeds (including overallotment): US$ 132.19m (offering in British Pound) / Bookrunners: Goldman Sachs International, Numis Securities Ltd, Canaccord Genuity Ltd, finnCap Ltd

- Kakaobank Corp (Banks | Seongnam, South Korea), raised US$ 409 M, placing 08 M ordinary or common shares. Financial advisors on the transaction: Morgan Stanley & Co

- Energy Transfer LP (Oil & Gas | Dallas, Texas), raised US$ 665 M, placing 87 M units. Financial advisors on the transaction: Citigroup Global Markets Inc, Morgan Stanley & Co LLC, JP Morgan Securities LLC