Equities

US Equities Rise Broadly, Led By Large Caps And Technology, As S&P 500 Closes Week Up 3.82%

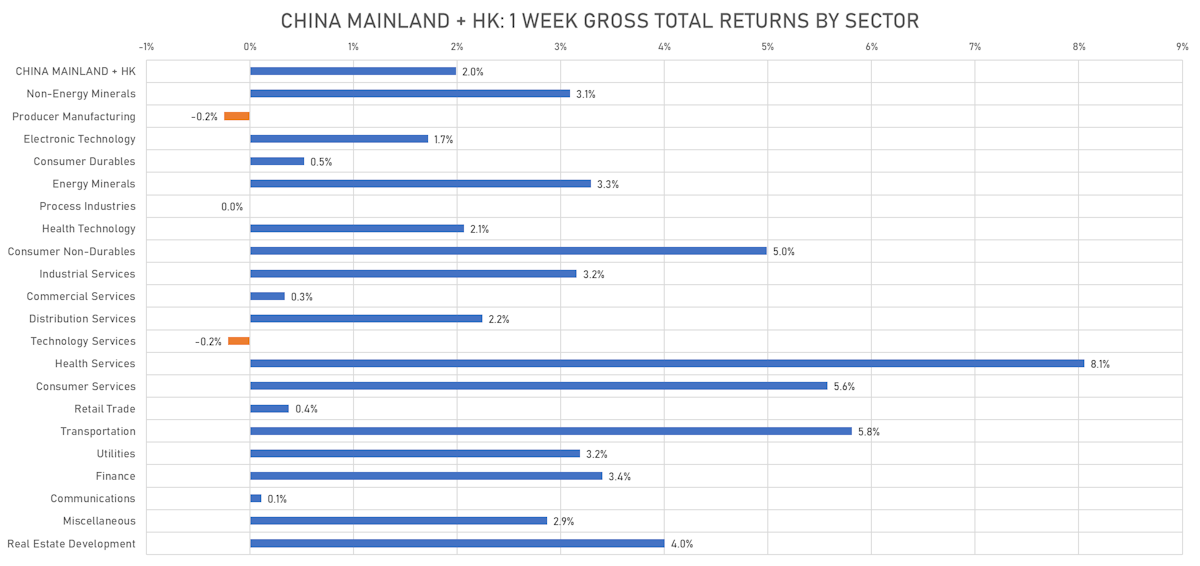

With the long-awaited defaults of Evergrande and Kaisa finally here and the government bringing in more supportive policies, Chinese equities started a solid rebound this week, which could continue into next year (HK + China have only returned +0.6% YTD)

Published ET

China Mainland + HK Gross Total Return (US$) This Week | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.95%; Nasdaq Composite up 0.73%; Wilshire 5000 up 0.68%

- 70.5% of S&P 500 stocks were up today, with 67.5% of stocks above their 200-day moving average (DMA) and 59.6% above their 50-DMA

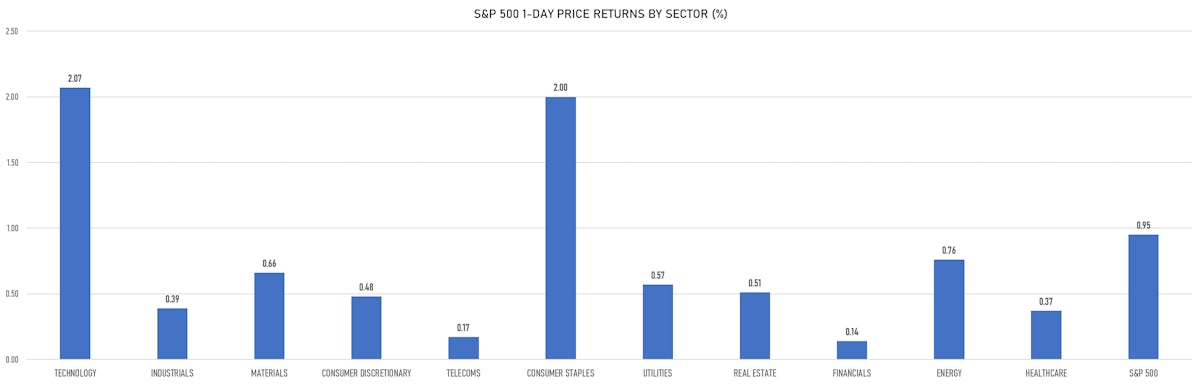

- Top performing sectors in the S&P 500: technology up 2.07% and consumer staples up 2.00%

- Bottom performing sectors in the S&P 500: financials up 0.14% and telecoms up 0.17%

- The number of shares in the S&P 500 traded today was 544m for a total turnover of US$ 72 bn

- The S&P 500 Value Index was up 0.8%, while the S&P 500 Growth Index was up 1.1%; the S&P small caps index was unchanged and mid-caps were up 0.1%

- The volume on CME's INX (S&P 500 Index) was 2.1m (3-month z-score: -0.1); the 3-month average volume is 2.2m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 down -0.30%; UK FTSE 100 down -0.40%; Hang Seng SH-SZ-HK 300 Index down -0.59%; Japan's TOPIX 500 down -0.75%

VOLATILITY

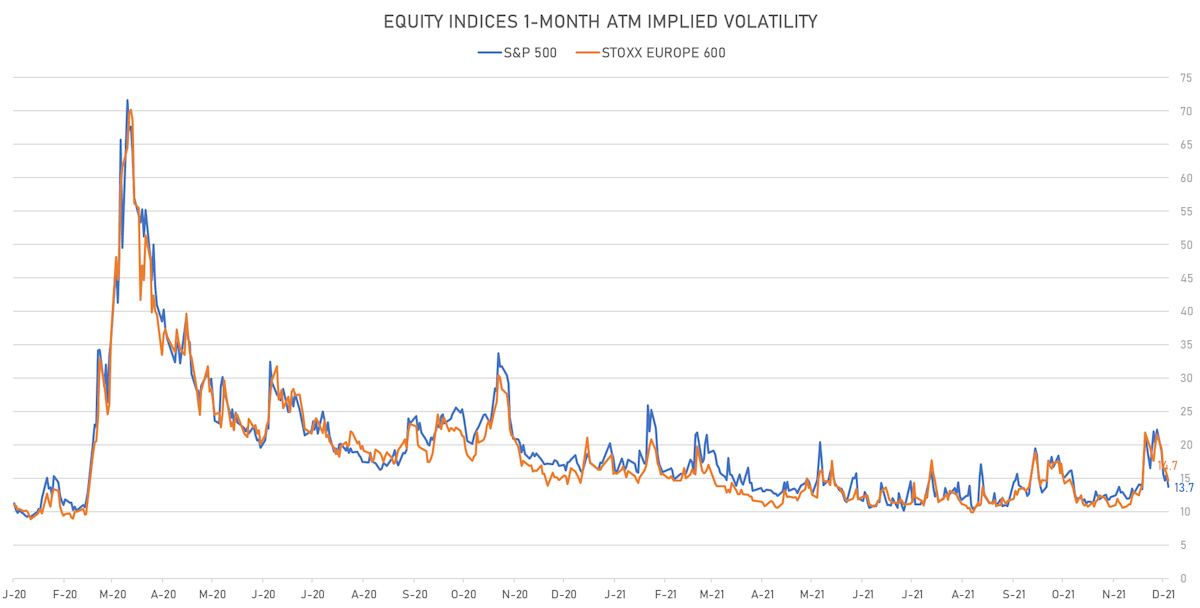

- 1-month at-the-money implied volatility on the S&P 500 at 13.7%, down from 15.7%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 14.7%, down from 15.7%

TOP WINNERS

- Arhaus Inc (ARHS), up 19.3% to $11.87 / 12-Month Price Range: $ 7.62-14.00 / Short interest (% of float): 0.3%; days to cover: 0.1

- Bottomline Technologies Inc (EPAY), up 18.7% to $53.05 / 12-Month Price Range: $ 36.05-55.09 / Short interest (% of float): 3.2%; days to cover: 3.3

- Oracle Corp (ORCL), up 15.6% to $102.63 / YTD price return: +58.6% / 12-Month Price Range: $ 59.04-98.95

- Full Truck Alliance Co Ltd (YMM), up 15.0% to $11.78 / 12-Month Price Range: $ 7.95-22.80 / Short interest (% of float): 2.2%; days to cover: 8.0

- Nu Holdings Ltd (NU), up 14.7% to $11.85 / 12-Month Price Range: $ 10.01-12.24

- Lightwave Logic Inc (LWLG), up 12.9% to $19.56 / 12-Month Price Range: $ .83-19.74 / Short interest (% of float): 1.6%; days to cover: 2.4

- Youdao Inc (DAO), up 11.9% to $13.36 / YTD price return: -49.6% / 12-Month Price Range: $ 7.02-42.17 / Short interest (% of float): 4.0%; days to cover: 4.4

- Oscar Health Inc (OSCR), up 11.6% to $10.89 / 12-Month Price Range: $ 8.24-37.00 / Short interest (% of float): 4.8%; days to cover: 4.4

- Sprinklr Inc (CXM), up 11.3% to $15.03 / 12-Month Price Range: $ 12.12-26.50 / Short interest (% of float): 10.9%; days to cover: 7.0

- Informatica Inc (INFA), up 10.1% to $38.52 / 12-Month Price Range: $ 27.51-37.50 / Short interest (% of float): 0.6%; days to cover: 0.5

BIGGEST LOSERS

- Everbridge Inc (EVBG), down 45.4% to $63.00 / YTD price return: -57.7% / 12-Month Price Range: $ 103.28-178.98 / Short interest (% of float): 12.8% (the stock is currently on the short sale restriction list)

- Figs Inc (FIGS), down 21.0% to $24.65 / 12-Month Price Range: $ 28.25-50.40 / Short interest (% of float): 11.3%; days to cover: 5.3 (the stock is currently on the short sale restriction list)

- indie Semiconductor Inc (INDI), down 19.9% to $12.00 / YTD price return: -9.2% / 12-Month Price Range: $ 8.00-16.33 / Short interest (% of float): 13.4%; days to cover: 5.1 (the stock is currently on the short sale restriction list)

- Pear Therapeutics Inc (PEAR), down 17.3% to $7.46 / 12-Month Price Range: $ 7.76-14.60 / Short interest (% of float): 0.3%; days to cover: 1.0 (the stock is currently on the short sale restriction list)

- Roivant Sciences Ltd (ROIV), down 13.6% to $8.93 / 12-Month Price Range: $ 5.80-10.99 / Short interest (% of float): 0.4%; days to cover: 2.5 (the stock is currently on the short sale restriction list)

- Grab Holdings Ltd (GRAB), down 11.9% to $7.12 / YTD price return: -44.6% / 12-Month Price Range: $ 7.60-18.11 / Short interest (% of float): 1.0%; days to cover: 3.0 (the stock is currently on the short sale restriction list)

- Riskified Ltd (RSKD), down 10.7% to $7.78 / 12-Month Price Range: $ 7.85-40.48 / Short interest (% of float): 1.3%; days to cover: 0.5 (the stock is currently on the short sale restriction list)

- Upstart Holdings Inc (UPST), down 10.5% to $160.75 / YTD price return: +294.5% / 12-Month Price Range: $ 22.61-401.49 / Short interest (% of float): 4.9%; days to cover: #N/A (the stock is currently on the short sale restriction list)

- Global Blue Group Holding Ltd (GB), down 9.7% to $7.00 / 12-Month Price Range: $ 5.74-15.90 / Short interest (% of float): 0.3%; days to cover: 10.3

- BioNTech SE (BNTX), down 9.3% to $257.68 / YTD price return: +216.1% / 12-Month Price Range: $ 80.55-464.00 / Short interest (% of float): 2.8%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

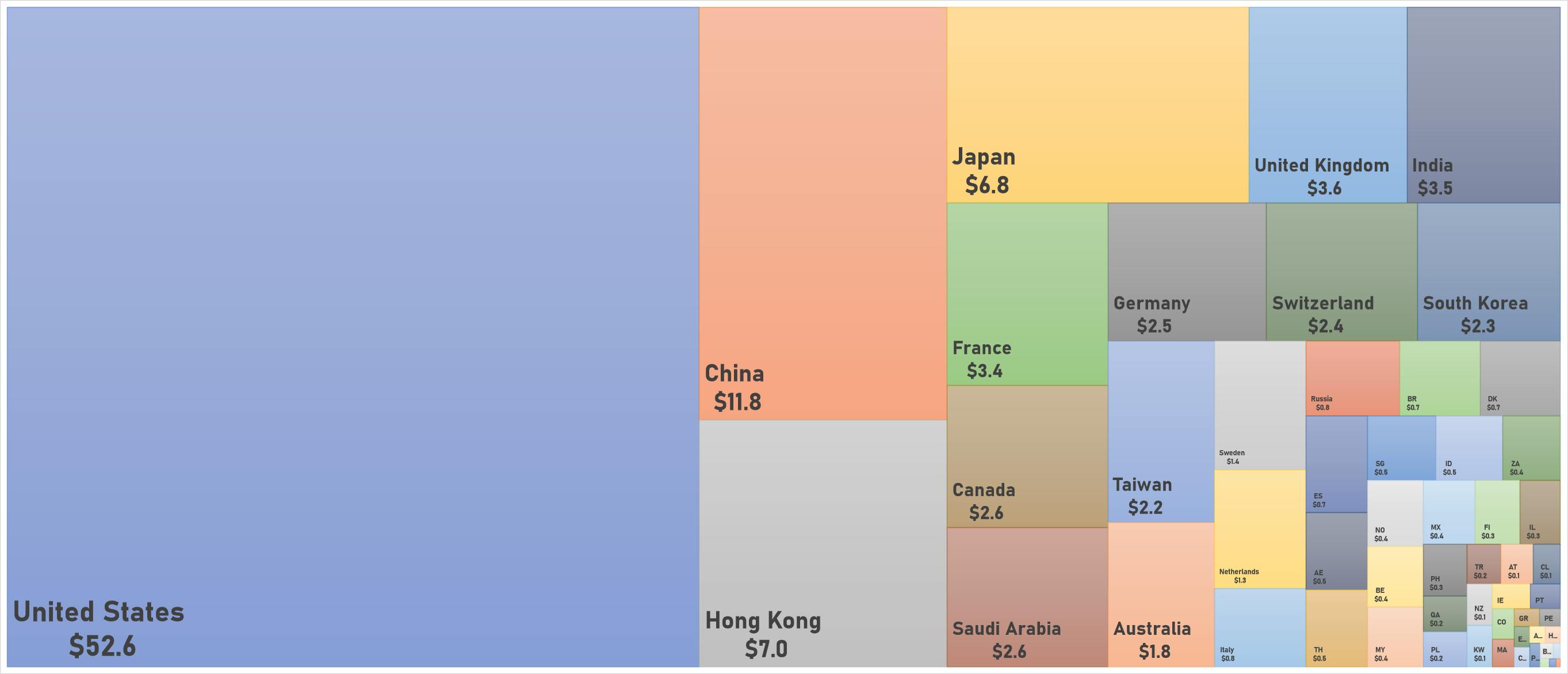

WORLD MARKET CAP BREAKDOWN BY COUNTRY

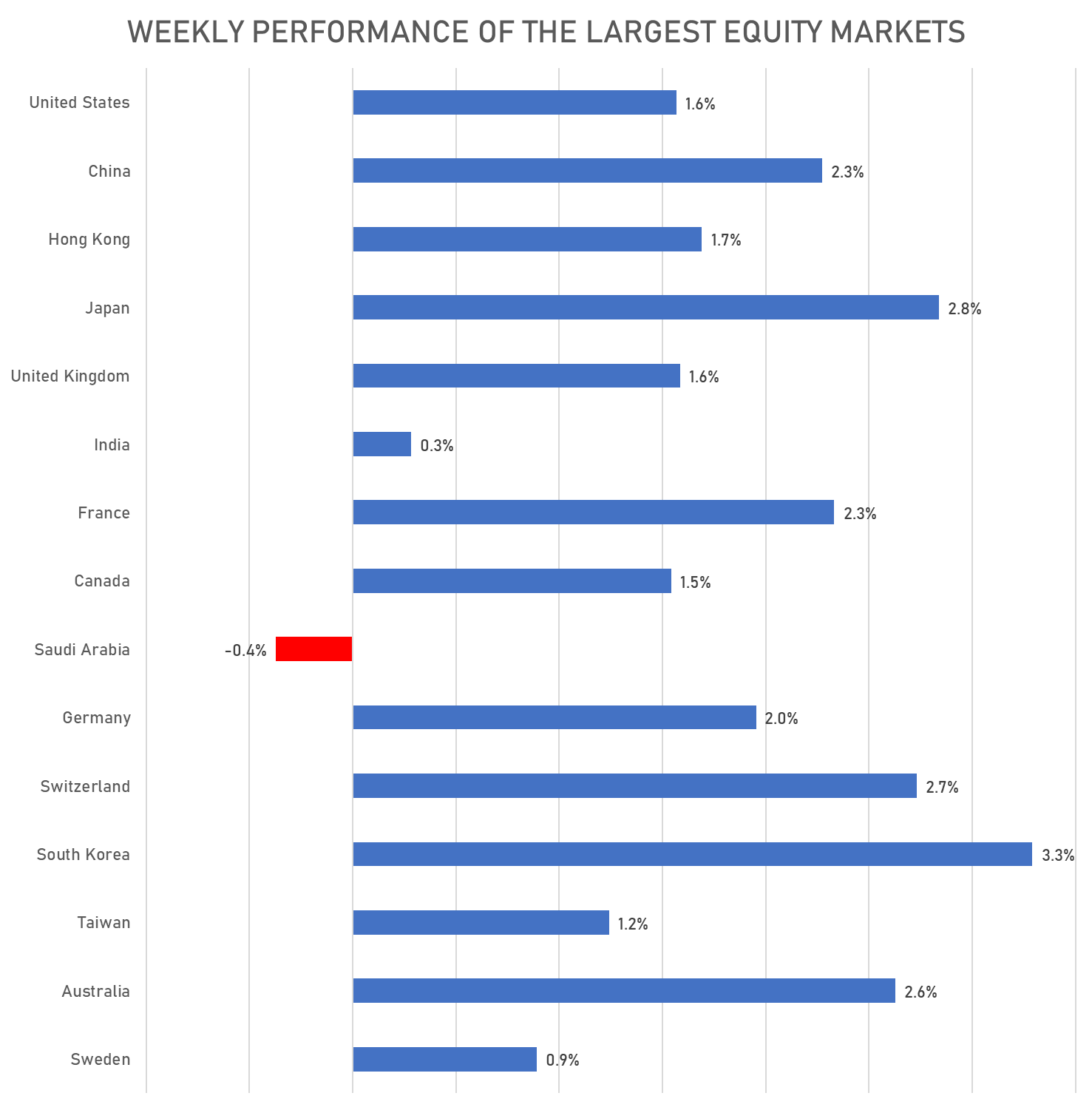

WEEKLY PERFORMANCE OF THE LARGEST GLOBAL EQUITY MARKETS

NEW IPOs ANNOUNCED OR PRICED

- Power & Digital Infrastructure Acquisition Ii Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: XPDBU / Gross proceeds (including overallotment): US$ 287.50m (offering in U.S. Dollar) / Bookrunners: BofA Securities Inc, Barclays Capital Inc

- Athena Technology Acquisition Corp II / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: ATEK.U / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc

- Growth For Good Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: GFGDU / Gross proceeds (including overallotment): US$ 220.00m (offering in U.S. Dollar) / Bookrunners: Credit Suisse Securities (USA) LLC, Barclays Capital Inc

- Southport Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: PORT.U / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Bofa Securities Inc

- Hyundai Engineering Co Ltd / South Korea - Industrials / Listing Exchange: Korea / Ticker: - / Gross proceeds (including overallotment): US$ 907m (offering in Korean Won) / Bookrunners: Goldman Sachs & Co, Samsung Securities Co Ltd, Korea Investment & Securities Co Ltd, NH Investment & Securities Co, Hana Financial Investment Co, Mirae Asset Daewoo Co Ltd, KBI Securities Co Ltd, Hyundai Motor Securities Co Ltd

- ThomasLloyd Energy Impact Trust PLC / United Kingdom - Financials / Listing Exchange: London / Ticker: TLEP / Gross proceeds (including overallotment): US$ 115.39m (offering in U.S. Dollar) / Bookrunners: Shore Capital & Corporate Ltd

- Kohoku Kogyo Co Ltd / Japan - High Technology / Listing Exchange: Tokyo 2 / Ticker: 6524 / Gross proceeds (including overallotment): US$ 104.68m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd

SECONDARIES / FOLLOW-ONS

- Agree Realty Corp / United States of America - Real Estate / Listing Exchange: New York / Ticker: ADC / Gross proceeds (including overallotment): US$ 340.75m (offering in U.S. Dollar) / Bookrunners: Wells Fargo Securities LLC, Morgan Stanley & Co LLC, Bofa Securities Inc

- Relmada Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: RLMD / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Guggenheim Securities LLC, Jefferies LLC

- Saudi Telecom Co SJSC / Saudi Arabia - Telecommunications / Listing Exchange: Saudi Exch / Ticker: 7010 / Gross proceeds (including overallotment): US$ 3,198.89m (offering in Saudi Arabian Riyal) / Bookrunners: Morgan Stanley Saudi Arabia, HSBC Saudi Arabia Ltd, Goldman Sachs Saudi Arabia Co, Credit Suisse Saudi Arabia Co, Citigroup Saudi Arabia, Saudi National Bank SJSC