Equities

Energy And Consumer Discretionary Sectors Lead Declines As US Equities Fall To Start The Week

Only about one third of S&P 500 stocks closed up today, with growth and small-cap stocks underperforming widely the broader market

Published ET

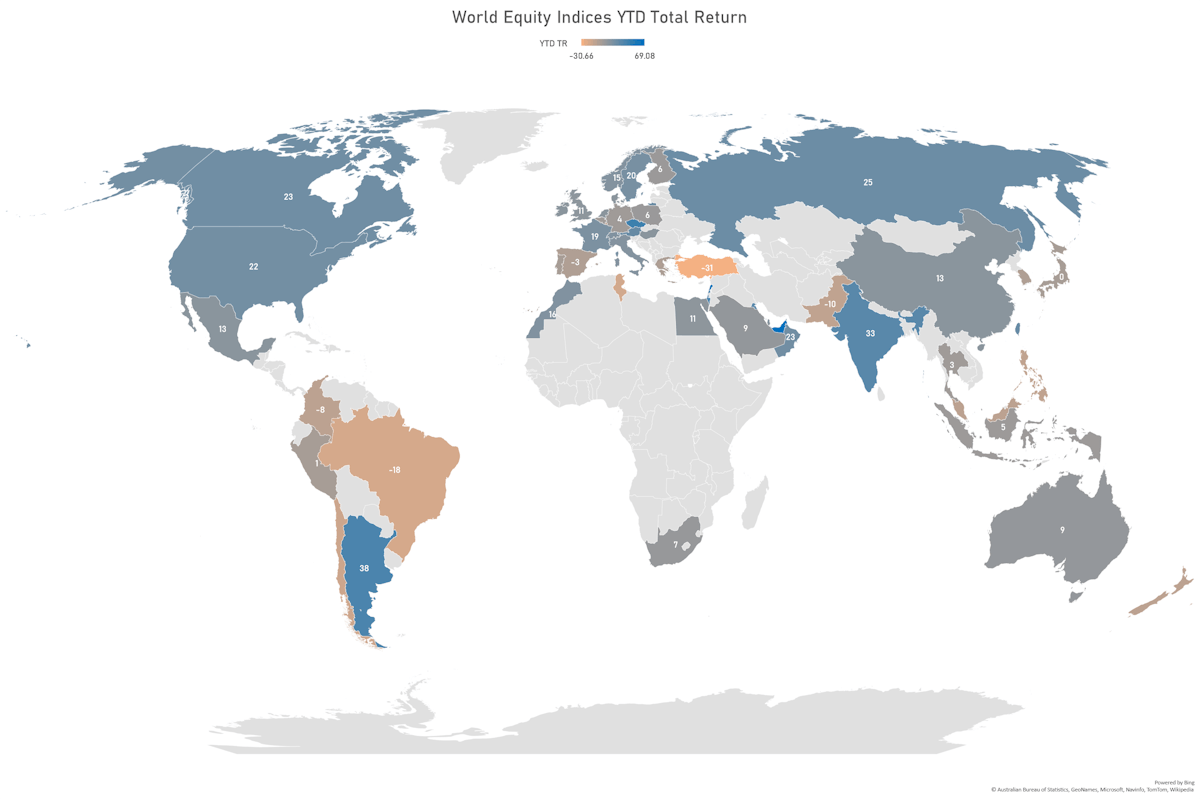

Year-To-Date Total Returns By Country | Sources: ϕpost, FactSet data

QUICK SUMMARY

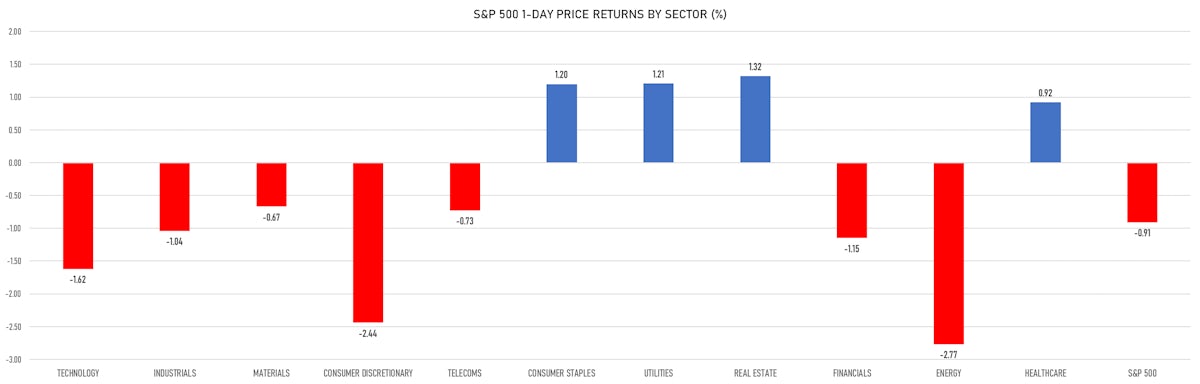

- Daily performance of US indices: S&P 500 down -0.91%; Nasdaq Composite down -1.39%; Wilshire 5000 down -0.99%

- 36.0% of S&P 500 stocks were up today, with 66.9% of stocks above their 200-day moving average (DMA) and 54.9% above their 50-DMA

- Top performing sectors in the S&P 500: real estate up 1.32% and utilities up 1.21%

- Bottom performing sectors in the S&P 500: energy down -2.77% and consumer discretionary down -2.44%

- The number of shares in the S&P 500 traded today was 676m for a total turnover of US$ 90 bn

- The S&P 500 Value Index was down -0.6%, while the S&P 500 Growth Index was down -1.2%; the S&P small caps index was down -1.7% and mid-caps were down -1.1%

- The volume on CME's INX (S&P 500 Index) was 2.4m (3-month z-score: 0.6); the 3-month average volume is 2.2m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 down -0.43%; UK FTSE 100 down -0.83%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -0.80%, Japan's TOPIX 500 down -0.07%

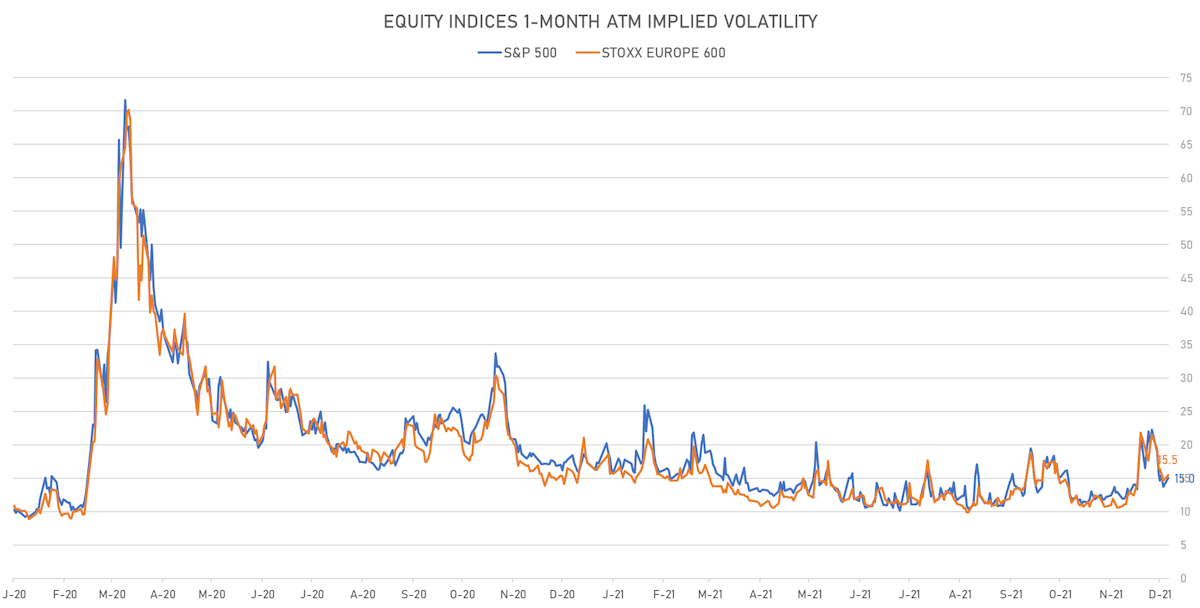

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 15.0%, up from 13.7%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 15.5%, up from 14.7%

TOP WINNERS

- Arena Pharmaceuticals Inc (ARNA), up 80.4% to $90.08 / YTD price return: +17.2% / 12-Month Price Range: $ 45.50-85.00 / Short interest (% of float): 3.1%; days to cover: 3.5

- Dingdong (Cayman) Ltd (DDL), up 18.4% to $15.61 / 12-Month Price Range: $ 12.90-46.00 / Short interest (% of float): 0.2%; days to cover: 5.2

- Tecnoglass Inc (TGLS), up 13.0% to $21.10 / YTD price return: +205.4% / 12-Month Price Range: $ 6.35-34.90 / Short interest (% of float): 2.7%; days to cover: 1.7

- Turquoise Hill Resources Ltd (TRQ), up 12.9% to $16.48 / YTD price return: +32.7% / 12-Month Price Range: $ 9.75-21.89 / Short interest (% of float): 2.7%; days to cover: 2.4

- Frank's International NV (XPRO), up 11.0% to $15.03 / YTD price return: -8.6% / 12-Month Price Range: $ 12.09-32.64 / Short interest (% of float): 1.4%; days to cover: 3.5

- Everbridge Inc (EVBG), up 9.7% to $69.13 / YTD price return: -53.6% / 12-Month Price Range: $ 57.58-178.98 / Short interest (% of float): 12.8%; days to cover: 10.1

- Nuvation Bio Inc (NUVB), up 9.0% to $9.95 / YTD price return: -15.0% / 12-Month Price Range: $ 7.30-15.23 / Short interest (% of float): 5.6%; days to cover: 10.3

- Radware Ltd (RDWR), up 8.6% to $34.78 / YTD price return: +25.3% / 12-Month Price Range: $ 24.93-39.78 / Short interest (% of float): 2.8%; days to cover: 3.9

- BioNTech SE (BNTX), up 8.0% to $278.22 / YTD price return: +241.3% / 12-Month Price Range: $ 80.55-464.00 / Short interest (% of float): 2.8%; days to cover: 0.6

- Clear Channel Outdoor Holdings Inc (CCO), up 7.9% to $3.29 / YTD price return: +99.4% / 12-Month Price Range: $ 1.26-3.70 / Short interest (% of float): 4.4%; days to cover: 8.6

BIGGEST LOSERS

- Allogene Therapeutics Inc (ALLO), down 21.7% to $14.11 / YTD price return: -44.1% / 12-Month Price Range: $ 12.90-39.12 / Short interest (% of float): 7.2%; days to cover: 4.4 (the stock is currently on the short sale restriction list)

- PowerSchool Holdings Inc (PWSC), down 15.5% to $17.00 / 12-Month Price Range: $ 17.57-36.56 / Short interest (% of float): 2.5%; days to cover: 4.6 (the stock is currently on the short sale restriction list)

- AMC Entertainment Holdings Inc (AMC), down 15.3% to $23.24 / YTD price return: +996.2% / 12-Month Price Range: $ 1.91-72.62 / Short interest (% of float): 16.2%; days to cover: 2.4 (the stock is currently on the short sale restriction list)

- Ke Holdings Inc (BEKE), down 15.3% to $18.73 / YTD price return: -69.6% / 12-Month Price Range: $ 15.15-78.00 / Short interest (% of float): 2.4%; days to cover: 2.1 (the stock is currently on the short sale restriction list)

- Arqit Quantum Inc (ARQQ), down 14.5% to $17.71 / 12-Month Price Range: $ 8.00-41.52 / Short interest (% of float): 1.5%; days to cover: 1.0 (the stock is currently on the short sale restriction list)

- Youdao Inc (DAO), down 14.1% to $11.48 / YTD price return: -56.7% / 12-Month Price Range: $ 7.02-42.17 / Short interest (% of float): 4.0%; days to cover: 4.4 (the stock is currently on the short sale restriction list)

- GameStop Corp (GME), down 13.9% to $136.88 / YTD price return: +626.5% / 12-Month Price Range: $ 12.14-483.00 / Short interest (% of float): 10.2%; days to cover: 2.7 (the stock is currently on the short sale restriction list)

- Kulicke and Soffa Industries Inc (KLIC), down 13.7% to $57.33 / YTD price return: +80.2% / 12-Month Price Range: $ 31.24-75.29 / Short interest (% of float): 12.3%; days to cover: 6.3 (the stock is currently on the short sale restriction list)

- Bakkt Holdings Inc (BKKT), down 13.4% to $12.58 / YTD price return: +24.8% / 12-Month Price Range: $ 8.00-50.80 / Short interest (% of float): 32.8%; days to cover: 0.5 (the stock is currently on the short sale restriction list)

- Nextdoor Holdings Inc (KIND), down 13.1% to $8.29 / 12-Month Price Range: $ 9.45-18.59 / Short interest (% of float): 5.8%; days to cover: 1.6 (the stock is currently on the short sale restriction list)

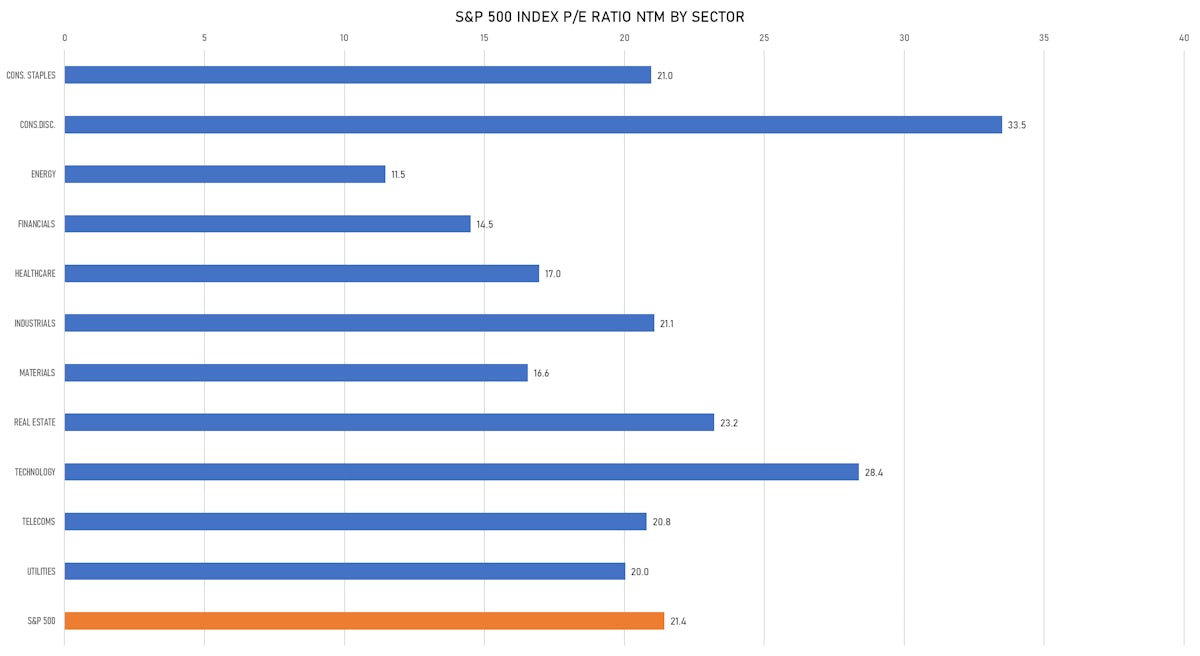

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Finatext Holdings Ltd / Japan - High Technology / Listing Exchange: Mothers / Ticker: 4419 / Gross proceeds (including overallotment): US$ 182.20m (offering in Japanese Yen) / Bookrunners: Daiwa Securities Co Ltd, Mitsubishi UFJ Morgan Stanley Securities Co Ltd

- Hangzhou SF Intra-city Industrial Co Ltd / China - Consumer Products and Services / Listing Exchange: Hong Kong / Ticker: N/A / Gross proceeds (including overallotment): US$ 250m (offering in Hong Kong Dollar) / Bookrunners: Merrill Lynch (Asia Pacific) Ltd, CLSA Equity Capital Markets Ltd, CMB International Capital Corp, Credit Suisse, Credit Suisse (Hong Kong) Ltd, China International Capital Corp HK Securities Ltd, Huatai Financial holdings (Hong Kong) Ltd, ABCI Capital Ltd, Futu Securities International (Hong Kong) Ltd

SECONDARIES / FOLLOW-ONS

- LG Corp / South Korea - High Technology / Listing Exchange: KOSDAQ / Ticker: 003550 / Gross proceeds (including overallotment): US$ 451.22m (offering in Korean Won) / Bookrunners: Morgan Stanley & Co