Equities

Big Drop In Technology Stocks And Another Day Of Outperformance For Value Over Growth

Decent volumes, slightly higher implied volatilities (though nothing scary), potentially opening to the door to a rally into the end of the year if the Fed proves less hawkish than the market tomorrow (which we expect)

Published ET

S&P 500 Value Index vs S&P 500 Growth Index | Source: Refinitiv

QUICK SUMMARY

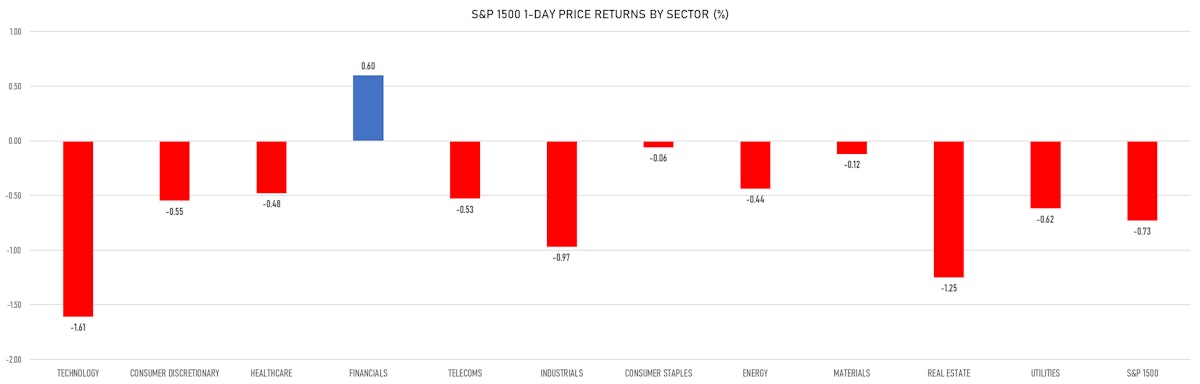

- Daily performance of US indices: S&P 500 down -0.75%; Nasdaq Composite down -1.14%; Wilshire 5000 down -0.78%

- 31.5% of S&P 500 stocks were up today, with 65.7% of stocks above their 200-day moving average (DMA) and 50.7% above their 50-DMA

- Top performing sectors in the S&P 500: financials up 0.62% and consumer staples down -0.06%

- Bottom performing sectors in the S&P 500: technology down -1.64% and real estate down -1.27%

- The number of shares in the S&P 500 traded today was 721m for a total turnover of US$ 90 bn

- The S&P 500 Value Index was down -0.2%, while the S&P 500 Growth Index was down -1.2%; the S&P small caps index was down -0.6% and mid-caps were down -0.5%

- The volume on CME's INX (S&P 500 Index) was 2.5m (3-month z-score: 0.6); the 3-month average volume is 2.2m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 down -0.84%; UK FTSE 100 down -0.18%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -0.13%, Japan's TOPIX 500 up 0.40%

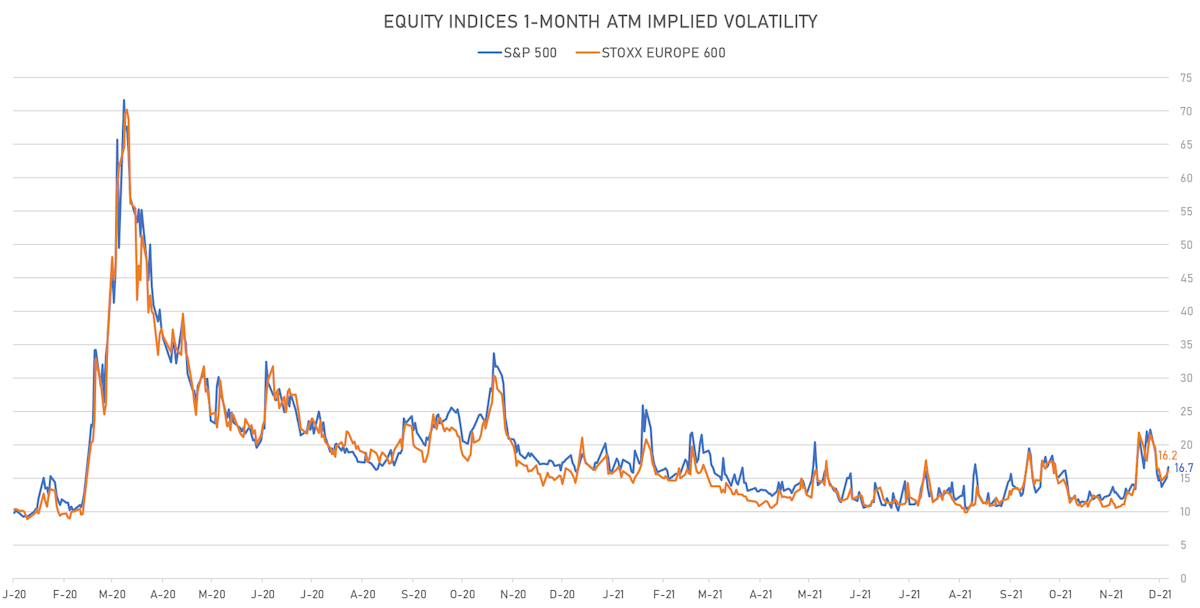

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 16.7%, up from 15.0%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 16.2%, up from 15.5%

TOP WINNERS

- Terminix Global Holdings Inc (TMX), up 18.0% to $44.15 / YTD price return: -13.4% / 12-Month Price Range: $ 36.30-55.00 / Short interest (% of float): 1.1%; days to cover: 2.1

- Allbirds Inc (BIRD), up 17.6% to $15.24 / 12-Month Price Range: $ 12.56-32.44 / Short interest (% of float): 20.9%; days to cover: 1.1

- Vicarious Surgical Inc (RBOT), up 9.4% to $10.83 / YTD price return: +6.6% / 12-Month Price Range: $ 9.50-15.79 / Short interest (% of float): 3.9%; days to cover: 7.8

- Beyond Meat Inc (BYND), up 9.3% to $69.31 / YTD price return: -44.6% / 12-Month Price Range: $ 62.06-221.00 / Short interest (% of float): 34.0%; days to cover: 4.7

- Neogen Corp (NEOG), up 8.2% to $43.41 / YTD price return: +9.5% / 12-Month Price Range: $ 36.51-48.85

- GameStop Corp (GME), up 7.9% to $147.69 / YTD price return: +683.9% / 12-Month Price Range: $ 12.14-483.00 / Short interest (% of float): 10.2%; days to cover: 2.7 (the stock is currently on the short sale restriction list)

- Elbit Systems Ltd (ESLT), up 7.7% to $172.33 / YTD price return: +31.8% / 12-Month Price Range: $ 118.53-162.77 / Short interest (% of float): 0.8%; days to cover: 3.9

- Bakkt Holdings Inc (BKKT), up 7.6% to $13.53 / YTD price return: +34.2% / 12-Month Price Range: $ 8.00-50.80 / Short interest (% of float): 32.8%; days to cover: 0.5 (the stock is currently on the short sale restriction list)

- Avanos Medical Inc (AVNS), up 7.3% to $31.38 / 12-Month Price Range: $ 28.99-53.61 / Short interest (% of float): 2.8%; days to cover: 4.9

- ArcelorMittal SA (MT), up 7.0% to $31.26 / YTD price return: +36.5% / 12-Month Price Range: $ 20.50-36.58 / Short interest (% of float): 0.8%; days to cover: 1.2

BIGGEST LOSERS

- Oscar Health Inc (OSCR), down 21.7% to $8.19 / 12-Month Price Range: $ 8.24-37.00 / Short interest (% of float): 4.8%; days to cover: 4.4 (the stock is currently on the short sale restriction list)

- Sunrun Inc (RUN), down 15.7% to $35.50 / YTD price return: -48.8% / 12-Month Price Range: $ 37.42-100.93 / Short interest (% of float): 15.7%; days to cover: 7.1 (the stock is currently on the short sale restriction list)

- Global Blood Therapeutics Inc (GBT), down 14.3% to $24.90 / YTD price return: -42.5% / 12-Month Price Range: $ 24.71-52.49 / Short interest (% of float): 10.3%; days to cover: 4.9 (the stock is currently on the short sale restriction list)

- Embark Technology Inc (EMBK), down 12.8% to $8.05 / 12-Month Price Range: $ 6.91-10.49 / Short interest (% of float): 0.2%; days to cover: 0.7 (the stock is currently on the short sale restriction list)

- VTEX (VTEX), down 12.6% to $13.16 / 12-Month Price Range: $ 12.81-33.36 / Short interest (% of float): 7.4%; days to cover: 5.5 (the stock is currently on the short sale restriction list)

- LumiraDx Ltd (LMDX), down 12.5% to $8.22 / 12-Month Price Range: $ 7.15-11.09 / Short interest (% of float): 0.2%; days to cover: 0.9 (the stock is currently on the short sale restriction list)

- SunPower Corp (SPWR), down 10.8% to $21.19 / YTD price return: -17.4% / 12-Month Price Range: $ 19.75-57.52 / Short interest (% of float): 17.4%; days to cover: 4.6 (the stock is currently on the short sale restriction list)

- Hagerty Inc (HGTY), down 10.7% to $16.78 / 12-Month Price Range: $ 9.61-19.97 / Short interest (% of float): 0.0%; days to cover: 0.1 (the stock is currently on the short sale restriction list)

- Sunnova Energy International Inc (NOVA), down 10.7% to $7.94 / YTD price return: -35.7% / 12-Month Price Range: $ 8.07-18.59 / Short interest (% of float): 5.8%; days to cover: 1.6 (the stock is currently on the short sale restriction list)

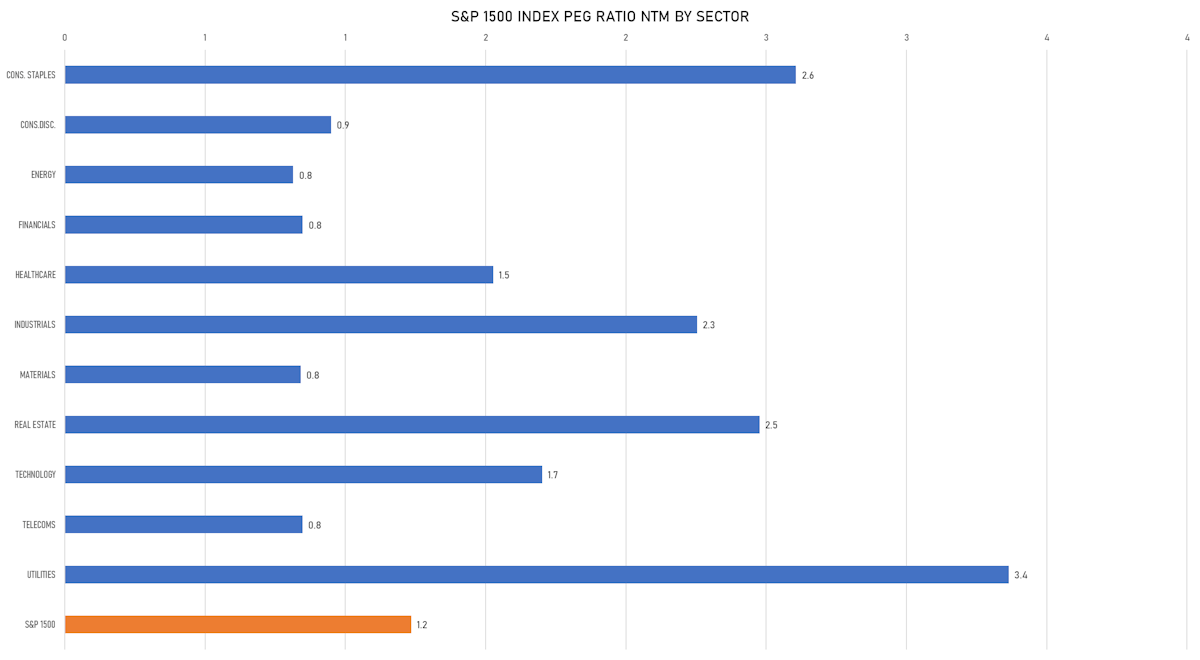

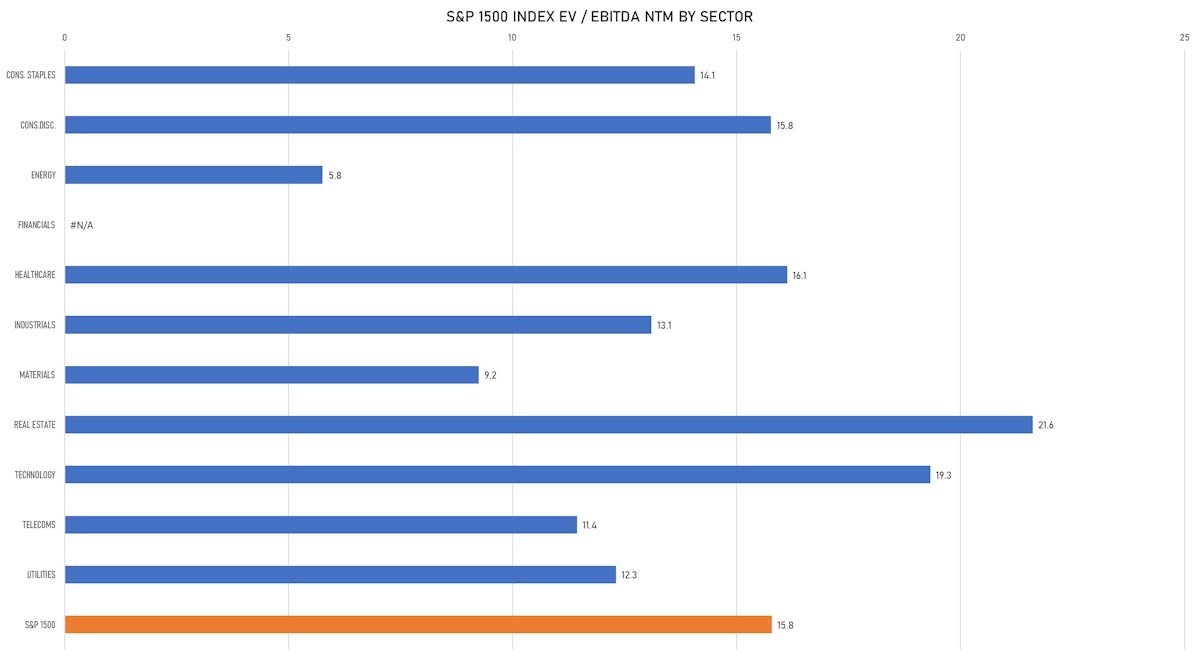

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Swiftmerge Acquisition Corp (Alternative Financial Investments | West Vancouver, Canada), raised US$ 200 M, placing 20 M units. Financial advisors on the transaction: BofA Securities Inc

- Bank of Lanzhou Co Ltd / China - Financials / Listing Exchange: ShenzSME / Ticker: 001227 / Gross proceeds (including overallotment): US$ 320m (offering in Chinese Yuan) / Bookrunners: China Securities Co Ltd

- Finatext Holdings Ltd / Japan - High Technology / Listing Exchange: Mothers / Ticker: 4419 / Gross proceeds (including overallotment): US$ 182.20m (offering in Japanese Yen) / Bookrunners: Daiwa Securities Co Ltd, Mitsubishi UFJ Morgan Stanley Securities Co Ltd

- Focuslight Technologies Inc / China - High Technology / Listing Exchange: SSES / Ticker: 688167 / Gross proceeds (including overallotment): US$ 278m (offering in Chinese Yuan) / Bookrunners: China Securities Co Ltd

- Jiujiang Shanshui Technology Co Ltd / China - Materials / Listing Exchange: ShenzChNxt / Ticker: 301190 / Gross proceeds (including overallotment): US$ 235m (offering in Chinese Yuan) / Bookrunners: Central China Securities

SECONDARIES / FOLLOW-ONS

- Southwestern Energy Co / United States of America - Energy and Power / Listing Exchange: New York / Ticker: SWN / Gross proceeds (including overallotment): US$ 328.20m (offering in U.S. Dollar) / Bookrunners: JP Morgan Securities LLC

- BELLUS Health Inc / Canada - Healthcare / Listing Exchange: Toronto / Ticker: BLU / Gross proceeds (including overallotment): US$ 175.00m (offering in U.S. Dollar) / Bookrunners: Evercore Group, RBC Capital Markets, Jefferies LLC

- LG Corp / South Korea - High Technology / Listing Exchange: KOSDAQ / Ticker: 003550 / Gross proceeds (including overallotment): US$ 451.22m (offering in Korean Won) / Bookrunners: Morgan Stanley & Co

- Suzhou Jinfu Technology Co Ltd / China - High Technology / Listing Exchange: ShenzChNxt / Ticker: 300128 / Gross proceeds (including overallotment): US$ 115.98m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- CSL Ltd (Pharmaceuticals | Melbourne, Australia), raised US$ 5,007 M, placing 26 M ordinary or common shares. Financial advisors on the transaction: Merrill Lynch Equities (Australia) Ltd, Goldman Sachs Australia Pty Ltd