Equities

US Equities Get The Year-End Rally Going With Risk-Free Event Calendar Post FOMC

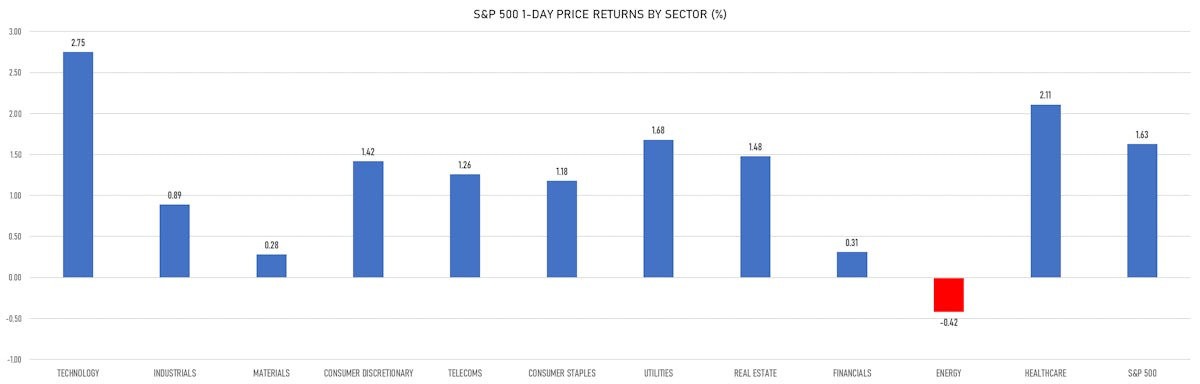

Huge outperformance of growth over value, as the technology and healthcare sectors led the way; energy was the only S&P 1500 sector posting a decline today

Published ET

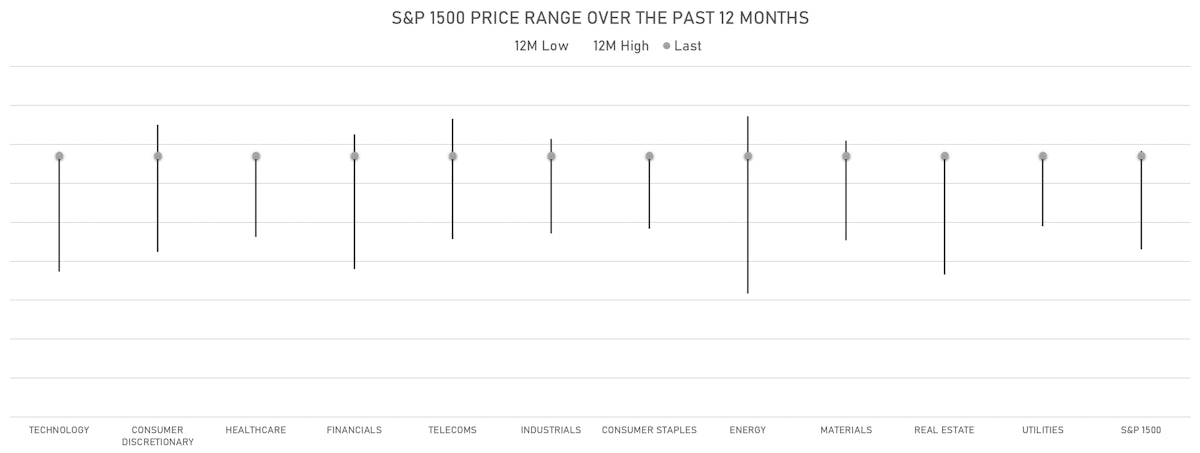

S&P 1500 Price Ranges Show Most Sectors Are At Or Close To Their All-Time Highs | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 1.63%; Nasdaq Composite up 2.15%; Wilshire 5000 up 1.59%

- 80.4% of S&P 500 stocks were up today, with 67.3% of stocks above their 200-day moving average (DMA) and 54.5% above their 50-DMA

- Top performing sectors in the S&P 500: technology up 2.75% and healthcare up 2.11%

- Bottom performing sectors in the S&P 500: energy down -0.42% and materials up 0.28%

- The number of shares in the S&P 500 traded today was 698m for a total turnover of US$ 91 bn

- The S&P 500 Value Index was up 0.9%, while the S&P 500 Growth Index was up 2.2%; the S&P small caps index was up 1.3% and mid-caps were up 1.1%

- The volume on CME's INX (S&P 500 Index) was 2.6m (3-month z-score: 0.8); the 3-month average volume is 2.2m and the 12-month range is 0.8 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 up 0.26%; UK FTSE 100 down -0.66%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -0.50%, Japan's TOPIX 500 up 1.38%

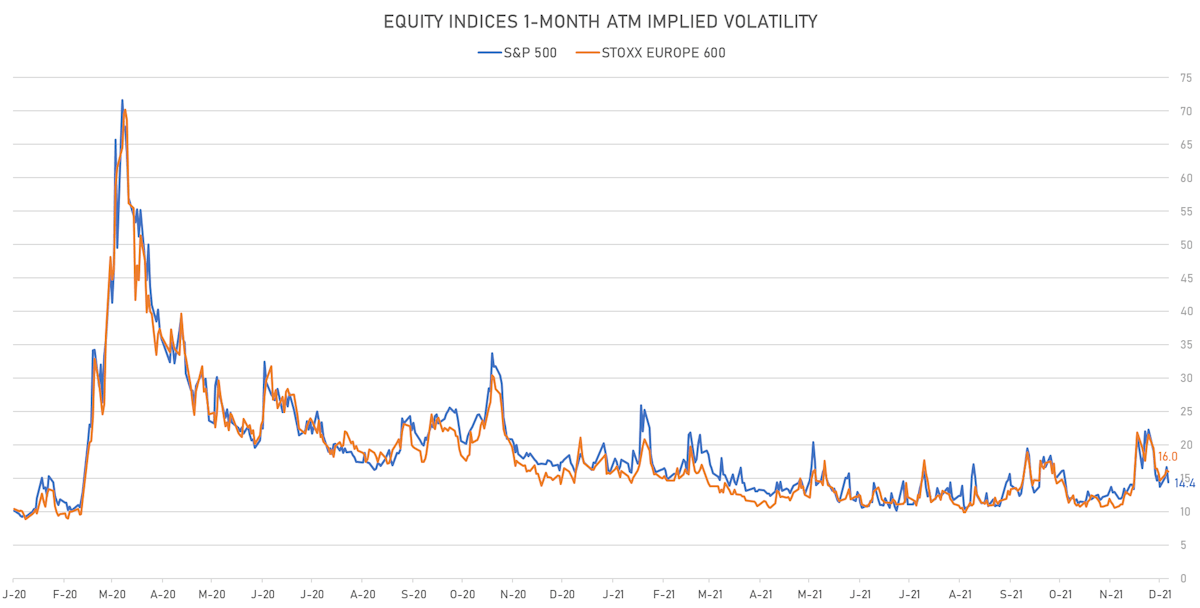

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 14.4%, down from 16.7%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 16.0%, down from 16.2%

NOTABLE S&P 500 EARNINGS RELEASES

- Lennar Corp (LEN | Consumer Cyclicals): missed EPS median estimate (3.91 act. vs. 4.17 est.) and missed revenue median estimate (8,434m act. vs. 8,495m est.), up 1.75% today, closed at 113.09 and at 111.40 (-1.49%) after hours

- HEICO Corp (HEI | Industrials): beat EPS median estimate (0.62 act. vs. 0.60 est.) and beat revenue median estimate (509m act. vs. 499m est.), up 1.40% today, closed at 141.05 and at 139.10 (-1.38%) after hours

- Nordson Corp (NDSN | Industrials): missed EPS median estimate (1.88 act. vs. 1.98 est.) and missed revenue median estimate (599m act. vs. 607m est.), up 1.72% today, closed at 269.12 and at 264.56 (-1.69%) after hours

- Toro Co (TTC | Industrials): beat EPS median estimate (0.56 act. vs. 0.52 est.) and beat revenue median estimate (961m act. vs. 957m est.), down -0.39% today, closed at 98.03 and at 97.60 (-0.44%) after hours

TOP WINNERS

- CMC Materials Inc (CCMP), up 33.9% to $195.50 / YTD price return: +29.2% / 12-Month Price Range: $ 119.19-198.61 / Short interest (% of float): 1.8%

- Design Therapeutics Inc (DSGN), up 15.9% to $20.36 / 12-Month Price Range: $ 12.52-50.50 / Short interest (% of float): 6.2%; days to cover: 17.8

- Bird Global Inc (BRDS), up 15.7% to $8.97 / 12-Month Price Range: $ 5.80-11.32 / Short interest (% of float): 1.4%; days to cover: 1.6

- Hims & Hers Health Inc (HIMS), up 15.5% to $6.35 / YTD price return: -56.5% / 12-Month Price Range: $ 5.47-25.40 / Short interest (% of float): 6.1%; days to cover: 3.4

- Ginkgo Bioworks Holdings Inc (DNA), up 14.2% to $10.85 / 12-Month Price Range: $ 7.91-15.86 / Short interest (% of float): 1.6%; days to cover: 3.5

- Global Blood Therapeutics Inc (GBT), up 13.3% to $28.20 / 12-Month Price Range: $ 24.61-52.49 / Short interest (% of float): 10.3%; days to cover: 4.9

- Ocugen Inc (OCGN), up 12.7% to $5.42 / YTD price return: +196.2% / 12-Month Price Range: $ .29-18.77 / Short interest (% of float): 25.5%; days to cover: 1.0

- Cohu Inc (COHU), up 12.6% to $38.85 / 12-Month Price Range: $ 29.00-51.86 / Short interest (% of float): 2.7%; days to cover: 2.4

- C3.ai Inc (AI), up 12.3% to $35.01 / YTD price return: -74.8% / 12-Month Price Range: $ 27.52-183.90

BIGGEST LOSERS

- ATAI Life Sciences NV (ATAI), down 31.9% to $6.82 / 12-Month Price Range: $ 10.00-22.91 / Short interest (% of float): 1.6%; days to cover: 3.6 (the stock is currently on the short sale restriction list)

- Legend Biotech Corp (LEGN), down 15.2% to $41.14 / YTD price return: +46.1% / 12-Month Price Range: $ 23.41-58.00 (the stock is currently on the short sale restriction list)

- Zai Lab Ltd (ZLAB), down 12.4% to $54.90 / YTD price return: -59.4% / 12-Month Price Range: $ 60.57-193.54 / Short interest (% of float): 3.8%; days to cover: 5.2 (the stock is currently on the short sale restriction list)

- Cerence Inc (CRNC), down 11.4% to $69.20 / YTD price return: -31.1% / 12-Month Price Range: $ 66.56-139.00 (the stock is currently on the short sale restriction list)

- ABM Industries Inc (ABM), down 11.0% to $40.88 / YTD price return: +8.0% / 12-Month Price Range: $ 36.31-55.48 / Short interest (% of float): 1.9%; days to cover: 4.3 (the stock is currently on the short sale restriction list)

- Beigene Ltd (BGNE), down 10.7% to $248.56 / YTD price return: -3.8% / 12-Month Price Range: $ 230.04-426.56 (the stock is currently on the short sale restriction list)

- Olink Holding AB (publ) (OLK), down 9.2% to $19.80 / 12-Month Price Range: $ 17.54-42.20 (the stock is currently on the short sale restriction list)

- Roblox Corp (RBLX), down 9.0% to $97.95 / 12-Month Price Range: $ 60.50-141.60 (the stock is currently on the short sale restriction list)

- Nucor Corp (NUE), down 8.6% to $108.22 / YTD price return: +103.5% / 12-Month Price Range: $ 47.94-128.81 / Short interest (% of float): 2.8%; days to cover: 2.2 (the stock is currently on the short sale restriction list)

- Sabre Corp (SABR), down 8.4% to $7.49 / YTD price return: -37.7% / 12-Month Price Range: $ 7.05-16.88 (the stock is currently on the short sale restriction list)

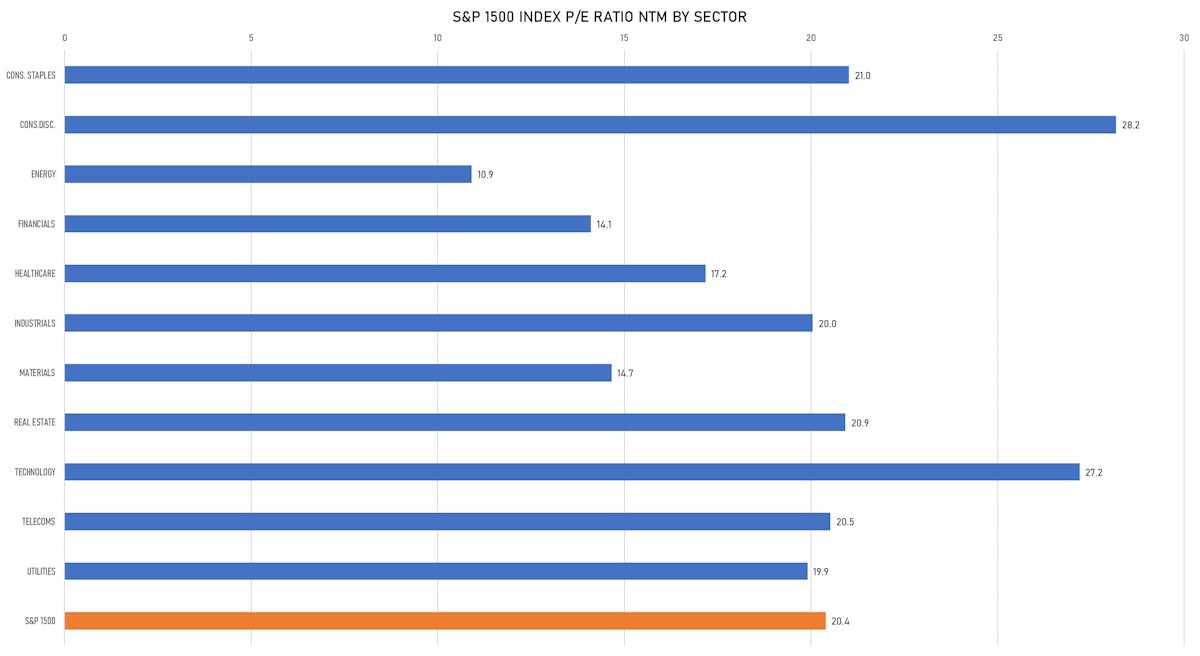

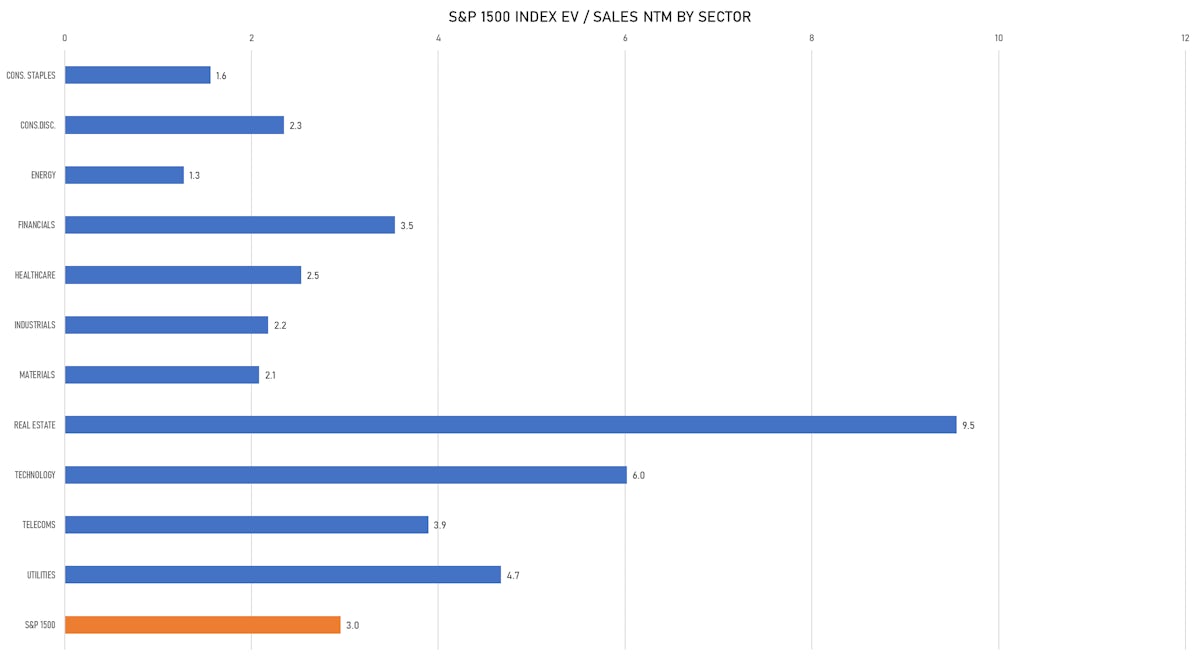

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Samsara Inc / United States of America - High Technology / Listing Exchange: New York / Ticker: IOT / Gross proceeds (including overallotment): US$ 805.00m (offering in U.S. Dollar) / Bookrunners: Allen & Co Inc, Goldman Sachs & Co, Morgan Stanley & Co LLC, JP Morgan Securities LLC

- SBI Funds Management Pvt Ltd / India - Financials / Listing Exchange: National / Ticker: N/A / Gross proceeds (including overallotment): US$ 526.04m (offering in Indian Rupee) / Bookrunners: Not Applicable

- ExaWizards Inc / Japan - High Technology / Listing Exchange: Mothers / Ticker: 4259 / Gross proceeds (including overallotment): US$ 222.22m (offering in Japanese Yen) / Bookrunners: Mitsubishi UFJ Morgan Stanley Securities Co Ltd, SMBC Nikko Securities Inc

- LBG Media PLC / United Kingdom - High Technology / Listing Exchange: London / Ticker: LBG / Gross proceeds (including overallotment): US$ 147.03m (offering in British Pound) / Bookrunners: Zeus Capital Ltd

- FTAC Emerald Acquisition Corp (Alternative Financial Investments | Philadelphia, Pennsylvania), raised US$ 220 M, placing 22 M units. Financial advisors on the transaction: Goldman Sachs & Co

- Solar Profit Energy Services SL (Building/Construction & Engineering | Barcelona, Spain), raised US$ 207 M, placing 20 M ordinary or common shares. Financial advisors on the transaction: GVC Gaesco Valores SV SA

SECONDARIES / FOLLOW-ONS

- Legend Biotech Corp / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: LEGN / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Jefferies LLC, Morgan Stanley & Co LLC, JP Morgan Securities LLC, Barclays Capital Inc, Piper Sandler & Co

- Leslies Inc / United States of America - Consumer Products and Services / Listing Exchange: Nasdaq / Ticker: LESL / Gross proceeds (including overallotment): US$ 256.25m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co LLC

- GCL-Poly Energy Holdings Ltd / Hong Kong - High Technology / Listing Exchange: Hong Kong / Ticker: 3800 / Gross proceeds (including overallotment): US$ 650.09m (offering in Hong Kong Dollar) / Bookrunners: China International Capital Corp HK Securities Ltd

- Karnov Group AB (Publishing | Stockholm, Sweden), raised US$ 642 M, placing 10 M ordinary or common shares. Financial advisors on the transaction: Carnegie Investment Bank AB, Barclays PLC, Nordea PLC