Equities

US Equity Indices Kick Off The New Year With A Decent Uptick On Average Volumes

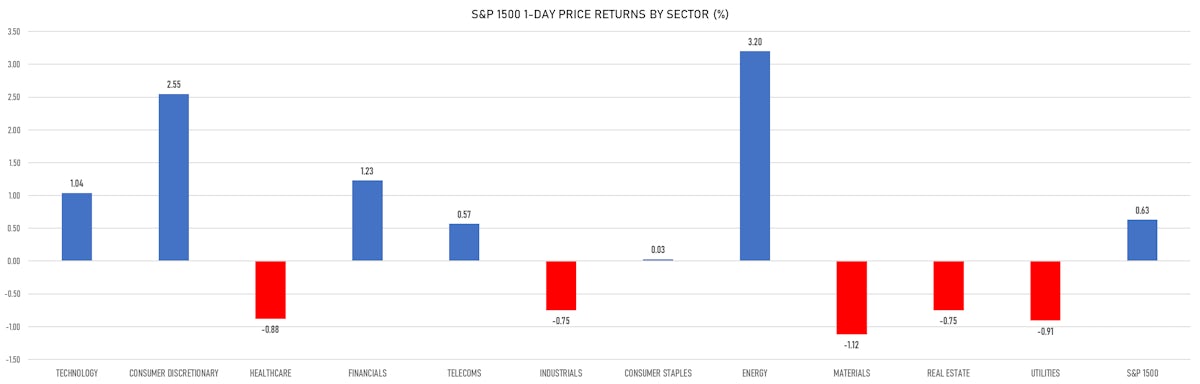

Under the hood, it was a mixed day with only about half of S&P 500 stocks rising, led by the energy and consumer discretionary sectors; growth and small caps overperformed the wider market

Published ET

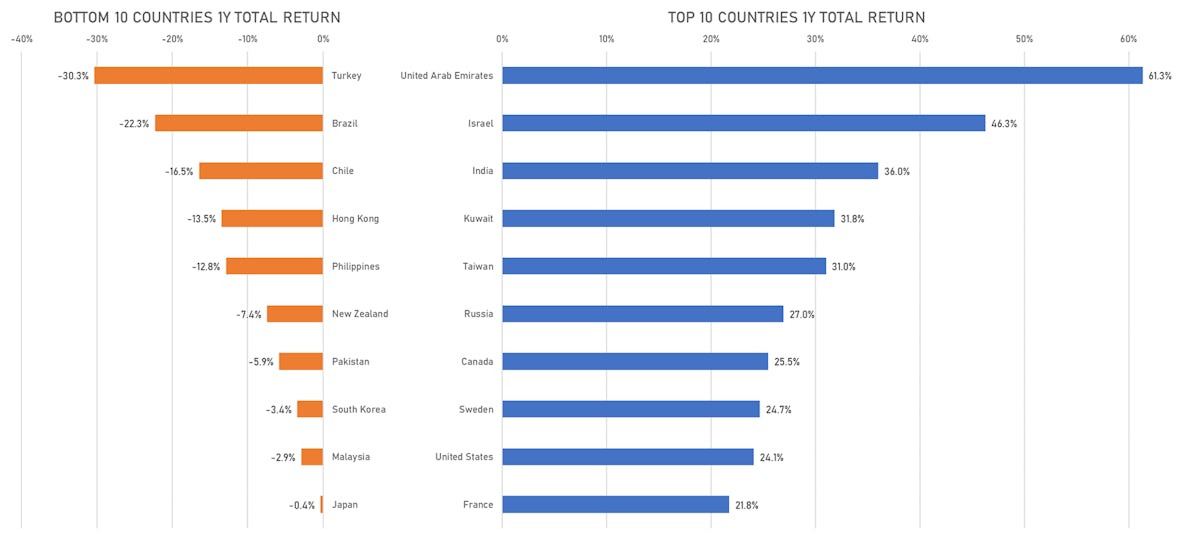

Top- and Bottom- Performing Countries In 2021 (1-Year US$ Total Returns) | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.64%; Nasdaq Composite up 1.20%; Wilshire 5000 up 0.68%

- 50.3% of S&P 500 stocks were up today, with 73.9% of stocks above their 200-day moving average (DMA) and 70.9% above their 50-DMA

- Top performing sectors in the S&P 500: energy up 3.10% and consumer discretionary up 2.76%

- Bottom performing sectors in the S&P 500: materials down -1.37% and healthcare down -0.98%

- The number of shares in the S&P 500 traded today was 587m for a total turnover of US$ 78 bn

- The S&P 500 Value Index was up 0.5%, while the S&P 500 Growth Index was up 0.8%; the S&P small caps index was up 1.1% and mid caps were up 0.3%

- The volume on CME's INX (S&P 500 Index) was 2.2m (3-month z-score: 0.1); the 3-month average volume is 2.2m and the 12-month range is 1.3 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 up 0.45%; UK FTSE 100 down -0.25%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -0.34%, and Japan's TOPIX 500 up 2.01%

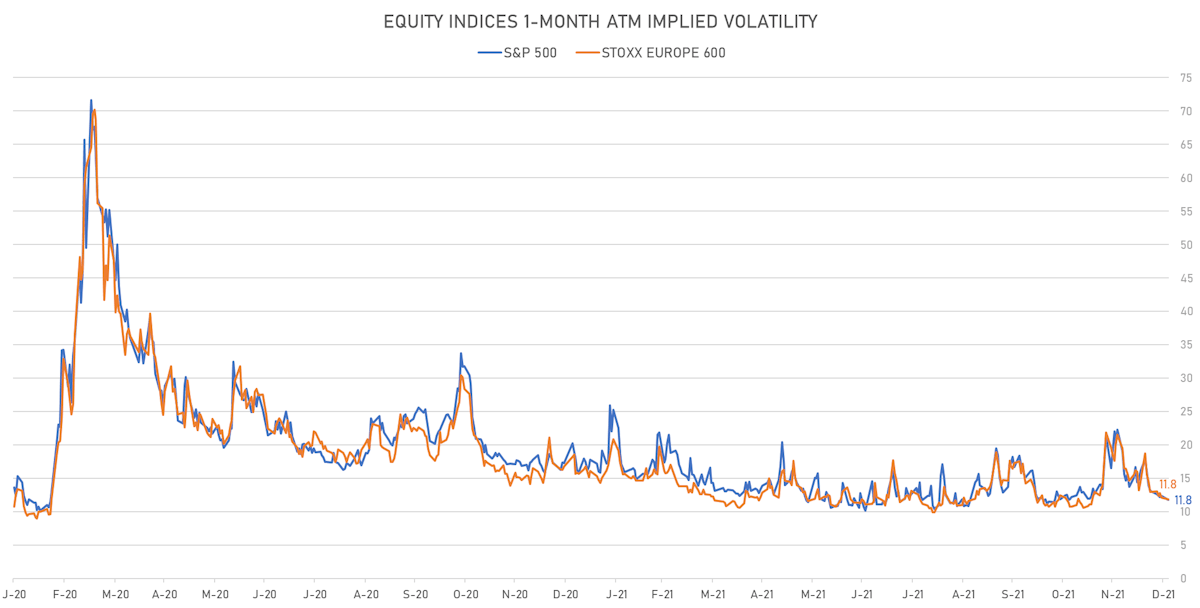

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 11.8%, down from 12.0%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.8%

TOP WINNERS

- Immunitybio Inc (IBRX), up 23.8% to $7.53 / YTD price return: +23.8% / 12-Month Price Range: $ 5.11-45.42 / Short interest (% of float): 12.9%; days to cover: 7.2

- Pear Therapeutics Inc (PEAR), up 23.1% to $7.63 / YTD price return: +23.1% / 12-Month Price Range: $ 4.85-14.60 / Short interest (% of float): 0.3%; days to cover: 0.8

- StoneCo Ltd (STNE), up 14.6% to $19.32 / YTD price return: +14.6% / 12-Month Price Range: $ 14.02-95.12 / Short interest (% of float): 6.6%; days to cover: 1.5

- Faraday Future Intelligent Electric Inc (FFIE), up 13.9% to $6.06 / YTD price return: +13.9% / 12-Month Price Range: $ 4.51-20.75 / Short interest (% of float): 10.8%; days to cover: 8.2

- Tesla Inc (TSLA), up 13.5% to $1,199.78 / YTD price return: +13.5% / 12-Month Price Range: $ 539.49-1,243.49 / Short interest (% of float): 3.2%; days to cover: 1.0

- Laredo Petroleum Inc (LPI), up 13.2% to $68.04 / YTD price return: +13.2% / 12-Month Price Range: $ 19.12-99.26 / Short interest (% of float): 18.1%; days to cover: 3.1

- Transocean Ltd (RIG), up 13.0% to $3.12 / YTD price return: +13.0% / 12-Month Price Range: $ 2.25-5.13 / Short interest (% of float): 10.4%; days to cover: 4.0

BIGGEST LOSERS

- Himax Technologies Inc (HIMX), down 18.6% to $13.02 / YTD price return: -18.6% / 12-Month Price Range: $ 7.01-17.88 / Short interest (% of float): 12.8%; days to cover: 6.4 (the stock is currently on the short sale restriction list)

- Arqit Quantum Inc (ARQQ), down 14.4% to $20.51 / YTD price return: -14.4% / 12-Month Price Range: $ 8.00-41.52 / Short interest (% of float): 3.0%; days to cover: 0.9 (the stock is currently on the short sale restriction list)

- CNH Industrial NV (CNHI), down 13.8% to $16.74 / YTD price return: -.9% / 12-Month Price Range: $ 12.46-19.69 / Short interest (% of float): 0.7%; days to cover: 1.6 (the stock is currently on the short sale restriction list)

- Fathom Digital Manufacturing Corp (FATH), down 12.9% to $6.90 / YTD price return: -12.9% / 12-Month Price Range: $ 6.46-11.00 / Short interest (% of float): 0.0%; days to cover: 0.2 (the stock is currently on the short sale restriction list)

- BioNTech SE (BNTX), down 10.1% to $231.85 / YTD price return: -10.1% / 12-Month Price Range: $ 83.00-464.00 / Short interest (% of float): 2.7%; days to cover: 0.5 (the stock is currently on the short sale restriction list)

- Karooooo Ltd (KARO), down 9.9% to $36.73 / YTD price return: -9.9% / 12-Month Price Range: $ 28.03-42.50 / Short interest (% of float): 0.2%; days to cover: 1.8

- Taro Pharmaceutical Industries Ltd (TARO), down 9.0% to $45.61 / YTD price return: -9.0% / 12-Month Price Range: $ 46.81-80.00 / Short interest (% of float): 1.2%; days to cover: 6.2 (the stock is currently on the short sale restriction list)

- Apollo Medical Holdings Inc (AMEH), down 8.8% to $67.04 / YTD price return: -8.8% / 12-Month Price Range: $ 18.26-133.23 / Short interest (% of float): 13.3%; days to cover: 9.5

- Confluent Inc (CFLT), down 8.3% to $69.92 / YTD price return: -8.3% / 12-Month Price Range: $ 37.71-94.97 / Short interest (% of float): 11.0%; days to cover: 2.3

- Expensify Inc (EXFY), down 8.2% to $40.38 / YTD price return: -8.2% / 12-Month Price Range: $ 32.85-51.06 / Short interest (% of float): 2.9%; days to cover: 1.2 (the stock is currently on the short sale restriction list)

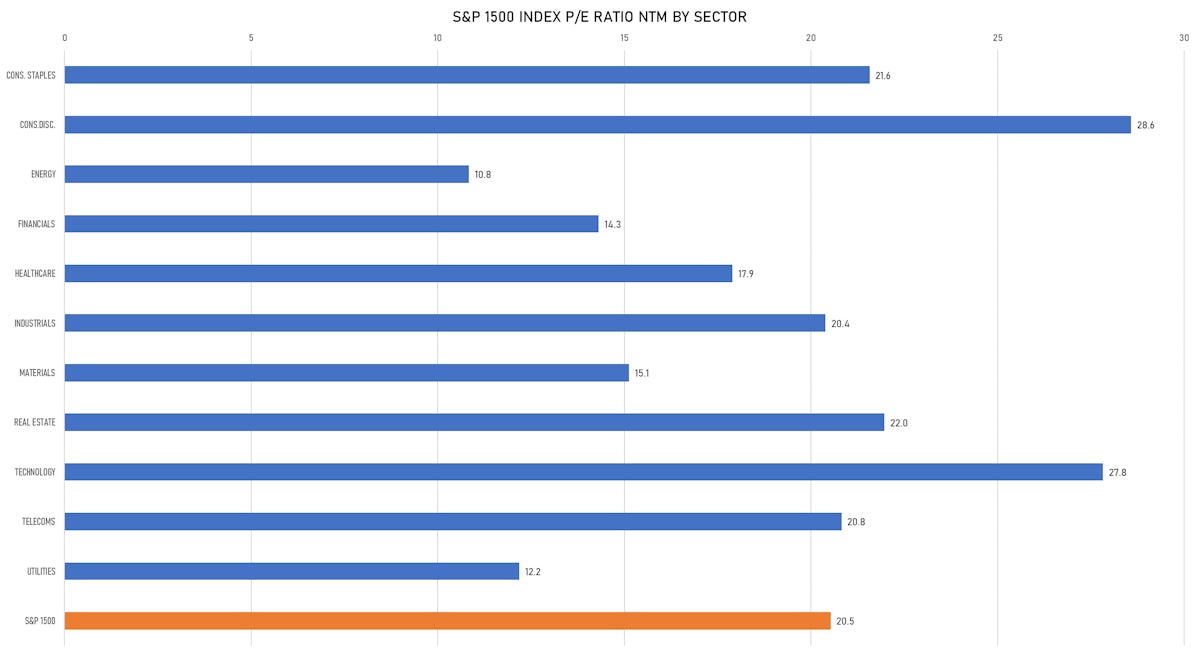

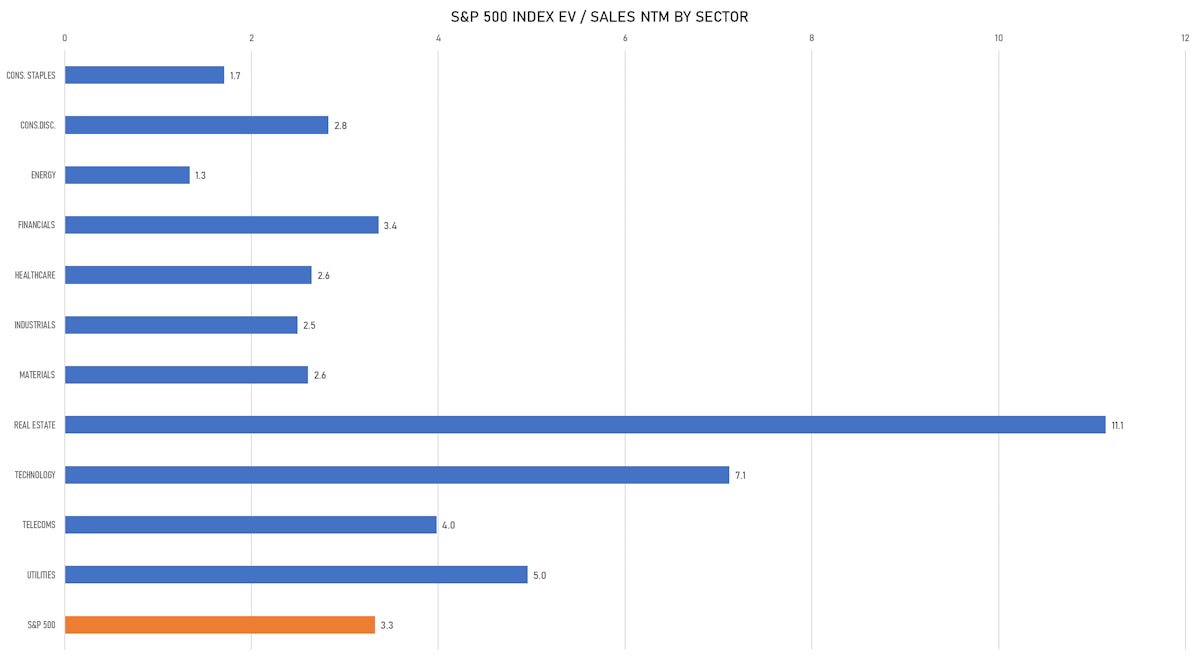

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- GLA II Meteora Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: GLAA.U / Gross proceeds (including overallotment): US$ 253m (offering in U.S. Dollar) / Bookrunners: Oppenheimer & Co Inc

- China Lithium Battery Technology Co Ltd / China - Energy and Power / Listing Exchange: Hong Kong / Ticker: - / Gross proceeds (including overallotment): US$ 1,000m (offering in U.S. Dollar) / Bookrunners: Not Applicable

SECONDARIES / FOLLOW-ONS

- Warner Music Group Corp (Motion Pictures / Audio Visual | New York, New York), gross proceeds of US$ 355 M. Financial advisors on the transaction: Morgan Stanley & Co LLC