Equities

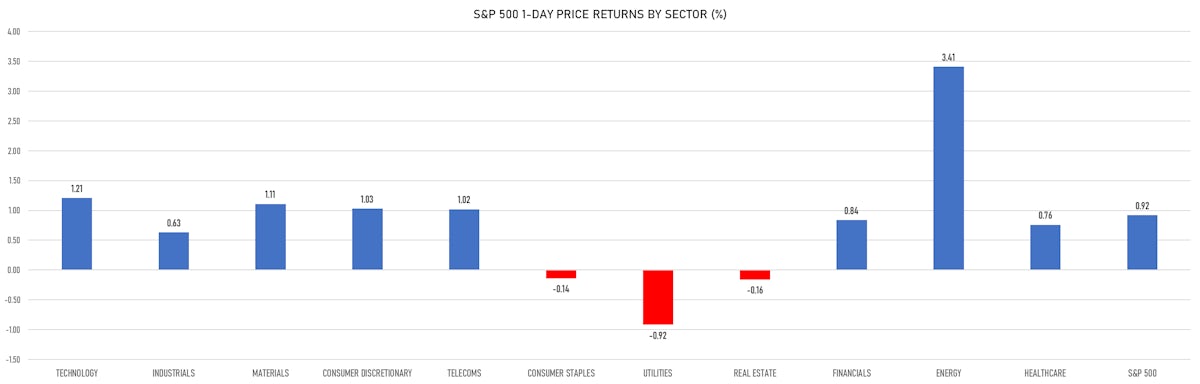

75% Up Day For S&P 500 Stocks, With Energy And Technology The Best Performing Sectors

As the Chinese economy is expected to start getting better in the second half of the year, the large underperformance of Chinese equities relative to the US and Europe may be about to turn around

Published ET

Comparison of the recent price performance of US, European, Chinese Equities | Source: FactSet

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.92%; Nasdaq Composite up 1.41%; Wilshire 5000 up 1.07%

- 74.5% of S&P 500 stocks were up today, with 71.1% of stocks above their 200-day moving average (DMA) and 65.3% above their 50-DMA

- Top performing sectors in the S&P 500: energy up 3.41% and technology up 1.21%

- Bottom performing sectors in the S&P 500: utilities down -0.92% and real estate down -0.16%

- The number of shares in the S&P 500 traded today was 578m for a total turnover of US$ 75 bn

- The S&P 500 Value Index was up 0.7%, while the S&P 500 Growth Index was up 1.1%; the S&P small caps index was up 0.7% and mid-caps were up 0.9%

- The volume on CME's INX (S&P 500 Index) was 2.2m (3-month z-score: 0.0); the 3-month average volume is 2.2m and the 12-month range is 1.3 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 up 0.84%; UK FTSE 100 up 0.62%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index up 1.42%, Japan's TOPIX 500 up 1.55%

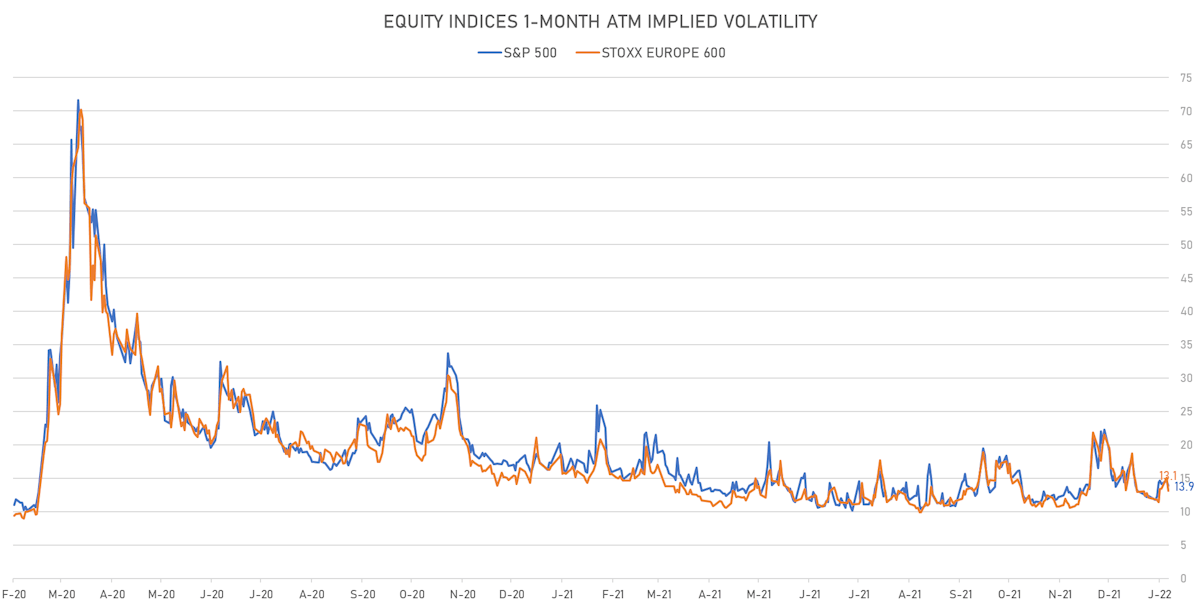

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 13.9%, down from 14.7%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 13.1%, down from 15.1%

NOTABLE US EARNINGS RELEASES

- Albertsons Companies Inc (ACI | Consumer Non-Cyclicals): beat EPS median estimate (0.79 act. vs. 0.59 est.) and beat revenue median estimate (16,728m act. vs. 16,102m est.), down -9.75% today, closed at $ 28.79 / share and traded at $ 32.00 (+11.15%) after hours

- TD Synnex Corp (SNX | Technology): beat EPS median estimate (2.86 act. vs. 2.68 est.) and beat revenue median estimate (15,611m act. vs. 15,521m est.), down -2.14% today, closed at $ 107.46 / share and traded at $ 109.70 (+2.08%) after hours

TOP WINNERS

- Virgin Orbit Holdings Inc (VORB), up 31.3% to $10.57 / YTD price return: +31.5% / 12-Month Price Range: $ 5.88-10.80 / Short interest (% of float): 1.0%; days to cover: 0.7

- Accolade Inc (ACCD), up 27.7% to $24.44 / YTD price return: -7.3% / 12-Month Price Range: $ 18.72-59.93 / Short interest (% of float): 6.9%; days to cover: 6.2

- Amylyx Pharmaceuticals Inc (AMLX), up 20.1% to $20.08 / 12-Month Price Range: $ 16.00-21.00

- Butterfly Network Inc (BFLY), up 19.5% to $7.55 / YTD price return: +12.9% / 12-Month Price Range: $ 5.77-29.13 / Short interest (% of float): 17.3%; days to cover: 6.3

- Illumina Inc (ILMN), up 17.0% to $423.80 / YTD price return: +11.4% / 12-Month Price Range: $ 341.03-555.77

- Solid Power Inc (SLDP), up 16.0% to $8.61 / YTD price return: -1.5% / 12-Month Price Range: $ 7.06-14.85 / Short interest (% of float): 2.5%; days to cover: 0.8

- EQRx Inc (EQRX), up 14.9% to $7.39 / YTD price return: +8.4% / 12-Month Price Range: $ 5.55-11.10 / Short interest (% of float): 0.3%; days to cover: 3.1

- Digital World Acquisition Corp (DWAC), up 14.1% to $63.80 / YTD price return: +24.1% / 12-Month Price Range: $ 9.84-175.00 / Short interest (% of float): 14.0%; days to cover: 0.7

- Lithium Americas Corp (LAC), up 13.9% to $30.49 / YTD price return: +4.7% / 12-Month Price Range: $ 11.84-41.56 / Short interest (% of float): 8.7%; days to cover: 1.7

- Oatly Group AB (OTLY), up 13.2% to $8.21 / YTD price return: +3.1% / 12-Month Price Range: $ 7.18-29.00 / Short interest (% of float): 2.9%; days to cover: 2.5

BIGGEST LOSERS

- Pacific Biosciences of California Inc (PACB), down 11.3% to $14.70 / YTD price return: -28.2% / 12-Month Price Range: $ 15.58-53.69 (the stock is currently on the short sale restriction list)

- Albertsons Companies Inc (ACI), down 9.7% to $28.79 / YTD price return: -4.6% / 12-Month Price Range: $ 15.97-37.85 / Short interest (% of float): 4.9%; days to cover: 7.2 (the stock is currently on the short sale restriction list)

- Fathom Digital Manufacturing Corp (FATH), down 9.4% to $5.31 / YTD price return: -33.0% / 12-Month Price Range: $ 5.04-11.00 / Short interest (% of float): 0.1%; days to cover: 0.2 (the stock is currently on the short sale restriction list)

- 360 DigiTech Inc (QFIN), down 8.0% to $18.45 / YTD price return: -19.5% / 12-Month Price Range: $ 12.40-45.00

- Apellis Pharmaceuticals Inc (APLS), down 7.5% to $41.15 / 12-Month Price Range: $ 27.50-73.00 / Short interest (% of float): 9.2%; days to cover: 5.4

- Olink Holding AB (publ) (OLK), down 7.5% to $13.38 / YTD price return: -26.5% / 12-Month Price Range: $ 10.64-42.20 / Short interest (% of float): 7.5%; days to cover: 9.1

- Sprouts Farmers Market Inc (SFM), down 6.8% to $28.74 / YTD price return: -3.2% / 12-Month Price Range: $ 19.28-30.90 / Short interest (% of float): 14.8%; days to cover: 8.5

- Sema4 Holdings Corp (SMFR), down 6.6% to $4.36 / YTD price return: -2.2% / 12-Month Price Range: $ 3.91-27.18 / Short interest (% of float): 5.8%; days to cover: 5.6

- BioNTech SE (BNTX), down 6.2% to $215.80 / YTD price return: -16.3% / 12-Month Price Range: $ 90.29-464.00 / Short interest (% of float): 2.7%; days to cover: 0.5

- Ero Copper Corp (ERO), down 6.0% to $13.13 / 12-Month Price Range: $ 13.33-25.99 / Short interest (% of float): 0.8%; days to cover: 24.9

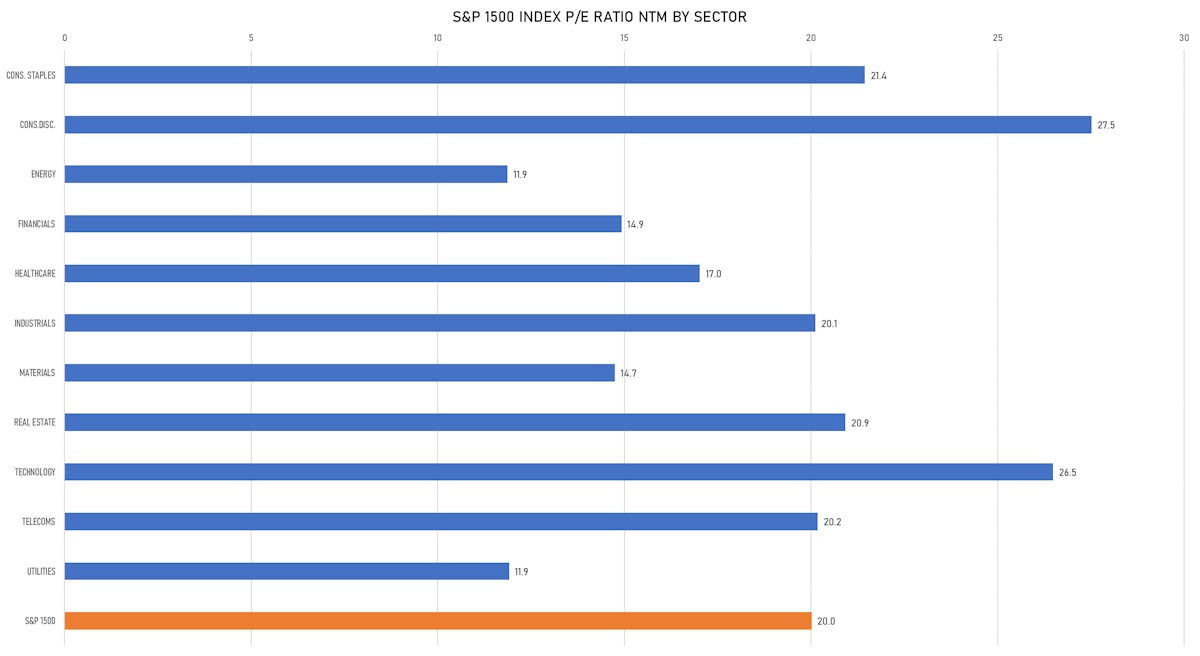

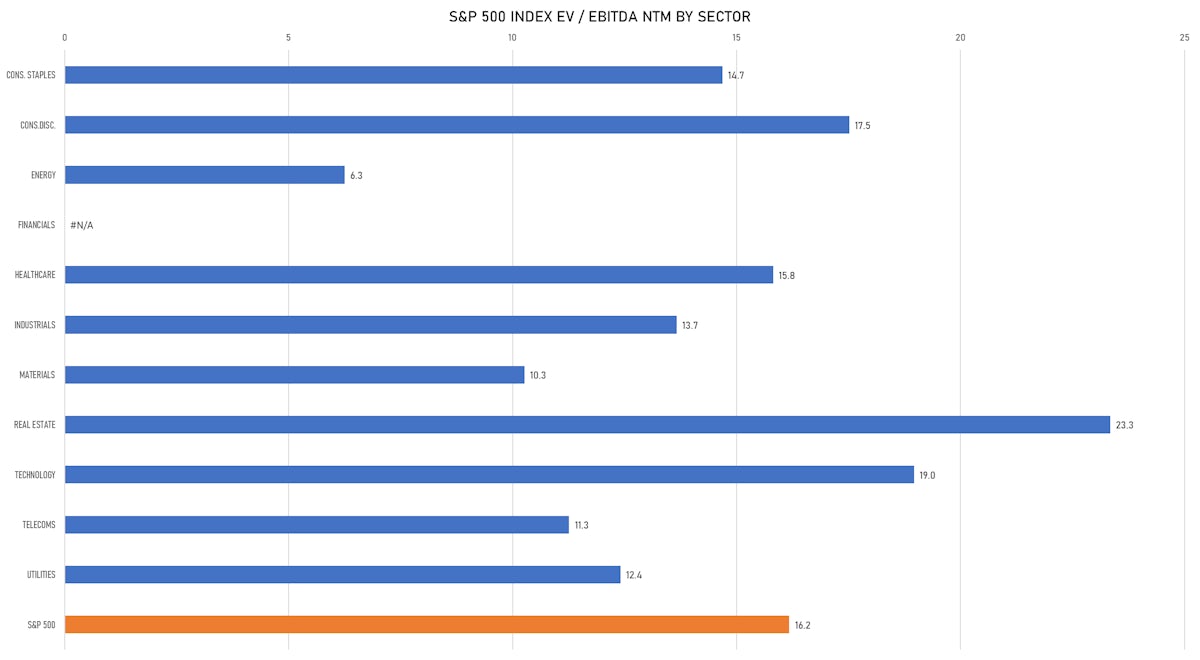

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Stemirna (Shanghai) Biotechnology Co Ltd / China - Healthcare / Listing Exchange: Hong Kong / Ticker: - / Gross proceeds (including overallotment): US$ 400.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Yidong Electronics Technology Co Ltd (Electronics | Dongguan, China Mainland), raised US$ 341 M, placing 58 M class a ordinary shares. Financial advisors on the transaction: China Merchants Securities Co Ltd

SECONDARIES / FOLLOW-ONS

- NetSTREIT Corp / United States of America - Real Estate / Listing Exchange: New York / Ticker: NTST / Gross proceeds (including overallotment): US$ 230.29m (offering in U.S. Dollar) / Bookrunners: Stifel Nicolaus & Co Inc, Citigroup Global Markets Inc, Wells Fargo Securities LLC, Bofa Securities Inc

- Mitsui Fudosan Logistics Park Inc / Japan - Real Estate / Listing Exchange: Tokyo / Ticker: 3471 / Gross proceeds (including overallotment): US$ 101.56m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd, Daiwa Securities Co Ltd, SMBC Nikko Securities Inc

- Deutsche Bank AG (Banks | Frankfurt Am Main, Germany), raised US$ 287 M, placing 21 M ordinary or common shares. Financial advisors on the transaction: Morgan Stanley Europe SE

- Commerzbank AG (Banks | Frankfurt, Germany), raised US$ 215 M, placing 25 M ordinary or common shares. Financial advisors on the transaction: Morgan Stanley Europe SE